DQ 4

Diunggah oleh

Jazzen Martinez0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

600 tayangan3 halaman1. Sam Company purchased 20% of another entity's ordinary shares for P6 million. The investee reported net income of P7 million and paid dividends of P4 million. Using the equity method, the carrying amount of the investment is increased by Sam's share of net income (20% of P7 million = P1.4 million) and reduced by Sam's share of dividends (20% of P4 million = P800,000), resulting in a year-end carrying amount of P6.6 million.

2. Forensic Company acquired a 10% interest in an investee for P3 million using cost method. It later acquired a 15% interest for P6.75 million.

Deskripsi Asli:

Judul Asli

DQ-4.docx

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Ini1. Sam Company purchased 20% of another entity's ordinary shares for P6 million. The investee reported net income of P7 million and paid dividends of P4 million. Using the equity method, the carrying amount of the investment is increased by Sam's share of net income (20% of P7 million = P1.4 million) and reduced by Sam's share of dividends (20% of P4 million = P800,000), resulting in a year-end carrying amount of P6.6 million.

2. Forensic Company acquired a 10% interest in an investee for P3 million using cost method. It later acquired a 15% interest for P6.75 million.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

600 tayangan3 halamanDQ 4

Diunggah oleh

Jazzen Martinez1. Sam Company purchased 20% of another entity's ordinary shares for P6 million. The investee reported net income of P7 million and paid dividends of P4 million. Using the equity method, the carrying amount of the investment is increased by Sam's share of net income (20% of P7 million = P1.4 million) and reduced by Sam's share of dividends (20% of P4 million = P800,000), resulting in a year-end carrying amount of P6.6 million.

2. Forensic Company acquired a 10% interest in an investee for P3 million using cost method. It later acquired a 15% interest for P6.75 million.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

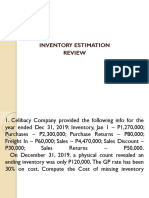

LYCEUM OF THE PHILIPPINES UNIVERSITY – Manila

College of Business Administration

Department of Accountancy and Management Accounting

De Jesus/Valientes/Chan/Gallardo

NAME: 17 d. A deduction from shareholders’ equity

SECTION: 18 4. Debt instruments held to maturity are reported at

19 a. Amortized cost

THEORY (1.00) 20 b. Fair value

1 6 c. The lower of amortized cost and fair value

2 7 d. Net realizable value

3 8 Raw Score Equivalent TOTAL 5. Equity investments irrevocably accounted for at fair value through

4 9 THEORY X 1.00 other comprehensive income are

5 10 PROBLEM X 1.50 a. Non-trading investments of less than 20%

NUMERICAL RESPONSE X 2.00 b. Trading investments of less than 20%

PROBLEM (1.50) c. Investments of between 20% and 50%

1 11 d. Investment of more than 50%

2 12 6. when an investor uses the equity method to account for investment

3 13 in ordinary shares, the investment account will be increased when

the investor recognizes

4 14

a. a proportionate interest in the net income of the

5 15 PERCENTAGE investee

6 16 EQUIVALENT b. a cash dividend received from the investee

7 17 c. periodic amortization of the goodwill

8 18 d. a share dividend received from the investee

9 19 7. subsequent to initial recognition, the investment property shall be

10 20 measured using

THEORY (1.00) a. fair value model or revaluation model

NUMERICAL RESPONSE (2.00) b. fair value through profit or loss model

1. It is an entity over which the investor has significant influence

1 c. cost model or fair value model

a. Associate

2 d. cost model or revaluation model

b. Investee

3 8. if the entity uses the fair value model for the investment property

c. Venture capital organization

4 changes in fair value are

d. Mutual fund

5 2. Under the equity method of accounting for investments an investor a. recognized in profit or loss

6 recognizes its share of the earnings in the period which the b. recognized in retained earnings

7 a. Investor sells the investment c. recognized in other comprehensive income

8 b. Investee declares a dividend d. not recognized

9 c. Investee pays dividend 9. an investment property is derecognized when

10 d. Earnings are reported by the investee a. it is disposed to a third party

11 3. When an investor uses the equity method to account for b. it is permanently withdrawn from use

12 investment in ordinary shares, cash dividends received by the c. no future economic benefits are expected from the

13 investor from the investee are recorded as disposal

14 a. Dividend income d. in all of these cases

15 b. A deduction from the investment income 10. under IFRS, assets classified as investment property are

16 c. A deduction from the investment account a. held for rental income

b. to be sold for a quick profit

1|Departmental Quiz 4 – Intermediate Accounting P -1

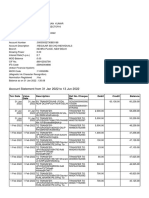

LYCEUM OF THE PHILIPPINES UNIVERSITY – Manila

College of Business Administration

Department of Accountancy and Management Accounting

De Jesus/Valientes/Chan/Gallardo

c. held for rental income or to be sold for a quick profit d. 300,000 a. 1,207,900

d. held for sale in the ordinary course of business e. 0 b. 1,198,000

5. On January 1, 2019, Forensic Company acquired a 10% interest c. 1,195,920

PROBLEM (1.50) in an investee for P3,000,000. The investment was accounted for d. 1,193,050

1. at the beginning of current year, Sam Company purchased 20% using the cost method. e. None of the above

of another entity’s ordinary shares outstanding for P6,000,000. 9. What is the interest income for the year?

The acquisition cost is equal to the carrying amount of the net On January 1, 2020, the entity acquired a further 15% interest in a. 95,840

assets acquired. During the current year, the investee reported net the investee for P6,750,000. On such date the carrying amount of b. 119,800

income of P7,000,000 and paid cash dividend of P4,000,000. the net assets of the investee was P36,000,000 and the fair value c. 80,000

What is the carrying amount of the investment in associate at year of the 10% interest was P4,500,000. d. 100,000

end? e. None of the above

a. 5,200,000 The fair value of the net assets of the investee is equal to the 10. On January 1, 2019 Paradox Company purchased 9% bonds with

b. 6,000,000 carrying amount except for an equipment whose fair value exceed a face amount of P4,000,000 for P3,756,000 to yield 10%. The

c. 6,600,000 carrying amount by P4,000,000. The equipment has a remaining bonds are dated January 1, 2019, mature on December 31, 2028,

d. 7,400,000 life of 5 years. The investee reported net income of P8,000,000 for and pay interest annually on December 31. The bonds are

e. None of the above 2020 and paid dividend of P5,000,000 on December 31, 2020 measured at amortized cost. What amount should be reported as

2. What is the investment income at year end? interest revenue for 2019?

a. 800,000 What is the gain on remeasurement to equity to be recognized for a. 400,000

b. 2,800,000 2020? b. 344,400

c. 3,200,000 a. 1,500,000 c. 360,000

d. 2,000,000 b. 4,500,000 d. 375,600

e. None of the above c. 2,250,000 11. During 2019, Knickknack Company purchased marketable equity

3. At the beginning of current year, Disgust Company purchased d. 0 securities to be measured at fair value through other

30,000 shares of an investee’s 200,000 outstanding shares for 6. What is the goodwill arising from the acquisition on January 1, comprehensive income. On December 31, 2019, the balance in

P6,000,000. On that date, the carrying amount of the acquired 2020? the unrealized loss on these securities was P200,000. There were

shares was P4,000,000. The entity attributed the excess of cost a. 2,250,000 no security transactions during 2020. Pertinent data on December

over carrying amount to patent with remaining useful life of 10 b. 1,250,000 31, 2020 are:

years. During the year, Disgust Company’s officers gained a c. 1,350,000

majority on the investee’s board of directors. The investee d. 350,000 Security Cost Market Value

reported earnings of P5,000,000 for the year and paid dividend of 7. What is the carrying amount of the investment in associate on X 2,100,000 1,600,000

P3,000,000 at year-end. What is the carrying amount of the December 31, 2020? Y 1,850,000 2,000,000

investment at year-end? a. 11,250,000 Z 1,050,000 900,000

a. 6,100,000 b. 11,800,000

b. 6,300,000 c. 12,000,000 In the statement of changes in equity for 2020, what amount

c. 5,550,000 d. 14,300,000 should be included as cumulative unrealized loss as component

d. 6,000,000 8. On July 1, 2019, Conair Company paid P1,198,000 for 10% bonds of other comprehensive income?

e. None of the above with a face amount of P1,000,000 to be held as financial assets at a. 500,000

4. How much is Investment Income at year-end? amortized cost. Interest is paid on June 30 and December 31. The b. 300,000

a. 750,000 bonds were purchased to yield 8%. The entity used the effective c. 200,000

b. 450,000 interest method. What is the carrying amount of the bond d. 0

c. 1,200,000 investment on December 31, 2019?

2|Departmental Quiz 4 – Intermediate Accounting P -1

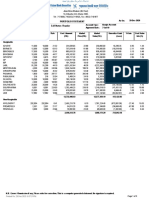

LYCEUM OF THE PHILIPPINES UNIVERSITY – Manila

College of Business Administration

Department of Accountancy and Management Accounting

De Jesus/Valientes/Chan/Gallardo

12. The following data pertains to Tyne Co.s investments in 15. What is the gain or loss to be recognized for the year ended 9. What is the investment Income for December 31, 2006?

marketable securities: December 31, 2020?

a. 189,000 loss Fuzzy monkey Tehnologies, Inc. purchased as a long-term investment $80

Cost Market Value b. 150,000 loss million of 8% bonds, dated January 1, on January 1, 2006. Management has

12/31/09 12/31/08 c. 300,000 gain the positive intent and ability to hold the bonds until maturity for bonds of

Trading 150,000 155,000 100,000 d. 450,000 loss similar risk and maturity the market yield was 10%. The price paid for the

Other 150,000 130,000 120,000 e. None of the above bonds was $66 million. Interest is received semiannually on June 30 and

Comprehensive December 31.

Income NUMERICAL RESPONSE (2.00) 10. What is the carrying amount of the bonds on December 31, 2006?

Zippydah SE has the following data at December 31, 2020. 11. What is the Interest Income for the year ending December 31,

What amount should Tyne report as unrealized holding gain its Securities Cost Fair Value 2006?

2009 income statement, assuming Tyne does not elect to use the Trading 120,000 124,000 12. What is the Amortization of Discount for the year ending December

fair value option to report its investments? Non-trading 100,000 94,000 31, 2006?

a. 50,000 The non-trading securities are held as a long-term investment. This is the

b. 55,000 first year of the company’s operations An entity constructed a shopping mall worth $110,000,000 that is intended

c. 60,000 1. What is the Unrealized Gain (Loss) to be reported in the Income for lease. The shopping mall is has a life of 10 years and a residual value of

d. 65,000 Statement? P10,000,000. An independent valuation expert provided the following fair

13. What is the net unrealized gain or loss to be reported in the other 2. What is the Unrealized Gain (Loss) to be reported in Equity? value at each subsequent year-end:

comprehensive income of 2009? Kadiliman acquired an investment worth 9,000,000, transaction cost related December 31, 2019 120,000,000

a. 0 to the investments amounts to 100,000 December 31, 2020 125,000,000

b. 10,000 3. What is the Cost of the Investment assuming it is held for trading? December 31, 2021 115,000,000

c. 15,000 4. What is the cost of investment assuming it is treated as other The entity follows the fair value model of accounting for investment property

d. 20,000 comprehensive income? 13. What is the Gain from change in fair value for 2019?

14. Dayanara Company owned three properties which are classified Northwest Paperboard Company, a paper and allied products manufacturer, 14. What is the Gain from change in fair value for 2020?

as investment property was seeking to gain a foothold in Canada. Toward that end, the company 15. What is the Gain from change in fair value for 2021?

Initial Cost Fair Value Fair Value bought 40% of the outstanding common shares of Vancouver Timber and 16. What is the depreciation expense for 2021?

12/31/2019 12/31/2020 Milling, Inc. On January 2, 2006, for $400 million. At the date of purchase, 17. What is the accumulated depreciation for 2021?

Property 1 2,700,000 3,200,000 3,500,000 the book value of Vancouver’s net assets was $775 million. The book values An entity insured the life of the president for P2,000,000 the entity being the

Property 2 3,450,000 3,050,000 2,850,000 and fair values for all balance sheet items were the same except for beneficiary the annual premium is P30,000 and dated January 1, 2019

Property 3 3,300,000 3,850,000 3,600,000 inventory and plant facilities. The fair value exceeded book value by $ 5 End of policy year Cash surrender value

million for the inventory and by $20 million for the plant facilities. The 2019 -

Each property was acquired three years ago with a useful life of estimated useful life of the plant facilities is 16 years. All inventory acquired 2020 -

25 years. The accounting policy is to use the fauir value model for was sold during 2006. Vancouver reported net income of $140 million for the 2021 30,000

investment property. What is the gain or loss to be recognized for year ended December 31, 2006. Vancouver paid a cash dividend of $30 2022 42,000

the year eneded December 31, 2019? million 2023 58,000

a. 189,000 loss 5. How much is the Excess of Cost over Carrying amount? The president died on June 30, 2023 and the policy was collectd on July 31,

b. 150,000 loss 6. How much is the Goodwill from acquisition? 2023

c. 300,000 gain 7. How much is the amortization of Undervaluation of Assets for the 18. What is the Life Insurance Expense for 2023?

d. 450,000 loss year ending December 31, 2006? 19. What is the Gain from Settlement for 2023?

e. None of the above 8. What is the carrying amount of the investment on December 31, 20. How much is the Life Insurance Expense for 2021?

2006?

3|Departmental Quiz 4 – Intermediate Accounting P -1

Anda mungkin juga menyukai

- Investment in Equity Securities 2Dokumen2 halamanInvestment in Equity Securities 2miss independentBelum ada peringkat

- Pract 1 - Exam2Dokumen2 halamanPract 1 - Exam2Sharmaine Rivera MiguelBelum ada peringkat

- Examination About Investment 7Dokumen3 halamanExamination About Investment 7BLACKPINKLisaRoseJisooJennieBelum ada peringkat

- 5.1 Seatwork Quiz Receivable FinancingDokumen2 halaman5.1 Seatwork Quiz Receivable FinancingSean Aaron Segucio0% (1)

- Review 105 - Day 15 P1Dokumen12 halamanReview 105 - Day 15 P1John De Guzman100% (1)

- Answers - Chapter 5 Vol 2Dokumen5 halamanAnswers - Chapter 5 Vol 2jamfloxBelum ada peringkat

- Phinma - University of Iloilo Bam 006: Midterm Exam: Amount UncollectibleDokumen4 halamanPhinma - University of Iloilo Bam 006: Midterm Exam: Amount Uncollectiblehoneyjoy salapantanBelum ada peringkat

- 1st Answer Keys PPT - Ia 2Dokumen44 halaman1st Answer Keys PPT - Ia 2mia uyBelum ada peringkat

- College of Accountancy Final Examination Acctg 206A InstructionsDokumen4 halamanCollege of Accountancy Final Examination Acctg 206A InstructionsCarmela TolinganBelum ada peringkat

- 1Dokumen2 halaman1Your MaterialsBelum ada peringkat

- Business Combination Q4Dokumen2 halamanBusiness Combination Q4Sweet EmmeBelum ada peringkat

- Comprehensive Topics HandoutsDokumen16 halamanComprehensive Topics HandoutsGrace CorpoBelum ada peringkat

- Framework of AccountingDokumen11 halamanFramework of AccountingAngelica ManaoisBelum ada peringkat

- 1Dokumen19 halaman1Angelica Castillo0% (1)

- P1.004 - PPE Depreciation and Derecognition (Illustrative Problems)Dokumen2 halamanP1.004 - PPE Depreciation and Derecognition (Illustrative Problems)Patrick Kyle AgraviadorBelum ada peringkat

- P1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Dokumen2 halamanP1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Patrick Kyle Agraviador0% (1)

- Acc7 q1Dokumen2 halamanAcc7 q1Jao FloresBelum ada peringkat

- Chap 013Dokumen667 halamanChap 013Rhaine ArimaBelum ada peringkat

- PL Act#4Dokumen2 halamanPL Act#4Jolina Pahayac50% (2)

- Problem 1Dokumen4 halamanProblem 1RexmarBelum ada peringkat

- Leslie Company Manufacturing Department Cost of Production Report For January Materials Conversion CostDokumen8 halamanLeslie Company Manufacturing Department Cost of Production Report For January Materials Conversion Costmaica G.Belum ada peringkat

- Revaluation: To The Treatment of Revaluation SurplusDokumen16 halamanRevaluation: To The Treatment of Revaluation SurplusTurks100% (1)

- Problem 30-1 (IAA)Dokumen7 halamanProblem 30-1 (IAA)Quinnie Apuli0% (1)

- Dysas - Fin Acc - 3rdDokumen5 halamanDysas - Fin Acc - 3rdJao FloresBelum ada peringkat

- MS 1806 Inventory ModelDokumen5 halamanMS 1806 Inventory ModelMariane MananganBelum ada peringkat

- AnswerQuiz - Module 8Dokumen4 halamanAnswerQuiz - Module 8Alyanna AlcantaraBelum ada peringkat

- Cost Activity 1Dokumen12 halamanCost Activity 1Dark Ninja100% (1)

- Process1 Process2 Process3Dokumen2 halamanProcess1 Process2 Process3Darwin Competente LagranBelum ada peringkat

- Basic Concepts and Job Order Cost CycleDokumen15 halamanBasic Concepts and Job Order Cost CycleGlaiza Lipana Pingol100% (2)

- AFST - Oct 17Dokumen9 halamanAFST - Oct 17kimkimBelum ada peringkat

- Learning Guide No. 3 - AnswersDokumen10 halamanLearning Guide No. 3 - AnswersXaivri Ylaina VrieseBelum ada peringkat

- Property, Plant and EquipmentDokumen40 halamanProperty, Plant and EquipmentNatalie SerranoBelum ada peringkat

- Lanimfa T.dela Cruz BSA-3A: Partnership OperationDokumen4 halamanLanimfa T.dela Cruz BSA-3A: Partnership Operationleonard dela cruzBelum ada peringkat

- Acc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - CainDokumen2 halamanAcc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - Cainslow dancerBelum ada peringkat

- Drill - ReceivablesDokumen7 halamanDrill - ReceivablesMark Domingo MendozaBelum ada peringkat

- Exercises Investment and Inventory PDFDokumen6 halamanExercises Investment and Inventory PDFLuke Myrrone Mangahas0% (1)

- B. Inventory EstimationDokumen6 halamanB. Inventory EstimationAce TevesBelum ada peringkat

- Group Act Cash 1papskie 1Dokumen3 halamanGroup Act Cash 1papskie 1Nicole ReyesBelum ada peringkat

- Accounting - Inventory Test BankDokumen3 halamanAccounting - Inventory Test BankAyesha RGBelum ada peringkat

- Investments Problem 1Dokumen9 halamanInvestments Problem 1Rex AdarmeBelum ada peringkat

- Exercise - Part 2Dokumen5 halamanExercise - Part 2lois martinBelum ada peringkat

- Chapter 7Dokumen18 halamanChapter 7kathleenBelum ada peringkat

- At 1 January 2020Dokumen6 halamanAt 1 January 2020Carl Yry Bitz100% (1)

- Accounting 106 Mr. Allan Leo T. Paran, Cpa Assignment No. 4.1 - Biological AssetsDokumen2 halamanAccounting 106 Mr. Allan Leo T. Paran, Cpa Assignment No. 4.1 - Biological AssetsRaprapBelum ada peringkat

- Case Study 1Dokumen3 halamanCase Study 1Vivek Pange0% (1)

- Global CompanyDokumen1 halamanGlobal Companydagohoy kennethBelum ada peringkat

- 01 AFAR L01 Partnership Formation & Operations PDFDokumen7 halaman01 AFAR L01 Partnership Formation & Operations PDFMikaela Salvador100% (1)

- Seatwork - Module 1Dokumen5 halamanSeatwork - Module 1Alyanna Alcantara100% (1)

- P1 1Dokumen12 halamanP1 1Donna Mae Hernandez0% (1)

- This Study Resource Was: Problem 1Dokumen2 halamanThis Study Resource Was: Problem 1Michelle J UrbodaBelum ada peringkat

- Additional Problems DepnRevaluation and ImpairmentDokumen2 halamanAdditional Problems DepnRevaluation and Impairmentfinn heartBelum ada peringkat

- Cup - Basic ParcorDokumen8 halamanCup - Basic ParcorJerauld BucolBelum ada peringkat

- Activity Based Costing ReviewerDokumen1 halamanActivity Based Costing ReviewerJonna LynneBelum ada peringkat

- TB (Service)Dokumen14 halamanTB (Service)Jerric CristobalBelum ada peringkat

- RevalDokumen2 halamanRevalRusselle Therese DaitolBelum ada peringkat

- Cash and Cash EquivalentsDokumen6 halamanCash and Cash EquivalentsPamela Mae PlatonBelum ada peringkat

- Worksheet No.1 (02/03/22)Dokumen3 halamanWorksheet No.1 (02/03/22)Sharmin ReulaBelum ada peringkat

- Intermediate AccountingDokumen7 halamanIntermediate AccountingMelissa Kayla Maniulit100% (1)

- This Study Resource Was: InvestmentsDokumen5 halamanThis Study Resource Was: InvestmentsMs Vampire100% (1)

- 4 Mock FAR 4th LEDokumen9 halaman4 Mock FAR 4th LENatalia LimBelum ada peringkat

- Scholarship Application Form v6 Refinitiv 1 1Dokumen3 halamanScholarship Application Form v6 Refinitiv 1 1Jazzen MartinezBelum ada peringkat

- PRACTICE SET Problem 257 258Dokumen2 halamanPRACTICE SET Problem 257 258Jazzen Martinez0% (1)

- standardMacCh05Dokumen26 halamanstandardMacCh05Jazzen MartinezBelum ada peringkat

- Accounting ReviewerDokumen1 halamanAccounting ReviewerJazzen MartinezBelum ada peringkat

- Chapter 8 Debentures and ChargesDokumen2 halamanChapter 8 Debentures and ChargesNahar Sabirah100% (1)

- E M - C5 - Case-StudyDokumen3 halamanE M - C5 - Case-StudyPRINCESS LYKA MAE PALOMARBelum ada peringkat

- FRL 433 International Investment and DiversificationDokumen38 halamanFRL 433 International Investment and DiversificationAnantharaman KarthicBelum ada peringkat

- Assignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundDokumen6 halamanAssignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundThricia Mae Lorenzo IgnacioBelum ada peringkat

- Research MethodologyDokumen4 halamanResearch MethodologyxyzzzzzzzzzzzzzBelum ada peringkat

- Crim AffidDokumen29 halamanCrim AffidAna AdolfoBelum ada peringkat

- 21U 2093 H Quiz 3Dokumen6 halaman21U 2093 H Quiz 3Akshit GoyalBelum ada peringkat

- Option Chain Manual FullDokumen29 halamanOption Chain Manual FullProduction 18-22Belum ada peringkat

- REVISION PaDokumen54 halamanREVISION PaNgoc Nguyen ThanhBelum ada peringkat

- Ov QPR GIVBp at 5 Q8 MDokumen15 halamanOv QPR GIVBp at 5 Q8 ManuranjankumarBelum ada peringkat

- Finance T CodeDokumen580 halamanFinance T CodeSisir PradhanBelum ada peringkat

- Assignment SampleDokumen16 halamanAssignment SamplejgukykBelum ada peringkat

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokumen2 halamanStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceEklavya GuptaBelum ada peringkat

- Ratio Analysis Cheat SheetDokumen1 halamanRatio Analysis Cheat SheetAtharva Gore100% (1)

- Capstone Project NBFC Loan Foreclosure PredictionDokumen48 halamanCapstone Project NBFC Loan Foreclosure PredictionAbhay PoddarBelum ada peringkat

- Investment Analysis and Portfolio ManagementDokumen26 halamanInvestment Analysis and Portfolio Managementkumar sahityaBelum ada peringkat

- Portfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularDokumen3 halamanPortfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularSumitBelum ada peringkat

- Final Questionnair PDFDokumen4 halamanFinal Questionnair PDFRinkesh K MistryBelum ada peringkat

- Personal Finance - Simulation 2Dokumen11 halamanPersonal Finance - Simulation 2api-256424425Belum ada peringkat

- VAT Invoice - 2023-02-28 - 00000006062065-2302-9647607Dokumen2 halamanVAT Invoice - 2023-02-28 - 00000006062065-2302-9647607falparslan5265Belum ada peringkat

- Government and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualDokumen30 halamanGovernment and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualJessicaHardysrbxd100% (14)

- Working Paper Egrement Ika SalinanDokumen1 halamanWorking Paper Egrement Ika Salinanfc BundaBelum ada peringkat

- Part I Debby Kauffman and Her Two Colleagues Jamie HiattDokumen2 halamanPart I Debby Kauffman and Her Two Colleagues Jamie HiattAmit PandeyBelum ada peringkat

- Sample TestDokumen6 halamanSample TestSajeni50% (2)

- MentahanDokumen2 halamanMentahanNoviyanti 008Belum ada peringkat

- Stock Market UbdDokumen25 halamanStock Market Ubdapi-355974187Belum ada peringkat

- Practice SumsDokumen9 halamanPractice SumsThanuja BhaskarBelum ada peringkat

- PRs SMEsDokumen77 halamanPRs SMEsMuhammad Arslan UsmanBelum ada peringkat

- Bravo PDFDokumen11 halamanBravo PDFObu LawrenceBelum ada peringkat

- Housing Finance A Comparative Study of SBI and HDFC BankDokumen3 halamanHousing Finance A Comparative Study of SBI and HDFC BankEditor IJTSRDBelum ada peringkat