Chapter 17 Team Problem

Diunggah oleh

Rachel Klein0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

76 tayangan3 halamanEach team member must print and sign his / her name in the space provided below. ABC Company purchased $500,000 of Part Inc.'s 9% bonds. 100,000 shares of Swim Inc. Common stock for $1,750,000.

Deskripsi Asli:

Judul Asli

Chapter_17_Team_Problem

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniEach team member must print and sign his / her name in the space provided below. ABC Company purchased $500,000 of Part Inc.'s 9% bonds. 100,000 shares of Swim Inc. Common stock for $1,750,000.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

76 tayangan3 halamanChapter 17 Team Problem

Diunggah oleh

Rachel KleinEach team member must print and sign his / her name in the space provided below. ABC Company purchased $500,000 of Part Inc.'s 9% bonds. 100,000 shares of Swim Inc. Common stock for $1,750,000.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

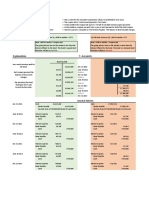

Chapter 17 Team Problem – Spring 2011 (10 points)

Instructions to teams: make this page the cover sheet to your solution. Staple it to

your solution in the upper left-hand corner. Each team member present and

participating must print and sign his / her name in the space provided below.

On January 1, 2007, ABC Company purchased the following investments:

• $500,000 of Part Inc.’s 9% bonds that were purchased to yield 10%. The

bonds were dated January 1, 2007, mature on January 1, 2012, and pay

interest on June 30 and December 31. The bonds were classified by Whole

Company as Held-To-Maturity Securities. (Round PV to nearest dollar)

• 4,000 shares (no significant influence) of Jump Inc. common stock for $25

per share, which were classified as Trading Securities.

• 9,000 shares (no significant influence) of Fish Company common stock for

$18 per share, which were classified as Trading Securities.

• 100,000 shares of Swim Inc. common stock for $1,750,000. This represents

a 35% interest in Swim Inc. and gives Whole Company significant influence

over Swim Inc.

During 2007, the following information pertains to ABC Company’s investments:

• On November 15, Fish Company paid a cash dividend of $1.37 per share.

• On December 15, Jump Inc. paid a cash dividend of $0.32 per share.

• On December 31, Swim Inc. reported net income of $722,500 for the year.

• On December 31, the investments had the following market values:

o Part Inc. $518, 375

o Jump Inc. $27 per share

o Fish Company $15 per share

o Swim Inc. $23 per share

During 2008, the following information pertains to ABC Company’s investments:

• On July 1, half of the Jump Inc. shares were sold for $34.50 per share.

• On October 15, Swim Inc. paid a cash dividend of $0.46 per share.

• On December 31, Swim Inc. reported net loss of $140,000 for the year.

• On December 31, the investments had the following market values:

o Part Inc. $514, 200

o Jump Inc. $21 per share

o Fish Company $11 per share

o Swim Inc. $24 per share

Required:

Prepare all 2007 and 2008 journal entries related to these securities.

Printed name and signature of each present and participating student:

Solution

2007 Journal Entries

1/1/07 HTM Securities 480,696

Cash 480,696

1/1/07 T/S – Jump(4,000*$25) 100,000

Cash 100,000

1/1/07 T/S – Fish(9,000 * $18) 162,000

Cash 162,000

1/1/07 Investment in Swim Inc. 1,750,000

Cash 1,750,000

6/30/07 Cash 22,500

HTM Securities 1,535

Interest Revenue 24,035

11/15/07 Cash(9,000*1.37) 12,330

Dividend Revenue 12,330

12/15/07 Cash (4,000*0.32) 1,280

Dividend Revenue 1,280

12/31/07 Cash 22,500

HTM Securities 1,612

Interest Revenue 24,112

12/31/07 Investment in Swim Inc. 252,875

Revenue from Investment 252,875

($722,500*35%)

Market Adjustment Entries:

Cost Market Difference

12/31/06

Jump Inc. 100,000 108,000 8,000

Fish Company 162,000 135,000 (27,000)

12/31/07 Unreal. Hold. G/L – Income 19,000

Securities FV Adjustment – TS 19,000

2008 Journal Entries

6/30/08 Cash 22,500

HTM Securities 1,692

Interest Revenue 24,192

Sale of Jump Inc. Stock:

Cost: 50,000 (2,000*25)

Selling Price: 69,000 (2,000*34.50)

Gain on Sale 19,000

7/1/08 Cash 69,000

T/S – Jump 50,000

Gain on Sale 19,000

10/15/08 Cash (100,000*.46) 46,000

Investment in Swim Inc. 46,000

12/31/08 Cash 22,500

HTM Securities 1,777

Interest Revenue 24,277

12/31/08 Loss from Investment 49,000

Investment in Swim Inc. 49,000

($140,000*35%)

Market Adjustment Entries:

Cost Market Difference

12/31/07

Jump Inc. 50,000 42,000 (8,000)

Fish Company 162,000 99,000 (63,000)

12/31/08 Unreal. Hold. G/L – Income 52,000

Securities FV Adjustment – TS 52,000

Cash Interest Dsct. Amort. Amortized

Part Inc Date Received Revenue Amort. Total Cost

FV 500,000 1/1/2007 0 480,696

PMT 22,500 6/30/2007 22,500 24,035 1,535 1,535 482,231

N 10 12/31/2007 22,500 24,112 1,612 3,146 483,842

I 5 6/30/2008 22,500 24,192 1,692 4,838 485,534

CPT PV 480,696 12/31/2008 22,500 24,277 1,777 6,615 487,311

Anda mungkin juga menyukai

- Investments in Debt Securities and Other Non-Current AssetsDokumen14 halamanInvestments in Debt Securities and Other Non-Current AssetsMarjorie NepomucenoBelum ada peringkat

- Bonds Payable ProblemsDokumen6 halamanBonds Payable ProblemsMarian Salinas DacuroBelum ada peringkat

- Investments in Debt SecuritiesDokumen13 halamanInvestments in Debt SecuritiesArkhie DavocolBelum ada peringkat

- Intacc 1Dokumen17 halamanIntacc 1Xyza Faye RegaladoBelum ada peringkat

- Journal Entries for Debt, Equity, and Share InvestmentsDokumen7 halamanJournal Entries for Debt, Equity, and Share InvestmentsJaneBelum ada peringkat

- Chap11_ConnectDokumen5 halamanChap11_ConnectThanh PhuongBelum ada peringkat

- ICP 8-1 SolutionDokumen1 halamanICP 8-1 SolutionThe oneBelum ada peringkat

- P16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsDokumen3 halamanP16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsRisky FernandoBelum ada peringkat

- Kelas Tambahan DDA 2 - Fiskal C - 030623Dokumen28 halamanKelas Tambahan DDA 2 - Fiskal C - 030623arek arekBelum ada peringkat

- Investment in Associate ExercisesDokumen7 halamanInvestment in Associate ExercisesJo KeBelum ada peringkat

- Ae 211 Problem 1-4 SolutionDokumen3 halamanAe 211 Problem 1-4 SolutionNhel AlvaroBelum ada peringkat

- Partnership Operation ReviewerDokumen4 halamanPartnership Operation ReviewerNathaly Nicolle CapuchinoBelum ada peringkat

- Chapter 20 CompilationDokumen41 halamanChapter 20 CompilationMaria Licuanan0% (1)

- MGMT AssignmentDokumen79 halamanMGMT AssignmentLuleseged Gebre100% (1)

- Proposal Tanaman MelonDokumen3 halamanProposal Tanaman Melondr walferBelum ada peringkat

- Problem: Andres Adi Putra S 43220110067 AKM2-Forum 6Dokumen17 halamanProblem: Andres Adi Putra S 43220110067 AKM2-Forum 6tes doangBelum ada peringkat

- Ak 2Dokumen12 halamanAk 2nikenapBelum ada peringkat

- Jawaban Kuis Uph Debt InvestmentDokumen3 halamanJawaban Kuis Uph Debt InvestmentSagita RajagukgukBelum ada peringkat

- Review Materials For INTERM2Dokumen10 halamanReview Materials For INTERM2Danna VargasBelum ada peringkat

- TP 1 - Accounting IIDokumen11 halamanTP 1 - Accounting IIAbiBelum ada peringkat

- P13 2aDokumen2 halamanP13 2aNaeem Arshad Arshad AliBelum ada peringkat

- Aol AccDokumen19 halamanAol AccANGELYCA LAURABelum ada peringkat

- Assignment #1Dokumen5 halamanAssignment #1FreelansirBelum ada peringkat

- Debt Investments - Answers - Ac&fvociDokumen9 halamanDebt Investments - Answers - Ac&fvociXander MerzaBelum ada peringkat

- Partnership QuizzerDokumen18 halamanPartnership QuizzerJehannahBarat100% (1)

- Non_Profit_OrganisationsDokumen6 halamanNon_Profit_OrganisationsRealGenius (Carl)Belum ada peringkat

- MCQ With AnswersDokumen27 halamanMCQ With AnswersAnonymous qi4PZkBelum ada peringkat

- BCD CorporationDokumen3 halamanBCD CorporationJohn Rey GalichaBelum ada peringkat

- MB2001 FA 2025 Week5B Liabilities Practice ExercisesDokumen31 halamanMB2001 FA 2025 Week5B Liabilities Practice ExerciseschloeileenspearsBelum ada peringkat

- 2020 Spring Midterm II A AnsKey PDFDokumen12 halaman2020 Spring Midterm II A AnsKey PDFEunice GuoBelum ada peringkat

- Profit Distribution in PartnershipsDokumen3 halamanProfit Distribution in PartnershipsLili OhBelum ada peringkat

- Corporation: ExampleDokumen3 halamanCorporation: Exampleibrahim mohamedBelum ada peringkat

- Jawaban Soal Assignment Advanced Accounting Patar Andreas ManaluDokumen12 halamanJawaban Soal Assignment Advanced Accounting Patar Andreas ManaluSolution Manual100% (1)

- Calculate Debt and Equity Investments for Noviana and Canaya CompaniesDokumen3 halamanCalculate Debt and Equity Investments for Noviana and Canaya CompaniesNida ShilvaBelum ada peringkat

- Solution For Chapter 16 Investments (13 E)Dokumen8 halamanSolution For Chapter 16 Investments (13 E)RaaBelum ada peringkat

- Debt investment journal entries and fair value adjustmentsDokumen5 halamanDebt investment journal entries and fair value adjustmentsRamelinium PurbaBelum ada peringkat

- Acct 4010 Ch2-Handout-SolutionDokumen4 halamanAcct 4010 Ch2-Handout-Solutionlokyee801mikiBelum ada peringkat

- Accounting For Business Combinations Final Term ExaminationDokumen3 halamanAccounting For Business Combinations Final Term ExaminationJasper LuagueBelum ada peringkat

- Pengakun IIDokumen9 halamanPengakun IIIkramamal TsaniBelum ada peringkat

- 50cb2fca 1597910723873pdf PDF FreeDokumen10 halaman50cb2fca 1597910723873pdf PDF FreefarandiBelum ada peringkat

- Accounting For Investments in AssociatesDokumen90 halamanAccounting For Investments in AssociatesJay-L TanBelum ada peringkat

- Chapter 20Dokumen26 halamanChapter 20GONZALES, MICA ANGEL A.Belum ada peringkat

- Partnership and Corporation Problem ExampleDokumen2 halamanPartnership and Corporation Problem ExampleGabrielle Ruthe LaoBelum ada peringkat

- Accounting for investmentsDokumen9 halamanAccounting for investmentsJennica CruzadoBelum ada peringkat

- Tamisha McQuilkin Final ExamDokumen8 halamanTamisha McQuilkin Final ExamTamisha McQuilkinBelum ada peringkat

- Exercise 1Dokumen5 halamanExercise 1Jade Y80% (5)

- BA 118.1 SME Exercise Set 5Dokumen1 halamanBA 118.1 SME Exercise Set 5Ian De DiosBelum ada peringkat

- Intacc 2-Investment in Debt SecuritiesDokumen7 halamanIntacc 2-Investment in Debt Securitiesrachel banana hammockBelum ada peringkat

- Session 17Dokumen23 halamanSession 17Serena KassabBelum ada peringkat

- ACCT104 Quizzes SolutionsDokumen2 halamanACCT104 Quizzes SolutionsAway To PonderBelum ada peringkat

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Dokumen1 halamanSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiBelum ada peringkat

- AMP PerformanceDokumen15 halamanAMP PerformanceaboodjBelum ada peringkat

- UAS PA 2020-2021 Ganjil - JawabanDokumen27 halamanUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaBelum ada peringkat

- Act130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Dokumen15 halamanAct130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Nhel AlvaroBelum ada peringkat

- Ias 32Dokumen3 halamanIas 32Yến Hoàng HảiBelum ada peringkat

- Tugas Kelompok Ke-2 (Minggu 4/ Sesi 6)Dokumen10 halamanTugas Kelompok Ke-2 (Minggu 4/ Sesi 6)liissylviaBelum ada peringkat

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDokumen45 halamanChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalBelum ada peringkat

- Auditing and Assurance: Specialized Industries: M12 Group WorkDokumen4 halamanAuditing and Assurance: Specialized Industries: M12 Group WorkEleonor ClaveriaBelum ada peringkat

- InvestDokumen5 halamanInvestJesselle H. BANAWOLBelum ada peringkat

- Using Economic Indicators to Improve Investment AnalysisDari EverandUsing Economic Indicators to Improve Investment AnalysisPenilaian: 3.5 dari 5 bintang3.5/5 (1)

- Introduction To Financial Statements and Other Financial Reporting TopicsDokumen18 halamanIntroduction To Financial Statements and Other Financial Reporting TopicsBima Karismanda DiantonoBelum ada peringkat

- Karambunai Corp (Kbunai-Ku) : Average ScoreDokumen11 halamanKarambunai Corp (Kbunai-Ku) : Average ScoreDlp HunterBelum ada peringkat

- D.E ShawDokumen4 halamanD.E Shawsankalp2rioBelum ada peringkat

- Artikel 6 - Dah Jizi (2018) Board Independence and The Efficacy of Social ReportingDokumen22 halamanArtikel 6 - Dah Jizi (2018) Board Independence and The Efficacy of Social ReportingZheJk 26Belum ada peringkat

- Walmart Financial Analysis and ValuationDokumen9 halamanWalmart Financial Analysis and ValuationAbeer ArifBelum ada peringkat

- Exotic Options Multiple Choice Test BankDokumen6 halamanExotic Options Multiple Choice Test BankKevin Molly KamrathBelum ada peringkat

- Dipifr 2004 Dec QDokumen8 halamanDipifr 2004 Dec QAhmed Raza MirBelum ada peringkat

- Indian Cold Chain Logistics Industry and Snowman LogisticsDokumen16 halamanIndian Cold Chain Logistics Industry and Snowman LogisticsSalman Mohammed ShirasBelum ada peringkat

- Investment Banking OverviewDokumen32 halamanInvestment Banking OverviewHesham Abd-AlrahmanBelum ada peringkat

- Project Report of SbicapDokumen65 halamanProject Report of SbicapChandrakant67% (6)

- Nidec Philippines Corporation Company ProfileDokumen35 halamanNidec Philippines Corporation Company ProfileVergel MartinezBelum ada peringkat

- GS DDM Fair Value ModelDokumen20 halamanGS DDM Fair Value ModelthiagopalaiaBelum ada peringkat

- What Is FinanceDokumen2 halamanWhat Is FinanceBon JoviBelum ada peringkat

- PDFDokumen240 halamanPDFHrishabh BharatiBelum ada peringkat

- Daily Report 20141212Dokumen3 halamanDaily Report 20141212Joseph DavidsonBelum ada peringkat

- Chap 3 Consolidations - Subsequent To The Date of AcquisitionDokumen14 halamanChap 3 Consolidations - Subsequent To The Date of AcquisitionEunice Ang100% (8)

- Assignment QuestionsDokumen5 halamanAssignment QuestionsRAJAT BANSAL0% (1)

- Mumbai University Report on Investment OptionsDokumen41 halamanMumbai University Report on Investment OptionsRahul MehtaBelum ada peringkat

- Declaration of Trust and Deed of Assignment SampleDokumen3 halamanDeclaration of Trust and Deed of Assignment SampleIpe Closa96% (24)

- Solution 4Dokumen5 halamanSolution 4askdgas50% (2)

- AnswersDokumen10 halamanAnswersSajidZiaBelum ada peringkat

- (Lapthorne) Factor Choices in The Ice AgeDokumen49 halaman(Lapthorne) Factor Choices in The Ice AgerlindseyBelum ada peringkat

- Sergei Fedotov: 20912 - Introduction To Financial MathematicsDokumen28 halamanSergei Fedotov: 20912 - Introduction To Financial MathematicsRajkumar35Belum ada peringkat

- Business Combination at Date of Acquisition Problem 1Dokumen8 halamanBusiness Combination at Date of Acquisition Problem 1Jason BautistaBelum ada peringkat

- Analyze Life Insurance CompaniesDokumen51 halamanAnalyze Life Insurance CompaniesAnonymous llMYrqnBelum ada peringkat

- CPM Group PDFDokumen14 halamanCPM Group PDFThach NgoBelum ada peringkat

- Analysis of Investment Options MBA ProjectDokumen64 halamanAnalysis of Investment Options MBA ProjectAshish Sood100% (2)

- SemiDokumen252 halamanSemiGBelum ada peringkat

- Exam3 PRM PDFDokumen378 halamanExam3 PRM PDFAlp SanBelum ada peringkat

- Family BusinessDokumen18 halamanFamily BusinessMutum Amarjeet100% (1)