RBI 31 March 2018

Diunggah oleh

Moneylife Foundation0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

3K tayangan28 halamanRBI 31 March 2018

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniRBI 31 March 2018

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

3K tayangan28 halamanRBI 31 March 2018

Diunggah oleh

Moneylife FoundationRBI 31 March 2018

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 28

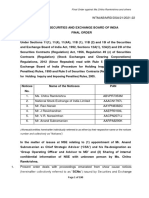

CONFIDENTIAL

Reserve Bank of India

Department of Co-operative Bank Supervision

Mumbai Regional Office

Inspection under Section 35 of the Banking Regulation Act, 1949 (AACS)

Punjab and Maharashtra Cooperative Bank Ltd., Mumbai

Financial Position as on March 31, 2018

1. Introduction & Overview ,

4.4 The XXIII inspection of the Punjab and Maharashtra Cooperative Bank Ltd., Mumbai, a

multi-state scheduled Tier Il bank, was conducted between October 15, 2018 and November

02, 2018 with reference to its audited financial position as on March 31, 2018 (Date of

Present Inspection - DP!) for the present period of review (PPR) between April 01,2017 and

March 31, 2018. The bank was last inspected with reference to its audited financial position

as on March 31, 2017 (Date of Last Inspection - DL!). For this purpose, apart from Head

Office (HO), loan accounts of some branches were examined at the HO. The inspection

report is based on the audited books and records of the bank, retums and other information

furnished by the bank as well as information obtained from other sources believed to be

reliable,

2. Paid up Share Capital - Assessment of Net Worth

2.1 Paid up Share Capital / Solvency / Net Worth

24.4 The paid-up shere capital (at book valiie) stood at ‘29421.68 lakh as on the DPI,

posting an increased by 2970.51 lakh (3.41%) since the DLI. It was mainly due to collection

of additional share capital from existing members, share linkage to borrowings and

admission of new members during the PPR.

2.1.2 The realizable value of the assets of the bank as on the DPI after making provisions

and depreciation assessed at 21119090.71 lakh was more than the outside liabilities at

1048469.99 lakh as worked out in Annex-VI. The real or exchangeable Value of paid up

share capital and reserves (net worth) was assessed at 270820.72 lakh. The divergence

between the book value and the assessed value is analysed in Annex Vil.

2.4.3 The real or exchangeable value of paid-up share capital, reserves and items not in the

nature of outside liabilities formed 6.74% of outside liabilities as on the DPI.

2,2 The details of total assets, risk-weighted assets (including off-balance sheet items),

capital funds and CRAR are furnished over leaf: (Zin lakh)

Si. a "| _As reported by the bank

No. Particulars | 34.03.2017 | 31

id by 10

31.03.2048

Punjab and Maharashtra Co-operative Bank Ltd, Mumba

Financial Position as on March 31, 2018,

[1 [Total Assets [_1054960.43 | 1166015.38 | 1054060.43 | 1166015.3¢

12. [Risk Weighted 734269.20 | 82638182 | 73096261) 763789.55

Assets - at |

3_| Tier | Capital 65336.34| _71860,73| _63467.98| 6646.15

4_| Tier Ii Capital 25139.92| __29731.79| _25763.14| _30706.5' |

Total Capital Funds | __90476.26, 101592.52| 89224.52/ _97039.40

5 | Tier! %) 8.90 8.69 6.69) 8.67

[6 [ert (%) 342 360 352| 405 1

7 | Overall CRAR (%) 42.32 12.29 aa) 272 |

2:2. The assessed CRAR of the bank increased from 12.21% as on the DLI to 12.72% as

on the DPI, mainly due to issue of long term deposits during the PPR which qualified for

inclusion in tier Il capital. The bank's assessed capital fund increased by %7814.88 lakh

(8.76%) as compared to increase in assessed RWAs by 232826.94 lakh (4.49%).

The difference between the reported and assessed CRAR was on account of a combination

of factors viz., incortect application of risk weights, reversal of interest capitalized on NPAs

(£107.65 lakh) and shortfall in loan loss provision (4336.93 lakh).

3, Funds Management

‘The profile of deposits as on the DL! & the DPI was as under: (@ in lakh)

Sr. 31.03.2017 | 31.03.2018 Increase!

Hee Benosis (OL) (oP!) | Decease (%)

1. | Total Deposits 901200.28| 993885.10 10.28

2. | Term Deposits (including

Domestic, Non-Resident & 706770.01 786653.45 44.30

Deposits of banks) (78.43) (79.15)

{% of total deposits)

%. | CASA (including Domestic, Non- 194430.27

Resident & Deposits of banks) (21.57) 2a) ene

(% of total deposits) “

4. | Top 20 depositors 71737.26 83012.03 46.72

(% of total deposits) (7.96) (8.35) 5

5. | Total number of depositors 1528283 1634048 6.92

6. |Number of depositors having

deposits up to 21.00 lakh 1345000 1434520 6.65

(Amount of deposits held by these (221925.04 ) | (225474.46) met

depositors) |

7. |Number of depositors having

deposits above 21.00 lakh 183283, 199528 8.86

(Amount of deposits held by these | (679275.24) | (768410.64)

depositors)

3.1 Composition of deposits: Proportion of CASA deposits to ts otal deposits decreased ©

from 21.57% as on the DLI to 20.85% as on the DPI while term deposits increased by

14.30% during the corresponding period, The main reason was the introduction of new terse

Pagd 2

082 6

Punjab and Ma

htra Co-operative Bank Ltd., Mumbai

Financial Position as an March 31, 2018

deposit schemes by the bank during the PPR at attractive rates of interest, e.g. PMC 100

Deposit Scheme @ 7.50% p.a., PMC 24 Deposit Scheme @8% p.a., PMC 13 Deposit

Scheme @8.25% p.a., etc

3.2 Maturity profile of term deposits: The maturity profile of term deposits as on the DPI

revealed that 69.18% of the term deposits were repayable within a period of one year,

28.75% of the term deposits were repayable within one to three years and remaining 4.07%

of the term deposits had a maturity period of above three years.

3.3 Average Cost of deposits: The average cost of deposits decreased from 7.65% (2016-

17) to 7.12% (2017-18) during the PPR mainly due to reduction/closure of term deposits

held with higher interest rates of above 9%. The interest rate range was between 4.0% and

7.15% with an additional 100 basis points for staff and 25 basis points for senior citizens for

some selected slabs. The bank had introduced four new term deposit schemes during the

PPR with interest rates ranging from 7,50% to 8.25% p.a. which boosted its ferm deposits,

3.3.1 As on the DPI, the bank's matured deposits stood at $7037.89 lakh and it had provided

%644.08 lakh towards interest payable on matured deposits at 7.50% p.a.

3.4 Borrowing & Lending operations: The outstanding borrowing as on the DP! was

825,179.72 lakh, consisting of Refinance 12,168.47 lakh and Long Term Deposits

(LTD) 213,011.25 lakh. The bank had issued LTDs with permission for issue of long term

deposits of 1500.00 lakh from the Central Registrar of Co-operative Societies on October

28, 2016 and informed RBI, DCBS, CO about the same vide their letter dated January 31,

2017. }

The bank also had borrowing arrangements in the nature of overdraft facility with HDF

Bank Ltd, against the security of its fixed deposits. The bank had résorted to. borrowing

through long term deposits, CBLO, refinance from and against its FDRs during the

PPR to meet its clearing mismatches, for increasing Tier I! capital and tending requirements,

The average cost of borrowing was 7.88%. The average dally orrawing duting the PPR

was %27287.36lakh( Refinance 212480.11 lakh, CBLO %4298.31 lakh, LTD 210332.00

lakh, under CROMS %159.96 lakh and against bank FDRs 216.98 lakh). The bank had paid

an interest of €259.49 lakh on CBLO, ODFD and CROMS borrowing, £978.23 lakh on

refinance and 912.54 lakh on LTD borrowing totalling €2150.26 lakh, The bank had directly

lent funds through Reverse REPO (LAF), in Call Money Market, CBLO, CROMS (interbank

Teverse repo), deployed in mutual funds and eamed an interest of 1405.63 lakh during the

PPR.

Punjab and Maharashtra Co-operative Bank Ltd, Mumbai

Financial Position as on March 31, 2018

3.5 CD ratio: CD ratio increased from 71 44% as on the DLI to 75.03% as on the DPI, due

to increase in advances by 15.83% vis-a-vis increase in deposits by 10.28% during the PPR.

CD ratio as per Supervisory Action Framework (SAF) stood at 69.25%

3.6 The outstanding balance of deposits accepted from non-scheduled UCBs was

252771.15 lakh (6.86% of previous year's deposits). Ithad deposits of €183228.19 lakh from

co-operative societies and institutions which formed 13.41% of its total deposits.

4, Investments

4.1 The investment policy for 2017-18 was reviewed by the Board on October 16, 2017 and

was generally in tune with RBI guidelines. However, a copy of the investment policy of the

bank was not forwarded to the Regional Office of the RBI certifying that the policy is in

accordance with the prescribed guidelines and the same has been put in place, which was

not in accordance’ with para no.-3.6 of the Master Circular on Investments DCBR

_BPD(PCB).MC.No.4/16:20.000/2015-16 dated July 1, 2015. ‘ (Action)

A.A The bank had maintained its SGL account with RBI, while its investments in various

bonds were held in the demat account (NSDL) maintained with itself. The bank had classified

its entire investments into Held to Maturity (HTM) and Available for Sale (AFS) categories

as on the DPI. The decrease in AFS portfolio was due to sale of securities held under AFS

category and shifting of securities from AFS to HTM category. The details of classification

of its investment portfolio as on the DL! and the DP! were as under: (@ in lakh)

DLI (31.03.2017) DPI (31.03.2018) J

Change

Classifi Non Non-

SLR Total SLR Total (%)

cation SLR SLR a

HTM 106185.29 =| 106185.29| 120308.95 =| 120308.95| 13.30

AFS 719604.26 | 4528.59 | 124132.87| 11 4703.84| 3932.09 | 115635.93 | (-)6.85

HFT 2685.96 i 2685.96 = - we NA

Total 228475.53 | 4528.59) 233004.12 232012.79 | 3932.09 | 235944.88 1.26

anerence to exposure norms: The bank had adhered fo “the regulatory

limits/prescriptions as regards investments in SLR, non-SLR securities and placement of

deposits with other banks. ;

4.4.2 Shifting! depreciation! Valuation! amortisation/income recognition:

4:.2.4 Shifting: The bank had shifted securities from AFS to HTM category and vice versa

during the PPR on April 28, 2017 with the prior approval of the Board on April 24, 2017.

‘There was a shifting loss of 8969.95 lakh. This amount was debited to P & L account under

the head ‘Provision against investment depreciation’. It had a system of automatic shift

Punjab and Maharashtra Co-operative Bank Ltd,, Mumbai

Financial Position as on March 31, 2018

of securities from HFT to AFS category after completion of 90 days of purchase (holding)

for which it had obtained post facto approval from Board periodically. It has done such

shifting on 17 occasions during PPR (last such shifting being on March 20, 2018),

aggregating %9973,50 lakh and depreciation/loss of $347.25 lakh in the shifting exercise

was debited to Profit and Loss account under the head ‘Provision against investment

depreciation’. No deficiency was observed in respect of the shifting exercise undertaken

during the PPR,

4.1.2.2 Valuation: The bank's AFS/HFT portfolio was marked to market at monthly intervals

by the bank as per FBIL rates and:there was depreciation of 8127.14 lakh in the securities

held under AFS/HFT category as on the DPI. Further, the bank held shares pertaining to

(0.87 lakh) and (0.36 lakh) aggregating to £1.23 lakh for which

it had made full provision as the dividends were irregular: Also; the bank held shares

pertaining to NPCI ('24.99 lakh) on which dividend was not received. Hence the bank had

Provided 24.99 lakh which was: covered under IDR. The bank held an Investment

Depreciation Reserve (IDR) of 21310.26 lakh as onthe DPI which was adequate to cover

above depreciation in investments, The excess IDR ("4310.26 lakh ~ (1277.14+1.23+24.99)

= 1303.36 lakh = °6.90 lakh) was ‘considered for calculating the net worth and CRAR Sete i

bank.

The bank held an Investment Fluctuation Reserve (IFR) of 27564.64 lakh (6.54%) of the

AFSIHFT portfolio (%115635.93 lakh) against requirement of 35781, 80 lakh (6% of AFS

Portfolio) and therefore, excess IFR of 21782.84 lakh was considered for the calculation of

assessed net worth of the bank.

4.1.2.3 The bank had amortized the premium of 2298.92 lakh during 2017-18 in respect of

securities held under HTM category and the same charged to the bank's P & L-account

during the year,

4.1.2.4 The bank had 12 brokers on its. panel and 35 transactions were routed ‘through them

during 2017-18, No irregularities were observed in this regard.

4.2 Audit & review: The investment Portfolio was subjected to a concurrent audit on

monthly basis by a firm of chartered accountants andan internal audit on a quarterly basis,

However, the concurrent auditors had not commented ‘on adherence to conformity with

broker limits of 5% of total transactions (both purchase and sale) entered into by the bank

during the PPR for each of the approved brokers as required in terms of Para 15.1.3 (v) of

Punjab and Maharashtra Co-operative Bank Ltd., Mumbal

Financial Position as on March 31, 2018

Master Circular on Investments DCBR.BPD(PCB). MC.No.4/16.20.000/2015-16 dated July

4, 2015 (Persisting Action)

42.4 The half yearly reviews of investment portfolio were undertaken during the year and

placed before the Board and forwarded to RBI. -

4.2.2 The Intemal Audit department of the bank was not auditing the transactions in

securities on an ongoing basis, as required in terms of Para 14.1.5 of RBI circular DCBR.

BPD (PCB).MC.No. 4/16.20.000 /2015-16 dated July 1, 2015. (Action)

4.2.3 The bank's Loan & Investment Committee of the Board met on 9 occasions during the

year.

4.3 The retum on investments (SLR / Non-SLR / Bank deposits) was 7.54% during 2017-18

vis-a-vis 7.69% during 2016-17. The reduction in the retum on investment was due to

reduction in interest on FORS placed with other banks.

4.4 The bank had undertaken 2665 transactions of purchase of government securities and

2600 transactions of sales during the PPR and eamed a profit (income) of 316.22 lakh

thereon. The bank had also eared an income of 1150.58 lakh from investments in eligible

mutual fund (debt) and 2176.93 lakh from Forex Treasury.

4.5 The deposit of “134.65 lakh with (by

. erstwhile «was considered as non-performing, for which the bank had

made full provision.

5. Loans & Advances:

5. Loans, Fixed Assets and Other Assets

Deficiencies in Credit Policy: The bank's credit policy was last reviewed by the Board on

July 04, 2017. The coverage and contents of the credit policy needed improvement as the

following important items were not included therein:

(i) It did not prescribe exposure limits to various economic sectors as approved by the BoD.

i) It did not prescribe manner/mechanism for monitoring/ensuring end-use of funds in

different type of loans.

(ii) It did not cover the frequency of ad hoc/temporary overdrafts in cash creditoverdraft

facilities that could be sanctioned.

(iv) The bank had not formulated a policy for classification, identification and

ating penal

action against wilful defaulters as prescribed vide para 5.4.4(c) of RBI Master Circular on

management of advances issued to UCBs vide DCBR.BPD.(PCB) MC No.14/13.05.000/

2015-16 dated July 1, 2015.

Punjab and Maharashtra Co-operative Bank Lid,, Mumbai

Financial Position as on March'31, 2018

(v) The credit policy did not prescribe amount of capitavowned funds to be

introduced/maintained by the promoters in the business concem in cash credit facilities

sanctioned for working capital requirement.

(vi) It did not prescribe a system of stipulating the Date of Commencement of Commercial

Operations/Production (OCCO/DCCP) in case of project loans. (Action all paras)

5.1 Growth in Advances: The bank’s loan portfolio increased from %643823.00 lakh as on

the DLI to 2745749.63 lakh as on the DPI, registering an increase of €101926.63 lakh

(15.83%).

5.1.4 Credit Concentration: As on the DPI, 484 loan accounts (0.01% of total number of

loan accounts) with outstanding balance of °230399.68 lakh formed 30.90% of total

advances which indicated thatthe bank's advances portfolio was skewed in favour of large

borrowers, thus, exposing the bank to credit concentration risk. (Action)

5.1.2 Compliance with statutory and regulatory norms: I

5.1.2.1 Lending to Priority Sector and Weaker Sections: The bank’s reported lending to

the protily sector and weaker sections at 16.58% and 5.73% respectively of ANBC of

previous year ('643823,00 lakh) was below the stipulation’ of 40% and 10% (of ANBC

respective}. The same was in nomacoordance of para 8.2 of RBI Circlar= DCBRL.BPD.

(PCB). MC...No:441/09,09,001/2016-16 dated July 4, 2015. As such, the bank had not

achieved the prescribed targets of lending towards priority sector and weaker sections in the

previous financial year as well, (Persisting Action)

The priority Sector and weaker section classification was done In the CBS by the branch

officials. However, its correctness was not independently verified by the Head Office.

Further, the bank was devoid of a robust reporting ‘system for priority sector ‘classification as

required under para 6(i) of RBI Master Circular, ibid. (Action).

5.4.3 Deficiencies in credit appraisal and supervision: {

(a) Exchange of Information to Credit Information Companies (CICs): The bank had

availed membership of-all the credit information companies (CICs) during the Eee

However, information exchange was not yet undertaken with

. Which

was in non-accordance with guidelines prescribed at para 3 of RBI Circular - DCR’ BPD.

(PCBIRCB). Cir No.13/16.74,000/2014-15 dated January 29, 2015. (Action)

(b) Deficiencies in cash credit facilities: The bank had not compared historical financial

performance over different financial years, achievement vis-&-vis projections made etc

during the renewal/enhancement of cash credit accounts. The credit policy did not preseri6

Punjab and Maharashtra Co-operative Bank Ltd, Mumbai

Financial Position as on March 31, 2018

amount of capital/owned funds to be introduced/maintained by the promoters in the business

concem in cash credit facilities sanctioned for working capital requirement. Cases were

observed wherein the promoters held very low capital/owned funds compared to quantum

of bank finance (LOI). In certain cases, the bank did not obtain detailed age-wise list of

debtors and creditors under the stock/book debt statements in cash credit accounts. Further,

such statements only declared data on stock without submission of any purchase/sale

invoices and did not contain details of stock financed by creditors, if any. Consequently, the

Drawing Power calculated by the bank in such cases was inaccurate. (Lol) (Action)

(c) Deficiencies in project loans: The bank did not fix the Date of Commencement of

Commercial Operations/Production (DCCO/DCCP) in project loans in non-adherence to

instructions advised by RBI vide Annex-8 to RBI Master Circular on Income Recognition,

Asset Classification, Provisioning and Other Related Matters - UCBs issued vide

DCBR.BPD. (PCB) MC No.12/09.14.000/2015-16 dated July. 1, 2015. Further,

milestonesideadiines for completion of various stages of the project were not

sought/established. (Lol) (Persisting Action)

(d) Diversion of funds and End-use of funds: In several loan accounts, the purpose of

the loan was for business expansion/development. However, the bank was not able to

produce records/documents confirming end-use of loan proceeds. Further, non-verification

of end use of funds was not in tune with para 4.11, 4.12 and 4.13 of RBI Master Circular on

Advances dated July 1, 2015. (Lol) (Action)

(e) Non-adherence to bank's credit policy: The bank had not adhered to its credit policy

as detailed below:

(In several cash credit accounts, there was no assessment of working capital

requirements of the borrower. (LOl)

(il) End use of funds was not verified by the bank in several accounts. (LO!)

(iii) In several cases, the bank had adjusted advances granted in one account by giving

accommodation in another account of the same borrower or its sister concem. (LOI)

(Action all)

(f) During the PPR, it was observed that in several loan accounts, bank had sanctioned new

loan facilities (to group accounts) to regularise/close the existing NPA accounts in non-

adherence to RB! instructions issued vide para 2.2.1 (ii) of MC on IRAC norms dated July

4, 2015. IO had treated such new loan alcs as non-performing as on the DPI. (Lol)

(Action)

5.1.4 Director-related Loans: The bank had sanctioned mortgage overdraft limit_of

“3000.00 lakh on December 07, 2010 to

Punjab and Maharashtra Co-operative Bank Lid., Mumbai

Financial Position as on March'31, 2018

which was further enhanced by ‘1000.00 lakh to "4000.00 lakh on December 21, 2012. The

Present Chairman of the bank and the then director of the bank'was one of the directors of

during the period when the loan Was sanctioned, Such acts: of

Sanetiorvenhancement of credit facility to entities related to the director went against the

spirit of RBI instructions issued vide Master Circular on Board of Directors ~ UCBs UBD.CO.

BPD (PCB) MC.No. 8/12.05.001/2010-11 dated July 4, 2010 and UBD.CO.BPD.

MC.No.8/12.05.001/2012-13 dated July 2, 2012, (Action)

Further; chaired the Board meeting dated May 31, 2017 to ratify the

approval of mortgage overdraft to twas |

observed that there were transactions routed from current account of shade Sih)

|

[directors of the company were ; |

from |

i I apianat | |

Such transactions between the.“

Chairman / his relatives and the company:in question, indicated lack of adherencé to

principles of corporate governance: cats (Action)

5.1.5 Quality of loan portfolio: aac di |

(2) Adherence to Income Recognition and Asset Classification (IRAC) norms: al

Deficiencies in NPA identification: The bank was yet to adopt NPA identification’on an

on-going basis as prescribed vide para 2.1.6 of RBI Master Circular on Income Recognition,

Asset Classification, Provisioning and Other Related Matters - Uces Issued vide

DCBR.BPD.(POB) MC:No.12/09.14.000/2016-16 dated July1, 2018. The bank had also {

established appropriate internal systems to’eliminate the tendency to delay or postpone the |

icentifcation of NPAs, especially in respect of high value accounts as prescribed i para |

3.3:5() of the RBI Master Circular, ibid. Further, the system prevailing for monito ng andy

Periodic follow-up of overdue accounts needed improvement (Action)

‘The bank had included the amount of unrealised interest in case of NPA loan actounts

(2941.28 lakh) on the asset side under the respective loan accounts instead of transferring

Ito "interest Revelvable' under loans and advances. On the labiity side of the balance

sheet, the corresponding amount was shown under a Separate head ‘Provision for interest

Capitalised on NPA accounts’ under ‘Other Liablies’ instead of showing the same ty

Punjab and Maharashtra Co-operative Bank Ltd., Mumbai

Financial Position as on March 31, 2018

‘Overdue Interest Reserve (OIR)’. Thus, the gross advances of the bank were inflated to this

extent by “2941.28 lakh. Further, the bank had shown its gross advances as ‘742608.35

lakh in its audited NPA statements. Thus, there was difference of the amount of gross

advances in audited balance sheet and audited NPA statement. (Action)

(by Restructured Accounts: The bank had not disclosed any restructured account as on

DPI. However, In case of a term loan account of

the bank vide appraisal note dated March 28, 2018 had extended the original

Date of Commencement of Commercial Operation (DCCO) from June 30, 2017 to

November 30, 2018, The IO has treated this as a restructured account as per 2.4 of Annex

8 of RBI Master circular on IRAC norms dated July 1, 2015. The same was also not disclosed

in the bank's annual balance sheet under ‘Notes on account’ as required in para 2.2.7.90 of

RBI Master circular, ibid. - (Action)

Further, during 2017-18 (til October 31, 2018), the bank had undertaken restructuring of

credit facility in respect of one borrower

which was restructured on May 24, 2018. The bank should undertake close

monitoring of such accounts for satisfactory performance during the specified period.

(Action)

(c) Special Mention Accounts (SMA) / Monitoring required: Certain potential NPAsiweak

accounts were observed during the course of Inspection on grounds of weakening

operational performance (as reflected from the statement of account/financial statements)

resulting in overdues/becoming NPAs til the closure date of inspection (LO). (Action)

(a) Quick Mortality: Further, in some cases (LON) it was observed that the credit facilities

sanctioned/disbursed became NPA within a year. The bank had not analysed the reasons

therefor. (Action)

(e) Identification of additional NPAs: The current inspection had identified divergence in

asset classification of loan accounts to the extent of €39384.91 lakh in case of 20 borrowers

as detailed at Annex-V. (Action)

(f) The profile of advances portfolio as on the DLI and the DPis given below: (@in lakh)

mi March 31, 2017 (DLI) March 31, 2018 (DPI)

Partiogiary Ks per bank | As perlO_| As per bank | As per!O

| (1) Standard Assets. Zi 632637.42 623057.12 730949.37 | 690431.86

(2) Sub-Standard Assets | 1763.26 8706.53 4632.17 38851.34

(3) Doubtful Assets 9406.79 42043.82 10152.56 416450.90

[(4) Loss Assets. 15.63/___15.53 15.53 15.53

(5) Gross NPAS 41185.58 (20765.88 14800.26 54185.17

(% of Gross NPAs) (4.74%) (3.23%) (1.98) (7.27)

(®. Gross Advances 643823.00 643823.00 745749.63 ea

Punjab and Maharashtra Co-operative Bank Lid,, Mumbai

Financial Position as on March’'31, 2018

[(BDDR ad ___5060.18 | 5060.18 [7085.18 | __7086.18

| (8) Net Advances | 636762.82/ 637848.68 | 73866445 | 735723.17

(9) Net NPAs | 6125.40) 14791.56 | 7715.08) 47099.99

(% of Net NPAs) _ (0.96%) (2.32%) (1.04) (6.40)

* The bank had included the amount of interest capitalised (2941.28 lakh) on the asset side under the total

amount of loans and advances ('745749.63 lakh). 10 had deducted the same from total loans end-advances

in assessment of gross NPAs and net NPAs in percentege terms.

The asset quality deteriorated both in absolute as well as percentage terms during thé PPR.

‘The assessed gross NPAs had increased from €20765,88 lakh (3.23%) to €54185.17 lakh

(7.27%) since the DLI, indicating poor credit appraisal and weak monitoring. The assessed

net NPAs stood at €47099.99 lakh (6.40%) as compared to #14791.56 lakh (2.32%) as on

the LI. (Action)

The interest capitalized in NPA accounts identified by the present inspection was €1077.65

lakh which was suggested for erosion in assessment of net profit, net worth and CRAR.

5.1.6 Recovery: The position of recoveries and NPAs during the last three years is given

below: (€inlakh)

NPAs at ] Write | Recove | Additions ‘Additions | NPAS as

beginnin | -Off | ries 7

Year g durin to NPAs to NPAs.

gthe during during P

Year - r

the year the year as |

asper |") I perio a,

bank

2015-16 | 5257.28 + 2146.56 4541.61 | « 7652.33 10171.94

2016-17 | 7652.33 7 1828.94 5062.16. 11185.58 _ 9580.30

2017-18 | 11485.58 = | 1508.27 $212.89 14800.26| — 30384.01 BHe5 7

Ofthe 1844 accounts classified as NPAs as on the DPI, registered notices were Sent i i 4 7

cases, 125 cases Were under arbitration, 231 cases were awards pending ‘execution and

awards were under execution in respect of 145 eases and action was not taken in 6

accounts. (Action) *

5.2.3 The bank had settled 36 NPAs involving 2301.77 lakH Under compromise settlement

during the PPR. No principal amount involved was written off. Further, the bank had not

written off or settied any loan accounts under OTS during the PPR’

5.3-1 Premises: The bank held 59 owned premises and 105 rented premises as on the DPI,

The bank had purchased six premises at Kandivali, Pal Pallash (Surat), Jogeshwari, Mulund,

Devkar Pannad Kolhapur and Bhandup Kukreja Comples Chembur during the PPR.

Page 11 of

i.

|

Bani

-

Nes

Punjab and Maharashtra Co-operative Bank Ltd., Mumbai

Financial Position as on March 31, 2018

5.3.2 Other Assets and Non-banking assets (NBAs): There were no intangibles in other

assets.

The bank held NBAs of @51.24 lakh as on DP! as compared to 2154.70 lakh as on the DLI.

The bank had reversed its NBAs to the tune of 103.46 lakb during the PPR with the due

approval of its board because the proper procedure for acquiring these NBAs was not

followed by the bank at the time of its acquisition.

6. Management

6.1 Performance of the Board of Director (BoD) and Committees

6.1.1 Formulation of Policies: The bank had framed policies on various functional areas

like credit, investment, ALM, audit, Forex Treasury, KYC/AML, recovery, risk management,

staff accountability, etc. These policies were reviewed during the PPR.

6.4.2 Composition of the Board of Directors (BoD): The composition of the Board of

Directors was as per the bye-laws of the bank.

6.1.3 Performance of the Board: The BoD held 11 meetings during the PPR. The average

attendance in the board meetings was 71.43%. The performance of the Board was not

considered satisfactory as the Chairman had not ensured adherence to the Dos and Don’ts

prescribed for Board of Directors regarding non-participation in the Board discussion, if a

proposal in which they are directly or indirectly interested in, came up for discussion, as

mentioned in para no. 6.1.4 of this IR. : ‘

6.1.4 Committees/Sub-committees of the BoD and their performance: The bank had

formed 4 Sub-Committees viz. Executive Committee, Loan and Investment Committee,

Recovery Committee and Audit Committee. The Loan and Investment Committee met on

nine occasions during the PPR and it needed to attend to various deficiencies pointed out

in para on Loansand Advances above. The Audit Committee met on five occasions during

PPR. The Recovery Committee and the Executive Committee each met on five occasions

during the year 2017-18. ‘The functioning of the Recovery Committee was not satisfactory

during the year as there was a substantial increase in the percentage of gross NPAs (7.42%)

and the quantum of recoveries in NPA accounts had fallen drastically. (Action)

6.2.1 The executive team needed to bestow more attention to rectify deficiencies related to

credit appraisal and post-sanction supervision mentioned in para no, 5.1.3 of the inspection

report. Performance of the BoD as well as some of the sub-committees were deficient in

some areas, such as;

(i) emerging and sensitive areas, requiring focussed approach eg. dispute resolution,

grievance redressal, annual business plan and information technology were not being

attended to by any committee of the BoD;

‘a.

Page fal

Punjab and Maharashtra Co-operative Bank Ltd, Mumbai

Financial Position as on March'31, 2018

(ii) BoD did not ensure the adherence to UCIC extant guidelines.

(iil) Some of the other deficient areas, such as management information system, review of

risk categorization of depositors’ accounts, inspection and IS audit, were not being given

due importance by the BoD or any of the committees; | (Action all)

6.2.2 Kt was required in terms of para 3.2 of RBI Circular’ DCBR.BPD (PCBIRCB)

Cir.No.2/14.01.062/2015-18 dated July 4, 2016 that the Audit Committee of the Board

Should review the implementation of the guideline as issued by RBI and submit a note,

thereon to the Board, at quarterly intervals. There was no evidence to substantiate that the

Committee discharged this responsibility. . (Action)

62.3 The performance of the BoD and the Executive Team was. not considered to be

Satisfactory in view of various deficiencies highlighted in this feport, specifically with regard

delayed initiation and compliance of audit reports, non-achievementof targets under Priority.

SectorMWeaker Section lending, increase in loss making branches (56), deficiencies

mentioned in para no. 9 of this report, etc,

6.3 There was 2-3 months delay in submission of some monthly/quarterly and half yearly

reviews to the Board. As such, the BoD did not adhere to the calendar of reviews as required

in terms of instructions contained in para § and Annex 2 of RBI circular DCBRBPD

(PCBIRCB) Cir-No.2/14.01.062 (2015-16 dated July 12015 (Lol).. (Action)

6.4 The bank had imparted training to its staff and officers ‘through in-house Programs and

deputation to external training establishments.

6.5 Control by HO, Controlling Offices: The bank had a three-t er Organizational structure

wherein the branches reported to the 12 Regional Offices (ROs). The ROs reported to the

HO and they exercised control over the branches through Varlous statements, periodic visits

by executives, concurrent audit and intemal audit, ‘

7. Earnings Appraisal

7.1 The trends of segment-wise details of income and expenditure during the last two years

aré furnished below:

(in lakh)

Particulars of Incomeand Expenditure | 201647 | 2017-18 Yara :

Income from: Advances: 8557.51 | 90310.78 5.54

Investments & inter-bank deposits | 18624.73 19256.09 3.38.

Other Operating Incom | 1o194.13 [7337.81 | (28.01

| Non-Operating Income 58.87 83.01 54.09 | |

Expenditure: Interest on Deposits/Borrowings 67406.60 |. 68015.38

0.90

ee ‘Other operating expenses 41317.67 | 11412.23| 0.83

ee Other expenses ‘es 1492.03 | 16373.39 5.69

Page 13 of

(Persisting Action) —

Punlab and Maharashira Co-operative Bonk Lid, Mumboi

Financial Postion as on March'31 Sty

The increase in interest income from advances was mainly due

of the bank by 16.83% during the PPR. The increase in incor

‘The details of profitability ratios are set out in table below:

PSG basa,

No | : Particulars

(@ in takhy

= 7

2016-17 2017-18

est Margin (Reported) (%)

| Adjusted NIM (assessed ag

-B- | Gost Income Ratio (Reported) (%) TEES

.8__| Staff Cost to Total Income Ratio (Repo

7 “| Other Overheads fo Total Income Rete

L___| Reported) (%) Sits

8 | Retum on Average Tolal Assets (%)*

oo | Retum on Average E Eaming Assets (%)" |

("Baséd on assessed PAT)

Punjab and Maharashtra Co-operative Bank Ltd., Mumbai

Financial Position as on March 31, 2018

and vendor services (franking).

8. Liquidity

8.1 The bank had maintained required level of Cash Reserve Ratio (CRR) and Statutory

Liquidity Ratio (SLR) during the PPR. On a ‘sample check, the compilation of NDTL by the:

bank was found to be in order.

8.1.2 The statement of Interest Rate Sensitivity was prepared on a monthly basis and

forwarded to RBI. The statements were put up to the Asset Liability Committee (ALCO)

generally on a monthly basis, However, the bank had not included the un-availed portion of

cash credit limit while reckoning the mismatches in the. ‘structural liquidity statement and the

interest rate sensitivity statement. This ‘was also mentioned in the previous year's inspection

report, (Persisting Action)

8.1.3 The bank’s ALM Policy (reviewed on April 25; 2018) and composition Of ALCO was in

accordance with RBI guidelines. ALCO held 11 meetings during the PPR, However, this

was not in accordance with para no. B (ALM ‘Organization/Structure) of the. bank's ALM

Policy wherein it was prescribed that the ALCO. meetings will take place at least once in a

month.

8.1.4 The bank had_ not set:any prudential limits on the individual interest rate sensitivity

94PS as required in terms of para 8.5 of the enclosure to the circular UBD. No. POT, SUCB

Cir. No.9/09.120.00/2001 dated April 02, 2002, (Action) |

8.1.5 The cumulative mismatches in various time buckets in the Statements of Structural

Liquidity were discussed in the ALCO meetings and statements of Interest Rate Sensitivity,

and Short-term Dynamic Liquidity were also discussed in the ALCO meetings, However,

Issues like desired maturity profile and mix ofthe incremental assets and liabilities, reviewir

the results of and progress in implementation of the decisions’ made in the us

meetings, management of trading'risk, funding and capital planning, profit planning and

business projection ete., were hot discussed as Specified vide para no. 3.4 and 5 of. hreular

UBD. No. POT. SUCB Cit: No.9/09.120.00/2001-2002 dated April 02; 2002

discussed in the ALCO meetings.

8.1.6 The bank.had:not carried out behavioural study of assets, lia

lability items during FY 2017-18 as required in tefms. of papa in

UBD.No.POT.SUCB.CIR.9/09.120.00/2001-2002 dated April02, 2002,

9. Systems and Control

9.1 KYC, AML and CFT \

9.1.1 Policy Adequacy and Adherence thereof i

were not

10. 9.1. of circular

9-1.1.1 KYC policy: The bank had a KYC policy, approved by its BoD, which was reviewed.<7 p=

:

ae

oY

Punlb and Maharashira Co-operative Bark Lid, Mumboi

Financial Postion as on March 31, 2010

Customer had credit facilities with other banks, if so, details needed to be Provided. However,

in majority of the accounts the same was left blank or details of facilities with other banks

\were not furnished. The bank was thus not following the instructions contained in para 4.3 ,

2015-16 dated duly 04, 2015 (LON. (Action)

b) * olnt General Manager was the Principal Ofncer and

Managing Director, was the Designated Director for KYC and AML.

9.1.1.3 CTRISTRICCRINTR Teporting to FIU-iND

a) The bank had furnished Cash Transaction Reports (CTR), Non-Profit Organization

Transaction Report (NTR) and Counterfeit ‘Currency Report (CCR) to FIU-IND, New Delhi

in time during the PPR in time. x

9.1.2 Compliance level

9.1.2.1(a) Know your customer (KYC) status:

Punjab and Maharashtra Co-operative Bank Ltd,, Mumbai

Financial Position as on March 31, 2018

As on the DPI, the bank had a total of 1256364 customers, out of which 49448 (3.94%)

customers (pertaining to merged banks) were KYC non-compliant. The bank had

undertaken various steps like personal follow up, sending letters, emails and messages on

registered mobiles. The bank was advised to ensure complete KYC compliance in all such

cases at the earliest. (Action)

(b) As on the DPI, out of 52039 customers (4.14%) which were due for KYC updation, 29250

customers had updated their KYC and remaining 22789 customers were pending KYC

updation. Reportedly, out of the above 22789 customers pending KY updation as on the

DPI, 3219 customers have updated their KYC {ill date (February 27, 2019) and in the

balance 19570 customers, the bank had frozen their accounts. (Action)

9.1.2.2 Risk categorization of customers:

The bank had done risk profiling of the customers on the basis of parameters such as

constitution, nature of transactions, volume of transactions, etc. The bank had reviewed risk

profiles on a halt-yearly basis. As on the DPI, the bank had classified 69.42%, 19.48% and

11.20% of customers under low, medium/moderate and high risk categories respectively.

9.1.2.3 Allotment of UCIC: The bank had reported to have completed allotment of Unique

Customer Identification Code (UCIC) to its customers. However, it was observed that in

Several cases, customers was allotted multiple UCICs which was not it accordance with -

guidelines prescribed at pata 62(a) of RB! Master Direction DBR:AML.BC.No.81/44.01.001/

2015-16 dated February 25, 2016 (Lol): (Action)

9.1.2.4 Uploading of Central KYC Registry (CKYCR): The bank had started uploading its

customers’ data on CKYCR from April 01, 2017 and uploaded 85484 customers’ data at

CKYCR as on the DPI. The bank had generated 142119: CKYCR Number (KIN) as on

‘September 30, 2018,

9-1.2.5 The bank had not included ‘thd. gender’ in current account opening form prescribed

by bank, where in any gender classification is envisaged. As such the bank had not adhered

to instructions contained in para 3.1 of Master Circular issued vide DCBR.CO.BPD.

(P@B).MC.No.15/ 12.05.001/ 2015-16 dated July 1, 2015,

9.2 Audit and Control:

9.2.1 Control mechanism:

(Action)

The bank had a Board approved audit policy which was last reviewed by the Board on April

24, 2017. The bank had an Audit and Vigilance (AV) Department headed by an officer in the

rank of Deputy General Manager. All the branches of the bank, including the HO, were

covered under a concurrent audit (monthly reporting for advances and KYC) and quarterly

Page 17 of 24

can

os

Punjab and Maharashtra Co-operative Bank Ltd., Mumbai

Financial Position as on March '31, 2018

‘or other areas. The bank also had a system of internal inspection for brariches on a yearly

basis (surprise visit) and for other departments at year/half yearly periodicity.

Itwas observed as under:

') The scope of concurrent audit and internal inspection was inadequate, as verification of

statements, HO returns, statutory retums were not covered in terms of Annex-I of RBI

Master Circular No. DCBR. CO. BPD(PCB) MC No. 3/ 12.05.001/ 2016-16 dated July

4, 2015,

Hl) | The internal inspection was conducted by bank's own staff, The bank conducted

/ concurrent audit through a Chartered Accountant firm and the reports and compliance

was submitted online, As per terms and conditions of scope given to the auditor,

reports were to be submitted within 15 days of the preceding month. However, delay

was observed in submission-of audit report, compliance by branches and closure of

compliance. (Lol). (Action: & ii)

9.2.2 RBI Inspection: The bank was last inspected by the Reserve Bank of India with

reference to its financial position as on March 31, 2017. The bank received report on March

08, 2018 and submitted its compliance in time. However, some deficiencies were still

~ persisting as listed in Annex VIII. (Action)

9.3 Information Technology Risk:

913-1 The bank had last reviewed its IS policy on April 24, 2017. The IS audit during the PPR

was conducted by The coverage of IS audit included software audit,

functional audit, firewall and network audit, web application assessments, data centre audit,

branch operations IS audit etc. DR drill was carried out twice in year ie. August 15, 2017 &

February 24, 2018. ‘Some issues was observed during the DR drill which was resolved in

consultation with the vendot. The bank had submitted compliance to the reports in time:

However, some paras were pending for compliance (Lol). ” (Action)

9.3.2 The bank had its own Data Centre at Thane and off-site Disaster Recovery’Site at

Bangaluru in the premises of

9.3.3 The bank had computerized all its branches under Finacle CBS system (wie.f. April

13, 2015) and provided intemet banking, mobile banking, NEFT and RTGS facilities to its

customers.

9.4 Management information System (MIS)

9.4.1 The bank’s HO exercised control over branches by generation of 205 MIS reports

through an in-house developed program and also various other statements were sought by

HO from branches.

9.4.2 The bank was regular in submission of prescribed returns to RBI through XI

Punjab and Maharashtra Co-operative Bank Ltd, Mumbal

Financial Position as on March 31, 2018

platform on time during the PPR.

9.4.3 The bank had filed the respective DI returns with DICGC on time during the PPR. The

bank had submitted the statutory auditor certificate on correctness of computation of

assessable deposits and premium to DICGC. %

9.5 House-keeping: The bank had undertaken reconciliation of bank accounts and

balancing of books of accounts regularly and same were as per general ledger as on the

DPI. There were no debit entries pending for more than three years in inter-bank or inter=

branch reconciliation as on the DPI.

9.6 Frauds & Vigilance

9.6.1 Frauds & vigilance: As on the DLI, 13 cases of fraud (total amount involved “139.20

lakh) were. outstanding as per FMR-2. No case was closed during the PPR. Two new cases

of fraud, involving an aggregate amount of 286.68 lakh, were detected and reported during

the PPR (Lol). There were 15 cases of fraud (total amount involved 225.88 lakh)

‘outstanding as per FMR-2 as on the DPI. The bank held required provisions under the head

of ‘Provision for Contingent liability’ in this regard. :

9.6.2 Annual review of fraud cases: The bank had reportedly conducted an ‘annual

review of the fraud/s and placed a note before the Board of Directors for information,

However, it was observed that the contents of the report wae. concise | and | it did not cover

aspects stich as analysis of frauds according to different categories,

frauds of “1.00 lakh and above, estimated loss to the: bank during the yeat on account of

frauds, composition with regard to frauds reported to the Police, ‘preventive/punitive steps

taken by the bank during the year to reduce/minimise the incidence of frauds, etc. as

required in. terms: of para64 of RBI Master © Circular. DCBR.

CO.BPD.MC.No,1/12.05.001/2015-16'dated July 1, 2015. (Action).

9.6.3 The bank had a staff accountability policy relating to frauds/embezzlement committed

by staff which was reviewed on March 31, 2017. During the PPR, action was initiated in

eight cases of fraud involving fifteen staff members.

9.7 Customer service:

9.7.1 Itwas observed that branches Were not providing clean environment (i.e: keeping walls

free of posters in the premises), as guided in Para 17 of RB} Master Circular No.

DCBR.CO.BPD.(PCB).MG.No.15/12,05,001/2018-16 dated July 1, 2015. (Action)

9.7.2 The bank had implemented clean note policy. It had provided’ currency note

counting/checking machines, CCTV cameras, alarm system and security guards at its

branches.

~

Punjab and Maharashtra Co-operative Bank Ltd., Mumbai

Financial Position as on March 31, 2018

9.7.3 The deficiencies observed during branch visit are as follows:

a) As reported by the bank, out of 143 ATMs location, only in 64 ATMs locations had

provided ramps at the entrance of the bank ATMs so that persons with disabilities / wheel

chair users could enter the branches and conduct business without difficulty. (Action)

9.7.4 Security aspects relating to Safe Deposit Lockers: a) It was observed from the

locker agreement form that the bank had not incorporated a clause in the locker agreement

that in case the locker was not operated for more than one year, the bank would have the

right to cancel the allotment of the locker and open the locker, even if the rent is paid

regularly, as guided in Para 4.1.4(a) & (b) of RBI Circular No.DCBR.CO.

BPD.(PCB).MC.No.15/12.05.001/ 2015-16 dated July 1, 2015, The same was rectified by

incorporated the clause in its form during the course of inspection.

9.7.5 Issuance of EMV Chip and PIN Cards: out of 748864 ATM cards, 300993 (40.19%)

were EMV cards. As such the bank had not adhered to the timeline indicated in RBI Circular

DPSS.CO.PD No.812/02.14.003/2016-17 dated September 15, 2016 for new issuances and

full migration to EMV Chip and PIN cards. (Action)

9.8 Complaints:

9.8.1 Grievance redressal mechanism in the bank was generally adequate. During the PPR,

the bank had received 283 complaints, one complaints from RBI and 27 complaints from

Office of Banking Ombudsman. The bank had reported that all the complaints have been

disposed of as'on the DPI. However, it was observed that the HO did not maintain the

branch+wise details of complaints received. (Action)

9.8.2 Customer Protection Policy: The bank had framed board approved Customer

Protection Policy on Unauthorized Electronic Banking Transactions on December 16, 2018.

The policy was generally in tune: with the guidelines issued by the RBI vide RBI Circular

DCBRBPDAPCBYRCB) Cir. No.06/12/05.001/2017-18 dated December 14, 2017.

However, the policy in this regard had not been-displayed prominently at branches (Borivali,

Kandivall & Dahisar) in terms of para 11 of the RBI Circular, ibid. (Action)

9.9 Others

9.9.1 Use of abridged name: The bank used an abridged version of its name (PMC.Bank)

in board displayed at Head office and website along with full name of the bank (Punjab and

Maharashtra Co-operative Bank Ltd.).

9.9.2 The bank had published its audited Balance Sheet and Profit and Loss Statement for

2017-48 in the Economic Times (all editions) on September 15, 2018 and submitted three

copies thereof to RBI.

Punjab and Maharashtra Co-operative Bank Ltd, Mumbai

Financial Position as on March'31, 2018

9.9.3 Out of 133 branches, 7 branches had exceeded the cash retention limit on more than

100 occasions during the PPR (Lol) and same was ratified by the Board.

10. Foreign Exchange Business

10.1.1 The bank had an Authorized Dealer - Category-| license No.16/2011 which was

renewed vide RBI, FED.MRO's letter dated October 30, 2017, As per this letter, the validity

Of the licence will be co-terminus with the banking licence issued by the Department of Co=

operative Bank Regulation. The bank had one ‘A’ category, four 'B’ category and 130 ‘C’

category branches as on the DPI. As indicated in the table below, forex business turnover

decreased by %480631.31 lakh (-24.44%) from %1966203.28 lakh in 2016-17 to

%1485571.97 lakh in 2017-18.

(Gin lakh)

Particulars | 201647 : 201748 z

of Turnover | Merchant | Inter-bank | % of | Merchant | Inter-bank % oF

(a) ® atob| (a) ~_(b) atob

Purchases — | 181627.98 | 1801117.39 | 22.67 | 7465303 |> 67058602 | 10.67

Sales _| 150162.33 | 833301.58 | 18.02 | 115797.92 | 627695.00| 18.45 |

Misc i

Total 331790.31 | 1634412.97 | 20.50 | 18735005) 1208221 02/ 4443)

2016-17 2017-18 |

‘Turmover from proprietary trading TaiGeaaaDe 73929200

Profit from forex operations 561.49 878.91)

Profit on Trading in Securities (6073.30 1643.73}

The percentage of the bank's merchant transactions to inter-bank transactions had decreased _

Substantially from 20.30% during 2016-17 to 14.43% during the PPR, due to rhodest decrease.

in inter-bank: transactions: (20.86%),.as. compared. to. substantial decrease (43.53%) in|

merchant transactions due to volatility in INR.

The profi from forex operations had increased during the PPR, mainly dus to increase in Lt

business and expor bills discounting undertaken during the year. Profit on trading in securities i

had decreased by 72.04% mainly due to decline in Forex Merchant Tumover during the year

2017-18 arising out of reduced forex business routed through the existing customers, high

volatility in USDVINR rate, uncertainty in international market, increase in commodity prices |

Under imports, etc. During the PPR, the bank carried out 153 buyer's credit transactions for

total amount of €27822,55 lakh and eamed income of 2235.56 lakh, During the previous year,

the bank carried out 90 buyer's credit transactions for total amount of £27709.00 lakh and

eamed income of 2314.92 lakh,

Punjab and Maharashtra Co-operative Bank Ltd., Mumbai

Financial Postion as on March 31, 2018

The bank’s board had aggregate daylight position limit of USD 120.00 lakh, net overnight

open position limit (NOOP) at % 650.00 lakh and Aggregate Gap limit at USD 50 milion,

which were generally adhered to by the bank. The bank had fixed internal limit/ exposure

limit for market risk management such as VaR limit (@ 452.00Jakh), Individual Currency Gap

Limit (IGL), etc. It had adhered to these limits. The bank was sending Gap statements to

RBI FED, MRO in the form of FTD and GPB daily which contained details of their open

positions, AGL maintained, and VaR computation, etc.

10.1.3 Management of funds in Nostro account, reconciliation: As on the DPI, the bank

had 4098 non-resident accounts with a closing balance of 218526.51 lakh including NRE

(3444 accounts, closing balance %17398.84 lakh) NRO (654 accounts, 1127.67 lakh).

Further it had foreign currency accounts FCNR-B (80 accounts, 2803.38 lakh) and EEFC (4

accounts, 279.74 lakh) as on the DPI. The bank's non-resident deposits aggregated

249409.63 lakh as on the DPI as compared to €16627.15 lakh as on the DLI, reflecting an

increase of 16.73% due to increase in FCNR (B) and NRE deposits during the PPR. The

bank maintained seven Nostro accounts

The bank had duly reconciled the outstanding entries in Nostro accounts, as on the DPI. and

on various other dates.

410.2 Export Outstanding (XOS)

10.2.1 As per age-wise summary report of export bills pending for realisation, 224 export

bills amounting to %4559.30 lakh were pending for payment realisation as detailed below:

2016-47 [2017-18

ey Numberof | Amount | Number of | Amount

sre bills (Zin lakh) bills (Zin lakh)

Leeetbana es | 108 3659.78 4B 1076.76

1702 Yrs 37 1102.18 116 2902.07

2705 Yrs 7 102.39 60 580.47

5 Yrs & Above ; : a

Total 173 4864.35 224 4559.30

The figure of unrealised exports bills had gone up substantially in| FY 2017-18 over FY 2016-

47. The bank needed to follow-up with the exporters for the realisation of export bills as large

number of bills were outstanding. (Action)

10.2.2 Bill of Entry (BEF): As on DPI, out of 194 Bill of Entries (BoE) for import transactions,

177 (92.67%) aggregating "1358.95 lakh were pending for submission of the documer

Punjab and Maharashtra Co-operative Sank Ltd., Mumbai

Financial Position as on March 31, 2018

evidence of import, (Lol) The bank needed to follow-up vigorously with the importers for

submission of the same, (Action)

10.2.3 The bank had undertaken 703 transactions involving tumover of £290.30 lakh under

“Money gram’ and ‘Express Money’ during the PPR and eared commission of 21.04 lakh

(31.96 lakh during 2016-17) from the MTSS activity. The income from MTSS activity

decreased by 20.91 lakh (46.67%) due to decrease in forex transactions during the PPR,

as compared to 2016-17.

10.2.4 The bank's Front Office (Dealing Room) consisted of four dealers which was

Segregated from Back Office. The mid-office had started functioning w.e.f, February 2016.

‘The bank did not adhere to the compulsory two-week continuous break In case of one dealer

( ) during 2017-18, Last year, another dealer had availed of 11 days’ leave but

had complied with the norms.during the PPR. Thus, the bank had not complied with para

No. 1.8 of Internal Control Guidelines dated February 3, 2014 issued by RBI, FED, Central

Office which specified that a system of an annual compulsory two-week (or longer)

Continuous break should be maintained for the dealers so that no dealer remains at the job

continuously. (Persisting Action)

10.2.5 During the PPR, concurrent audit of the bank's forex business was conducted by

@ CA audit firm and report was submitted on a monthly basis,

The audit scope prescribed by the bank, covering areas of FOREX, exports, imports,

Forward Contracts, Counter Part limits, merchant forex transactions, Non-Resident

deposits, etc. was adequate,

11, Off-Balance Sheet Business: :

11.1 Seven bank guarantees (BGs) involving %21.27 lakh were invoked during the PPR and

were made good by the bank from the FDR ‘margin held against such BGs. Further, as on

the DPI, 875 BGs/Buyers Credit amounting to 812393.49 lakh were outstanding, out of

which 28 BGs had expired but not cancelled in view of noncrecelpt of original documents

from the respective customers, The bank had 129 LCs involving 273260.82 lakh outstanding

as on the DPI. No LC had devolved during the PPR,

11.2 Forward Contracts: There were 67 forward contracts ‘amounting to 225774.21 lakh

outstanding as on the DPI. There were no matured forward contracts outstanding as on the

DPI and no rollover of contracts was observed during the PPR:

14.3 The Depositor Education and Awareness Fund Scheme, 2014 (DEA Fund): The

bank in its auelted balance sheet as.on the DPI had disclosed the amount transferred to

DEA Fund as 1140.43 lakh, No discrepancy was observed in DEA Fund clain/certificat

vor cel

i

Punjab and Maharashtra Co-operative Bank Ltd, Mumbai

Financial Position as on March 31, 2018

Page 24 of 24

CONFIDENTIAL

Reserve Bank of India

Department of Co-operative Bank Supervision

Mumbai Regional Office

Inspection under Section 35 of the Banking Regulation Act, 1949 (AACS)

Punjab and Maharashtra Cooperative Bank Ltd., Mumbai

Financial Position as on March 31, 2018

‘Summary of findings

1. Capital Adequacy

(The net worth was assessed at $70620.72 lakh as 6n March 34, 2018(Date

of Present Inspection- DPI) as against £65898.70 lakh as on March 31, 2017

(Date of Last Inspection - DLI) and as such, the bank had complied. vith

Section 11(1) and Section 22(3) (a) of the Banking Regulation Act, 1949

(AACS).

(il) The bank had reported CRAR at 12.29% as on the DPI. However, the

assessed CRAR was at 12.72%. The difference between the reported and

assessed CRAR was on account of a combination of factors viz, ine

appliaton of sk weight, reversal of interest capitalized on NPAs

shortfall in loan loss provision. : 1

2. Asset Quality

(i) The loan portfolio increased by 2101926.63 lakh (5. 83%) from 2649823. 00

lakh to 2745749.63 lakh during the present period of review (PPR).

(ii) The assessed gross NPAs and net NPAs increased from 3.23% and 2! 32% as

on the:DLI to 7.27% and 6.40% as on the DPI. +

(iii) The bank had not achieved the targets fixed for Tending under priority sector

and weaker section. It had adhered to the: ceiling of exposure to. housing,

(iv) The bank had adhered to the single. & group borrower exposure limits during

the PPR. It had adhered to the ceiling of exposure tovhousing, RE & CRE,

except old Housing loan cases.

(v)__ The bank was yet to adopt NPA identification on an on-going basis.

wi

a

@

qi)

(iil)

(iv)

™)

i) The bank had not disclosed any restructured accounts as on DPI. However,

the IO had treated one account as a restructured account, as per extant

guidelines.

Investments

The bank had adhered to investment related regulatory limits/prescriptions

such as gross and single inter-bank exposure norms, investment in non-SLR

securities, etc. during 2017-18.

The total investment portfolio of the bank increased by 1.26% from

%233004.12 lakh as on the DLI to % 235944.89 lakh as on the DPI.

The average return on investments (SLR, non-SLR investments and bank

deposits) was 7.54% during 2017-18.

The half yearly reviews of investment portfolio were undertaken during the

year and placed before the Board and forwarded to RBI.

The bank's investment operations were subjected to an internal/ concurrent

audit on a monthly basis. However, the concurrent auditors had not

commented on adherence to conformity with broker limits of 5% of total

transactions (both purchase and sale) entered into by the bank during the

year.

(vi) The bank held an Investment Depreciation Reserve (IDR) of 1310.26 lakh as

.on the DPI which was adequate to cover depreciation in investments. Further,

the bank held an Investment Fluctuation Reserve (IFR) of %7564.64 lakh

against requirement of 25781.80 lakh (5% of AFS portfolio) and therefore,

excess IFR of %1782.84 lakh was considered for the calculation of assessed

net worth.

4 Management

()) The management of the bank was vested in an elected Board of Directors

comprising 14 directors including two professional directors and CEO. The

present Board was elected on March 25, 2015 for a period of five years

(ji) The bank constituted four'sub-committees excluding ALCO. The functioning

of the sub committees except Recovery Committee was ‘considered to be

generally satisfactory.

(iii) There was a deterioration in the financial position of branches as the number

of loss making branches had increased from 47 (37.60%) as on the DLI to 56

(41.79%) as on the DPI.

5. Earnings

(i) The reported operating profit of the bank increased by 4.61% (£929.61 lakh)

from %20174.07 lakh during 2016-17 to 21 103.68 lakh during 2017-18.

(ii) The reported Net Interest Margin (NIM) increased from 3.71% to 3.85% due to

higher increase in interest income by 12.94% as compared -to interest

expenditure which increased by 1.68% only. The assessed NIM was 3.76%

during PPR.

(i) The return on average total assets and return on average saming assets both

declined during the PPR due to decrease in assessed net profit on account of

Provision for loan losses suggested by the IO.

(W)AS against the reported net profit of £10090.22 lakh, the assessed profit was

4675.64 lakh in view of suggested reversal of interest capitalized erorn 65

lakh) and loan loss provision (4336.93 lakh)

Liquidity & Funds Management ia

(i) The: deposits. of the bank increased by 10.28% from %901200.28 lakh | to

%993885.10 lakh. Proportion of CASA ‘deposits to its total deposits increased

from: 21.57% as on the DLI to 28.18% as on the DPI while term departs ;

increased by 10.96% during the corresponding period. t

Ai) The average cost of deposits decreased from 7.65% (2016-17) to 7: 12%

(2017-18) mainly due to increase in ¢ CASA, deposits. by 7.82% during the BPR

and reduction in deposits held with higher interest rates above 9%,

(iii) CD ratio increased from 71.44% as ‘on the DLI to 75.03% as on the. DPI,

to. increase in advances by 15.83% vis-&-vis increase in deposits by 10 28%

during the PPR, . ‘

(W)The bank had maintained required level of CRR and SLR during 2017-18, ©

7. Systems and Control

) The bank had framed a KYC policy and it had generally adhered to KYO

guidelines,

(1) In the current account opening forms, only the names of the other bankers

Were mentioned by the customer without indicating the nature of account.

(ili) The bank had not included ‘third gender’ in the current account opening form

prescribed by RBI

(v)It was observed that customers were allotted mulliple UCICs which was not in

accordance with guidelines issued by RBI.

(v) The bank had not forwarded the suspect notes to the Issue Office of RBI after

receipt from the police authorities and completion of the preservation period.

(vi) There was a delay in submission of some concurrent audit and internal audit

reports and compliance thereof.

(v)The bank had not maintained the register of complaints received at the

branches.

8. Foreign Exchange Business:

(The profit from forex operations had decreased during the PPR, mainly due

to major decrease in merchant transactions as well as modest decrease in

inter-bank transactions during the PPR, as compared to previous year.

(ii) The revenue from forex operations had increased during the PPR mainly due

to increase in LC business undertaken during the year.

(il) The bank's non-resident deposits aggregated 219409.63 lakh as on the DPI

as compared to %16627.15 lakh as on the DLI, reflecting an increase of

16.73% due to increase in FCNR (B) and NRE deposits during the PPR.

(iv) As on DPI, out of 191 Bill of Entries (BoE) for import transactions, 177

(92.67%) aggregating “1358.95 lakh were pending for submission of the

. documentary evidence of import

9. Off balance sheet items

() Seven bank guarantees (BGs) involving £21.37 lakh were invoked during the

PPR.

(i) “There were 67 forward contracts amounting to 225774.21 lakh outstanding as

on the DPI.

nrthesenstannunananenansneatinsuannnitlgesanavenensen

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- City Union Bank Inspection ReportDokumen114 halamanCity Union Bank Inspection ReportMoneylife Foundation100% (1)

- City Union Bank Inspection ReportDokumen114 halamanCity Union Bank Inspection ReportMoneylife Foundation100% (1)

- City Union Bank Inspection ReportDokumen114 halamanCity Union Bank Inspection ReportMoneylife Foundation100% (1)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Syndicate Bank Risk Assessment and Inspection Reports Shared by RBIDokumen276 halamanSyndicate Bank Risk Assessment and Inspection Reports Shared by RBIMoneylife Foundation100% (5)

- Syndicate Bank Risk Assessment and Inspection Reports Shared by RBIDokumen276 halamanSyndicate Bank Risk Assessment and Inspection Reports Shared by RBIMoneylife Foundation100% (5)

- Syndicate Bank Risk Assessment and Inspection Reports Shared by RBIDokumen276 halamanSyndicate Bank Risk Assessment and Inspection Reports Shared by RBIMoneylife Foundation100% (5)

- 30-Dec-2020-Memorandum To Sebi and Justice BN AgrawalDokumen17 halaman30-Dec-2020-Memorandum To Sebi and Justice BN AgrawalMoneylife FoundationBelum ada peringkat

- RBI Wilful Defaulters PSBs Annex 1 RTIDokumen51 halamanRBI Wilful Defaulters PSBs Annex 1 RTIMoneylife Foundation83% (6)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Report of The Fact-Finding Mission On Media's Reportage of The Ethnic Violence in ManipurDokumen24 halamanReport of The Fact-Finding Mission On Media's Reportage of The Ethnic Violence in ManipurThe WireBelum ada peringkat

- Bombay High Court Issues Rules For Video Conferencing For CourtsDokumen14 halamanBombay High Court Issues Rules For Video Conferencing For CourtsMoneylife FoundationBelum ada peringkat

- Bombay High Court Issues Rules For Video Conferencing For CourtsDokumen14 halamanBombay High Court Issues Rules For Video Conferencing For CourtsMoneylife FoundationBelum ada peringkat

- MLF Presentation To SEBI Mahalingam Committee 13 May 2022Dokumen13 halamanMLF Presentation To SEBI Mahalingam Committee 13 May 2022Moneylife FoundationBelum ada peringkat

- SIC Pandes OrderDokumen5 halamanSIC Pandes OrderMoneylife FoundationBelum ada peringkat

- MLF Presentation To SEBI Mahalingam Committee 13 May 2022Dokumen13 halamanMLF Presentation To SEBI Mahalingam Committee 13 May 2022Moneylife FoundationBelum ada peringkat

- Mohan Gopal Letter2PMDokumen12 halamanMohan Gopal Letter2PMMoneylife FoundationBelum ada peringkat

- Order For Home TestingDokumen3 halamanOrder For Home TestingMoneylife FoundationBelum ada peringkat

- SEBI Final Order Against Ms. Chitra Ramkrishna and OthersDokumen190 halamanSEBI Final Order Against Ms. Chitra Ramkrishna and OthersMoneylife FoundationBelum ada peringkat

- Monthly Data YCEW Dec 2021Dokumen4 halamanMonthly Data YCEW Dec 2021Moneylife FoundationBelum ada peringkat

- Mohan Gopal Letter2PMDokumen16 halamanMohan Gopal Letter2PMMoneylife FoundationBelum ada peringkat

- SEBI Final Order Against Ms. Chitra Ramkrishna and OthersDokumen190 halamanSEBI Final Order Against Ms. Chitra Ramkrishna and OthersMoneylife FoundationBelum ada peringkat

- SEBI Final Order Against Ms. Chitra Ramkrishna and OthersDokumen190 halamanSEBI Final Order Against Ms. Chitra Ramkrishna and OthersMoneylife FoundationBelum ada peringkat

- ANMI Sub112 Dated 29 Dec To MOF On Limitation ClauseDokumen2 halamanANMI Sub112 Dated 29 Dec To MOF On Limitation ClauseMoneylife FoundationBelum ada peringkat

- NSE List of Expelled Brokers 19 Oct 2021Dokumen7 halamanNSE List of Expelled Brokers 19 Oct 2021Moneylife FoundationBelum ada peringkat

- Joint-Representation Extension Filing TAR ITReturnsDokumen7 halamanJoint-Representation Extension Filing TAR ITReturnsMoneylife FoundationBelum ada peringkat

- Erratic and Irresponsible Approach of Finance Ministry Towards IT InfrastructureDokumen10 halamanErratic and Irresponsible Approach of Finance Ministry Towards IT InfrastructureMoneylife FoundationBelum ada peringkat

- Reliance Capital Limited: Vu VM of ' ('Dokumen4 halamanReliance Capital Limited: Vu VM of ' ('Moneylife Foundation100% (1)

- Letter To CJI On WritDokumen2 halamanLetter To CJI On WritMoneylife FoundationBelum ada peringkat

- PR DICGC AmendmentAct2021 Section18A PaymentToDepositorsOfInsuredBanksUnder AIDDokumen3 halamanPR DICGC AmendmentAct2021 Section18A PaymentToDepositorsOfInsuredBanksUnder AIDMoneylife FoundationBelum ada peringkat

- NSE List of Expelled Brokers 19 Oct 2021Dokumen7 halamanNSE List of Expelled Brokers 19 Oct 2021Moneylife FoundationBelum ada peringkat

- SC Order Northern Railways Vs Sanjay Shukla 06 Sep 2021Dokumen7 halamanSC Order Northern Railways Vs Sanjay Shukla 06 Sep 2021Moneylife FoundationBelum ada peringkat