Mohave Tax Appeal

Diunggah oleh

surgen602Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Mohave Tax Appeal

Diunggah oleh

surgen602Hak Cipta:

Format Tersedia

PETITION FOR REVIEW OF REAL PROPERTY VALUATION

PURSUANT TO A.R.S. TITLE 42, Ch. 15, Art. 3 and Ch. 16, Art. 1-5

FILED FOR TAX YEAR ________

See instructions for complete filing

• In all counties EXCEPT Maricopa and Pima, mail or hand deliver all copies of this completed petition to the County Assessor EXCEPT

the last page. Retain the last page “Taxpayer Copy” as your receipt. In Maricopa and Pima Counties, submit ONLY the Assessor’s

copy and retain remaining copies. Taxpayers receiving a Notice of Value have sixty days from the date the notice was mailed to file this

petition. United States Postal Service postmark dates are evidence of the dates petitions were filed and decisions were mailed.

• The County Assessor reserves the right to reject any petition not meeting statutory requirements. Only one petition for each parcel

or economic unit will be accepted. Any duplicate petitions will be returned.

• IMPORTANT: COMPLETE SECTIONS 1 THROUGH 10 WHERE APPLICABLE. SHADED AREAS ARE FOR OFFICIAL USE ONLY.

1. DATE FILED __________________ COUNTY __________________ BOOK ________________ MAP _________ PARCEL _____________

2. PROPERTY ADDRESS OR LEGAL DESCRIPTION: _______________________________________________________________

3. IF THIS IS A MULTIPLE PARCEL APPEAL CHECK HERE . ATTACH A MULTIPLE PARCEL APPEAL FORM (DOR 82131). SEE INSTRUCTIONS.

4. USE OF PROPERTY: COMMERCIAL / INDUSTRIAL (SPECIFY TYPE: Apartment, Office, warehouse, etc.) ________________

VACANT LAND AGRICULTURAL OTHER

5A. TYPE OR PRINT OWNER’S NAME. 5B. MAIL DECISION TO (PRINT OR TYPE):

NAME NAME

ADDRESS ADDRESS

CITY STATE ZIP CITY STATE ZIP

5C. IF OWNERSHIP HAS CHANGED CHECK HERE . ATTACH RECORDED DOCUMENTATION.

6. PETITION COMPLETED BY: (Specify Owner, Agent, Attorney, etc.)

NAME TELEPHONE

ADDRESS CITY STATE ZIP

AGENTS ONLY: STATE BOARD OF APPRAISAL NUMBER ______________________ STATE BOARD OF EQUALIZATION NUMBER

7. BASIS FOR PETITION: MARKET SALES APPROACH COST APPROACH INCOME APPROACH OTHER (explain below)

Additional documents submitted must contain the book, map, and parcel number and be attached to the petition. Evidence contained in this appeal

could be the basis for either increasing or decreasing the valuation or changing the legal classification of the property.

8. VALUE SHOWN ON LIMITED

FULL CASH PROPERTY LEGAL ASMT

NOTICE OF VALUE VALUE $ VALUE $ CLASS RATIO

9. OWNER’S OPINION FULL CASH LIMITED

PROPERTY LEGAL ASMT

OF VALUE VALUE $ VALUE $ CLASS RATIO

10. I HEREBY AFFIRM THAT THE INFORMATION INCLUDED OR IN MARICOPA AND PIMA COUNTIES ONLY: Check here

ATTACHED IS TRUE AND CORRECT. if you want this appeal to be heard “On The Record”. This means

that neither you nor the Assessor will appear in person before the

X________________________________________________________ State Board of Equalization to offer testimony. Submit any additional

SIGNATURE OF PROPERTY OWNER OR REPRESENTATIVE

written or typed information with this appeal.

________________________ ___________________________

TELEPHONE EMAIL ADDRESS CHECK HERE TO REQUEST A MEETING WITH THE ASSESSOR.

ASSESSOR’S FULL CASH LIMITED LEGAL

PROPERTY ASMT

DECISION VALUE $ VALUE $ CLASS RATIO

BASIS FOR DECISION:

FOR OFFICIAL USE ONLY

FOR OFFICIAL USE ONLY

DATE RECEIVED DATE DECISION MAILED REVIEWED BY ASSESSOR OR CHIEF DEPUTY

COUNTY BOARD OF LIMITED

EQUALIZATION FULL CASH PROPERTY LEGAL ASMT

DECISION VALUE $ VALUE $ CLASS RATIO

BASIS FOR DECISION:

DATE RECEIVED DATE DECISION MAILED CHAIRMAN OR CLERK OF THE BOARD

DOR 82130 (12/06) ASSESSOR COPY

ADMINISTRATIVE APPEALS PROCEDURES

STEP I - APPEALS TO THE ASSESSOR

• FILING DEADLINE: File petitions with the County Assessor in the county in which the property is located

within sixty days of the date postmarked on the Notice of Valuation.

• IN ALL COUNTIES EXCEPT MARICOPA AND PIMA: Mail or hand deliver the first two copies of the

completed Petition for Review to the County Assessor. Retain the last page “Taxpayer Copy” as your

receipt.

• IN MARICOPA AND PIMA COUNTIES: Mail or hand deliver ONLY the top copy of the completed Petition

for Review to the County Assessor. Retain the remaining copies for possible further appeals.

• You may file an appeal on your own or you may name an agent to represent you in the administrative

appeals process. If an agent is designated, an Agency Authorization form (DOR 82130AA) must accompany

the Petition for Review.

• Only one appeal for each parcel or economic unit will be accepted by the Assessor. Any duplicate petitions

will be returned.

The County Assessor reserves the right to reject any petition not meeting statutory requirements. If the Assessor

rejects your petition for failure to include substantial information, you may file an amended petition within fifteen

days after the rejection notice was mailed. If the rejection notice is mailed by the Assessor on or before June 15,

you may file an amended appeal with the County Assessor. If the rejection notice is mailed by the Assessor after

June 15, you may file an amended appeal to the State Board of Equalization in Maricopa and Pima counties, or

to the County Board of Equalization in all other counties.

• The Assessor must rule on all appeals no later than August 15. If your request has been denied, you may

file an appeal with the County Board or State Board of Equalization.

STEP II - APPEALS TO EITHER THE COUNTY OR STATE BOARD OF EQUALIZATION

• Appeals in Maricopa and Pima Counties MUST be filed with the STATE Board of Equalization (SBOE).

If you are a tax agent, contact the SBOE at (602) 364-1600 for the SBOE number required in item 6. Appeals

in all other counties MUST be filed with the COUNTY Board of Equalization in the county in which the

property is located.

• File the Petition for Review within twenty-five days after the Assessor’s decision is mailed.

• In Maricopa and Pima counties, Rules of the SBOE containing filing requirements can be obtained by

calling (602) 364-1600 or by accessing the State Board’s Web site @ http//www.sboe.state.az.us. For

appeals filed in Maricopa and Pima counties, include a copy of the Assessor’s original Notice of Valuation.

• You may request that your appeal to the SBOE be reviewed “On The Record” by checking the appropriate

box in item 10 of the petition form. There will be no appearance before the Board and no oral testimony will

be permitted. However, you may submit written evidence for consideration.

• Include a copy of the Agency Authorization form, if applicable, and the Assessor’s decision with the petition

if it is on a separate form.

• Both the State and County Board of Equalization must rule on all appeals no later than October 15.

APPEALS TO TAX COURT

• If you have filed an appeal through the administrative appeals process, you may appeal to the Tax Court

within sixty days of the mailing date of the most recent administrative decision. If you file an appeal with the

Court, the administrative appeals process is suspended pending a determination by the Court.

• If you have not started the administrative appeals process, you may appeal directly to the Tax Court on or

before December 15 of the valuation year.

SEE NEXT PAGE FOR INSTRUCTIONS ON COMPLETING THE PETITION FOR REVIEW

DOR 82130-I (11/04)

INSTRUCTIONS

PETITION FOR REVIEW OF VALUATION

Information necessary to complete this petition is contained on the Notice of Valuation. Additional

information regarding your property value or classification may be obtained from the County Assessor

of the county in which the property is located.

• The following forms may need to be used in conjunction with the Petition for Review (DOR form 82130) in

the administrative appeals process and can be obtained from your local County Assessor:

1. Agency Authorization form (DOR 82130AA)

2. Appropriate Income and Expense Statement from the DOR 82300 series.

3. Multiple Parcel Appeal form (DOR 82131)

4. Agricultural Land Use Application (DOR 82916)

COMPLETING THIS FORM

• Complete items 1 through 10 where applicable and retain the last page “Taxpayer Copy” as your receipt.

• You MUST state the method or methods of valuation on which you are basing your appeal in item 7 and

provide substantial information justifying your opinion of value.

If your appeal is based on:

1. The market sales approach, include the full cash value for at least one comparable property within the

same geographic area as the property in question or the sale of the property in question.

2. The cost approach, include all costs (materials, labor, architectural fees, construction finance costs,

builder’s profit) to build or rebuild the improvement(s), plus the land value.

3. The income approach, include a completed and notarized Income and Expense Statement (DOR) 82300

and the appropriate Supplement for the type of property (DOR 82300-1 through DOR 82300-7).

• If you are appealing to obtain qualified agricultural classification, provide the Assessor with a completed

Agricultural Land Use Application form (DOR 82916) together with substantial information justifying your appeal.

MULTIPLE PARCEL APPEAL

• You may file an appeal for more than one parcel if all of the parcels are one of the following:

1. Part of the same economic unit. An “Economic Unit” is a combination of parcels in which land and

improvements are used for mutual economic benefit. An economic unit may be comprised of properties

which are neither contiguous nor owned by the same owner. However, they must be managed and

operated on a unitary basis and each parcel must make a functional contribution to the operation of

the unit. “Functional Contribution” is a positive economic benefit created by the use of an individual

parcel in an economic unit.

2. Owned by the same owner, have the same use, have the same appeal basis, and are located in the

same geographic area. Criteria for determination of “Same Use” includes, but is not limited to, legal

class, property use code, unit value, and zoning. “Geographic Area” means an area for which common

property valuation characteristics may reasonably be identified, such as a subdivision, neighborhood,

market area, or an Assessor’s book and map.

• It is strongly recommended that only parcels with common ownership, physical characteristics and

location be included on a Multiple Parcel Appeal form (DOR 82131). Failure to file multiple parcels under

the above conditions could result in a decision based on incomplete information or a possible denial of

the appeal. In Items 8 and 9 of the petition form, enter the total full cash and limited values for all parcels

included in the appeal.

• You may request a meeting with the County Assessor by checking the appropriate box in item 10. If you

are unable to meet with the Assessor at the time and place set by the Assessor, you may wish to submit

written evidence to support the petition before the date of the meeting. All issues you wish to appeal must

be included on the Petition for Review.

Anda mungkin juga menyukai

- Application For Michigan Vehicle Title: Use Tax Return Claim For Tax ExemptionDokumen1 halamanApplication For Michigan Vehicle Title: Use Tax Return Claim For Tax ExemptionNancyBelum ada peringkat

- Maritime LienDokumen1 halamanMaritime LienRohan Moxley100% (1)

- tr-11L 16050 7Dokumen1 halamantr-11L 16050 7d4rk3Belum ada peringkat

- LD 0274Dokumen3 halamanLD 0274thomasjchen888100% (1)

- Reg138 PDFDokumen2 halamanReg138 PDFManny TileBelum ada peringkat

- Gehl Finance ApplicationDokumen1 halamanGehl Finance ApplicationRazvan MitruBelum ada peringkat

- SA Rental ApplicationDokumen2 halamanSA Rental ApplicationGvz HndraBelum ada peringkat

- Texas Certificate of TitleDokumen2 halamanTexas Certificate of TitleArq Isaac TriujequeBelum ada peringkat

- Uscg Document Change FormDokumen2 halamanUscg Document Change FormDoug Gould100% (2)

- Liberian SIRB Form PDFDokumen2 halamanLiberian SIRB Form PDFArpit Roy100% (1)

- LD0274Dokumen3 halamanLD0274Isaiah SikoraBelum ada peringkat

- CG1258Dokumen4 halamanCG1258Fred beyBelum ada peringkat

- TDI-46 Draft Template - a1j53000003I5zpAACDokumen4 halamanTDI-46 Draft Template - a1j53000003I5zpAACnga23sem33300Belum ada peringkat

- ONLINE - Property, Casualty, Marine Claim Form 2020Dokumen2 halamanONLINE - Property, Casualty, Marine Claim Form 2020kimdodok123Belum ada peringkat

- BBFS IndividualDokumen1 halamanBBFS IndividualMuhammad IqbalBelum ada peringkat

- Affadavit On Assets and LiabilitiesDokumen5 halamanAffadavit On Assets and LiabilitiesvamseeBelum ada peringkat

- CG-1258 - USCG Documentation FormDokumen4 halamanCG-1258 - USCG Documentation Formkeithfrost84Belum ada peringkat

- CG 1340Dokumen2 halamanCG 1340Wes PetersBelum ada peringkat

- DL NewBusPermit-BACOORDokumen2 halamanDL NewBusPermit-BACOOROlive Dago-oc100% (1)

- Placer County Fictitious Business NameDokumen2 halamanPlacer County Fictitious Business NameSierra Nevada Media Group100% (1)

- Ism SS-52 PDFDokumen1 halamanIsm SS-52 PDFNard CruzBelum ada peringkat

- Information To The Trenton Central Office or Bring in Person To Any Motor Vehicle AgencyDokumen1 halamanInformation To The Trenton Central Office or Bring in Person To Any Motor Vehicle AgencyNard CruzBelum ada peringkat

- Application For Registration, Renewal, Replacement or Transfer of Plates And/or StickersDokumen4 halamanApplication For Registration, Renewal, Replacement or Transfer of Plates And/or Stickersdccab33Belum ada peringkat

- Corpotare Status:: N/A N/A N/ADokumen3 halamanCorpotare Status:: N/A N/A N/AAdnan MasoodBelum ada peringkat

- Vendor Setup Form Axess MX - English VersionDokumen4 halamanVendor Setup Form Axess MX - English VersionElizabeth MoralesBelum ada peringkat

- Escort Application PDFDokumen2 halamanEscort Application PDFshashank shuklaBelum ada peringkat

- Escort ApplicationDokumen2 halamanEscort Applicationshashank shuklaBelum ada peringkat

- State of North Carolina: CountyDokumen2 halamanState of North Carolina: CountyBill WalkerBelum ada peringkat

- Edeclaration of Source Funds FormDokumen2 halamanEdeclaration of Source Funds FormRaymond WilliamsBelum ada peringkat

- Application For Rental: Applicant InformationDokumen2 halamanApplication For Rental: Applicant InformationGeraldyneBelum ada peringkat

- Title Paper PDFDokumen2 halamanTitle Paper PDFJason KennedyBelum ada peringkat

- Format of ComplaintDokumen3 halamanFormat of ComplaintNipun JainBelum ada peringkat

- REG 227, Application For Duplicate or Paperless TitleDokumen2 halamanREG 227, Application For Duplicate or Paperless Titlefoufou79100% (1)

- A&LDokumen4 halamanA&LAb pBelum ada peringkat

- Application For Replacement or Transfer of Title: DMV Use OnlyDokumen2 halamanApplication For Replacement or Transfer of Title: DMV Use OnlyDoug LymanBelum ada peringkat

- Branch Office Representative Office: General Information Sheet (Gis)Dokumen3 halamanBranch Office Representative Office: General Information Sheet (Gis)Anonymous IR2l00eBelum ada peringkat

- CG-1340 Bill of SaleDokumen2 halamanCG-1340 Bill of SaleAdam WynnsBelum ada peringkat

- Capital One Purchase Assurance Claim FormDokumen1 halamanCapital One Purchase Assurance Claim FormdarcelcollinsonBelum ada peringkat

- Commercial Loan ApplicationDokumen4 halamanCommercial Loan ApplicationFederal Bureau investigationBelum ada peringkat

- LoanLiner App 11 2021Dokumen4 halamanLoanLiner App 11 2021Michael Joshua DanielBelum ada peringkat

- Application For RegistrationDokumen2 halamanApplication For RegistrationjimBelum ada peringkat

- Acord 1 (1046) SDokumen1 halamanAcord 1 (1046) Spredrag nikolicBelum ada peringkat

- Mechanics LienDokumen3 halamanMechanics LienjdBelum ada peringkat

- Application For Irrevocable Documentary Letter of CreditDokumen4 halamanApplication For Irrevocable Documentary Letter of CreditDungBelum ada peringkat

- Pilar Sorsogon Bpls-FormDokumen4 halamanPilar Sorsogon Bpls-FormKevin Albert Dela CruzBelum ada peringkat

- Custom FormDokumen1 halamanCustom Formluisa100% (1)

- SF95 DOJ TortFormDokumen2 halamanSF95 DOJ TortFormcamwills2Belum ada peringkat

- Application For Title or Registration: CoachDokumen2 halamanApplication For Title or Registration: CoachJerry BeckBelum ada peringkat

- Clearance From SSSDokumen2 halamanClearance From SSSnathalie velasquez86% (7)

- 370 BfillDokumen2 halaman370 BfillJohnny LolBelum ada peringkat

- SC DMV Form 400Dokumen7 halamanSC DMV Form 400IronMonkeyL255Belum ada peringkat

- 2022 08 18 05 16 46 Loan Appl Form 1Dokumen5 halaman2022 08 18 05 16 46 Loan Appl Form 1Jasmin GriffithBelum ada peringkat

- 500 Fictitious Business Name Statement and AOI PDFDokumen4 halaman500 Fictitious Business Name Statement and AOI PDFgeeBelum ada peringkat

- Unarmed Security Guard ApplicationDokumen1 halamanUnarmed Security Guard ApplicationPedro CadenaBelum ada peringkat

- SF95 Equifax TortFormDokumen2 halamanSF95 Equifax TortFormcamwills2100% (2)

- Credit App FormDokumen2 halamanCredit App FormEugene Kwadwo AnaneBelum ada peringkat

- 268 FillDokumen2 halaman268 FillChris JimenezBelum ada peringkat

- Export Request FormatDokumen2 halamanExport Request FormatScribdTranslationsBelum ada peringkat

- Business Ratios and Formulas: A Comprehensive GuideDari EverandBusiness Ratios and Formulas: A Comprehensive GuidePenilaian: 3 dari 5 bintang3/5 (1)

- 2020 Safety Strategy - Training SlidesDokumen28 halaman2020 Safety Strategy - Training SlidesThaís Felipe GermanoBelum ada peringkat

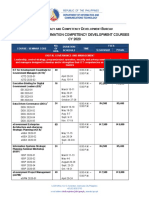

- ICT L C D B Digital Transformation Competency Development Courses CY 2020Dokumen4 halamanICT L C D B Digital Transformation Competency Development Courses CY 2020Val BasilBelum ada peringkat

- Foucault Friendship As A Way of LifeDokumen4 halamanFoucault Friendship As A Way of LifeEddie Higgins100% (2)

- Form Emsd Ee Ct2B: Fresh Water Cooling Towers Scheme Notification of Completion of Cooling Tower InstallationDokumen3 halamanForm Emsd Ee Ct2B: Fresh Water Cooling Towers Scheme Notification of Completion of Cooling Tower InstallationSimoncarter LawBelum ada peringkat

- Relationship PyramidDokumen1 halamanRelationship PyramidRussell HodgesBelum ada peringkat

- Presentation 1Dokumen6 halamanPresentation 1Adharsh SelvarajBelum ada peringkat

- Summary of OrientalismDokumen9 halamanSummary of OrientalismSadia ShahBelum ada peringkat

- TDP NotesDokumen29 halamanTDP NotesShivani NawaleBelum ada peringkat

- ColoursDokumen3 halamanColoursCrina CiupacBelum ada peringkat

- CV Muhammad Imran Riaz 1 P A G e MobiSerDokumen3 halamanCV Muhammad Imran Riaz 1 P A G e MobiSerAmna Khan YousafzaiBelum ada peringkat

- Citizens Charter Valenzuela CityDokumen591 halamanCitizens Charter Valenzuela CityEsbisiemti ArescomBelum ada peringkat

- EXTAC - 1010 - Rev - NONCOMBATANT EVACUATION OPERATIONSDokumen96 halamanEXTAC - 1010 - Rev - NONCOMBATANT EVACUATION OPERATIONSAbrarBelum ada peringkat

- DOT PuzzleDokumen2 halamanDOT Puzzledesai628Belum ada peringkat

- Chapter 5 Customer SatisfactionDokumen23 halamanChapter 5 Customer SatisfactionChristian BallespinBelum ada peringkat

- Learn With Facebook - Digital-Skills-Modules-Combined-04-24 PDFDokumen182 halamanLearn With Facebook - Digital-Skills-Modules-Combined-04-24 PDFMostesareBelum ada peringkat

- Circular No. 51/08 All Heads of Institutions Affiliated To The BoardDokumen3 halamanCircular No. 51/08 All Heads of Institutions Affiliated To The BoardAdeeba KhanBelum ada peringkat

- HRM Jury Assignment - Part 1.case StudyDokumen7 halamanHRM Jury Assignment - Part 1.case StudyNAMITHA KIBelum ada peringkat

- Why Is Slow-Motion Used in MoviesDokumen2 halamanWhy Is Slow-Motion Used in MoviesBCSM-F20-216 UnknownBelum ada peringkat

- Community Health Nursing Notes (Second Year)Dokumen6 halamanCommunity Health Nursing Notes (Second Year)anette katrinBelum ada peringkat

- Sam Selvon The Lonely LondonersDokumen59 halamanSam Selvon The Lonely LondonersAndy LinBelum ada peringkat

- Components of Curriculum DesignDokumen8 halamanComponents of Curriculum DesignRea SaliseBelum ada peringkat

- Document (1) Do G FGGFDokumen6 halamanDocument (1) Do G FGGFUtsha Roy UtshoBelum ada peringkat

- PMP Cheat SheetDokumen2 halamanPMP Cheat Sheetyogesh sharma89% (9)

- Accident Reporting and Investigation: A. GeneralDokumen7 halamanAccident Reporting and Investigation: A. Generalwaseemyounis123Belum ada peringkat

- Indian Business Ventures AbroadDokumen64 halamanIndian Business Ventures AbroadDeepak SinghBelum ada peringkat

- Level 6 Diploma in Business ManagementDokumen4 halamanLevel 6 Diploma in Business ManagementGibsonBelum ada peringkat

- HRP Project HRMC Group 5Dokumen8 halamanHRP Project HRMC Group 5Ankita Fate H21129Belum ada peringkat

- 18 06 08 Primark-2Dokumen2 halaman18 06 08 Primark-2Sachin RailhanBelum ada peringkat

- Singapore High Speed Rail Project 2017Dokumen14 halamanSingapore High Speed Rail Project 2017Jigisha VasaBelum ada peringkat

- Animals and Human Language (Unit 02)Dokumen2 halamanAnimals and Human Language (Unit 02)Maryam Raza100% (1)