UK Company - Short Tax Return Form - CT600

Diunggah oleh

princessz_leoDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

UK Company - Short Tax Return Form - CT600

Diunggah oleh

princessz_leoHak Cipta:

Format Tersedia

Page 1

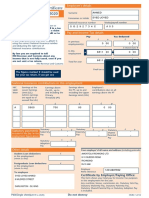

Company - Short Tax Return form

CT600 (Short) (2007) Version 2

for accounting periods ending on or after 1 July 1999

Your company tax return

If we send the company a Notice to deliver a company tax return (form CT603) it has to comply by the filing

date, or we charge a penalty, even if there is no tax to pay. A return includes a company tax return form, any

Supplementary Pages, accounts, computations and any relevant information.

Is this the right form for the company? Read the advice on pages 3 to 6 of the Company tax return guide

(the Guide) before you start.

The forms in the CT600 series set out the information we need and provide a standard format for

calculations. Use the Guide to help you complete the return form. It contains general information you may

need and box by box advice

Company information

Company name

Company registration number Tax Reference as shown on the CT603 Type of company

Registered office address

Postcode

About this return

This is the above company's return for the period Accounts

from (dd/mm/yyyy) to (dd/mm/yyyy) I attach accounts and computations

for the period to which this return relates

Put an 'X' in the appropriate box(es) below for a different period

A repayment is due for this return period

If you are not attaching accounts and

A repayment is due for an earlier period computations, say why not

Making more than one return for this

company now

This return contains estimated figures

Company part of a group that is not small

Disclosure of tax avoidance schemes

Supplementary Pages

Notice of disclosable avoidance schemes If you are enclosing any Supplementary Pages put

an ‘X’ in the appropriate box(es)

Transfer pricing Loans to participators by close companies,

form CT600A

Compensating adjustment claimed

Charities and Community Amateur Sports

Company qualifies for SME exemption Clubs (CASCs), form CT600E

Disclosure of tax avoidance schemes,

form CT600J

HMRC 08/07 CT600 (Short) (2007) Version 2

Page 2

Company tax calculation

Turnover

1 Total turnover from trade or profession 1 £

Income

3 Trading and professional profits 3 £

4 Trading losses brought forward claimed against profits 4 £

box 3 minus box 4

5 Net trading and professional profits 5 £

6 Bank, building society or other interest, and profits and 6 £

gains from non-trading loan relationships

11 Income from UK land and buildings 11 £

14 Annual profits and gains not falling under any other heading 14 £

Chargeable gains

16 Gross chargeable gains 16 £

17 Allowable losses including losses brought forward 17 £

box 16 minus box 17

18 Net chargeable gains 18 £

sum of boxes 5, 6, 11, 14 & 18

21 Profits before other deductions and reliefs 21 £

Deductions and Reliefs

24 Management expenses under S75 ICTA 1988 24 £

30 Trading losses of this or a later accounting period

under S393A ICTA 1988 30 £

31 Put an 'X' in box 31 if amounts carried back from later 31

accounting periods are included in box 30

32 Non-trade capital allowances 32 £

35 Charges paid 35 £

box 21 minus boxes 24, 30, 32 and 35

37 Profits chargeable to corporation tax 37 £

Tax calculation

38 Franked investment income 38 £

39 Number of associated companies in this period 39

or

40 Associated companies in the first financial year 40

41 Associated companies in the second financial year 41

42 Put an 'X' in box 42 if the company claims to be charged at the starting rate or the

small companies’ rate on any part of its profits, or is claiming marginal rate relief 42

Enter how much profit has to be charged and at what rate of tax

Financial year (yyyy) Amount of profit Rate of tax Tax

43 44 £ 45 46 £ p

53 54 £ 55 56 £ p

total of boxes 46 and 56

63 Corporation tax 63 £ p

64 Marginal rate relief 64 £ p

65 Corporation tax net of marginal rate relief 65 £ p

66 Underlying rate of corporation tax 66 • %

67 Profits matched with non-corporate distributions 67

68 Tax at non-corporate distributions rate 68 £ p

69 Tax at underlying rate on remaining profits 69 £ p

See note for box 70 in CT600 Guide

70 Corporation tax chargeable 70 £ p

CT600 (Short) (2007) Version 2

Page 3

79 Tax payable under S419 ICTA 1988 79 £ p

80 Put an ‘X’ in box 80 if you completed box A11 in the 80

Supplementary Pages CT600A

84 Income tax deducted from gross income included in profits 84 £ p

85 Income tax repayable to the company 85 £ p

total of boxes 70 and 79 minus box 84

86 Tax payable - this is your self-assessment of tax payable 86 £ p

Tax reconciliation

91 Tax already paid (and not already repaid) 91 £ p

box 86 minus box 91

92 Tax outstanding 92 £ p

box 91 minus box 86

93 Tax overpaid 93 £ p

Information about capital allowances and balancing charges

Charges and allowances included in calculation of trading profits or losses

Capital allowances Balancing charges

105 - 106 Machinery and plant - long-life assets 105 £ 106 £

107 - 108 Machinery and plant - other (general pool) 107 £ 108 £

109 - 110 Cars outside general pool 109 £ 110 £

111 - 112 Industrial buildings and structures 111 £ 112 £

113 - 114 Other charges and allowances 113 £ 114 £

Charges and allowances not included in calculation of trading profits or losses

Capital allowances Balancing charges

115 - 116 Non-trading charges and allowances 115 £ 116 £

117 Put an 'X' in box 117 if box 115

117

includes flat conversion allowances

Expenditure

118 Expenditure on machinery and plant on which first year allowance is claimed 118 £

119 Put an 'X' in box 119 if claim includes enhanced capital 119

allowances for designated energy-saving investments

120 £

120 Qualifying expenditure on machinery and plant on long-life assets

121 Qualifying expenditure on machinery and plant on other assets 121 £

Losses, deficits and excess amounts

122 Trading losses Case I calculated under S393 ICTA 1988 124 Trading losses calculated under S393 ICTA 1988

122 £ Case V 124 £

125 Non-trade deficits on calculated under S82 FA 1996 127 Schedule A losses calculated under S392A ICTA 1988

loan relationships and

derivative contracts 125 £ 127 £

129 Overseas property calculated under S392B ICTA 1988

130 Losses Case VI

calculated under S396 ICTA 1988

business losses Case V 129 £ 130 £

131 Capital losses calculated under S16 TCGA 1992 136 Excess management calculated under S75 ICTA 1988

expenses

131 £ 136 £

CT600 (Short) (2007) Version 2

Page 4

Overpayments and repayments

Small repayments

If you do not want us to make small repayments please either put an 'X' in box 139 or complete box 140

below. 'Repayments' here include tax, interest, and late-filing penalties or any combination of them.

Do not repay £20 or less 139 Do not repay sums of 140 £ or less. Enter whole figure only

Bank details (for person to whom the repayment is to be made)

Repayment is made quickly and safely by direct credit to a bank or building society account.

Please complete the following details:

Name of bank or building society Branch sort code

149 150

Account number Name of account

151 152

Building society reference

153

Payments to a person other than the company

Complete the authority below if you want the repayment to be made to a person other than the company.

I, as (enter status - company secretary, treasurer, liquidator or authorised agent, etc.)

154

of (enter name of company)

155

authorise (enter name)

156

(enter address)

157

Postcode

Nominee reference

158

to receive payment on the company's behalf.

Signature

159

Name (in capitals)

160

Declaration

Warning - Giving false information in the return, or concealing any part of the company's profits or tax

payable, can lead to both the company and yourself being prosecuted.

Declaration

The information I have given in this company tax return is correct and complete to the best of my

knowledge and belief.

Signature

Name (in capitals) Date (dd/mm/yyyy)

Status

CT600 (Short) (2007) Version 2

Anda mungkin juga menyukai

- CT600 2021 Version 3 04 22Dokumen11 halamanCT600 2021 Version 3 04 22Antoon Lorents0% (1)

- HMRC Tax Calculation & Tax Year Overview RequirementsDokumen7 halamanHMRC Tax Calculation & Tax Year Overview RequirementsbswaminaBelum ada peringkat

- Apply for Police CertificateDokumen17 halamanApply for Police CertificateShelby GordonBelum ada peringkat

- EXPORT INVOICE for Readymade GarmentsDokumen2 halamanEXPORT INVOICE for Readymade GarmentsAjay KumarBelum ada peringkat

- ED KitchenerBusinessDirectoryDokumen312 halamanED KitchenerBusinessDirectorymkpasha55mpBelum ada peringkat

- HMRC Specialist Investigations Offshore Coordination Unit Letter, Oct. 2013Dokumen6 halamanHMRC Specialist Investigations Offshore Coordination Unit Letter, Oct. 2013punktlichBelum ada peringkat

- Motor Vehicle Licensed RepairersDokumen1.572 halamanMotor Vehicle Licensed RepairersWaf EtanoBelum ada peringkat

- Company Industry Employee Count Country: Plastic OmniumDokumen4 halamanCompany Industry Employee Count Country: Plastic OmniumA AlamBelum ada peringkat

- HMRC Distraint Warning Notice 11951164Dokumen1 halamanHMRC Distraint Warning Notice 11951164Nechifor Laurenţiu-CătălinBelum ada peringkat

- Visa Procedure For Different CountriesDokumen231 halamanVisa Procedure For Different CountriesGovindarajan HarikrishnaBelum ada peringkat

- Preview HALIFAXDokumen4 halamanPreview HALIFAX13KARATBelum ada peringkat

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Dokumen1 halamanAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaBelum ada peringkat

- KEDC InvestorsDokumen24 halamanKEDC InvestorssabaagencyBelum ada peringkat

- Costel Mitrofan, SA Tax Return 1Dokumen2 halamanCostel Mitrofan, SA Tax Return 1Flutur GavrilBelum ada peringkat

- Bank MuscatDokumen11 halamanBank MuscatwaewrichBelum ada peringkat

- 02 # Alrajhi InvoiceDokumen1 halaman02 # Alrajhi Invoicezia uddinBelum ada peringkat

- Maynilad Water Bill DetailsDokumen1 halamanMaynilad Water Bill DetailsJenelyn DomalaonBelum ada peringkat

- Homeroom PTA Members: Name of Student Father Mother Pta MemberDokumen1 halamanHomeroom PTA Members: Name of Student Father Mother Pta MemberMark BantolinaoBelum ada peringkat

- Lab: Cecri: Pay Slip For The Month of Jan 2015Dokumen1 halamanLab: Cecri: Pay Slip For The Month of Jan 2015venkateshBelum ada peringkat

- View / Print Statement: Select Your Account / Credit Card Statement View SettingsDokumen2 halamanView / Print Statement: Select Your Account / Credit Card Statement View Settingskhadeerabk7925Belum ada peringkat

- Budhdeo-Hundal-Mathew Vs HMRC - 2020Dokumen27 halamanBudhdeo-Hundal-Mathew Vs HMRC - 2020hyenadogBelum ada peringkat

- Leaving UK - Getting Tax RightDokumen4 halamanLeaving UK - Getting Tax RightAbhay PatodiBelum ada peringkat

- HMRC Vs Curzon Capital LTDDokumen29 halamanHMRC Vs Curzon Capital LTDhyenadogBelum ada peringkat

- Claims Form PDFDokumen2 halamanClaims Form PDFStefani PalmerBelum ada peringkat

- Rama Telecom: Billed To: Shipped ToDokumen1 halamanRama Telecom: Billed To: Shipped ToLila DeviBelum ada peringkat

- CAR CARE INVOICEDokumen2 halamanCAR CARE INVOICESuresh JadhavBelum ada peringkat

- 05063XXX6349 2016oct12 2016nov10 PDFDokumen2 halaman05063XXX6349 2016oct12 2016nov10 PDFCaitlin MunroBelum ada peringkat

- Farnell: Please Email Your Remittance Advice ToDokumen2 halamanFarnell: Please Email Your Remittance Advice ToMohammed Mosaad LyricsBelum ada peringkat

- Construction Industry Scheme Payment and Deduction StatementDokumen1 halamanConstruction Industry Scheme Payment and Deduction Statement13KARATBelum ada peringkat

- Proof of Address TempDokumen1 halamanProof of Address TempJayrold O'ConnellBelum ada peringkat

- Payslip Month Ending 30 November 2022Dokumen1 halamanPayslip Month Ending 30 November 2022zeppo1234Belum ada peringkat

- Payment July 2023Dokumen1 halamanPayment July 2023AGRON REMEDIES PRIVATE LIMITEDBelum ada peringkat

- Norway CompaniesDokumen32 halamanNorway CompaniesRavi Shroff100% (1)

- Zerodha Securities DP details for client Pradeep Kumar YadavDokumen1 halamanZerodha Securities DP details for client Pradeep Kumar YadavPradeep Kumar YadavBelum ada peringkat

- Completion LetterDokumen2 halamanCompletion LetterCharles WheadonBelum ada peringkat

- Cfo UkDokumen20 halamanCfo Ukkishor waghmare0% (1)

- Insurance CompaniesDokumen3 halamanInsurance CompaniesMuhammad Umair RasheedBelum ada peringkat

- Inbound Regular InvoiceDokumen3 halamanInbound Regular InvoiceMutiara RachmawatyBelum ada peringkat

- Kevin O DonnellDokumen4 halamanKevin O DonnellITBelum ada peringkat

- Fit NoteDokumen1 halamanFit NoteSammy RobertsBelum ada peringkat

- Banking Companies and Locations ListDokumen12 halamanBanking Companies and Locations ListsheelBelum ada peringkat

- Business Account 2Dokumen2 halamanBusiness Account 2api-294872040Belum ada peringkat

- Fintech 10 PDF FreeDokumen24 halamanFintech 10 PDF Freegaju619Belum ada peringkat

- PayslipDokumen1 halamanPayslipmoriyambugam1Belum ada peringkat

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDokumen6 halamanICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanBelum ada peringkat

- TalkTalk NumbersDokumen6 halamanTalkTalk NumbersCharles MasonBelum ada peringkat

- Statement 517014 78338832 22 Dec 2023Dokumen5 halamanStatement 517014 78338832 22 Dec 2023cressidafunkeadedareBelum ada peringkat

- Gov - Uk: Register For and File Your Self Assessment Tax ReturnDokumen4 halamanGov - Uk: Register For and File Your Self Assessment Tax ReturnJane Yonzon-RepolBelum ada peringkat

- 64-8 Form (Másolat)Dokumen2 halaman64-8 Form (Másolat)Molnar FerencneBelum ada peringkat

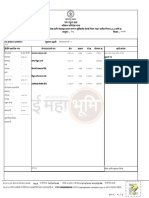

- 7 12Dokumen2 halaman7 12995aarveeBelum ada peringkat

- Official ReceiptDokumen1 halamanOfficial ReceiptMari Creon A. BaumgardnerBelum ada peringkat

- Certificate of Registration For Value Added Tax in The United Arab EmiratesDokumen1 halamanCertificate of Registration For Value Added Tax in The United Arab EmiratesDS QwerityBelum ada peringkat

- Amount Due: Summary of Charges Current Bill Period RsDokumen1 halamanAmount Due: Summary of Charges Current Bill Period RsSmaranika BehuraBelum ada peringkat

- FATCA CRS Curing DeclarationDokumen1 halamanFATCA CRS Curing DeclarationramdpcBelum ada peringkat

- Inbound Paper SA1 Form With Instruction - SignedDokumen3 halamanInbound Paper SA1 Form With Instruction - SignedKushal SharmaBelum ada peringkat

- StatusOutcome 04 February 2020Dokumen6 halamanStatusOutcome 04 February 2020Takacs Marcel100% (1)

- Complete Your Company Tax Return GuideDokumen42 halamanComplete Your Company Tax Return GuidehnajmBelum ada peringkat

- HMRC PDFDokumen17 halamanHMRC PDFjohnnybck1125Belum ada peringkat

- BAAC4206 CH 3 Income Tax UKDokumen35 halamanBAAC4206 CH 3 Income Tax UKWijdan Saleem EdwanBelum ada peringkat

- Chapter 5: Corporate Tax Learning ObjectivesDokumen19 halamanChapter 5: Corporate Tax Learning ObjectivesLogaa UthyasuriyanBelum ada peringkat

- Bravia KDL 5100Dokumen119 halamanBravia KDL 5100djdr0Belum ada peringkat

- UK Border Agency Register of Sponsors Licensed Under The Points-Based System To Employee Foreign CitizensDokumen2.068 halamanUK Border Agency Register of Sponsors Licensed Under The Points-Based System To Employee Foreign Citizensprincessz_leoBelum ada peringkat

- Handbook Peugeot 107Dokumen140 halamanHandbook Peugeot 107Bocage4xBelum ada peringkat

- Pseudo Trader's Unique Reference Number (TURN) ApplicationDokumen4 halamanPseudo Trader's Unique Reference Number (TURN) Applicationprincessz_leoBelum ada peringkat

- Inward Processing Relief How To Obtain Duty Relief On Goods Imported From Outside The EC For Re-ExportDokumen123 halamanInward Processing Relief How To Obtain Duty Relief On Goods Imported From Outside The EC For Re-Exportprincessz_leoBelum ada peringkat

- 2010 Statistics On Businesses in The UK - Office of National StatisticsDokumen410 halaman2010 Statistics On Businesses in The UK - Office of National Statisticsprincessz_leoBelum ada peringkat

- Guide To Incorporating A Company in The UK and Naming It - Companies HouseDokumen65 halamanGuide To Incorporating A Company in The UK and Naming It - Companies Houseprincessz_leoBelum ada peringkat

- Business Rates For Working From Home in UK (England & Wales) - Valuation Office AgencyDokumen2 halamanBusiness Rates For Working From Home in UK (England & Wales) - Valuation Office Agencyprincessz_leoBelum ada peringkat

- Company ActDokumen761 halamanCompany ActNicquainCTBelum ada peringkat

- Guide To Business Names For UK Businesses - Department of Enterprise Trade and InvestmentDokumen28 halamanGuide To Business Names For UK Businesses - Department of Enterprise Trade and Investmentprincessz_leoBelum ada peringkat

- Guide To Incorporating A Company in The UK - Business LinkDokumen8 halamanGuide To Incorporating A Company in The UK - Business Linkprincessz_leoBelum ada peringkat

- UK Trade Imports by Post - How To Complete Customs DocumentsDokumen11 halamanUK Trade Imports by Post - How To Complete Customs Documentsprincessz_leoBelum ada peringkat

- Drayton Lifestyle Time Switch User Manual For Model LP111, LP711, LP LP112, LP241, LP522, LP722Dokumen2 halamanDrayton Lifestyle Time Switch User Manual For Model LP111, LP711, LP LP112, LP241, LP522, LP722princessz_leo67% (3)

- How To File Accounts To Companies House UK - A Guide BookDokumen36 halamanHow To File Accounts To Companies House UK - A Guide Bookprincessz_leoBelum ada peringkat

- Importing To The UK Customs Procedures and Customs DebtDokumen24 halamanImporting To The UK Customs Procedures and Customs Debtprincessz_leoBelum ada peringkat

- What Is Share CapitalDokumen18 halamanWhat Is Share Capitalprincessz_leoBelum ada peringkat

- Olympus Digital Voice Recorder WS-311M WS-321M Manual EnglishDokumen102 halamanOlympus Digital Voice Recorder WS-311M WS-321M Manual Englishprincessz_leoBelum ada peringkat

- Corporate Tax Self Assessment GuideDokumen36 halamanCorporate Tax Self Assessment Guideprincessz_leoBelum ada peringkat

- UK Trade and Investment Department Forming A Company in UK LeafletDokumen7 halamanUK Trade and Investment Department Forming A Company in UK Leafletprincessz_leoBelum ada peringkat

- Zanussi Washer Dryer Manual English WJS 55 W, WJS 1455 W, WJS 1655 WDokumen32 halamanZanussi Washer Dryer Manual English WJS 55 W, WJS 1455 W, WJS 1655 Wprincessz_leoBelum ada peringkat

- Finolex Industries 2QFY18 Results Show Muted GrowthDokumen10 halamanFinolex Industries 2QFY18 Results Show Muted GrowthAnonymous y3hYf50mTBelum ada peringkat

- Warren Buffet LessonsDokumen79 halamanWarren Buffet Lessonspai_ganes8002Belum ada peringkat

- Notes in Business CombinationDokumen5 halamanNotes in Business CombinationEllen BuenafeBelum ada peringkat

- Taxation Principles ExplainedDokumen135 halamanTaxation Principles ExplainedCMBDB100% (1)

- 2 Exercises On FS 2023-2024 Additional For GformDokumen2 halaman2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzBelum ada peringkat

- 4 Hypothesis Testing in The Multiple Regression ModelDokumen49 halaman4 Hypothesis Testing in The Multiple Regression Modelhirak7Belum ada peringkat

- Đề thi thử Deloitte-ACE Intern 2021Dokumen60 halamanĐề thi thử Deloitte-ACE Intern 2021Tung HoangBelum ada peringkat

- Activity-Based Management QuestionsDokumen27 halamanActivity-Based Management QuestionsRimon DomiyandraBelum ada peringkat

- FIN600 Module 3 Notes - Financial Management Accounting ConceptsDokumen20 halamanFIN600 Module 3 Notes - Financial Management Accounting ConceptsInés Tetuá TralleroBelum ada peringkat

- Huzafa Tuition Centre Income Statement & Balance Sheet 2019Dokumen2 halamanHuzafa Tuition Centre Income Statement & Balance Sheet 2019Huzafa Tuition CentreBelum ada peringkat

- Thermo Fisher Acquires Life Technologies Finance ModelDokumen19 halamanThermo Fisher Acquires Life Technologies Finance Modelvardhan0% (2)

- Burnet v. Guggenheim, 288 U.S. 280 (1933)Dokumen8 halamanBurnet v. Guggenheim, 288 U.S. 280 (1933)Scribd Government DocsBelum ada peringkat

- Dividend PolicyDokumen8 halamanDividend PolicyHarsh SethiaBelum ada peringkat

- CREATE Act implementation guidelinesDokumen51 halamanCREATE Act implementation guidelinesTreb LemBelum ada peringkat

- Abm 005 2Q Week 12 PDFDokumen10 halamanAbm 005 2Q Week 12 PDFJoel Vasquez MalunesBelum ada peringkat

- Building Economics and Cost ControlDokumen25 halamanBuilding Economics and Cost ControlDr Sarbesh Mishra100% (1)

- The Nature of The Public SectorDokumen14 halamanThe Nature of The Public Sectorhiwatari_sasuke100% (1)

- Application For MC DD TT FCY 03062018 UnionbankDokumen2 halamanApplication For MC DD TT FCY 03062018 UnionbankMelvin Salo55% (11)

- Ch27 Test Bank 4-5-10Dokumen18 halamanCh27 Test Bank 4-5-10KarenBelum ada peringkat

- Chapter-2 - Dividend DecisionsDokumen54 halamanChapter-2 - Dividend DecisionsRaunak YadavBelum ada peringkat

- Philex Mining Corp Vs CIRDokumen2 halamanPhilex Mining Corp Vs CIRWilliam Christian Dela Cruz100% (2)

- Accounting For Income TaxDokumen6 halamanAccounting For Income TaxGirl Lang AkoBelum ada peringkat

- Patent Infringement Damages - A Brief Summary - Articles - FinneganDokumen14 halamanPatent Infringement Damages - A Brief Summary - Articles - FinneganneelgalaBelum ada peringkat

- Illustrative Financial Statements O 201210Dokumen316 halamanIllustrative Financial Statements O 201210Yogeeshwaran Ponnuchamy100% (1)

- LAW 102 (Reviewer)Dokumen15 halamanLAW 102 (Reviewer)Marie GarpiaBelum ada peringkat

- Quiz No. 2 FSA Oral Recits Quiz3Dokumen1 halamanQuiz No. 2 FSA Oral Recits Quiz3Louiza Kyla AridaBelum ada peringkat

- Smart Waste Management: MGT 1022 Lean Start Up ManagementDokumen28 halamanSmart Waste Management: MGT 1022 Lean Start Up Managementsabharish varshan410Belum ada peringkat

- Monthly Sales: PriceDokumen5 halamanMonthly Sales: PriceChicken NoodlesBelum ada peringkat

- Module 1 - Recording Business TransactionDokumen11 halamanModule 1 - Recording Business Transactionem fabi100% (1)

- 9.hilton 9E Global Edition Solutions Manual Chapter08 (Exercise+problem)Dokumen22 halaman9.hilton 9E Global Edition Solutions Manual Chapter08 (Exercise+problem)Anisa VrenoziBelum ada peringkat