Derivatives Trading Strategies

Diunggah oleh

Prabhakar ChamarthiDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Derivatives Trading Strategies

Diunggah oleh

Prabhakar ChamarthiHak Cipta:

Format Tersedia

Derivatives Trading Strategies

Paolo Tasca

In about 600 pages this technical handbook describes in detailed form more than 100 financial derivatives trading

strategies. The aim is to introduce the reader to the comprehension of functional mechanisms behind the exchanged-

traded financial futures and options trading strategies.

Both practitioners (eg traders) and students of finance are the users to who this “ready to use” handbook has

been written.

Joining together a constant scientific strictness with a simple language, the contents are understandable by

everyone with a basic finance training. The First part is an helpful introduction which, step by step will guide the reader

toward the world of derivatives market. Since every trading strategy is intimately related to the features of the adopted

contracts, the book examines the most updated trading strategies used by professional traders in the industry with clear

practical examples referred to Italian Derivative Market (IDEM) contracts. Basically: stock futures/option and index

futures/options.

In the first general part named “Financial Derivatives”, the book examines the characteristic of equity-index

futures and options contracts, the different pricing methodologies and the features of options’ Greeks..

The second part named “Futures Trading Strategies”, begins describing the simplest directional futures trading

strategies. Later on, we will move to analyze the relative value trading strategies and for ending the synthetic futures

positions.

The Third part, “Options Trading Strategies” starts describing the so called ‘simple option strategies’, to move

later towards the mechanisms behind the bullish strategies, the bearish strategies, the delta neutral strategies, the

diagonal combinations and the synthetic option positions.

In the Fourth part, “Derivatives Markets and Financial Systemic Crises” we end up with a review of the

heterogeneous and controversial opinions about the pros and cons of derivatives market and speculation in undermining

the stability of financial markets.

The handbook is equipped with STAROPTION©. This software implements a locked-trade. An arbitrage

strategy that selecting in real time among about 900 options on the same underlying, crosses match together the prices

of four options (1 long call + 1 long put + 1 short call + 1 short put) with the purpose to replicate a synthetic long futures

position and a synthetic short future position on stock-indexes. Developed in VBasic, STAROPTION © is able to

dialogue with any brokerage trading system, by means of DDE protocol.

Advanced School of Economics

Ca’ Foscari_University of Venice w w w . u n i v e . i t © 2008

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Arbitrage Pricing TheoryDokumen4 halamanArbitrage Pricing TheoryVijaya KadiyalaBelum ada peringkat

- Diva Shoes, IncDokumen17 halamanDiva Shoes, Inc洪禹Belum ada peringkat

- IM PandeyDokumen45 halamanIM PandeyRahul KhannaBelum ada peringkat

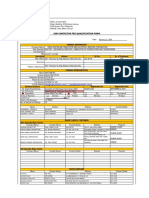

- PEMI - Redemption Order Form (ROF)Dokumen1 halamanPEMI - Redemption Order Form (ROF)ippon_osotoBelum ada peringkat

- Axitrader Ebook1 7 Lessons Forex Market Types v2 PDFDokumen18 halamanAxitrader Ebook1 7 Lessons Forex Market Types v2 PDFem00105Belum ada peringkat

- DATEM Pre Qualification FormDokumen4 halamanDATEM Pre Qualification FormGilbert PinedaBelum ada peringkat

- SEBI Handbook 15Dokumen216 halamanSEBI Handbook 15adoniscalBelum ada peringkat

- Sufiyan ComDokumen56 halamanSufiyan ComManish Agarwal100% (1)

- InvestingDokumen74 halamanInvestingapi-238711136Belum ada peringkat

- Karimi v. Deutsche Bank ComplaintDokumen36 halamanKarimi v. Deutsche Bank ComplaintWashington Free BeaconBelum ada peringkat

- 2018 MayDokumen64 halaman2018 MayVeriaktar Veriaktaroğlu100% (2)

- Fin TRM Comm RM 2Dokumen12 halamanFin TRM Comm RM 2Sam KuBelum ada peringkat

- Sanket Gajjar-Trader CarnivalDokumen24 halamanSanket Gajjar-Trader CarnivalDhiraj LokhandeBelum ada peringkat

- Project Financing by Banks and NBFCSDokumen105 halamanProject Financing by Banks and NBFCSjignay86% (22)

- Process of Deposit MobilizationDokumen6 halamanProcess of Deposit MobilizationMuhammad Yasir89% (18)

- Unit-1 - AR ACTDokumen174 halamanUnit-1 - AR ACTgeorgianaborzaBelum ada peringkat

- Ambit Capital Mr. KN Sivasubramanian AddressDokumen19 halamanAmbit Capital Mr. KN Sivasubramanian AddressbrijsingBelum ada peringkat

- The Weekly Peak: Peak Theories Research LLCDokumen6 halamanThe Weekly Peak: Peak Theories Research LLCfcamargoeBelum ada peringkat

- ERXGen BreakOut MultiCurrency TraderDokumen2 halamanERXGen BreakOut MultiCurrency TradercocoBelum ada peringkat

- Businessstandardpaper PDFDokumen18 halamanBusinessstandardpaper PDFaashaBelum ada peringkat

- VWAP Intraday Strategy for StocksDokumen11 halamanVWAP Intraday Strategy for Stockssudharshanan100% (1)

- Fidr 20221222 EngDokumen8 halamanFidr 20221222 EngEric ZoomBelum ada peringkat

- ProspectusDokumen224 halamanProspectusSamrat ShindeBelum ada peringkat

- BAC Prospectus PDFDokumen25 halamanBAC Prospectus PDFDaniel KwanBelum ada peringkat

- Powers and Functions of SEBIDokumen11 halamanPowers and Functions of SEBIMeenakshi Singh100% (1)

- HaiDokumen20 halamanHaikuku's entertainmentBelum ada peringkat

- Tahoe Reports Protest at La ArenaDokumen3 halamanTahoe Reports Protest at La ArenaSuriname MirrorBelum ada peringkat

- Exchange Rate and It's TypeDokumen4 halamanExchange Rate and It's Typeanish-kc-8151Belum ada peringkat

- Duration, Convexity Calculator For US TreasuriesDokumen12 halamanDuration, Convexity Calculator For US TreasuriesThanh CongBelum ada peringkat

- Oct 2011: Qualitative Evaluation To Determine The Necessity of Step 1 of The Goodwill Impairment TestDokumen3 halamanOct 2011: Qualitative Evaluation To Determine The Necessity of Step 1 of The Goodwill Impairment TestSingerLewakBelum ada peringkat