Corporate News: .DJI 12,226.34 .SPX 1,327.22 .IXIC 2,782.27

Diunggah oleh

Andre_Setiawan_1986Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Corporate News: .DJI 12,226.34 .SPX 1,327.22 .IXIC 2,782.27

Diunggah oleh

Andre_Setiawan_1986Hak Cipta:

Format Tersedia

March 1st 2011

U.S. blue chips pushed higher on Monday as the Dow Jones Industrial Average settled the day up

95.89 points or 0.79% at 12,226.34. S&P 500 index also finished 0.56% higher at 1,327.22. Tech-

heavy Nasdaq composite however, only managed to eke out a tiny gain of 1.22 points or 0.04% to

settle at 2,782.27.

March is coming, and that means goodbye to February. Let’s take a look at last month’s top gainers

and losers too. DIS was the top gainer in February. Thanks to the superb earnings report, DIS had

seen its price soaring 12.59%. CVX was the runner-up in February, as strong earnings and high oil

prices have been the catalysts to CVX’s rise. DD was at the third, however.

At the other end of the horizon, CSCO suffered 11.32% decline after a disappointing earnings report

while WMT lost 8.32% throughout the month. MSFT was at the third place as it saw a 4.25% decline

last month. MSFT’s link-up with Nokia has not been a popular thing among investors and this put even

a bigger doubt on the equity market regarding MFST’s future.

Since the beginning of the year, DIS reigned supreme with 16.61% return, second to the oil giant

XOM which soared 16.97% since early January. XOM owed much of its gains to its strong earnings

report with an additional bonus of soaring oil prices. GE is at the next slot, gaining 14.38% and

followed by another oil titan, CVX.

Under the 12-month perspective, the mighty CAT remains the best performing stock with 80.42% of

gains. DD follows at the second place with 62.72%, while CVX at the third with 43.50%. DIS and

XOM are at the fourth and fifth with gains of 40.01% and 31.58%, respectively.

As earnings season had passed, March offers geopolitics as the theme of the month. Middle East

instability has led to a soaring oil prices and at the same time sent the gold price climbing.

Geopolitics will focus on the post-crisis Egypt and the currently chaotic Libya and most importantly,

which Mid-East country will be next? Geopolitics however, has a rather short-term, yet violent impact.

Corporate News

GE Aviation obtained a share in the recent contract won by BA as the conglomerate will be

providing its technology in mission control systems for BA’s KC-46A aircraft used in the tanker

contract.

BA has delivered its 300th 737-800 plane to Ryanair, while announcing that TAM SA’s order

value at about $568 million.

MMM outlined the results of its tender offer for Winterthur Technologie AG stocks of which 56.1%

of Winterthur shares were tendered. Including shares obtained from outside of the tender, MMM

will own 85.3% of Winterthur shares. The definitive results will be announced on March 3rd.

JPM was said to be involved in about 10,000 different law suits, which could require the bank to

supply an additional $4.5 billion to prepare for legal losses.

FujiFilm plans to buy MRK’s bio-drug units MSD Biologics Ltd. and Diosynth RTP Inc.

1 .DJI 12,226.34 (+0.79%) .SPX 1,327.22 (+0.56%) .IXIC 2,782.27 (+0.04%)

March 1st 2011

PFE’s XIAPEX has received approval from European Commission and will be available in the

European markets later this year.

Centrica Plc. has appointed HPQ to work on the tech migration outsourcing services worth $400

million and extending at 7-year period. The contract will enable Centrica to become a utility-

based private cloud computing environment.

IBM was the top server vendor in Q4 2010 with market share of 37.4%, pushing it to the number

one position. Server revenue climbed 21.9% and 2 points of market share have been gained. IBM

also number one in UNIX, as its revenue rose 12% which, in effect pushed the Big Blue’s market

share to 53.9%.

INTC is seen missing its Q1 guidance, according to JPM analysts. Weak PC demand was the key

factor behind the analysis. PC unit estimate has been lowered from up 9.5% to up 7.0%

compared to a year earlier. INTC has been kept at NEUTRAL, however. INTC also announced that

its acquisition of McAfee has been completed.

T will begin selling AMZN’s Kindle 3G in its stores starting March 6. Meanwhile, T also plans to

launch location-based texting service, making it the first carrier to offer such service.

VZ has extended its tender offer to obtain all of outstanding shares of Terremark for $19.00 per

share in cash with no interest and less any required withholding taxes.

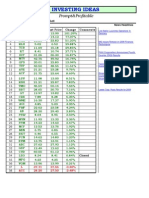

Price Performance - as of Feb 28th 2011

Code Last Dy WTD MTD YTD 12-Mos Code Last Dy WTD MTD YTD 12-Mos

AA 16.85 1.02% 1.02% 4.46% 9.49% 26.69% JPM 46.69 0.02% 0.02% 4.83% 10.07% 11.25%

AXP 43.57 0.09% 0.09% -0.66% 1.51% 14.09% KFT 31.84 0.41% 0.41% 4.29% 1.05% 11.99%

BA 72.01 -0.40% -0.40% 4.02% 10.34% 14.01% KO 63.92 -0.61% -0.61% 2.75% -2.81% 21.24%

BAC 14.29 0.63% 0.63% 5.07% 7.12% -14.23% MCD 75.68 1.67% 1.67% 3.28% -1.41% 18.53%

CAT 102.93 0.91% 0.91% 7.58% 9.90% 80.42% MMM 92.23 2.19% 2.19% 5.48% 6.87% 15.07%

CSCO 18.56 -0.43% -0.43% -11.32% -8.26% -23.72% MRK 32.57 1.18% 1.18% -1.51% -9.63% -11.69%

CVX 103.75 1.62% 1.62% 11.12% 13.70% 43.50% MSFT 26.58 0.11% 0.11% -4.25% -4.77% -7.29%

DD 54.87 1.48% 1.48% 9.11% 10.00% 62.72% PFE 19.24 2.01% 2.01% 6.01% 9.88% 9.63%

DIS 43.74 1.84% 1.84% 12.59% 16.61% 40.01% PG 63.05 0.33% 0.33% -1.79% -1.99% -0.36%

GE 20.92 0.48% 0.48% 3.56% 14.38% 30.26% T 28.38 0.89% 0.89% 3.24% -3.40% 14.39%

HD 37.47 1.05% 1.05% 2.10% 6.87% 20.10% TRV 59.93 0.55% 0.55% 7.38% 7.57% 13.96%

HPQ 43.63 2.23% 2.23% -4.13% 3.63% -14.10% UTX 83.54 0.20% 0.20% 2.59% 6.12% 21.69%

IBM 161.88 -0.25% -0.25% 1.68% 10.30% 27.30% VZ 36.92 2.64% 2.64% 3.62% 3.19% 27.62%

INTC 21.47 -1.78% -1.78% 0.05% 2.09% 4.58% WMT 51.98 0.44% 0.44% -8.32% -3.62% -3.87%

JNJ 61.44 3.02% 3.02% 2.38% -0.66% -2.48% XOM 85.53 0.22% 0.22% 8.28% 16.97% 31.58%

Disclaimer: This report is provided for information purposes only. It is not an offer to sell or to buy any securities. This

report has been prepared based on sources believed to be reliable, but there is no assurance or guarantee regarding its

completeness and accuracy. The author accepts no responsibility or liability arising from any use of the report.

2 .DJI 12,226.34 (+0.79%) .SPX 1,327.22 (+0.56%) .IXIC 2,782.27 (+0.04%)

Anda mungkin juga menyukai

- The Smart Card ReportDari EverandThe Smart Card ReportWendy AtkinsPenilaian: 4 dari 5 bintang4/5 (4)

- Says "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Dokumen4 halamanSays "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Andre SetiawanBelum ada peringkat

- Earnings Lifted The Street: UpbeatDokumen6 halamanEarnings Lifted The Street: UpbeatAndre SetiawanBelum ada peringkat

- Dow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Dokumen5 halamanDow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Andre_Setiawan_1986Belum ada peringkat

- Deal Boosted Dow: .DJI 12,036.53 (+178.01) .SPX 1,298.38 (+19.18) .IXIC 2,692.09 (+48.42)Dokumen5 halamanDeal Boosted Dow: .DJI 12,036.53 (+178.01) .SPX 1,298.38 (+19.18) .IXIC 2,692.09 (+48.42)Andre SetiawanBelum ada peringkat

- To Middle East: ReturnDokumen5 halamanTo Middle East: ReturnAndre_Setiawan_1986Belum ada peringkat

- Lifted The Mood: PayrollsDokumen5 halamanLifted The Mood: PayrollsAndre SetiawanBelum ada peringkat

- Disenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Dokumen5 halamanDisenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Andre SetiawanBelum ada peringkat

- Of Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Dokumen4 halamanOf Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Andre SetiawanBelum ada peringkat

- Or No Shutdown?Dokumen6 halamanOr No Shutdown?Andre_Setiawan_1986Belum ada peringkat

- Calling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Dokumen5 halamanCalling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Andre SetiawanBelum ada peringkat

- Penalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Dokumen6 halamanPenalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Andre SetiawanBelum ada peringkat

- Under The Microscope: .DJI 12,595.37 (+115.49) .SPX 1,347.24 (+11.99) .IXIC 2,847.54 (+21.66)Dokumen5 halamanUnder The Microscope: .DJI 12,595.37 (+115.49) .SPX 1,347.24 (+11.99) .IXIC 2,847.54 (+21.66)Andre SetiawanBelum ada peringkat

- Strikes Back: .DJI 11,774.59 (+161.29) .SPX 1,273.72 (+16.84) .IXIC 2,636.05 (+19.23)Dokumen4 halamanStrikes Back: .DJI 11,774.59 (+161.29) .SPX 1,273.72 (+16.84) .IXIC 2,636.05 (+19.23)Andre SetiawanBelum ada peringkat

- Inners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Dokumen5 halamanInners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Andre SetiawanBelum ada peringkat

- .Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Dokumen6 halaman.Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Andre SetiawanBelum ada peringkat

- Investing Ideas - Week in Review 11Dokumen3 halamanInvesting Ideas - Week in Review 11Speculator_NojusBelum ada peringkat

- Of QE2?: .DJI 12,220.59 (+50.03) .SPX 1,313.80 (+4.14) .IXIC 2,743.06 (+6.64)Dokumen7 halamanOf QE2?: .DJI 12,220.59 (+50.03) .SPX 1,313.80 (+4.14) .IXIC 2,743.06 (+6.64)Andre_Setiawan_1986Belum ada peringkat

- Index Last Δ (%) : Dow Jones 11,891.93 S&P 500 1,286.12 Nasdaq 2,700.08Dokumen4 halamanIndex Last Δ (%) : Dow Jones 11,891.93 S&P 500 1,286.12 Nasdaq 2,700.08Andre_Setiawan_1986Belum ada peringkat

- Dow 12,062.26 +20.29 0.17% S&P 500 1,307.10 +3.07 0.24% Nasdaq 2,753.88 +4.32 0.16%Dokumen4 halamanDow 12,062.26 +20.29 0.17% S&P 500 1,307.10 +3.07 0.24% Nasdaq 2,753.88 +4.32 0.16%Andre SetiawanBelum ada peringkat

- ValuEngine Weekly December 10, 2010Dokumen9 halamanValuEngine Weekly December 10, 2010ValuEngine.comBelum ada peringkat

- Crunch: CommodityDokumen5 halamanCrunch: CommodityAndre SetiawanBelum ada peringkat

- On Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Dokumen5 halamanOn Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Andre SetiawanBelum ada peringkat

- ValuEngine Weekly Newsletter May 13, 2011Dokumen10 halamanValuEngine Weekly Newsletter May 13, 2011ValuEngine.comBelum ada peringkat

- The Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Dokumen4 halamanThe Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Andre SetiawanBelum ada peringkat

- ValuEngine Weekly Newsletter February 18, 2011Dokumen10 halamanValuEngine Weekly Newsletter February 18, 2011ValuEngine.comBelum ada peringkat

- To Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Dokumen5 halamanTo Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Andre SetiawanBelum ada peringkat

- Day Ahead: .DJI 12,258.20 .SPX 1,330.97 .IXIC 2,798.74Dokumen3 halamanDay Ahead: .DJI 12,258.20 .SPX 1,330.97 .IXIC 2,798.74Andre_Setiawan_1986Belum ada peringkat

- Season Greetings!: (Earnings)Dokumen6 halamanSeason Greetings!: (Earnings)Andre SetiawanBelum ada peringkat

- Orporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Dokumen4 halamanOrporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Andre SetiawanBelum ada peringkat

- VE Weekly 101119Dokumen8 halamanVE Weekly 101119ValuEngine.comBelum ada peringkat

- Daily Market Commentary - April 19 2016Dokumen2 halamanDaily Market Commentary - April 19 2016NayemBelum ada peringkat

- The Season Ends : EPS Estimates (Left) and Revenues Expectations (Right) On HD, WMT and HPQDokumen4 halamanThe Season Ends : EPS Estimates (Left) and Revenues Expectations (Right) On HD, WMT and HPQAndre SetiawanBelum ada peringkat

- ValuEngine Weekly Newsletter May 6, 2011Dokumen12 halamanValuEngine Weekly Newsletter May 6, 2011ValuEngine.comBelum ada peringkat

- SectorDokumen2 halamanSectorMd. Real MiahBelum ada peringkat

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDokumen7 halamanThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comBelum ada peringkat

- ValuEngine Weekly Newsletter May 27, 2011Dokumen10 halamanValuEngine Weekly Newsletter May 27, 2011ValuEngine.comBelum ada peringkat

- Super Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualDokumen5 halamanSuper Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualAndre SetiawanBelum ada peringkat

- Company Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Dokumen5 halamanCompany Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Nikesh BeradiyaBelum ada peringkat

- Analysis On Stock Trading by Mansukh Investment & Trading Solution 13/05/2010Dokumen5 halamanAnalysis On Stock Trading by Mansukh Investment & Trading Solution 13/05/2010MansukhBelum ada peringkat

- American Airline Case StudyDokumen10 halamanAmerican Airline Case StudyFathi Salem Mohammed Abdullah100% (5)

- Data Dampak Ekonomi COVID-19 - Sum - SendDokumen52 halamanData Dampak Ekonomi COVID-19 - Sum - SendQA ARNABelum ada peringkat

- ValuEngine Weekly Newsletter March 30, 2010Dokumen15 halamanValuEngine Weekly Newsletter March 30, 2010ValuEngine.comBelum ada peringkat

- Weekly Apr 08 - Apr 12 12Dokumen9 halamanWeekly Apr 08 - Apr 12 12Safwan SaadBelum ada peringkat

- ValuEngine Weekly Newsletter March 25, 2011Dokumen11 halamanValuEngine Weekly Newsletter March 25, 2011ValuEngine.comBelum ada peringkat

- Investing Ideas - Week in Review 10Dokumen3 halamanInvesting Ideas - Week in Review 10Speculator_NojusBelum ada peringkat

- Factor Boosted The Dow: .DJI 12,763.31 (+72.35) .SPX 1,360.48 (+4.82) .IXIC 2,872.53 (+2.65)Dokumen6 halamanFactor Boosted The Dow: .DJI 12,763.31 (+72.35) .SPX 1,360.48 (+4.82) .IXIC 2,872.53 (+2.65)Andre SetiawanBelum ada peringkat

- Investing Ideas - Week in Review 09Dokumen3 halamanInvesting Ideas - Week in Review 09Speculator_NojusBelum ada peringkat

- ValuEngine Weekly Newsletter April 22, 2011Dokumen11 halamanValuEngine Weekly Newsletter April 22, 2011ValuEngine.comBelum ada peringkat

- Orporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Dokumen4 halamanOrporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Andre SetiawanBelum ada peringkat

- ValuEngine Weekly NewsletterDokumen14 halamanValuEngine Weekly NewsletterValuEngine.comBelum ada peringkat

- ValuEngine Weekly Newsletter January 28, 2011Dokumen8 halamanValuEngine Weekly Newsletter January 28, 2011ValuEngine.comBelum ada peringkat

- Hot-Accounts Google FinanceDokumen5 halamanHot-Accounts Google Financerbp_1973Belum ada peringkat

- Market Overview: September 4, 2009Dokumen11 halamanMarket Overview: September 4, 2009ValuEngine.comBelum ada peringkat

- ValuEngine Weekly Newsletter September 17, 2010Dokumen8 halamanValuEngine Weekly Newsletter September 17, 2010ValuEngine.comBelum ada peringkat

- Slumped, Again: Revenues in Billions of Dollars Earnings Per ShareDokumen5 halamanSlumped, Again: Revenues in Billions of Dollars Earnings Per ShareAndre SetiawanBelum ada peringkat

- Shutdown, For Now: .DJI 12,380.05 (-29.44) .SPX 1,328.17 (-5.34) .IXIC 2,780.42 (-15.72)Dokumen5 halamanShutdown, For Now: .DJI 12,380.05 (-29.44) .SPX 1,328.17 (-5.34) .IXIC 2,780.42 (-15.72)Andre_Setiawan_1986Belum ada peringkat

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDokumen10 halamanThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comBelum ada peringkat

- Domestic Equity Outlook - Indices Continue To Gain Ground Amidst VolatilityDokumen9 halamanDomestic Equity Outlook - Indices Continue To Gain Ground Amidst Volatilitygaganbiotech20Belum ada peringkat

- For Impact: BracingDokumen6 halamanFor Impact: BracingAndre_Setiawan_1986Belum ada peringkat

- Shutdown, For Now: .DJI 12,380.05 (-29.44) .SPX 1,328.17 (-5.34) .IXIC 2,780.42 (-15.72)Dokumen5 halamanShutdown, For Now: .DJI 12,380.05 (-29.44) .SPX 1,328.17 (-5.34) .IXIC 2,780.42 (-15.72)Andre_Setiawan_1986Belum ada peringkat

- The S&P and On To Earnings Again: .DJI 12,266.75 (+65.16) .SPX 1,312.62 (+7.48) .IXIC 2,744.97 (+9.59)Dokumen4 halamanThe S&P and On To Earnings Again: .DJI 12,266.75 (+65.16) .SPX 1,312.62 (+7.48) .IXIC 2,744.97 (+9.59)Andre_Setiawan_1986Belum ada peringkat

- Or No Shutdown?Dokumen6 halamanOr No Shutdown?Andre_Setiawan_1986Belum ada peringkat

- .Dji 12,213.09 .SPX 1,321.82 .Ixic 2,765.77Dokumen5 halaman.Dji 12,213.09 .SPX 1,321.82 .Ixic 2,765.77Andre_Setiawan_1986Belum ada peringkat

- Of QE2?: .DJI 12,220.59 (+50.03) .SPX 1,313.80 (+4.14) .IXIC 2,743.06 (+6.64)Dokumen7 halamanOf QE2?: .DJI 12,220.59 (+50.03) .SPX 1,313.80 (+4.14) .IXIC 2,743.06 (+6.64)Andre_Setiawan_1986Belum ada peringkat

- Stock Focus: BA: Feb 22nd MTD Resistances 2.89% 2.09% Supports YTD 12-Month Outlook 8.69% 12.30% Strategy BADokumen1 halamanStock Focus: BA: Feb 22nd MTD Resistances 2.89% 2.09% Supports YTD 12-Month Outlook 8.69% 12.30% Strategy BAAndre_Setiawan_1986Belum ada peringkat

- Stock Focus: KFT: Feb 23rd MTD Resistances 0.67% 3.63% Supports YTD 12-Month Outlook 0.54% 11.43% Strategy KFTDokumen2 halamanStock Focus: KFT: Feb 23rd MTD Resistances 0.67% 3.63% Supports YTD 12-Month Outlook 0.54% 11.43% Strategy KFTAndre_Setiawan_1986Belum ada peringkat

- .Dji 12,044.40 (+59.79) .SPX 1,304.28 (+9.17) .Ixic 2,715.61 (+14.59)Dokumen6 halaman.Dji 12,044.40 (+59.79) .SPX 1,304.28 (+9.17) .Ixic 2,715.61 (+14.59)Andre_Setiawan_1986Belum ada peringkat

- Day Ahead: .DJI 12,258.20 .SPX 1,330.97 .IXIC 2,798.74Dokumen3 halamanDay Ahead: .DJI 12,258.20 .SPX 1,330.97 .IXIC 2,798.74Andre_Setiawan_1986Belum ada peringkat

- Industrial News: Dow 12,391.25 +73.11 +0.59% S&P 500 1,343.01 +2.58 +0.19% Nasdaq 2,833.95 +2.37 +0.08%Dokumen6 halamanIndustrial News: Dow 12,391.25 +73.11 +0.59% S&P 500 1,343.01 +2.58 +0.19% Nasdaq 2,833.95 +2.37 +0.08%Andre_Setiawan_1986Belum ada peringkat

- Technical Focus: DIS: Dow 12,041.97 +1.81 0.02% S&P 500 1,304.03 - 3.56 - 0.27% Nasdaq 2,749.56 - 1.63 - 0.06%Dokumen3 halamanTechnical Focus: DIS: Dow 12,041.97 +1.81 0.02% S&P 500 1,304.03 - 3.56 - 0.27% Nasdaq 2,749.56 - 1.63 - 0.06%Andre_Setiawan_1986Belum ada peringkat

- Dow 12,273.26 +43.97 +0.36% S&P 500 1,329.15 +7.28 +0.55% Nasdaq 2,809.44 +18.99 +0.68%Dokumen6 halamanDow 12,273.26 +43.97 +0.36% S&P 500 1,329.15 +7.28 +0.55% Nasdaq 2,809.44 +18.99 +0.68%Andre_Setiawan_1986Belum ada peringkat

- Dow 12,288.17 +61.53 +0.50% S&P 500 1,336.32 +8.31 +0.63% Nasdaq 2,825.56 +21.21 +0.76%Dokumen6 halamanDow 12,288.17 +61.53 +0.50% S&P 500 1,336.32 +8.31 +0.63% Nasdaq 2,825.56 +21.21 +0.76%Andre_Setiawan_1986Belum ada peringkat

- Dow 12,318.14 +29.97 +0.24% S&P 500 1,340.43 +4.11 +0.31% Nasdaq 2,831.58 +6.02 +0.21%Dokumen5 halamanDow 12,318.14 +29.97 +0.24% S&P 500 1,340.43 +4.11 +0.31% Nasdaq 2,831.58 +6.02 +0.21%Andre_Setiawan_1986Belum ada peringkat

- Dow 12,226.64 - 41.55 - 0.34% S&P 500 1,328.01 - 4.31 - 0.32% Nasdaq 2,804.35 - 12.83 - 0.46%Dokumen6 halamanDow 12,226.64 - 41.55 - 0.34% S&P 500 1,328.01 - 4.31 - 0.32% Nasdaq 2,804.35 - 12.83 - 0.46%Andre_Setiawan_1986Belum ada peringkat

- Dow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Dokumen5 halamanDow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Andre_Setiawan_1986Belum ada peringkat

- Dow 12,268.19 - 5.07 - 0.04% S&P 500 1,332.32 +3.17 +0.24% Nasdaq 2,817.18 +7.74 +0.28%Dokumen6 halamanDow 12,268.19 - 5.07 - 0.04% S&P 500 1,332.32 +3.17 +0.24% Nasdaq 2,817.18 +7.74 +0.28%Andre_Setiawan_1986Belum ada peringkat

- Dow 12,161.63 +69.48 0.57% S&P 500 1,319.05 +8.18 0.62% Nasdaq 2,783.99 +14.69 0.53%Dokumen5 halamanDow 12,161.63 +69.48 0.57% S&P 500 1,319.05 +8.18 0.62% Nasdaq 2,783.99 +14.69 0.53%Andre_Setiawan_1986Belum ada peringkat

- Index Last Δ (%) : Dow Jones 11,891.93 S&P 500 1,286.12 Nasdaq 2,700.08Dokumen4 halamanIndex Last Δ (%) : Dow Jones 11,891.93 S&P 500 1,286.12 Nasdaq 2,700.08Andre_Setiawan_1986Belum ada peringkat

- MG 201010Dokumen3 halamanMG 201010Andre_Setiawan_1986Belum ada peringkat

- Vault Guide To Top Finance FirmsDokumen313 halamanVault Guide To Top Finance Firmspandamusic46100% (1)

- A.W.Cohen - Three Point Reversal Method of Point & Figure Stock Market Trading PDFDokumen132 halamanA.W.Cohen - Three Point Reversal Method of Point & Figure Stock Market Trading PDFGanesh100% (6)

- STOCKS & COMMODITIES The Traders PDFDokumen48 halamanSTOCKS & COMMODITIES The Traders PDFjakokBelum ada peringkat

- Stocks vs. Gold - Updated Historical Chart - Longtermtrends PDFDokumen3 halamanStocks vs. Gold - Updated Historical Chart - Longtermtrends PDFJagjyot SinghBelum ada peringkat

- Final PPT On Dow TheoryDokumen21 halamanFinal PPT On Dow Theorypari0000100% (2)

- Contractors Electrical WebpageDokumen4 halamanContractors Electrical WebpageJAGUAR GAMINGBelum ada peringkat

- Technical AnalysisDokumen35 halamanTechnical Analysisjuliet tio0% (1)

- Sears Stores ClosingDokumen2 halamanSears Stores ClosingLarryDCurtisBelum ada peringkat

- Cmt3 Prep QuestionsDokumen34 halamanCmt3 Prep Questionschaudharyarvind75% (4)

- MLB 150 AccsDokumen11 halamanMLB 150 Accsok na ata toBelum ada peringkat

- Mid-Year Forecast 2020: Larry WilliamsDokumen11 halamanMid-Year Forecast 2020: Larry WilliamsRejv Offenders100% (2)

- Stock Market Research Paper 5Dokumen13 halamanStock Market Research Paper 5api-549214190Belum ada peringkat

- Resultado: Buscar Fabricante o Prefijos MACDokumen10 halamanResultado: Buscar Fabricante o Prefijos MACJosé LuisBelum ada peringkat

- Short Adxcellence Power Trend Strategies Charles SchaapDokumen85 halamanShort Adxcellence Power Trend Strategies Charles SchaapMedical Skg100% (1)

- PTS Morning Call 12-14-09Dokumen4 halamanPTS Morning Call 12-14-09PrismtradingschoolBelum ada peringkat

- Saturn Retrograde Will Trigger Global RecessionDokumen26 halamanSaturn Retrograde Will Trigger Global RecessionmichaBelum ada peringkat

- Investments Canadian Canadian 8th Edition Bodie Test BankDokumen39 halamanInvestments Canadian Canadian 8th Edition Bodie Test Banka609526046Belum ada peringkat

- Numserie Nit Tipo Modelo NummotorDokumen42 halamanNumserie Nit Tipo Modelo NummotorDayana SernaBelum ada peringkat

- Nasdaq Outpaces Blue Chips, S&P 500 As Tech Stocks Rally: Dell Explores Spinning Off $50 Billion Vmware StakeDokumen34 halamanNasdaq Outpaces Blue Chips, S&P 500 As Tech Stocks Rally: Dell Explores Spinning Off $50 Billion Vmware Stakeenock-readersBelum ada peringkat

- Sectors of The Dow StocksDokumen1 halamanSectors of The Dow StocksTrader CatBelum ada peringkat

- New York Times - Looking Back at The Crash of 1929Dokumen73 halamanNew York Times - Looking Back at The Crash of 1929cdromuserBelum ada peringkat

- The Wall Street Journal - 24.02.2021Dokumen34 halamanThe Wall Street Journal - 24.02.2021xguessBelum ada peringkat

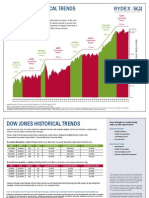

- Rydex Historical TrendsDokumen2 halamanRydex Historical TrendsVinayak PatilBelum ada peringkat

- The Domestic and International Financial MarketplaceDokumen56 halamanThe Domestic and International Financial MarketplaceMillyBelum ada peringkat

- Section 1 - Dow Jones Index Options: Essential Terms and DefinitionsDokumen17 halamanSection 1 - Dow Jones Index Options: Essential Terms and DefinitionspkkothariBelum ada peringkat

- 308-Chapter 2, 3, 4, 5 &7Dokumen15 halaman308-Chapter 2, 3, 4, 5 &7Mohammad AnikBelum ada peringkat

- Deal Money SIP PDFDokumen71 halamanDeal Money SIP PDFSaurav KumarBelum ada peringkat

- Pivot Table NewsDokumen705 halamanPivot Table Newspuneet.sBelum ada peringkat

- Percuma Punya SoftwareDokumen80 halamanPercuma Punya SoftwareSitus Teknik SipilBelum ada peringkat

- Ip ProjectDokumen11 halamanIp ProjectDhruvBelum ada peringkat