CIR v. Algue - G.R. No. L-28896 - February 17, 1988 - DIGEST

Diunggah oleh

Aaron AristonJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CIR v. Algue - G.R. No. L-28896 - February 17, 1988 - DIGEST

Diunggah oleh

Aaron AristonHak Cipta:

Format Tersedia

Commissioner of Internal Revenue v. Algue, et.al.

G.R. No. L-28896

Feb 17, 1988

Cruz, J.:

FACTS:

The Philippine Sugar Estate Development Company (PSEDC) appointed Algue Inc. as its

agent, authorizing it to sell its land, factories, and oil manufacturing process. The Vegetable Oil

Investment Corporation (VOICP) purchased PSEDC properties. For the sale, Algue received a

commission of P125,000 and it was from this commission that it paid Guevara, et. al. organizers of

the VOICP, P75,000in promotional fees. In 1965, Algue received an assessment from the

Commissioner of Internal Revenue in the amount of P83,183.85 as delinquency income tax for years

1958 and 1959. Algue filed a protestor request for reconsideration which was not acted upon by the

Bureau of Internal Revenue (BIR). The counsel for Algue had to accept the warrant of distraint and

levy. Algue, however, filed a petition for review with the Court of Tax Appeals.

ISSUE:

Whether the assessment was reasonable.

HELD:

Taxes are the lifeblood of the government and so should be collected without unnecessary

hindrance. Every person who is able to pay must contribute his share in the running of the

government. The Government, for his part, is expected to respond in the form of tangible and

intangible benefits intended to improve the lives of the people and enhance their moral and

material values. This symbiotic relationship is the rationale of taxation and should dispel the

erroneous notion that is an arbitrary method of exaction by those in the seat of power. Tax

collection, however, should be made in accordance with law as any arbitrariness will negate the very

reason for government itself. For all the awesome power of the tax collector, he may still be stopped

in his tracks if the taxpayer can demonstrate that the law has not been observed. Herein, the

claimed deduction (pursuant to Section 30[a] [1] of the Tax Code and Section 70 [1] of Revenue

Regulation 2: as to compensation for personal services) had been legitimately by Algue Inc. It has

further proven that the payment of fees was reasonable and necessary in light of the efforts exerted

by the payees in inducing investors (in VOICP) to involve themselves in an experimental enterprise

or a business requiring millions of pesos. The assessment was not reasonable.

Anda mungkin juga menyukai

- CIR vs. AlgueDokumen2 halamanCIR vs. AlgueJayson AbabaBelum ada peringkat

- G.R. No. L-28896Dokumen7 halamanG.R. No. L-28896Klein CarloBelum ada peringkat

- Cir vs. Algue DigestDokumen1 halamanCir vs. Algue DigestTinyssa Paguio50% (2)

- Caltex v. COA - DigestDokumen2 halamanCaltex v. COA - DigestChie Z. Villasanta71% (7)

- Victorias Milling V Municipality of Victorias DigestDokumen1 halamanVictorias Milling V Municipality of Victorias Digestgel94100% (2)

- Sarasola vs. Trinidad, 40 Phil. 52Dokumen8 halamanSarasola vs. Trinidad, 40 Phil. 52Machida Abraham100% (1)

- CIR v. Santos Rules on RTC Authority to Review Tax PolicyDokumen1 halamanCIR v. Santos Rules on RTC Authority to Review Tax PolicyKeith Balbin100% (3)

- CIR V SantosDokumen1 halamanCIR V SantosLizzy WayBelum ada peringkat

- SISON V ANCHETADokumen4 halamanSISON V ANCHETAMayflor BalinuyusBelum ada peringkat

- Philippine Guaranty Co. v CIR rules reinsurance premiums ceded to foreign insurers subject to withholding taxDokumen2 halamanPhilippine Guaranty Co. v CIR rules reinsurance premiums ceded to foreign insurers subject to withholding taxKate Garo100% (2)

- City of Baguio vs. de Leon DigestDokumen2 halamanCity of Baguio vs. de Leon DigestKath Leen100% (1)

- Abakada Guro vs Ermita VAT caseDokumen29 halamanAbakada Guro vs Ermita VAT caseMario P. Trinidad Jr.100% (2)

- Tan v. Del Rosario Case DigestDokumen2 halamanTan v. Del Rosario Case DigestJsim83% (6)

- NAPOCOR Tax Exemption Ruled Invalid by SCDokumen1 halamanNAPOCOR Tax Exemption Ruled Invalid by SCIsh100% (3)

- Case DigestDokumen25 halamanCase DigestJay TabuzoBelum ada peringkat

- Sison Vs AnchetaDokumen1 halamanSison Vs AnchetaJf Maneja100% (3)

- Case Digest, Reyes V AlmanzorDokumen1 halamanCase Digest, Reyes V AlmanzorJerremiah Josh Rodis Rementilla100% (2)

- Philippine Bank of Communications tax refund caseDokumen1 halamanPhilippine Bank of Communications tax refund caseKkee DdooBelum ada peringkat

- Gomez V Palomar Case DigestDokumen2 halamanGomez V Palomar Case DigestRichard Gultiano LibagoBelum ada peringkat

- 5 Chavez Vs Ongpin - DigestDokumen2 halaman5 Chavez Vs Ongpin - DigestGilbert Mendoza100% (5)

- Regulation vs TaxationDokumen2 halamanRegulation vs TaxationBryce King100% (1)

- Republic vs. Philippine Rabbit Bus Inc DigestDokumen4 halamanRepublic vs. Philippine Rabbit Bus Inc DigestJesa Bayoneta100% (1)

- Republic of The Philippines Vs CAGUIOADokumen14 halamanRepublic of The Philippines Vs CAGUIOAAnonymous NWnRYIWBelum ada peringkat

- Caltex Vs Commission On Audit 1992Dokumen1 halamanCaltex Vs Commission On Audit 1992Praisah Marjorey PicotBelum ada peringkat

- Phil Guaranty V CIR DigestDokumen2 halamanPhil Guaranty V CIR DigestMaria Reylan Garcia100% (2)

- Villanueva V City of IloiloDokumen3 halamanVillanueva V City of IloiloPatricia Gonzaga100% (1)

- Roxas Vs CtaDokumen23 halamanRoxas Vs CtaMyra De Guzman PalattaoBelum ada peringkat

- CIR VS. CENTRAL LUZON DRUG CORP. RULING ON TAX CREDIT CLAIMDokumen1 halamanCIR VS. CENTRAL LUZON DRUG CORP. RULING ON TAX CREDIT CLAIMBea CadornaBelum ada peringkat

- CIR Vs Baier-Nickel CaseDokumen2 halamanCIR Vs Baier-Nickel CasemarwantahsinBelum ada peringkat

- Hospital Property Tax ExemptionDokumen2 halamanHospital Property Tax ExemptionAriel Versola Gapasin100% (1)

- Taxation Law I Case DigestsDokumen40 halamanTaxation Law I Case DigestsChristopher G. Halnin100% (19)

- Case Digest TaxationDokumen8 halamanCase Digest Taxationtats100% (4)

- Paseo Realty & Development Corporation vs. Court of AppealsDokumen12 halamanPaseo Realty & Development Corporation vs. Court of AppealsMp CasBelum ada peringkat

- Creba v. Romulo Case DigestDokumen2 halamanCreba v. Romulo Case DigestApril Rose Villamor60% (5)

- Digest-Philex Mining Corporation, Petitioner, vs. Commissioner of Internal Revenue, Court of AppealsDokumen3 halamanDigest-Philex Mining Corporation, Petitioner, vs. Commissioner of Internal Revenue, Court of AppealsRon Chris Lastimoza100% (2)

- Local Taxation Case Prohibits Double TaxationDokumen1 halamanLocal Taxation Case Prohibits Double TaxationFrancesca Isabel MontenegroBelum ada peringkat

- Manila Theater Tax UpheldDokumen1 halamanManila Theater Tax UpheldJSMendozaBelum ada peringkat

- 066 British American Tobacco Vs Camacho 585 Scra 36 DigestDokumen1 halaman066 British American Tobacco Vs Camacho 585 Scra 36 Digestjayinthelongrun100% (1)

- Chavez V Ongpin Case DigestDokumen1 halamanChavez V Ongpin Case DigestKatrine Olga Ramones-CastilloBelum ada peringkat

- National Development Company Vs CIRDokumen7 halamanNational Development Company Vs CIRIvy ZaldarriagaBelum ada peringkat

- CIR v. CA - Non-Profit Educational Institutions Not Subject to Contractor's TaxDokumen3 halamanCIR v. CA - Non-Profit Educational Institutions Not Subject to Contractor's TaxFox Briones Alfonso100% (1)

- Cir V. Ca G.R. NO. 124043 OCTOBER 14, 1998 Laws: Section 27 of National Internal Revenue Code (NIRC)Dokumen2 halamanCir V. Ca G.R. NO. 124043 OCTOBER 14, 1998 Laws: Section 27 of National Internal Revenue Code (NIRC)Vian O.100% (1)

- Juan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeDokumen2 halamanJuan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeLucifer MorningBelum ada peringkat

- Case DigestsDokumen209 halamanCase DigestsEloisa Katrina MadambaBelum ada peringkat

- Request of Atty. ZialcitaDokumen2 halamanRequest of Atty. ZialcitaAngelo Castillo100% (1)

- Tan V Del Rosario DigestDokumen2 halamanTan V Del Rosario DigestJA Quibz100% (1)

- Commissioner of Internal Revenue V EasternDokumen2 halamanCommissioner of Internal Revenue V EasternlchieSBelum ada peringkat

- Philippine Supreme Court rules income approach should be used over comparable sales to assess rent-controlled propertiesDokumen6 halamanPhilippine Supreme Court rules income approach should be used over comparable sales to assess rent-controlled propertiesMadelle PinedaBelum ada peringkat

- Philippine Acetylene Tax RulingDokumen12 halamanPhilippine Acetylene Tax RulingKeith BalbinBelum ada peringkat

- Progressive Development v. QC - 172 SCRA 629 (1989)Dokumen6 halamanProgressive Development v. QC - 172 SCRA 629 (1989)Nikki Estores GonzalesBelum ada peringkat

- CIR V American RubberDokumen2 halamanCIR V American RubberKath Leen0% (1)

- Maceda vs. Macaraig DigestDokumen2 halamanMaceda vs. Macaraig DigestElaine HonradeBelum ada peringkat

- 4 - CIR v. Pineda, 21 SCRA 105Dokumen4 halaman4 - CIR v. Pineda, 21 SCRA 105Lemuel Montes Jr.Belum ada peringkat

- Republic v. COCOFEDDokumen2 halamanRepublic v. COCOFEDmenforever100% (1)

- CIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Dokumen4 halamanCIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Kath Leen100% (1)

- Tax Case Digest - Commissioner of Internal Revenue Vs Algue Inc GR No L-28896Dokumen2 halamanTax Case Digest - Commissioner of Internal Revenue Vs Algue Inc GR No L-28896Anthony Pineda100% (1)

- G.R. No. L-28896 February 17, 1988 Case DiegstDokumen2 halamanG.R. No. L-28896 February 17, 1988 Case DiegstChiiBiiBelum ada peringkat

- CIR v Algue Ruling on P75k DeductionDokumen2 halamanCIR v Algue Ruling on P75k DeductionAbegaile LucianoBelum ada peringkat

- Supreme Court Upholds P75k Deduction for Algue IncDokumen2 halamanSupreme Court Upholds P75k Deduction for Algue IncJeffrey Medina100% (1)

- Commissioner of Internal Revenue vs. Algue IncDokumen8 halamanCommissioner of Internal Revenue vs. Algue IncBesprenPaoloSpiritfmLucenaBelum ada peringkat

- Aledro-Runa v. LEADC - Possession & LachesDokumen2 halamanAledro-Runa v. LEADC - Possession & LachesAaron AristonBelum ada peringkat

- Abigael An Epina-Dan v. Marco Dan - Req. of Psychological IncapacityDokumen2 halamanAbigael An Epina-Dan v. Marco Dan - Req. of Psychological IncapacityAaron AristonBelum ada peringkat

- Collector of Internal Revenue v. Club Filipino, Inc. de CebuDokumen2 halamanCollector of Internal Revenue v. Club Filipino, Inc. de CebuAaron AristonBelum ada peringkat

- C3h - 16 Go v. PeopleDokumen4 halamanC3h - 16 Go v. PeopleAaron AristonBelum ada peringkat

- Agtarap v. Agtarap GR No. 177099 & 177192 June 8, 2011 Nachura, J.: FactsDokumen4 halamanAgtarap v. Agtarap GR No. 177099 & 177192 June 8, 2011 Nachura, J.: FactsAaron AristonBelum ada peringkat

- C3f - 3 - People v. SabayocDokumen4 halamanC3f - 3 - People v. SabayocAaron AristonBelum ada peringkat

- Solidum Et Al vs. People - G.R. No. 192123 - March 10, 2014 - DIGEST PDFDokumen3 halamanSolidum Et Al vs. People - G.R. No. 192123 - March 10, 2014 - DIGEST PDFAaron AristonBelum ada peringkat

- Pryce Corporation v. China Banking CorporationDokumen2 halamanPryce Corporation v. China Banking CorporationAaron AristonBelum ada peringkat

- Philippine Bank Tax Refund PrescriptionDokumen2 halamanPhilippine Bank Tax Refund PrescriptionAaron Ariston100% (2)

- Carillo v. People - G.R. No. 86890 - January 21, 1994 - DIGESTDokumen2 halamanCarillo v. People - G.R. No. 86890 - January 21, 1994 - DIGESTAaron AristonBelum ada peringkat

- F1iv - 3 People v. CanilaoDokumen2 halamanF1iv - 3 People v. CanilaoAaron AristonBelum ada peringkat

- C3c - 13 - Note 2 - Neri v. Senate - Full CaseDokumen28 halamanC3c - 13 - Note 2 - Neri v. Senate - Full CaseAaron AristonBelum ada peringkat

- F1iii - 2 Gov - T of Hongkong v. OlaliaDokumen2 halamanF1iii - 2 Gov - T of Hongkong v. OlaliaAaron AristonBelum ada peringkat

- C3h-7 People v. Feliciano GR No. 196735 May 5, 2014 Leonen, J.Dokumen3 halamanC3h-7 People v. Feliciano GR No. 196735 May 5, 2014 Leonen, J.Aaron AristonBelum ada peringkat

- C3h2 - 1 People v. AbriolDokumen2 halamanC3h2 - 1 People v. AbriolAaron AristonBelum ada peringkat

- D2b - 6 MetroBank v. CADokumen2 halamanD2b - 6 MetroBank v. CAAaron AristonBelum ada peringkat

- D2b - 7 Delos Santos v. CoADokumen3 halamanD2b - 7 Delos Santos v. CoAAaron AristonBelum ada peringkat

- C3g - 2 People v. NardoDokumen2 halamanC3g - 2 People v. NardoAaron AristonBelum ada peringkat

- C3h - 1 Patula v. PeopleDokumen3 halamanC3h - 1 Patula v. PeopleAaron AristonBelum ada peringkat

- C3h - 4 People v. BernalDokumen2 halamanC3h - 4 People v. BernalAaron AristonBelum ada peringkat

- C3f - 2 - People v. UlitDokumen3 halamanC3f - 2 - People v. UlitAaron AristonBelum ada peringkat

- F1v - 1 Office of The Ombudsman v. ReyesDokumen2 halamanF1v - 1 Office of The Ombudsman v. ReyesAaron AristonBelum ada peringkat

- Entries in Official Records Sabili v. COMELEC & Florencio GR No. 193261 April 24, 2012 Sereno, J.: FactsDokumen2 halamanEntries in Official Records Sabili v. COMELEC & Florencio GR No. 193261 April 24, 2012 Sereno, J.: FactsAaron AristonBelum ada peringkat

- C3c - 12 - Note 1 - Senate v. Ermita Full CaseDokumen38 halamanC3c - 12 - Note 1 - Senate v. Ermita Full CaseAaron AristonBelum ada peringkat

- F1ii - 2 People v. PatentesDokumen3 halamanF1ii - 2 People v. PatentesAaron AristonBelum ada peringkat

- F1iv - 2 Dela Llana v. BiongDokumen3 halamanF1iv - 2 Dela Llana v. BiongAaron AristonBelum ada peringkat

- C3h - 5 Tison v. CaDokumen3 halamanC3h - 5 Tison v. CaAaron AristonBelum ada peringkat

- C3h2 - 4 People v. DurananDokumen2 halamanC3h2 - 4 People v. DurananAaron AristonBelum ada peringkat

- C3c - 8 - Chan v. ChanDokumen2 halamanC3c - 8 - Chan v. ChanAaron AristonBelum ada peringkat

- Calculate ROI, EVA, Residual Income for Company DivisionsDokumen3 halamanCalculate ROI, EVA, Residual Income for Company DivisionsDhiva Rianitha ManurungBelum ada peringkat

- Telus 26941340 2023 12 27Dokumen12 halamanTelus 26941340 2023 12 27kristyn.phillips26Belum ada peringkat

- Tax1 (T31920)Dokumen82 halamanTax1 (T31920)Charles TuazonBelum ada peringkat

- Guest Checkout GuideDokumen7 halamanGuest Checkout GuideechxBelum ada peringkat

- CT Ant - Approved Quotation Repiping of WaterlineDokumen1 halamanCT Ant - Approved Quotation Repiping of Waterlinejohn philip OcapanBelum ada peringkat

- Chapter 6Dokumen18 halamanChapter 6marieieiemBelum ada peringkat

- GST On Restaurants GST Regime: Rate of Bills Type of Restaurants Tax RateDokumen17 halamanGST On Restaurants GST Regime: Rate of Bills Type of Restaurants Tax RateshyamBelum ada peringkat

- Taxation of Individuals QuizzerDokumen37 halamanTaxation of Individuals QuizzerJc QuismundoBelum ada peringkat

- VAT problems with sales and purchase calculationsDokumen3 halamanVAT problems with sales and purchase calculationsReginald ValenciaBelum ada peringkat

- TRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSDokumen2 halamanTRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSNFNLBelum ada peringkat

- Corporate Tax PlanningDokumen85 halamanCorporate Tax PlanningLavi KambojBelum ada peringkat

- Income From Salary QUESTIONSDokumen20 halamanIncome From Salary QUESTIONSSiva SankariBelum ada peringkat

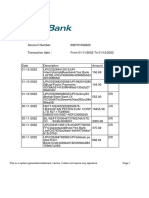

- Account Activity: Transaction Date Post Date Transaction Reference No. Description Debit Credit BalanceDokumen1 halamanAccount Activity: Transaction Date Post Date Transaction Reference No. Description Debit Credit BalanceAtiq_2909Belum ada peringkat

- Statement 1669899891666Dokumen6 halamanStatement 1669899891666Vetsa VivekBelum ada peringkat

- Statement of Axis Account No:917010040330266 For The Period (From: 09-06-2021 To: 08-09-2021)Dokumen13 halamanStatement of Axis Account No:917010040330266 For The Period (From: 09-06-2021 To: 08-09-2021)Saurabh DandriyalBelum ada peringkat

- Acct 2020 Excel Budget Problem FinalDokumen12 halamanAcct 2020 Excel Budget Problem Finalapi-301816205Belum ada peringkat

- List PDFDokumen4 halamanList PDFCarlos Rivero0% (1)

- RR No. 14-12 PDFDokumen10 halamanRR No. 14-12 PDFJerwin DaveBelum ada peringkat

- Proc No. 307-2002 Excise TaxDokumen15 halamanProc No. 307-2002 Excise Taxcsyena28225Belum ada peringkat

- SSGC Duplicate Bill20210123 090016Dokumen1 halamanSSGC Duplicate Bill20210123 090016Ghulam Baqir MazariBelum ada peringkat

- Tax 3Dokumen1 halamanTax 3Rakesh KumarBelum ada peringkat

- ANSYS Explicit STR (Autodyn Part 1) PDFDokumen3 halamanANSYS Explicit STR (Autodyn Part 1) PDFnguyenhBelum ada peringkat

- Constitutional Framework of GST in IndiaDokumen20 halamanConstitutional Framework of GST in IndiaABBelum ada peringkat

- Rahul 123456789Dokumen2 halamanRahul 123456789Rahul KumarBelum ada peringkat

- Assessment Types and Procedures in Indian Income TaxDokumen12 halamanAssessment Types and Procedures in Indian Income TaxTanvi JawdekarBelum ada peringkat

- Notas Localizacion ARg 1Dokumen2 halamanNotas Localizacion ARg 1Viviana E. EstradaBelum ada peringkat

- PLDT Vs Davao CityDokumen1 halamanPLDT Vs Davao CityLouie CascaraBelum ada peringkat

- CVTech Order MiniBaja 2014Dokumen1 halamanCVTech Order MiniBaja 2014Ammar HasanBelum ada peringkat

- InvoiceDokumen1 halamanInvoiceSohib PawaiBelum ada peringkat

- Free Water BillDokumen1 halamanFree Water BillDuurgaaBelum ada peringkat