Print This Page

Diunggah oleh

Tenali Chandana0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan1 halamanIncome Tax sections at a glance. Section Salary: 10(10) Head Gratuity Limit 1. 3,50,000 2. Actual 3. Yr 15 / 30 Ang salary of 10 months (Basic+DA+Comm) If gratuity is also available: Accumulated Pension 1 / 2 1. Actual 2. 3,00,000 3. 10 months avg salary(last drawn) 4. Leave Encashment max 30 days for every completed yr of service.

Deskripsi Asli:

Judul Asli

print_this_page

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniIncome Tax sections at a glance. Section Salary: 10(10) Head Gratuity Limit 1. 3,50,000 2. Actual 3. Yr 15 / 30 Ang salary of 10 months (Basic+DA+Comm) If gratuity is also available: Accumulated Pension 1 / 2 1. Actual 2. 3,00,000 3. 10 months avg salary(last drawn) 4. Leave Encashment max 30 days for every completed yr of service.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan1 halamanPrint This Page

Diunggah oleh

Tenali ChandanaIncome Tax sections at a glance. Section Salary: 10(10) Head Gratuity Limit 1. 3,50,000 2. Actual 3. Yr 15 / 30 Ang salary of 10 months (Basic+DA+Comm) If gratuity is also available: Accumulated Pension 1 / 2 1. Actual 2. 3,00,000 3. 10 months avg salary(last drawn) 4. Leave Encashment max 30 days for every completed yr of service.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

CAclubindia News : Income Tax sections at a glance Page 1 of 1

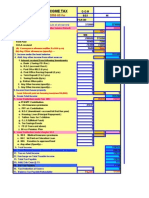

Income Tax sections at a glance

Section Head Limit Remarks

Salary:

1. 3,50,000 Basic + DA (forming part of

2. Actual retirement benefits) +

10(10) Gratuity

3. Yr*15/30*Ang salary of 10 Months Comm based on % of turn

(Basic+DA+Comm) over

If gratuity is also available:

Accumulated Pension*1/3

10(10A) Pension

Otherwise:

Accumulated pension*1/2

1. Actual

Basic + DA (forming part of

2. 3,00,000

retirement benefits) +

10(10AA) Leave Encashment 3. 10 months avg salary(last drawn)

Comm based on % of turn

4. leave encashment max 30 days for every

over

completed yr of service

1. Actual

Retrenchment 2. 5,00,000

10(10B)

Compensation 3. Amount calculated in accordance with

Industrial Dispute Act

1. Actual

2. 5,00,000

3. Last drawn salary*3*Months of

10(10C) voluntary Retirement

completed yr of service

4. Last drawn salary* Balance no of months

in yr of service left

Basic + DA (forming part of

1. Actual

retirement benefits) +

10(13A) House Rent Allowance 2. Rent paid - 10% of salary

Comm based on % of turn

3. 40% or 50% of salary

over

10(19) Family Pension 15000 or 1/3rd of Family Pension

11(1A) Capital Gains

11(2) Accumulations of Income

Income from Voluntary

12

Contributions

Tax Exemption to Political

13A

Parties

1. 5,000

16(ii) Entertainment Allowance 2. Actual Basic

3. 20% of Basic

House Property:

GAV

Less: Municiple Taxes

(a). Sum reasonably expected from letting

Unrealisable rent

(b). Actual rent recd or receivable

Annual Value NAV

(c). If owing to such vacancy actual rent

Less: 30% of NAV

recd or receivable < (a), Actual rent

Int(Max 150,000)

paid/payable

25AA Arrears of rent received Deduction 30% allowed

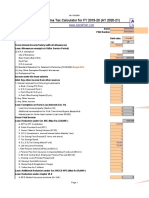

Deductions from GTI:

80C LIC, PF Etc 1,00,000* Maximum of 1,00,000

80CCC Pension Funds 1,00,000*

80CCD Pension scheme of CG 1,00,000*

Spouse, Parents and

80D Medical Insurance Premia 20000 for SS/ 15000 for other

children

Spouse, Parents and

80DD Handicapped Dependant 75000 for severe/50000 for normal children, Bro & Sis

(Dependent)

60000 for SS/40000 for other or

80DDB Medical treatment

Actual (Whichever is less)

80E Higher education Entire amount for 7 yr from Initial Ass Yr.

No ceiling of 10% of Adj GTI

50% for Gandhi, nehru/100% other

80G Donation to funds etc Ceiling of 10% of Adj GTI

100% for family planning, sport etc

50% for mandir, charitable etc

1. 2000 PM

80GG Rent paid 2. 25% of TI (After all deductions)

3. Exp.-10% of TI (After all deductions)

donation to scientific

80GGA 100%

research

Political parties by

80GGB 100%

company

Political Parties by

80GGC 100%

Individual

80JJA Bio Degradable waste 100% for 5 consecutive assessment

Employement of new 30% of additional wages paid to new

80JJAA

workmen regular workmen for 3 Ass yr.

80LA offshore bankng units 100% for 5 yr/50% for next 5 yr

1. For Banking, Cottage, Fishing, Milk

Etc=100%

2. Other-

80P Co Operative societies

a. Consumer Co-Op Socity=100%

b. Other=50%

3. Other=100%

1. Lumpsum- 100% Royalty>15% shall be

80QQB Royalty from Books 2. Not Lumpsum- Actual or 3,00,000 ignored, if not paid

(lower) Lumpsum

80RRB Royalty from Patents Actual or 3,00,000 (lower) Not available to NR

80U Person with Disability 75000 for severe/50000 for normal

80-IA a. Infrastructure 100% for 10 yr out of 20 yr's

b. Telecommunication 100% for 5 yr and 30% for next 5 yr

c. SEZ/IT park developmt 100% for 10 yr out of 15 yrs

d. Power business 100% for 10 yr out of 15 yrs

80-IAB SEZ developmt 100% for 10 yr out of 15 yrs

Taxation of Firms:

Surcharge 10% applicable even if firms Net Income is below Rs. 1 Cr

Maximum Interest on Capital Account 12%

Remuneration to working partner only and only with authorisation in partnership deed

Maximum 50,000 or 90% of Book

Business Firm First 75,000

limit: Profit( Higher)

Next 75,000 60%

balance profit*(before adjusting

40%

remuneration to partners)

50,000 or 90% of Book

Professional Firm First 1,00,000

Profit( Higher)

Next 1,00,000 60%

balance profit 40%

Remuneration and Interest is allowed from presumptive income U/s 44AD,44AE & 44AF.

If there is a change in constitution of firm than share of retired partner shall not be carry forward

Presumptive Taxation:

44AD Civil Construction 8% of Gross receipt

44AE Goods carriage 3500/3150 PM for Heavy/Light Vehicle

44AF Retail Business 5% of Turnover

Capital Gain: Repurchase

54 House to house 1 Yr prior or 2 yr after pur/3yr construct

54B land to land (Agri) 2 Yr from date of transfer

54D L&B to L&B 3yr from date of transfer (Compulsary Acquisition)

Any capital assets to

54EC 6 Month from date of transfer

Shares etc.

Not own >1 house other

54F Other to House 1 Yr prior or 2 yr after pur/3yr construct

than new asset

54G L&B/P&M to L&B/P&M 1 yr prior or 3 yr after fron dt of trnsfer (Urben to Non Urben)

54GA L&B/P&M to L&B/P&M 1 yr prior or 3 yr after fron dt of trnsfer (Urben to SEZ)

139(3) Return of loss Before 31st Oct of relevant AY

Before 1 Yr from end of Relevent AY or Before completn of

139(4) Belated return

Assessment

Return filed originaly U/s 139(1)/142(1)

139(5) Revised Return Before 1 Yr from end of AY or compln of

Assessment.

Defective/Incomplete

139(9)

return

139A PAN

139B Tax return prepares

234A Default in furnishing ROI 1% P.M. or part of Month

1% P.M. or part of Month From April 1 to date of

234B Default in payt of Adv. Tax

If Adv tax paid is <90% of Tax due. determination of Income

234C Deferment of Adv tax 1% P.M. or part of Month

234D Int on Excess Refund 0.50% PM or part of month

Source : -

http://www.caclubindia.com/articles/print_this_page.asp?article_id=1480 22-Mar-11

Anda mungkin juga menyukai

- Salaries NotesDokumen48 halamanSalaries Notesbhatiasanjay89Belum ada peringkat

- 30 SalaryDokumen13 halaman30 SalaryBahi Rathan RBelum ada peringkat

- Income From HPDokumen17 halamanIncome From HPaKSHAT sHARMABelum ada peringkat

- Income From SalaryDokumen35 halamanIncome From SalaryNistha RayBelum ada peringkat

- Whichever Is Lower: A) DeductionsDokumen3 halamanWhichever Is Lower: A) Deductions8151 KATALE PRIYANKABelum ada peringkat

- Chapter 4a PDFDokumen14 halamanChapter 4a PDFBrinda RBelum ada peringkat

- About The Charts: CA Pooja Kamdar DateDokumen8 halamanAbout The Charts: CA Pooja Kamdar DatekbalakarthikaBelum ada peringkat

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Dokumen5 halamanBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARIBelum ada peringkat

- Sunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Dokumen14 halamanSunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Prashant singhBelum ada peringkat

- Salary Income and House Property Loss ITR FilingDokumen7 halamanSalary Income and House Property Loss ITR FilingSushant MishraBelum ada peringkat

- incone from salary ppts.pdf348Dokumen48 halamanincone from salary ppts.pdf348saloniagarwalagarwal3Belum ada peringkat

- Lecture 4to9 - SalaryDokumen15 halamanLecture 4to9 - SalaryVandana VaidyaBelum ada peringkat

- Shree Chanakya Education Society's Indira Institute of Management, Pune Master of Business Administration Semester - IIDokumen5 halamanShree Chanakya Education Society's Indira Institute of Management, Pune Master of Business Administration Semester - IIBanti guptaBelum ada peringkat

- FORM 16 CERTIFICATEDokumen3 halamanFORM 16 CERTIFICATEDebesh KuanrBelum ada peringkat

- Afsal TaxDokumen2 halamanAfsal Taxplacementcell Govt ITI AttingalBelum ada peringkat

- G Vittal 16 FrontDokumen1 halamanG Vittal 16 FrontSRINIVAS MBelum ada peringkat

- Income Tax Calculator titleDokumen12 halamanIncome Tax Calculator titleUdaysinh PatilBelum ada peringkat

- 2.2-Module 2-Part 2 PDFDokumen12 halaman2.2-Module 2-Part 2 PDFArpita ArtaniBelum ada peringkat

- 2.2 Module 2 Part 2Dokumen12 halaman2.2 Module 2 Part 2Arpita ArtaniBelum ada peringkat

- Section A - CASE QUESTIONS (Total: 50 Marks) : PC - Taxation (June 2012 Session)Dokumen12 halamanSection A - CASE QUESTIONS (Total: 50 Marks) : PC - Taxation (June 2012 Session)Steven LukBelum ada peringkat

- Head Salary PDFDokumen48 halamanHead Salary PDFRvi MahayBelum ada peringkat

- NPS Tax Benefits - at A GlanceDokumen2 halamanNPS Tax Benefits - at A GlanceDurgeshTiwariBelum ada peringkat

- Form 16 Part - BDokumen3 halamanForm 16 Part - BdivanshuBelum ada peringkat

- Income Tax Calculation Statement For The Year 2001-2002Dokumen1 halamanIncome Tax Calculation Statement For The Year 2001-2002elango128Belum ada peringkat

- 02 - Taxation - Chapter-2 - Salary Part-1Dokumen27 halaman02 - Taxation - Chapter-2 - Salary Part-1apandeyproBelum ada peringkat

- PAYSLIP Nov-2022 - NareshDokumen3 halamanPAYSLIP Nov-2022 - NareshDharshan RajBelum ada peringkat

- Income Tax Declaration Form FY 22 23 AY 23 24Dokumen2 halamanIncome Tax Declaration Form FY 22 23 AY 23 24kishoreBelum ada peringkat

- Direct Taxes Module 2 Class NotesDokumen13 halamanDirect Taxes Module 2 Class NotesSwetha AshokBelum ada peringkat

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Dokumen2 halaman(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarBelum ada peringkat

- Form 16 Fy 19 20 Part BDokumen3 halamanForm 16 Fy 19 20 Part BMilind MoreBelum ada peringkat

- Tax Calculator - Indian Income Tax 2008-09Dokumen7 halamanTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Income Tax Calculator Fy 2019 20 v4Dokumen9 halamanIncome Tax Calculator Fy 2019 20 v4Anil KesarkarBelum ada peringkat

- Payslip Oct-2022 NareshDokumen3 halamanPayslip Oct-2022 NareshDharshan Raj0% (1)

- Form PDF 453493910110820Dokumen7 halamanForm PDF 453493910110820deepkaryan1988Belum ada peringkat

- ArthikDisha IT Cal FY 2023 24 AY 2024 25Dokumen6 halamanArthikDisha IT Cal FY 2023 24 AY 2024 25SridharBelum ada peringkat

- IT Calculator 2018 LiteDokumen6 halamanIT Calculator 2018 LiteHr PoonamBelum ada peringkat

- Q1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDokumen40 halamanQ1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDhiraj YAdavBelum ada peringkat

- Manish Soni - Offer LetterDokumen2 halamanManish Soni - Offer LetterMd SharidBelum ada peringkat

- MCQs All Sets F 1Dokumen46 halamanMCQs All Sets F 1PSK WRITINGSBelum ada peringkat

- LALYDokumen2 halamanLALYplacementcell Govt ITI AttingalBelum ada peringkat

- Income From SalaryDokumen60 halamanIncome From SalaryroopamBelum ada peringkat

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Dokumen10 halamanCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583Belum ada peringkat

- Hhaps6093h Partb 2020-21Dokumen3 halamanHhaps6093h Partb 2020-21Siva Kumar SBelum ada peringkat

- Ablpt1672m Partb 2021-22Dokumen3 halamanAblpt1672m Partb 2021-22foni123Belum ada peringkat

- Form No. 16: Part BDokumen3 halamanForm No. 16: Part Bsanjay chauhanBelum ada peringkat

- Salary: Basic of Charge (Sec - 15)Dokumen15 halamanSalary: Basic of Charge (Sec - 15)Rajesh NangaliaBelum ada peringkat

- 77taxability of Retirement Benefits 231122 092942Dokumen9 halaman77taxability of Retirement Benefits 231122 092942jasontamang565Belum ada peringkat

- Dwypr7472e Partb 2023-24Dokumen3 halamanDwypr7472e Partb 2023-24Ganapathy ABelum ada peringkat

- Sunil BDokumen2 halamanSunil Bplacementcell Govt ITI AttingalBelum ada peringkat

- FORM No. 16: Name and Address of The Employee Name and Address of The EmployerDokumen6 halamanFORM No. 16: Name and Address of The Employee Name and Address of The EmployerRavi KattruBelum ada peringkat

- Unit 2 Exemptions RulesDokumen7 halamanUnit 2 Exemptions RulesSuseela PBelum ada peringkat

- Allowances Allowable To Tax PayerDokumen13 halamanAllowances Allowable To Tax PayerbabakababaBelum ada peringkat

- Payslip Sep-2022 NareshDokumen3 halamanPayslip Sep-2022 NareshDharshan RajBelum ada peringkat

- Form 16 - IT DEPT TCS Eserve Part B - 20222023Dokumen3 halamanForm 16 - IT DEPT TCS Eserve Part B - 20222023Suraj KumarBelum ada peringkat

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 804939620180718 Assessment Year: 2018-19Dokumen5 halamanItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 804939620180718 Assessment Year: 2018-19CHRISTY JOSEBelum ada peringkat

- 112029X - 2022 For 16 Part BDokumen3 halaman112029X - 2022 For 16 Part BMeetanshi AggarwalBelum ada peringkat

- Housing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodDokumen4 halamanHousing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodJoey AlbertBelum ada peringkat

- Vodafone service grievance unresolvedDokumen2 halamanVodafone service grievance unresolvedSojan PaulBelum ada peringkat

- Ei 22Dokumen1 halamanEi 22larthBelum ada peringkat

- 11 Days Banner Advertising Plan for Prothom AloDokumen4 halaman11 Days Banner Advertising Plan for Prothom AloC. M. Omar FaruqBelum ada peringkat

- Learn Jèrriais - Lesson 1 2Dokumen19 halamanLearn Jèrriais - Lesson 1 2Sara DavisBelum ada peringkat

- Hwa Tai AR2015 (Bursa)Dokumen104 halamanHwa Tai AR2015 (Bursa)Muhammad AzmanBelum ada peringkat

- Ford Investigative Judgment Free EbookDokumen73 halamanFord Investigative Judgment Free EbookMICHAEL FAJARDO VARAS100% (1)

- Vivarium - Vol 37, Nos. 1-2, 1999Dokumen306 halamanVivarium - Vol 37, Nos. 1-2, 1999Manticora VenerabilisBelum ada peringkat

- Edsml Assignment SCM 2 - Velux GroupDokumen20 halamanEdsml Assignment SCM 2 - Velux GroupSwapnil BhagatBelum ada peringkat

- Religious Marriage in A Liberal State Gidi Sapir & Daniel StatmanDokumen26 halamanReligious Marriage in A Liberal State Gidi Sapir & Daniel StatmanR Hayim BakaBelum ada peringkat

- Marine Insurance Final ITL & PSMDokumen31 halamanMarine Insurance Final ITL & PSMaeeeBelum ada peringkat

- Account statement for Rinku MeherDokumen24 halamanAccount statement for Rinku MeherRinku MeherBelum ada peringkat

- Language Hub Student S Book Elementary Unit 1 1Dokumen9 halamanLanguage Hub Student S Book Elementary Unit 1 1Paulo MalheiroBelum ada peringkat

- Narrative On Parents OrientationDokumen2 halamanNarrative On Parents Orientationydieh donaBelum ada peringkat

- Olimpiada Engleza 2010 Etapa Locala IXDokumen4 halamanOlimpiada Engleza 2010 Etapa Locala IXAdrian TufanBelum ada peringkat

- San Beda UniversityDokumen16 halamanSan Beda UniversityrocerbitoBelum ada peringkat

- Pindyck Solutions Chapter 5Dokumen13 halamanPindyck Solutions Chapter 5Ashok Patsamatla100% (1)

- Intermediate Macro 1st Edition Barro Solutions ManualDokumen8 halamanIntermediate Macro 1st Edition Barro Solutions Manualkietcuongxm5100% (22)

- Overtime Request Form 加班申请表: Last Name First NameDokumen7 halamanOvertime Request Form 加班申请表: Last Name First NameOlan PrinceBelum ada peringkat

- Ola Ride Receipt March 25Dokumen3 halamanOla Ride Receipt March 25Nachiappan PlBelum ada peringkat

- Science Club-6Dokumen2 halamanScience Club-6Nguyễn Huyền Trang100% (1)

- Murder in Baldurs Gate Events SupplementDokumen8 halamanMurder in Baldurs Gate Events SupplementDavid L Kriegel100% (3)

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerDokumen40 halamanPPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshBelum ada peringkat

- In Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghDokumen1 halamanIn Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghRohith KumarBelum ada peringkat

- Why EIA is Important for Development ProjectsDokumen19 halamanWhy EIA is Important for Development Projectsvivek377Belum ada peringkat

- ERP in Apparel IndustryDokumen17 halamanERP in Apparel IndustrySuman KumarBelum ada peringkat

- Day 16. The 10th ScoringDokumen8 halamanDay 16. The 10th ScoringWahyu SaputraBelum ada peringkat

- Sefer Yetzirah PDFDokumen32 halamanSefer Yetzirah PDFWealthEntrepreneur100% (1)

- Cover Letter For Post of Business Process Improvement CoordinatorDokumen3 halamanCover Letter For Post of Business Process Improvement Coordinatorsandeep salgadoBelum ada peringkat

- Conference ListDokumen48 halamanConference ListDebopriya MajumderBelum ada peringkat