Welstaro 20100720

Diunggah oleh

noman.786Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Welstaro 20100720

Diunggah oleh

noman.786Hak Cipta:

Format Tersedia

20 July 2010

COMPANY

REPORT

Welspun Corp Limited BUYBUY

TheCompany

The Company:

Industry: Pipes Manufacturing & Construction

Welspun Corp Ltd (formerly known as Welspun Gujarat Stahl Rohren Current Price 246

Ltd) or “Welcorp” is the world's leading Pipe manufacturing company. Target Price 308

The company manufactures high-grade Sub-merged arc welded Market Cap (Cr.) 5024

(SAW) pipes; both Spiral 'HSAW' & Longitudinal 'LSAW' and also 52 Week H/L 296/191

FV 5

Electric resistance welded (ERW) pipes. The current capacity

Book Value/Share 142

(including its manufacturing facility in US) is broken into HSAW

BSE Sensex 17937

(900,000 MTPA), LSAW (350,000 MTPA) and ERW (250,000

NSE Nifty 5383

MTPA). In addition to pipes, Welcorp also provide value added

BSE Code 532144

services such as coating and bending of pipes. In 2007, Welcorp was NSE Code WELCORP

named as the world's second largest producer of pipes of 16" diameter Reuters Code WGSR.BO

and above by the Financial Times, UK. Bloomberg Code WLCO:IN

1 Yr Stock / Index Performance

160.0

Welspun 140.0

Corp Ltd

120.0

100.0

Welspun Welspun Pipes

80.0

Ductile/Cast Welspun Natural Ltd. (Proposed 60.0

Iron Pipes Inc. USA Resources LSAW Plant)

Private Ltd. 40.0

20.0

Welspun Tubular 0.0

LLC 7/20/2009 10/26/2009 2/1/2010 5/10/2010

Welspun Global

(Pipes, coating Sensex Welspun Corp

and Double Trade LLC

Jointing)

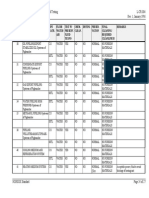

Company FY 09 FY 10 FY 11E FY 12E

Net Revenue 5739.5 7350.3 8566.7 9886.0

The Company:

Investment Rationale

Operating Exp. 5104.8 6031.6 7190.4 8285.3

EBITDA 634.8 1318.6 1376.3 1600.7

Profit after Tax 213.5 610.4 629.7 745.5

Huge Market Opportunity for Pipe manufacturers; Globally EPS 11.4 29.9 30.8 36.5

ROE% 13.7% 21.0% 18.1% 17.9%

Pipelines are used in various industries and applications including ROCE% 4.8% 10.5% 10.2% 11.1%

EV/EBITDA 9.9 4.4 4.1 3.1

water, oil and natural gas and related products and sewage

Share Holding Pattern as on June 30, 2010

transportation as well as in oil refineries, petrochemical plants, Oil

Country Tubular Goods (OCTG) applications and in mechanical, General Public

16% Promoters

55%

Other Investors

structural, chemical, automobile and general engineering industries. 12%

Due to its inherent advantage such as low Operational cost, Safety in

transportation and protection against pilferage; Pipelines are the

Institutions

preferred mode of transportation for fluids, globally. Continuously 17%

increasing demand for Crude oil and Natural Gas has necessitated the

Tapan Trivedi

development and improvement of proper logistics infrastructure Tel - 0484-2796211

across the globe. Email: tapan.trivedi@jrg.co.in

For Private Circulation Only

COMPANY

REPORT

Different types of Pipes and their uses

Pipes are mainly classified on the basis of their manufacturing process into Welded pipes,

Seamless and Spun pipes.

Different types of Pipes and their usage

Units: inPipe

Rs Crore Units

Diameter

: in Rs Crore Industry Application

Seamless 0.5" to 14" Oil & Gas Transportation, Boiler and Automotive

ERW 0.5" to 22" Oil & Gas from Hub to Station

Ductile/Cast Iron 3" to 39" Water and Sewage

SAW

LSAW 16" to 50" Oil & Gas Transportation

HSAW 18" to 100" Oil & Gas and Water Transportation

Source: Company Annual Report

Welded steel pipes are generally manufactured from Hot rolled and Cold rolled steel coils

using the Electrical Resistance welding (ERW) process.

Submerged arc welded (SAW) pipes are another category which is primarily used in the

Energy industry, particularly for oil and natural gas transportation. SAW pipes are made

from steel plates and hot rolled steel coils. Under this, Longitudinal Saw (LSAW) pipes

are generally used for transportation of oil and natural gas in high temperature and

pressure applications in refineries and petrochemical units while Spiral/Helical Saw

(HSAW) pipes are generally used for transportation of crude and refined petroleum

products and natural gas under low pressure conditions.

Growth in Hydrocarbon sector fueling the demand in Pipe industry

Historically, the hydrocarbon sector has been one of the largest consumers of SAW and

ERW pipes globally. Accordingly, the outlook for Pipe industry is closely linked to the

growth in Oil exploration and production (E&P) and deep sea drilling.

The Global Economic slowdown during the previous year inflicted the demand and prices

of petroleum products for most part of 2009. With the affect of this, the Capex projects in

the Oil & Gas Onshore drilling and eventually in the transportation segment came to a

standstill. Despite these Short-term hiccups, the overall trend in the global pipeline

industry remains robust.

Shrinking oil and natural gas reserves coupled with rising demand is expected to fuel huge

investments in E&P. Over the next few years, the Capex activities in the hydrocarbon

industry are set to increase exponentially driven by demand in Middle East, North

America, CIS and Asia.

Moreover, with Crude Oil prices rising higher and higher, Natural gas is increasingly

emerging as a fuel of choice due to its qualities like environmentally friendly, scalable,

efficient and abundancy. Over the years, Gas has grown from a marginal fuel consumed in

For Private Circulation Only

COMPANY

REPORT

in regionally disconnected markets to a fuel that is transported across great distances for

consumption in many different economic sectors.

Increasing acceptance of Natural gas over Crude oil is driving Major gas pipeline

construction across the globe. Over the next five years, the pipeline Capex is

expected to be over US$78 Bln.

Expected Capital Expenditure - Global Pipeline development

Region No. of Projects Length Quantity (MT) Buss. Potential (Bln $)

North America 199 68615 13.7 16.5

Latin America 49 32880 6.6 7.9

Europe 124 46478 9.3 11.2

Africa 61 24400 4.9 5.9

Middle East 129 46664 9.3 11.2

Asia 156 91509 18.3 22

Australasia 46 16467 3.3 4

Total 764 327013 65.4 78.5

Source: Simdex, US, May 2010 update Data

Notes: 1. Conversion rate of 200 MT/KM;

2. Conversion rate of $1,200/MT

As per the Simdex data for May 2010, the international market is expected to create an

overall Pipe demand of more than 65 Mln MT until 2014 with an opportunity of more than

$78 Bln across the globe. According to the analysis, Asia alone is expected to create a

demand for over 18 Mln MT of pipe lines, contributing more than 28% of the total global

pipe demand in the next five years. The other significant demand would be coming from

North America and Latin American region which is estimated to up the demand for over

20 Mln MT i.e. nearly 30% of the total global demand. Other regions like Middle East and

Europe too are expected to add more than 90,000 Km's of pipelines and eventually

creating a pipe demand of 18 Mln MT.

Region-wise expected demand, based on No. of Projects

Australasia

6%

Asia

21%

North America

26%

Middle East

17%

Latin America

6%

Africa Europe

8% 16%

Source: Simdex, US, May 2010 update

Moreover, there is large scale replacement demand to arrive from the US as more than 1

Mln Miles of pipelines in the US were laid down during the 1960's and 1970's. Going with

the average economic lifetime of the pipelines of around 30 years, US can lead to

significant addition to total pipes demand in the world.

For Private Circulation Only

COMPANY

REPORT

Domestic demand too seems robust

In the domestic space too, Natural gas has emerged as one of the most preferred fuel due to

its environmentally benign nature, greater efficiency and cost effectiveness. The

production of Natural gas, which was almost negligible at the time of independence, is at

present at the level of around 87 MMSCMD.

As already discussed above, Pipeline is the cheapest and the most efficient mode of

transportation for all kinds of petroleum products across the globe. Due to low level of

investment for the development of logistical infrastructure in the past in India, only a

limited quantity of total petroleum products is transported through pipelines. However,

due to the underlying advantages of pipelines over other means of transportation, huge

investment has been planned by major Hydrocarbon companies in the nation.

Welcorp increasing its Capacity to boost future growth

To cater the huge opportunity for pipe manufacturers in the domestic and the international

market, Welcorp is stepping up its total Pipes capacity to more than 2 Mln MTPA by FY

12E. Welcorp's current pipes capacity is around 1.5 Mln MTPA which is the second largest

pipes manufacturing capacity in the world (Financial Times, UK). Its total capacity,

(including its manufacturing facility in US) is broken into HSAW capacity of 0.9 Mln

MTPA; LSAW 0.35 Mln MTPA and ERW 0.25 Mln MTPA. In addition to pipes; it

provides services like coating and bending of pipes. In its process of backward

integration, it also ventured into manufacturing Plates and Coils (2008) with a capacity of

1.5 Mln MTPA, the first step towards making Pipes from Steel Slabs.

(In 000' MT) Welcorp Pipes Capacity (Current and Planned)

1200

1100 1100

1000

900 900

800

650

600

400 400 400

400 350 350 350 350 350 350

250 250 250 250 250 250 250

200

0

FY 06 FY 07 FY 08 FY 09 FY 10 2011E 2012E

HSAW LSAW ERW

Source: Company Data, JRG Research

Currently, Welcorp plans to increase its LSAW pipes capacity by 0.3 Mln MTPA at its

plant in Anjar while also adding 0.1 Mln MTPA capacity of HSAW pipes. While the

management is confident of adding around 0.45 Mln MTPAof capacity by FY 11E, we

expect the plants to be fully commissioned only after FY 11.

The expansion will further enhance Welcorp's hold in the industry wherein it already is an

accredited supplier to over 50 Major oil and gas companies across the world. Moreover, a

company which already derives more than 75% of its revenues through exports; increase

For Private Circulation Only

COMPANY

REPORT

in capacity will further elevate its position in the global pipe manufacturing industry.

Order Book firm, expect further improvement in the future

As of June 2010, Welcorp's consolidated order book stands at over Rs 7100 Crore.

Recently the company got Rs 700 Crore for Pipes and plates from the Middle East. The

total order backlog of the company is in line with FY 10 financial performance of the

company and provides decent Revenue visibility for the next twelve months. In terms of

volumes, the total tonnage has increased to around 0.9 Mln MT in the Pipe manufacturing

segment, up from the 0.8 Mln MT which was at the end of FY 10.

(In 000' MT)

Quarterly Trend in Volumes of Pipes and Plates for Welcorp (In 000' MT)

Yearly Growth in Volumes of Pipes and Plates for Welcorp

250.0 1400

1200

200.0

1000

150.0

800

600

100.0

400

50.0

200

0.0 0

Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 FY 06 FY 07 FY 08 FY 09 FY 10 FY 11E FY 12E

Pipes Plates Pipes Plates

Source: Company Data, JRG Research

During FY 10, Welcorp sold pipes to the tune of 0.81 Mln MT and is targeting to sell more

than 1 Mln MT of pipes in FY 11E. The current Rs 700 Crore Order only strengthens the

company's expectation for the current fiscal year. Other than pipes, Welcorp also plans to

sell around 0.6 Mln MT of plates in FY11E; up by more than 55% of FY 10 sales of over

0.38 Mln MT of plates. Over the next two years, we expect the sales volume in the Pipe

and the Plates segment to grow at a GACR of around 18% and 40% respectively. Though

the volume growth is seen firm, margins are expected to taper down a bit due to lower

sales realization coupled with increasing cost of key raw materials.

Welcorp enters Construction sector through MSK Acquisition

Welspun Infratech Ltd., a wholly owned subsidiary of Welcorp has recently acquired

majority stake in the construction company, MSK Projects India Ltd for an all cash deal.

MSK is primarily engaged into Engineering, Procurement and Construction projects in

the Road and Industrial segment. The company also owns a number of BOOT (Build Own

Operate Transfer) assets in Road, water and bus terminals. The acquisition enhances

Welcorp's presence in the highly growing Infrastructure market in India, at the same time

will step-up its position as an One-stop-solution provider in the Line Pipe segment

ranging from Manufacturing of Plate & Coil to Line Pipe and finally to Pipe laying.

Welcorp is expecting MSK to cross Rs 1000 Crore mark by FY 12 in Revenue from

around Rs 420 Crore in FY 10. Based on these estimates, MSK should be able to

For Private Circulation Only

COMPANY

REPORT

contribute around 9% of the Net Sales of cumulative Welcorp in FY 12E. Though, in our

estimates of Welcorp, we have not factored any financial growth emerging from MSK as

of now.

Majority stake in Saudi Arabian Pipe manufacturing firm to enhance hold in GCC

region

Welcorp has initiated agreements to acquire majority stake in Aziz European Pipe Factory

Llc, a Saudi Arabian pipe and pipe coating facility. It is one of the largest Spiral Pipe

manufacturing facilities in the region, with total installed capacity on 270,000 MTPA of

Pipes. Other than Pipes, Welscorp will also hold majority stake in Azia's recently

commissioned Pipe coating facility thus enabling it to provide complete solution to the

Oil and Gas majors and water companies in the GCC (Gulf Corporation Council) region.

Valuation and Financial Projections

Financial Projections - Welspun Corp Limited

Units:In Rs Crore FY 09 FY 10 FY 11E FY 12E

Net Sales 5739.5 7350.3 8566.7 9886.0

Other Income 18.7 18.5 20.0 20.0

Net Raw Materials 4002.7 4748.4 5739.7 6603.9

% of Sales 69.7% 64.6% 67.0% 66.8%

Staff Cost 132.2 277.9 208.5 248.0

Other Expenses 969.9 1005.4 1242.2 1433.5

Operating Exp 5104.8 6031.6 7190.4 8285.3

EBITDA 634.8 1318.6 1376.3 1600.7

OPM 11.1% 17.9% 16.1% 16.2%

Depreciation 143.3 206.1 256.9 314.8

Interest 176.6 207.1 199.5 193.3

Provision for Taxes 120.0 313.6 310.2 367.2

% of Tax 36.0% 33.9% 33.0% 33.0%

Net Profit 213.5 610.4 629.7 745.5

OPM 3.7% 8.3% 7.3% 7.5%

Continuing with its firm performance FY 10, Welcorp is expected to step-up its growth in

the coming years. Aided by increasing capacity and soaring long-term demand for

pipelines in the global arena, the company is expected to record more than 18% and 40%

growth in Sales volumes in the Pipe and the Plates segment of the company by FY 12E.

Due to marginal contraction in realizations, the Top-line is expected to register a CAGR of

more than 16% and rise to Rs 9886 Crore (FY 12E) as equated to Rs 7350 Crore (FY 10).

Drop in realization coupled with rising input costs is expected to inflict company's

operating profit performance which are seen growing moderately at around 10% CAGR

to Rs 1601 Crore (FY 12E) as compared to Rs 1319 Crore (FY 10). The Operating margins

are seen stabilizing around the 16% mark for the next two fiscal years.

For Private Circulation Only

COMPANY

REPORT

(In Rs. Crore) Yearly Trend in Net Sales, EBITDA and OPM

12000 20.0%

17.9% 9886 18.0%

10000 16.4%

16.1% 16.0%

16.2%

8567

14.0%

8000

12.4% 7350

12.0%

11.1%

6000 5740 10.0%

8.0%

3994

4000

6.0%

2679

4.0%

2000 1601

1319 1376

655 635 2.0%

333

0 0.0%

FY 07 FY 08 FY 09 FY 10 FY 11E FY 12E

Net Sales EBITDA OPM

Source: Company Data, JRG Research

Increase in Capacity is expected to result into higher depreciation costs for Welcorp while

capital raised through QIP to pay-off and convert the high cost debt is anticipated to

reduce the interest expenses of the company going forward. The Bottom-line of the

company is expected to clock a CAGR of 10.5% and jump to Rs 745 Crore (FY 12E) as

against Rs 610 Crore (FY 10). NPM's are seen dipping to 7.3% levels in FY 11E, while

witness marginal improvement towards 7.5% in FY 12E.

Recommendation

At the Trailing market price of Rs 246, Welcorp is trading at 8X and less than 7X its FY

11E and FY 12E EPS of Rs 31 and Rs 37 respectively. Considering the firm performance

of the company over the years, healthy Order Book position coupled with the Large-scale

planned investment in the Pipelines sector we expect Welcorp looks attractive for

Medium to Long-term. Thus, recommend Investors to “Buy” the stock for a Target

price of Rs 308 in Twelve months.

For Private Circulation Only

COMPANY

REPORT

Profit and Loss Statement Key Ratios

Units: in Rs Crore FY 09 FY 10 FY 11E FY 12E Units: in Rs Crore FY 09 FY 10 FY 11E FY 12E

Net Sales 5739.5 7350.3 8566.7 9886.0 Valuations (x)

% Growth 43.7% 28.1% 16.6% 15.4% EPS 11.4 29.9 30.8 36.5

Net Raw Materials 4002.7 4748.4 5739.7 6603.9 PER 21.5 8.2 8.0 6.7

% of Sales 69.7% 64.6% 67.0% 66.8% CEPS 19.1 40.0 43.4 51.9

Staff Cost 132.2 277.9 208.5 248.0 CPER 12.8 6.1 5.7 4.7

% of Sales 2.3% 3.8% 2.4% 2.5% P/BV 2.9 1.7 1.4 1.2

Other Expenses 969.9 1005.4 1242.2 1433.5 Dividend Yield 0.6% 0.8% 1.0% 1.0%

% of Sales 16.9% 13.7% 14.5% 14.5% EV/EBITDA 9.9 4.4 4.1 3.1

Operating Expenses 5104.8 6031.6 7190.4 8285.3 EV/Sales 1.1 0.8 0.7 0.5

% Growth 52.9% 18.2% 19.2% 15.2% EV/Total Assets 1.4 1.0 0.9 0.7

EBITDA 634.8 1318.6 1376.3 1600.7 Profitability %

% Growth -3.2% 107.7% 4.4% 16.3% EBITDA Margin % 11.1% 17.9% 16.1% 16.2%

OPM 11.1% 17.9% 16.1% 16.2% PAT Margin % 3.7% 8.3% 7.3% 7.5%

Other Income 1870.0% 1853.0% 2000.0% 2000.0% ROCE 4.8% 10.5% 10.2% 11.1%

Depreciation 143.3 206.1 256.9 314.8 RONW 13.7% 21.0% 18.1% 17.9%

EBIT 510.2 1131.1 1139.4 1305.9 Efficiency Ratio

Interest 176.6 207.1 199.5 193.3 Debtors Days 29.3 40.1 40.0 40.0

Profit Before Tax 333.6 924.0 939.9 1112.6 Inventory Days 166.1 100.9 120.0 120.0

Provision for Taxes 120.0 313.6 310.2 367.2 Asset Turnover (Total) 1.3 1.3 1.4 1.5

% of Tax 36.0% 33.9% 33.0% 33.0% Leverage Ratio

Net Profit 213.5 610.4 629.7 745.5 Debt/Equity 1.7 0.9 0.7 0.5

% Growth -37.3% 185.9% 3.2% 18.4% Debt/EBITDA 4.2 1.9 1.7 1.3

OPM 3.7% 8.3% 7.3% 7.5% Interest coverage ratio 2.9 5.5 5.7 6.8

Balance Sheet Statement Cash Flow Statement

Units: in Rs Crore FY 09 FY 10 FY 11E FY 12E Units: in Rs Crore FY 09 FY 10 FY 11E FY 12E

Sources of Funds Cash from Operations 1319.5 787.8 643.0 1091.4

Share Capital 93.3 102.2 102.2 102.2 Cash from Investing -743.8 -334.2 -320.2 -320.2

Reserves & Surplus 1466.4 2799.0 3368.9 4054.5 Cash from Financing 101.0 301.0 -305.8 -272.6

Net Worth 1559.7 2901.1 3471.0 4156.7 Net change in Cash 676.7 754.6 17.1 498.5

Foreign Currency Item 0.0 7.5 Opening Cash balance 270.3 947.0 1701.6 1718.6

Secured Loans 2643.5 1865.4 1665.4 1465.4 Closing Cash balance 947.0 1701.6 1718.6 2217.2

Unsecured Loans 10.3 682.2 682.2 682.2

Total Debt 2653.8 2547.6 2347.6 2147.6

Deferred Tax Liability 248.8 337.7 350.0 400.0

Capital Employed 4462.3 5793.4 6175.6 6711.3

Application of Funds

Gross Block 3484.4 3881.0 4181.0 4481.0

Less: Depreciation 384.7 588.9 845.8 1160.6

Net Block 3099.7 3292.1 3335.2 3320.4

Capital WIP 580.8 541.2 541.2 541.2

Investments 114.0 159.6 200.0 200.0

Foreign Currency Item 35.5 0.0 0.0 0.0

Current Assets 4584.9 5150.0 6147.1 7303.9

Income on Investments 11.3 1.3

Inventories 2611.3 2032.2 2816.5 3250.2

Sundry Debtors 460.1 807.6 941.0 1085.6

Cash and Bank 947.0 1701.6 1718.6 2217.2

Loans and Advances 555.2 607.3 671.0 751.0

Current Liabilities 3895.5 3227.0 3898.0 4505.7

Provisions 60.1 125.7 150.0 150.0

Net Current Assets 632.4 1800.3 2099.1 2649.2

Deferred Revenue Exp 3.1 3.0 0.0 1.0

Total Assets 4462.4 5793.2 6175.6 6711.3

For Private Circulation Only

Capital Benefits

Corporate Office: JRG Securities Ltd, JRG House, Ashoka Road, Kaloor, Kochi, Kerala – 682017, Tel: 91-484-2796211-332

E-mail: jrg.research@jrg.co.in

Institution Desk: JRG Securities Ltd., Universal Industrial Estate, 210/211, 2nd Floor, J.P. Road, Near Wadia High School,

Andheri (W), Mumbai – 400058; Tel: 91-22- 26711059/26719939

Disclaimer:

This document has been prepared by JRG Securities Ltd. and is meant for the recipient for use as intended and not for circulation. The information presented in this

document is not an offer/recommendation to buy or sell securities. Opinions expressed in this article are the independent views of the author(s). The information/s,

opinions and analysis contained are collected from sources believed to be reliable, but no representation, expressed or implied, is made as to its accuracy, completeness

or correctness. Neither JRG Securities Ltd., nor any person connected with it, accepts any liability arising from the use of this document. It should be noted that price and

value of the security/ies referred to in this report may go up or down and that past performance is not a guide for future performance. Investors are urged to exercise their

own judgment before investment as security/ies discussed in this report may not be suitable for all investors. Investors must make their own investment decision based on

their own investment objectives, goals and financial position and based on their own analysis. We will be updating you in due course about the positive or negative

developments, directly or indirectly affecting the security/ies discussed in this report. But, it should be noted that JRG Securities and its associated companies, their

directors and employees do not undertake any obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may

prevent JRG Securities from doing so. JRG Securities Ltd., may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities

of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential

conflict of interest with respect to security/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Safeguarding PhilosophyDokumen47 halamanSafeguarding PhilosophyAnonymous QSfDsVxjZ100% (8)

- IFRSDokumen103 halamanIFRSnoman.786100% (2)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Penspen Brochure 2015 UKDokumen19 halamanPenspen Brochure 2015 UKperrychemBelum ada peringkat

- India Foriegn Trade Policy Handbook of Procedures - HandbookYear2007 - 2014Dokumen142 halamanIndia Foriegn Trade Policy Handbook of Procedures - HandbookYear2007 - 2014JoyBelum ada peringkat

- Applicability of REACH For Leather and Leather Products Including FootwearDokumen23 halamanApplicability of REACH For Leather and Leather Products Including FootwearsonikhanBelum ada peringkat

- Applicability of REACH For Leather and Leather Products Including FootwearDokumen23 halamanApplicability of REACH For Leather and Leather Products Including FootwearsonikhanBelum ada peringkat

- Micro Study of An Indian Broking House...Dokumen120 halamanMicro Study of An Indian Broking House...noman.786100% (3)

- XI Comm Group Short Answer and Detailed QuestionsDokumen12 halamanXI Comm Group Short Answer and Detailed QuestionsKhalil AhsanBelum ada peringkat

- Simulation of Rapid Depressurization and PDFDokumen13 halamanSimulation of Rapid Depressurization and PDFhoangvubui4632100% (1)

- A High Performance, Damage Tolerant Fusion Bonded Epoxy CoatingDokumen15 halamanA High Performance, Damage Tolerant Fusion Bonded Epoxy CoatingpaimpillyBelum ada peringkat

- 5.4.2 Pipeline Identification Colours PDFDokumen2 halaman5.4.2 Pipeline Identification Colours PDFst_calvoBelum ada peringkat

- CV - Piping & PipelineDokumen2 halamanCV - Piping & PipelineEs KnBelum ada peringkat

- ToR Topographical Survey For LOWASCO Draft 28082014Dokumen4 halamanToR Topographical Survey For LOWASCO Draft 28082014marting690% (1)

- Piping Fabrication, Installation, Flushing and Testing Annex BDokumen2 halamanPiping Fabrication, Installation, Flushing and Testing Annex BNaBelum ada peringkat

- Salt in Crude Analyser ASTM D3230 IP 265: Key Features Principles of OperationDokumen2 halamanSalt in Crude Analyser ASTM D3230 IP 265: Key Features Principles of Operationابوالحروف العربي ابوالحروفBelum ada peringkat

- Tutorial PipephaseDokumen39 halamanTutorial PipephaseWil Vasquez CBelum ada peringkat

- 3 - Development of An Inspection Robot ForDokumen7 halaman3 - Development of An Inspection Robot ForZaida AsyfaBelum ada peringkat

- EUB Measurement Directive 017Dokumen120 halamanEUB Measurement Directive 017eaglespirit2Belum ada peringkat

- ATP 4-43 Petroleum Supply Operations GuideDokumen242 halamanATP 4-43 Petroleum Supply Operations GuideGerry SantosBelum ada peringkat

- Foamglas Application GuidelinesDokumen36 halamanFoamglas Application GuidelinesArgiliathBelum ada peringkat

- Presentation of Mr. Sambasiva Rao UppalaDokumen27 halamanPresentation of Mr. Sambasiva Rao UppalaRabindra RaiBelum ada peringkat

- Specification FOR Carbon Steel Seamless Linepipe For Submarine Pipelines (Sour Service)Dokumen27 halamanSpecification FOR Carbon Steel Seamless Linepipe For Submarine Pipelines (Sour Service)GomathyselviBelum ada peringkat

- Engineering Tie-In Meter ChecklistDokumen2 halamanEngineering Tie-In Meter Checklistnaren_013Belum ada peringkat

- GE SPS Comp Brochure - 6-15 EnglishDokumen12 halamanGE SPS Comp Brochure - 6-15 EnglishEdinsonUribeTorres100% (1)

- OGS Short Courses Calendar Cairo July 2021 To June 2022: UpstreamDokumen33 halamanOGS Short Courses Calendar Cairo July 2021 To June 2022: UpstreamHany SalahBelum ada peringkat

- Pigging Multi-Diameter Lines and Other Specialist TechniquesDokumen6 halamanPigging Multi-Diameter Lines and Other Specialist TechniquesscrbdgharaviBelum ada peringkat

- Transport and Communication in IndiaDokumen16 halamanTransport and Communication in IndiaKrish AggrawalBelum ada peringkat

- Fuel Flexibility in Conventional and Dry Low Emissions Industrial Gas TurbinesDokumen30 halamanFuel Flexibility in Conventional and Dry Low Emissions Industrial Gas TurbinesHenrik13Belum ada peringkat

- HazardEX Novembro 2019 PDFDokumen48 halamanHazardEX Novembro 2019 PDFGabriel BonaroskiBelum ada peringkat

- Tracerase: Operating and Instruction ManualDokumen16 halamanTracerase: Operating and Instruction ManualKrishnaBelum ada peringkat

- Texas Natural Gas Prices DropDokumen2 halamanTexas Natural Gas Prices Dropdavid romeroBelum ada peringkat

- As 2885.3-2001 Pipelines - Gas and Liquid Petroleum Operation and MaintenanceDokumen8 halamanAs 2885.3-2001 Pipelines - Gas and Liquid Petroleum Operation and MaintenanceSAI Global - APACBelum ada peringkat

- Ipc2012 90450Dokumen7 halamanIpc2012 90450Marcelo Varejão CasarinBelum ada peringkat

- Bringing Oil To The Market Oil - Pipeline - Tariffs - 2012 - enDokumen100 halamanBringing Oil To The Market Oil - Pipeline - Tariffs - 2012 - enkalite123Belum ada peringkat