Challan280 060705

Diunggah oleh

Uttam AuddyDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Challan280 060705

Diunggah oleh

Uttam AuddyHak Cipta:

Format Tersedia

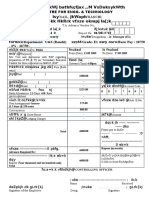

tqykbZ 2005 o vkxs ds Hkqxrkuksa ds fy, @ For payments from July 2005 onwards

* egRoiw.kZ % Ñi;k pkyku Hkjus ls igys fVIi.kh ihNs ns[ksa A ,dy izfr¼{ks-ys-vf/kdkjh ds ikl Hkstus ds fy,½ /

Important: Please see notes overleaf before filling up the challan. Single Copy (to be sent to the ZAO)

pkyku la- @ vkbZ mi;qDr dj (,d ij fu'kku yxkosa) @ Tax Applicable (Tick One) * fu/kkZj.k o"kZ

(0020) dEifu;ksa ij vk;dj (fuxe dj)

Vh ,u ,l INCOME-TAX ON COMPANIES Assessment

CHALLAN NO. / (CORPORATION TAX) Year

ITNS (0021) vk;dj (dEifu;ksa ls fHkUu)

-

280 INCOME-TAX (OTHER THAN COMPANIES)

LFkk;h ys[kk la[;k @ Permanent Account Number

iwjk uke @ Full Name

iwjk irk] uxj vkSj jkT; lfgr @ Complete Address with City & State

Qksu u-@Tel. No. fiu@Pin

Hkqxrku funsZ'ku (,d ij fu'kku yxkosa) / Type of Payment (Tick One)

vfrdj @ Surtax (102)

vfxze dj @ Advance Tax (100) ns'kh daifu;ksa ds forfjr ykHk ij dj @ Tax on Distributed

Profits of Domestic Companies (106)

Lo;a fu/kZj.k dj @ Self Assessment Tax (300)

;wfuV /kjdksa dks forfjr vk; ij dj @

fu;fer fu/kZj.k ij dj @ Tax on Regular Assessment (400) Tax on Distributed Income to Unit Holders (107)

Hkqxrku dk fooj.k @ DETAILS OF PAYMENTS izkIrdrkZ cSad esa iz;ksx ds fy;s

jkf'k (dsoy :- esa) @ Amount (in Rs. Only)

FOR USE IN RECEIVING BANK

vk;dj @ Income Tax [kkrs ls MschV @ psd ds ØsfMV dh rkjh[k

Debit to A/c / Cheque credited on

vf/Hkkj @ Surcharge

f'k{kk midj @ Education Cess

rk- / DD ek- / MM o"kZ / YY

C;kt @ Interest

cSad dh eksgj ds fy, LFkku

'kkfLr @ Penalty

SPACE FOR BANK SEAL

vU; @ Others

tksM+ @ Total

tksM+ ('kCnksa esa) @ Total (in words)

djksM @ CRORES yk[k @ LACS

gtkj @ lSdM+k @ ngkbZ @ TENS bdkbZ @ UNITS

THOUSANDS HUNDREDS

udn @ [kkrs ls MschV @ psd la- fnukad

Paid in Cash/ Debit to A/c /Cheque No. Dated

vnkdrkZ cSad @ Drawn on

(cSad ,oa 'kk[kk dk uke) @ (Name of the Bank and Branch)

}kjk tek fd;k A

fnukad @ Date : tek djus okys O;fDr ds gLrk{kj :-@Rs.

Signature of person making payment

;gka ls dkVs a@ Tear Here

djnkrk dk izfri.kZ @ Taxpayers' Counterfoil (djnkrk }kjk Hkjk tk,xk)

(To be filled up by tax payer) cSad dh eksgj ds fy, LFkku

SPACE FOR BANK SEAL

LFkk;h ys[kk la- @ PAN

Received from

(uke) @ (Name)

ls udn@[kkrs ls MschV @ psd la- :-

Cash/ Debit to A/c /Cheque No. for Rs.

#- ('kCnks esa)

Rs. (in words)

vnkdrkZ cSad @ Drawn on

(cSad ,oa 'kk[kk dk uke) @ (Name of the Bank and Branch)

}kjk

on account of

dEifu;ksa@Companies

/ dEifu;ksa ls fHkUu@ Other than Companies dj@Tax

Income Tax on (tks ykxw uk gks mls dkV nsa) @ Strike out whichever is not applicable)

Type of Payment ...................................................... (To be filled up by person making the payment)

ds :i esa fu/kZj.k o"kZ @ for the Assessment Year

–

ds fy, izkIr gqvk :-@Rs.

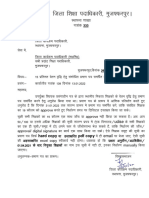

*fVIi.kh@NOTES

1. Ñi;k gj izdkj ds Hkqxrku ds fy, vyx&vyx pkyku dk iz;ksx djsa A

Please use a separate challan for each type of payment.

2. Ñi;k uksV djsa fd vkidk LFkk;h ys[kk la[;k n'kkZuk vfuok;Z gS A

Please note that quoting your Permanent Account Number (PAN) is mandatory.

3. Ñi;k uksV djsa fd vk;dj vf/fu;e] 1961 dh /kjk 272 ch ds vuqlkj >wBk LFkk;h ys[kk la[;k

n'kkZus ij 10000@& :i;s ds naM dh O;oLFkk gS A

Please note that quoting false PAN may attract a penalty of Rs. 10,000/- as per section 272B of I.T.

Act, 1961.

4. Ñi;k uksV djsa fd vihy i+Qhl tek djokus gsrq ;k rks eq[; 'kh"kZ 020 ;k 021 (djnkrk dh izkfLFkfr

ij fuHkZj djrk gS) dks ^^mi;qDr dj** ds vUrxZr fpfUgr djuk gS_ ftlds i'pkr_ xkS.k 'kh"kZ_ Lor%

fu/kZj.k dj (300) dks ^Hkqxrku funsZ'ku* ds vUrxZr fpfUgr djuk gS rFkk vU; dss vUrxZr ^Hkqxrku

dk fooj.k* esa jkf'k Hkjuh gS A

Please note that to deposit Appeal Fees either Major Head 020 or 021 (depending upon the tax

payer's status) has to be ticked under 'Tax Applicable'. Followed by this; Minor Head: Self Assess-

ment Tax (300) has to be ticked under 'Type of Payment' and the amount is to be filled under Others

in 'Details of Payments'

5. Cykd vof/ ds ekeyksa esa djks] vihy 'kqYdksa vkfn dks tek djus ds fy, vof/ ds igys fu/kZj.k o"kZ

dk mYys[k djrs gq, Cykd vof/ ds vafre fu/kZj.k o"kZ dh izfof"V djsaA mnkgj.k ds rkSj ij ;fn Cykd

vof/ 1-04-85 ls 5-3-96 rd gS rks fu/kZj.k o"kZ ds fy;s n'kkZ;s x, LFkku esa 1986&97 dh izfof"V djuh

gksxhA ;fn dj tek djok, tk jgs gSa rks Hkqxrku ds izdkj ds vUrxZr Lor% fu/kZj.k dj (300) dks fpfUgr

djsa rFkk ^^dj** ds vUrxZr jkf'k fy[ks tcfd vihy jkf'k ds laca/ esa ^^vU;** ds vUrxZr jkf'k HkjsaA

To deposit taxes, appeal fees, etc. in respect of block period cases, enter the first Assessment Year

of the block period followed by the last Assessment Year of the period. For example, if the block

period is 1/04/85 to 5/3/96, it would be entered as 1986-97 in the space indicated for Assessment

Year. If taxes are being deposited, tick the box Self Assessment (300) under Type of Payment and

fill up amount under 'Tax' while in respect of appeal fees, enter amount under 'Others'.

Ñi;k bl pkyku dk iz;ksx iwoZ i`"B ij n'kkZ;sa djksa (Hkqxrku funs'Z ku) dks tek djkus ds fy, djsaA Ñi;k bl

pkyku dk iz;ksx Ïksr ij dkVs x, dj (Vh Mh ,l) Ïksr dj laxzg.k (Vh-lh-,l-) dks tek djkus ds fy, ugha

djsaA

PLEASE USE THIS CHALLAN FOR DEPOSITING TAXES (TYPES OF PAYMENT) MENTIONED OVERLEAF.

KINDLY DO NOT USE THIS CHALLAN FOR DEPOSITING TAX DEDUCTION AT SOURCE (TDS)

d`i;k tkap djsa fd cSad ikorh esa fuEufyf[kr lwpuk miyC/ gS %&

1- cSad 'kk[kk dk 7 vad dh ch ,l vkj dksM

2- pkyku tek djus dh rkjh[k (fnu] ekg] o"kZ)

3- pkyku Øe la[;k

vkidks bldk vk; dh fooj.kh esa mYys[k djuk gksxkA

KINDLY ENSURE THAT THE BANK'S ACKNOWLEDGEMENT CONTAINS THE

FOLLOWING:-

1. 7 DIGIT BSR CODE OF THE BANK BRANCH

2. DATE OF DEPOSIT OF CHALLAN (DD MM YY)

3. CHALLAN SERIAL NUMBER

THESE WILL HAVE TO BE QUOTED IN YOUR RETUN OF INCOME.

Anda mungkin juga menyukai

- UNCITRAL Guide United Nations Commission On International Trade LawDokumen56 halamanUNCITRAL Guide United Nations Commission On International Trade Lawsabiont100% (2)

- National Football League FRC 2000 Sol SRGBDokumen33 halamanNational Football League FRC 2000 Sol SRGBMick StukesBelum ada peringkat

- Mozal Finance EXCEL Group 15dec2013Dokumen15 halamanMozal Finance EXCEL Group 15dec2013Abhijit TailangBelum ada peringkat

- Project Formulation and Appraisalpdf PDFDokumen12 halamanProject Formulation and Appraisalpdf PDFabhijeet varadeBelum ada peringkat

- How To Convert Files To Binary FormatDokumen1 halamanHow To Convert Files To Binary FormatAhmed Riyadh100% (1)

- Concrete Repair Manual (2017)Dokumen59 halamanConcrete Repair Manual (2017)Fernando EscriváBelum ada peringkat

- Data StructuresDokumen4 halamanData StructuresBenjB1983Belum ada peringkat

- Electronic Spin Inversion: A Danger To Your HealthDokumen4 halamanElectronic Spin Inversion: A Danger To Your Healthambertje12Belum ada peringkat

- Form-1 Declaration FormDokumen2 halamanForm-1 Declaration FormDaphne Anderson25% (4)

- Kautilya Arthshastra: Utkirith Prasasn Vidhi Evam Sasan PradhliDari EverandKautilya Arthshastra: Utkirith Prasasn Vidhi Evam Sasan PradhliBelum ada peringkat

- Top 100 Chemical CompaniesDokumen11 halamanTop 100 Chemical Companiestawhide_islamicBelum ada peringkat

- Logiq v12 SM PDFDokumen267 halamanLogiq v12 SM PDFpriyaBelum ada peringkat

- Challan 280Dokumen2 halamanChallan 280api-3854061Belum ada peringkat

- Challan 282Dokumen2 halamanChallan 282api-3854061Belum ada peringkat

- Challan 281Dokumen2 halamanChallan 281Paymaster ServicesBelum ada peringkat

- Examination, 2021: VfkokDokumen8 halamanExamination, 2021: Vfkoktech with yashBelum ada peringkat

- Lksuvj QKWJ Bathfu Fjax ,.M Vsduksykwth Lsy Jkwaph K KK HKRRK Vfxze Okmpj La ( KDokumen2 halamanLksuvj QKWJ Bathfu Fjax ,.M Vsduksykwth Lsy Jkwaph K KK HKRRK Vfxze Okmpj La ( KscBelum ada peringkat

- Union Bank Account Opening FormDokumen4 halamanUnion Bank Account Opening FormRishin Ahammed0% (1)

- Okidksl Fyfevsm: Wapcos KRK KR HKRRK Fcy@Dokumen2 halamanOkidksl Fyfevsm: Wapcos KRK KR HKRRK Fcy@Shivani Sumitt MittalBelum ada peringkat

- Earnedleaveform 22Dokumen1 halamanEarnedleaveform 22Akhilesh YadavBelum ada peringkat

- Advertisement PDFDokumen7 halamanAdvertisement PDFGourang SahuBelum ada peringkat

- Xq#Dqy Dkaxm+H Lefo'Ofo - Ky ) GFJ) Kj&249404: Gurukula Kangri (Deemed To Be Univeristy), Haridwar-249404Dokumen3 halamanXq#Dqy Dkaxm+H Lefo'Ofo - Ky ) GFJ) Kj&249404: Gurukula Kangri (Deemed To Be Univeristy), Haridwar-249404Jumba JumbaBelum ada peringkat

- Dezpkjh Hkfo" Fuf/K Laxbu) NRRHLX - : Qkez&9 La'KksfèkrDokumen1 halamanDezpkjh Hkfo" Fuf/K Laxbu) NRRHLX - : Qkez&9 La'KksfèkrTaru MehtaBelum ada peringkat

- TFR TaDokumen2 halamanTFR TaRAKHI KUMARIBelum ada peringkat

- Patch Progress CorrectedDokumen3 halamanPatch Progress CorrecteddaisyBelum ada peringkat

- SVS Term and ConditionsDokumen36 halamanSVS Term and ConditionsAskand SolankiBelum ada peringkat

- Bcom Vi Sem Accounting Indirect Tax May 2018Dokumen5 halamanBcom Vi Sem Accounting Indirect Tax May 2018virat kohliBelum ada peringkat

- KJ (K.M Dezpkjh P U VK KSXDokumen34 halamanKJ (K.M Dezpkjh P U VK KSXHariom YadavBelum ada peringkat

- MRRJK (K.M Eqdr Fo"Ofo - Ky : Lelr Ikb Øeksa GSRQ Izos"K Vkosnu&IDokumen4 halamanMRRJK (K.M Eqdr Fo"Ofo - Ky : Lelr Ikb Øeksa GSRQ Izos"K Vkosnu&IZez SamuelBelum ada peringkat

- Dkfyunhiqje Vkokl Kstuk Ds Xksdqy LSDVJ Esa Ek0 Iz/Kkuea H Vkokl Kstuk Ds Vurxzr 04 Eaftys Nqczy VK Oxz Ds 312 Hkouksa DK Fuekz.K, Oa Fodkl DK ZaDokumen29 halamanDkfyunhiqje Vkokl Kstuk Ds Xksdqy LSDVJ Esa Ek0 Iz/Kkuea H Vkokl Kstuk Ds Vurxzr 04 Eaftys Nqczy VK Oxz Ds 312 Hkouksa DK Fuekz.K, Oa Fodkl DK Zaupavp cd14Belum ada peringkat

- @legalglossary - LLB 6th Sem Taxtion LawDokumen28 halaman@legalglossary - LLB 6th Sem Taxtion Lawrishavh yadavBelum ada peringkat

- LH-,L-VKBZ-VKJ-&JK"V H Oulifr Vuqla/Kku Lalfkku: Osclkbv@Dokumen7 halamanLH-,L-VKBZ-VKJ-&JK"V H Oulifr Vuqla/Kku Lalfkku: Osclkbv@Rajat TripathiBelum ada peringkat

- IEC Monitoring Form HindiDokumen3 halamanIEC Monitoring Form HindiDeepkamal JaiswalBelum ada peringkat

- CD-2043 - 20200712100403 Durg University QPDokumen11 halamanCD-2043 - 20200712100403 Durg University QPManohar SumathiBelum ada peringkat

- 2022092394Dokumen2 halaman2022092394Syed AhmadBelum ada peringkat

- ESIC SPECIMEN - Form-1 Declaration FormDokumen2 halamanESIC SPECIMEN - Form-1 Declaration FormnimishshrivastavBelum ada peringkat

- Question Paper Code: 1058: Economics (Macro Economics)Dokumen6 halamanQuestion Paper Code: 1058: Economics (Macro Economics)Samarth GaurBelum ada peringkat

- Jain Gazette 10 Feb All PG Web PDFDokumen14 halamanJain Gazette 10 Feb All PG Web PDFSiddarth JainBelum ada peringkat

- MRRJK (K.M Eqdr Fo"Ofo - Ky : Uttarakhand Open University Lelr Ikb Øeksa GSRQ Izos"K Vkosnu&IDokumen4 halamanMRRJK (K.M Eqdr Fo"Ofo - Ky : Uttarakhand Open University Lelr Ikb Øeksa GSRQ Izos"K Vkosnu&IjotaBelum ada peringkat

- DK Kzy Lahkkxh Ifj Kstuk A H Yksd Fuekz.K Fohkkx) Ifj Kstuk Fø Kuo U BDKBZ) U K Dysdvj DK Kzy Ds Ikl Flfoy Ykbzu Ckyk?Kkv E-IzDokumen2 halamanDK Kzy Lahkkxh Ifj Kstuk A H Yksd Fuekz.K Fohkkx) Ifj Kstuk Fø Kuo U BDKBZ) U K Dysdvj DK Kzy Ds Ikl Flfoy Ykbzu Ckyk?Kkv E-Izfemetib312Belum ada peringkat

- Leave Application FormDokumen1 halamanLeave Application FormRehmat RattuBelum ada peringkat

- CP - KURMI - ITAX - CALC - 2023-24 (Version 1) 2Dokumen1 halamanCP - KURMI - ITAX - CALC - 2023-24 (Version 1) 2ankit.johnnyBelum ada peringkat

- 15% वेतन निर्धारण 333 29.01.22Dokumen2 halaman15% वेतन निर्धारण 333 29.01.22adityasrivastva633Belum ada peringkat

- PIQ FormDokumen2 halamanPIQ FormAditya KumarBelum ada peringkat

- Daniel Pandey: E-Mail AddressDokumen3 halamanDaniel Pandey: E-Mail AddressDaniel PandeyBelum ada peringkat

- czu Dylvj Yksgjlh Ftyk /kerjh Fohkkxh F O"Khz DK Z Kstuk Fohkkx DK Uke%& Yksd Fuek - KZ Fohkkx) Lahkkx&/KerjhDokumen4 halamanczu Dylvj Yksgjlh Ftyk /kerjh Fohkkxh F O"Khz DK Z Kstuk Fohkkx DK Uke%& Yksd Fuek - KZ Fohkkx) Lahkkx&/KerjhvickyBelum ada peringkat

- ?KKS"K.KK I K: 4-Tue DH FRFFK Fnu Eghuk O"Kz 5 - Osokfgd Fookfgr@ Izkflfkfr Vfookfgr Fo/KokDokumen4 halaman?KKS"K.KK I K: 4-Tue DH FRFFK Fnu Eghuk O"Kz 5 - Osokfgd Fookfgr@ Izkflfkfr Vfookfgr Fo/KokHarsha VardhanBelum ada peringkat

- High Court VigyapanDokumen24 halamanHigh Court Vigyapanrahul tyagiBelum ada peringkat

- PNB 107 - Daily Cash Balance BookDokumen1 halamanPNB 107 - Daily Cash Balance BookelliaCruzBelum ada peringkat

- Data Base PerformaDokumen14 halamanData Base Performaashji10Belum ada peringkat

- Siri Fort Swimming Pool Form PDFDokumen3 halamanSiri Fort Swimming Pool Form PDFShukla Bala100% (1)

- Notice No.-9 - JGGLCCE-2021 - 24.06Dokumen1 halamanNotice No.-9 - JGGLCCE-2021 - 24.06sonumonuu096Belum ada peringkat

- Class XII NCERT Books Geography Part 2Dokumen122 halamanClass XII NCERT Books Geography Part 2Vishal JangirBelum ada peringkat

- MumtDokumen7 halamanMumtkashyapdevish24Belum ada peringkat

- Tokgj Uoksn Fo - Ky ) X H) Ftyk% CHM Egk-: F'K (KK Ea Ky ) Ldwy F'K (KK VKSJ LK (KJRK Fohkkx) HKKJR LJDKJDokumen1 halamanTokgj Uoksn Fo - Ky ) X H) Ftyk% CHM Egk-: F'K (KK Ea Ky ) Ldwy F'K (KK VKSJ LK (KJRK Fohkkx) HKKJR LJDKJSuhas DokeBelum ada peringkat

- (DJ Iz - Kkyh) : ECO by Rashid SirDokumen4 halaman(DJ Iz - Kkyh) : ECO by Rashid SirankitrajeBelum ada peringkat

- IT Investment Form PDFDokumen1 halamanIT Investment Form PDFratnadeep takkeBelum ada peringkat

- 7 Nischay Project Report On 30 April 2022Dokumen12 halaman7 Nischay Project Report On 30 April 2022Manish ranjanBelum ada peringkat

- SSC Cpo Complete Maths BookDokumen267 halamanSSC Cpo Complete Maths Bookbibek kumarBelum ada peringkat

- Egkrek Xka/Kh DK'KH Fo - Kihb) Okjk - KLH: Lukrd Ikb Øe LHV La ( K) Ikb Øe DKSM RFKK Kqyd Fooj.KDokumen8 halamanEgkrek Xka/Kh DK'KH Fo - Kihb) Okjk - KLH: Lukrd Ikb Øe LHV La ( K) Ikb Øe DKSM RFKK Kqyd Fooj.KAbhijeet RawatBelum ada peringkat

- Tendernotice 1Dokumen1 halamanTendernotice 1Keshav SoniBelum ada peringkat

- Upsdm Course List-Dei-contact DetailsDokumen1 halamanUpsdm Course List-Dei-contact Detailsanislinek15Belum ada peringkat

- Giriraj 10th JuneDokumen12 halamanGiriraj 10th JuneSunny DuggalBelum ada peringkat

- Haryana Ration Card Form New PDFDokumen2 halamanHaryana Ration Card Form New PDFvir boyBelum ada peringkat

- Vtkzu DV©RH Kwa: Mazagon Dock Shipbuilders LimitedDokumen1 halamanVtkzu DV©RH Kwa: Mazagon Dock Shipbuilders LimitedMukesh KannanBelum ada peringkat

- Computer Sikhein: Software, Internet Evam Mulitmedia Par Adharit Upyogi PustakDari EverandComputer Sikhein: Software, Internet Evam Mulitmedia Par Adharit Upyogi PustakBelum ada peringkat

- Sankshipt Prayavachi Evam Vilom Shabadkosh: Civil Service, Bank Po, Railway, Tet, School Va College Ke Chatr-Chatro Evam Sabhi Pratiyogi Parichao Ke Liye Upyogi PustakDari EverandSankshipt Prayavachi Evam Vilom Shabadkosh: Civil Service, Bank Po, Railway, Tet, School Va College Ke Chatr-Chatro Evam Sabhi Pratiyogi Parichao Ke Liye Upyogi PustakBelum ada peringkat

- Thyroid Function Tests FaqDokumen1 halamanThyroid Function Tests FaqUttam AuddyBelum ada peringkat

- Armsform IiibDokumen1 halamanArmsform IiibUttam AuddyBelum ada peringkat

- Govt. of West Bengal Directorate of Commercial Tax E-Challan FormDokumen1 halamanGovt. of West Bengal Directorate of Commercial Tax E-Challan FormUttam AuddyBelum ada peringkat

- First Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoDokumen5 halamanFirst Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoUttam AuddyBelum ada peringkat

- Management of Natural Resources Introduction - Tutorvista PDFDokumen2 halamanManagement of Natural Resources Introduction - Tutorvista PDFUttam AuddyBelum ada peringkat

- Taking Action MiniDokumen19 halamanTaking Action MiniallienmonkeysBelum ada peringkat

- Preventive VigilanceDokumen3 halamanPreventive VigilanceUttam AuddyBelum ada peringkat

- Salient Features of The 9th Bipartite SettlementDokumen2 halamanSalient Features of The 9th Bipartite SettlementUttam AuddyBelum ada peringkat

- Ring and Johnson CounterDokumen5 halamanRing and Johnson CounterkrsekarBelum ada peringkat

- ZygalDokumen22 halamanZygalShubham KandiBelum ada peringkat

- 1.water, Acids, Bases, Buffer Solutions in BiochemistryDokumen53 halaman1.water, Acids, Bases, Buffer Solutions in BiochemistryÇağlaBelum ada peringkat

- CN1111 Tutorial 4 QuestionDokumen3 halamanCN1111 Tutorial 4 Questionthenewperson0% (1)

- Semi Detailed Lesson PlanDokumen2 halamanSemi Detailed Lesson PlanJean-jean Dela Cruz CamatBelum ada peringkat

- How To Launch Remix OS For PCDokumen2 halamanHow To Launch Remix OS For PCfloapaaBelum ada peringkat

- Binary OptionsDokumen24 halamanBinary Optionssamsa7Belum ada peringkat

- EKRP311 Vc-Jun2022Dokumen3 halamanEKRP311 Vc-Jun2022dfmosesi78Belum ada peringkat

- Dwnload Full Beckers World of The Cell 9th Edition Hardin Solutions Manual PDFDokumen35 halamanDwnload Full Beckers World of The Cell 9th Edition Hardin Solutions Manual PDFgebbielean1237100% (12)

- Resume 1Dokumen2 halamanResume 1Aidie HerreraBelum ada peringkat

- Application of Geoelectric Method For GroundwaterDokumen11 halamanApplication of Geoelectric Method For GroundwaterMunther DhahirBelum ada peringkat

- EKC 202ABC ManualDokumen16 halamanEKC 202ABC ManualJose CencičBelum ada peringkat

- Modern and Nonlinear OpticsDokumen181 halamanModern and Nonlinear Opticssoma_venuBelum ada peringkat

- DION IMPACT 9102 SeriesDokumen5 halamanDION IMPACT 9102 SeriesLENEEVERSONBelum ada peringkat

- Guidelines For Prescription Drug Marketing in India-OPPIDokumen23 halamanGuidelines For Prescription Drug Marketing in India-OPPINeelesh Bhandari100% (2)

- List of Sovereign States and Dependent Territories by Birth RateDokumen7 halamanList of Sovereign States and Dependent Territories by Birth RateLuminita CocosBelum ada peringkat

- 1Dokumen3 halaman1Stook01701Belum ada peringkat

- Production of Bioethanol From Empty Fruit Bunch (Efb) of Oil PalmDokumen26 halamanProduction of Bioethanol From Empty Fruit Bunch (Efb) of Oil PalmcelestavionaBelum ada peringkat

- QP 12math Term 1Dokumen11 halamanQP 12math Term 1sarthakBelum ada peringkat

- Midi Pro Adapter ManualDokumen34 halamanMidi Pro Adapter ManualUli ZukowskiBelum ada peringkat