Greenpath's Weekly Mortgage Newsletter - 3/28/2011

Diunggah oleh

CENTURY 21 AwardHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Greenpath's Weekly Mortgage Newsletter - 3/28/2011

Diunggah oleh

CENTURY 21 AwardHak Cipta:

Format Tersedia

Weekly Mortgage Newsletter

provided to you by

Mortgage rates moved slightly higher last week on international inflation concerns and reduced fears

Week of regarding international situations. Analysts are now expecting the Bank of England, similar to the US

March 27, Federal Reserve, to raise interest rates in the UK following a report of increasing prices. While the

2011 nuclear crisis continues in Japan, it appears the market has absorbed it impact to this point. Also,

there is some easing of concerns over the military action in Libya. Stock markets rallied during the

week, pulling money out of Treasuries, and helping push some interest rates upward.

Mortgage This week has some big economic reports due that could set a directional trend for mortgage rates for

Market the next few weeks. Consumer Confidence is due, and is expected to dip. If it does not, mortgage

Commentary rates will likely continue upward, especially if Friday’s employment data and ISM Index come in with

positive readings. Of course, with so many major international items in play, we could easily have

some news that generates uncertainty in the market, and rates might move back downward.

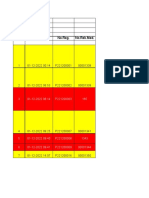

This Week’s Top Economic Reports and Events 30Yr 15Yr 1Yr ARM

Mortgage Rates

Report/Event Date Prior Est. Impact

PCE Prices - Core 3/28 0.1% 0.2% Moderate 5.00%

After last week’s international inflation concerns, any reading over 0.2% 4.50%

will likely create some moderate upward pressure on mortgage rates. 4.00%

Consumer Confidence 3/29 70.4 65.0 Significant 3.50%

With measures of consumer attitudes slipping, a larger-than-expected 3.00%

drop in Confidence would generate some downward pressure on rates. 1/6 1/20 2/3 2/17 3/3 3/17

12,500.00

Unemployment Rate 4/1 8.9% 8.9% Significant

Dow Jones

With so many signs that the economy is gaining a firmer footing, a drop 12,250.00

in the unemployment rate would help pressure mortgage rates up quickly.

12,000.00

Nonfarm Payrolls 4/1 192K 185K Significant

11,750.00

If the unemployment rate drops and more jobs were created than

expected last month, mortgage rates will experience upward pressure. 11,500.00

30-Dec 13-Jan 27-Jan 10-Feb 24-Feb 10-Mar 24-Mar

ISM Manufacturing Index 4/1 61.4 61.4 Significant

9.00

With manufacturing continuing to power much of the recovery, an

Historical Rates

unexpected drop would likely create some downward pressure on rates. 6.00

Mortgage Rate Interest Rates and Indexes

3.00

Trends 1 Yr T-Bill 0.230% 11th D. COFI 1.484%

Short-Term ÎÎ 10 Yr T-Note 3.290% COSI 2.220% 0.00

Mar-06 Mar-07 Mar-08 Mar-09 Mar-10

Long-Term ÎÎ 6 Month Libor 0.460% CODI 0.327% 1 Yr CMT MTA COFI

CODI Prime

Volatility High Prime Rate 3.250% MTA 0.307%

10 Year Treasury Note Trend

3.75

To Receive This Newsletter

from your Home Mortgage

3.50

Consultant, Please Contact

3.25 Them Directly

3.00

30-Dec 13-Jan 27-Jan 10-Feb 24-Feb 10-Mar 24-Mar

10 Year Treasury Note 20 Day Moving Ave 26800 Aliso Viejo Pkwy, Suite 100, Aliso Viejo, CA 92656

Anda mungkin juga menyukai

- David Romero Interview California Real Estate August 2012Dokumen8 halamanDavid Romero Interview California Real Estate August 2012CENTURY 21 AwardBelum ada peringkat

- International Women's Day 2014Dokumen1 halamanInternational Women's Day 2014CENTURY 21 AwardBelum ada peringkat

- RIS MEDIA July CoverDokumen5 halamanRIS MEDIA July CoverCENTURY 21 AwardBelum ada peringkat

- South 1Dokumen1 halamanSouth 1CENTURY 21 AwardBelum ada peringkat

- 7.27 North OHDDokumen1 halaman7.27 North OHDCENTURY 21 AwardBelum ada peringkat

- 7.27 South I OHDDokumen1 halaman7.27 South I OHDCENTURY 21 AwardBelum ada peringkat

- 7.27 South IIDokumen1 halaman7.27 South IICENTURY 21 AwardBelum ada peringkat

- SouthDokumen1 halamanSouthCENTURY 21 AwardBelum ada peringkat

- Greenpath's Weekly Mortgage Newsletter - 8/28/2011Dokumen1 halamanGreenpath's Weekly Mortgage Newsletter - 8/28/2011CENTURY 21 AwardBelum ada peringkat

- CENTURY 21 Award Meets With Councilmember Todd GloriaDokumen3 halamanCENTURY 21 Award Meets With Councilmember Todd GloriaCENTURY 21 AwardBelum ada peringkat

- NorthDokumen1 halamanNorthCENTURY 21 AwardBelum ada peringkat

- Greenpath's Weekly Mortgage Newsletter - 10/2/2011Dokumen1 halamanGreenpath's Weekly Mortgage Newsletter - 10/2/2011CENTURY 21 AwardBelum ada peringkat

- The New Age of Real EstateDokumen5 halamanThe New Age of Real EstateCENTURY 21 AwardBelum ada peringkat

- South 2Dokumen1 halamanSouth 2CENTURY 21 AwardBelum ada peringkat

- Greenpath's Weekly Mortgage Newsletter - 7/31/2011Dokumen1 halamanGreenpath's Weekly Mortgage Newsletter - 7/31/2011CENTURY 21 AwardBelum ada peringkat

- Greenpath's Weekly Mortgage NewsletterDokumen1 halamanGreenpath's Weekly Mortgage NewsletterCENTURY 21 AwardBelum ada peringkat

- South 1Dokumen1 halamanSouth 1CENTURY 21 AwardBelum ada peringkat

- North 1Dokumen1 halamanNorth 1CENTURY 21 AwardBelum ada peringkat

- South 1Dokumen1 halamanSouth 1CENTURY 21 AwardBelum ada peringkat

- North 2Dokumen1 halamanNorth 2CENTURY 21 AwardBelum ada peringkat

- Greenpath's Weekly Mortgage Newsletter - 5/1/2011Dokumen1 halamanGreenpath's Weekly Mortgage Newsletter - 5/1/2011CENTURY 21 AwardBelum ada peringkat

- Training Wheels: YouTubeDokumen14 halamanTraining Wheels: YouTubeCENTURY 21 AwardBelum ada peringkat

- June ContestDokumen1 halamanJune ContestCENTURY 21 AwardBelum ada peringkat

- Greenpath's Weekly Mortgage NewsletterDokumen1 halamanGreenpath's Weekly Mortgage NewsletterCENTURY 21 AwardBelum ada peringkat

- North 1Dokumen1 halamanNorth 1CENTURY 21 AwardBelum ada peringkat

- South 2Dokumen1 halamanSouth 2CENTURY 21 AwardBelum ada peringkat

- SouthDokumen1 halamanSouthCENTURY 21 AwardBelum ada peringkat

- North 1Dokumen1 halamanNorth 1CENTURY 21 AwardBelum ada peringkat

- May ContestDokumen1 halamanMay ContestCENTURY 21 AwardBelum ada peringkat

- North 2Dokumen1 halamanNorth 2CENTURY 21 AwardBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- PKL Geri RevDokumen3 halamanPKL Geri RevKurniati NiaBelum ada peringkat

- Antox Pickling Paste MSDSDokumen10 halamanAntox Pickling Paste MSDSKrishna Vacha0% (1)

- Aquatic Ecology and LimnologyDokumen96 halamanAquatic Ecology and LimnologySale AlebachewBelum ada peringkat

- DIAGEO2Dokumen12 halamanDIAGEO2Tatiana Zuleta RojasBelum ada peringkat

- Guidance Counseling EssentialsDokumen2 halamanGuidance Counseling EssentialsElizabeth E. FetizaBelum ada peringkat

- TST-13 Aircraft Manual With 503 Engine LSA Rev.1Dokumen52 halamanTST-13 Aircraft Manual With 503 Engine LSA Rev.1smeassick100% (1)

- ADDITIONAL SOLVED PROBLEMS AND MINICASESDokumen155 halamanADDITIONAL SOLVED PROBLEMS AND MINICASESMera Birthday 2021Belum ada peringkat

- 16-Bit UUID Numbers DocumentDokumen28 halaman16-Bit UUID Numbers DocumentJuan M Iñiguez RBelum ada peringkat

- DC72D MK2 Genset Controller User Manual V1.5Dokumen61 halamanDC72D MK2 Genset Controller User Manual V1.5Cristobal AvecillaBelum ada peringkat

- Neonatal Resuscitation: Dr. (Col) C.G.Wilson Professor& H.O.D (Paed)Dokumen38 halamanNeonatal Resuscitation: Dr. (Col) C.G.Wilson Professor& H.O.D (Paed)shaharuddin_yahayaBelum ada peringkat

- Different Types of Volcanic HazardsDokumen5 halamanDifferent Types of Volcanic HazardsJohn Carlo BañasBelum ada peringkat

- Here's Your Water Bill: LitresDokumen4 halamanHere's Your Water Bill: Litrestvnm2ymmkdBelum ada peringkat

- Understand TSGLI BenefitsDokumen2 halamanUnderstand TSGLI BenefitsJoseph LawerenceBelum ada peringkat

- Explorations in PersonalityDokumen802 halamanExplorations in Personalitypolz2007100% (8)

- CoWIN Portal StepsDokumen23 halamanCoWIN Portal StepsU VenkateshBelum ada peringkat

- Climate and Cultural IdentityDokumen2 halamanClimate and Cultural IdentityCha AbolucionBelum ada peringkat

- Lappasieugd - 01 12 2022 - 31 12 2022Dokumen224 halamanLappasieugd - 01 12 2022 - 31 12 2022Sri AriatiBelum ada peringkat

- Police Log January 23, 2016Dokumen9 halamanPolice Log January 23, 2016MansfieldMAPoliceBelum ada peringkat

- Unit 23 The Interior LandscapeDokumen21 halamanUnit 23 The Interior LandscapesBelum ada peringkat

- Comparative Analysis of Mineral Constituents of Ethanol Leaf and SeedDokumen9 halamanComparative Analysis of Mineral Constituents of Ethanol Leaf and SeedKIU PUBLICATION AND EXTENSIONBelum ada peringkat

- Research Paper - Perceptions of Grade 11 STEM Students Towards ContraceptivesDokumen9 halamanResearch Paper - Perceptions of Grade 11 STEM Students Towards ContraceptivesKyle BinuyaBelum ada peringkat

- 20190904020842HI Kobelco Tier 4 Final SK140SRL BrochureDokumen2 halaman20190904020842HI Kobelco Tier 4 Final SK140SRL BrochureAkhmad SebehBelum ada peringkat

- Specialty PIPE SCHEDULES PDFDokumen1 halamanSpecialty PIPE SCHEDULES PDFAlfred LamBelum ada peringkat

- Usos HummusDokumen36 halamanUsos HummusAlisson FernandaBelum ada peringkat

- 02AdvancedThinkAhead1 Term3 TL2Dokumen4 halaman02AdvancedThinkAhead1 Term3 TL2marina dominguez sanchezBelum ada peringkat

- SKC EPAM-5000 Instruction Manual PDFDokumen90 halamanSKC EPAM-5000 Instruction Manual PDFmegacobBelum ada peringkat

- Geoheritage of Labuan Island: Bulletin of The Geological Society of Malaysia December 2016Dokumen14 halamanGeoheritage of Labuan Island: Bulletin of The Geological Society of Malaysia December 2016songkkBelum ada peringkat

- Handout2 Fischer CarbeneDokumen5 halamanHandout2 Fischer CarbeneMuhammad ShimaBelum ada peringkat

- Piling Procedure - IoclDokumen8 halamanPiling Procedure - IocltpgggkBelum ada peringkat

- Bed MakingDokumen14 halamanBed MakingHarold Haze Cortez100% (1)