Shivu Project

Diunggah oleh

harishshettyDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Shivu Project

Diunggah oleh

harishshettyHak Cipta:

Format Tersedia

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Dissertation submitted to the

BANGALORE UNIVERSITY

In partial fulfillment of the requirements for the award of the

POST GRADUATE DEGREE

of

MASTER OF COMMERCE

Submitted by

SHIVAKUMAR S.L.

Reg. No. O8ATCM1028

Under the guidance of

Dr. H. PRAKASH,

M.Com, M.B.A., Ph.D.

Co-ordinator – M.B.A

Govt. R.C.College of Commerce & Management

Govt. R.C. College of Commerce & Management 1

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Palace Road, Bangalore – 560 001.

2009-10

CO-ORDINATOR’S CERTIFICATE

This is to certify that the dissertation entitled

“AN EXPLORATORY STUDY ON DEBT

RECOVERY MANAGEMENT OF CO-OPERATIVE

BANKS WITH SPECIAL RFERENCE TO THE

BANGALORE CITY CO-OPERATIVE BANK LTD.”

is the bonafide research work carried out by Mr.

SHIVAKUMAR S.L. bearing Reg. No.

08ATCM1028 under the guidance and supervision

of Dr.H.PRAKASH, Co-ordinator of M.B.A., Govt.

R.C. College of Commerce and Management.

Govt. R.C. College of Commerce & Management 2

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Place: Bangalore Dr. M.ASHFAQ

AHMED

Date: Co-ordinator–

M.Com

GUIDE’S CERTIFICATE

This is to certify that the dissertation entitled

“AN EXPLORATORY STUDY ON DEBT

RECOVERY MANAGEMENT OF CO-OPERATIVE

BANKS WITH SPECIAL RFERENCE TO THE

BANGALORE CITY CO-OPERATIVE BANK LTD.”

is the bonafide research work carried out by Mr.

SHIVAKUMAR S.L. bearing Reg. No.

08ATCM1028 under my guidance.

Govt. R.C. College of Commerce & Management 3

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Place: Bangalore

Dr.H.PRAKASH

Date: Co-

ordinator of M.B.A

STUDENT’S DECLARATION

I hereby declare that the dissertation entitled

“AN EXPLORATORY STUDY ON DEBT RECOVERY

MANAGEMENT OF CO-OPERATIVE BANKS WITH

Govt. R.C. College of Commerce & Management 4

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

SPECIAL RFERENCE TO THE BANGALORE CITY

CO-OPERATIVE BANK LTD.” has been carried out

by me under the guidance and supervision of

Dr.H.PRAKASH, M.Com, M.B.A., Ph.D,

Govt.R.C.College of Commerce & Management,

Bangalore., submitted in partial fulfillment for the

award of degree of Master of Commerce of

Bangalore University.

I also declare that no part of this

representation has been previously published or

submitted as a project representation for any degree,

diploma, fellowship or any other similar title to any

university or institution.

Place: Bangalore

SHIVAKUMAR S.L.

Date: Reg. No.

08ATC M1028

Govt. R.C. College of Commerce & Management 5

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

ACKNOWLEDGMENT

I am happy to express my gratitude to

Prof.H.K. KUMARARAJ URS, Principal of

Govt. R. C. College of commerce and

management & Dr.M.ASHFAQ AHMED, Co-

ordinator of M.com for their encouragement,

guidance and many valuable ideas imported to

me for my project, with great pressure.

I extend my gratitude towards internal

guide of the project Dr. H.PRAKASH, Co-

odinator of MBA, and external guides

Mr.N.MANJUNATHA, General Manager,

Mr.K.G.RAJU, Deputy General Manager and

Mr.B.GANGADHARA, Asst. General

Manager of the BCCB Ltd., and also

Mr.SATHISHA.H.K. (Asst. Prof. GFGC,

Nagamangala), under whose valuable

guidance, constant interest and

encouragement I have been able to complete

the project successfully. This co-operation is

not useful only for this project but, will also be

a constant source of inspiration for the future.

I am also thankful to my parents, all my

lecturers and my friends for theirs constant

help in preparation of my project successfully.

Govt. R.C. College of Commerce & Management 6

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

SHIV

AKUMAR S.L.

Re

g. No. 08ATCM1028

CERTIFICATE BY THE PRINCIPAL

This is to certify that the project “AN

EXPLORATORY STUDY ON DEBT RECOVERY

MANAGEMENT OF CO-OPERATIVE BANKS

WITH SPECIAL RFERENCE TO THE

BANGALORE CITY CO-OPERATIVE BANK LTD.”

has been completed by Mr. SHIVAKUMAR S.L.

bearing Reg.No.08ATCM1028 under the guidance

of Dr.H.PRAKASH, Co-ordinator of M.B.A.

Govt. R.C. College of Commerce & Management 7

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

This dissertation is based on original result

and has not formed the basis for the award previously

of any degree, diploma, associate ship, fellowship or

any other similar title.

Prof. H.K.KUMARARAJ URS

Principal

CONTENTS

CHAPT PAGE

DESCRIPTION

ER NO. NO.

CHAPTER INTRODUCTION 1 - 45

–1 Introduction about banking industry

History of modern banking in India

Classification of banks

Functions of Banking

Co-operative Banks

Definitions & features of Co-

operative banks

Structure of Co-operative Banks

Introduction of Debt Recovery

Management

Meaning of Debt Recovery

Management

Introduction to NPAs

Meaning of NPAs

RBI guidelines on Income

Recognition

Govt. R.C. College of Commerce & Management 8

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Accounting Standard – 9 on

Revenue Recognition issued by ICAI

RBI Guidelines on Classification &

provisioning requirement of Bank

Advances

Impact of NPAs

Consequences of NPAs

Objectives of Debt Recovery

Management

Factor affecting the recovery of

Loans & Advances

Recovery Methods

CHAPTER RESEARCH DESIGN 46 - 49

–2 Title of the study

Statement of the problem

Objectives of the study

Scope of the study

Research Methodology

Plan of analysis

Limitations of the study

Chapter layout

CHAPTER BANK PROFILE 50 - 57

–3 History of the bank

Goals & objectives of the bank

Vision statement

Organization structure

List of board of directors

Statement of growth of the bank

Braches of the bank

Awards & competitors details

CHAPTER ANALYSIS & INTERPRETATION OF 58 - 78

–4 DATA

Govt. R.C. College of Commerce & Management 9

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

CHAPTER SUMMARY OF FINDINGS, 79 - 83

–5 SUGGESTIONS & CONSLUSIONS

BIBLIOGRAPY

ANNEXTURE – QUESTIONNAIRE

Govt. R.C. College of Commerce & Management 10

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

LIST OF TABLES

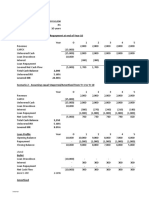

TABLE Showing Recovery as a Percentage of Loans

65

4.1 & Advances

TABLE

Showing Status of NPAs in the bank 67

4.2

TABLE Showing Net NPAs & Recovery performance of

69

4.3 the bank

TABLE Showing Net NPAs as a percentage of Loans &

71

4.4 Advances

TABLE

Growth of Deposits 73

4.5

TABLE

Loan Position of the Bank 75

4.6

TABLE

Profit Position of the Bank 77

4.7

LIST OF GRAPHS

GRAPH Showing Recovery as a Percentage of Loans

66

4.1 & Advances

GRAPH

Showing Status of NPAs in the bank 68

4.2

GRAPH Showing Net NPAs & Recovery performance of

70

4.3 the bank

GRAPH Showing Net NPAs as a percentage of Loans &

72

4.4 Advances

GRAPH

Showing Growth of Deposits 74

4.5

GRAPH

Showing Loan Position of the Bank 76

4.6

Govt. R.C. College of Commerce & Management 11

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

GRAPH

Showing Profit Position of the Bank 78

4.7

CHAPTER – 01

INTRODUCTION

INTRODUCTION ABOUT BANKING INDUSTRY:

The word bank originated the French word ‘benque’ or

Italian ‘banco’ which means an office for monitory transaction

over the counter. In those days banks or desks were used as

centers for monitory transactions.

During the barter system also, there existed traces of

banking, i.e. people used to deposit cattle and agricultural

products in specified places get loans of some other form in

exchange for these. There is solid evidence found in records

excavated from Mesopotamia, showing some bank existed

around 1700 B.C. During this time barley, silver, gold, copper,

etc., were used as a standard for valuation.

ORIGIN OF BANKING INDUSTRY:

Greece was the first country to introduce a satisfactory

system of coinage. After the invention of coins started, a

Govt. R.C. College of Commerce & Management 12

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

meaningful system of banking came into existence taking

into account all the avenue of banking a credit system.

Rome was the first country to start a bank at the

department of state level in the 4th century B.C. with

transactions such as depositing and investments in other

forms. In India ancient records show that banking was

popular and money lending was a common practice among

the common people.

In the olden days’ Goldsmith, merchants and money lenders

conducted the business. They had transactions among

themselves by which funds were transferred from one

business firm to another. They had no general or uniform

principles of banking, lending, rate of interest, etc.

INTRODUCTION TO BANKING IN INDIA

The Indian Companies Act defines the term banking as

“accepting for the purpose of lending or investment of

deposits of money from the public, repayable on demand or

otherwise and withdrawable by cheque, draft or otherwise”.

A Banker is a dealer in money and credit. The business

of Banking consists of borrowing and lending banks acts as

financial intermediaries between savers (lenders) and

Govt. R.C. College of Commerce & Management 13

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

investors (borrowers) by accepting deposits of money from a

large number of customers and lending a major position of a

accumulated ‘pool’ of money to those who wish to borrower.

In this process banks secure reasonable return for the savers,

make funds available to the investors at a cost and earn a

profit for themselves after covering the cost of funds and

providing for corporate taxes to the government. Thus, the

banking institutions in a country mobilizes savings by

accepting monetary deposits from the people, participate in

the mechanism for the exchange of goods and services and

extend credit while lending money.

HISTORY OF MODERN BANKING IN INDIA

Pre-nationalization period:

The history of modern banking in India dates back to the

last quarter of 18th century. During this period the English

agency houses of Bombay and Calcutta started banking

business to India. They setup the Bank of Hindustan around

1770 followed by setting up of quasi government banking

institutions like presidency bank of Bombay in 1840 and

presidency Bank of Madras in 1873.

Govt. R.C. College of Commerce & Management 14

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

In 1921 all these banks were amalgamated and imperial

bank was constituted. In the late 19th and early 20th centuries,

the Swadeshi Movement inspired to start banks in India. The

Indian Banks were established during this period. In 1935 the

Reserve Bank of India was established as a central bank for

regulating and controlling the Banking business in the

country. Soon after independence, the Reserve Bank was

nationalized in September 1948. The outlook of Reserve Bank

further changed after the inception of planning in 1950-51

and the country adopting a socialistic pattern of society.

Govt. R.C. College of Commerce & Management 15

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Post-nationalization period:

On an account of the top-sided growth of the banking

system and to bridge the gap between a few industrial

houses and banks, the scheme of the social control was

imposed on banks with effect from Feb 1, 1969. It resulted in

setting up of National Credit Council for more equitable

distribution of bank credit and legislative changes in the

Banking Regulation Act for making the board of directors of

the banks more board based. As a result the government

resorted to a more radical measure by nationalizing 14 major

banks on July 1969. Later on in April 1980, six more banks

were nationalized to achieve the objective.

The objective of nationalization was to control the

commanding heights of economy and to meet progressively

and serve the needs of the developing economy in

conforming to the national policy and objectives. Another

welcome feature of post – nationalization period is setting up

of regional rural banks setting up of regional rural banks as

per the provisions of the Regional Rural Bank Act 1976.

These banks confine in themselves the simplicity of

operations as required by local conditions and the efficiency

and business like approach of commercial banks. At the end

of June 1986 there were 194 regional rural banks covering

342 districts. Thus, the banking system, during the post –

Govt. R.C. College of Commerce & Management 16

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

nationalization period has undergone a major structural

transformation. There has been a phenomenal expansion of

branch network particularly the hitherto under banked areas.

Present scenario of banking industry:

The Indian banking can be broadly categorized into

nationalized (government oriented), private banks and

specialized banking institution. The RBI acts as a centralized

body monitoring any discrepancies and shortcoming in the

system. Since the nationalized banks have required a place

of prominence and has then seen tremendous progress.

The need to become highly customer focused has forced

the slow of moving public sector banks to adapt a fast track

approach.

The Indian Banking has come a long way from a sleepy

business institution to a highly proactive and dynamic

activity. This transformation has been largely brought by the

large close of liberalization and economic reform that allowed

banks to explore new business opportunities rather than

generating revenue from conventional stream i.e. borrowing

and lending. The Co-operative banks too have invested

heavily in information technology to after computerized

banks services o its clients.

Govt. R.C. College of Commerce & Management 17

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

New Generation Banking:

The liberalized policy of government of India permitted

entry of private sector in banking, the industry has witnessed

the entry of new generation private banks. The major

parameter that distinguishes these banks from all the other

banks in Indian Banking is the level of services that is offered

to the customer. Verifying the focus has always being

centered on the customer understanding his needs and

delighting him with various configurations of benefits and a

wide portfolio of product and services. The popularities of

these banks can be gauged by the fact, that in as short span

of time, these banks have gained considerable customer

confidence and consequently have shown impressive growth

sales.

CLASSIFICATION OF BANKS

Banks are classified into several types based on the

function they perform. Generally banks are classified into

1. Investment banks

2. Exchange banks

3. Commercial banks

Govt. R.C. College of Commerce & Management 18

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

4. Co-operative banks

5. Land development banks

6. Savings banks

7. Central banks

FUNCTIONS OF BANKING

A. The main functions are as follows;

1. Borrowing of money in the form of deposits.

2. Lending or advancing of money in the form of different

types of loan.

3. The drawing, making, accepting, discounting, buying

and selling, collecting and dealing in bills of exchange,

promissory notes, coupons, drafts, bills of lading, railway

receipts, warrants, debentures, certificates, securities

both negotiable and non-negotiable.

4. The granting and issuing of credit, travelers cheques,

etc.

Govt. R.C. College of Commerce & Management 19

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

5. The acquiring, holding, issuing on commission,

underwriting, dealing in stock, funds, shares,

debentures, bonds, securities of all kinds.

6. Providing safe deposits vaults.

7. Collecting transmitting of money and securities.

8. The purchasing and selling of bonds scripts and other

forms of securities on behalf of constituents or others.

9. Buying and selling of foreign notes.

B. The subsidiary functions are as follows;

1. Acting as agents for governments or local

authorities or any other persons.

2. Carrying out agency business of any description.

3. Contracting for public and private loans and

negotiation and issuing the same.

4. Carrying on guarantee and indemnity business.

5. Managing to sell and realize any property or any

interest in any such property.

6. Undertaking and executing of trusts.

Govt. R.C. College of Commerce & Management 20

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

7. Granting of pensions and allowances and making

payments towards pensions.

Govt. R.C. College of Commerce & Management 21

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

CO-OPERATIVE BANKS

The Co operative banks in India started functioning

almost 100 years ago. The Cooperative bank is an important

constituent of the Indian Financial System, judging by the

role assigned to co operative, the expectations the co

operative is supposed to fulfill, their number, and the number

of offices the cooperative bank operate. Though the co

operative movement originated in the West, but the

importance of such banks have assumed in India is rarely

paralleled anywhere else in the world. The cooperative banks

in India play an important role even today in rural financing.

The businesses of cooperative bank in the urban areas also

have increased phenomenally in recent years due to the

sharp increase in the number of primary co-operative banks.

While the co-operative banks in rural areas mainly

finance agricultural based activities including farming, cattle,

milk, hatchery, personal finance etc. along with some small

scale industries and self-employment driven activities, the

co-operative banks in urban areas mainly finance various

categories of people for self-employment, industries, small

scale units, home finance, consumer finance, personal

finance, etc.

Govt. R.C. College of Commerce & Management 22

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Co operative Banks in India are registered under the Co-

operative Societies Act. The cooperative bank is also

regulated by the RBI. They are governed by the Banking

Regulations Act 1949 and Banking Laws (Co-operative

Societies) Act, 1965.

Cooperative banks in India finance rural

areas under:

1. Farming

2. Cattle

3. Milk

4. Hatchery

5. Personal finance

Cooperative banks in India finance urban

areas under:

1. Self-employment

2. Industries

3. Small scale units

Govt. R.C. College of Commerce & Management 23

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

4. Home finance

5. Consumer finance

6. Personal finance

According to NAFCUB the total deposits & landings of

Cooperative Banks in India is much more than Old Private

Sector Banks & also the New Private Sector Banks. This

exponential growth of Co operative Banks in India is

attributed mainly to their much better local reach, personal

interaction with customers and their ability to catch the nerve

of the local clientele.

EVOLUTION OF CO-OPERATAIVE BANK IN INDIA

The Cooperatives were first started in Europe to serve

the credit-starved people in Europe as a self-reliant, self-

managed people’s movement with no role for the

Government. British India replicated the Raiffeisen-type

cooperative movement in India to mitigate the miseries of

the poor farmers, particularly harassment by moneylenders.

The first credit cooperative society was formed in

Banking in the year 1903 with the support of Government of

Bengal. It was registered under the Friendly Societies Act of

the British Government. Cooperative Credit Societies Act of

Govt. R.C. College of Commerce & Management 24

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

India was enacted on 25th March 1904. Cooperation became

a State subject in 1919. In 1951, 501 Central Cooperative

Unions were renamed as Central Cooperative Banks. Land

Mortgage Cooperative Banks were established in 1938 to

provide loans initially for debt relief and land improvement.

Cooperatives have played an important role in the

liberation and development of our country. The word

Cooperative has become synonymous for dedicated and

efficient management of rural credit system. Reserve Bank of

India started refinancing cooperatives for Seasonal

Agricultural Operations from 1939. From 1948, Reserve Bank

started refinancing State Cooperative Banks for meeting the

credit needs of Central Cooperative Banks and through them

the Primary Agricultural Cooperative Societies. Only 3% of

rural families availed farm credit in 1951.

In 1954, the All India Rural Credit Survey Committee

recommended strengthening of DCC Banks and PACS with

State partnership and patronage to solve the farmers’ woes.

Registrar of Cooperative Societies became the custodian of

Cooperatives from 1962 with the enactment of respective

State Acts. Reserve Bank introduced Seasonality and Scale of

Finance for crop loans and provided for conversion,

replacement and reschedulement to tide over crop loss due

to calamities.

Govt. R.C. College of Commerce & Management 25

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

The Primary Agricultural Cooperative Societies became

multipurpose. Reorganization of PACS into viable units, FSCS,

LAMPS started under action programme of RBI in 1964. The

finding of All India Rural Credit Review Committee that

coverage of cooperatives is limited to hardly 30% of farmers

led to nationalization of Banks. However, Cooperatives have

played a key role in meeting the credit needs of weaker

sections of farmers.

The establishment of Regional Rural Banks from 1975

has not reduced the problems of rural credit as they reached

only 6% of the farmers. Cooperatives have contributed their

part in the implementation of 20-point programme and

Integrated Rural Development Programme. Though the

Cooperatives were lagging behind in rural credit till 1991,

they regained their prime place with 62% share in rural crop

loans between 1991 and 2001

DEFINITION OF CO-OPERATIVE BANKS:

In the words of Henry Wolff “Co-operative banking is an

agency which is in a position to deal with the small means on

his own terms”.

Devine defines “a mutual society formed composed and

governed by working people themselves for encouraging

Govt. R.C. College of Commerce & Management 26

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

regular saving and generating miniature loans on easy terms

of interest and repayments”.

FEATURES OF CO-OPERATIVE BANK:

1. They are organized and managed on the principles of

co-operation self-help and mutual help. They function

with the rule of “one member one vote”.

2. Co-operative banks perform all the main banking

function of deposit mobilization, supply of credit and

provision for remittance facilities.

3. Co-operative banks belong to the money market as

well as the capital markets.

4. Co-operative banks are perhaps the first

government supported agency in India.

5. Co-operative banks accept current, saving, fixed

and other types of time deposits from individuals and

institutions including banks.

6. Co-operative banks do banking business mainly in

the agricultural and rural sector.

7. Some co-operative banks are schedule co-

operative banks while others are non-schedule co-

operative banks.

Govt. R.C. College of Commerce & Management 27

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

8. Co-operative banks also required to comply with

requirement of statutory liquidity ratio [SLR] and cash

reserve ratio [CRR] liquidity requirements as other

scheduled and non-scheduled banks.

STRUCTURE OF COOPERATIVE BANKS

Co-operative

Banks

STATE URBAN

STATE LAND

CO- CO-

DEVELOPMEN

OPERATIVE OPERATIVE

T BANKS

BANKS BANKS

CENTRAL CENTRAL

CO- LAND

OPERATIVE DEVELOPME

BANKS NT BANKS

PRIMARY BRANCHES OF

PRIMARY

AGRICULTU STATE LAND

LAND

RAL CREDIT DEVELOPMENT

DEVELOPME

SOCIETIES BANKS

NT BANKS

REFORMS IN CO-OPERATIVE BANKS

Govt. R.C. College of Commerce & Management 28

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

The field of rural credit is so vast in India the problems

so diverse and complex and the field of experimentation so

wise that only if the important issues and challenges before

the rural credit are taken adequately cooperative banks as

major purveyors of rural credit would be able to make the

crucial difference in the lives of millions of our countrymen in

the countryside.

The financial sector reforms 1991 aimed at promoting a

diversified and efficient, competitive financial sector with the

ultimate objective of improving the efficiency of available

resources, increasing the return on investments and

promoting an accelerated growth of the real sector of the

economy. In conformity with this and banking sector reforms

gave raise to reforms in cooperative sector, which is an

integral part in delivery of rural credit and promote its

growth.

Reserve Bank of India has over the years put its faith in

cooperative banks as they hold a major share in agricultural

credit. With its number if branches it can percolate to all the

corners of the country. The Indian financial system has

undergone several changes and now comprises of

widespread network of financial institutions. Accordingly the

Govt. R.C. College of Commerce & Management 29

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

co-operative credit structure has also grown. Despite the

progress reforms are required to bring out efficiently reduce

non-performing assets and increase capital base.

These reforms aim at improving the financial health and

capabilities by prescribing prudential norms. Prudential

norms are required for cooperative banks to reduce non-

performing assets. Due to the non-performing assets co-

operative credit system is affected as a whole.

Govt. R.C. College of Commerce & Management 30

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

DEBT RECOVERY MANAGEMENT

INTRODUCTION:

The efficiency of a financial institution as a financial

intermediary depends to a great extent on timely recovery of

loans. Abnormal delay in recovery of loans builds up NPAs

which affect FI’s adversely with respect to liquidity and

impair their ability to service the maturing liabilities. The

blocked funds in NPAs increase the cost of financial

intermediary as FI’s resort to raising deposits and borrowings

at a higher cost as a measure to minimize the imbalance

between cash outflow and cash inflow arising out of the

NPAs. This has an adverse impact on the profitability of the

banks both in the short run and long run.

Good recovery is an important ingredient for profitability

of any financial institution as it leads to increased financial

capacity to deliver credit.

The business of a bank is managing risks and its

effectiveness lies in an efficient recovery management.

Better recovery performance corresponds to lower NPAs.

MEANING OF RECOVERY MANAGEMENT:

Govt. R.C. College of Commerce & Management 31

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Recovery Management is the process of planning,

testing, and implementing the recovery procedures and

standards required to restore service in the event of a

component failure; either by returning the component to

normal operation, or taking alternative actions to restore

service.

Recovery Management is the acknowledgement that

failures will occur regardless of how well the system is

designed. The intent is to anticipate and minimize the impact

of these failures through the implementation of predefined,

pretested, documented recovery plans and procedures.

DEBT:

The word debt comes from the Latin Debere which means “to

owe”.

DEFINITION OF DEBT:

According to Recovery of debts due to Banks and

Financial Institutions Act, 1993 debt means “Any

liability(inclusive of interest) which is alleged as due from any

person by a bank or a financial institution or by a consortium

of banks or FI’s during the course of any business activity

undertaken by the bank or the FI or the consortium under

any law for the time being in force , in cash or otherwise ,

whether secured or unsecured or whether payable under a

Govt. R.C. College of Commerce & Management 32

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

decree or order of any civil court or otherwise and subsisting

on , and legally recoverable on , the date of the application” .

RECOVERY:

In simple words recovery means to get back our own

thing back which we have given it to others. In banks

recovery means to get back the amount back which they

have given to the customers in the form of loans and

advances.

Recovery is “the process of regaining and saving

something lost or in danger of becoming costs”. Recovery is

a key to the stability of the banking sector.

OVERDUES, RECOVERY AND NPAs:

Overdues and Recovery:

The term "over dues" is used to convey the meaning

that installments of loans and Interest thereon are not paid

on due date.

The term "recovery" of dues relates to repayments of

loans and interest thereon in time. Therefore, over dues exist

if recovery of loans is not in time.

Govt. R.C. College of Commerce & Management 33

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

NON PERFORMING ASSETS

INTRODUCTION TO NON-PERFORMING ASSETS

Indian laws permitted banks to conceal much with the

result that the balance sheet and profit and loss account

rarely revealed the true state of their affairs.

The Narasimhan committee therefore strongly

emphasized the need for bringing transparency in the

financial statements of the banks and recommended for a

new set of formats for balance sheet and profit and loss

statements which were made effective from 1991-1992.

Banks provide loans advances subjects to borrowers

promise for the payment of principal and interest in the

future. In this process banks are exposed to various types of

risks including credit risk arising from Non-performing of

loans and defaults of borrowers.

Moreover with globalization and diversified ownership

where credit rating agencies constantly review the strength

of the banks managing the levels of NPAs assumes greater

importance.

The cost of financial intermediation by banks is high

partly because of the cross subsidization of NPA. NPAs are

inevitable burden of the banking industry. NPAs badly affect

Govt. R.C. College of Commerce & Management 34

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

the financial health of the banks. Hence control and

management of NPAs have assumed serious importance. It is

well known fact that NPAs are the threat on the profitability

of the banks because the banks have not only to make

provisions but they have to meet the cost of funding these

unremunerative assets.

ADVANCES IN THE BANKING SECTOR ARE CLASSIFIED

INTO TWO CATEGORIES ARE AS FOLLOWS:

Advances which are yielding revenue and there is no

immediate likelihood of their going other way called as

standard assets.

Advances which have stopped yielding revenue beyond a

period have the instances of irregularity in repayment,

chances of recovery bleak in some cases, chances of

recovery absolutely in some other cases categorized as

sub standard assets doubtful assets and loss assets

depending on their nature of irregularity and chance of

recovery.

MEANING OF NON-PERFORMING ASSETS

An asset is classified as non-performing asset

(NPAs) if dues in the form of principal and interest are not

paid by the borrower for a period of 180 days. However with

Govt. R.C. College of Commerce & Management 35

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

effect from March 2004, default status would be given to a

borrower if dues are not paid for 90 days. If any advance or

credit facilities granted by bank to a borrower become non-

performing, then the bank will have to treat all the

advances/credit facilities granted to that borrower as non-

performing without having any regard to the fact that there

may still exist certain advances / credit facilities having

performing status.

RBI GUIDELINES ON INCOME RECOGNITION

(INTEREST INCOME ON NPAS)

Banks recognize income including interest income on

advances on accrual basis. That is, income is accounted for

as and when it is earned.

The prima-facie condition for accrual of income is that it

should not be unreasonable to expect its ultimate collection.

However, NPAs involves significant uncertainty with respect

to its ultimate collection.

Considering this fact, in accordance with the guidelines

for income recognition issued by the Reserve Bank of India

(RBI), banks should not recognize interest income on such

NPAs until it is actually realized.

Govt. R.C. College of Commerce & Management 36

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

WHAT DOES ACCOUNTING STANDARD 9 (AS- 9) ON

REVENUE RECOGNITION ISSUED BY ICAI SAY?

The Accounting Standard 9 (AS 9) on `Revenue

Recognition' issued by the Institute Of Chartered Accountants

of India (ICAI) requires that the revenue that arises from the

use by others of enterprise resources yielding interest should

be recognized only when there is no significant uncertainty

as to its measurability or collectability.

Also, interest income should be recognized on a time

proportion basis after taking into consideration rate

applicable and the total amount outstanding.

IS RBI GUIDELINES ON NPAS AND ICAI ACCOUNTING

STANDARD- 9 ON REVENUE RECOGNITION CONSISTENT

WITH EACH OTHER?

In view of the guidelines issued by the Reserve Bank of

India (RBI), interest income on NPAs should be recognized

only when it is actually realized.

As such, a doubt may arise as to whether the aforesaid

guidelines with respect to recognition of interest income on

NPAs on realization basis are consistent with Accounting

Standard 9, `Revenue Recognition'.

Govt. R.C. College of Commerce & Management 37

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

For this purpose, the guidelines issued by the RBI for

treating certain assets as NPAs seem to be based on an

assumption that the collection of interest on such assets is

uncertain.

Therefore complying with AS- 9, interest income is not

recognized based on uncertainty involved but is recognized

at a subsequent stage when actually realized thereby

complying with RBI guidelines as well.

In order to ensure proper appreciation of financial

statements, banks should disclose the accounting policies

adopted in respect of determination of NPAs and basis on

which income is recognized with other significant accounting

policies.

RBI GUIDELINES ON CLASSIFICATION OF BANK

ADVANCES:

Reserve Bank of India (RBI) has issued guidelines on

provisioning requirement with respect to bank advances. In

terms of these guidelines, bank advances are mainly

classified into:

STANDARD ASSETS: Standard accounts are those

which are well conducted and in which no threat of

default. All “performing assets are to be classified as

“standard”.

Govt. R.C. College of Commerce & Management 38

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

SUB-STANDARD ASSETS: It is classified as non-

performing asset for a period not exceeding 18 months.

DOUBTFUL ASSETS: Asset that has remained NPA for

a period exceeding 18 months is a doubtful asset.

LOSS ASSETS: Here loss is identified by the banks

concerned or by internal auditors or by external auditors

or by Reserve Bank India (RBI) inspection.

In terms of RBI guidelines, as and when an asset

becomes a NPA, such advances would be first classified as a

sub-standard one for a period that should not exceed 18

months and subsequently as doubtful assets.

It should be noted that the above classification is only

for the purpose of computing the amount of provision that

should be made with respect to bank advances and certainly

not for the purpose of presentation of advances in the bank’s

balance sheet.

The Third Schedule to the Banking Regulation Act, 1949,

solely governs presentation of advances in the balance sheet.

Banks have started issuing notices under the

Securitization Act, 2002 directing the defaulter to either pay

back the dues to the bank or else give the possession of the

Govt. R.C. College of Commerce & Management 39

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

secured assets mentioned in the notice. However, there is a

potential threat to recovery if there is substantial erosion in

the value of security given by the borrower or if borrower has

committed fraud. Under such a situation it will be prudent to

directly classify the advance as a doubtful or loss asset, as

appropriate.

RBI GUIDELINES ON PROVISIONING REQUIREMENT OF

BANK ADVANCES:

As and when an asset is classified as an NPA, the bank

has to further sub-classify it into sub-standard, loss and

doubtful assets. Based on this classification, bank makes the

necessary provision against these assets.

Reserve Bank of India (RBI) has issued guidelines on

provisioning requirements of bank advances where the

recovery is doubtful. Banks are also required to comply with

such guidelines in making adequate provision to the

satisfaction of its auditors before declaring any dividends on

its shares.

In case of loss assets, guidelines specifically require that

full provision for the amount outstanding should be made by

the concerned bank. This is justified on the grounds that such

Govt. R.C. College of Commerce & Management 40

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

an asset is considered uncollectible and cannot be classified

as bankable asset.

Also in case of doubtful assets, guidelines requires the

bank concerned to provide entirely the unsecured portion

and in case of secured portion an additional provision of 20%-

50% of the secured portion should be made depending upon

the period for which the advance has been considered as

doubtful.

For instance, for NPAs which are up to 1-year old,

provision should be made of 20% of secured portion, in case

of 1-3 year old NPAs up to 30% of the secured portion and

finally in case of more than 3 year old NPAs up to 50% of

secured portion should be made by the concerned bank.

In case of a sub-standard asset, a general provision of

10% of total out standings should be made.

Reserve Bank of India (RBI) has merely laid down the

minimum provisioning requirement that should be complied

with by the concerned bank on a mandatory basis. However,

where there is a substantial uncertainty to recovery, higher

provisioning should be made by the bank concerned.

IMPACT OF NON PERFORMING ASSETS:

Govt. R.C. College of Commerce & Management 41

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

a) Non-Performing Assets are drag on profitability of

banks because besides provisioning banks are also

required to meet the cost of funding these unproductive

assets.

b) Non-Performing Assets reduce earning capacity of

assets. Return on assets also gets affected.

c) As Non-performing Assets not earn any income,

they adversely affect capital adequacy ratio.

d) No recycling of funds.

e) Non-Performing assets also attract cost of capital

for maintaining capital adequacy ratio.

f) Non-Performing assets demoralize the operating

staff and the stake holders.

g) It will badly affect the image of the bank

concerned.

h) Affect the moral of the employees and decisions

making for fresh loans suffer.

i) Enhances administrative, legal and recovery costs.

CONSEQUENCES OF NON-PERFORMING ASSETS

Govt. R.C. College of Commerce & Management 42

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

DIRECT:

A. It affects profitability of the unit substantially.

B. Affects banks credibility and render rising of fresh

capital from the market difficult.

C. Recycling of funds gets blocked.

INDIRECT:

A. Reduction in lending rate is made difficult.

B. Affect risk taking ability which ultimately affects

competitiveness of the branch unit.

C. Lack of market competitiveness results in slump in

credit expansion. The cost of poor quality loans is

shifted to bank customers through higher spread

OBJECTIVES OF DEBT RECOVERY MANAGEMENT

1. To review customer account details

2. To identify overdue transactions.

3. To resolve overdue and disputed transactions.

4. To reduce Non-Performing Assets and thereby avoiding

its impact on the performance of the bank.

Govt. R.C. College of Commerce & Management 43

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

5. To minimize the imbalance between cash outflow and

cash inflow arising out of the non performing assets.

FACTORS AFFECTING THE RECOVERY OF LOANS

BY BANKS:

The factors may be broadly classified in to two;

(1) INTERNAL FACTORS

A. BANKS RELATED:

Improper Identification Of Borrower

Lack Of Appraisal Skills

Delay In Loan Sanctioning

Lack Of Post-Disbursement Follow- Up

Poor Management Information System.

B. BORROWER RELATED

Diversion Of Funds

Willful Default

Govt. R.C. College of Commerce & Management 44

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Personal Accident, Death Etc.

Shifting Of Place Of Residence / Business

(2) EXTERNAL FACTORS

Natural Calamities

Loan Waiver, Write off etc.

Changes In Policy Environment

Changes In Economic Conditions

Legal Process

RECOVERY METHODS:

As soon as the borrower becomes defaulter, generally the

bank follows two methods of recovery.

1. General recovery methods.

Govt. R.C. College of Commerce & Management 45

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

2. Legal recovery methods.

GENERAL RECOVERY METHODS

The general recovery methods are usually the primary

collection process consists of the following activities.

AWARENESS CALLING: When the first payment is

due from the customer, a call is initiated to make him

aware of the date of payment of his dues to the bank.

Customer details are also verified during the process.

COLLECTION CALLING: This activity involves

contacting the customer over the phone, making him

aware that he has missed the due date and thereby

requesting him to pay the arrears at the earliest.

Repeat calls are made if the customer does not

honour his promises.

DEMAND NOTICES: In the event of the customer not

responding to the telephonic calls, a written

communication is issued to the customer informing

him of the status of the account and calling upon him

Govt. R.C. College of Commerce & Management 46

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

to effect payment towards the overdues in the

account.

FIELD COLLECTION: This activity involves meeting

the customer at his place of meeting or residence.

Repeat visits will be made to persuade the customer

to repay the loan or even to strike a compromise deal

if it is found that the financial position of the

customer has deteriorated as a result of which

recovery of the entire dues may not be possible.

Finally, if the customer has disappeared or refuses to

have any contact with the bank a final detailed notice

should be issued to the borrower through the legal

council better taking legal proceedings against him.

LEGAL RECOVERY METHODS:

When all efforts to recover an advance in the normal course

fail, banks have to resort to legal and other remedies. The

options available to banks are the following:

1. Civil Courts

2. Criminal Court

Govt. R.C. College of Commerce & Management 47

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

3. Lok Adalats

4. Debt Recovery Tribunals (DRT)

5. SARFAESI Act

a. Taking possession and sale of assets of the

borrower

b. Securitization of the debt and sale to Asset

Reconstruction Companies

6. Sale of Debt to other banks / NBFCs.

7. Compromise and write off

CIVIL COURTS

When all efforts to recover an advance fail, banks resort to

legal action. However, recovering any money through the

civil courts is a time consuming process due to the elaborate

procedures to be followed and the large number of cases

pending in all courts. Often it takes more than a decade to

effect recoveries. The procedure involved is as follows;

1. Bank’s lawyer will issue a notice (legal notice) to the

borrowers and guarantors giving them one more chance

to settle their dues within the time specified in the

notice.

Govt. R.C. College of Commerce & Management 48

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

2. On the borrowers/guarantors ignoring the legal notice

the bank’s lawyer will draft a “plaint” to be filled in the

court to initiate legal action. The plaint will be drafted

based on the information provided by the bank. The

plaint has to be drafted on judicial stamp paper of

required value, as specified by the state governments.

3. The plaints will be filed in the civil court under whose

jurisdiction the bank branch is.

4. The court will admit the case and allot a number

5. The court will issue a summons to the plaintiff (bank)

and defendants (borrowers and guarantors) to appear

before the court for a hearing.

6. If the defendants deny the allegations of the plaintiff,

which they usually do, the plaintiff is asked to prove the

charges made by them in the plaint.

7. The process of proving the charges could take several

hearings and stretch over a long period.

8. After the hearings are completed the court will deliver

its judgment.

9. If the court decides in favour of the bank, they will issue

a “decree” or order directing the defendants to pay the

amount decreed to the plaintiff and authorizing the

Govt. R.C. College of Commerce & Management 49

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

plaintiff to take possession and dispose of the securities,

if any, with the help of the court.

10. The plaintiff will file with the court a petition for

execution of the decree. The bank will request the court

to appoint a receiver to take possession of the securities

and dispose them off on behalf of the bank. In case it is

a clean advance, the bank has to ascertain the assets of

the borrowers / guarantors and provide the details in the

execution petition to enable the “receiver” to attach the

assets, take possession and sell them to recover the

dues to the bank.

CRIMINAL COURT

Under section 138 of Negotiable Instruments Act,

causing a cheque to be dishonoured is a criminal offence. If a

cheque is dishonoured, the payee can initiate criminal

proceedings against the drawer of the cheque, provided

notice of dishonour was given to him. Normally, before filing

a case the lawyer of the plaintiff would send a notice to the

drawer of the cheque and give him one more opportunity to

pay the amount of the cheque. Once a case is filed, the court

can impose a fine equivalent to twice the amount of the

cheque and / or imprison the drawer of the cheque for up to 2

years.

Govt. R.C. College of Commerce & Management 50

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Banks and finance companies resort to this remedy

whenever post dated cheques taken by them for payment of

loans / installments are dishonored.

LOK ADALATS

To facilitate speedy settlement of cases involving small

amounts and to reduce the burden on courts, the

Government of India passed the legal services authorities act

1987 under which the National Legal Services Authority was

set up. Similar authorities were set up at the state, district

and taluk levels too. The primary role of the agencies is to

resolve disputes, both civil cases involving amounts up to

Rs.10 lakhs and simple criminal cases including cases under

section 138 of NI Act for dishonour of cheques, through

reconciliation and settlement. When disputes are affected

through compromise the settlement is much faster. Such

settlements are effected by Lok Adalats which are run by the

respective legal services authority Lok Adalats which are run

by the respective legal services authority. Lok Adalats do not

levy any charge from the parties to the dispute. Their role is

conciliatory only and cannot hear arguments and pass an

Govt. R.C. College of Commerce & Management 51

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

order like a court. The orders passed by Lok Adalats have the

legal status of Decrees issued by courts.

Lok Adalats can entertain only cases referred to them by

civil and criminal courts or the legal service authority. No

other person can directly approach a Lok Adalat. Parties to

the dispute have to first file a case in a civil court. After

hearing both the sides, if the court decides that it is a fit case

for compromise, the court may refer it to the Lok Adalat for

settlement.

The Lok Adalats are presided over by the judges of

courts, as an additional responsibility. The judge of a district

court may also head a Lok Adalat at the centre. As a district

judge, he may refer a case to the Lok Adalat and then decide

the case as the presiding officer of the Lok Adalat. If the

Adalat is not able to work out a compromise, the parties can

continue the case in the court.

DEBT RECOVERY TRIBUNALS

Alarmed by the large amounts of bank funds blocked in

litigation, government if India passed the recovery of debts

Govt. R.C. College of Commerce & Management 52

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

due to banks and financial institutions act in 1993, under

which a new set of institution called debt recovery tribunals

or DRTs were set up to deal with cases for recovery of dues

to banks and financial institutions, expeditiously. DRTs being

tribunals and not courts are not required to follow the

elaborate procedures that courts are required to follow under

the civil procedure code. Hence they are able to dispose of

cases expeditiously. Further, since they deal with only cases

relating to dues to banks and FIs, they have developed

necessary expertise to deal with such cases which also

facilitates speedy disposal. To prevent DRTs from getting

clogged with small value cases, it has been specified that

only cases for Rs.10 lacs and above can be filed with DRTs.

THE PROCEDURE INVOLVED IN DRT PROCEEDINGS ARE:

1. Filing of application with the registrar of DRT.

2. Admission of the application after scrutiny and allotment

of number by the registrar.

3. Issue of summons by the presiding officer. Repeated

attempts are made till the summons is served. In case

summons cannot be served in the usual manner

summons could be made by publication in newspapers.

4. Once the summons is served the case is listed for

hearing by the presiding officer.

Govt. R.C. College of Commerce & Management 53

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

5. In case the bank seeks any interim order such as

attachment of the security an affidavit has to be

submitted to the presiding officer on the case being

listed.

6. Within 30 days of receipt of summons the defendants

have to file their written statements on the points raised

by the bank in their interrogatory.

7. At the subsequent hearings the arguments of the parties

will be heard, witnesses will be examined and

documentary proof presented by the parties examined

by the presiding officer.

8. The presiding officer will pass final orders, asking the

defendants to pay the amount that is proved to be

owing by them within the permitted period.

9. If the defendants do not pay the amount within the

permitted period, the presiding officer will issue a

“Recovery Certificate”. Details of the security will be

given in the RC.

10. The recovery officer will issue a demand notice

asking the defendants to pay the due to the bank.

11. If the defendants do not pay the amount due within

15days from the date of receipt of the RC, the recovery

officer will attach the properties of the defendants,

Govt. R.C. College of Commerce & Management 54

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

appoint a receiver to manage the properties and auction

them. Even without appointment of ea receiver the

recovery officer can proceed to sell the attached

properties.

12. The recovery officer has powers to order arrest of

the defendants in case they refuse to pay the dues

despite having the means to pay or obstructs recovery

proceedings by trying to abscond, removing / alienating

his properties or giving false information about his

properties.

Recovery of debt through DRT being much faster than

through civil courts, banks have practically stopped filing civil

suits for recovery except for recovery of amounts up to Rs.10

lakhs for which there is no other alternative.

SARFAESI Act

The Securitization and Reconstruction of Financial

Assets and Enforcement of Security Interest Act were passed

in 2002 to give greater powers to banks to recover amounts

due to them. The act also facilitated sale of loans by the

banks to asset Reconstruction Companies.

Govt. R.C. College of Commerce & Management 55

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

• Recovery of debt without intervention of DRT/court

• The SARFAESI Act authorizes banks to do the following

without the intervention of the court or DRT provided at

least 75% of the secured creditors, by value, of the

company agree to initiate action under SARFAESI act:

• Issue a notice and restrain the borrower from

transferring the charged assets by sale or lease.

• Take possession of the charged assets of the borrower,

subject to giving a notice period of 60 days to enable

the debtor to pay their dues.

• Appoint a person to manage the assets taken over

(similar to appointment of receiver)

• Sell the charged assets.

• Order those who owe money to the borrowers to deposit

the amounts with the bank(similar to issuing garnishee

order)

Effectively, the act authorizes banks to do all that is

necessary to recover money due to them without having to

go to DRT or court. The only limitation is that the bank should

be a secured debtor to initiate action under SARFAESI Act.

Banks can take action under SARFAESI Act even when a case

relation to the same debt is pending in a DRT or a court.

Govt. R.C. College of Commerce & Management 56

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Since banks can recover only secured debt under SARFAESI

Act, they need the help of DRT for recovery of unsecured

debt. Bank can initiate action under the SARFAESI Act even in

the case of a company under liquidation. However, the banks

have to give an undertaking to the official liquidator that out

of the sale proceeds, the amounts due under the Workmen

Compensation Act will be paid first.

In case the borrower has a grievance against the bank

that has initiated proceedings under SARFAESI Act, they can

file an appeal with the local DRT after depositing with them

50% of the dues to the bank. This condition has been

stipulated to prevent frivolous appeals to prevent banks from

proceeding under the SARFAESI Act.

While the DRT Act and SARFAESI Act have improved the

recoverability of bad debts fact remains that it involves a lot

of effort, cost and time. Legal remedies are inherently time

consuming even if they are administered by the banks

themselves or by specialized institutions like DRT. Since

recovering bad debts as expeditiously as possible is

beneficial to banks in terms of being able to redeploy the

funds profitably and using the time and effort spent on

recovery for generating new business, banks prefer to

recover bad debts by sale to others who are willing to buy the

bad debts at a discount or by making a compromise

Govt. R.C. College of Commerce & Management 57

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

settlement with the borrowers themselves and waiving some

portion of the dues in return or recovering the balance

amount immediately.

SECURITIZATION OF DEBT AND SALE TO ARC’S

SARFAESI Act authorized setting up of Asset

Reconstruction Companies (ARCs) to enable banks to get rid

of their NPAs by selling them to ARCs. The RBI was

authorized to issue detailed guidelines regarding ARCS and to

regulate them.

ARCs primary business being buying and recovering bad

loans, they are in a better position to pay focused attention

to recovery of bad loans and to develop necessary expertise

in the activity. The banks are benefited as the bad loans are

moved out of their balance sheet, which helps them to

present a better financial picture. The bad loans are

transferred to ARCs at a discount to the book value so that

the ARC can earn a profit from the activity. For instance, if

the loan outstanding is Rs.23lacs, an ARC may take it over at,

say Rs.19 lacs. The sale price will be decided by mutual

agreement. At the time of takeover, the ARC will issue

Security Receipt for Rs.19 lacs to the Bank. As and when

recoveries are made, the amount, less expenses incurred for

recovery, will be paid by the ARC to the bank. Any recovery

Govt. R.C. College of Commerce & Management 58

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

in excess of Rs. 19 lacs will usually be shared at some pre-

decided ratio between the ARC and bank. ARC’s profit comes

from such excess recovery.

If the entire or part of the amount is not recovered even

after 5 years, the bank has to buy back the unrecovered

portion of the loan from the ARC and make a provision in

their books.

Every year the portfolio taken over by ARC has to be

rated by CRISIL. If according to their assessment the amount

recoverable is less than the amount of the outstanding

security receipt, the bank has to make a provision for the

short fall. For instance, suppose the ARC does not recover

any part of the Rs.19 lacs during the first year. At the end of

the first year, if CRISIL assesses the recoverable amount to

be Rs.17.5 lakhs only, the bank has to make a provision of

Rs.1.5lacs to cover the shortfall.

SALE OF NPAS TO OTHER BANKS/NBFCs

Some banks like Kodak Band and Standard Chartered

Bank have created a business out of bad loans. They buy bas

loans from other banks at a discount with a view to make a

profit from higher recoveries. They have set up specialized

departments for buying and recovering bad loans. The prices

at which bad loans are sold are decided mutually by the

selling and buying banks. The selling bank gets immediate

Govt. R.C. College of Commerce & Management 59

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

cash for loans sold and gets rid of the bad loans from their

balance sheet. Sale of bad loan to another bank is more

attractive to banks compared to sale to ARCs because of

immediate receipt of cash as against receipt of Security

Receipt from ARCs. RBI has issued the following guidelines

with respect to sale of bad loans by a bank to another bank

or NBFC.

• Banks can sell only assets which have remained

NPAs in their books for at least two years.

• The sale has to be on without recourse basis, i.e.,

the entire risk should pass on to the buyer.

• The buyer has to make upfront payment. The price

cannot be contingent upon recovery.

• The selling bank cannot buy back the assets sold.

• The selling band cannot provide and guarantee or

other comforts to the buyer.

• The buyer cannot sell the asset purchased from

one bank to another bank within 15 months from the

date of purchase.

The buyer has to do all due diligence before negotiating a

price and buying the bad assets. The seller can sell individual

assets or a pool of assets as one unit.

Govt. R.C. College of Commerce & Management 60

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

COMPROMISE SETTLEMENTS AND WRITE OFF

A. Compromise settlements

Since legal remedies take time and sale of bad debts to

ARCs and other banks involve large discounts, banks find it

more expedient to effect compromise settlements with the

borrowers and recover as much of the bad debts as possible.

In certain situations like defective documents or poor security

cover, compromise settlement may be the only viable option

as legal remedies or sale of asset may not be possible at all.

The starting point in negotiating a compromise

settlement is crystallizing the total amount due. This would

include the following;

a. Balance Outstanding In The Account

Principal

Unpaid interest

Unpaid penal interest

b. Uncharged interest from the date the account

became NPA till the date of settlement.

c. Expenses incurred since the account became NPA

Govt. R.C. College of Commerce & Management 61

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Insurance premium paid

Expenses on security arrangements, if any

Legal expenses

When negotiating compromise settlements, banks are guided

by the following factors;

a. Value of security available.

b. Likely time taken for realization of the security

c. Likely cost involved in making the recoveries

d. The present value of the likely net cash inflows from

the above discounted at a reasonable rate of interest.

e. The sacrifice to be made in terms of

Waiver of unpaid interest / penal interest

Waiver of uncharged interest

Write off of principal amount

f. Whether the provision made in the account is

sufficient to cover the concessions or whether the

account has already been written off.

g. Impact on profit and loss account in the current year;

amount of concession in excess of provision available

Govt. R.C. College of Commerce & Management 62

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

will reduce current year profit, if the provisions are

more than the concessions there will be a net credit

to the profit and loss account. Similarly if the account

has already been written off, any recovery will help to

increase the current year profits.

B.WRITE OFF

Banks make provision to cover NPAs as per guidelines

issued by RBI. While the NPA will remain as a debit balance in

the advances accounts, the provisions will accumulate as a

credit balances in the provisions account. The total amount of

NPAs outstanding in the books is known as Gross NPA. The

Gross NPA less the provisions made against them is called

Net NPA. Effectively the net NPA is the actual bad debts of

the bank.

Banks continue to carry both the NPA and the provisions

in their books rather than adjusting the provisions against the

balance in the accounts in the hope that the bad debt will be

recovered, in which case the provision can be credited back

to the profit and loss account or used to cover another bad

accounts. A point comes when the provisions made for an

account has to be adjusted against the balance in the

account by debiting the provision account and crediting the

advance account. Setting of the provision against the debit

Govt. R.C. College of Commerce & Management 63

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

balance in the advance account is called write off. When an

account is written off, the balances in both the provision

account and the advance account come down.

Writing off the balance in an account does not take

away the right of the bank to recover the amount from the

customer. Even after write off banks continue their recovery

efforts including cases filed with DRT. Banks maintain records

of all written off accounts to facilitate such recovery efforts.

Govt. R.C. College of Commerce & Management 64

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

CHAPTER-02

RESEARCH DESIGN

TITLE OF THE STUDY:

“An Exploratory study on Debt Recovery

Management of co-operative banks with

special reference to The Bangalore City Co-

operative Bank Ltd”.

STATEMENT OF THE PROBLEM:

Banks were never so serious in their efforts to ensure

timely recovery and consequent reduction of NPA’s as they

are today. As we all know growing percentage of non-

performing assets is a big concern for modern as well as

traditional financial institutions. If recovery is been made

effective then certainly it will reflect positively on reducing

percentage of NPA’s. So recovery management, of fresh

Govt. R.C. College of Commerce & Management 65

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

loans or old loans, is central to NPA management. Hence the

focus is on Debt Recovery Management of “The BCCB Ltd.”

Govt. R.C. College of Commerce & Management 66

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

OBJECTIVES OF THE STUDY:

(1) To study the objectives of Debt Recovery

Management of the bank.

(2) To study the Debt Recovery Policy and Debt

Recovery Methods of the bank.

(3) To study the position of NPA’s in the bank.

(4) To understand how non-performing asset affect the

performance of the bank.

(5) To offer suggestions on the basis of analysis and

interpretations made.

SCOPE OF THE STUDY:

The scope of this study is limited only to the study of

Debt Recovery Management in “The Bangalore City Co-

operative Bank Ltd”.

RESEARCH METHODOLOGY:

The methodology used in the study is an exploratory

research design and in order to arrive at the above objective

both primary data and secondary data has been collected.

Govt. R.C. College of Commerce & Management 67

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

1. PRIMARY DATA: “Primary data is first hand information

which is collected a fresh and thus happens to be original

in character”.

This data is collected through personal discussions with

the DEPUTY GENERAL MANAGER, ASSISTANT GENERAL

MANAGER and other officials in charge of recovery

department through structured questionnaire were held.

2. SECONDARY DATA: “Secondary data are those which

have already been passed through the statistical process”

This data is collected through Annual Reports of the bank,

Books on Research Topic, Journals, and Websites.

PLAN OF ANALYSIS:

The data collected is raw and it is complied, classified,

tabulated and then analysed using statistical tools like simple

percentages. Graphs and Charts are used to highlight the

statistics. Based on these data analysed and interpreted,

suggestion and conclusions are drawn.

LIMITATIONS OF THE STUDY:

Govt. R.C. College of Commerce & Management 68

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

Due to time constraint depth analysis could not be made.

Some of the information is considered confidential and not

available for the study.

The data taken for analysis and interpretation is for a

limited period (only the recent three years data has been

considered i.e. from 2006-07 to 2008-09).

The study is confined to only one Bank i.e., The Bangalore

City Co-operative Bank Ltd.

The study is subject to the views and statistics as

expressed by the concerned officials of the bank.

CHAPTER LAYOUT:

The chapter layout of this project is as follows.

CHAPTER-1: INTRODUCTION

CHAPTER-2: RESEARCH DESIGN

CHAPTER-3: BANK PROFILE

CHAPTER-4: ANALYSIS AND INTERPRETATION OF DATA

CHAPTER-5: SUMMARY OF FINDINGS, SUGGESTIONS

AND CONCLUSION

Govt. R.C. College of Commerce & Management 69

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

BIBLIOGRAPHY AND ANNEXURE

CHAPTER – 03

BANK PROFILE

History of “The Bangalore City Co-Operative Bank

Limited”

“THE BANGALORE CITY CO-OPERATIVE BANK LIMITED” was

the first urban co-operative bank in the country started in April 06,

1907 by Sri.K.Ramaswamy and others.

[Administrative Office: No.3, Pampamahakavi Road, Chamarajpet,

Bangalore – 560018.]

The Bangalore City Co-operative Bank Limited was

established under the Co-operative society act bearing

Govt. R.C. College of Commerce & Management 70

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

registration number 314/CS, dated 08.04.1907 from the Registrar

of Co-operative Societies in Karnataka and the License was

granted by RBI No.UBD/KA/642, dated 11.11.1986 for conducting

the “Banking Business”. The bank has 12 branches along with one

administrative office and all branches have been

computerized under the jurisdiction of Bangalore

City Co-operative Corporation, Bangalore

Development Authority and Bangalore urban &

peripheral areas. The operation of the bank is

throughout Bangalore Co-operative Limited.

Trademark of “The Bangalore City Co-operative

Bank Ltd”:

In consideration of the application submitted to the Govt. of India,

to get registered the above image of godess Lakshmi as

Trademark, as per the Trademark Act of 1959, sec 23(2), rule

62(1) Trademark No.943843 dated 31-7-2000 the Govt. approved

and registered the above image as a trademark and has been

given letter of approval on 15-03-2008.

GOALS AND OBJECTIVES OF THE BANK:

The Bangalore City Co-operative Bank Ltd., believes that every

individual from each status of society needs affordable, relevant

and quality services. The goals and objectives of bank are as

follows;

1. To take measures / steps to increase the deposits to

Rs.500 crores and loans and advances to Rs.370 crores.

Govt. R.C. College of Commerce & Management 71

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”

2. To earn more than Rs.9 crores of net profit.

3. To reduce the net non-performing assets to 0%.

4. To give more advantages to customers by converting

all the branches into core- banking system.

5. To take steps to have own building for all the branches.

6. To provide more and more training and development

programmes to increase efficiency of employees.

7. To encourage savings, self help and co-operative

principles among the members and depositors of the bank.

8. To undertake banking transaction and co-operative

system as per direction of RBI, Central Government and

State Government.

9. To reduce the cost of the management through the

honorary services of members and thereby keep the cost of

credit as low as possible.

10. To promote the effectiveness of credit and to reduce

the risk in granting a credit through careful and continuous

supervision of the operations of the borrowing members.

VISION STATEMENT

OUR VISION IS OUR MISSION

Founded in 1907, this unique financial institution rests on

the pillars of thrift, fellowship, character, accommodation and the

selfless service of all individuals and organizations who wish to

help themselves progress. We see ourselves as a family of honest,

loyal and committed professionals, harmoniously employing

Govt. R.C. College of Commerce & Management 72

An Exploratory study on Debt Recovery Management at “The BCCB Ltd”