Gold Mining Production Methodology

Diunggah oleh

anant ashwaryaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Gold Mining Production Methodology

Diunggah oleh

anant ashwaryaHak Cipta:

Format Tersedia

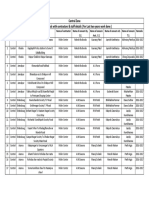

Gold mine production data

Methodology Note

Overview

The gold market is broad and complex, so producing statistics on demand and supply is

challenging. But having such statistics is crucial to understanding the fundamentals of the

market. The World Gold Council overcomes the complexity to produce a robust,

comprehensive and well-researched series of global gold demand and supply data. We

publish these data and supporting commentary in our quarterly Gold Demand Trends report.

1 Mine production data provider

Our core mine supply data are provided by Metals Focus, a leading independent precious

metals consultancy. Metals Focus meets our strict criteria for the provision of demand and

supply data, which includes the need for an extensive global network, an experienced team,

and a robust methodology. These elements combine to create a framework for collecting

accurate, granular and transparent estimates for gold demand and supply.

2 Data collection framework

The following are the essential components of the gold mine production data collection

framework:

2.1 Global network of contacts

With regard to the gold mining industry, this network includes exploration-stage companies,

mining companies, financial institutions, investors, industry associations, governments, NGOs

and suppliers of goods and services. The latter includes suppliers of consumables such as

cyanide, lime, explosives, fuel, power and grinding media; technical consultants, mining

contractors and transport companies.

Field research involves frequent communication with contacts. Face-to-face meetings are

vital when seeking proprietary, non-public information. This entails regular travel to major

mining countries.

2.2 Access to data from a wide range of publicly available/subscription-based sources

To obtain the best estimates, quantitative data from a variety of public and subscription-

based sources must be combined with the private, confidential quantitative and qualitative

information gathered through extensive field research. This includes, but is not limited to, the

company reports of mining companies, trade association disclosures and international

customs and trade statistics.

2.3 Mining sector expertise

An experienced team of research analysts with sector expertise is an essential component of

the data collection framework, providing deep insight into the gold mining industry.

Interpreting data and competently extrapolating from limited, or contradictory information are

vital skills. Analysts must be able to conduct field research in an effective way, using

sensitivity and discretion, with careful regard to confidentiality. The analyst team must have a

broad skill set, encompassing resource geology, mineral economics, mine engineering, ore

processing, Social Licence to Operate (SLTO) and governance. Experience of working in the

industry is invaluable.

World Gold Council Gold mine production data 24 August 2018 1

2.4 Comprehensive, clear, methodical approach

A clearly-defined methodology is essential in collating, estimating and analysing mine

production data. This requires an understanding of the limitations of data sources; publicly-

available information must be interrogated for accuracy, integrity and completeness. An

ability to correctly interpret such data considering quantitative and qualitative information from

private sources is essential. And finally, the data must be subject to consistent overview and

approval.

A collaborative, team-based approach to market analysis is similarly vital. Accurate,

continuous communication between the mine supply analysts and the broader market

research team ensures cross-referencing of data from multiple sources and market

perspectives; for instance, in correlating between gold mine production data provided by

miners and flows reported by governments, transport companies, traders and refiners. Given

the highly interconnected, global nature of the gold market it is important that the knock-on

effects on other areas of the market due to developments relating to mine production are fully

appreciated.

3 Data collection process

Metals Focus’ global gold mine production data series are constructed using a ‘bottom up’

approach, augmented by "top down" comparison with other available data. As a starting

point, mine-by-mine production data is collected wherever available. This mine-by-mine data

is collated and cross-referenced against figures published by governments and industry

associations, trade statistics, and data from other sources, such as refiners and transport

companies. In this way, an estimate of mine production is established at the individual

country level, before being aggregated up to a global number.

Published reports from publicly-listed mining companies provide a significant portion of the

mine-by-mine production data collected. The analyst team systematically captures this data,

usually on a quarterly basis, depending on companies' reporting schedules. Other data

required for cross-referencing country-level production totals is usually collected by means of

direct communication with the sources mentioned above, which involves international travel

for face-to-face meetings.

3 Data collection process

The following issues are important with respect to the interpretation of mine production data.

4.1 "Contained" gold, versus "refined" or "paid" gold

When considering gold mine production data, it is important to understand the basis of the

number being reported. In some cases, miners may report the amount of gold contained in

the intermediate product (usually doré but sometimes a lower grade concentrate) delivered to

the trader, smelter or refiner. Alternatively, they may report the quantity of metal for which

they are paid by the smelter or refiner, which in the case of doré is usually 99.9% of the

contained gold, but somewhat lower in the case of gold in concentrate. Metals Focus report

mine production on a paid, or refined basis, as this facilitates more consistent, accurate

reconciliation with gold miners' revenues.

4.2 Gold produced versus gold sold

Due to the timing of sales and build-up or draw-down of gold in the ore processing circuit,

there can be significant differences between the amount of gold produced by a mine in a

given period and the amount sold to refiners. Consistency in reporting these figures is

World Gold Council Gold mine production data 24 August 2018 2

therefore important. Metals Focus reports mine production on a produced, rather than sold

basis.

4.3 Artisanal and small-scale mining (ASM)

Artisanal and small-scale mining (ASM) is characterised by its informal nature and a lack of

mechanisation. It is often carried out in developing countries as an alternative to subsistence

farming, using simple, low-productivity extractive processes, with minimal capital investment.

ASM provides a livelihood for an estimated 40 million people globally across a range of

commodities, predominantly in Africa, Latin America and Asia. Given its dispersed,

sometimes illegal nature, quantifying production from ASM sources is difficult. Metals Focus

includes estimates of ASM output in its country production statistics, by cross-referencing

information from numerous sources, including government statistics, reports by development

agencies, and personal contact with fieldworkers and exploration company personnel. Insight

is also received from refiners, traders and transport companies.

4.4 Accuracy

Given the opacity and complexity of the gold market, supply and demand statistics are best

thought of as estimates, with some estimates being more accurate than others. For example,

mine production data from publicly-listed mining companies are very accurate. As described

above, data relating to ASM production are inherently more uncertain and are more likely to

be revised. The data collection framework and process are, however, designed to ensure that

each estimate is as accurate as possible based on the information available at that point in

time.

4.5 Revisions

Revisions to statistics are common place and are to be welcomed as a sign of improved

market intelligence. Many macroeconomic indicators, such as gross domestic product

estimates, are revised. Gold statistics are no different. The first estimate of the supply and

demand data will capture a certain amount of information. But over time new information may

come to light which is incorporated into the data. The World Gold Council is committed to

publishing the most accurate, up-to-date gold demand and supply data available. We are

transparent with revisions to our data series, which will be updated to reflect any new

information that comes to light or if new measurement methods are introduced.

World Gold Council Gold mine production data 24 August 2018 3

Anda mungkin juga menyukai

- Mineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryDari EverandMineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryBelum ada peringkat

- Gold in South AfricaDokumen218 halamanGold in South AfricaErrolHT100% (1)

- Principles of Mining: Valuation, Organization and AdministrationDari EverandPrinciples of Mining: Valuation, Organization and AdministrationBelum ada peringkat

- Sectorial Analysis of Mining and Oil and Gas IndustryDokumen20 halamanSectorial Analysis of Mining and Oil and Gas IndustryMayur Bhanushali-Mange100% (1)

- Additional Information Mining Industry Data SurveyDokumen24 halamanAdditional Information Mining Industry Data SurveyYevhen KurilovBelum ada peringkat

- GFMS Copper Survey 2014 UpdateDokumen32 halamanGFMS Copper Survey 2014 UpdateCarlos A. Espinoza MBelum ada peringkat

- Mining Capital: Methods, Best-Practices and Case Studies for Financing Mining ProjectsDari EverandMining Capital: Methods, Best-Practices and Case Studies for Financing Mining ProjectsBelum ada peringkat

- Environmental Analysis of Diamond Mining IndustryDokumen21 halamanEnvironmental Analysis of Diamond Mining IndustryVivian Vo89% (9)

- ISSER Research ResponseDokumen14 halamanISSER Research ResponseFuaad DodooBelum ada peringkat

- Gold Market Lending BlanchardDokumen28 halamanGold Market Lending Blanchardbabstar999Belum ada peringkat

- EY Mining Eye Q2 2012Dokumen14 halamanEY Mining Eye Q2 2012milisteBelum ada peringkat

- Reporting Mineral Resources and Mineral Reserves in The United States of AmericaDokumen24 halamanReporting Mineral Resources and Mineral Reserves in The United States of AmericaSeyedRezaMinerBelum ada peringkat

- Rio Tinto Iron OreDokumen68 halamanRio Tinto Iron Orehatschi1Belum ada peringkat

- Perspectives On The Diamond Industry White Paper PDFDokumen22 halamanPerspectives On The Diamond Industry White Paper PDFPaul CelenBelum ada peringkat

- After The DiscoveryDokumen3 halamanAfter The DiscoveryPoornima P MBelum ada peringkat

- Global Mining Chemicals Market Analysis & Forecast (2014 - 2020)Dokumen13 halamanGlobal Mining Chemicals Market Analysis & Forecast (2014 - 2020)Sanjay MatthewsBelum ada peringkat

- T P S V C: HE Etroleum Ector Alue HainDokumen33 halamanT P S V C: HE Etroleum Ector Alue HainAdeltus NovatBelum ada peringkat

- Silver: United StatesDokumen4 halamanSilver: United StatesMichael WarnerBelum ada peringkat

- 2018 OPEC Oil Production Data - The Role of Secondary SourcesDokumen24 halaman2018 OPEC Oil Production Data - The Role of Secondary SourcesBlasBelum ada peringkat

- An ICGLR-Based Tracking and Certication System For Minerals From The Great Lakes RegionProposalDokumen39 halamanAn ICGLR-Based Tracking and Certication System For Minerals From The Great Lakes RegionProposalLorraine M. ThompsonBelum ada peringkat

- De Beers ReportDokumen90 halamanDe Beers Reportavinram100% (1)

- Mining Royalties, Global Study of Their Impact On Investors, Government, and Civil SocietyDokumen320 halamanMining Royalties, Global Study of Their Impact On Investors, Government, and Civil SocietydaveanthonyBelum ada peringkat

- WMC Official Case 2015Dokumen33 halamanWMC Official Case 2015Nayaka AnggerBelum ada peringkat

- Gold Survey 2013 Update 2: Prepared by Thomson Reuters GFMSDokumen44 halamanGold Survey 2013 Update 2: Prepared by Thomson Reuters GFMSVaggelis PanagiotopoulosBelum ada peringkat

- Mining Explained E-BookDokumen18 halamanMining Explained E-BookHannans Reward Ltd89% (9)

- World Mining EquipmentDokumen4 halamanWorld Mining EquipmentMichael WarnerBelum ada peringkat

- Brochure ManganeseDokumen6 halamanBrochure ManganeseChetan GargBelum ada peringkat

- Gathering, Measurement, and Processing: An Overview of The Upstream, Midstream, and Downstream Segments of Our IndustryDokumen27 halamanGathering, Measurement, and Processing: An Overview of The Upstream, Midstream, and Downstream Segments of Our IndustryvrajakisoriDasiBelum ada peringkat

- A Guide For Reporting Exploration Information, Mineral Resources, and Mineral ReservesDokumen17 halamanA Guide For Reporting Exploration Information, Mineral Resources, and Mineral ReservesMarchellevandra GomisBelum ada peringkat

- CODA Project by Ashita PrabhugaonkarDokumen41 halamanCODA Project by Ashita PrabhugaonkarashprabhaBelum ada peringkat

- Oil and Gas Creation Value Chain Noc - Chapter - 1Dokumen33 halamanOil and Gas Creation Value Chain Noc - Chapter - 1elsobkiBelum ada peringkat

- L24 - Reporting CodesDokumen15 halamanL24 - Reporting CodesUnathi MaqinaBelum ada peringkat

- GK Executive Summary 1.2Dokumen7 halamanGK Executive Summary 1.2kingdomtruck1Belum ada peringkat

- Industry Structure, Supply-Demand and Stake Holders: Chapter-3Dokumen21 halamanIndustry Structure, Supply-Demand and Stake Holders: Chapter-3VGBelum ada peringkat

- 011-Rupprecht - Samrec Proposal 2016Dokumen10 halaman011-Rupprecht - Samrec Proposal 2016Siva Kumar MathanBelum ada peringkat

- Código JORCDokumen44 halamanCódigo JORCPatricio LeddyBelum ada peringkat

- Samrec VersionDokumen38 halamanSamrec VersionAgus BismaBelum ada peringkat

- Question 1-Overview of The Retail Jewellery Industry and StructureDokumen18 halamanQuestion 1-Overview of The Retail Jewellery Industry and Structuretalom2cmBelum ada peringkat

- An Intelligent Gold Price Prediction Based On Automated Machine and K-Fold Cross Validation LearningDokumen10 halamanAn Intelligent Gold Price Prediction Based On Automated Machine and K-Fold Cross Validation LearningRida HamadBelum ada peringkat

- Candelaria Acquisiton Presentation Oct 6 2014Dokumen34 halamanCandelaria Acquisiton Presentation Oct 6 2014Perico PalotesBelum ada peringkat

- Chapter 2Dokumen30 halamanChapter 2agga1111Belum ada peringkat

- JORC Code & StandardsDokumen3 halamanJORC Code & Standardsjast5Belum ada peringkat

- CristalMiningCorp BusinessPlanDokumen32 halamanCristalMiningCorp BusinessPlanfatimasc100% (1)

- Baseline Study Two: Mukungwe Artisanal Mine, South Kivu, Democratic Republic of CongoDokumen38 halamanBaseline Study Two: Mukungwe Artisanal Mine, South Kivu, Democratic Republic of CongoJim BobBelum ada peringkat

- Brochure Iron OreDokumen8 halamanBrochure Iron Orelavu_chowdaryBelum ada peringkat

- White Paper - Mine Planners Lie With NumbersDokumen20 halamanWhite Paper - Mine Planners Lie With NumbersGbi Mining Intelligence100% (2)

- More Transparent Supply ChainDokumen16 halamanMore Transparent Supply ChainCharles BinuBelum ada peringkat

- Applied Case Study AnalysesDokumen9 halamanApplied Case Study AnalysesTapiwaNicholasBelum ada peringkat

- August 2016: Clearing A Path To Production Chinchillas Silver-Lead-Zinc DepositDokumen15 halamanAugust 2016: Clearing A Path To Production Chinchillas Silver-Lead-Zinc DepositalambertBelum ada peringkat

- Financial Statement Analysis and Valuation For Rio Tinto CompanyDokumen9 halamanFinancial Statement Analysis and Valuation For Rio Tinto CompanyBachia Trương100% (1)

- Planning For The Next 10 YEARS Expanding and Managing Our Mineral Resource BaseDokumen7 halamanPlanning For The Next 10 YEARS Expanding and Managing Our Mineral Resource BaseWalter Cruz MermaBelum ada peringkat

- CMC Business PlanDokumen32 halamanCMC Business PlanRobert ShisokaBelum ada peringkat

- Decommissioning in The North Sea - Demand Vs Capacity - Low-ResDokumen100 halamanDecommissioning in The North Sea - Demand Vs Capacity - Low-ResQasim Ismail100% (1)

- Gold Trade Data - April 2021Dokumen16 halamanGold Trade Data - April 2021PGG DriveBelum ada peringkat

- BGR (2019) Mapping of The DRC Artisanal Copper-Cobalt Sector Engl-MinDokumen59 halamanBGR (2019) Mapping of The DRC Artisanal Copper-Cobalt Sector Engl-MinDiem NsontaBelum ada peringkat

- Exploration in Farmland Report, AustraliaDokumen24 halamanExploration in Farmland Report, AustraliaAlberto Lobo-Guerrero SanzBelum ada peringkat

- Myanmar Golds New FrontierDokumen14 halamanMyanmar Golds New FrontierOlivia Jackson100% (1)

- Multi Grade-ReportDokumen19 halamanMulti Grade-Reportjoy pamorBelum ada peringkat

- FPSCDokumen15 halamanFPSCBABER SULTANBelum ada peringkat

- Trần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisDokumen2 halamanTrần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisTrần Phương MaiBelum ada peringkat

- On The Linguistic Turn in Philosophy - Stenlund2002 PDFDokumen40 halamanOn The Linguistic Turn in Philosophy - Stenlund2002 PDFPablo BarbosaBelum ada peringkat

- All Zone Road ListDokumen46 halamanAll Zone Road ListMegha ZalaBelum ada peringkat

- CAP214 Web Devlopment PDFDokumen9 halamanCAP214 Web Devlopment PDFAlisha AgarwalBelum ada peringkat

- LAW OF ContractDokumen1 halamanLAW OF ContractKhurshid Manzoor Malik50% (2)

- Speaking Test FeedbackDokumen12 halamanSpeaking Test FeedbackKhong TrangBelum ada peringkat

- Claim &: Change ProposalDokumen45 halamanClaim &: Change ProposalInaam Ullah MughalBelum ada peringkat

- Account Statement From 1 Jan 2017 To 30 Jun 2017Dokumen2 halamanAccount Statement From 1 Jan 2017 To 30 Jun 2017Ujjain mpBelum ada peringkat

- Flabbergasted! - Core RulebookDokumen160 halamanFlabbergasted! - Core RulebookRobert RichesonBelum ada peringkat

- Magnetism 1Dokumen4 halamanMagnetism 1krichenkyandex.ruBelum ada peringkat

- " Thou Hast Made Me, and Shall Thy Work Decay?Dokumen2 halaman" Thou Hast Made Me, and Shall Thy Work Decay?Sbgacc SojitraBelum ada peringkat

- Lista Agentiilor de Turism Licentiate Actualizare 16.09.2022Dokumen498 halamanLista Agentiilor de Turism Licentiate Actualizare 16.09.2022LucianBelum ada peringkat

- CAPE Env. Science 2012 U1 P2Dokumen9 halamanCAPE Env. Science 2012 U1 P2Christina FrancisBelum ada peringkat

- Rebecca Young Vs CADokumen3 halamanRebecca Young Vs CAJay RibsBelum ada peringkat

- Sample Financial PlanDokumen38 halamanSample Financial PlanPatrick IlaoBelum ada peringkat

- Imogen Powerpoint DesignDokumen29 halamanImogen Powerpoint DesignArthur100% (1)

- Q & A Set 2 PDFDokumen18 halamanQ & A Set 2 PDFBharathiraja MoorthyBelum ada peringkat

- AnnulmentDokumen9 halamanAnnulmentHumility Mae FrioBelum ada peringkat

- What Is SCOPIC Clause - A Simple Overview - SailorinsightDokumen8 halamanWhat Is SCOPIC Clause - A Simple Overview - SailorinsightJivan Jyoti RoutBelum ada peringkat

- Session Guide - Ramil BellenDokumen6 halamanSession Guide - Ramil BellenRamilBelum ada peringkat

- Project Report On ICICI BankDokumen106 halamanProject Report On ICICI BankRohan MishraBelum ada peringkat

- Jurnal UlkusDokumen6 halamanJurnal UlkusIndri AnggraeniBelum ada peringkat

- TN Vision 2023 PDFDokumen68 halamanTN Vision 2023 PDFRajanbabu100% (1)

- Churches That Have Left RCCG 0722 PDFDokumen2 halamanChurches That Have Left RCCG 0722 PDFKadiri JohnBelum ada peringkat

- First Aid General PathologyDokumen8 halamanFirst Aid General PathologyHamza AshrafBelum ada peringkat

- Government College of Engineering Jalgaon (M.S) : Examination Form (Approved)Dokumen2 halamanGovernment College of Engineering Jalgaon (M.S) : Examination Form (Approved)Sachin Yadorao BisenBelum ada peringkat

- Custom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityDokumen1 halamanCustom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityAndrew HunterBelum ada peringkat

- IndianJPsychiatry632179-396519 110051Dokumen5 halamanIndianJPsychiatry632179-396519 110051gion.nandBelum ada peringkat

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyDari EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyPenilaian: 5 dari 5 bintang5/5 (22)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeDari EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimePenilaian: 4.5 dari 5 bintang4.5/5 (88)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveDari EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveBelum ada peringkat

- Summary of Zero to One: Notes on Startups, or How to Build the FutureDari EverandSummary of Zero to One: Notes on Startups, or How to Build the FuturePenilaian: 4.5 dari 5 bintang4.5/5 (100)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurDari Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurPenilaian: 4 dari 5 bintang4/5 (2)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizDari EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizPenilaian: 4.5 dari 5 bintang4.5/5 (112)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldDari Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldPenilaian: 5 dari 5 bintang5/5 (20)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryDari EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryPenilaian: 4 dari 5 bintang4/5 (26)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthDari EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthPenilaian: 4.5 dari 5 bintang4.5/5 (1026)

- Anything You Want: 40 lessons for a new kind of entrepreneurDari EverandAnything You Want: 40 lessons for a new kind of entrepreneurPenilaian: 5 dari 5 bintang5/5 (46)

- The Master Key System: 28 Parts, Questions and AnswersDari EverandThe Master Key System: 28 Parts, Questions and AnswersPenilaian: 5 dari 5 bintang5/5 (62)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeDari EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimePenilaian: 4.5 dari 5 bintang4.5/5 (58)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedDari EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedPenilaian: 4.5 dari 5 bintang4.5/5 (38)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleDari EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistiblePenilaian: 4.5 dari 5 bintang4.5/5 (48)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessDari EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessPenilaian: 4.5 dari 5 bintang4.5/5 (407)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyDari EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyPenilaian: 4.5 dari 5 bintang4.5/5 (300)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeDari EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifePenilaian: 5 dari 5 bintang5/5 (22)

- Your Next Five Moves: Master the Art of Business StrategyDari EverandYour Next Five Moves: Master the Art of Business StrategyPenilaian: 5 dari 5 bintang5/5 (799)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursDari EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursPenilaian: 5 dari 5 bintang5/5 (24)

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchDari EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchPenilaian: 4 dari 5 bintang4/5 (114)

- 7 Secrets to Investing Like Warren BuffettDari Everand7 Secrets to Investing Like Warren BuffettPenilaian: 4.5 dari 5 bintang4.5/5 (121)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsDari EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsPenilaian: 5 dari 5 bintang5/5 (48)

- Transformed: Moving to the Product Operating ModelDari EverandTransformed: Moving to the Product Operating ModelPenilaian: 4 dari 5 bintang4/5 (1)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsDari EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsPenilaian: 5 dari 5 bintang5/5 (2)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelDari EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelPenilaian: 5 dari 5 bintang5/5 (51)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDari EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyBelum ada peringkat

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessDari EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessPenilaian: 4.5 dari 5 bintang4.5/5 (24)

- WEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouDari EverandWEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouPenilaian: 4.5 dari 5 bintang4.5/5 (87)