Real Time Bond Prices

Diunggah oleh

ManjishtaKainthJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Real Time Bond Prices

Diunggah oleh

ManjishtaKainthHak Cipta:

Format Tersedia

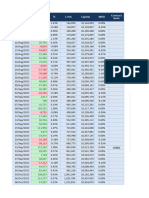

MATURITY-WISE DETAILS OF OUTRIGHT TRADES RECEIVED BY CCIL

AS ON 22-Nov-16

Price(Rs.) Yield(%)

ISIN No. Security Description Maturity Date Volume (Rs. Crs)

High Low Weighted High Low Weighted

Maturity

Average Average

Central Government Securities

Upto 3 Years

IN0020130038 7.28% GS 2019 03-Jun-19 1049.00 102.67 102.58 102.62 6.1631 6.1215 6.1424

IN0020110014 7.83% GOVT.STOCK2018 11-Apr-18 555.10 102.45 102.22 102.22 6.1275 5.9510 6.1239

IN0020010107 8.07% GS 2017 15-Jan-17 397.00 100.28 100.24 100.27 6.1826 5.9468 6.0034

IN0020090042 6.90% GOVT.STOCK 2019 13-Jul-19 65.00 101.90 101.80 101.85 6.1463 6.1052 6.1273

IN0020080068 6.05% GOVT.STOCK 2019 02-Feb-19 51.00 99.96 99.85 99.91 6.1213 6.0670 6.0915

IN0020120021 8.07% GOVT.STOCK 2017 03-Jul-17 50.00 101.15 101.15 101.15 6.1065 6.1065 6.1065

IN0020030097 5.64% GOVT. STOCK 2019 02-Jan-19 2.10 98.87 98.25 98.66 6.5381 6.2164 6.3271

IN0020020163 6.25% G.S 2018 02-Jan-18 1.95 100.20 99.75 100.03 6.4793 6.0532 6.2170

IN0020030063 5.69% GOVT. STOCK 2018 25-Sep-18 1.20 98.75 98.75 98.75 6.4157 6.4157 6.4157

IN0020030048 6.05% GOVT. STOCK 2019 12-Jun-19 1.00 99.00 99.00 99.00 6.4793 6.4793 6.4793

Sub Total : 2,173.35

3 Years upto 7 Years

IN0020140029 8.27% GS 2020 09-Jun-20 2488.80 106.52 106.35 106.43 6.2436 6.1914 6.2201

IN0020110022 7.80% GOVT.STOCK 2021 11-Apr-21 694.78 105.80 105.70 105.75 6.2891 6.2635 6.2773

IN0020020171 6.35% G.S 2020 02-Jan-20 691.60 100.47 99.70 100.35 6.4550 6.1785 6.2202

IN0020130012 7.16% GOVT STOCK 2023 20-May-23 569.19 104.25 103.80 104.13 6.4345 6.3517 6.3730

IN0020120054 8.12% Govt Stock 2020 10-Dec-20 385.00 106.63 106.50 106.55 6.2749 6.2395 6.2615

IN0020160050 6.84% GS 2022 19-Dec-22 207.00 102.75 102.59 102.67 6.3199 6.2883 6.3050

IN0020070028 8.08% GOVT.STOCK 2022 02-Aug-22 118.30 108.08 107.89 107.94 6.4009 6.3618 6.3916

IN0020100015 7.80% GOVT.STOCK 2020 03-May-20 100.00 104.84 104.84 104.84 6.2150 6.2150 6.2150

IN0020110030 8.79% GOVT.STOCK 2021 08-Nov-21 75.00 110.31 110.30 110.31 6.3356 6.3334 6.3341

IN0020060318 7.94% GOVT.STOCK 2021 24-May-21 50.00 106.51 106.25 106.46 6.3232 6.2585 6.2722

IN0020030014 6.30% GOVT. STOCK 2023 09-Apr-23 21.95 100.95 99.50 100.68 6.3949 6.1162 6.1672

IN0020060037 8.20% GOVT.STOCK 2022 15-Feb-22 8.00 108.65 108.00 108.32 6.3730 6.2323 6.3027

IN0020089028 7% FERT COS GOI SPL BOND 2022 10-Dec-22 7.20 101.45 101.20 101.33 6.7540 6.7034 6.7287

IN0020030055 6.17% GOVT. STOCK 2023 12-Jun-23 6.55 100.25 99.00 99.82 6.3581 6.1223 6.2038

IN0020120013 8.15% GOVT.STOCK 2022 11-Jun-22 5.50 107.85 107.75 107.84 6.4647 6.4439 6.4458

IN0020020072 8.35% G.S. 2022 14-May-22 0.11 108.50 108.50 108.50 6.4804 6.4804 6.4804

Sub Total : 5,428.98

22-Nov-16 6:23:57PM Page 1 of 9

MATURITY-WISE DETAILS OF OUTRIGHT TRADES RECEIVED BY CCIL

AS ON 22-Nov-16

Price(Rs.) Yield(%)

ISIN No. Security Description Maturity Date Volume (Rs. Crs)

High Low Weighted High Low Weighted

Maturity

Average Average

7 Years upto 10 Years

IN0020150093 7.59% GS 2026 11-Jan-26 27724.37 108.30 107.27 107.98 6.5194 6.3754 6.4202

IN0020160035 6.97% GS 2026 06-Sep-26 16424.50 105.10 104.30 104.75 6.3709 6.2632 6.3101

IN0020150010 7.68% GS 2023 15-Dec-23 6377.00 107.64 107.32 107.47 6.3752 6.3208 6.3488

IN0020150036 7.72% GS 2025 25-May-25 2820.00 108.28 107.55 108.00 6.5481 6.4403 6.4810

IN0020090034 7.35% GOVT.STOCK 2024 22-Jun-24 2247.00 105.75 105.15 105.56 6.4781 6.3802 6.4108

IN0020140045 8.40% GS 2024 28-Jul-24 685.00 111.10 110.93 111.02 6.5629 6.5362 6.5486

IN0020120047 8.20% GOVT.STOCK 2025 24-Sep-25 600.00 110.32 109.80 110.06 6.7096 6.6354 6.6718

IN0020089069 6.90% OIL MKTG COS GOI SB 2026 04-Feb-26 115.00 100.07 100.07 100.07 6.8875 6.8875 6.8875

IN0020130061 8.83% GOVT STOCK 2023 25-Nov-23 85.00 113.10 112.95 113.00 6.4993 6.4743 6.4910

IN0020120039 8.33% GOVT.STOCK 2026 09-Jul-26 30.09 111.79 111.00 111.61 6.7555 6.6504 6.6737

IN0020110048 9.15% GOVT.STOCK 2024 14-Nov-24 30.00 115.60 115.10 115.18 6.6767 6.6020 6.6643

IN0020079029 7.95% OIL MKTG COS GOI SB 2025 18-Jan-25 2.25 104.65 104.65 104.65 7.1840 7.1840 7.1840

Sub Total : 57,140.21

10 Years and above

IN0020160019 7.61% GS 2030 09-May-30 21772.26 109.95 109.27 109.61 6.5620 6.4898 6.5257

IN0020150069 7.59% GS 2029 20-Mar-29 14871.00 109.10 108.36 108.65 6.5873 6.5037 6.5539

IN0020150028 7.88% GS 2030 19-Mar-30 8055.40 111.44 110.70 111.15 6.6547 6.5761 6.6073

IN0020160068 7.06% GS 2046 10-Oct-46 559.85 103.55 102.60 103.17 6.8535 6.7805 6.8096

IN0020140060 8.15% GS 2026 24-Nov-26 320.00 111.10 110.80 110.98 6.6541 6.6153 6.6308

IN0020070069 8.28% GOVT.STOCK 2027 21-Sep-27 192.06 112.35 112.10 112.12 6.6895 6.6591 6.6873

IN0020140011 8.60% GS 2028 02-Jun-28 190.25 114.50 113.88 114.33 6.8394 6.7675 6.7877

IN0020140078 8.17% GS 2044 01-Dec-44 188.82 116.40 115.90 116.13 6.8822 6.8463 6.8656

IN0020040039 7.5% GOVT. STOCK 2034 10-Aug-34 185.03 107.40 106.55 107.07 6.8543 6.7748 6.8054

IN0020150051 7.73% GS 2034 19-Dec-34 171.00 109.80 109.45 109.64 6.8122 6.7804 6.7948

IN0020050012 7.40% GOVT.STOCK 2035 09-Sep-35 127.10 106.50 105.15 105.91 6.9052 6.7816 6.8349

IN0020020106 7.95% G.S 2032 28-Aug-32 123.25 111.39 109.15 111.10 6.9818 6.7624 6.7904

IN0020140052 8.24% GS 2033 10-Nov-33 115.00 114.40 113.90 114.16 6.8419 6.7964 6.8182

IN0020070036 8.26% GOVT.STOCK 2027 02-Aug-27 65.07 112.50 111.35 112.06 6.7504 6.6090 6.6629

IN0020080050 6.83% GOVT.STOCK 2039 19-Jan-39 61.00 101.70 100.53 101.15 6.7824 6.6808 6.7283

IN0020130053 9.20% GOVT. STOCK 2030 30-Sep-30 60.40 120.75 120.30 120.71 6.8993 6.8545 6.8584

IN0020150044 8.13% GS 2045 22-Jun-45 55.00 116.35 115.90 116.07 6.8536 6.8217 6.8414

22-Nov-16 6:23:57PM Page 2 of 9

MATURITY-WISE DETAILS OF OUTRIGHT TRADES RECEIVED BY CCIL

AS ON 22-Nov-16

Price(Rs.) Yield(%)

ISIN No. Security Description Maturity Date Volume (Rs. Crs)

High Low Weighted High Low Weighted

Maturity

Average Average

IN0020060086 8.28% GOVT.STOCK 2032 15-Feb-32 52.00 113.22 113.10 113.20 6.8768 6.8650 6.8668

IN0020110063 8.83% GOVT.STOCK 2041 12-Dec-41 30.00 122.25 122.25 122.25 6.9434 6.9434 6.9434

IN0020100031 8.30% GOVT.STOCK 2040 02-Jul-40 25.00 115.90 115.90 115.90 6.9222 6.9222 6.9222

IN0020060078 8.24% GOVT.STOCK 2027 15-Feb-27 5.00 111.90 111.90 111.90 6.6179 6.6179 6.6179

IN0020150077 7.72% GS 2055 26-Oct-55 5.00 111.95 111.95 111.95 6.8379 6.8379 6.8379

IN0020030022 6.13% GOVT. STOCK 2028 04-Jun-28 3.20 99.95 99.45 99.64 6.1971 6.1358 6.1734

IN0020020247 6.01% GOVT. STOCK 2028 25-Mar-28 0.70 97.25 96.60 96.93 6.4357 6.3527 6.3942

Sub Total : 47,233.39

Total for Central Government Securities : 111,975.93

22-Nov-16 6:23:57PM Page 3 of 9

MATURITY-WISE DETAILS OF OUTRIGHT TRADES RECEIVED BY CCIL

AS ON 22-Nov-16

Price(Rs.) Yield(%)

ISIN No. Security Description Maturity Date Volume (Rs. Crs)

High Low Weighted High Low Weighted

Maturity

Average Average

State Government Securities

Upto 3 Years

IN3420090042 7.96% W.Bengal GS 2019 08-Jul-19 25.00 103.46 103.46 103.46 6.5000 6.5000 6.5000

IN3320150045 8.31 UP SPL BOND 2019 04-Oct-19 10.00 103.93 103.86 103.90 6.7986 6.7720 6.7853

IN1020070026 8.45% ANDHRA GS 2017 20-Jun-17 0.43 100.75 100.75 100.75 7.0790 7.0790 7.0790

Sub Total : 35.43

3 Years upto 7 Years

IN2020110093 8.62% Kerala GS 2021 07-Sep-21 50.00 107.70 107.70 107.70 6.7100 6.7097 6.7099

IN2220110109 8.76% MAHARASHTRA GS 2022 22-Feb-22 40.00 108.50 108.48 108.49 6.8063 6.8025 6.8046

IN1320120034 8.97% BIHAR GS 2022 21-Nov-22 20.00 110.25 110.25 110.25 6.8558 6.8558 6.8558

IN2020110077 8.70% Kerala GS 2022 25-Jan-22 20.00 108.13 108.12 108.13 6.8068 6.8052 6.8060

IN3420110162 8.66% W.Bengal GS 2022 25-Jan-22 20.00 107.96 107.95 107.96 6.8064 6.8047 6.8056

IN1020130010 8.25% Andhra Pradesh SDL 2023 25-Apr-23 15.00 106.63 106.55 106.58 6.9658 6.9500 6.9599

IN1520160145 6.68% GUJARAT SDL 2022 23-Nov-22 12.00 100.60 100.04 100.27 6.6718 6.5574 6.6241

IN3120120073 8.86% Tamilnadu GS 2022 03-Oct-22 10.00 109.75 109.75 109.75 6.8115 6.8115 6.8115

IN1020130085 9.38% ANDHRA PR SDL 2023 23-Oct-23 10.00 112.82 112.82 112.82 7.0074 7.0074 7.0074

IN3120120057 8.92% Tamilnadu GS 2022 05-Sep-22 10.00 109.83 109.83 109.83 6.8301 6.8301 6.8301

IN1620120072 8.86% Haryana GS 2022 03-Oct-22 10.00 109.65 109.35 109.50 6.8908 6.8313 6.8611

IN2020120027 9.15% Kerala GS 2022 23-May-22 9.00 109.82 109.55 109.64 7.0266 6.9699 7.0070

IN3420120096 8.89% WEST BENGAL SDL 2022 07-Nov-22 7.00 109.92 109.90 109.91 6.8372 6.8343 6.8358

IN1020160389 6.63% ANDHRA SDL 2021 23-Nov-21 1.00 100.13 100.13 100.13 6.5991 6.5991 6.5991

Sub Total : 234.00

7 Years upto 10 Years

IN2220160104 7.39% MAHARASHTRA SDL 2026 09-Nov-26 450.00 104.15 103.78 103.84 6.8600 6.8088 6.8510

IN2920150348 8.39% RAJASTHAN UDAY BOND 2025 15-Mar-25 413.78 107.91 107.91 107.91 7.1100 7.1100 7.1100

IN1620150129 8.38% HARYANA SDL 2026 27-Jan-26 200.00 109.64 109.48 109.56 6.9624 6.9399 6.9512

IN2220150014 8.25% MAHARASHTRA SDL 2025 13-May-25 130.00 108.22 108.22 108.22 6.9500 6.9500 6.9500

IN2220150089 8.23% MAHARASHTRA SDL 2025 09-Sep-25 130.00 108.30 108.30 108.30 6.9500 6.9500 6.9500

IN1620150186 8.21% HARYANA UDAY BOND 2026 31-Mar-26 125.00 107.55 107.48 107.51 7.1000 7.0898 7.0959

IN2920160123 8.19% RAJASTHAN UDAY BOND 2026 23-Jun-26 110.00 108.10 107.17 107.62 7.1425 7.0135 7.0798

IN1520140105 8.05% GUJARAT SDL 2025 25-Feb-25 100.00 107.22 107.13 107.17 6.9000 6.8861 6.8944

22-Nov-16 6:23:57PM Page 4 of 9

MATURITY-WISE DETAILS OF OUTRIGHT TRADES RECEIVED BY CCIL

AS ON 22-Nov-16

Price(Rs.) Yield(%)

ISIN No. Security Description Maturity Date Volume (Rs. Crs)

High Low Weighted High Low Weighted

Maturity

Average Average

IN3320150581 8.30% UP UDAY BOND 2026 21-Mar-26 93.84 108.00 108.00 108.00 7.1100 7.1100 7.1100

IN2920150355 8.39% RAJASTHAN UDAY BOND 2026 15-Mar-26 80.97 108.77 108.59 108.59 7.1100 7.0850 7.1097

IN2020140140 8.06% KERALA SDL 2025 11-Feb-25 70.00 107.17 107.10 107.13 6.9100 6.8999 6.9050

IN2920150223 8.3% RAJASTHAN SDL 2026 13-Jan-26 60.00 109.50 109.12 109.19 6.9346 6.8803 6.9236

IN1920140101 8.05% KARNATAKA SDL 2025 25-Feb-25 60.00 107.13 107.13 107.13 6.9000 6.9000 6.9000

IN3320150573 8.52% UP UDAY BOND 2025 21-Mar-25 50.00 108.73 108.73 108.73 7.1100 7.1100 7.1100

IN1520150104 8.27% GUJARAT SDL 2026 13-Jan-26 50.00 109.01 108.65 108.88 6.9721 6.9211 6.9395

IN1320150056 8.6% BIHAR SDL 2026 09-Mar-26 50.00 111.50 111.07 111.29 6.9599 6.9007 6.9303

IN2020140074 9.07% KERALA SDL 2024 27-Aug-24 50.00 112.10 112.10 112.10 7.0181 7.0181 7.0181

IN3320150698 8.48% UP UDAY BOND 2025 29-Mar-25 50.00 108.37 107.80 108.01 7.2175 7.1300 7.1845

IN3320150706 8.21% UP UDAY BOND 2026 29-Mar-26 50.00 107.41 107.00 107.20 7.1676 7.1100 7.1388

IN1520160087 7.6% GUJARAT SDL 2026 09-Aug-26 50.00 105.10 105.10 105.10 6.8700 6.8700 6.8700

IN2220150055 8.28% MAHARASHTRA SDL 2025 29-Jul-25 50.00 108.89 108.85 108.87 6.9054 6.9000 6.9031

IN3320160267 7.41% UTTARPRADESH SDL 2026 09-Nov-26 40.00 103.92 103.85 103.88 6.8700 6.8597 6.8649

IN2920150454 8.21% RAJASTHAN UDAY BOND 2026 31-Mar-26 36.30 107.40 107.40 107.40 7.1110 7.1110 7.1110

IN2220160070 7.16% MAHARASHTRA SDL 2026 28-Sep-26 25.99 102.41 101.86 102.24 6.8949 6.8182 6.8425

IN1920160018 7.14% KARNATAKA SDL 2026 13-Oct-26 25.00 102.15 101.95 102.08 6.8637 6.8359 6.8462

IN2020130141 9.41% KERALA SDL 2024 30-Jan-24 25.00 113.50 113.35 113.47 7.0101 6.9852 6.9902

IN3620160058 7.18% UTTARAKHAND SDL 2026 13-Oct-26 20.00 102.10 101.43 101.77 6.9759 6.8823 6.9291

IN3320160093 8.32% UP UDAY BOND 2025 02-Jun-25 20.00 107.70 107.68 107.69 7.1030 7.1000 7.1015

IN1020150075 7.98% ANDHRA SDL 2025 14-Oct-25 20.00 107.05 106.70 106.88 6.9552 6.9041 6.9297

IN1020140076 8.46% ANDHRA PRADESH SDL 2024 26-Nov-24 20.00 109.80 109.79 109.80 6.8508 6.8496 6.8502

IN3320160028 8.03% UTTARPRADESH SDL 2026 11-May-26 20.00 107.40 107.39 107.40 6.9506 6.9495 6.9501

IN1320150031 8.54% BIHAR SDL 2026 10-Feb-26 15.00 110.70 110.70 110.70 6.9457 6.9457 6.9457

IN3320160101 8.14% UP UDAY BOND 2026 02-Jun-26 15.00 107.04 107.04 107.04 7.1102 7.1102 7.1102

IN3120150211 8.53% TAMILNADU SDL 2026 09-Mar-26 15.00 111.03 111.03 111.03 6.9001 6.9001 6.9001

IN1920140077 8.24% KARNATAKA SDL 2024 24-Dec-24 15.00 108.00 107.85 107.90 6.9529 6.9295 6.9446

IN1920160034 7.37% KARNATAKA SDL 2026 09-Nov-26 10.00 103.80 103.70 103.75 6.8508 6.8371 6.8440

IN3620160074 7.42% UTTARAKHAND SDL 2026 09-Nov-26 10.00 104.06 103.99 104.03 6.8600 6.8500 6.8550

IN2220150147 8.21% MAHARASHTRA SDL 2025 09-Dec-25 10.00 108.70 108.20 108.45 6.9716 6.9001 6.9359

IN1020160033 7.85% ANDHRA SDL 2026 13-Jul-26 10.00 106.67 106.67 106.67 6.8900 6.8900 6.8900

IN4520160107 7.16% TELANGANA SDL 2026 13-Oct-26 10.00 102.40 102.35 102.38 6.8278 6.8209 6.8244

22-Nov-16 6:23:57PM Page 5 of 9

MATURITY-WISE DETAILS OF OUTRIGHT TRADES RECEIVED BY CCIL

AS ON 22-Nov-16

Price(Rs.) Yield(%)

ISIN No. Security Description Maturity Date Volume (Rs. Crs)

High Low Weighted High Low Weighted

Maturity

Average Average

IN2220160088 7.15% MAHARASHTRA SDL 2026 13-Oct-26 10.00 102.20 102.07 102.14 6.8568 6.8388 6.8478

IN2220160096 7.22% MAHARASHTRA SDL 2026 26-Oct-26 9.00 102.92 102.28 102.50 6.8979 6.8094 6.8675

IN2020160072 7.61% KERALA SDL 2026 09-Aug-26 9.00 105.09 104.01 104.72 7.0309 6.8805 6.9316

IN2220160039 7.84% MAHARASHTRA SDL 2026 13-Jul-26 8.50 106.47 106.02 106.19 6.9700 6.9076 6.9467

IN1520150062 7.96% GUJARAT SDL 2025 14-Oct-25 8.00 106.91 106.90 106.91 6.9068 6.9053 6.9061

IN1520140097 8.07% GUJARAT SDL 2025 11-Feb-25 7.00 106.97 106.50 106.89 7.0130 6.9400 6.9526

IN3120160095 7.58% TAMILNADU SDL 2026 24-Aug-26 5.04 104.75 103.30 103.92 7.1029 6.9005 7.0159

IN3120160137 7.39% TAMILNADU SDL 2026 09-Nov-26 5.00 103.85 103.85 103.85 6.8501 6.8501 6.8501

IN2120160030 7.38% MADHYAPRADESH SDL 2026 14-Sep-26 5.00 103.72 103.30 103.55 6.9091 6.8508 6.8744

IN2920150256 8.65% RAJASTHAN SDL 2026 24-Feb-26 5.00 111.55 111.55 111.55 6.9351 6.9351 6.9351

IN1620150178 8.21% HARYANA UDAY BOND 2025 31-Mar-25 2.28 107.15 106.89 107.06 7.1000 7.0600 7.0737

IN1620160193 7.18% HARYANA SDL 2026 28-Sep-26 2.20 102.55 102.55 102.55 6.8184 6.8184 6.8184

IN3120160038 8.01% TAMILNADU SDL 2026 11-May-26 2.00 107.33 106.75 107.04 7.0213 6.9402 6.9808

IN1520160061 7.83% GUJARAT SDL 2026 13-Jul-26 0.50 106.52 106.52 106.52 6.8911 6.8911 6.8911

IN2920150447 8.21% RAJASTHAN UDAY BOND 2025 31-Mar-25 0.25 106.58 106.58 106.58 7.1478 7.1478 7.1478

IN2120160071 7.4% MADHYAPRADESH SDL 2026 09-Nov-26 0.21 103.60 103.60 103.60 6.8938 6.8938 6.8938

IN3320150342 8.23% UTTARPRADESH SDL 2025 09-Dec-25 0.10 106.50 106.50 106.50 7.2372 7.2372 7.2372

Sub Total : 2,864.96

10 Years and above

IN1320160113 6.89% BIHAR SDL 2026 23-Nov-26 632.83 100.50 100.00 100.24 6.8900 6.8202 6.8565

IN3320160275 6.85% UTTARPRADESH SDL 2026 23-Nov-26 388.53 100.16 100.00 100.10 6.8500 6.8284 6.8354

IN2720160067 6.87% ODISHA SDL 2031 23-Nov-31 327.67 100.09 100.00 100.05 6.8700 6.8603 6.8641

IN3120160145 6.84% TAMILNADU SDL 2026 23-Nov-26 246.10 100.22 100.00 100.12 6.8400 6.8093 6.8235

IN2220160112 6.82% MAHARSHTRA SDL 2026 23-Nov-26 116.28 100.10 100.00 100.05 6.8200 6.8061 6.8125

IN1620160235 6.86% HARYANA SDL 2026 23-Nov-26 105.00 100.29 100.07 100.18 6.8502 6.8195 6.8348

IN1320160063 7.68% BIHAR UDAY BOND 2027 07-Sep-27 90.00 104.60 104.15 104.33 7.1200 7.0615 7.0972

IN3320160135 8.35% UP UDAY BOND 2029 02-Jun-29 80.00 109.47 109.47 109.47 7.1900 7.1900 7.1900

IN3820160023 6.87% PUDUCHERRY SDL 2031 23-Nov-31 70.72 100.00 100.00 100.00 6.8700 6.8700 6.8700

IN3720160032 6.9% JHARKHAND SDL 2026 23-Nov-26 65.00 100.50 100.36 100.44 6.8497 6.8302 6.8384

IN2020160114 6.85% KERALA SDL 2026 23-Nov-26 49.98 100.14 100.00 100.05 6.8500 6.8304 6.8431

IN2820150364 8.71% PUNJAB UDAY BOND 2031 31-Mar-31 40.52 113.84 113.65 113.80 7.1698 7.1500 7.1545

IN3320150631 8.77% UP UDAY BOND 2031 21-Mar-31 40.00 114.55 114.41 114.46 7.1450 7.1304 7.1395

22-Nov-16 6:23:57PM Page 6 of 9

MATURITY-WISE DETAILS OF OUTRIGHT TRADES RECEIVED BY CCIL

AS ON 22-Nov-16

Price(Rs.) Yield(%)

ISIN No. Security Description Maturity Date Volume (Rs. Crs)

High Low Weighted High Low Weighted

Maturity

Average Average

IN3320150623 8.62% UP UDAY BOND 2030 21-Mar-30 35.50 112.39 112.30 112.38 7.1700 7.1600 7.1615

IN1920160042 6.83% KARNATAKA SDL 2026 23-Nov-26 34.00 100.12 100.08 100.11 6.8188 6.8133 6.8145

IN3320150607 8.71% UP UDAY BOND 2028 21-Mar-28 31.24 112.12 111.30 111.58 7.2296 7.1300 7.1960

IN1020160108 7.27% ANDHRA SDL 2035 13-Oct-35 30.00 103.50 101.60 103.13 7.1137 6.9338 6.9685

IN3320150615 8.45% UP UDAY BOND 2029 21-Mar-29 8.60 110.66 110.27 110.50 7.1786 7.1336 7.1524

IN3320150714 8.42% UP UDAY BOND 2027 29-Mar-27 6.25 109.24 109.10 109.11 7.1581 7.1398 7.1563

IN3320160127 8.49% UP UDAY BOND 2028 02-Jun-28 5.00 110.56 110.56 110.56 7.1304 7.1304 7.1304

IN3420160100 6.88% WESTBENGAL SDL 2026 23-Nov-26 5.00 100.26 100.26 100.26 6.8444 6.8444 6.8444

IN2820150349 8.47% PUNJAB UDAY BOND 2029 31-Mar-29 0.80 110.17 110.17 110.17 7.2106 7.2106 7.2106

IN3320140103 8.61 UP SPECIAL BOND 2028 04-Oct-28 0.30 110.80 110.80 110.80 7.2363 7.2363 7.2363

Sub Total : 2,409.32

Total for State Government Securities : 5,543.71

22-Nov-16 6:23:57PM Page 7 of 9

MATURITY-WISE DETAILS OF OUTRIGHT TRADES RECEIVED BY CCIL

AS ON 22-Nov-16

Price(Rs.) Yield(%)

ISIN No. Security Description Maturity Date Volume (Rs. Crs)

High Low Weighted High Low Weighted

Maturity

Average Average

Treasury Bills

Upto 1 Year

IN002016X215 24/11/2016 MATURING 91 DTB 24-Nov-16 3745.00 99.98 99.98 99.98 6.2700 5.8500 6.2518

IN002016X231 08/12/2016 MATURING 91 DTB 08-Dec-16 786.50 99.76 99.76 99.76 5.9300 5.8500 5.9111

IN002016X330 16/02/2017 MATURING 91 DTB 16-Feb-17 583.23 98.65 98.64 98.65 5.9000 5.8950 5.8950

IN002016Z137 28/09/2017 MATURING 364 DTB 28-Sep-17 225.00 95.22 95.22 95.22 5.9350 5.9300 5.9344

IN002016Z111 31/08/2017 MATURING 364 DTB 31-Aug-17 225.00 95.65 95.63 95.64 5.9400 5.9100 5.9189

IN002016Z020 27/04/2017 MATURING 364 DTB 27-Apr-17 220.00 97.56 97.55 97.55 5.9100 5.9000 5.9091

IN002016Y064 15/12/2016 MATURING 182 DTB 15-Dec-16 210.00 99.65 99.65 99.65 5.9100 5.9000 5.9095

IN002016Y098 26/01/2017 MATURING 182 DTB 26-Jan-17 200.00 98.98 98.98 98.98 5.9000 5.9000 5.9000

IN002015Z261 16/03/2017 MATURING 364DTB 16-Mar-17 158.50 98.22 98.21 98.21 5.9000 5.8400 5.8991

IN002016X314 02/02/2017 MATURING 91 DTB 02-Feb-17 111.00 98.89 98.87 98.87 5.9000 5.7799 5.8950

IN002016X249 15/12/2016 MATURING 91 DTB 15-Dec-16 101.50 99.65 99.65 99.65 5.8500 5.8500 5.8500

IN002015Z188 24/11/2016 MATURING 364DTB 24-Nov-16 50.00 99.98 99.98 99.98 6.3000 6.1700 6.2740

IN002016Z129 14/09/2017 MATURING 364 DTB 14-Sep-17 45.50 95.45 95.42 95.42 5.9400 5.9000 5.9396

IN002016X256 22/12/2016 MATURING 91DTB 22-Dec-16 30.00 99.53 99.53 99.53 5.9000 5.9000 5.9000

IN002016Y155 20/04/2017 MATURING 182 DTB 20-Apr-17 20.00 97.66 97.66 97.66 5.9200 5.9200 5.9200

IN002016Z061 22/06/2017 MATURING 364 DTB 22-Jun-17 20.00 96.70 96.70 96.70 5.9000 5.9000 5.9000

IN002016Y122 09/03/2017 MATURING 182 DTB 09-Mar-17 18.00 98.32 98.32 98.32 5.8900 5.8798 5.8883

IN002016X298 19/01/2017 MATURING 91 DTB 19-Jan-17 15.00 99.08 99.08 99.08 5.9700 5.9700 5.9700

IN002015Z238 02/02/2017 MATURING 364 DTB 02-Feb-17 11.00 98.87 98.87 98.87 5.9000 5.8500 5.8727

IN002015Z220 19/01/2017 MATURING 364 DTB 19-Jan-17 10.00 99.08 99.08 99.08 5.9700 5.9700 5.9700

IN002016X280 12/01/2017 MATURING 91 DTB 12-Jan-17 7.50 99.20 99.20 99.20 5.9000 5.8700 5.8900

IN002015Z212 05/01/2017 MATURING 364 DTB 05-Jan-17 5.00 99.31 99.31 99.31 5.9400 5.9400 5.9400

IN002016Y114 23/02/2017 MATUIRNG 182 DTB 23-Feb-17 5.00 98.53 98.53 98.53 5.9007 5.9007 5.9007

IN002016Y072 29/12/2016 MATURING 182 DTB 29-Dec-16 5.00 99.43 99.43 99.43 5.8500 5.8500 5.8500

IN002016X264 29/12/2016 MATURING 91 DTB 29-Dec-16 4.50 99.43 99.43 99.43 5.8502 5.8500 5.8501

IN002016X322 09/02/2017 MATURING 91DTB 09-Feb-17 2.00 98.78 98.78 98.78 5.8000 5.8000 5.8000

IN002016Y080 12/01/2017 MATURING 182 DTB 12-Jan-17 2.00 99.21 99.21 99.21 5.8500 5.8500 5.8500

IN002015Z196 08/12/2016 MATURING 364 DTB 08-Dec-16 1.00 99.76 99.76 99.76 5.8800 5.8800 5.8800

IN002016X306 26/01/2017 MATURING 91 DTB 26-Jan-17 0.50 98.99 98.99 98.99 5.7997 5.7997 5.7997

22-Nov-16 6:23:57PM Page 8 of 9

MATURITY-WISE DETAILS OF OUTRIGHT TRADES RECEIVED BY CCIL

AS ON 22-Nov-16

Price(Rs.) Yield(%)

ISIN No. Security Description Maturity Date Volume (Rs. Crs)

High Low Weighted High Low Weighted

Maturity

Average Average

Total for Treasury Bills : 6,817.73

Grand Total of Outright trades in Central/State Govervment Securities and 124,337.37

Treasury Bills across various maturities.:

22-Nov-16 6:23:57PM Page 9 of 9

Anda mungkin juga menyukai

- Chapter 17 Flashcards - QuizletDokumen34 halamanChapter 17 Flashcards - QuizletAlucard77777Belum ada peringkat

- HDFC Bank LTD Repayment Schedule: Date: 10/08/2021Dokumen3 halamanHDFC Bank LTD Repayment Schedule: Date: 10/08/2021Prabhu SpBelum ada peringkat

- Liquidity RiskDokumen24 halamanLiquidity RiskTing YangBelum ada peringkat

- The Clearing Corporation of India Ltd Settlement ReportDokumen5 halamanThe Clearing Corporation of India Ltd Settlement ReportRohit AggarwalBelum ada peringkat

- Outstanding Stock 2021-22 List of Government of India Securities Outstanding As On February 08, 2022Dokumen4 halamanOutstanding Stock 2021-22 List of Government of India Securities Outstanding As On February 08, 2022Alpha TraderBelum ada peringkat

- Fimmda ValuationDokumen8 halamanFimmda ValuationAvinashBelum ada peringkat

- List of G-Secs As On 31.03.2023Dokumen6 halamanList of G-Secs As On 31.03.2023TRISHNA BILLAVABelum ada peringkat

- BONDS RITEL - Harga BRIefx - 2022-09-23Dokumen1 halamanBONDS RITEL - Harga BRIefx - 2022-09-23upinBelum ada peringkat

- Phu Nhuan Jewelry Price History Over 5 YearsDokumen24 halamanPhu Nhuan Jewelry Price History Over 5 YearsPhuong NguyenBelum ada peringkat

- RPT Schedule ExportDokumen1 halamanRPT Schedule ExportFernandoFredyBelum ada peringkat

- FBIL GSec Prices Yields IndiaDokumen212 halamanFBIL GSec Prices Yields IndiaRanjana JainBelum ada peringkat

- Price History - 2001-2020Dokumen61 halamanPrice History - 2001-2020Sebi SabauBelum ada peringkat

- Aaa & GsecDokumen3 halamanAaa & GsecPravin SinghBelum ada peringkat

- Sale & Purchase Detail Neel Ent-21-22Dokumen3 halamanSale & Purchase Detail Neel Ent-21-22Neel GuptaBelum ada peringkat

- STOCK MARKET CLOSING PRICESDokumen34 halamanSTOCK MARKET CLOSING PRICESEdgar Francisco Hernandez PeñuelasBelum ada peringkat

- Tableau 16 Radiolomed 2022Dokumen6 halamanTableau 16 Radiolomed 2022soumaya azzaziBelum ada peringkat

- AsdarDokumen2 halamanAsdarEko VanderBelum ada peringkat

- Trans History 1Dokumen7 halamanTrans History 1Krown FundsBelum ada peringkat

- Government bond yields and maturity datesDokumen4 halamanGovernment bond yields and maturity datesSsenkandwa JovanBelum ada peringkat

- Piano Di AmmortamentoDokumen2 halamanPiano Di AmmortamentoAnnunziata DE STASIBelum ada peringkat

- TBills As at 20th Jan 2022Dokumen4 halamanTBills As at 20th Jan 2022Ssenkandwa JovanBelum ada peringkat

- Ngày HBC MWG Return (HBC) Return (MWG) Portfolio ReturnDokumen10 halamanNgày HBC MWG Return (HBC) Return (MWG) Portfolio ReturnLinh LinhBelum ada peringkat

- USDA Export Sales Report - Current and Recent HistoryDokumen2 halamanUSDA Export Sales Report - Current and Recent HistoryPhương NguyễnBelum ada peringkat

- 28062019Dokumen173 halaman28062019ParehjuiBelum ada peringkat

- VaR Calculation ModelDokumen9 halamanVaR Calculation ModelatpugajoopBelum ada peringkat

- Porfolio AnalysisDokumen3 halamanPorfolio AnalysisTRISHNA BILLAVABelum ada peringkat

- KCBC Ifb-Bond Calc - 16feb2022Dokumen55 halamanKCBC Ifb-Bond Calc - 16feb2022Edel AchiengBelum ada peringkat

- TBills As at 17th Jan 2022Dokumen4 halamanTBills As at 17th Jan 2022Ssenkandwa JovanBelum ada peringkat

- Trading DairyDokumen16 halamanTrading DairyhellocproBelum ada peringkat

- Share PricesDokumen36 halamanShare PricesRishab BansalBelum ada peringkat

- Loan Comparison: Short Term vs Long TermDokumen10 halamanLoan Comparison: Short Term vs Long TermAhmed AwaisBelum ada peringkat

- SE 24 Tahun 2017Dokumen52 halamanSE 24 Tahun 2017yukidiwiBelum ada peringkat

- Math 1Dokumen16 halamanMath 1สิรภพ นวลนิ่มBelum ada peringkat

- Silver Futures Historical Prices - Investing - Com IndiaDokumen5 halamanSilver Futures Historical Prices - Investing - Com IndiaArundhathi MBelum ada peringkat

- T. Bills Auction Profile: Rs. in MillionDokumen1 halamanT. Bills Auction Profile: Rs. in MillionhitagentBelum ada peringkat

- Dinda Puspita N - 213209039 - Resiko Dan ReturnDokumen9 halamanDinda Puspita N - 213209039 - Resiko Dan ReturnDindaBelum ada peringkat

- PRE22020444Dokumen2 halamanPRE22020444Ashish MishraBelum ada peringkat

- Mankeu (1) SellaDokumen11 halamanMankeu (1) SellatarissaBelum ada peringkat

- Stock Market Close Prices and RatesDokumen11 halamanStock Market Close Prices and Ratestarissa YusrianiBelum ada peringkat

- Stock Tracker-24.11.2020Dokumen6 halamanStock Tracker-24.11.2020Dinaj AttanayakaBelum ada peringkat

- SBI Analysis Reveals Bank's Dominance in IndiaDokumen16 halamanSBI Analysis Reveals Bank's Dominance in IndiaFascinating ShashiBelum ada peringkat

- Clix REPAYMENT - SCHEDULE - REPORT AC2019091353787Dokumen1 halamanClix REPAYMENT - SCHEDULE - REPORT AC2019091353787Manohar ChaudharyBelum ada peringkat

- BukaDokumen3 halamanBukamohsadam774Belum ada peringkat

- Kawanihan NG Ingatang-Yaman: Press ReleaseDokumen2 halamanKawanihan NG Ingatang-Yaman: Press ReleasejessBelum ada peringkat

- Repayment Schedule: Instl NumDokumen2 halamanRepayment Schedule: Instl NumSyed Shahnawaz NabiBelum ada peringkat

- Fecha Enka Argos Monomeros Rentabilidad S&P 500 ( GSPC)Dokumen14 halamanFecha Enka Argos Monomeros Rentabilidad S&P 500 ( GSPC)angelica peñaBelum ada peringkat

- Aluminum 360Dokumen12 halamanAluminum 360SaurabhBelum ada peringkat

- CFDokumen21 halamanCFaditya chandBelum ada peringkat

- Franklin India Blue mutual fund daily NAV and returnsDokumen84 halamanFranklin India Blue mutual fund daily NAV and returnsMilan MeherBelum ada peringkat

- Kelompok 7Dokumen24 halamanKelompok 7Dany RachmandanyBelum ada peringkat

- Taksit Sayısı Tarih Taksit Anapara Faiz KKDF BSMV Kalan Ana paraDokumen1 halamanTaksit Sayısı Tarih Taksit Anapara Faiz KKDF BSMV Kalan Ana paraPasha BlackAxe TurkOgameBelum ada peringkat

- MCD Historical Data ExcelDokumen7 halamanMCD Historical Data Excelakm30001Belum ada peringkat

- WACC Tvs Mototrs - Aditya Chand - 2211020Dokumen38 halamanWACC Tvs Mototrs - Aditya Chand - 2211020aditya chandBelum ada peringkat

- Tỉ Giá VNDUSD Hằng Tháng (2019 - 2023)Dokumen1 halamanTỉ Giá VNDUSD Hằng Tháng (2019 - 2023)justinbui85Belum ada peringkat

- ICICI Prudential MFDokumen2 halamanICICI Prudential MFDOLLY KHAPREBelum ada peringkat

- Group 5 ExcelDokumen16 halamanGroup 5 ExcelNa HàBelum ada peringkat

- Papel IibbDokumen1 halamanPapel IibbPamela IbañezBelum ada peringkat

- SAMEKSDokumen3 halamanSAMEKSsayden tarımBelum ada peringkat

- Loan Repayment Schedule: Customer DetailsDokumen3 halamanLoan Repayment Schedule: Customer DetailsJasbind yadavBelum ada peringkat

- CGS ActforAdditionalPointsDokumen1 halamanCGS ActforAdditionalPointsxander clyde cagasBelum ada peringkat

- FD Vs Debt FundDokumen4 halamanFD Vs Debt FundCharan RoyBelum ada peringkat

- Bond ValuationDokumen78 halamanBond ValuationManjishtaKainthBelum ada peringkat

- ReportDokumen2 halamanReportManjishtaKainthBelum ada peringkat

- Bridging Industry and Academia at HR Summit 2019Dokumen1 halamanBridging Industry and Academia at HR Summit 2019ManjishtaKainthBelum ada peringkat

- Event Date: 22 Venue: Target Audience: Students and Faculty MembersDokumen1 halamanEvent Date: 22 Venue: Target Audience: Students and Faculty MembersManjishtaKainthBelum ada peringkat

- Chernobyl SummaryDokumen1 halamanChernobyl SummaryManjishtaKainthBelum ada peringkat

- Comparing SBI Pehla Kadam & Pehli Udaan, HDFC Kids Advantage Account & Junior Savings Account On 7PDokumen3 halamanComparing SBI Pehla Kadam & Pehli Udaan, HDFC Kids Advantage Account & Junior Savings Account On 7PManjishtaKainthBelum ada peringkat

- Bank or Market Based EconomyDokumen1 halamanBank or Market Based EconomyManjishtaKainthBelum ada peringkat

- Project Report On STUDY OF RISK PERCEPTIDokumen58 halamanProject Report On STUDY OF RISK PERCEPTIGanesh TiwariBelum ada peringkat

- Good Hope PLC: Annual ReportDokumen11 halamanGood Hope PLC: Annual ReporthvalolaBelum ada peringkat

- Introduction To Financial Management Managerial AccountingDokumen10 halamanIntroduction To Financial Management Managerial AccountingAvisha JainBelum ada peringkat

- The Collapse of Continental IllinoisDokumen7 halamanThe Collapse of Continental IllinoisginaBelum ada peringkat

- 4Q2022 ExternalCodeSets v1Dokumen266 halaman4Q2022 ExternalCodeSets v1yikega7894Belum ada peringkat

- Difference Between Private Company and Public CompanyDokumen7 halamanDifference Between Private Company and Public CompanyAtif KhanBelum ada peringkat

- CMO BofA 07-24-2023 AdaDokumen8 halamanCMO BofA 07-24-2023 AdaAlejandroBelum ada peringkat

- CARE Ratings LimitedDokumen1 halamanCARE Ratings LimitedDasari PrabodhBelum ada peringkat

- FINMARKETS - Prelim ExamDokumen7 halamanFINMARKETS - Prelim ExamArmalyn CangqueBelum ada peringkat

- To Study Financial Performance Analysis of Lakshmi Vilas BankDokumen12 halamanTo Study Financial Performance Analysis of Lakshmi Vilas BankVel MuruganBelum ada peringkat

- Northern RockDokumen15 halamanNorthern RockÁi PhươngBelum ada peringkat

- Bulacan Bamboo CraftDokumen22 halamanBulacan Bamboo CraftCarlamae Carpio Mendiola60% (5)

- B7110-001 Financial Statement Analysis and Valuation PDFDokumen3 halamanB7110-001 Financial Statement Analysis and Valuation PDFLittleBlondie0% (2)

- Kos PembangunanDokumen7 halamanKos Pembangunansyenfiq97Belum ada peringkat

- Final PB87 Sol. MASDokumen2 halamanFinal PB87 Sol. MASLJ AggabaoBelum ada peringkat

- Assessment and EvaluationDokumen9 halamanAssessment and EvaluationDhruv MalhotraBelum ada peringkat

- Offshore BankingDokumen5 halamanOffshore BankingMahmudulHasanRixuBelum ada peringkat

- Introduction to Financial MarketsDokumen16 halamanIntroduction to Financial MarketsMick MalickBelum ada peringkat

- Oderid56301 Lhihbp3sDokumen11 halamanOderid56301 Lhihbp3sTanmoy NaskarBelum ada peringkat

- Securities QP1Dokumen5 halamanSecurities QP1Max PayneBelum ada peringkat

- CVPA: Mirabel ManufacturingDokumen2 halamanCVPA: Mirabel Manufacturing2K22DMBA48 himanshiBelum ada peringkat

- R07 Discounted Cash Flow Applications SlidesDokumen35 halamanR07 Discounted Cash Flow Applications Slidesmugheeskhan6Belum ada peringkat

- CFA - 6, 7 & 9. Financial Reporting and AnalysisDokumen3 halamanCFA - 6, 7 & 9. Financial Reporting and AnalysisChan Kwok WanBelum ada peringkat

- The Economic Status of Indias Disinvested Central Public Sector EnterprisesDokumen8 halamanThe Economic Status of Indias Disinvested Central Public Sector EnterprisesEditor IJTSRDBelum ada peringkat

- Sanofi-Aventis Financial Analysis: Submitted To: Sohail SawaniDokumen21 halamanSanofi-Aventis Financial Analysis: Submitted To: Sohail SawaniSaba Ilyas100% (2)

- Financial Analysis of Britannia and DaburDokumen8 halamanFinancial Analysis of Britannia and DaburBiplab MondalBelum ada peringkat

- 54542-Form 10KA Bannerless AsFiledDokumen198 halaman54542-Form 10KA Bannerless AsFiledYoungInvestor SgBelum ada peringkat

- Accounting Equation AssignmentDokumen5 halamanAccounting Equation AssignmentIce Voltaire B. Guiang100% (1)