Service Tax Cable Operator

Diunggah oleh

Saktiswarup TripathyHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Service Tax Cable Operator

Diunggah oleh

Saktiswarup TripathyHak Cipta:

Format Tersedia

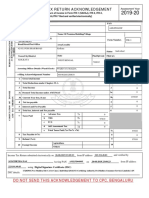

SPECIMEN FORM ST 3 Page 1

S.T.-3 Return [ How to Write ]

Please Note : - 1) Submit return twice a year :- a) For April to September - On or before 25th October b) For October to March - On or before 25th

2) Submit 3 or 4 copies ( 4 copies if acknowledgement is required on S.T.-3 return ) ( All copies should be legible )

3) All figures should be in Rupees only.

4) Late filing of Return will attract penalty upto Rupees 1000/- .

SPECIMEN FORM ST 3

.

COMMISSIONERATE:

RETURN OF SERVICE TAX CREDITED TO THE GOVERNMENT OF INDIA FOR THE PERIOD A P R TO S E

1. Name & Address of the Assessee : M/s. Raj Satellite Service Phone No. : 747XXXX 2. Whether in Individual or proprietary firm or partnership firm or any other (please

3. Category of Service : Cable Operator 4. Service Tax Registration No. : CBL/Pune-170 5. STC No. AACPK4897D/ 6. ECC NO. 1 0 7 1 4

ST/001

Name of the Taxable Month(s) Value of taxable Value of taxable Amount of Service Amount of Amount of Details of payment made to the Mode of P

Service Provided service service realized Tax payable service tax Interest, Government credit

charged or billed (indicate Break-up adjusted In terms If any,

(indicate break-up of the amount of sub-rule (3) Payable

of the amount Month-wise) of rule 6 of the

Month-wise) Service Tax

Rules, 1994 Cash

Tax

(8a)

* Service Interest Any other Challan No

Tax Paid amount Amount Journal Slip

paid paid **

(1) (2) (3) (4) (5) (6) (7) (7) (b) (7) (c) (8) (i) (8)

(7) (a)

Cable Operator Apr 2002 5000 4000 200 ---- ---- ---- ---- ---- ---- ---

Cable Operator May 2002 4000 5000 250 ---- ---- ---- ---- ---- ---- ---

Cable Operator Jun 2002 6000 5000 250 ---- ---- ---- ---- ---- ---- ---

Total of the 1st 15000 14000 700 ---- ---- 700 ---- ---- 500 1 /02-03 1

Quarter

Cable Operator July 2002 8000 8000 400 ---- 8 400 8 ---- 408 2 /02-03 2

Cable Operator Aug 2002 7000 7000 350 ---- ---- 350 ---- ---- 350 3 /02-03 2

Cable Operator Sept 2002 9000 9000 450 ---- ---- 450 ---- ---- 350 4 /02-03 17.10.

Total of the 2nd 24000 24000 1200 ---- 8 1200 8 ---- 1108 ---

Quarter

GROSS TOTAL 39000 38000 1900 ---- 8 1900 8 ---- 1608 ---

*Please specify and enclose documentary evidence ** Please specify on what account the amount has been paid

SELF-ASSESSMENT MEMORANDUM

1. I/We declare that the above particulars are in accordance with the records and books maintained by us and are correctly stated.

2. I/We have assessed and paid the Service Tax correctly in terms of the provisions of the Act and rules made thereunder.

3. I/We have paid duty within the time specified in these rules and in case of delay. I/We have deposited the interest leviable as per the section 75 of the Act. (Worksheet of in

Date :

file://localhost/C:/excise/st3.htm 1/22/2009 8:36:10 AM

SPECIMEN FORM ST 3 Page 2

file://localhost/C:/excise/st3.htm 1/22/2009 8:36:10 AM

Anda mungkin juga menyukai

- Shihab Ay 2019-20 Itr PDFDokumen1 halamanShihab Ay 2019-20 Itr PDFjijil mp100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKunda MalleshBelum ada peringkat

- Anuj ASAPM2826N ITR-VDokumen1 halamanAnuj ASAPM2826N ITR-Vapi-27088128Belum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDebabrata pahariBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurumuzpatBelum ada peringkat

- Itr-V Aaifp5094r 2009-10 97108320300909Dokumen1 halamanItr-V Aaifp5094r 2009-10 97108320300909dharmendraganatra2Belum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSmr OrganizationsBelum ada peringkat

- 2019 11 21 19 47 45 253 - 1574345865253 - XXXCB7195X - Acknowledgement PDFDokumen1 halaman2019 11 21 19 47 45 253 - 1574345865253 - XXXCB7195X - Acknowledgement PDFgvcBelum ada peringkat

- PDF Class NoteDokumen1 halamanPDF Class NoteSachin KadamBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAkhileshBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnil kadamBelum ada peringkat

- Indian Income Tax Return Acknowledgement for AY 2018-19Dokumen1 halamanIndian Income Tax Return Acknowledgement for AY 2018-19Bimal Kumar MaityBelum ada peringkat

- Disconnection Notice and Bill For: Nitisendu SahaDokumen2 halamanDisconnection Notice and Bill For: Nitisendu SahaKalyan GaineBelum ada peringkat

- 2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFDokumen1 halaman2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFVarun MgBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARBelum ada peringkat

- Form16Rpt 169567-1Dokumen3 halamanForm16Rpt 169567-1ishalshamnasBelum ada peringkat

- Government of Telangana Commercial Taxes DepartmentDokumen8 halamanGovernment of Telangana Commercial Taxes DepartmentAbhishek SinghBelum ada peringkat

- 2018 09 25 14 48 26 422 - 1537867106422 - XXXPT2924X - Acknowledgement PDFDokumen1 halaman2018 09 25 14 48 26 422 - 1537867106422 - XXXPT2924X - Acknowledgement PDFAnand ThakurBelum ada peringkat

- 2020 11 22 11 41 29 647 - 1606025489647 - XXXPJ7641X - Itrv 1Dokumen1 halaman2020 11 22 11 41 29 647 - 1606025489647 - XXXPJ7641X - Itrv 1Ritesh MehtaBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKarthikJacobBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYBelum ada peringkat

- Challan ReceiptDokumen1 halamanChallan ReceiptMani SankarBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageO P TulsyanBelum ada peringkat

- US Internal Revenue Service: f8860 - 2004Dokumen2 halamanUS Internal Revenue Service: f8860 - 2004IRSBelum ada peringkat

- ACKDokumen1 halamanACKSAITEJA SOLVENT PURCHASEBelum ada peringkat

- 2020 09 09 13 45 31 911 - 1599639331911 - XXXPM4309X - Itrv PDFDokumen1 halaman2020 09 09 13 45 31 911 - 1599639331911 - XXXPM4309X - Itrv PDFMd Ali MujawarBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarBelum ada peringkat

- Indian Income Tax Return Acknowledgement SummaryDokumen1 halamanIndian Income Tax Return Acknowledgement SummaryMithlesh KumarBelum ada peringkat

- 2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementDokumen1 halaman2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementKanahiya TandonBelum ada peringkat

- ITRDokumen1 halamanITRpradip_jsr13Belum ada peringkat

- INDIAN INCOME TAX RETURN ACKNOWLEDGEMENTDokumen3 halamanINDIAN INCOME TAX RETURN ACKNOWLEDGEMENTnikhilbhorBelum ada peringkat

- Nation: MarketDokumen9 halamanNation: MarketDebashis MitraBelum ada peringkat

- Indian Income Tax Return Acknowledgement SummaryDokumen1 halamanIndian Income Tax Return Acknowledgement SummaryShankar SagarBelum ada peringkat

- E FilingDokumen4 halamanE FilingAvigyan BasuBelum ada peringkat

- Indian Income Tax Return AcknowledgementDokumen1 halamanIndian Income Tax Return AcknowledgementSai SanthoshBelum ada peringkat

- Itr 19-20Dokumen1 halamanItr 19-20Ashwani KumarBelum ada peringkat

- Indian Income Tax Return Acknowledgement for Assessment Year 2019-20Dokumen1 halamanIndian Income Tax Return Acknowledgement for Assessment Year 2019-20vvn HarishBelum ada peringkat

- 2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFDokumen1 halaman2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFArjunJaiBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurukarthik giriBelum ada peringkat

- Itr-V Bogpp6352h 2017-18 225020870280917Dokumen1 halamanItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalururengarajan82Belum ada peringkat

- US Internal Revenue Service: f8860 - 2005Dokumen2 halamanUS Internal Revenue Service: f8860 - 2005IRSBelum ada peringkat

- Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVDokumen1 halamanMeghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVYunusShaikhBelum ada peringkat

- 2018 06 24 21 25 03 178 - 1529855703178 - XXXPR0215X - Acknowledgement PDFDokumen1 halaman2018 06 24 21 25 03 178 - 1529855703178 - XXXPR0215X - Acknowledgement PDFRamasubramaniam AnantharamanBelum ada peringkat

- Indian Income Tax Return Acknowledgement for Assessment Year 2018-19Dokumen1 halamanIndian Income Tax Return Acknowledgement for Assessment Year 2018-19ARK EXPORT AND IMPORTBelum ada peringkat

- Summary of The Bill: Disconnection Notice and Bill ForDokumen2 halamanSummary of The Bill: Disconnection Notice and Bill ForSayan DeyBelum ada peringkat

- PDF 759518980120718Dokumen1 halamanPDF 759518980120718HARDIK BANSALBelum ada peringkat

- Indian Income Tax Return AcknowledgementDokumen1 halamanIndian Income Tax Return AcknowledgementNeethinathanBelum ada peringkat

- Itr-V Avapn7956m 2019-20 370567540270620Dokumen1 halamanItr-V Avapn7956m 2019-20 370567540270620kaysenterprises636Belum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSAI MOHANBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMukul BajajBelum ada peringkat

- 2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFDokumen1 halaman2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFsonal aBelum ada peringkat

- Indian Income Tax Return Acknowledgement SummaryDokumen1 halamanIndian Income Tax Return Acknowledgement SummaryJayabrata sahooBelum ada peringkat

- Itr-V Einps2648m 2019-20 617536290160719Dokumen1 halamanItr-V Einps2648m 2019-20 617536290160719ACSFZRBelum ada peringkat

- 2020 09 29 22 59 51 720 - 1601400591720 - XXXPT9510X - ItrvDokumen1 halaman2020 09 29 22 59 51 720 - 1601400591720 - XXXPT9510X - Itrvkrunal07786Belum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruসোমতীর্থ দাসBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAyush mittalBelum ada peringkat

- Electrical & Mechanical Components World Summary: Market Values & Financials by CountryDari EverandElectrical & Mechanical Components World Summary: Market Values & Financials by CountryBelum ada peringkat