Maximize Your CTC

Diunggah oleh

amitgkDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Maximize Your CTC

Diunggah oleh

amitgkHak Cipta:

Format Tersedia

42 The Economic Times Wealth, December 13, 2010

Jobs & Income

EARNING

Maximise your take-home

Get the most out of your salary by making it tax-efficient and customising it to suit your

day-to-day cash requirements and long-term savings needs

BINOY PRABHAKAR around compensation packages. For example, to attune compensation to their expense make them tax-efficient. While there is no rule

state-run explorer ONGC, which follows a patterns and tax planning. “For most of thumb for an ideal salary, the structure

E

xecutive compensation packages simple compensation structure broken up into companies, a flexible salary is a USP,” says should broadly be defined by an individual's

are so up-to-the-second that fixed pay variable pay and field duty Gangapriya Chakraverti, principal with global current expenses and future needs. The tables

thumbing through the salary slips allowances, recently introduced a system HR consulting firm Mercer. on this page provide a quick look at how you can

of some companies can make you wherein an employee can tailor the salary to But there is a thin line between flexible pay ensure a high take-home by restructuring a

feel like a relic. A stack of minimise the income tax outgo. structures and tax avoidance. While companies salary package.

elements such as meal coupons, customised This so-called cafeteria approach is being do offer some room to employees, they look to Chartered accountants and HR professionals

allowance pool and below-the-line benefits embraced by a growing number of companies. avoid disputes with the taxman, who could agree that there is no rule of thumb for

have entered the compensation structures in A spokesman for Maruti Suzuki, India’s biggest challenge flexible salaries. “Despite the flexibili- designing an ideal salary structure. Sure, the

recent times, underscoring the profound shifts carmaker, says, “All the tax-saving ty offered by companies, tax rules on earning take-home should match your current

in how pay packages are being designed. opportunities for employee are utilised by our components limit the scope for manoeuvring,” requirements but the cash allowances and

Central to this shift is attracting talent. Com- company in letter and spirit.” After shrinking says Chakraverti. deferred benefits must take into account your

panies, even public-sector undertakings, are the items of pay to as less as four, many If you are among the lucky ones who have the spending pattern and future needs.

increasingly tearing down the complexity employers are giving employees the freedom freedom to rejig pay structures, you too can Companies are now increasingly structuring

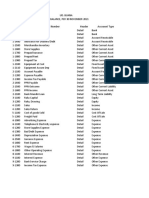

One CTC, Three Salaries: How a monthly CTC of

`1.5 lakh translates into different take-homes C. HIGH TAKE-HOME

Take-home is almost 90

% of CTC but no benefits

Income head

E

A. LOW TAKE-HOM

`/month

gratuity are high B. MEDIUM TAKE-HOME A Consultancy fee

of CTC but PF and 1,50,000 Consul-

Take-home is 63.8% Take-home is 79.9% of CTC to meet higher expenses tants, who

B Deductible expenses get a

`/month Suitable for (monthly) lumpsum

Income head people who Income head `/month This structure Conveyance and fuel

60,000 suits someone 15,000 amount as

Basic live in rented Car EMI fee, can

A 30,000 A Basic 40,000

accommoda- who needs a 7,800

deduct

HRA tion and pay a HRA 20,000 higher cash flow Car insurance and mainte

15,000 nance 2,000 expenses

Special allowance high rent. Special allowance 48,000 to meet higher Telephone bill

3,000 from their

costs.

B REIMBURSEMENTS (monthly) Entertainment taxable

TS (monthly) 12,000

B REIMBURSEMEN It is also ideal Conveyance 18,000 The low HRA Newspapers & journals income.

10,000 3,000

Conveyance for those who suits those Driver's salary

4,000 Telephone bill 3,000

don't mind who live in 4,000 No

Telephone bill large deduc- Entertainment 10,000 Electricity deferred

8,000 their own 1,000

Entertainment tions on Newspapers and journals 4,000 house but have Peon's salary benefit

2,000 8,000

journals account of means the

Newspapers and C ANNUAL REIMBURSEMENTS high expenses, Depreciation (car, laptop, equip

RSEMENTS deferred bene- such as a big ment) 5,000 onus is on

C ANNUAL REIMBU fits such as PF Medical 1,200 Stationary and postage them to

1,250 home loan. 1,200

Medical or gatuity. LTA 1,000 Car parking charges save for

1,500 800

The effective Total expenses their sun-

LTA D OTHER BENEFITS

S The effective tax rate is low 62,800 set years.

D OTHER BENEFIT tax rate is close PF contribution 4,800 C TDS @ 10.3%

8,000 at 9% but has 15,450

Yearly bonus to the national Gratuity 3,050 factored in the Net take home

7,200 1,34,550

PF contribution average of E CTC (A+B+C+D) (per month) 1,50,000 tax benefits As % of CTC

3,050 12.5%, though on a home 89.7

Gratuity this could go up

F Deductions Effective tax rate

1,50,000 loan

(per month) 7.6%

E CTC (A+B+C+D) if the person is PF (own contribution) 4,800

Deductions not living on PF (employer's contribution) 4,800

F 7,200

on) rent. Note: All three examples

PF (own contributi Tax 13,500 assume annual tax sav-

tribution) 7,200

PF (employer's con Total Deductions 23,100 ing investments of `1.2

18,910

Tax G Salary income (A-F) 84,900 lakh under Sec 80 C and

33,310 Sec 80CCF and medical

Total Deductions H Cash reimbursements 35,000

insurance of `15,000. In

71,690

F)

G Salary income (A- Net take home income (G+H) 1,19,900 case of B, an additional

24,000

ursem ents deduction of `1.5 lakh

H Cash reimb As % of CTC 79.9%

ome (G+H) 95,690 has been claimed

Net take ho me inc Effective tax rate 9%

63.8% against interest paid on

As % of CTC housing loan.

12.6%

Effective tax rate

RAJ

Tax-saving potential: Not too much because cash Tax-saving potential: With 23% of CTC as cash Tax-saving potential: A raft of expenses incurred for

allowances are just 16% of CTC. reimbursements and home loan to pay, tax is much lower. professional duties are exempt from tax.

Paperwork: Not difficult because most of the Paperwork: Proof of high conveyance expenses and Paperwork: Very high. The taxpayer has to keep records of the

allowances are within reasonable limits. entertainment perks will have to be provided. expenses for up to eight years after filing the returns.

Anda mungkin juga menyukai

- House-Senate Comparison of Key ProvisionsDokumen11 halamanHouse-Senate Comparison of Key Provisionsapi-25909546Belum ada peringkat

- Fair Pay Buckmaster en 43654Dokumen6 halamanFair Pay Buckmaster en 43654gokcenBelum ada peringkat

- Deducting Expenses As An Employee: Self-Employment: Is It For You?Dokumen11 halamanDeducting Expenses As An Employee: Self-Employment: Is It For You?The VaultBelum ada peringkat

- PDF Spring 2010Dokumen4 halamanPDF Spring 2010bgourl10431Belum ada peringkat

- Components of CTCDokumen2 halamanComponents of CTCakv.imccmbaBelum ada peringkat

- Based Result Incentive & Collective Short TermDokumen49 halamanBased Result Incentive & Collective Short TermNino KazBelum ada peringkat

- Tutorial in Week 11 (Based On Week 10 Lecture) Beginning 14 May 2018 TOPIC: Executive Compensation Solutions Q1 AttachedDokumen5 halamanTutorial in Week 11 (Based On Week 10 Lecture) Beginning 14 May 2018 TOPIC: Executive Compensation Solutions Q1 AttachedhabibBelum ada peringkat

- Workday Compensation OverviewDokumen11 halamanWorkday Compensation OverviewHaritha100% (1)

- Tally Tips - Accounting Heads of Incomes - ExpensesDokumen12 halamanTally Tips - Accounting Heads of Incomes - ExpensescooBelum ada peringkat

- INVESTING IN HIGH DIVIDEND STOCKS FOR RETIREMENT INCOMEDokumen1 halamanINVESTING IN HIGH DIVIDEND STOCKS FOR RETIREMENT INCOMEsaurabhmba1986Belum ada peringkat

- Human Resource Management: Employee Compensation GuideDokumen4 halamanHuman Resource Management: Employee Compensation Guideaqsa goharBelum ada peringkat

- Accounting For Decision Making and Control 8th Edition Zimmerman Solutions Manual Full Chapter PDFDokumen68 halamanAccounting For Decision Making and Control 8th Edition Zimmerman Solutions Manual Full Chapter PDFfinnhuynhqvzp2c100% (12)

- Compensation and Benefits: (Bob) Bouquet Flexibility Compensation ComponentsDokumen3 halamanCompensation and Benefits: (Bob) Bouquet Flexibility Compensation ComponentsdasdBelum ada peringkat

- 72823cajournal Feb2023 20Dokumen7 halaman72823cajournal Feb2023 20S M SHEKARBelum ada peringkat

- Ebook Compensation PayrollDokumen9 halamanEbook Compensation PayrollKhyati BhardwajBelum ada peringkat

- EBITDA Misunderstood and MisusedDokumen3 halamanEBITDA Misunderstood and Misusedangela mesiasBelum ada peringkat

- TIA Tax Effective Restructuring For SMEsDokumen9 halamanTIA Tax Effective Restructuring For SMEsShamir GuptaBelum ada peringkat

- Aerogenerador Bombeo Condiciones EconomicasDokumen4 halamanAerogenerador Bombeo Condiciones EconomicassaraBelum ada peringkat

- Acc4575 Compare Coverplus CPXDokumen2 halamanAcc4575 Compare Coverplus CPXorangecantonBelum ada peringkat

- Wa0020.Dokumen3 halamanWa0020.Piyush LanjewarBelum ada peringkat

- 白皮书 赢在代理商报酬Dokumen12 halaman白皮书 赢在代理商报酬邹 ZOU圣嘉 FayeBelum ada peringkat

- 4 Current Liabilities MGMTDokumen5 halaman4 Current Liabilities MGMTMark Lawrence YusiBelum ada peringkat

- Answers: 高顿财经ACCA acca.gaodun.cnDokumen12 halamanAnswers: 高顿财经ACCA acca.gaodun.cnIskandar BudionoBelum ada peringkat

- Employee Relations - New ParadigmDokumen8 halamanEmployee Relations - New ParadigmAkshita Chamaria LundiaBelum ada peringkat

- New Syllabus - Budgets (HL Only)Dokumen12 halamanNew Syllabus - Budgets (HL Only)Sonam ThakkarBelum ada peringkat

- Fusion HCM Talent Management Student GuideDokumen20 halamanFusion HCM Talent Management Student Guidevreddy123Belum ada peringkat

- WP2020 06 Transitioning From JobKeeperDokumen13 halamanWP2020 06 Transitioning From JobKeeperRabee TourkyBelum ada peringkat

- Transfer Pricing - F5 Performance Management - ACCA Qualification - Students - ACCA GlobalDokumen13 halamanTransfer Pricing - F5 Performance Management - ACCA Qualification - Students - ACCA GlobalAshura ShaibBelum ada peringkat

- The Financial Plan: Hisrich Peters ShepherdDokumen24 halamanThe Financial Plan: Hisrich Peters ShepherdStylo ButtniBelum ada peringkat

- 2022T3 Week 2 Lecture SlidesDokumen17 halaman2022T3 Week 2 Lecture Slidesa45247788989Belum ada peringkat

- 3.4.3 MotivationDokumen28 halaman3.4.3 Motivationakio haruBelum ada peringkat

- MAS First Preboard QuestionsDokumen12 halamanMAS First Preboard QuestionsVillanueva, Mariella De VeraBelum ada peringkat

- What is included in CTC and how it differs from take home salaryDokumen5 halamanWhat is included in CTC and how it differs from take home salaryDevika ChandgadkarBelum ada peringkat

- Need of Revision of Employee Compensation in Government Services of NepalDokumen5 halamanNeed of Revision of Employee Compensation in Government Services of NepalBhupesh ShresthaBelum ada peringkat

- Canada Labor SectionDokumen47 halamanCanada Labor SectionGalaaBoldooBelum ada peringkat

- How To Manage Payroll Processes at Your Organization: An Introductory Guide OnDokumen13 halamanHow To Manage Payroll Processes at Your Organization: An Introductory Guide OnsamBelum ada peringkat

- Visa Insights 2019: Earned Wage AccessDokumen16 halamanVisa Insights 2019: Earned Wage AccessMaria José MartínezBelum ada peringkat

- HR Block Income Tax Return Checklist Individuals 0620 FADokumen1 halamanHR Block Income Tax Return Checklist Individuals 0620 FAAlBelum ada peringkat

- HR Block Income Tax Return Checklist Individuals 0620 FADokumen1 halamanHR Block Income Tax Return Checklist Individuals 0620 FAdeBelum ada peringkat

- International Compensation MGMTDokumen30 halamanInternational Compensation MGMTIqbal SyedBelum ada peringkat

- Port+Harcourt+DisCo+Rate+Case+Application July+2023Dokumen3 halamanPort+Harcourt+DisCo+Rate+Case+Application July+2023Ibitola AbayomiBelum ada peringkat

- 1630390201257Dokumen3 halaman1630390201257ARKAJIT DEY-DMBelum ada peringkat

- UntitledDokumen28 halamanUntitledBusiness UpdateBelum ada peringkat

- MinterEllison Pro Bono COVID-19 Small Business Support Guide 1 May 2020Dokumen5 halamanMinterEllison Pro Bono COVID-19 Small Business Support Guide 1 May 2020Michael LoBelum ada peringkat

- Berkshire Industries PLC - Sesi 10, KELOMPOK 2Dokumen6 halamanBerkshire Industries PLC - Sesi 10, KELOMPOK 2hilfamoramaritoBelum ada peringkat

- This Is An Example of What Some of The Upfront Costs May Be. Be Sure To Plan For These in Your Budget, As Well As Ongoing ExpensesDokumen7 halamanThis Is An Example of What Some of The Upfront Costs May Be. Be Sure To Plan For These in Your Budget, As Well As Ongoing ExpensesJose AlexanderBelum ada peringkat

- WS-WP-Getting The Most From Compensation ProgramsDokumen10 halamanWS-WP-Getting The Most From Compensation ProgramsbaderalyamiBelum ada peringkat

- HRM648 Chapter 18Dokumen36 halamanHRM648 Chapter 182021485676Belum ada peringkat

- Corporate FinanceDokumen8 halamanCorporate FinanceAnkur KaushikBelum ada peringkat

- The Projected Unit Credit MethodDokumen34 halamanThe Projected Unit Credit MethodJoshua Sto DomingoBelum ada peringkat

- The Essentials of Compensation ManagementDokumen21 halamanThe Essentials of Compensation ManagementUnicorn SpiderBelum ada peringkat

- New Standards in Revenue RecognitionDokumen5 halamanNew Standards in Revenue RecognitionSantosh NathanBelum ada peringkat

- Group 5 CL Accounting Theory 9th Meeting Chapter 10 ExpenseDokumen6 halamanGroup 5 CL Accounting Theory 9th Meeting Chapter 10 ExpenseEggie Auliya HusnaBelum ada peringkat

- Earnings Management: Good, Bad or Downright Ugly?: by Paul DunmoreDokumen7 halamanEarnings Management: Good, Bad or Downright Ugly?: by Paul DunmoreKaiWenNgBelum ada peringkat

- Job Offer-Gold Loan Relationship Officer-LOANS AGAINST GOLD-Marketing Branches OperationsDokumen3 halamanJob Offer-Gold Loan Relationship Officer-LOANS AGAINST GOLD-Marketing Branches OperationsKarthi selvaBelum ada peringkat

- Offer Letter For TrainingDokumen3 halamanOffer Letter For Trainingmunnatechchannel01Belum ada peringkat

- Cost Recovery: Turning Your Accounts Payable Department into a Profit CenterDari EverandCost Recovery: Turning Your Accounts Payable Department into a Profit CenterBelum ada peringkat

- The Mechanics of Law Firm Profitability: People, Process, and TechnologyDari EverandThe Mechanics of Law Firm Profitability: People, Process, and TechnologyBelum ada peringkat

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityDari EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityBelum ada peringkat

- Financial Reporting and Analysis: - Session 4-Professor Raluca Ratiu, PHDDokumen54 halamanFinancial Reporting and Analysis: - Session 4-Professor Raluca Ratiu, PHDDaniel YebraBelum ada peringkat

- NFP Report 8 Mar 2019Dokumen4 halamanNFP Report 8 Mar 2019Dian LanBelum ada peringkat

- Assessment of Local Fiscal Performance DevelopmentsDokumen2 halamanAssessment of Local Fiscal Performance DevelopmentsKei SenpaiBelum ada peringkat

- Lecture 5 PDFDokumen28 halamanLecture 5 PDFJaniceBelum ada peringkat

- Liquidity of Siddhartha Bank Limited: A Summer Project Report Submitted ToDokumen35 halamanLiquidity of Siddhartha Bank Limited: A Summer Project Report Submitted Tosumeet kcBelum ada peringkat

- Jaiib Previous Year Question PapersDokumen3 halamanJaiib Previous Year Question PapersAbhijeet RawatBelum ada peringkat

- Tax benefits non-profit organisations PakistanDokumen4 halamanTax benefits non-profit organisations PakistanNoor ArfeenBelum ada peringkat

- Case+Study+AnswerDokumen4 halamanCase+Study+Answercynthia dewiBelum ada peringkat

- Project Financial AnalysisDokumen79 halamanProject Financial AnalysisAngel CastilloBelum ada peringkat

- Simulates Midterm Exam. IntAcc1 PDFDokumen11 halamanSimulates Midterm Exam. IntAcc1 PDFA NuelaBelum ada peringkat

- NORTHERN TRUST CORPORATION OWNS IRSDokumen3 halamanNORTHERN TRUST CORPORATION OWNS IRStravis smithBelum ada peringkat

- Accounting Note or SampleDokumen2 halamanAccounting Note or Samplenilo bia100% (1)

- Tenancy AgreementDokumen3 halamanTenancy AgreementseunoyebanjiesqBelum ada peringkat

- Pangea Mortgage Capital Closes $8.5 Million LoanDokumen3 halamanPangea Mortgage Capital Closes $8.5 Million LoanPR.comBelum ada peringkat

- International Money TransferDokumen2 halamanInternational Money TransferMainSq100% (1)

- A Project Report On Comparative Study inDokumen82 halamanA Project Report On Comparative Study inBhawna Rajput100% (1)

- Notes Payable Are Obligations Accompanied by A Written Promise To Pay A Certain Amount of Money To TheDokumen5 halamanNotes Payable Are Obligations Accompanied by A Written Promise To Pay A Certain Amount of Money To TheMelchie RepospoloBelum ada peringkat

- Credit Rating Agencies PDFDokumen17 halamanCredit Rating Agencies PDFAkash SinghBelum ada peringkat

- Introduction To XRPDokumen15 halamanIntroduction To XRPiwan.herisetiadi6833Belum ada peringkat

- Auditing 2&3 Theories Reviewer CompilationDokumen9 halamanAuditing 2&3 Theories Reviewer CompilationPaupauBelum ada peringkat

- 4.unit-4 Capital BudgetingDokumen51 halaman4.unit-4 Capital BudgetingGaganGabriel100% (1)

- Sample Solved Question Papers For IRDA 50 Hours Agents Training ExamDokumen15 halamanSample Solved Question Papers For IRDA 50 Hours Agents Training ExamPurnendu Sarkar100% (3)

- Mba Projects ListDokumen22 halamanMba Projects ListPayal MishraBelum ada peringkat

- List of Uae Insurance CompaniesDokumen9 halamanList of Uae Insurance CompaniesFawad IqbalBelum ada peringkat

- Bodie Essentials of Investments 12e Chapter 05 PPT AccessibleDokumen37 halamanBodie Essentials of Investments 12e Chapter 05 PPT AccessibleEdna DelantarBelum ada peringkat

- Cindy MYOB 2Dokumen1 halamanCindy MYOB 2SMK NusantaraBelum ada peringkat

- Final Thesis MA Tigist TesfayeDokumen51 halamanFinal Thesis MA Tigist Tesfayekiya felelkeBelum ada peringkat

- Commercial Banking in IndiaDokumen25 halamanCommercial Banking in IndiafahimpiscesBelum ada peringkat

- Warehouse Line Operations: Titan Lenders CorpDokumen13 halamanWarehouse Line Operations: Titan Lenders CorpNye LavalleBelum ada peringkat

- Delegated Regulation Annex enDokumen20 halamanDelegated Regulation Annex enNickBelum ada peringkat