Customer Value in Banks

Diunggah oleh

Vaibhav GoyalDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Customer Value in Banks

Diunggah oleh

Vaibhav GoyalHak Cipta:

Format Tersedia

134 Finance – Challenges of the Future

CHARACTERISTICS THAT FORM CUSTOMER VALUE IN

BANKS: A RESEARCH ON ATMs (AUTOMATED TELLER

MACHINE)

Assist. Prof. Nilsun SARIYER, PhD

Onsekiz Mart University, TURKEY

1. Introduction that customers establish with the

organization come fore. If the customer

Customer value concept has has increased emotional tie the customer

been discussed in marketing for the last goes on buying the products of the

two decades. Many of the concepts such business. Desired value is characteristics

as perceived value, shopping value, net that provide positive value to customers.

value of the customer, consumer value These characteristics are simple and

have been used in the same meaning. they are provided without a need to

Moreover, many of the concepts used performing a marketing research.

with “customer value concept” such as Unexpected value is providing value to

value, benefit, price, quality, loyalty, above customers’ expectations. It helps

satisfaction have still been under in strengthening the ties between

discussion. customers and the business. Another

Discussing customer value point that should be kept in mind is that

requires us to mention a two sided these values can only be referred to as

concept including “the value given by the value if they are perceived by the

customer” and “the value given to the customer.

customer”. These two values are not

given by the seller organization. They are 2. Measurement of customer value

the values perceived by the customers.

Therefore, rather than the customer When studies on customer value

value, the concept of perceived value is are examined it can be seen that they

used. This value can be defined as the increasingly consist of how customers

benefit which the customer obtains in express value. Holbrook identified

return for what the customer gives. As it characteristics of customer value as

can be understood from the definition, effectiveness, quality, social value, game,

the way of providing value to customers aesthetics and altruism. Mathwicks,

is possible through increased benefit. In Malhotra and Rigdon expressed that

other words, adding services, things that customer value is a formation of a set of

customers view as critical, beneficial or concepts that are visual appeal,

unique is necessary. From this point, entertainment, escapism, enjoyment,

three values that businesses provide to efficiency and economic value.

their customers can be expressed as Bono referred customer value as

expected value, desired value and perceived value, actual value, entry

unexpected value. Expected value is value, side values, synergy value,

standard services or goods for the security value, attractivity value, fashion

customers given by the business value, function value, easiness value and

depending on its own capacity of tying value. Noumann divided the values

production and marketing. Expected identified by Bono into two category and

value is a concept where emotional ties classified them as characteristics that

Year VIII, No.9/2009 135

depend on experience and

characteristics that depend on operation. 3. Customer value in the banks

Holbrook also identified the factors of

efficiency, excellence, politics esteem, Great innovations in information

play, aesthetics, morality and spirituality. technology and communication have

Sheth, Neuman, and Gross revolutionized the banking industry.

expressed customer value as social, Banks took huge leaps particularly by

economic, functional, informational and using technological infrastructure rapidly.

situational. In the same manner, they Banks that adopt innovations of

proved that customer value consists of technology fast attempt to increase

functional, emotional, social, situational satisfaction levels of their customers. Call

and informational dimensions. For this centers, ATM machines and kiosks are

purpose they developed the PERVAL such examples. However, customer

scale. In the formation process of the dissatisfaction is quite high. Some of the

scale 85 statements were used in the banks aim to increase customer value by

beginning and then the number of the giving importance to customer relations

statements was eliminated to 19 at the management and data mining. Banks try

end of the studies. Moreover, Sweeney to pursue different service programs to

and Soutar’s scale to identify perceived customer groups which they create by

value of durable consumer goods at using the data. The purpose of their

brand level have still been accepted and efforts aims increasing the perceived

used by many academics. However, it value of their customers. Highly

should be considered that Sweeney and competitive nature of banking industry

Soutar’s scale measures the selling which consists of competition among

process as one phase –pre-selling, time state owned and privately owned barks

of selling and after selling and it accepts require keeping current customers doing

customer value as multi-dimensional and business and moving towards creating

ignores informational and situational customer value rather than customer

values. satisfaction. Studies on this topic support

Petrick developed SERV- banks’ moving towards creating customer

PERVAL scale starting from PERVAL value. Loveman stresses the need to

scale. They concluded that customer create customer value besides turning

value is formed by quality, emotional data into information. Payne and Jahoda

value, monetary price, behavioral price expressed moving towards creating new

and reputation. Following Petrick, values to customers rather than the

Sanchez, Callariso, Rodriguez and values served to users. On the other

Moliner developed a different scale for hand Woodruff stresses the importance

the services and measured customer to create high values to customers due to

st

value. They attempted to identify the highly competitive nature of the 21

value of services used by customers by a century. Banks serve their customers

scale that they called GLOVAL, the first with the unexpected values by adding

study performed in tourism sector values new values each day. How do customers

of functional value (establishment), perceive the values created by the

functional value (professionalism), banks? This study aims to find an answer

functional value (quality), functional value to this question.

(price), emotional value and social value

dimensions have been identified. In 4. The purpose of the research

another study of this scale, Roig,

Sanchez, Teno and Monzonis identified This study aims to identify

some dimensions in bank services and whether or not customers see the

tourism services. characteristics that banks add in order to

create value to customers as “customer

value”. For this purpose, how current

136 Finance – Challenges of the Future

customers place characteristics which October-November 2008 from the

the banks provide to them while they use customers who performed their banking

banking services as different dimensions transactions using ATM machines by

have been examined. Scales developed face to face survey method in front of the

about customer value have been used in machines. The sampling method used in

this research. Because the aim of this the study is one of the non-random

study is to identify how customers place sampling methods, convenience

the services of businesses as customer sampling.

value. So the study does not try to In the questionnaire form,

identify value dimensions. classified measurement method which as

unmetrical but categorical characteristics

5. Material and method studied in Bono, Naumann and

Holbrook’s customer value has been

adopted to banks. These characteristics

In the research that has

are performance, color, respectability,

descriptive features, data have been

innovation, comfort, easiness of use,

primarily gathered. Considering various

appearance, accessibility, speed, touch-

types of the services given by the banks

screen, image wholeness, continuous

performing a reduction in the services to

functioning, pleasure of use, coverage,

be analyzed was decided to be

reputation and stability. The survey has

performed. Therefore only a single

been conducted on 30 users first as pilot

service of the banks has been studied.

study and then it has been implemented.

Yet, in the selection of the service, the

The survey has been conducted on 350

factor of service coverage for all

people face to face. As a result of pre-

consumers was taken into consideration.

evaluation 47 completed surveys were

So ATM machines were selected. ATM

eliminated as they were found faulty and

machines occurred as a result of

misleading. Data obtained from 303

technological improvements can be used

consumers were analyzed by using multi-

in drawing out/ in money, transferring

dimensional scaling method. SPSS 15.0

money to deposit accounts and between

software has been used in the analysis.

accounts, requesting cheque book,

issuing traveler’s cheque and accepting

credit card applications. In this regard, 6. Findings

ATM machines are inseparable parts of

the banking system. Besides above Before starting the

mentioned characteristics of ATM multidimensional scaling analysis internal

machines several characteristics such as reliability of the characteristics included in

the ability to use the machine without the analysis has been examined.

bank card, not only for drawing money Variables that are irrelevant to internal

but also drawing in money, issuing reliability have been excluded. As a result

traveler’s cheque, accepting credit card of two reliability analyses variables of

application, money transfers, showing performance, respectability, innovation,

television advertisements on the screen, comfort, stability, wholeness, aesthetics,

presentation of new services, applicability reputation, and color have been

of the ATM machine for all branch excluded. The rest of the characteristics

operations add new values every day. were included in the multidimensional

Considering above mentioned topics, scaling analysis. In order to test reliability

ATM machines have been selected for and validity of the results of

the research. Another factor that ATM multidimensional scaling analysis

machine users are usually the current appropriateness index and tension

2

customers of the banks has been values known as R have been

effective in selecting ATM machines. considered. As a result of 3 repetitive

Data obtained between the dates of figure R2 of our research has been 0,

Year VIII, No.9/2009 137

79130. This value is the square number Table 1: Results of two dimensional

of correlation index and it is expected to demonstrations

be high. 60 % and over is a desired Object Dimension

result. Tension value in our research has Number Object name (Coordinates)

been 0,18718. This value shows the 1 2

quality of multi-dimensional scaling. 1 Nice view ,0935 -,9584

Ratios below 2,5 demonstrate that 2 Touch screen 1,9522 -,8298

3 Reliability ,1301 ,1556

multidimensional scaling is at very good 4 Accessibility ,2135 ,7825

levels. 5 Bank -,6931 -1,5221

association

Table 1 includes the 6 Easiness of use ,6186 ,6458

demonstration results obtained in order 7 Color 1,8393 -1,4540

to draw out spatial map as a result of the 8 Coverage ,7616 ,4474

analysis. Figure 1 demonstrates the

spatial map drawn by SPSS 15.0.

Figure 1: Spatial Map of Customer Value

This map shows the value that seen as an aesthetical characteristic.

customers give to ATM. Axis is named as Touch screen has been selected as the

aesthetics characteristics and using most aesthetical characteristic by the

characteristics that depend on the use of respondents with their 1,9522

ATMs. demonstration value.

Characteristics on the right field Characteristics above “0” point

of “0” point are those that are related to are those related to use of ATM such as

aesthetics. These are nice view, touch accessibility, easiness of use, coverage

screen, color, reliability, accessibility, and security and below “0” point are

easiness of use, and coverage. Bank those that are related to characteristics

customers regard these characteristics unrelated to the use of ATM such as nice

as aesthetical characteristics of ATMs. view, touch screen, color and bank

Characteristics on the left field of “0” association. In relation to the use, the

point is called as bank association. It is most significant characteristics from the

138 Finance – Challenges of the Future

point of customers has been accessibility the placement of the characteristics.

with a demonstration value of 0,7825. These are characteristics that are related

Bank association with a demonstration to aesthetics and use, characteristics that

value of -1,5221 has been the are related to aesthetics but unrelated to

characteristic that has not been related to use, characteristics that are unrelated to

the use of ATM. aestheticism but related to use and

characteristics that are unrelated to both.

7. Conclusion When each field is considered it could be

seen that there are different

Businesses attempt to attract characteristics. While characteristics that

customers by creating value. Each are related to aestheticism and use are

characteristic they add for this purpose is accessibility, easiness of use, coverage,

perceived as a value by the customer. and security; characteristics that are

This research shows how customers related to aestheticism but unrelated to

evaluate the value as a result of the use are touch-screen, color, and nice

sacrifice they bear. ATMs have been view. The only characteristic that has

chosen so that particularly the customers been unrelated to both aestheticism and

who have ties with the bank have been use has been bank association. No

preferred. Current customers have been characteristics unrelated to aestheticism

targeted so that it could be understood but related to use has been found in the

that characteristics of ATM machines research. Adding value in this field is

have been but forward as a value could important in that banks could create new

be understood. At the end of the values to their customers that shows a

research it has been identified that path for future studies on the issue.

customers consider characteristics of Because apart from previous scales of

aesthetics and use of ATMs have come customer value, a multi dimensional

fore while the machines are used. This scaling has been used to identify a

research concludes that customers different approach in understanding what

perceive ATMs in two dimensions; characteristics customers give

characteristics of aestheticism and use. importance and turn them into value has

Different dimension can be referred to in been tried to be discussed.

REFERENCES

De Ruyter, K., (“The dynamics of the service delivery process: a value-based

Wetzels, J.K., approach”, International Journal of Research in Marketing, 14,

Lemmınk, M.J. and pp.231-243.

Mattson, J.

Dodds, W. B.; “Effect of price, brand and store information on buyers' product

Monroe, K.B. and evaluations”, Journal of Marketing Research, 28, pp.307-319.

Grewal D.

Hall, J. E., Shaw, M. “Gender differences in a modified perceived value construct for

R., Lascheit J. and intangible products”, Visionary Marketing for the 21st Century: Facing

Robertson, N. the Challenge, pp. 457-462,

(http://smib.vuw.ac.nz:8081/www/ANZMAC2000/CDsite/papers/

h/Hall2.PDF)

Holbrook, M. B. “The nature of customer value: an axiology of services in the

consumption experience”, In Service Quality: New Directions in

Theory and Practice, Ed: R. Rust ve R. L. Oliver, Sage Publication,

pp. 21-71.

Holbrook, M. B. “Consumption experience, customer value, and subjective personel

introspection:an illustrative photografic essay”, Journal of Business

Year VIII, No.9/2009 139

Research, 28 (6), pp. 714-725.

Kantamnenı, S. P. “Measuring perceived value: scale development and research findings

and Coulson, K. R. from a consumer survey”, The Journal of Marketing Management, 6

(2), pp. 72-86.

Khalifa, A.S. “Customer value: a review of recent literature and an integrative

configuration”, Management Decision, 42 (5), pp. 645-666.

Mathwicks, C., “Experiential value: conceptualization, measurement and application

Malhotra, N. ve in the catalog and internet shopping environment”, Journal of

Rigdon, E. Retailing, 77(1), pp. 39-56.

Monroe, K.B. Pricing, Making Profitable Decisions, 2nd ed., London: McGraw Hill.

Payne1, R. and “The glasgow social self-efficacy scale—a new scale for measuring

Jahoda, A. social self-efficacy in people with intellectual disabilit”, Clinical

Psychology and PsychotherapyClin. Psychol. Psychother. 11, pp.

265–274.

Petrıck, J. F. “Experience use history as a segmentation tool to examine golf

travellers' satisfaction, perceived value and repurchase intentions”,

Journal of Vacation Marketing, 8 (4), pp. 332-342.

Petrick, J. F. “Development of a multi-dimensional scale for measuring the

perceived value of a service”, Journal of Leisure Research, Second

Quarter, 34 (2), pp. 119-134.

Roig, J.C.F., “Customer perceived value in banking services”, International Journal

Garcia,J. S., Tena, of Bank Marketing, 24 (5), pp. 266-283.

M. A. M. and

Manzois, J. L.

Sanchez, J, “Perceived value of the purchase of a tourism product”, Tourism

Callarısa, L., Management, 27, pp. 394-409.

Rodrıez, R. M. and

Molıner, M. A.

Sanchez- “The conceptualisation and measurement of customer value in

Fernandez, J., services”, International Journal of Market Research, 51 (1), pp. 93-

Inısesta-Bonillo, 113.

R.A. and Holbrook,

M. B.

Sheth, J. N., “Why we buy what we buy: a theory of consumption value”, Journal of

Newman, B. I. and Business Research, 22 (March), pp. 159-170.

Gross, B. L.

Sweeney, J. C., “The role of perceived risk in the quality-value relationship: a study in

Soutar, G. N. and a retail environment”, Journal of Retailing, 75 (1), pp. 75-105.

Johnson, L. W.

Zeithaml, V. A. “Consumer perceptions of price, quality and value: a means-end

model and syntheis of evidence”, Journal of Marketing, 52 (July), pp.

2-22.

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

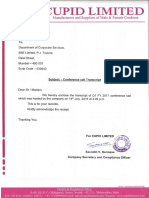

- Conference Call Transcript (Company Update)Dokumen24 halamanConference Call Transcript (Company Update)Shyam SunderBelum ada peringkat

- FRM Exam Preparation Handbook 2012 PDFDokumen15 halamanFRM Exam Preparation Handbook 2012 PDFDennis LoBelum ada peringkat

- V Guide To FX Fowards PDFDokumen5 halamanV Guide To FX Fowards PDFVaibhav GoyalBelum ada peringkat

- Choudhry Basis Trade Jul06 LogoDokumen13 halamanChoudhry Basis Trade Jul06 LogoJaphyBelum ada peringkat

- Glossary of Terms Used in Mutual Fund IndustryDokumen10 halamanGlossary of Terms Used in Mutual Fund IndustryVaibhav GoyalBelum ada peringkat

- Micrsoft Excel TrainingDokumen19 halamanMicrsoft Excel TrainingdombipinBelum ada peringkat

- FRM Imp PointsDokumen3 halamanFRM Imp PointsVaibhav GoyalBelum ada peringkat

- FRM Exam Preparation Handbook 2012 PDFDokumen15 halamanFRM Exam Preparation Handbook 2012 PDFDennis LoBelum ada peringkat

- 8 Keys Ratios To Look at Before Buying A ShareDokumen7 halaman8 Keys Ratios To Look at Before Buying A ShareVaibhav GoyalBelum ada peringkat

- Warehouse Receipt LoansDokumen4 halamanWarehouse Receipt LoansVaibhav GoyalBelum ada peringkat

- Indian Railways: The World's Second Largest Railway NetworkDokumen4 halamanIndian Railways: The World's Second Largest Railway NetworkVaibhav GoyalBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Kevin Klinger PDFDokumen226 halamanKevin Klinger PDFfernandowfrancaBelum ada peringkat

- Arbitration ClausesDokumen14 halamanArbitration Clausesramkannan18Belum ada peringkat

- Impact of LiberalisationDokumen23 halamanImpact of Liberalisationsourabhverdia100% (5)

- Capital Market: Unit II: PrimaryDokumen55 halamanCapital Market: Unit II: PrimaryROHIT CHHUGANI 1823160Belum ada peringkat

- North America Equity ResearchDokumen8 halamanNorth America Equity ResearchshamashmBelum ada peringkat

- Role CFODokumen32 halamanRole CFOChristian Joneliukstis100% (1)

- Volume 01 - Pe 02Dokumen123 halamanVolume 01 - Pe 02drunk PUNISHER100% (1)

- What Are Mutual Funds?Dokumen8 halamanWhat Are Mutual Funds?ShilpiVaishkiyarBelum ada peringkat

- BT India Factsheet - NewDokumen2 halamanBT India Factsheet - NewsunguntBelum ada peringkat

- Hrmsr83pay b1001Dokumen988 halamanHrmsr83pay b1001Vinay KuchanaBelum ada peringkat

- The Daimlerchrysler Merger - A Cultural Mismatch?Dokumen10 halamanThe Daimlerchrysler Merger - A Cultural Mismatch?frankmdBelum ada peringkat

- Cases On CommodatumDokumen10 halamanCases On CommodatumAlfons Janssen MarceraBelum ada peringkat

- Managing With Agile - Peer-Review Rubric (Coursera)Dokumen8 halamanManaging With Agile - Peer-Review Rubric (Coursera)awasBelum ada peringkat

- 0452 s05 QP 2Dokumen16 halaman0452 s05 QP 2Nafisa AnwarAliBelum ada peringkat

- Air BNB Business AnalysisDokumen40 halamanAir BNB Business AnalysisAdolf NAibaho100% (1)

- MCR2E Chapter 1 SlidesDokumen14 halamanMCR2E Chapter 1 SlidesRowan RodriguesBelum ada peringkat

- Fresher Finance Resume Format - 4Dokumen2 halamanFresher Finance Resume Format - 4Dhananjay KulkarniBelum ada peringkat

- C 1044Dokumen28 halamanC 1044Maya Julieta Catacutan-EstabilloBelum ada peringkat

- Role of Business Research ch#1 of Zikmound BookDokumen18 halamanRole of Business Research ch#1 of Zikmound Bookzaraa1994100% (1)

- General Awareness 2015 For All Upcoming ExamsDokumen59 halamanGeneral Awareness 2015 For All Upcoming ExamsJagannath JagguBelum ada peringkat

- Australian Government Data Centre Strategy Strategy 2010-2025Dokumen8 halamanAustralian Government Data Centre Strategy Strategy 2010-2025HarumBelum ada peringkat

- The Meatpacking Factory: Dardenbusinesspublishing:228401Dokumen2 halamanThe Meatpacking Factory: Dardenbusinesspublishing:228401354Prakriti SharmaBelum ada peringkat

- Event Planning Rubric - Alternative Event Project Template Luc PatbergDokumen1 halamanEvent Planning Rubric - Alternative Event Project Template Luc Patbergapi-473891068Belum ada peringkat

- Invoice: Telecom Equipment Pte LTDDokumen1 halamanInvoice: Telecom Equipment Pte LTDRiff MarshalBelum ada peringkat

- CV B Sahoo (AGM) 101121Dokumen4 halamanCV B Sahoo (AGM) 101121Benudhar SahooBelum ada peringkat

- Reading For The Real World - 2nd - AK - 3Dokumen24 halamanReading For The Real World - 2nd - AK - 3vanthuannguyenBelum ada peringkat

- Organization Development and Change: Chapter Twenty: Organization TransformationDokumen16 halamanOrganization Development and Change: Chapter Twenty: Organization TransformationGiovanna SuralimBelum ada peringkat

- MTC Strategic Plan 2012 To 2016Dokumen42 halamanMTC Strategic Plan 2012 To 2016Ash PillayBelum ada peringkat

- ResearchDokumen10 halamanResearchElijah ColicoBelum ada peringkat

- GST 310319Dokumen66 halamanGST 310319Himmy PatwaBelum ada peringkat