HISL DP Tariff - Migration Cases

Diunggah oleh

mohitjain20100 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

38 tayangan1 halamanClients with POA in favour of HISL Nil Rs. 600 pa. To be paid on quarterly basis (Rs. 300 pa. For clients opting for transaction statement through email) Rs. 2 / - per certificate plus courier charges of Rs. Per demat request charges will be applied at actual charged by bank.

Deskripsi Asli:

Judul Asli

HISL DP Tariff _ Migration Cases

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniClients with POA in favour of HISL Nil Rs. 600 pa. To be paid on quarterly basis (Rs. 300 pa. For clients opting for transaction statement through email) Rs. 2 / - per certificate plus courier charges of Rs. Per demat request charges will be applied at actual charged by bank.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

38 tayangan1 halamanHISL DP Tariff - Migration Cases

Diunggah oleh

mohitjain2010Clients with POA in favour of HISL Nil Rs. 600 pa. To be paid on quarterly basis (Rs. 300 pa. For clients opting for transaction statement through email) Rs. 2 / - per certificate plus courier charges of Rs. Per demat request charges will be applied at actual charged by bank.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

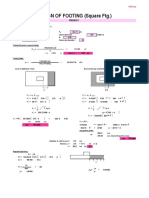

HSBC InvestDirect Securities (India) Limited

Regd. Office: Dhana Singh Processor Premises, J B Nagar, Andheri - Kurla Road, Andheri (E), Mumbai - 400059.

Tel: +91-22-6789 7777, Fax: +91-22-6789 7968, Email: customerservice@hsbcinv.com

Website: www.HSBCInvestDirect.co.in

DP ID : 12064100 SEBI Regn No.: IN-DP-CDSL-5462010

CHARGES FOR DEPOSITORY SERVICES

Charge Head Clients with POA in favour of HISL Clients without POA

Advance charges* Nil Rs. 3000/-

Annual Maintenance Rs. 600 PA. to be paid on quarterly Rs. 600 PA. to be paid on quarterly

charge ** basis (Rs. 300 pa. for clients opting basis (Rs. 300 pa. for clients opting

for transaction statement through for transaction statement through

email) email)

Dematerialization Rs. 2/- per certificate plus courier Rs. 2/- per certificate plus courier

Charges charges of Rs.35 per demat request. charges of Rs.35 per demat request.

Debit Instruction charges Rs. 15/- plus depository charges at Rs. 15/- plus depository charges at

– Market actual per transactions actual per transactions

Off Market / Inter 0.02% of transaction value subject 0.02% of transaction value subject

depository Transactions to minimum of Rs. 25/- per debit to minimum of Rs. 25/- per debit

instruction plus depository charges instruction plus depository charges

at actual per transactions at actual per transactions

Pledge charges 0.02% of the value of securities, 0.02% of the value of securities,

Creation / Closure and subject of a minimum of Rs. 25/- subject of a minimum of Rs. 25/-

confirmation of both

Pledge charges for 0.03% of the transaction charges 0.03% of the transaction charges

Invocation subject of minimum of Rs. 50/- subject of minimum of Rs. 50/-

Rematerialization Rs. 25/- per certificate for every Rs. 25/- per certificate for every

charges 100 securities or part thereof OR a 100 securities or part thereof OR a

flat fee of Rs. 25/- per certificate; flat fee of Rs. 25/- per certificate;

whichever is higher whichever is higher

Failed / Rejected Rs. 25/- per transaction Rs. 25/- per transaction

transactions

Demat Rejection charges Rs. 35/- per rejection Rs. 35/- per rejection

Adhoc / Non periodic Rs. 35/- (Rs. 500/- for foreign Rs. 35/- (Rs. 500/- for foreign

statement requests address) per request address) per request

Cheque bounce charges Charges will be applied at actual Charges will be applied at actual

charged by bank. charged by bank.

* To be adjusted with normal charges. ** AMC waived for the 1st year for existing Clients.

Notes :

• Annual Maintenance Charges are non-refundable and are levied in advance

• All depository charges would be billed at actual and would be over and above the charges specified above. The above charges are

exclusive of Service Tax and other levies from Government and statutory bodies as applicable from time to time

• The ad- valorem charges shall be levied on the value of the transactions arrived at in accordance with rates provided by depository

• Out of pocket expenses incurred on the Dispatch of securities for Dematerialisation and communication charges incurred on out station

calls / faxes made specifically on request of the clients will be charged on actual.

• DP bills should be paid on or before the due date. Interest shall be levied upto 2% per month on outstanding amount for non payment

from the bill due date.

• Any advance payments over and above the normal due amount can also be made. Any such higher amount paid than the minimum

amount payable shall be adjusted against the bills raised from time to time.

• Services not mentioned herein will be charged separately as per the rate applicable from time to time.

• Charges and/or Service standards are subject to revision at our sole discretion. These changes would be informed by circulars sent by

ordinary post.

• In case of inability to recover service charges/ account maintenance charges/ fees/ other charges/ deposits due to inadequate balance in

your bank account, invalid electronic debit mandate, closure or blocking of the bank account, depletion of advance/ deposit (for DP

customers who do not maintain trading account with us) below the stipulated limit of Rs 1,000/-, or due to any other reason, further

processing of your DP instructions and any other depository services shall be discontinued until clearance of payment of such charges/

fees/ deposits to us. Any loss/damages/expenses/costs incurred or suffered by you due to discontinuation of depository serves as

stated herein shall be borne by you and neither HSBC InvestDirect Securities (India) Ltd. nor any of its directors, employees, and

associates shall be liable for the same.

• All payments will be debited from the trading account maintained with HISL. In case of Cheque or DD payments, all payments have to be

made favouring “HSBC InvestDirect Securities (India) Ltd.”. Payment through cheque or Demand drafts payable at the local branch

where the account is opened. Out station cheque will not be accepted.

• NRI customers would be required to submit ECS mandate to debit DP charges from linked bank accounts.

Trading Code :

x x x

First Holder Second Holder Third Holder

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Guide To Downloading and Installing The WebMethods Free Trial Version - Wiki - CommunitiesDokumen19 halamanGuide To Downloading and Installing The WebMethods Free Trial Version - Wiki - CommunitiesHieu NguyenBelum ada peringkat

- Datascope System 98Dokumen16 halamanDatascope System 98Guillermo ZalazarBelum ada peringkat

- Pay Policy and Salary ScalesDokumen22 halamanPay Policy and Salary ScalesGodwin MendezBelum ada peringkat

- Leadership and Decision Making PDFDokumen34 halamanLeadership and Decision Making PDFNhi PhamBelum ada peringkat

- Solution Problem 1 Problems Handouts MicroDokumen25 halamanSolution Problem 1 Problems Handouts MicrokokokoBelum ada peringkat

- Project Management PDFDokumen10 halamanProject Management PDFJamalBelum ada peringkat

- Legal Framework of Industrial RelationsDokumen18 halamanLegal Framework of Industrial Relationsdeepu0787Belum ada peringkat

- Bill (Law) : Jump To Navigation Jump To SearchDokumen9 halamanBill (Law) : Jump To Navigation Jump To SearchPunitBelum ada peringkat

- CSP Study Course 2 Willard StephensonDokumen137 halamanCSP Study Course 2 Willard Stephensonsamer alrawashdehBelum ada peringkat

- Asia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Dokumen21 halamanAsia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Donnie HavierBelum ada peringkat

- MAYA1010 EnglishDokumen30 halamanMAYA1010 EnglishjailsondelimaBelum ada peringkat

- Lab - Report: Experiment NoDokumen6 halamanLab - Report: Experiment NoRedwan AhmedBelum ada peringkat

- Report - Fostering The Railway Sector Through The European Green Deal PDFDokumen43 halamanReport - Fostering The Railway Sector Through The European Green Deal PDFÁdámHegyiBelum ada peringkat

- CS 252: Computer Organization and Architecture II: Lecture 5 - The Memory SystemDokumen29 halamanCS 252: Computer Organization and Architecture II: Lecture 5 - The Memory SystemJonnahBelum ada peringkat

- Expanded Breastfeeding ActDokumen9 halamanExpanded Breastfeeding ActJohn Michael CamposBelum ada peringkat

- Determination of The Amount of Hardness in Water Using Soap SolutionDokumen3 halamanDetermination of The Amount of Hardness in Water Using Soap SolutionlokeshjoshimjBelum ada peringkat

- Taiwan Petroleum Facilities (1945)Dokumen85 halamanTaiwan Petroleum Facilities (1945)CAP History LibraryBelum ada peringkat

- University of MauritiusDokumen4 halamanUniversity of MauritiusAtish KissoonBelum ada peringkat

- Design of Footing (Square FTG.) : M Say, L 3.75Dokumen2 halamanDesign of Footing (Square FTG.) : M Say, L 3.75victoriaBelum ada peringkat

- General Director AdDokumen1 halamanGeneral Director Adapi-690640369Belum ada peringkat

- Ex-Capt. Harish Uppal Vs Union of India & Anr On 17 December, 2002Dokumen20 halamanEx-Capt. Harish Uppal Vs Union of India & Anr On 17 December, 2002vivek6593Belum ada peringkat

- 0601 FortecstarDokumen3 halaman0601 FortecstarAlexander WieseBelum ada peringkat

- Electric Baseboard StelproDokumen4 halamanElectric Baseboard StelprojrodBelum ada peringkat

- Torque Converter Lock-Up FunctionDokumen2 halamanTorque Converter Lock-Up Functioncorie132100% (1)

- In The High Court of Delhi at New DelhiDokumen3 halamanIn The High Court of Delhi at New DelhiSundaram OjhaBelum ada peringkat

- Series 90 100cc Pump Parts ManualDokumen152 halamanSeries 90 100cc Pump Parts ManualHernan Garcia67% (3)

- Treatment of Textile Effluents by Low Cost Agricultural Wastes Batch Biosorption Study PDFDokumen6 halamanTreatment of Textile Effluents by Low Cost Agricultural Wastes Batch Biosorption Study PDFimran24Belum ada peringkat

- 2018 Master Piping Products Price ListDokumen84 halaman2018 Master Piping Products Price ListSuman DeyBelum ada peringkat

- The Application of 1,2,3-PropanetriolDokumen2 halamanThe Application of 1,2,3-PropanetriolAlisameimeiBelum ada peringkat

- Buffett Wisdom On CorrectionsDokumen2 halamanBuffett Wisdom On CorrectionsChrisBelum ada peringkat