Trendgraphix Monthly Real Estate Report, March 2011

Diunggah oleh

Jim HamiltonDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Trendgraphix Monthly Real Estate Report, March 2011

Diunggah oleh

Jim HamiltonHak Cipta:

Format Tersedia

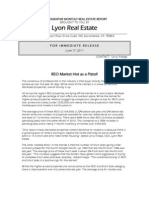

TRENDGRAPHIX MONTHLY REAL ESTATE REPORT

BROUGHT TO YOU BY

Lyon Real Estate

3640 American River Drive, Suite 100, Sacramento, CA 95864

FOR IMMEDIATE RELEASE

MARCH 23, 2011

CONTACT: Larry Knapp / CEO

(916) 978 - 4288

Big Jump in New Sales

According to Trendgraphix, there was a big jump in new sales (pendings) in January

and again in February. A deeper dive into the data suggests that most of the increase is

in the category of short sales. “This would be a good sign because any successful short

sale is one less potential REO, one less homeowner losing their home to foreclosure, and

one less house for the bank to have to take into their inventory,” stated Larry Knapp,

CEO, Lyon Real Estate. The data also indicates that the lenders have started to get their

arms around the process of getting out of a bad loan before they have to take

ownership; all of these things are good for the market. There is also a trend, although

hard to quantify, that may skew the short sale numbers. “We’re hearing that some

agents may be reporting a short sale as ‘pending’ when the seller accepts an offer rather

than waiting for the banks approval of the sales price,” continued Knapp. “This would

tend to inflate the number of short sale pendings for a few months. We’ll have to wait

and see how much of the increase is real and how much might come from a different

way of reporting sales.”

The greatest number of properties that are selling are under $300,000 and those sales

are averaging just over $100 per square foot. As the price range moves higher the

asking price per square foot is higher as well, and fewer properties are selling. “What

this suggests is that there is an abundance of buyers willing to pay bargain prices (i.e. in

the low $100 per square foot) and we know there is an abundance of distressed

properties in that bargain price category,” stated Knapp. “As long as an inventory of the

distressed properties remains readily available, prices will remain at these bargain

levels. With the large numbers of REO’s and Short Sale properties still in queue to hit the

market every month it would appear that these bargain prices will last for quite some

time into the future.”

Detailed information for individual areas (next page)

In the Tri County area of Sacramento, Placer and El Dorado Counties

This month compared to last month

• Closed Sales were down 6% (1,606 from 1,702)

• New Accepted Contracts (pendings) were up 31% (3,280 from 2,504)

• Inventory was down 3% (7,581 from 7,839)

• Total Months of Inventory was up 2% (to 4.7 months from 4.6) and

• Average Price Per Square Foot was down 2% (to $118 from $121).

This month compared to the same month a year ago…

• Closed Sales were up 1% (1,606 from 1,597)

• New Accepted Contracts (pendings) up 51% (3,280 from 2,175)

• Inventory was up 28% (7,581 from 5,936)

• Total Months of Inventory was up 27% (4.7 months from 3.7 months) and

• Average Price Per Square Foot was down 8% ($118 from $128)

Sacramento County

This month compared to last month

• Closed Sales were down 7% (1,156 from 1,245)

• New Accepted Contracts (pendings) were up 35% (2,362 from 1,756)

• Inventory was down 3% (5,198 from 5,375)

• Total Months of Inventory was up 4% (to 4.5 months from 4.3) and

• Average Price Per Square Foot was down 3% (to $110 from $113).

This month compared to the same month a year ago…

• Closed Sales were down 1% (1,156 from 1,170)

• New Accepted Contracts (pendings) were up 48% (2,362 from 1,599)

• Inventory was up 39% (5,198 from 3,749)

• Total Months of Inventory was up 40% (to 4.5 months from 3.2) and

• Average Price Per Square Foot was down 8% (to $110 from $119).

Placer County

This month compared to last month

• Closed Sales were down 2% ( 319 from 324)

• New Accepted Contracts (pendings) were up 16% (644 from 556)

• Inventory was down 4% (1,479 from 1,534)

• Total Months of Inventory was down 2% (to 4.6 months from 4.7) and

• Average Price Per Square Foot was down 1% (to $134 from $135).

This month compared to the same month a year ago…

• Closed Sales were up 6% ( 319 from 302)

• New Accepted Contracts (pendings) were up 51% (644 from 426)

• Inventory was up 15% (1,479 from 1,283)

• Total Months of Inventory was up 9% (to 4.6 months from 4.2) and

• Average Price Per Square Foot was down 8% (to $134 from $145).

El Dorado County

This month compared to last month

• Closed Sales were down 2% (131 from 133)

• New Accepted Contracts (pendings) were up 44% (276 from 192)

• Inventory was down 3% (907 from 935)

• Total Months of Inventory was down 2% (to 6.9 months from 7) and

• Average Price Per Square Foot was down 3% (to $135 from $139).

This month compared to the same month a year ago…

• Closed Sales were up 5% (131 from 125)

• New Accepted Contracts (pendings) were up 84% (276 from 150)

• Inventory was remained the same at 907

• Total Months of Inventory was down 5% (to 6.9 months from 7.3) and

• Average Price Per Square Foot was down 7% (to $135 from $145).

Yolo County

This month compared to last month

• Closed Sales were up 5% (105 from 100)

• New Accepted Contracts (pendings) were up 43% (224 from 157)

• Inventory was down 7% (449 from 482)

• Total Months of Inventory was down 11% (to 4.3 months from 4.8) and

• Average Price Per Square Foot was up 4% (to $138 from $133).

This month compared to the same month a year ago…

• Closed Sales were up 21% (105 from 87)

• New Accepted Contracts (pendings) were up 59% (224 from 141)

• Inventory was up 27% (449 from 353)

• Total Months of Inventory was up 5% (to 4.3 months from 4.1) and

• Average Price Per Square Foot was down 5% (to $138 from $145).

Nevada County

This month compared to last month

• Closed Sales were down 34% (23 from 35)

• New Accepted Contracts (pendings) were down 9% (29 from 32)

• Inventory was down 5% (349 from 369)

• Total Months of Inventory was up 44% (to 15.2 months from 10.5) and

• Average Price Per Square Foot was down 8% (to $156 from $169).

This month compared to the same month a year ago…

• Closed Sales were down 21% (23 from 29)

• New Accepted Contracts (pendings) were down 36% (29 from 45)

• Inventory was down 21% (349 from 442)

• Total Months of Inventory remained the same at 15.2 months and

• Average Price Per Square Foot was down 8% (to $156 from $169).

San Joaquin County

This month compared to last month

• Closed Sales were down 7% (602 from 644)

• New Accepted Contracts (pendings) were up 27% (1,203 from 946)

• Inventory was down 5% (2,334 from 2,451)

• Total Months of Inventory was up 2% (to 3.9 months from 3.8) and

• Average Price Per Square Foot was down 2% (to $95 from $97).

This month compared to the same month a year ago…

• Closed Sales were down 7% (602 from 650)

• New Accepted Contracts (pendings) were up 30% (1,203 from 927)

• Inventory was up 37% (2,334 from 1,698)

• Total Months of Inventory was up 48% (to 3.9 months from 2.6) and

• Average Price Per Square Foot was down 3% (to $95 from $98).

About Trendgraphix, Inc.

Trendgraphix, Inc. is a real estate reporting company based in Sacramento that uses

local MLS data to provide highly-visual market statistical graphs to real estate brokers,

agents, and MLS/Realtor associations across the USA. Trendgraphix's programs are

currently used by tens of thousands of agents in more than 100 brokerages in 18 U.S.

states. For more information visit www.TrendGraphix.com or email

mcarter@trendgraphix.com

Anda mungkin juga menyukai

- Lyon Real Estate Press Release April 2012Dokumen2 halamanLyon Real Estate Press Release April 2012Lyon Real EstateBelum ada peringkat

- Lyon Real Estate Press Release May 2012Dokumen2 halamanLyon Real Estate Press Release May 2012Lyon Real EstateBelum ada peringkat

- Lyon Real Estate Press Release June 2012Dokumen2 halamanLyon Real Estate Press Release June 2012Lyon Real EstateBelum ada peringkat

- Lyon Real Estate Press Release March 2012Dokumen2 halamanLyon Real Estate Press Release March 2012Lyon Real EstateBelum ada peringkat

- San Diego, CA 92154 Market ConditionsDokumen2 halamanSan Diego, CA 92154 Market ConditionsBrian WardBelum ada peringkat

- Nest Realty Q2 2013 Charlottesville Real Estate Market ReportDokumen9 halamanNest Realty Q2 2013 Charlottesville Real Estate Market ReportJonathan KauffmannBelum ada peringkat

- TRNDGX PressRelease Aug2011Dokumen2 halamanTRNDGX PressRelease Aug2011deedrileyBelum ada peringkat

- March 2015 Market UpdateDokumen4 halamanMarch 2015 Market UpdateDan DunlapBelum ada peringkat

- REMAX National Housing Report - July 2012 FinalDokumen2 halamanREMAX National Housing Report - July 2012 FinalSheila Newton TeamBelum ada peringkat

- Lyon Real Estate Press Release January 2012Dokumen2 halamanLyon Real Estate Press Release January 2012Lyon Real EstateBelum ada peringkat

- CoreLogic Weekly Market Update Week Ending 2016 December 4Dokumen6 halamanCoreLogic Weekly Market Update Week Ending 2016 December 4Australian Property ForumBelum ada peringkat

- Union City-Full PDFDokumen6 halamanUnion City-Full PDFHarry KharaBelum ada peringkat

- Real Estate: Sales Las Vegas Market April 2014Dokumen6 halamanReal Estate: Sales Las Vegas Market April 2014Gideon JoffeBelum ada peringkat

- Q2 2012 Charlottesville Nest ReportDokumen9 halamanQ2 2012 Charlottesville Nest ReportJim DuncanBelum ada peringkat

- June 2015 Market UpdateDokumen4 halamanJune 2015 Market UpdateDan DunlapBelum ada peringkat

- Existing Home Sales August 2011Dokumen1 halamanExisting Home Sales August 2011Jessica Kister-LombardoBelum ada peringkat

- Greater Metropolitan Denver Market Update FEBRUARY, 2012Dokumen3 halamanGreater Metropolitan Denver Market Update FEBRUARY, 2012Michael KozlowskiBelum ada peringkat

- Victoria Market Shows Modest GainsDokumen2 halamanVictoria Market Shows Modest GainsKevin WhiteBelum ada peringkat

- Pleasanton Full Market Report (Week of January 27th, 2014)Dokumen6 halamanPleasanton Full Market Report (Week of January 27th, 2014)Harry KharaBelum ada peringkat

- January Existing Home SalesDokumen1 halamanJanuary Existing Home SalesJessica Kister-LombardoBelum ada peringkat

- Existing Home SalesDokumen1 halamanExisting Home SalesJessica Kister-LombardoBelum ada peringkat

- GBRAR Monthly Indicators 04/2014Dokumen12 halamanGBRAR Monthly Indicators 04/2014Greater Baton Rouge Association of REALTORS® (GBRAR)Belum ada peringkat

- May 2012 Housing ReportDokumen18 halamanMay 2012 Housing Reportamyjbarnett1575Belum ada peringkat

- Weekend Market Summary Week Ending 2014 April 6Dokumen3 halamanWeekend Market Summary Week Ending 2014 April 6Australian Property ForumBelum ada peringkat

- Union City Full Market Report (Week of Nov 4, 2013)Dokumen6 halamanUnion City Full Market Report (Week of Nov 4, 2013)Harry KharaBelum ada peringkat

- Nantucket Real Estate Report: June Weddings Were Not The Only ReasonDokumen4 halamanNantucket Real Estate Report: June Weddings Were Not The Only ReasonDan DunlapBelum ada peringkat

- Santa Clara County Market Update - October 2011Dokumen4 halamanSanta Clara County Market Update - October 2011Gwen WangBelum ada peringkat

- Hayward Full Market Report (Week of October 28, 2013)Dokumen6 halamanHayward Full Market Report (Week of October 28, 2013)Harry KharaBelum ada peringkat

- Hayward Full Market ReportDokumen6 halamanHayward Full Market ReportHarry KharaBelum ada peringkat

- GBRAR Monthly Indicators 05/14Dokumen12 halamanGBRAR Monthly Indicators 05/14Greater Baton Rouge Association of REALTORS® (GBRAR)Belum ada peringkat

- Hayward Full Report Market (Week of November 18, 2013)Dokumen6 halamanHayward Full Report Market (Week of November 18, 2013)Harry KharaBelum ada peringkat

- Housing Prices in First Quarter Rise in Active Local Market: News ReleaseDokumen2 halamanHousing Prices in First Quarter Rise in Active Local Market: News ReleaseTed BauerBelum ada peringkat

- Fremont Full Market ReportDokumen6 halamanFremont Full Market ReportHarry KharaBelum ada peringkat

- Livermore Full Market Report (Week of March 3, 2014)Dokumen6 halamanLivermore Full Market Report (Week of March 3, 2014)Harry KharaBelum ada peringkat

- December 2013 Chicago Real Estate Market ReportDokumen15 halamanDecember 2013 Chicago Real Estate Market ReportShay HataBelum ada peringkat

- Housing Market Report Aug 2013 SalesDokumen6 halamanHousing Market Report Aug 2013 SalesGideon JoffeBelum ada peringkat

- Fremont Full Market ReportDokumen6 halamanFremont Full Market ReportHarry KharaBelum ada peringkat

- January 2015 Market UpdateDokumen4 halamanJanuary 2015 Market UpdateDan DunlapBelum ada peringkat

- Weekly Market Update Week Ending 2016 March 20Dokumen5 halamanWeekly Market Update Week Ending 2016 March 20Australian Property ForumBelum ada peringkat

- May 2015 Market UpdateDokumen4 halamanMay 2015 Market UpdateDan DunlapBelum ada peringkat

- Austin Housing Supply Overview - August 2011Dokumen7 halamanAustin Housing Supply Overview - August 2011Bryce CathcartBelum ada peringkat

- July 2015 RAPV Sales ReportDokumen6 halamanJuly 2015 RAPV Sales ReportJim KinneyBelum ada peringkat

- Fremont Full Market Report (Week of November 18, 2013)Dokumen6 halamanFremont Full Market Report (Week of November 18, 2013)Harry KharaBelum ada peringkat

- Union City Full Market Report (Week of February 10, 2014)Dokumen6 halamanUnion City Full Market Report (Week of February 10, 2014)Harry KharaBelum ada peringkat

- Victoria Solidly in A Seller'S MarketDokumen2 halamanVictoria Solidly in A Seller'S MarketKevin WhiteBelum ada peringkat

- Newark Full Market Report (Week of January 27th, 2014)Dokumen6 halamanNewark Full Market Report (Week of January 27th, 2014)Harry KharaBelum ada peringkat

- Fremont Full Market Report (Week of January 21, 2014)Dokumen6 halamanFremont Full Market Report (Week of January 21, 2014)Harry KharaBelum ada peringkat

- Hayward Full Market Report (Week of January 21, 2014)Dokumen6 halamanHayward Full Market Report (Week of January 21, 2014)Harry KharaBelum ada peringkat

- Hayward Full Market ReportDokumen6 halamanHayward Full Market ReportHarry KharaBelum ada peringkat

- CREB - November 2011 Calgary Real Estate StatisticsDokumen10 halamanCREB - November 2011 Calgary Real Estate StatisticsMike FotiouBelum ada peringkat

- Union City-Full ReportDokumen6 halamanUnion City-Full ReportHarry KharaBelum ada peringkat

- March 2016 Press Release and Statistics ReportDokumen11 halamanMarch 2016 Press Release and Statistics Reportapi-315971262Belum ada peringkat

- Weekend Market Summary Week Ending 2014 March 2Dokumen3 halamanWeekend Market Summary Week Ending 2014 March 2Australian Property ForumBelum ada peringkat

- January 2015 WH Market ReportDokumen4 halamanJanuary 2015 WH Market ReportSean PageBelum ada peringkat

- Calgary Real Estate November 2011 Monthly Housing StatisticsDokumen19 halamanCalgary Real Estate November 2011 Monthly Housing StatisticsCrystal TostBelum ada peringkat

- 2010MktFcst FolsomDokumen21 halaman2010MktFcst FolsomjimsactoBelum ada peringkat

- REALTORS® Land Institute February 2015 Land Business Survey Conducted by The National Association of REALTORS®Dokumen38 halamanREALTORS® Land Institute February 2015 Land Business Survey Conducted by The National Association of REALTORS®National Association of REALTORS®Belum ada peringkat

- Full Value: Proven Methods to Price and Sell Your Home for Maximum ProfitDari EverandFull Value: Proven Methods to Price and Sell Your Home for Maximum ProfitBelum ada peringkat

- How to MAXIMIZE Your Home Appraisal Value - Ask the Real Estate ExpertDari EverandHow to MAXIMIZE Your Home Appraisal Value - Ask the Real Estate ExpertBelum ada peringkat

- Unlock Your Guide to Profitable Home Sales: Sell your home for Top and Fast DollarDari EverandUnlock Your Guide to Profitable Home Sales: Sell your home for Top and Fast DollarBelum ada peringkat

- Lending PartnersDokumen1 halamanLending PartnersJim HamiltonBelum ada peringkat

- Fiscal Cliff EV Sept 12Dokumen4 halamanFiscal Cliff EV Sept 12Jim HamiltonBelum ada peringkat

- The 3 8% TaxDokumen11 halamanThe 3 8% Taxsanwest60Belum ada peringkat

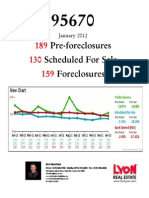

- Foreclosure Stats, 95670Dokumen2 halamanForeclosure Stats, 95670Jim HamiltonBelum ada peringkat

- Online Presentation For SellersDokumen28 halamanOnline Presentation For SellersJim HamiltonBelum ada peringkat

- NAR Housing - Sacramento (October 2012)Dokumen29 halamanNAR Housing - Sacramento (October 2012)Jim HamiltonBelum ada peringkat

- Short Sale Listing PresentationDokumen14 halamanShort Sale Listing PresentationJim Hamilton100% (1)

- Buyers Presentation, Jim Hamilton Real EstateDokumen9 halamanBuyers Presentation, Jim Hamilton Real EstateJim HamiltonBelum ada peringkat

- DH GroupDokumen10 halamanDH GroupJim HamiltonBelum ada peringkat

- Short Sale Listing PresentationDokumen14 halamanShort Sale Listing PresentationJim Hamilton100% (1)

- Vendor ListDokumen5 halamanVendor ListJim HamiltonBelum ada peringkat

- Foreclosure Stats, FolsomDokumen2 halamanForeclosure Stats, FolsomJim HamiltonBelum ada peringkat

- UntitledDokumen1 halamanUntitledJim HamiltonBelum ada peringkat

- Welcome: Jim Hamilton Real EstateDokumen28 halamanWelcome: Jim Hamilton Real EstateJim HamiltonBelum ada peringkat

- Distressed Homeowner GuideDokumen9 halamanDistressed Homeowner GuideJim HamiltonBelum ada peringkat

- High School Maps SCUSDDokumen1 halamanHigh School Maps SCUSDJim HamiltonBelum ada peringkat

- Vendor ListDokumen4 halamanVendor ListJim HamiltonBelum ada peringkat

- Folsom Trends Newsletter January 2012Dokumen2 halamanFolsom Trends Newsletter January 2012Jim HamiltonBelum ada peringkat

- Hannaford Cross Newsletter Summer 2011Dokumen2 halamanHannaford Cross Newsletter Summer 2011Jim HamiltonBelum ada peringkat

- LendersDokumen1 halamanLendersJim HamiltonBelum ada peringkat

- Folsom Bike Trail MapDokumen2 halamanFolsom Bike Trail MapJim HamiltonBelum ada peringkat

- Rent V Buy Custom W-Jim Hamilton PDFDokumen1 halamanRent V Buy Custom W-Jim Hamilton PDFJim HamiltonBelum ada peringkat

- Jim Hamilton Real Estate, ProfileDokumen2 halamanJim Hamilton Real Estate, ProfileJim HamiltonBelum ada peringkat

- Press Release June 2011, Lyon Real EstateDokumen3 halamanPress Release June 2011, Lyon Real EstateJim HamiltonBelum ada peringkat

- Jim Hamilton Real Estate, ProfileDokumen2 halamanJim Hamilton Real Estate, ProfileJim HamiltonBelum ada peringkat

- Elementry Schools Map SCUSDDokumen1 halamanElementry Schools Map SCUSDJim HamiltonBelum ada peringkat

- 10-04-11 Sacto AORDokumen118 halaman10-04-11 Sacto AORJimHamiltonBelum ada peringkat

- EDC Schools and District MAPDokumen1 halamanEDC Schools and District MAPJim HamiltonBelum ada peringkat

- Middle Schools Map SCUSDDokumen1 halamanMiddle Schools Map SCUSDJim HamiltonBelum ada peringkat

- Folsom Area School Attendance BoundariesDokumen1 halamanFolsom Area School Attendance BoundariesJim HamiltonBelum ada peringkat

- Sep 2018payslip KenyaairwaysDokumen1 halamanSep 2018payslip Kenyaairwaysrobert mogakaBelum ada peringkat

- Commercial Real Estate Manager in Los Angeles CA Resume Robert HarrisDokumen2 halamanCommercial Real Estate Manager in Los Angeles CA Resume Robert HarrisRobertHarrisBelum ada peringkat

- Beginners Guide To Liens DeedsDokumen24 halamanBeginners Guide To Liens Deedsvituco1230% (1)

- The Record-Of-Rights: MutationDokumen45 halamanThe Record-Of-Rights: MutationAnonymous lfw4mfCmBelum ada peringkat

- Kamlesh Dissertation PDFDokumen154 halamanKamlesh Dissertation PDFSeema rojBelum ada peringkat

- Demand Letter Qualified Written Request2Dokumen7 halamanDemand Letter Qualified Written Request2klg_consultant8688Belum ada peringkat

- Pittman v. Home Owners' Loan Corp., 308 U.S. 21 (1939)Dokumen5 halamanPittman v. Home Owners' Loan Corp., 308 U.S. 21 (1939)Scribd Government DocsBelum ada peringkat

- International Bankers: Robber Barons?Dokumen209 halamanInternational Bankers: Robber Barons?William Litynski100% (4)

- PNB V SanaoDokumen15 halamanPNB V SanaoJahzel Dela Pena CarpioBelum ada peringkat

- MCQs On Transfer of Property ActDokumen81 halamanMCQs On Transfer of Property Acthemangi kambleBelum ada peringkat

- The Origins of Michael Burry, OnlineDokumen2 halamanThe Origins of Michael Burry, OnlineekidenBelum ada peringkat

- Sales Promotion - BFSIDokumen10 halamanSales Promotion - BFSIAdnan patelBelum ada peringkat

- Merchant Banking Unit 3Dokumen33 halamanMerchant Banking Unit 3Anantha Krishna BhatBelum ada peringkat

- Solid Bank Corp v. Permanent HomesDokumen12 halamanSolid Bank Corp v. Permanent HomesjoshmagiBelum ada peringkat

- FDIC Manual of PoliciesDokumen688 halamanFDIC Manual of PolicieshelmetheadbobBelum ada peringkat

- A Study On Farmers' Choice of Agricultural Finance in Vellore District, Tamil NaduDokumen11 halamanA Study On Farmers' Choice of Agricultural Finance in Vellore District, Tamil NaduVishnu NarayananBelum ada peringkat

- Stamped-Petition For ReviewDokumen348 halamanStamped-Petition For ReviewjamcguireBelum ada peringkat

- Private Limited: Memorandum of Association OFDokumen5 halamanPrivate Limited: Memorandum of Association OFAnonymous 2g24pum1cBelum ada peringkat

- Banking ArrangementsDokumen3 halamanBanking ArrangementsJyoti LalwaniBelum ada peringkat

- Northumberland County Anthracite Outdoor Adventure Area AuthorityDokumen8 halamanNorthumberland County Anthracite Outdoor Adventure Area Authorityogladoun10Belum ada peringkat

- Features and Types of Long-Term Debt, Preferred Stock, and Common StockDokumen3 halamanFeatures and Types of Long-Term Debt, Preferred Stock, and Common StockMM Fakhrul IslamBelum ada peringkat

- The Manitoba Housing Authority Application GuidelinesDokumen8 halamanThe Manitoba Housing Authority Application GuidelinesRobin ParkBelum ada peringkat

- Money Market & Its Role in Financial Market IntegrationDokumen28 halamanMoney Market & Its Role in Financial Market IntegrationHarshil ShahBelum ada peringkat

- Chapter - 3 Short Term FinancingDokumen11 halamanChapter - 3 Short Term FinancingmuzgunniBelum ada peringkat

- Data Governance The Way ForwardDokumen41 halamanData Governance The Way ForwardC. Plummer100% (1)

- 103 Rodriguez V ReyesDokumen1 halaman103 Rodriguez V Reyesluigimanzanares0% (1)

- Quiz No 13Dokumen13 halamanQuiz No 13xiadfreakyBelum ada peringkat

- Annex I: Please Delete Whichever Is InappropriateDokumen21 halamanAnnex I: Please Delete Whichever Is InappropriateVintonius Raffaele PRIMUSBelum ada peringkat

- CIMA F3 Notes - Financial Strategy - Chapter 3Dokumen11 halamanCIMA F3 Notes - Financial Strategy - Chapter 3athancox5837100% (2)

- Court Rules Implied Trust Over PropertiesDokumen1 halamanCourt Rules Implied Trust Over PropertiesRuth TenajerosBelum ada peringkat