If You Have Difficulty Answering The Following Questions, Learn More About This Topic by Reading Our

Diunggah oleh

Nii AdjeiJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

If You Have Difficulty Answering The Following Questions, Learn More About This Topic by Reading Our

Diunggah oleh

Nii AdjeiHak Cipta:

Format Tersedia

NOTE: For multiple-choice and true/false questions, simply place your cursor over what you

think is the correct answer. (There is no need to click the answer.) For fill-in-the-blank

questions place your cursor over the _________.

If you have difficulty answering the following questions, learn more about this topic by

reading our Break-even Point Explanation.

We also have Crosswords and Q&A for this topic.

1. Fixed Expenses do not change in total when there is a modest change in sales. True False

2. An example of a fixed expense would be a 5% sales commission. True False

3. Property taxes and rent are often fixed expenses. True False

4. Variable expenses change in total as volume changes. True False

5. An example of a variable expense is an office manager's monthly salary. True False

6. A retailer's cost of goods sold is an example of a variable expense. True False

7. Contribution margin is defined as sales (or revenues) minus variable expenses. True False

Break-even point is the point where revenues equal the total of all expenses

8. True False

including the cost of goods sold.

The break-even point in dollars of revenues is equal to the total of the fixed

9. True False

expenses divided by the contribution margin per unit.

If a company requires a profit of $30,000 (instead of breaking even), the

10. $30,000 should be combined with the fixed expenses in order to compute the True False

point at which the company will earn $30,000.

If a company has mixed expenses, the fixed component can be combined with

11. the company's fixed expenses and the variable component can be combined True False

with the company's variable expenses.

12. Decreasing a company's fixed expenses should reduce the break-even point. True False

The contribution margin per unit is the selling price per unit minus the fixed

13. True False

expenses per unit.

Break-even analysis is useful for companies that sell products, but it is not

14. True False

useful for companies that provide services.

Use this information to answer questions 15 through 17:

Selling Price per unit $ 17

Fixed Expenses

Selling &

$ 130,000

Administrative

Interest Expense $ 10,000

Variable Expenses

Cost of Goods Sold $4

Selling &

$3

Administrative

15. What is the company's contribution margin?

$10 $13 $14

16. What is the break-even point in units?

10,000 14,000 20,000

If the company wants to earn a profit of $42,000 instead of breaking even, what is the

17.

number of units the company must sell?

14,000 18,200 26,000

Use this information to answer questions 18 through 20:

Fixed Expenses

Rent $ 24,000

Salaries $ 40,000

Depreciation $ 13,000

Variable Expenses

Cost of Goods Sold 58% of sales

Supplies 7% of sales

Sales Commissions 5% of sales

18. What is the company's contribution margin ratio?

30% 70% Cannot be determined

19. What is the break-even point in dollars?

$77,000 $110,000 $256,667

If the company wants to earn a profit of $35,000 instead of breaking even, what is the

20.

amount of sales or revenue dollars the company must achieve?

$112,000 $145,000 $373,333

Let our new 2011 Master Accounting Download Package

help you learn accounting.

C. BREAKEVEN ANALYSIS

For any business, there is a certain level of sales at which there is neither a profit nor a loss. Total

income and total costs are equal. This point is known as thebreakeven point. It is easy to calculate,

and can also be found by drawing a graph called abreakeven chart.

Calculation of Breakeven Point

Example:

The organising committee of a Christmas party have set the selling price at £21 per ticket.

They have agreed with a firm of caterers that a buffet would be supplied at a cost of £13.50.

Anda mungkin juga menyukai

- Day Trading Academy: Complete Day Trading Guide for Beginners and Advanced Investors: Top Trading Strategies that Every Elite Trader is Using: Option and Stock Trading AdviceDari EverandDay Trading Academy: Complete Day Trading Guide for Beginners and Advanced Investors: Top Trading Strategies that Every Elite Trader is Using: Option and Stock Trading AdvicePenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Computing Profits LessonDokumen22 halamanComputing Profits LessonMYRRH TRAINBelum ada peringkat

- HMCost3e SM Ch16Dokumen35 halamanHMCost3e SM Ch16Bung Qomar100% (2)

- Leverage and Capital StructureDokumen8 halamanLeverage and Capital StructureC H ♥ N T ZBelum ada peringkat

- Mas HW1Dokumen19 halamanMas HW1anncabrito29Belum ada peringkat

- Break Even Point ExplanationDokumen2 halamanBreak Even Point ExplanationEdgar IbarraBelum ada peringkat

- What Is The Breakeven Point (BEP) ?Dokumen3 halamanWhat Is The Breakeven Point (BEP) ?Niño Rey LopezBelum ada peringkat

- Break-Even Point, Return On Investment and Return On SalesDokumen8 halamanBreak-Even Point, Return On Investment and Return On SalesGaurav kumarBelum ada peringkat

- CHAPTER 8 AnswerDokumen14 halamanCHAPTER 8 AnswerCarl MarceloBelum ada peringkat

- CHAPTER 8 AnswerDokumen14 halamanCHAPTER 8 AnswerKenncyBelum ada peringkat

- Cost-Volume-Profit Relationship: Reefat Arefin KhanDokumen17 halamanCost-Volume-Profit Relationship: Reefat Arefin KhanSakib Bin AlamBelum ada peringkat

- ENTREPRENEURSHIP 12 Q2 M8 Computation of Gross ProfitDokumen18 halamanENTREPRENEURSHIP 12 Q2 M8 Computation of Gross ProfitMyleen CastillejoBelum ada peringkat

- EME5Dokumen8 halamanEME5MoonlitBelum ada peringkat

- What Is The Breakeven Point (BEP) ?Dokumen4 halamanWhat Is The Breakeven Point (BEP) ?Muhammad NazmuddinBelum ada peringkat

- Break-Even Analysis/Cvp AnalysisDokumen41 halamanBreak-Even Analysis/Cvp AnalysisMehwish ziadBelum ada peringkat

- ENTREPRENEURSHIP QUARTER 2 MODULE 10 Computation-of-Gross-ProfitDokumen11 halamanENTREPRENEURSHIP QUARTER 2 MODULE 10 Computation-of-Gross-Profitrichard reyesBelum ada peringkat

- Break Even AnalysisDokumen9 halamanBreak Even AnalysisBankatesh ChoudharyBelum ada peringkat

- Chapter 3Dokumen21 halamanChapter 3Florencio FanoBelum ada peringkat

- The Seventh Commandment: Walk Before You RunDokumen11 halamanThe Seventh Commandment: Walk Before You RunDavid 'Valiant' OnyangoBelum ada peringkat

- Entrep12 Q2 Mod8 Computation-Of-Gross-Profit v2Dokumen16 halamanEntrep12 Q2 Mod8 Computation-Of-Gross-Profit v2Bianca Christine AgustinBelum ada peringkat

- FSA - Commonly Asked Questions-2021Dokumen27 halamanFSA - Commonly Asked Questions-2021Abhishek MishraBelum ada peringkat

- Financial Plan: Start-Up FundingDokumen6 halamanFinancial Plan: Start-Up FundingAchilles Adrian AguilanBelum ada peringkat

- Financial Plan: Start-Up FundingDokumen6 halamanFinancial Plan: Start-Up FundingAchilles Adrian AguilanBelum ada peringkat

- In BusinessDokumen6 halamanIn BusinessPhoebe LlameloBelum ada peringkat

- 03 Cost Volume Profit Analysis ANSWER KEYDokumen2 halaman03 Cost Volume Profit Analysis ANSWER KEYJemBelum ada peringkat

- What Is CVP Analysis?: Variable and Fixed ProfitDokumen6 halamanWhat Is CVP Analysis?: Variable and Fixed ProfitMark Aldrich Ubando0% (1)

- Profitability Ratios: 1. Profit Ratios Related To SalesDokumen8 halamanProfitability Ratios: 1. Profit Ratios Related To SalesRakesh KumarBelum ada peringkat

- Breakeven Revision NOTE WORDDokumen1 halamanBreakeven Revision NOTE WORDNguyen Dac ThichBelum ada peringkat

- Profit and Cashflow Don't Necessarily Go Hand in HandDokumen13 halamanProfit and Cashflow Don't Necessarily Go Hand in HandJack DanielBelum ada peringkat

- CVP AnalysisDokumen18 halamanCVP AnalysisKashvi MakadiaBelum ada peringkat

- COST-VOLUME-PROFIT RELATIONSHIPS (KEY TERMS & CONCEPTS TO KNOW) (ACC102-Chapter5new PDFDokumen21 halamanCOST-VOLUME-PROFIT RELATIONSHIPS (KEY TERMS & CONCEPTS TO KNOW) (ACC102-Chapter5new PDFBarbie GarzaBelum ada peringkat

- Cost-Volume-Profit Analysis: A Managerial Planning Tool: Discussion QuestionsDokumen41 halamanCost-Volume-Profit Analysis: A Managerial Planning Tool: Discussion Questionshoodron22100% (1)

- CVP AnalysisDokumen17 halamanCVP AnalysisDianne Mae LeysonBelum ada peringkat

- Cot 1-Computation of Gross ProfitDokumen24 halamanCot 1-Computation of Gross ProfitRuffa LBelum ada peringkat

- Cost Volume Profit AnalysisDokumen4 halamanCost Volume Profit AnalysisPratiksha GaikwadBelum ada peringkat

- Cost Volume Profit AnalysisDokumen16 halamanCost Volume Profit AnalysisAlthon JayBelum ada peringkat

- Fundamentals of Cost-Volume-Profit Analysis: True / False QuestionsDokumen276 halamanFundamentals of Cost-Volume-Profit Analysis: True / False QuestionsAstrid AboitizBelum ada peringkat

- 1521strategic Cost Management K-3-ADokumen15 halaman1521strategic Cost Management K-3-APratham KochharBelum ada peringkat

- TASK 1. Directions : Write True If The Statement Is Correct & Write False If You Think The Answer Is Not CorrectDokumen2 halamanTASK 1. Directions : Write True If The Statement Is Correct & Write False If You Think The Answer Is Not CorrectMadeleine Rayos100% (1)

- Prices of Products, Volume or Level of Activity, Per Unit Variable Costs, Total Fixed Costs, and Mix of Products SoldDokumen40 halamanPrices of Products, Volume or Level of Activity, Per Unit Variable Costs, Total Fixed Costs, and Mix of Products SoldSnn News TubeBelum ada peringkat

- Break-Even AnalysisDokumen2 halamanBreak-Even AnalysisMahadie HasanBelum ada peringkat

- Solutions Manual Chapter 4 Cost-Volume-Profit RelationshipsDokumen85 halamanSolutions Manual Chapter 4 Cost-Volume-Profit RelationshipsMynameBelum ada peringkat

- Business Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONDokumen20 halamanBusiness Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONJhudiel Dela ConcepcionBelum ada peringkat

- CVP SummaryDokumen4 halamanCVP SummaryliaBelum ada peringkat

- Entrep Module 8Dokumen8 halamanEntrep Module 8Trisha BantingBelum ada peringkat

- 03 Cost Volume Profit AnalysisDokumen6 halaman03 Cost Volume Profit AnalysisPhoebe WalastikBelum ada peringkat

- Suggested Answers (Chapter 7)Dokumen7 halamanSuggested Answers (Chapter 7)kokomama231Belum ada peringkat

- Chapter 4Dokumen77 halamanChapter 4Shruthi ShettyBelum ada peringkat

- Module 4business MathDokumen9 halamanModule 4business MathJohniel MartinBelum ada peringkat

- Firms in Competitive P MarketsDokumen51 halamanFirms in Competitive P Marketsamitnd55Belum ada peringkat

- Break Even Point AnalysisDokumen6 halamanBreak Even Point AnalysisLouis FrongelloBelum ada peringkat

- For ReportingDokumen6 halamanFor ReportingColeen Rich - BobierBelum ada peringkat

- Lesson 10 (Printer-Friendly Version)Dokumen8 halamanLesson 10 (Printer-Friendly Version)gretatamaraBelum ada peringkat

- PVC Analysis QNDokumen14 halamanPVC Analysis QNAnipa HubertBelum ada peringkat

- Break Even AnalysisDokumen15 halamanBreak Even AnalysisPawan BiswaBelum ada peringkat

- Profit, Loss, and Break-Even: To Compute The PROFITDokumen4 halamanProfit, Loss, and Break-Even: To Compute The PROFITtreshiaBelum ada peringkat

- Group 2 CVP RelationDokumen40 halamanGroup 2 CVP RelationJeejohn Sodusta0% (1)

- Week - Cost-Volume-profit AnalysisDokumen20 halamanWeek - Cost-Volume-profit Analysistraptrap19Belum ada peringkat

- Cost Volume Profit AnalysisDokumen1 halamanCost Volume Profit AnalysisReika OgaliscoBelum ada peringkat

- Pricing The Job-Mark-Up, Overhead & ProfitDokumen6 halamanPricing The Job-Mark-Up, Overhead & Profitbeq97009Belum ada peringkat

- Single StepDokumen1 halamanSingle StepMerza DyanBelum ada peringkat

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDokumen36 halamanLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamBelum ada peringkat

- Management and Cost Accounting 10th Edition Drury Solutions ManualDokumen17 halamanManagement and Cost Accounting 10th Edition Drury Solutions Manualeliasvykh6in8100% (27)

- Hospital Industry IIIDokumen6 halamanHospital Industry IIIIra Grace De Castro100% (1)

- Unit 21 - Motives For Spending, Saving and BorrowingDokumen20 halamanUnit 21 - Motives For Spending, Saving and BorrowingbielBelum ada peringkat

- Manual Accounting NotesDokumen14 halamanManual Accounting NotesAbaan SalimBelum ada peringkat

- Current Ratio: Therefore, The Current Ratio of SAIL Is Better Than Tata SteelDokumen8 halamanCurrent Ratio: Therefore, The Current Ratio of SAIL Is Better Than Tata SteelcarzlifeBelum ada peringkat

- HUL Annual Report 2020 - 21Dokumen2 halamanHUL Annual Report 2020 - 21Arkin DixitBelum ada peringkat

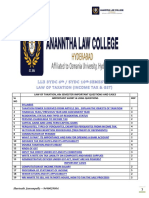

- Taxation - 6 SemesterDokumen28 halamanTaxation - 6 SemesterKhalid123Belum ada peringkat

- Manufacturing Operations - Theory ReviewerDokumen4 halamanManufacturing Operations - Theory Reviewerquinn ezekielBelum ada peringkat

- CHP 8 FsaDokumen26 halamanCHP 8 Fsaabhaymac22Belum ada peringkat

- Wild Wood Case StudyDokumen6 halamanWild Wood Case Studyaudrey gadayBelum ada peringkat

- Chapter 16 Sol 2020 WKDokumen53 halamanChapter 16 Sol 2020 WKVu Khanh LeBelum ada peringkat

- Payslip For The Month of November 2020: Cms It Services Private LimitedDokumen2 halamanPayslip For The Month of November 2020: Cms It Services Private LimitedKrishna AryanBelum ada peringkat

- Benefit/Cost Ratio: Engineering EconomyDokumen12 halamanBenefit/Cost Ratio: Engineering EconomyChristine Alderama MurilloBelum ada peringkat

- Mitra S.K. Group of Companies: Accounts ManualDokumen21 halamanMitra S.K. Group of Companies: Accounts ManualdebashisdasBelum ada peringkat

- Moller Maersk PDF FinalDokumen10 halamanMoller Maersk PDF Finalanna sBelum ada peringkat

- Amfori BSCI Fair RemuDokumen2 halamanAmfori BSCI Fair RemuFaridUddin Ahmed100% (1)

- 1-6 Statement of Cash FlowDokumen26 halaman1-6 Statement of Cash FlowHazel Joy DemaganteBelum ada peringkat

- Annual Comprehensive Financial Report: State of Texas - 2021Dokumen354 halamanAnnual Comprehensive Financial Report: State of Texas - 2021Connect me onlineBelum ada peringkat

- Profile Summary: Ca Vaibhav KumarDokumen3 halamanProfile Summary: Ca Vaibhav KumarThe Cultural CommitteeBelum ada peringkat

- Financial Statement of DeliDokumen5 halamanFinancial Statement of DeliBishowraj PariyarBelum ada peringkat

- 1macroeconomics Under Graduate Course Chapters 123Dokumen159 halaman1macroeconomics Under Graduate Course Chapters 123fiker tesfaBelum ada peringkat

- Acc 178 - TG 7Dokumen6 halamanAcc 178 - TG 7John Michael SorianoBelum ada peringkat

- Notice of Reassessment 2021 08 16 06 13 55 692252Dokumen4 halamanNotice of Reassessment 2021 08 16 06 13 55 692252api-676582318Belum ada peringkat

- Pay Slip 13867 July, 2021Dokumen1 halamanPay Slip 13867 July, 2021Jemal YayaBelum ada peringkat

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDokumen8 halamanManila Cavite Laguna Cebu Cagayan de Oro DavaoRaymond RosalesBelum ada peringkat

- Payslip 5 2022Dokumen1 halamanPayslip 5 2022All in OneBelum ada peringkat

- Activity 2 3Dokumen2 halamanActivity 2 3MA. FRITZIE DE ASISBelum ada peringkat

- Business Math 11 - 12 q2 Clas 3 Joseph AurelloDokumen10 halamanBusiness Math 11 - 12 q2 Clas 3 Joseph AurelloKim Yessamin Madarcos100% (1)