Assignment 3 Part II - Key

Diunggah oleh

zbqzwHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Assignment 3 Part II - Key

Diunggah oleh

zbqzwHak Cipta:

Format Tersedia

1.

A central bank's international reserves consists of its holdings of

A) gold.

B) foreign and domestic currency holdings.

C) domestic assets and precious metals.

D) silver and gold.

E) foreign assets and gold.

2 Under fixed exchange rate, in general

A) the expected rate of domestic currency depreciation is high.

B) the expected rate of currency depreciation is one.

C) the foreign and domestic interest rates are unequal.

D) the domestic and foreign interest rates are equal, R = R*.

E) R = R* + (Ee - E)/E.

3 By fixing the exchange rate, the central bank gives up its ability to

A) increase government spending.

B) influence the economy through monetary policy.

C) influence the economy through fiscal policy.

D) adjust taxes.

E) depreciate the domestic currency.

4. Fiscal expansion under fixed exchange rates will have what temporary effect?

A) the exchange rate will increase.

B) there will be no effect.

C) the exchange rate will decrease.

D) the money supply will decrease.

E) output will decrease.

5. The expectation of future devaluation causes a balance of payments crisis marked by

A) a sharp fall in reserves and a rise in the home interest rate above the world interest rate.

B) a sharp rise in reserves and a fall in the home interest rate below the world interest rate.

C) a sharp rise in reserves and an even greater rise in the home interest rate above the world

interest.

D) a sharp fall in reserves and an even bigger fall in the home interest rate below the world interest

rate.

E) a sharp rise in reserves and a rise in the home interest rate to the level of the world interest.

6.Please define and give an example of sterilized foreign exchange intervention.

Answer:

Sterilized foreign exchange intervention occurs when a central bank carries out equal foreign and

domestic asset transactions in opposite directions to nullify the impact on the domestic money

supply. An example is a central bank purchasing $100 of domestic assets but selling $100 of

foreign bonds.

7.A balance sheet for the central bank of Pecunia is shown below:

Central Bank Balance Sheet

Assets Liabilities

Foreign assets $1,000 Deposits held by private banks $500

Domestic assets$1,500 Currency in circulation $2,000

Please write the new balance sheet if the bank makes a sterilized transaction by selling $100 of

foreign assets for domestic currency and then purchasing $100 of domestic assets by writing a

check on itself.

8. If the central bank does not purchase foreign assets when output increases but instead holds the

money stock constant, can it still keep the exchange rate fixed at E0? Please explain.

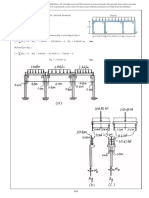

9. Use a figure to illustrate the ineffectiveness of monetary policy to spur on an economy under a

fixed exchange rate.

10. Use a figure to explain the potential effectiveness of fiscal policy to spur on the economy

under a fixed exchange rate.

11. Define devaluation and use a figure to show the effect of a currency devaluation on the

economy.

12. Please describe in detail a self-fulfilling currency crisis.

13. Use a figure to explain how a balance of payments crisis and its hand in capital flight.

For 9-13, find the answers in the textbook.

Anda mungkin juga menyukai

- Survival Investing with Gold & SilverDari EverandSurvival Investing with Gold & SilverPenilaian: 4.5 dari 5 bintang4.5/5 (2)

- Is The US 2012 Presidential Election Tipping Point for the fall of the Greenback?Dari EverandIs The US 2012 Presidential Election Tipping Point for the fall of the Greenback?Belum ada peringkat

- Chapter 18Dokumen29 halamanChapter 18Paul LeeBelum ada peringkat

- Madura ch4 TBDokumen11 halamanMadura ch4 TBSameh Ahmed Hassan80% (5)

- Exchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Dokumen11 halamanExchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Trần Thị Bảo TrinhBelum ada peringkat

- Practice Multiple Choice QuestionsDokumen5 halamanPractice Multiple Choice QuestionsAshford ThomBelum ada peringkat

- Exchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Dokumen11 halamanExchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%rufik der100% (2)

- Homework Topic 6 - To SendDokumen4 halamanHomework Topic 6 - To SendThùy NguyễnBelum ada peringkat

- International Finance Essay AnswersDokumen8 halamanInternational Finance Essay AnswersPrateek MathurBelum ada peringkat

- HW3Dokumen20 halamanHW3wecaanBelum ada peringkat

- Chapter 4Dokumen14 halamanChapter 4Selena JungBelum ada peringkat

- IFM TB Ch08Dokumen9 halamanIFM TB Ch08isgodBelum ada peringkat

- Chapter 4-Exchange Rate DeterminationDokumen21 halamanChapter 4-Exchange Rate DeterminationMelva CynthiaBelum ada peringkat

- Final RevisionqDokumen9 halamanFinal RevisionqgeovannimagdyBelum ada peringkat

- Madura Chapter 8Dokumen9 halamanMadura Chapter 8MasiBelum ada peringkat

- International Finance-Final ExamDokumen5 halamanInternational Finance-Final ExamTrang ĐoànBelum ada peringkat

- Practice Set 10 With Answers 2022Dokumen6 halamanPractice Set 10 With Answers 2022Romit BanerjeeBelum ada peringkat

- ECON 3010 Intermediate Macroeconomics SoDokumen5 halamanECON 3010 Intermediate Macroeconomics Sohamelat benachourBelum ada peringkat

- Ps1 EF4331 - Revised Answer)Dokumen9 halamanPs1 EF4331 - Revised Answer)Jason YP KwokBelum ada peringkat

- Chapter 13 AnswerDokumen19 halamanChapter 13 AnswerKathy WongBelum ada peringkat

- IFM TB ch06Dokumen14 halamanIFM TB ch06Manar AdelBelum ada peringkat

- Chapter 2 & 4 Exchange Rate DeterminationDokumen5 halamanChapter 2 & 4 Exchange Rate DeterminationRim RimBelum ada peringkat

- Section A (Multiple Choice Questions) : Ractice EcturesDokumen4 halamanSection A (Multiple Choice Questions) : Ractice Ecturesolaef1445Belum ada peringkat

- Chapter 4Dokumen17 halamanChapter 4celinekhalil2003Belum ada peringkat

- ÖrnekSoru IFM MidtermDokumen5 halamanÖrnekSoru IFM MidtermMustafa TotanBelum ada peringkat

- Fixed Exchange Rates and Foreign Exchange InterventionDokumen9 halamanFixed Exchange Rates and Foreign Exchange InterventionlayhomaBelum ada peringkat

- Exercises For RevisionDokumen3 halamanExercises For Revisiontrinhmyngoc.uebBelum ada peringkat

- ExamSolution123 AbhishekDokumen6 halamanExamSolution123 AbhishekAbhishek SaxenaBelum ada peringkat

- 2015 With SolutionDokumen8 halaman2015 With SolutiondasmeshBelum ada peringkat

- Relationships Among Inflation, Interest Rates, and Exchange RatesDokumen13 halamanRelationships Among Inflation, Interest Rates, and Exchange RatesibrahimBelum ada peringkat

- Seminar 4 AnswersDokumen7 halamanSeminar 4 AnswersSharBelum ada peringkat

- SIB 675 - Assignment 2upDokumen6 halamanSIB 675 - Assignment 2upMelissa TothBelum ada peringkat

- Review Chapter 8-10 Session 2 With AnswerDokumen5 halamanReview Chapter 8-10 Session 2 With AnswerJijisBelum ada peringkat

- Ec 305 FinalDokumen66 halamanEc 305 Finalsahmed706100% (3)

- Madura Chapter 6 PDFDokumen13 halamanMadura Chapter 6 PDFRizaldy Aji MuzakkyBelum ada peringkat

- Practice MCDokumen4 halamanPractice MCHoang Trung NguyenBelum ada peringkat

- (Macro) Bank Soal Uas - TutorkuDokumen40 halaman(Macro) Bank Soal Uas - TutorkuDella BianchiBelum ada peringkat

- Final Exam: 1 Uncovered Interest Parity and Taxation: 10 MinutesDokumen10 halamanFinal Exam: 1 Uncovered Interest Parity and Taxation: 10 MinutestigerwlinBelum ada peringkat

- Madura Chapter 6Dokumen13 halamanMadura Chapter 6MasiBelum ada peringkat

- Madura CHP 6Dokumen13 halamanMadura CHP 6nabilredascribd100% (4)

- Econ 102 Quiz 2 A Spring 2016-17Dokumen4 halamanEcon 102 Quiz 2 A Spring 2016-17e110807Belum ada peringkat

- Chapter 6 Government Influence On Exchange Rates QuizDokumen7 halamanChapter 6 Government Influence On Exchange Rates Quizhy_saingheng_7602609100% (3)

- Final 2018Dokumen7 halamanFinal 2018Ismail Zahid OzaslanBelum ada peringkat

- EC290 Mock Midterm FinalDokumen8 halamanEC290 Mock Midterm FinalNikhil VenugopalBelum ada peringkat

- Chapter 9Dokumen6 halamanChapter 9smileseptemberBelum ada peringkat

- Financial Market and Institutions Ch16Dokumen8 halamanFinancial Market and Institutions Ch16kellyBelum ada peringkat

- IFM TB ch21Dokumen10 halamanIFM TB ch21Mon LuffyBelum ada peringkat

- MCQ Parity KeyDokumen6 halamanMCQ Parity Key21070653Belum ada peringkat

- C) The Higher Prices of Foreign Goods Spurs Domestic Competitors To Cut PricesDokumen10 halamanC) The Higher Prices of Foreign Goods Spurs Domestic Competitors To Cut PriceskbogdanoviccBelum ada peringkat

- Chpter 06 QuizDokumen3 halamanChpter 06 QuizGall AnonimBelum ada peringkat

- Final Class PracticeDokumen4 halamanFinal Class PracticeLinh VũBelum ada peringkat

- Hridoy MD Jahid Hossain (2016006704) .Docx 2Dokumen3 halamanHridoy MD Jahid Hossain (2016006704) .Docx 2Jh HridoyBelum ada peringkat

- Exercises For Revision With SolutionDokumen4 halamanExercises For Revision With SolutionThùy LinhhBelum ada peringkat

- Macroeconomics Unit 4 Multiple ChoiceDokumen13 halamanMacroeconomics Unit 4 Multiple ChoiceAleihsmeiBelum ada peringkat

- Econ 379Dokumen4 halamanEcon 379Sijo VMBelum ada peringkat

- Problem Set #: Intermediate Macroeconomics 101 Due 20/8/12Dokumen10 halamanProblem Set #: Intermediate Macroeconomics 101 Due 20/8/12Akansha JaiswalBelum ada peringkat

- Review Chapter 8-10 WK Session With AnswerDokumen13 halamanReview Chapter 8-10 WK Session With AnswerJijisBelum ada peringkat

- Summary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionDari EverandSummary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionBelum ada peringkat

- 02 Adaptive Tracking Control of A Nonholonomic Mobile RobotDokumen7 halaman02 Adaptive Tracking Control of A Nonholonomic Mobile Robotchoc_ngoayBelum ada peringkat

- New CVLRDokumen2 halamanNew CVLRanahata2014Belum ada peringkat

- AccreditationDokumen6 halamanAccreditationmyra delos santosBelum ada peringkat

- Power Off Reset ReasonDokumen4 halamanPower Off Reset Reasonmaiacalefato72Belum ada peringkat

- VTP Renault 6.14.1 Web Version - Pdf.pagespeed - Ce.c T5zGltXA PDFDokumen176 halamanVTP Renault 6.14.1 Web Version - Pdf.pagespeed - Ce.c T5zGltXA PDFIbrahim AwadBelum ada peringkat

- Problemas Del Capitulo 7Dokumen26 halamanProblemas Del Capitulo 7dic vilBelum ada peringkat

- ISDM - Lab Sheet 02Dokumen4 halamanISDM - Lab Sheet 02it21083396 Galappaththi S DBelum ada peringkat

- BMR - Lab ManualDokumen23 halamanBMR - Lab ManualMohana PrasathBelum ada peringkat

- Bare Copper & Earthing Accessories SpecificationDokumen14 halamanBare Copper & Earthing Accessories SpecificationJayantha SampathBelum ada peringkat

- Marine Products: SL-3 Engine ControlsDokumen16 halamanMarine Products: SL-3 Engine ControlsPedro GuerraBelum ada peringkat

- ELEN 325 Lab 1 PrelabDokumen8 halamanELEN 325 Lab 1 PrelabAndrew ZellerBelum ada peringkat

- Plea Agreement of ThomasbergDokumen10 halamanPlea Agreement of ThomasbergSal CoastBelum ada peringkat

- Rfa TB Test2Dokumen7 halamanRfa TB Test2Сиана МихайловаBelum ada peringkat

- GMDS - Course - FinalDokumen282 halamanGMDS - Course - FinalLuisPazPerdomo100% (1)

- Questionnaire Exercise: Deals Desk Analyst Please Answer Below Questions and Email Your Responses Before First Technical Round of InterviewDokumen2 halamanQuestionnaire Exercise: Deals Desk Analyst Please Answer Below Questions and Email Your Responses Before First Technical Round of InterviewAbhinav SahaniBelum ada peringkat

- Dell PowerEdge M1000e Spec SheetDokumen2 halamanDell PowerEdge M1000e Spec SheetRochdi BouzaienBelum ada peringkat

- OOPS Module 1Dokumen26 halamanOOPS Module 1robinptBelum ada peringkat

- Cash & Cash EquivalentsDokumen2 halamanCash & Cash EquivalentsYoonah KimBelum ada peringkat

- Satisfaction Attributes and Satisfaction of Customers: The Case of Korean Restaurants in BataanDokumen10 halamanSatisfaction Attributes and Satisfaction of Customers: The Case of Korean Restaurants in BataanMaraBelum ada peringkat

- Consultant Agreement PDFDokumen6 halamanConsultant Agreement PDFRathore&Co Chartered AccountantBelum ada peringkat

- Disaster Management in Schools: Status ReportDokumen28 halamanDisaster Management in Schools: Status ReportRamalingam VaradarajuluBelum ada peringkat

- Victory Magazine 2012 PDFDokumen19 halamanVictory Magazine 2012 PDFijojlBelum ada peringkat

- 13 DocumentsDokumen38 halaman13 DocumentsPoorClaresBostonBelum ada peringkat

- Lesson 2 - Graphing Rational Numbers On A Number LineDokumen9 halamanLesson 2 - Graphing Rational Numbers On A Number Linehlmvuong123Belum ada peringkat

- EconiQ High Voltage Roadmap 1629274842Dokumen1 halamanEconiQ High Voltage Roadmap 1629274842Daniel CaceresBelum ada peringkat

- MasafiDokumen2 halamanMasafiSa LaBelum ada peringkat

- Legal DraftingDokumen28 halamanLegal Draftingwadzievj100% (1)

- Windows XP, Vista, 7, 8, 10 MSDN Download (Untouched)Dokumen5 halamanWindows XP, Vista, 7, 8, 10 MSDN Download (Untouched)Sheen QuintoBelum ada peringkat

- Coding Guidelines-CDokumen71 halamanCoding Guidelines-CKishoreRajuBelum ada peringkat

- Output LogDokumen480 halamanOutput LogBocsa CristianBelum ada peringkat