How Major Bills Fared at The State Capitol

Diunggah oleh

Honolulu Star-Advertiser0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

7K tayangan1 halamanHere is the status of major bills near the halfway point of the 60-day legislative session.

Judul Asli

How major bills fared at the state Capitol

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHere is the status of major bills near the halfway point of the 60-day legislative session.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

7K tayangan1 halamanHow Major Bills Fared at The State Capitol

Diunggah oleh

Honolulu Star-AdvertiserHere is the status of major bills near the halfway point of the 60-day legislative session.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

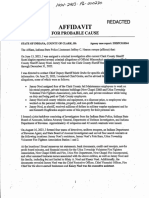

B4 > > H O N O L U L U S TA R - A D V E R T I S E R > > S U N D AY 3 / 8 / 2 0

LOCAL

HOW MAJOR BILLS FARED AT THE CAPITOL

Here is the status of major bills near the halfway point of the 60-day legislative session. The bills that are alive have passed at least one chamber of the Legislature.

The bills that are failing were not approved by the House or Senate by Thursday’s procedural deadline. Failing bills can be revived later, however,

and measures can be rewritten to change their effect before the session adjourns in May.

CONSUMER PUBLIC HEALTH/ HOUSING/

GOVERNMENT TAXES EDUCATION PROTECTION/LABOR SAFETY SOCIAL SERVICES ENVIRONMENT HOMELESSNESS

PASSING PASSING PASSING PASSING PASSING PASSING PASSING PASSING

State construction Income tax increase School facilities Minimum wage Gun magazines COVID-19 funding Coal Crisis intervention

HB 2725 HD1 HB 2385 HD1 SB 3103 SD2/HB 2544 HB 2541 HD1 HB 1902 HD2/SB 2519 SD2 SB 75 SD2/HB 1629 HD1 HB 2657 HD3 HB 933 HD2

Would appropriate Would increase the state Would establish the Would increase the state Would ban large capacity Would appropriate Would prohibit all coal Would create a crisis in-

$4.9 billion for state income tax on upper-in- School Facilities Agency, minimum wage from rifle magazines that can $10.5 million to state de- burning as of Dec. 31, tervention and diversion

construction, includ- come residents to collect which would be respon- $10.10 today to $11 per hold more than 10 partments for the public 2022. program to divert people

ing about $1.8 billion an additional $61 million. sible for all public school hour in 2021; $12 per bullets. Large capacity health response for the in need of mental health

in borrowed funds. The top rate is now 11%, development, planning, hour on 2022; $12.50 magazines are already next four months to the Wind energy services or suffering

HB 2188 HD1

Includes $200 million for and the bill would estab- and construction. per hour in 2023; and banned in Hawaii for coronavirus outbreak, from addiction who are

modifications to the H-1 lish new rates of 12% $13 per hour in 2024. handguns. including monitoring Would establish a 1-mile deemed to be a danger

Freeway eastbound from for single filers making Expand preschool Would also make the arrivals at state airports setback from the nearest to themselves or others

Waikele to the Halawa $375,000 or more, and HB 2543 HD1

state earned income tax Red light cameras and harbors, sanitation existing dwelling unit to appropriate health

Would expand Preschool SB 2994 SD2/HB 1676 HD1 for certain wind energy

area, and $113 million 13% for single filers mak- credit refundable, and teams, public commu- care and away from the

for construction of an ing $450,000 or more. Open Doors Program increase the food/excise Would authorize counties nications, equipment, facilities in agricultural criminal justice system.

additional H-1 lane east- High-income joint filers eligibility from 4-year-old tax credit to $150 per to use camera systems lab costs, quarantine districts. Requires a study

bound from the Middle and heads of households children to all children person for families that to issue tickets to people and other related costs. on the effects of noise Public order

who are 3- to 4-years who run red lights. from wind energy facilities HB 2607 HD1

Street area to Vineyard would see comparable earn less than $30,000 House bill would provide

Boulevard. increases. old who are 2 years prior per year. Those tax House bill would initially money for next year. on the health of residents. Would establish the

starting kindergarten. credits would cost the limit the system to 10 offense of urinating or

Lower voting age Excise tax hike Establishes a program state an extra $73 million intersections in urban Mental health beds School buses defecating in a public

SB 4 SD1 HB 1990 HD2 HB 2522 HD1/SB 2505 SD2 SB 2325 SD2

for the Department a year. Honolulu, and allow only place within business

Would propose a con- Would impose a new of Human Services warnings to be issued Would require the Health Would require all school districts. Violation would

stitutional amendment to half-percent excise tax to award grants for Flavored products during the first month. Department to repurpose bus contracts entered be punishable by fines of

lower the qualifying age surcharge in 2031 to preschools to help them SB 2228 SD2 unused state facilities into by the state starting up to $100.

to 16 for voters. collect more than expand capacity. Would prohibit the sale Ammunition sales for short-term residential in 2050 require that the

$380 million a year to of flavored products HB 2736 HD/SB 2635 SD2

use by patients with contractors’ vehicles Foreign buyers

Ranked voting help fund educational Hawaii Promise for electronic smoking Would require that gun substance abuse or be propelled by electric SB 3110 SD1

SB 2006 SD2 HB 2250 HD1 owners present proof power or a non-fossil Would prohibit non-U.S.

facilities and highways, devices. Would include mental health conditions.

Would establish ranked including protecting Would expand the “last e-liquid and electronic that they own a legally Would authorize use of fuel, and to be equipped citizens, businesses

choice voting for special highways from climate dollar” scholarship smoking devices within registered firearm before Medicaid reimbursement with seat belts. and trusts significantly

federal elections and for change damage; and program for students in the definition of “tobacco they can buy ammunition money to retrofit state controlled by non-U.S.

vacant County Council also prepay public the community college products,” making them for that weapon. facilities such as Leahi

Clean cars citizens from acquiring

HB 2699 HD2

seats. workers’ retirement system to students in subject to state cigarette Hospital, the old Kona residential property in

health benefits and boost Hawaii’s four-year uni- and tobacco taxes.

Dangerous drugs judiciary complex or hos- Would establish a clean Hawaii.

Lobbying rule the balance in hurricane versities if they major in SB 2793 SD1

pitals in Hilo to provide transportation goal

HB 2124 HD1

reserve trust fund. teaching, health care, en- Child restraints Would establish a new treatment beds. for the state of 100% Empty houses tax

Would prohibit former HB 2004 HD1/SB 2106 SD2 misdemeanor offense of light-duty clean vehicles SB 2216 SD2

gineering or social work.

governors, lieutenant REIT tax Gov. David Ige proposed Would require rear-facing promoting a dangerous Family leave by the end of 2045. Would levy a new “Emp-

governors and cabinet SB 2697 SD1 $19 million in funding for child safety seats for chil- drug in the fourth degree SB 2491 SD2 ty Homes Tax” of 5% of

members from lobbying Would disallow the tax the program. dren under 2 years old. punishable by up to a Would instruct Depart-

Spittlebug pest assessed value per year

SB 3042 SD1/HB 2532 HD1

lawmakers or the ad- deduction for dividends year in jail in cases where ment of Labor and Indus- against the owners of

ministration for one year paid out by real estate Teacher raises Helicopters a suspect is caught with trial Relations to develop Would appropriate funds residential units that are

after they are terminated investment trusts, ef- SB 2488 SD2 HB1907 HD2 dangerous drugs such a family leave insurance to the Department of occupied less than 50

from their positions. fectively imposing state Would fund extra pay for Would prohibit the as cocaine or metham- program to provide up to Agriculture for its efforts days per year.

corporate income taxes teachers in hard-to-fill po- operation of a helicopter phetamine in amounts 16 weeks of paid family to mitigate two-lined

Emoluments on most REITs. Trusts sitions including special for commercial purposes less than two grams. leave. Leave could be spittlebug infestations Homeless air fare

HB 361 HD1 SD2 in the state. The original HB 1945 HD1

with all of their Hawaii education, hard-to-staff without a valid instrument Possession of less than used to care for a child

Would prohibit the gov- properties committed to geographic locations rating from the Federal two grams of dangerous or family member, and bills proposed to spend Would fund efforts by

ernor and each county affordable housing would and Hawaiian language Aviation Administration. drugs is currently a felony benefits would range $1 million. Hawaii Tourism Authority

mayor from holding any still be eligible for the immersion programs. punishable by up to five from 50% to 90% of and Hawaii Lodging and

other employment or re- Autonomous cars years in prison.

Brown water Tourism Association to

deduction. REITs gross the employee’s average SB 2776 SD2

ceiving any emolument. an estimated $1.3 billion

Better schools HB 2590 HD2

weekly wage up to a address homelessness

a year from their Hawaii

HB 2697 HD1 Would establish a Inherited guns maximum of $1,000

Would direct the in tourist and resort

Benefit cuts Would establish a “No two-year autonomous HB 2709 HD2 Department of Health areas. Would provide

HB 2678 HD1 operations, but pay no per week. Coverage to perform water quality

corporate income tax. Time To Lose” commis- vehicles testing program. Would require that would be financed with half of the air fare to

Would require forfeiture sion to examine how representatives be testing during brown wa- send homeless people

of a state or county em- Gender equity employer and employee ter advisories, and inform

Carbon tax Hawaii public schools appointed to the estates contributions, with the back to their families on

ployee’s compensation SB 2636 SD2 the public of health risks

SB 3150 SD2 can be internationally of deceased gun owners employee contribution the mainland, with the

and fringe benefits upon Would impose a new competitive. Would require publicly to ensure all firearms associated with water other half provided by

a work-related felony held corporations that capped at half the cost of runoff. Would require

carbon tax by increasing are properly disposed of the coverage. the families.

conviction. the barrel tax on imported

College savings have their principal exec- or transferred to legally the state Auditor to

oil, and offer a tax credit

HB 1469 HD2 SD1 utive offices in Hawaii to qualified new owners. Aid in dying conduct a performance Land development

State contracts Would establish a state include women on their SB 2582 SD1 and management audit of SB 3104 SD2

HB 2020 HD1 to offset the cost of

the new tax on people income tax deduction for boards of directors. Drunken driving Would reduce the man- the DOH Environmental Would establish a

Would require the state contributions made to SB 2234 Management Division. residential leasehold

procurement office to earning 60% or less of Wifi and internet datory waiting period for

median income. the Hawaii 529 college Would lower the terminally ill patients who program in the Hawaii

establish a past-per- savings program starting SB 2307 SD2/HB 2055

threshold blood alcohol Solid waste Housing Finance and

formance database for Would require all state wish to use lethal doses SB 3084 SD2/HB2155 HD1

E-cigarette tax in 2020. concentration for the of prescription drugs to Development Corpora-

government contractors. SB 2227 SD2 and state-funded facilities offense of operating a Would set a goal of tion to develop afford-

Requires certain con- School violence with wireless access to end their lives. Would reducing the state’s

Would impose the vehicle while under the allow some advanced able housing. Authorizes

tract awards take into HB 2703 HD2 have filters to restrict solid waste stream prior

state’s tobacco tax on influence of an intoxicant practice registered $275 million to develop

account a contractor’s e-cigarettes. Would establish a access to pornography from .08 grams of alco- to disposal by 70% by infrastructure for afford-

past performance. pilot program to prevent sites. Exempts state- nurses to prescribe the 2030. House bill would

hol in breath or blood to drugs. able housing, and allows

Litter control targeted school violence owned housing and .05 grams. set the goal at 80%. developers to ask the

Tax credits SB 2301 SD1 by creating threat dormitories.

SB 3007 SD2 Edible cannabis Cesspools counties rather than the

Would increase the state assessment teams at Ghost guns HB 2097 HD2 Land Use Commission

Would require the cigarette tax to fund the the elementary, middle, LGBTQ+ HB 2744 HD1 HB 2151 HD1

to reclassify land areas

state to make public HB 2037 HD2 Would authorize licensed Would offer grants to

cleanup of cigarette litter. high school and college Would crack down on marijuana dispensaries between 15 acres and

the names of taxpayers level for targeted violence Would create a state so-called “ghost guns” assist low- and mod- 25 acres when most of

to sell edible cannabis

who receive tax credits Rental car tax including shootings or panel of the lesbian, gay, by creating a new felony products.

erate-income property the development will be

for specific economic HB 1930 HD1/SB 2687 SD1 bombings. Teams would bisexual, transgender, offense of purchasing, owners with upgrading affordable housing.

activities. Would increase the state develop protocols for queer, plus commission manufacturing or other- Elder abuse or converting a cesspool.

motor vehicle rental coping with threats and to advocate for equity for wise obtaining firearm SB 531 SD2 Would apply to cesspools Rental housing

surcharge from $5 per would train the public. that population. parts for the purpose of Would make financial identified as failing by the SB 2206 SD2/HB 1817 HD2

FAILING day to an unspecified assembling a gun with no Department of Health. Would commit

Cannabis cards exploitation of a vulnera-

amount. The original bill Play outside serial number. ble adult by a caregiver $200 million to the rent-

AG subpoenas proposed an increase SB 2061 SD2 SB 2543 SD2

al housing revolving fund

Would prohibit the punishable by up to 20 FAILING

to $8 per day. Senate Would establish the No Would prohibit employ- Sports officials years in prison. to develop affordable

Attorney General from Child Left Inside program ers from discriminating SB 2612 SD1

bill would boost the rentals.

any investigation in con-

surcharge from $5 to $8 to award grants promot- in hiring or termination Would establish the Treatment or jail? Red Hill

nection with nonviolent ing outdoor education because a worker is offense of assault against SB 2631 SD1/HB 1620 HD2 Would prohibit operation First-time buyers

on Maui only to help fund

civil disobedience that and recreation programs. a medical cannabis a sports official. of an underground SB 2409 SD3/HB 2066 HD1

the Honoapiilani Highway Would permit judges to

is protected under the cardholder. storage system with a Would establish a state

realignment project. refer criminal defendants

Constitution. Teacher taxes Property forfeiture to diversion programs

capacity of 100,000 program to provide

Renters’ credit SB 2261 SD2 Employment HB 2069 HD1 gallons or more mauka matching funds for down

Disclose clients or treatment court if

HB 1957 HD2/SB 2627 SD2 Would provide an discrimination Would prohibit civil asset the defendants have

of the underground injec- payments to help current

Would require candi- income tax exclusion SB 2193 /HB 1782 HD1 tion control line, including

Would adjust the income forfeiture of private prop- serious and persistent and returning residents

dates for state offices the U.S. Navy’s Red Hill

tax credit for low-income of $30,000 to reduce Would prohibit many erty unless the covered mental illnesses. House buy a primary residence.

to disclose the names fuel storage tanks.

renters, and automati- taxes for full-time school employers from consid- offense is a felony for bill would apply to petty House bill would create

of clients they have

cally adjust the credit in teachers, special edu- ering felony convictions which the property owner misdemeanors. a down payment loan

assisted before state cation teachers, school that are older than five has been convicted.

Emissions tax

agencies. future years based on the Would impose a 3% tax guarantee program for

consumer price index. librarians, and school years and misdemeanor Fetal alcohol on the sale of gasoline- first-time home buyers.

HHL commission The original version of the counselors employed convictions older than Contact visitation HB 2047 HD1

SB 2349 SD1 powered vehicles that Fire protection

Would require at least bill would have set the by the Department of three years for employ- Would create a task

Would require all state get mileage of less than SB 2131 SD2

five Hawaiian Homes new credit at $200 per Education or a charter ment purposes. Currently force to identify therapies

correctional facilities to 20 miles per gallon, and

Commission members exemption per year. The school. employers can consider and home- and commu- Would establish an

allow family members a 2% tax on sales on income tax credit for

to be Native Hawaiians renters’ credit has not felony convictions that nity-based care services

Loan forgiveness to engage in contact vehicles that get 20 to the installation of an

or current Hawaiian been increased since it occurred within the last to help children and

SB 2052 SD2 visitation with inmates 24 mpg. Revenue from automatic fire sprinkler

homestead lessees, and was set at $50 per year 10 years, and misde- adults with fetal alcohol

Would add early child- at any state correctional the tax would be used to system in any new one-

at least two of those per exemption in 1981. meanor convictions spectrum disorders.

hood education teachers facility during official provide rebates for pur- or two-family dwelling

be on the wait list for within the last five years.

Doctors’ exemption to the Hawaii educator visiting hours. Psychologists chasers of electric cars.

Hawaiian homelands. used only for residential

SB 2542 SD2 loan program and allow College athletes SB 3075 SD1

Emissions testing purposes.

Lawmakers teach Would exempt medical the education loans of SB 2673 SD2 Would require the state

FAILING Would require passenger

Would propose an services from the state those teachers to be Would establish the right Board of Psychology to vehicles to be tested for

amendment to the state excise tax if they are forgiven after five years of of postsecondary student establish a pilot program emissions as part of the FAILING

Constitution to specif- provided by physicians teaching. athletes in intercollegiate Reduced fines on Kauai to grant

Would require courts to required yearly inspec-

ically allow members and advanced practice athletics to receive prescriptive authority to tion, excepting those

Affordable housing

of the Legislature to be compensation for the use reduce traffic fines for Would allow property

registered nurses who qualified psychologists. vehicles manufactured

employed as faculty at FAILING of their names, images, low-income motorists. owners to temporarily

are acting as primary prior to 1975 and within

the University of Hawaii. or likenesses. The collective amount of Medical release lease space to individu-

care health providers. the preceding five years.

Property tax the fines would not be HB 1972 HD2 als to camp or otherwise

Candidates’ quiz Proposes amendments allowed to exceed 1% of Would create a medical Scrap car tax occupy space on the

Would require candi- FAILING to the Hawaii state Con- FAILING the motorists’ incomes. release program for ill, Would establish a new property, so long as no

dates for county election stitution to provide that disabled or impaired motor vehicle registration health and safety ordi-

to take the civics prac- Food exemption the taxation of real prop- Scrap HI-5 Fireworks searches nances are violated.

Would require sheriff’s inmates who pose a low tax of $25 per year to pay

tice test published by Would exempt food pur- erty shall be under the Would repeal the deposit risk to public safety. for the disposal of aban-

the U.S. Citizenship and concurrent jurisdiction of beverage container pro- deputies with explo- Taxation

chases, medical services doned motor vehicles.

Immigration Services, the counties and also the gram. sive-sniffing dogs to ran- Would establish a

and feminine hygiene

and would publish the Board of Education for domly inspect incoming FAILING Sun screen surcharge equal to 25%

products from the state

results. excise tax starting in the purpose of funding Insulin cost cap shipping containers. Would require that, of the net proceeds from

teacher compensation. Would require insurance Fluoridation beginning Jan. 1, 2023, the sale of certain res-

2020. Tougher penalties

Transit tax plans to cap the cost of Would fluoridate Hawaii’s only sunscreen products idential property within

Would propose an Promise loans co-pays for insulin. Would increase penalties

Conveyance tax for the crimes of assault, public water supplies. containing active ingredi- five years after the date

amendment to the state Would increase the state Would convert the ents classified by the U.S. of purchase if the owner

Constitution to authorize conveyance tax rate for Hawaii Promise college Smoking ban burglary, criminal proper- Retirement savings is ineligible for a county

Would ban smoking ty damage and theft. Food and Drug Admin-

the Legislature to residential investment scholarship program to a Would establish a Hawaii istration as a category I, homeowner’s exemption

establish a tax surcharge loan program. on the grounds of drug Retirement Savings Pro-

properties worth Monetary bail generally recognized as on property tax.

on real property near treatment facilities. gram for private sector

$2 million or more. Would prohibit courts safe and effective, ingredi-

rapid transit stations to Expulsions employees. Housing access

Resale tax Would prohibit the Electric discount from requiring a monetary ent, shall be sold, offered

Would amend the state

finance development of Would require the Public bail as a condition for for sale, or distributed for

infrastructure in those Would impose a new tax expulsion and limit the Senior benefits Constitution to mandate

suspensions of children Utilities Commission to release when a person Would establish the sale in the state.

areas. of 25% on the proceeds the state “shall assure”

participating in the establish preferential is charged with a petty Hawaii Senior Benefits

from the sale of condo- Glyphosate study each resident has

Executive Office on Early electricity rates for misdemeanor, a traffic Payment Program to

miniums or single-family Would establish a access to housing.

Learning’s public prekin- homes located within violation, with certain provide qualifying senior

homes if the properties glyphosate task force to

dergarten program. a one-mile radius of a exceptions. citizens in Hawaii with a

are resold by non-owner assess the impact of gly-

utility-scale wind energy monthly stipend to defray

occupants within five phosate on Hawaii’s nat-

facility. cost of living expenses.

years of the date of the ural environment, human

initial purchase. health and agriculture.

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Police Statement From Principal Murphy To HPDDokumen6 halamanPolice Statement From Principal Murphy To HPDHonolulu Star-AdvertiserBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Logistics CostingDokumen21 halamanLogistics CostingRuchita RajaniBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- 2023 Legislative Report Release To LegislatureDokumen22 halaman2023 Legislative Report Release To LegislatureHonolulu Star-AdvertiserBelum ada peringkat

- FINAL 20230810 CWRM W Maui Fire LTR From WMLCDokumen3 halamanFINAL 20230810 CWRM W Maui Fire LTR From WMLCHonolulu Star-Advertiser100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Ptmail m0617 Sms Smart Money Secrets A Quick Start GuideDokumen15 halamanPtmail m0617 Sms Smart Money Secrets A Quick Start Guidepkj009Belum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Meet The 2024 Hawaii State LegislatureDokumen1 halamanMeet The 2024 Hawaii State LegislatureHonolulu Star-AdvertiserBelum ada peringkat

- GOP House Committee Letter To Hawaiian Electric, Hawaii Public Utilities Commission and Hawai'i State Energy OfficeDokumen4 halamanGOP House Committee Letter To Hawaiian Electric, Hawaii Public Utilities Commission and Hawai'i State Energy OfficeHonolulu Star-AdvertiserBelum ada peringkat

- Case Digest Incomplete TaxDokumen135 halamanCase Digest Incomplete TaxHencel GumabayBelum ada peringkat

- Capital Budgeting, Cash Flows & Decision Making ProcessDokumen47 halamanCapital Budgeting, Cash Flows & Decision Making ProcessAnifahchannie PacalnaBelum ada peringkat

- Dallas Pearce, Redacted Investigation Report FinalDokumen53 halamanDallas Pearce, Redacted Investigation Report FinalHonolulu Star-AdvertiserBelum ada peringkat

- Hawaii Department of Health MemoDokumen18 halamanHawaii Department of Health MemoHonolulu Star-AdvertiserBelum ada peringkat

- Chap 017Dokumen27 halamanChap 017Xeniya Morozova Kurmayeva100% (4)

- BSBFIM601 Assessment TaskDokumen29 halamanBSBFIM601 Assessment Tasksingh singh50% (4)

- All-State Girls Soccer TeamDokumen1 halamanAll-State Girls Soccer TeamHonolulu Star-AdvertiserBelum ada peringkat

- Indictments Against Sebastian Mahkwan and Paul CameronDokumen11 halamanIndictments Against Sebastian Mahkwan and Paul CameronHonolulu Star-AdvertiserBelum ada peringkat

- DOT OST 2023 0186 0009 - Attachment - 1Dokumen14 halamanDOT OST 2023 0186 0009 - Attachment - 1Honolulu Star-AdvertiserBelum ada peringkat

- DOT OST 2023 0186 0010 - Attachment - 1Dokumen8 halamanDOT OST 2023 0186 0010 - Attachment - 1Honolulu Star-AdvertiserBelum ada peringkat

- EPA Drinking Water Complaints Investigation ReportDokumen9 halamanEPA Drinking Water Complaints Investigation ReportHonolulu Star-AdvertiserBelum ada peringkat

- Ready For Kindergarten AssessmentDokumen1 halamanReady For Kindergarten AssessmentHonolulu Star-AdvertiserBelum ada peringkat

- The Honolulu Star-Advertiser All-State Football Team 2023Dokumen1 halamanThe Honolulu Star-Advertiser All-State Football Team 2023Honolulu Star-AdvertiserBelum ada peringkat

- Letter To ParentsDokumen1 halamanLetter To ParentsHonolulu Star-AdvertiserBelum ada peringkat

- Attempted Murder Suspect Sidney Tafokitau WantedDokumen1 halamanAttempted Murder Suspect Sidney Tafokitau WantedHonolulu Star-AdvertiserBelum ada peringkat

- CSA PRC State Sponsored Cyber Living Off The LandDokumen24 halamanCSA PRC State Sponsored Cyber Living Off The LandHonolulu Star-AdvertiserBelum ada peringkat

- Hawaii Baseball Report - July 16, 2023Dokumen1 halamanHawaii Baseball Report - July 16, 2023Honolulu Star-AdvertiserBelum ada peringkat

- Top HMSA Officers' CompensationDokumen1 halamanTop HMSA Officers' CompensationHonolulu Star-AdvertiserBelum ada peringkat

- All-State Softball TeamDokumen1 halamanAll-State Softball TeamHonolulu Star-AdvertiserBelum ada peringkat

- HSTA 2023 2027 Member Settlement SummaryDokumen6 halamanHSTA 2023 2027 Member Settlement SummaryHonolulu Star-AdvertiserBelum ada peringkat

- May 2023 Sky WatchDokumen1 halamanMay 2023 Sky WatchHonolulu Star-AdvertiserBelum ada peringkat

- All-State Boys Basketball TeamDokumen1 halamanAll-State Boys Basketball TeamHonolulu Star-AdvertiserBelum ada peringkat

- Star-Advertiser Girls Basketball All-State TeamDokumen1 halamanStar-Advertiser Girls Basketball All-State TeamHonolulu Star-AdvertiserBelum ada peringkat

- BOR Settlements RPRT Roh8-12 FY22Dokumen10 halamanBOR Settlements RPRT Roh8-12 FY22Honolulu Star-AdvertiserBelum ada peringkat

- All-State Boys Soccer TeamDokumen1 halamanAll-State Boys Soccer TeamHonolulu Star-AdvertiserBelum ada peringkat

- UH vs. UCSB BoxscoreDokumen20 halamanUH vs. UCSB BoxscoreHonolulu Star-AdvertiserBelum ada peringkat

- Full Text of Mayor Rick Blangiardi's State of City SpeechDokumen16 halamanFull Text of Mayor Rick Blangiardi's State of City SpeechHonolulu Star-AdvertiserBelum ada peringkat

- CSS Hawaii Final Report For Redaction Redacted FinalDokumen570 halamanCSS Hawaii Final Report For Redaction Redacted FinalHonolulu Star-AdvertiserBelum ada peringkat

- University of Hawaii AD Search LetterDokumen2 halamanUniversity of Hawaii AD Search LetterHonolulu Star-AdvertiserBelum ada peringkat

- X Engineering EconomicsDokumen39 halamanX Engineering EconomicsMikaellaTeniolaBelum ada peringkat

- SFP Act 2021Dokumen4 halamanSFP Act 2021moreBelum ada peringkat

- Module 1 - International MarketingDokumen49 halamanModule 1 - International MarketingRejoy JohnBelum ada peringkat

- Business Intelligence Applied in Small Size For Profit CompaniesDokumen13 halamanBusiness Intelligence Applied in Small Size For Profit CompaniesMiguel de la CruzBelum ada peringkat

- Andreatta Article James LeBeauDokumen8 halamanAndreatta Article James LeBeauxjaxBelum ada peringkat

- (ACYFAR 5) ReflectionDokumen28 halaman(ACYFAR 5) ReflectionAl ChuaBelum ada peringkat

- Diskusi 7 Bahasa Inggris NiagaDokumen2 halamanDiskusi 7 Bahasa Inggris NiagaRamdhaniBelum ada peringkat

- Business AccountingDokumen16 halamanBusiness AccountingMark 42Belum ada peringkat

- WING Investor Presentation IR Website 2018 WingstopDokumen37 halamanWING Investor Presentation IR Website 2018 WingstopAla BasterBelum ada peringkat

- Probable Cause Affidavit FiledDokumen6 halamanProbable Cause Affidavit Filedjulia.huffmanBelum ada peringkat

- Finance 301 Exam 1 Flashcards - QuizletDokumen11 halamanFinance 301 Exam 1 Flashcards - QuizletPhil SingletonBelum ada peringkat

- The Use of White Out, Black Out, or Alteration of Original Information Will Void This Document.Dokumen2 halamanThe Use of White Out, Black Out, or Alteration of Original Information Will Void This Document.Vivo MayvelBelum ada peringkat

- Government Accounting: (Unified Account Code Structure)Dokumen13 halamanGovernment Accounting: (Unified Account Code Structure)Mariella AngobBelum ada peringkat

- Income From House Propert Notes (Chapterof ICSI) PDFDokumen28 halamanIncome From House Propert Notes (Chapterof ICSI) PDFSHIVAM AGRAHARIBelum ada peringkat

- Education Is Not A Luxury But A Basic Human Right. in The Light of This Do You Think Governments Should Make Basic and Higher Education Free For All?Dokumen4 halamanEducation Is Not A Luxury But A Basic Human Right. in The Light of This Do You Think Governments Should Make Basic and Higher Education Free For All?technofreak9Belum ada peringkat

- Cane FurnitureDokumen10 halamanCane FurnitureYaseen KhanBelum ada peringkat

- PNC INFRATECH - ASM ProjectDokumen11 halamanPNC INFRATECH - ASM ProjectAbhijeet kohatBelum ada peringkat

- Preliminary Topic Five - Financial MarketsDokumen12 halamanPreliminary Topic Five - Financial MarketsBaro LeeBelum ada peringkat

- Hagar Industrial Systems Company HiscDokumen1 halamanHagar Industrial Systems Company HiscDoreenBelum ada peringkat

- Cost EstimationDokumen11 halamanCost EstimationTamiko MitzumaBelum ada peringkat

- High School Franchise Rs. 8.02 Million Sep-2020Dokumen19 halamanHigh School Franchise Rs. 8.02 Million Sep-2020Zeeshan NazirBelum ada peringkat

- AverageDokumen9 halamanAveragewithraviBelum ada peringkat

- Perc MCQ For EconomicsDokumen9 halamanPerc MCQ For EconomicscleoBelum ada peringkat

- Form No. 35 (See Rule 45)Dokumen3 halamanForm No. 35 (See Rule 45)Savoir PenBelum ada peringkat