"FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192

Diunggah oleh

Snehasish Padhy0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan2 halamantax

Judul Asli

Untitled Document

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Initax

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan2 halaman"FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192

Diunggah oleh

Snehasish Padhytax

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

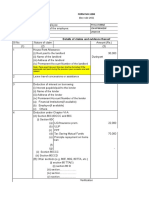

"FORM NO.

12BB (See rule 26C)"

Statement showing particulars of claims by an employee for

deduction of tax under section 192

1.Name and address of the employee: Mr. HARE RAM SAHU

2.Permanent Account Number of the employee: AMSPS1752K

3.Financial year: 2019-2020

Details of claims and evidence thereof

Sl. Evidence /

Nature of claim Amount(Rs.)

No. particulars

(1) (2) (3) (4)

1. House Rent Allowance:

(i) Rent paid to the landlord 0

(ii) Name of the landlord

(iii) Address of the landlord

(iv) Permanent Account Number

of the landlord

Note: Permanent Account

Number shall be

furnished if the aggregate rent

paid

during the previous year exceeds

one lakh rupees

2. Leave travel concessions or

0

assistance

3. Others

4 (i). Deduction of interest on

borrowing:

4 (ii). Deduction of interest on

borrowing (Letout property/

second housing loan):

4 (iii). Deduction of interest on

borrowing ( Add. Hsg loan

80EE):

5. Deduction under Chapter VI-A

(A) Section 80C,80CCC and

80CCD

(i) Section 80C

(a) Public Provident Fund

50000

(PPF)

(b) Life Insurance Premium

75000

paid

(ii) Section 80CCC 0.00 80CCC

Pension

Scheme

(iii) Section 80CCD 50000.00 80CCD(1B)

National

Pension

Scheme

(NPS)

(B)Other sections (e.g. 80E, 80G,

80TTA, etc.)under Chapter VI-A.

(a) 80CCD(1B) 50000.00 80CCD(1B)

National

Pension

Scheme

(NPS)

Verification

I, Mr. HARE RAM SAHU, son/daughter of do hereby certify

that the information given above is complete and correct.

Place

Date 25/04/2019 (Signature of the employee)

Designation : CHIEF MANAGER Full Name : Mr. HARE

(ELECT.) RAM SAHU

Anda mungkin juga menyukai

- Crisil Sme Connect Dec11Dokumen60 halamanCrisil Sme Connect Dec11Lao ZhuBelum ada peringkat

- Section 12BB IT ExampleDokumen2 halamanSection 12BB IT Examplebhaskar ghoshBelum ada peringkat

- Section 12BBDokumen2 halamanSection 12BBbhaskar ghoshBelum ada peringkat

- Income Tax Declaration Form - FORM-NO. 12BBDokumen10 halamanIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalBelum ada peringkat

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Dokumen1 halamanStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajBelum ada peringkat

- Form12BB ZensarDokumen2 halamanForm12BB ZensarRam GuggulBelum ada peringkat

- Form12BB-258 (HARDIK K - PATEL)Dokumen1 halamanForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringBelum ada peringkat

- Form 12 BBDokumen2 halamanForm 12 BBHarsh GandhiBelum ada peringkat

- Form 12BB (See Rule 26C)Dokumen2 halamanForm 12BB (See Rule 26C)Biswadip BanerjeeBelum ada peringkat

- Form 12 BBDokumen2 halamanForm 12 BBSanjay SalunkheBelum ada peringkat

- Form-No.12bb 2020-21Dokumen1 halamanForm-No.12bb 2020-21Sk SerafatBelum ada peringkat

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Dokumen2 halamanStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarBelum ada peringkat

- File 20042020153269734Dokumen1 halamanFile 20042020153269734Skill IndiaBelum ada peringkat

- Form12BB 1Dokumen2 halamanForm12BB 1kolhe2377Belum ada peringkat

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Dokumen1 halamanMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaBelum ada peringkat

- Form 12 BBSampleDokumen2 halamanForm 12 BBSampleAbhishekChauhanBelum ada peringkat

- FORM12BBDokumen1 halamanFORM12BBBotla RajaBelum ada peringkat

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Dokumen1 halamanStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulBelum ada peringkat

- Income-Tax Rules, 1962Dokumen2 halamanIncome-Tax Rules, 1962Henna KadyanBelum ada peringkat

- Form 12BBDokumen2 halamanForm 12BBPintu pajaiBelum ada peringkat

- Epsf Form12bb 93445Dokumen1 halamanEpsf Form12bb 93445dasari.samratBelum ada peringkat

- Form - 12bb of Income TaxDokumen2 halamanForm - 12bb of Income Taxchan chadoBelum ada peringkat

- Form 12 BBDokumen2 halamanForm 12 BBPriyadharshini RamamurthyBelum ada peringkat

- Form12bb 5663202Dokumen2 halamanForm12bb 5663202uttamraochopade52Belum ada peringkat

- Form 12 BB MsirDokumen1 halamanForm 12 BB MsirrajeshBelum ada peringkat

- Epsf Form12bb 215322Dokumen1 halamanEpsf Form12bb 215322anil sangwanBelum ada peringkat

- Epsf Form12bb 215322Dokumen1 halamanEpsf Form12bb 215322anil sangwanBelum ada peringkat

- Form 12BB in Excel FormatDokumen9 halamanForm 12BB in Excel FormatAnonymous gG31dZ9OBelum ada peringkat

- Income Tax Savings Declaration Form EngDokumen2 halamanIncome Tax Savings Declaration Form EngDedyTo'tedongBelum ada peringkat

- 002WZ3744Dokumen3 halaman002WZ3744DrVarsha Priya SinghBelum ada peringkat

- Serv Let ControllerDokumen2 halamanServ Let ControllerAbhishekShuklaBelum ada peringkat

- Form. 12BBDokumen6 halamanForm. 12BBaruyl001Belum ada peringkat

- New Form 12BBDokumen2 halamanNew Form 12BBramanBelum ada peringkat

- Form 12BB and POI Report-1574532776601Dokumen2 halamanForm 12BB and POI Report-1574532776601Akshay RahatwalBelum ada peringkat

- IT DeclarationDokumen1 halamanIT DeclarationprasathBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBAnonymous DbmKEDxBelum ada peringkat

- Itrform12bb PDFDokumen3 halamanItrform12bb PDFRudolph Antony ThomasBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBAnonymous DbmKEDxBelum ada peringkat

- Fabdd PDFDokumen3 halamanFabdd PDFSahil KumarBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBDedyTo'tedongBelum ada peringkat

- Itrform12bb PDFDokumen3 halamanItrform12bb PDFSahil KumarBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBPrAbHaS DarLiNgBelum ada peringkat

- Itrform12bb PDFDokumen3 halamanItrform12bb PDFMeghana JoshiBelum ada peringkat

- Itrform 12 BBDokumen3 halamanItrform 12 BBWater SpecBelum ada peringkat

- Itrform12bb PDFDokumen3 halamanItrform12bb PDFMuhammed RiyazBelum ada peringkat

- Investment Declaration Form - 2023-24Dokumen2 halamanInvestment Declaration Form - 2023-24shrlsBelum ada peringkat

- Form No.12Bb: Details of Claims and Evidence ThereofDokumen2 halamanForm No.12Bb: Details of Claims and Evidence Thereofvijay sharmaBelum ada peringkat

- IT DeclarationDokumen1 halamanIT Declarationswapna vijayBelum ada peringkat

- Form 12BBDokumen1 halamanForm 12BBdeepak.payalBelum ada peringkat

- 7705 Form16-B-201819-461 PDFDokumen1 halaman7705 Form16-B-201819-461 PDFAnonymous vlaen0sHBelum ada peringkat

- Form12bb 23-24Dokumen1 halamanForm12bb 23-24hanu549549Belum ada peringkat

- 7523 Form16-B-201819-353Dokumen1 halaman7523 Form16-B-201819-353Anonymous vlaen0sHBelum ada peringkat

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Dokumen2 halamanStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurBelum ada peringkat

- Form No.12Bb: Details of Claims and Evidence ThereofDokumen2 halamanForm No.12Bb: Details of Claims and Evidence ThereofVighneshwarBhatBelum ada peringkat

- Form No.12Bb: Details of Claims and Evidence ThereofDokumen2 halamanForm No.12Bb: Details of Claims and Evidence ThereofsujupsBelum ada peringkat

- Form No.12Bb: Details of Claims and Evidence ThereofDokumen2 halamanForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaBelum ada peringkat

- Form 12BB in Excel FormatDokumen2 halamanForm 12BB in Excel FormatJTO NIBBelum ada peringkat

- Form No.12Bb: Details of Claims and Evidence ThereofDokumen2 halamanForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaBelum ada peringkat

- IT Declaration-1555459035665Dokumen1 halamanIT Declaration-1555459035665Pooja ParabBelum ada peringkat

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Dokumen1 halamanSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaBelum ada peringkat

- Temporary Power Supply FormDokumen2 halamanTemporary Power Supply FormSnehasish PadhyBelum ada peringkat

- 7SR11 and 7SR12 Argus FlyerDokumen2 halaman7SR11 and 7SR12 Argus FlyerSnehasish PadhyBelum ada peringkat

- Government of Odisha: E-ChallanDokumen1 halamanGovernment of Odisha: E-ChallanSnehasish PadhyBelum ada peringkat

- L3 L1 L2 L3: Cooler Feed Conveyor (05-1C-101B)Dokumen19 halamanL3 L1 L2 L3: Cooler Feed Conveyor (05-1C-101B)Snehasish PadhyBelum ada peringkat

- Check List of Main Air Blower-SAP (B) : Date: 13/10/2018 Shift: "A"Dokumen1 halamanCheck List of Main Air Blower-SAP (B) : Date: 13/10/2018 Shift: "A"Snehasish PadhyBelum ada peringkat

- Fish Bone Diagram: Yellow Belt RefresherDokumen33 halamanFish Bone Diagram: Yellow Belt RefresherSnehasish PadhyBelum ada peringkat

- Echo Research CR10 ReportDokumen72 halamanEcho Research CR10 ReportComunicación EfectivaBelum ada peringkat

- FDNACCT Reflection Paper PDFDokumen4 halamanFDNACCT Reflection Paper PDFCrystal Castor LabragueBelum ada peringkat

- Parking Garage Planning and OperationDokumen182 halamanParking Garage Planning and OperationKhan Lala100% (1)

- Basic Documents and Transactions Related To Bank DepositsDokumen18 halamanBasic Documents and Transactions Related To Bank DepositsDiana Fernandez MagnoBelum ada peringkat

- Caf 8 Cma Autumn 2015Dokumen4 halamanCaf 8 Cma Autumn 2015mary50% (2)

- TX 105 Estate TaxDokumen2 halamanTX 105 Estate TaxRose Kristy SindayenBelum ada peringkat

- Lecture Notes On Trade and Other ReceivablesDokumen5 halamanLecture Notes On Trade and Other Receivablesjudel ArielBelum ada peringkat

- Documents To Check Before Buying A HouseDokumen13 halamanDocuments To Check Before Buying A Housenshetty22869Belum ada peringkat

- 1 Working Capital Management & Cash ManagementDokumen41 halaman1 Working Capital Management & Cash ManagementAibhy Cacho YapBelum ada peringkat

- Mathematics & Decision MakingDokumen9 halamanMathematics & Decision MakingXahed AbdullahBelum ada peringkat

- Sample Project Report - PLUMBINGDokumen2 halamanSample Project Report - PLUMBINGVirendra ChavdaBelum ada peringkat

- Payout Request FormDokumen2 halamanPayout Request FormSATHISHLATEST2005100% (11)

- Functions in ExcelDokumen37 halamanFunctions in Excelssnil1970100% (1)

- Insolvency and Bankruptcy Board of India NCLT - ChennaiDokumen2 halamanInsolvency and Bankruptcy Board of India NCLT - ChennaiGuna KrishBelum ada peringkat

- Prudential Bank V Don Alviar and Georgia AlviarDokumen2 halamanPrudential Bank V Don Alviar and Georgia AlviarRZ Zamora100% (2)

- Financing Road Projects in India Using PPP SchemeDokumen13 halamanFinancing Road Projects in India Using PPP SchemeAneeb100% (2)

- Prospect Theory - Bounded RationalityDokumen57 halamanProspect Theory - Bounded RationalityalishehzadBelum ada peringkat

- Amendment To Negotiable Instruments ActDokumen5 halamanAmendment To Negotiable Instruments ActRamanujarInstitutionalLearningBelum ada peringkat

- Wise Transaction Disclosure 1698248770342Dokumen2 halamanWise Transaction Disclosure 1698248770342ALJANE QUILICOLBelum ada peringkat

- DS700 Carer Alllowance Claim FormDokumen28 halamanDS700 Carer Alllowance Claim FormHassan Mussa KhamisBelum ada peringkat

- Stock Valuation 6 04112020 033540pmDokumen24 halamanStock Valuation 6 04112020 033540pmabcBelum ada peringkat

- Chap. 5 Variable CostingDokumen8 halamanChap. 5 Variable CostingAnand DubeyBelum ada peringkat

- Kurikulum S1 Finance & Banking Peminatan BankingDokumen6 halamanKurikulum S1 Finance & Banking Peminatan BankingIka Yunsita PratiwiBelum ada peringkat

- Bank of The Philippine Islands Green Finance FrameworkDokumen7 halamanBank of The Philippine Islands Green Finance FrameworkMarilyn CailaoBelum ada peringkat

- Statement Bank MBBDokumen13 halamanStatement Bank MBBminyak bidara01Belum ada peringkat

- Cred Transaction Case Doctrines (De-Leon Manzano)Dokumen6 halamanCred Transaction Case Doctrines (De-Leon Manzano)Angela FeriaBelum ada peringkat

- Audit List of Important QuestionsDokumen18 halamanAudit List of Important QuestionsParas0% (1)

- Chapter I and Chapter IiDokumen32 halamanChapter I and Chapter IiDhanya vijeeshBelum ada peringkat

- Chapter Four Interm P2Dokumen10 halamanChapter Four Interm P2saed cabdiBelum ada peringkat