Interest Rate Swaps: Pre-2008 Crisis

Diunggah oleh

Jasvinder JosenHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Interest Rate Swaps: Pre-2008 Crisis

Diunggah oleh

Jasvinder JosenHak Cipta:

Format Tersedia

capital 46 THEEDGE mal aysia | january 17, 2011

derivatives world

Interest Rate Swaps: Pre-2008 crisis

T

he interest rate derivatives market the IRS to Company B would be: [- Libor + 6% • Arbitrage opportunities

is the largest derivatives market in - 8% = - Libor – 2%] So, synthetically the com- The IRS market is closely linked to the in-

the world, and among the oldest. In- by pany has managed to pay on its bond, Libor + terest rate futures and forwards markets.Arbi-

terestingly, the credit crisis of 2008 Jasvin Josen 2%, and can now benefit from further falls in trageurs continuously trade between forwards,

has turned out to be one of the wa- the interest rate. The rate may still seem high futures and swaps resulting in the rates for the

tershed moments for this highly compared with newly issued bonds, but con- different derivatives within the same tenor to

established market. time deposits and receives three-month Libor sidering the issuing cost of bonds, the swap stay in close proximity.

The swap market has undergone an evolu- (London Interbank Offer Rate), for example, + transaction does seem worthwhile.

tion — a change in the motivation of trading, 0.2% on its mortgages. Say the Libor at the first Some important features of

which has brought about new risk that was three-month interval is 5%. The bank makes a Speculation interest rate swaps

considered negligible before the crisis. This margin of 0.2% from its lending business. Say Interest rate swaps are also very often used by Before we go further, it would be useful to un-

article will first brief the reader on the plain-

after three months,Libor falls to 4.8%.The bank’s market participants who want to take profit derstand some important features of the IRS,

vanilla interest rate swap and its prime trad- margins are now being squeezed. from the movement in interest rates.The main such as:

ing motivations before the crisis. Bank A would be interested in entering into speculators in the swap market are the propri- • Reset dates

a fixed-for-floating IRS (see Chart 1) where it etary trading desks of investment banks and These are pre-set dates when the floating

What is an interest rate swap could swap the fixed interest paid on its time hedge funds. rate in the IRS will be reset to

An interest rate swap (IRS) is an agreement be- deposits with a three-month Libor. In this way, Traditionally, an investor the current rate. For exam-

tween two parties to swap interest payments Bank A is not exposed to the changes in Libor who expects interest rates The swap market ple, an IRS that has one float-

on an agreed notional sum of the same cur- as the interest rate risk is hedged with the IRS. to fall would purchase cash has undergone ing leg paying three-month

rency. In the case of a plain-vanilla IRS, par- The IRS will slightly reduce the bank’s overall bonds,whose price increases an evolution Libor (say 5%) will be re-set

ties exchange fixed interest rates with floating margin, but eliminates the bigger downside as interest rates fall. Today, — a change in every three months at pre-de-

interest rates. when Libor moves the other way. investors with a similar view termined dates.At these dates,

The interest rate swap is an important tool could enter a floating-for- the motivation the three-month Libor (which

in hedging for banks and corporations. They Hedging with interest rate swaps — cor- fixed interest rate swap; as of trading, which was 5%) will be changed to the

can also be attractive speculation instruments porations interest rates fall, investors has brought about current rate (say 4.8%).

as we will see later. Say Company B issued a 10-year fixed bond pay a lower floating rate in new risk that • Fixed rate or swap rate

at 8% and it is into its fifth year now. Interest exchange for the same fixed was considered In a previous article, “Finan-

Hedging with interest rate swaps rates have fallen, and the company wishes it rate. negligible before cial Wizardry in Swaps — the

— commercial banks had issued a floating rate bond instead. It is not A speculator can also take the crisis Greek case” ( March 8, 2010),

Commercial banks that are funded on time too late. It can enter into an IRS as in Chart 2. a view of the shape of the the swap rate for a cross cur-

deposits (paying fixed rates) and issue float- Company B pays the floating Libor and receives interest rate curve, an ex- rency swap was discussed. In

ing rate mortgages are exposed to interest rate a fixed rate of 6% from the swap counter-party. ample of which can be seen any fixed-for-floating swap,

risk. For instance, say Bank A pays 5% on its The net effect of the cash flows of the bond and in Chart 3.The speculator may believe that the the fixed rate to be paid by the fixed rate

difference between the six-month Libor rates payer will be such that it makes the swap

will fall further relative to the three-year swap “fair”. In other words, at the inception of

rate. The Libor only has maturities of up to 12 the swap, the price of the swap should

Chart 1 – Hedging with interest rate swaps months. He enters into a constant maturity ideally be zero. Now, the price of the swap

swap paying the six-month Libor rate and re- is simply the present value of its floating

(commercial banks) ceiving the three-year swap rate (which is pe- and fixed cash flows. To make the price

riodically set to the market swap rate). zero, the fixed rate is adjusted to make the

present value zero. This fixed rate is also

The interest rate swap market known as the swap rate or the at-market

The interest rate swap market flourishes not swap rate.

only for the reasons of hedging and specula-

Speculation

tion, but also because of two more important New developments

features:rate swaps are also very often used by Now

Interest market that we have a reasonable

participants who want level of under-

to take a view

• Quality spread differential between standing of the plain-vanilla interest rate swap,

andfirms

profit from the movement in interest rates.inThe main speculators in the swap market

the next article, we will study how the swap

areDue

proprietary tradinglevels

to the varying desk of investment banks

of counter-party and hedge

market funds.

changed after the 2008 crisis, bring-

risk of companies, there is often a “quality ing about “basis risk” which was considered

Traditionally, an investor

spread differential”, whoallows

which expectedbothinterest rates to fall would

par- insignificant beforepurchase cashafford

but cannot bonds,

to be

Hedging with the IRS – The example of the corporation ties to

whose benefit

price will from an interest

increase as the rate swap.rates

interest Say fall.

sidelined

Today,now.

investors with a similar view could

Bank

enter A (rated AAA) is able

a floating-for-fixed to borrow

interest fundsas interest rates fall, investors would pay a

rate swap;

Say Company B issued a 10 year fixed bond at 8% and it is into its 5th year now. Interest at Libor + 2% while Bank B (rated BBB) will Jasvin Josen is a specialist in developing

lower

havefloating rateatin

to borrow exchange

Libor forcould

+ 3%.They the same

enterfixed rate.

methodologies for valuation of various

rates have fallen and the company wished it issued a floating rate bond instead. It isAnot intotooan IRScan

speculator where

alsoBank

take aB view

pays Libor

of the+shape

2.5% ofderivative products.

the interest She has

rate curve, over 10 of

an example

late. It can enter into an IRS as in Chart 2. Company B pays the floating LIBOR and receives and receives a fixed rate from Bank A. This years’ experience in investment banking

which is aChart 3.

is beneficial forThe

Bankspeculator may believe

B as it is cheaper than that

andthe

thedifference

financialbetween

industry the six-month

in Europe and

fixed rate of 6% from the swap counterparty. The net effect of the cash flows of theLIBOR bond

financing from

rates will fallthe market.

further As for

relative toBank A, Asia. Comments:

the three-year jasvin@gmail.com.

swap rate. The LIBOR only has

and the IRS to Company B would be: [- LIBOR +6% - 8% = - LIBOR – 2%] So, synthetically thethefixedofrate

maturities up negotiated

to 12 months.is often into aReaders

also better

He enters constantmay also follow

maturity her at http://

swap paying the six-

than borrowing on the market. derivativetimes.blogspot.com.

company has managed to pay on its bond, LIBOR + 2% and can now benefit from further month LIBOR rate and receiving the three-year swap rate (which is periodically set to the

Cusatis, Thomas: Hedging instruments and risk management

falls in the interest rate. The rate may still seem high compared to newly issued bonds, market

butswap rate).

Hedging with the IRS – The example of the corporation

considering the issuing cost of bonds, the swap transaction does seem worthwhile. Chart 3 – An example of an Interest Rate (Yield) Curve

Chart 2 – Hedging with interest rate swaps (corporations) Chart 3 – An example of an interest rate (yield) curve

Say Company

Chart 2B–issued a 10

Interest year

Rate fixed(Hedging

Swap 8% and it2)is into its 5th year now. Interest

bond atexample

rates have fallen and the company wished it issued a floating rate bond instead. It is not too

late. It can enter into an IRS as in Chart 2. Company B pays the floating LIBOR and receives a

fixed rate of 6% from the swap counterparty. The net effect of the cash flows of the bond

and the IRS to Company B would be: [- LIBOR +6% - 8% = - LIBOR – 2%] So, synthetically the

company has managed to pay on its bond, LIBOR + 2% and can now benefit from further

falls in the interest rate. The rate may still seem high compared to newly issued bonds, but

considering the issuing cost of bonds, the swap transaction does seem worthwhile.

Chart 2 – Interest Rate Swap (Hedging example 2)

Source: Cusatis, Thomas: Hedging Instruments and Risk Management

The IRS market

Anda mungkin juga menyukai

- Tiburon Capital ManagementDokumen6 halamanTiburon Capital Managementbastian99Belum ada peringkat

- JPM - Abs-Cdo 2009-09-25Dokumen95 halamanJPM - Abs-Cdo 2009-09-25Ryan JinBelum ada peringkat

- PerformanceAttributionOfOptions SingleStockOptionExposureAndBrinsonFachlerEffectsDokumen9 halamanPerformanceAttributionOfOptions SingleStockOptionExposureAndBrinsonFachlerEffectstachyon007_mechBelum ada peringkat

- Hedging Illiquid AssetsDokumen16 halamanHedging Illiquid Assetspenfoul29Belum ada peringkat

- Fabozzi Fofmi4 Ch11 ImDokumen12 halamanFabozzi Fofmi4 Ch11 ImYasir ArafatBelum ada peringkat

- Duration Times SpreadDokumen24 halamanDuration Times SpreadfrolloosBelum ada peringkat

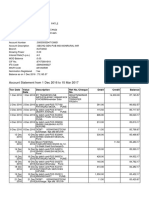

- Account statement showing transactions from Dec 2016 to Feb 2017Dokumen4 halamanAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuBelum ada peringkat

- The Credit Hedging Agency Model Vs Credit Default SwapsDokumen3 halamanThe Credit Hedging Agency Model Vs Credit Default SwapsJasvinder JosenBelum ada peringkat

- Converting Swap To FuturesDokumen6 halamanConverting Swap To FuturesJasvinder JosenBelum ada peringkat

- Pricing of A CDODokumen2 halamanPricing of A CDOJasvinder Josen100% (1)

- 26 Structured RepoDokumen4 halaman26 Structured RepoJasvinder JosenBelum ada peringkat

- Structured ProductsDokumen23 halamanStructured ProductssunnyBelum ada peringkat

- Wikki - Derivatives TypesDokumen10 halamanWikki - Derivatives TypesSanthoshBelum ada peringkat

- Cdo Modeling OverviewDokumen37 halamanCdo Modeling OverviewtwinbedtxBelum ada peringkat

- GIOA Book Return and Total Return Good Bad UglyDokumen55 halamanGIOA Book Return and Total Return Good Bad UglyrpcampbellBelum ada peringkat

- Credit DerivativesDokumen37 halamanCredit DerivativesshehzadshroffBelum ada peringkat

- 8 Japan Structured Products Forum 2007Dokumen10 halaman8 Japan Structured Products Forum 2007Marius AngaraBelum ada peringkat

- CDS Valuation 2011Dokumen15 halamanCDS Valuation 2011Saúl García AcostaBelum ada peringkat

- Constructing A Liability Hedging Portfolio PDFDokumen24 halamanConstructing A Liability Hedging Portfolio PDFtachyon007_mechBelum ada peringkat

- (Columbia University, Derman) Trading Volatility As An Asset ClassDokumen37 halaman(Columbia University, Derman) Trading Volatility As An Asset ClassLevi StraussBelum ada peringkat

- Asset Swaps: Not For Onward DistributionDokumen23 halamanAsset Swaps: Not For Onward Distributionjohan oldmanBelum ada peringkat

- Single Name Credit DerivativesDokumen32 halamanSingle Name Credit DerivativesapluBelum ada peringkat

- A primer on whole business securitization financing structureDokumen13 halamanA primer on whole business securitization financing structureSam TickerBelum ada peringkat

- The+Incredible+Shrinking+Stock+Market - Dec2015Dokumen8 halamanThe+Incredible+Shrinking+Stock+Market - Dec2015jacekBelum ada peringkat

- (Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesDokumen13 halaman(Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesrlindseyBelum ada peringkat

- Modeling Autocallable Structured ProductsDokumen21 halamanModeling Autocallable Structured Productsjohan oldmanBelum ada peringkat

- Fabozzi CH 32 CDS HW AnswersDokumen19 halamanFabozzi CH 32 CDS HW AnswersTrish Jumbo100% (1)

- Beyond Traditional Beta 032015Dokumen24 halamanBeyond Traditional Beta 032015Ton ChockBelum ada peringkat

- Understanding Collateralized Loan Obligations 2022Dokumen11 halamanUnderstanding Collateralized Loan Obligations 2022Alex B.Belum ada peringkat

- Topic 33 - Credit Derivatives and Credit-Linked Notes AnswerDokumen7 halamanTopic 33 - Credit Derivatives and Credit-Linked Notes AnswerGaurav BansalBelum ada peringkat

- CDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsDokumen26 halamanCDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsSimran AroraBelum ada peringkat

- Volatility Exchange-Traded Notes - Curse or CureDokumen25 halamanVolatility Exchange-Traded Notes - Curse or CurelastkraftwagenfahrerBelum ada peringkat

- Collateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and VadmsDokumen5 halamanCollateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and Vadmsddelis77Belum ada peringkat

- Lehman ARM IndexDokumen19 halamanLehman ARM IndexzdfgbsfdzcgbvdfcBelum ada peringkat

- Valuation and Hedging of Inv Floaters PDFDokumen4 halamanValuation and Hedging of Inv Floaters PDFtiwariaradBelum ada peringkat

- CMS Inverse FloatersDokumen8 halamanCMS Inverse FloaterszdfgbsfdzcgbvdfcBelum ada peringkat

- Callable BrochureDokumen37 halamanCallable BrochurePratik MhatreBelum ada peringkat

- Convexity and Volatility PDFDokumen20 halamanConvexity and Volatility PDFcaxapBelum ada peringkat

- 7 Myths of Structured ProductsDokumen18 halaman7 Myths of Structured Productsrohanghalla6052Belum ada peringkat

- Hedge Fund Collapse Due to Rising Interest RatesDokumen1 halamanHedge Fund Collapse Due to Rising Interest RatesPoorvaBelum ada peringkat

- Structured Product - Credit Linked NoteDokumen8 halamanStructured Product - Credit Linked Notelaila22222lailaBelum ada peringkat

- Hedge Fund Risk Management: September 2009Dokumen18 halamanHedge Fund Risk Management: September 2009Alan LaubschBelum ada peringkat

- Class 23: Fixed Income, Interest Rate SwapsDokumen21 halamanClass 23: Fixed Income, Interest Rate SwapsKarya BangunanBelum ada peringkat

- BondsDokumen41 halamanBondsmsohaib7Belum ada peringkat

- BNPP Structured Retail and PB Products 2005 StudyDokumen32 halamanBNPP Structured Retail and PB Products 2005 StudyjcsaucaBelum ada peringkat

- (Bank of America) Guide To Credit Default SwaptionsDokumen16 halaman(Bank of America) Guide To Credit Default SwaptionsAmit SrivastavaBelum ada peringkat

- CDOPrimerDokumen40 halamanCDOPrimermerton1997XBelum ada peringkat

- JPM Fixed inDokumen236 halamanJPM Fixed inMikhail ValkoBelum ada peringkat

- Anatomy of Credit CPPI: Nomura Fixed Income ResearchDokumen15 halamanAnatomy of Credit CPPI: Nomura Fixed Income ResearchAlviBelum ada peringkat

- Demystifying Equity Risk-Based StrategiesDokumen20 halamanDemystifying Equity Risk-Based Strategiesxy053333Belum ada peringkat

- The Tri-Party Repo Market Before The 2010 Reforms ImportDokumen83 halamanThe Tri-Party Repo Market Before The 2010 Reforms ImportFuad SheikhBelum ada peringkat

- CdosDokumen53 halamanCdosapi-3742111Belum ada peringkat

- Yield IncomeDokumen22 halamanYield IncomejBelum ada peringkat

- Lehman Brothers ABS Credit Default Swaps - A Primer - December 9, 2005Dokumen21 halamanLehman Brothers ABS Credit Default Swaps - A Primer - December 9, 2005AC123123Belum ada peringkat

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsDari EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsBelum ada peringkat

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketDari EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketBelum ada peringkat

- Life Settlements and Longevity Structures: Pricing and Risk ManagementDari EverandLife Settlements and Longevity Structures: Pricing and Risk ManagementBelum ada peringkat

- 26 Structured RepoDokumen4 halaman26 Structured RepoJasvinder JosenBelum ada peringkat

- Leveraged Super Seniors of The Pre Credit CrisisDokumen1 halamanLeveraged Super Seniors of The Pre Credit CrisisJasvinder JosenBelum ada peringkat

- Measuring Market Risk: The DeltaDokumen1 halamanMeasuring Market Risk: The DeltaJasvinder JosenBelum ada peringkat

- Negative Yield in BondsDokumen1 halamanNegative Yield in BondsJasvinder JosenBelum ada peringkat

- Pricing The Probability of A Rare EventDokumen4 halamanPricing The Probability of A Rare EventJasvinder JosenBelum ada peringkat

- Islamic Derivatives: Valuing Profit Rate SwapsDokumen1 halamanIslamic Derivatives: Valuing Profit Rate SwapsJasvinder JosenBelum ada peringkat

- Leveraged Super Seniors - The Valuation QuestionDokumen3 halamanLeveraged Super Seniors - The Valuation QuestionJasvinder JosenBelum ada peringkat

- Measuring Delta in Derivative PortfoliosDokumen1 halamanMeasuring Delta in Derivative PortfoliosJasvinder JosenBelum ada peringkat

- CAT Bonds - Fear of The Unknown?Dokumen1 halamanCAT Bonds - Fear of The Unknown?Jasvinder JosenBelum ada peringkat

- Pricing Convertible SecuritiesDokumen1 halamanPricing Convertible SecuritiesJasvinder JosenBelum ada peringkat

- Auditing Derivatives: Model ValidationDokumen4 halamanAuditing Derivatives: Model ValidationJasvinder JosenBelum ada peringkat

- 26 Structured RepoDokumen4 halaman26 Structured RepoJasvinder JosenBelum ada peringkat

- Auditing Derivatives: Middle Office (Valuation)Dokumen4 halamanAuditing Derivatives: Middle Office (Valuation)Jasvinder JosenBelum ada peringkat

- Delta One: What Does It Do?Dokumen1 halamanDelta One: What Does It Do?Jasvinder JosenBelum ada peringkat

- Valuation of Derivatives: So What Do We Do?Dokumen1 halamanValuation of Derivatives: So What Do We Do?Jasvinder JosenBelum ada peringkat

- Valuation of Derivatives: The Importance of Getting It RightDokumen4 halamanValuation of Derivatives: The Importance of Getting It RightJasvinder JosenBelum ada peringkat

- Interest Rate Swaps: Post-2008 CrisisDokumen5 halamanInterest Rate Swaps: Post-2008 CrisisJasvinder JosenBelum ada peringkat

- Gold ETFs and DerivativesDokumen1 halamanGold ETFs and DerivativesJasvinder JosenBelum ada peringkat

- The Crash of 2:45 - An AutopsyDokumen5 halamanThe Crash of 2:45 - An AutopsyJasvinder JosenBelum ada peringkat

- Auditing Derivatives: Value at RiskDokumen7 halamanAuditing Derivatives: Value at RiskJasvinder JosenBelum ada peringkat

- The Crash of 2.45: Lessons LearntDokumen1 halamanThe Crash of 2.45: Lessons LearntJasvinder JosenBelum ada peringkat

- Audit Derivatives: Product Control - Think of What Can Go WrongDokumen3 halamanAudit Derivatives: Product Control - Think of What Can Go WrongJasvinder JosenBelum ada peringkat

- Wrong Way Risk - A PremierDokumen1 halamanWrong Way Risk - A PremierJasvinder JosenBelum ada peringkat

- Auditing Derivatives: Risk ManagementDokumen5 halamanAuditing Derivatives: Risk ManagementJasvinder JosenBelum ada peringkat

- Sovereign Bonds - The FundamentalsDokumen1 halamanSovereign Bonds - The FundamentalsJasvinder JosenBelum ada peringkat

- Farmers, Miners and The State in Colonial Zimbabwe (Southern Rhodesia), c.1895-1961Dokumen230 halamanFarmers, Miners and The State in Colonial Zimbabwe (Southern Rhodesia), c.1895-1961Peter MukunzaBelum ada peringkat

- Companies List 2014 PDFDokumen36 halamanCompanies List 2014 PDFArnold JohnnyBelum ada peringkat

- Blkpay YyyymmddDokumen4 halamanBlkpay YyyymmddRamesh PatelBelum ada peringkat

- Sri Lanka 2017 May PMRDokumen46 halamanSri Lanka 2017 May PMRlutfiBelum ada peringkat

- 5d7344794eaa11567835257 1037739Dokumen464 halaman5d7344794eaa11567835257 1037739prabhakaran arumugamBelum ada peringkat

- Trade For Corporates OverviewDokumen47 halamanTrade For Corporates OverviewZayd Iskandar Dzolkarnain Al-HadramiBelum ada peringkat

- Forecasting PDFDokumen87 halamanForecasting PDFSimple SoulBelum ada peringkat

- Global Hotels and ResortsDokumen32 halamanGlobal Hotels and Resortsgkinvestment0% (1)

- Social Science Class Viii WORKSHEET-1-Map WorkDokumen2 halamanSocial Science Class Viii WORKSHEET-1-Map WorkChahal JainBelum ada peringkat

- How High Would My Net-Worth Have To Be. - QuoraDokumen1 halamanHow High Would My Net-Worth Have To Be. - QuoraEdward FrazerBelum ada peringkat

- Balance StatementDokumen5 halamanBalance Statementmichael anthonyBelum ada peringkat

- Fruits & Veg DatabaseDokumen23 halamanFruits & Veg Databaseyaseer303Belum ada peringkat

- 6021-P3-Lembar KerjaDokumen48 halaman6021-P3-Lembar KerjaikhwanBelum ada peringkat

- EdpDokumen163 halamanEdpCelina SomaBelum ada peringkat

- Information Technology Telecommunications and Information ExchangeDokumen48 halamanInformation Technology Telecommunications and Information Exchangescribd4tavoBelum ada peringkat

- The Welcome Magazine FLORENCEDokumen52 halamanThe Welcome Magazine FLORENCEJohn D.Belum ada peringkat

- Data 73Dokumen4 halamanData 73Abhijit BarmanBelum ada peringkat

- Renewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsDokumen1 halamanRenewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsVinodkumar ShethBelum ada peringkat

- MK-101 Sec-F Group-4 Executive SummaryDokumen16 halamanMK-101 Sec-F Group-4 Executive SummarySantosh Rajan Iyer0% (1)

- RS Cashless India Projuct PDFDokumen90 halamanRS Cashless India Projuct PDFRAJE100% (1)

- Common Rationality CentipedeDokumen4 halamanCommon Rationality Centipedesyzyx2003Belum ada peringkat

- Business Model Analysis of Wal Mart and SearsDokumen3 halamanBusiness Model Analysis of Wal Mart and SearsAndres IbonBelum ada peringkat

- Women Welfare Schemes of Himachal Pradesh GovtDokumen4 halamanWomen Welfare Schemes of Himachal Pradesh Govtamitkumaramit7Belum ada peringkat

- Liberal View of State: TH THDokumen3 halamanLiberal View of State: TH THAchanger AcherBelum ada peringkat

- Construction EngineeringDokumen45 halamanConstruction EngineeringDr Olayinka Okeola100% (4)

- Coffe Production in Colombia PDFDokumen4 halamanCoffe Production in Colombia PDFJuanes RestrepoBelum ada peringkat

- Packaged Tea Leaves Market ShareDokumen22 halamanPackaged Tea Leaves Market ShareKadambariBelum ada peringkat

- Lecture Var SignrestrictionDokumen41 halamanLecture Var SignrestrictionTrang DangBelum ada peringkat

- Marico's Leading Brands and Targeting StrategiesDokumen11 halamanMarico's Leading Brands and Targeting StrategiesSatyendr KulkarniBelum ada peringkat