NIFTY Outlook 11th April

Diunggah oleh

Ankit GuptaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

NIFTY Outlook 11th April

Diunggah oleh

Ankit GuptaHak Cipta:

Format Tersedia

Nifty Daily Outlook

SWASTIKA INTELLIGENCE GROUP

11th April 2011

Intraday R1: 5820 R2: 5860 R3: 5900

Levels for S1: 5750 S2: 5720 S3: 5700

NIFTY

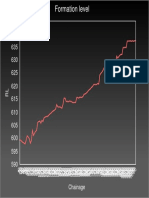

6450 - NSE50 [NIFTY] (5,805.35, 5,830.30, 5,777.90, 5,779.40, -66.0000) 6450

6400 6400

6350 6350

6300 6300

6250 6250

6200 6200

6150 6150

6100 6100

6050 6050

6000 6000

5950 5950

5900 5900

5850 5850

5800 5800

5750 5750

5700 5700

5650 5650

5600 5600

5550 5550

5500 5500

5450 5450

5400 5400

5350 5350

5300 5300

5250 5250

5200 5200

5150 5150

5100 5100

80 Relative Strength Index (58.1760) 80

75 75

70 70

65 65

60 60

55 55

50 50

45 45

40 40

35 35

30 30

25 25

150 MACD (93.6237) 150

100 100

50 50

0 0

-50 -50

-100 -100

-150 -150

13 20 27 4 11 18 25 1 8 15 22 29 6 13 20 27 3 10 17 24 31 7 14 21 28 7 14 21 28 4 11 18 25

September October November December 2011 February March April

NIFTY witnessed a Gap Down opening of almost 37 points but soon we

see a short covering up to 5830 which is days high but we are unable to

hold this gain and gradually sellers activated in the market and we saw a

lower high lower low formation whole day . The February 2011 IIP Data

are announced today which was less than markets’ expectations on

Monthly Basis, but at the same time was poor on Yearly Basis. The January

IIP Numbers were at 3.60% Vs 3.70% (MoM Basis) and April-February IIP

Numbers were at 7.8% Vs 10.00% (YoY Basis). Immediately after the

announcement of IIP Numbers, NIFTY again dipped to the low, this time

was particularly dragged by CAPITAL GOODS, REALITY, and AUTO Stocks.

And finally closed near days low of 5778 at 5785 with a fall of .96%

Swastika Intelligence Group,

Contact : research@swastika.co.in 1st Floor , Bandukwala Building, British Hotel Lane, Fort

Mumbai

Nifty Daily Outlook

SWASTIKA INTELLIGENCE GROUP

11th April 2011

RSI value is 58.1. RSI is falling and going towards the region of lower

limit. MACD is above the signal line and its value is 93.6. Through

Bollinger Band a good confirmation of bearish market can be seen

as the price line is now fully away from the upper band . The

volatility is quiet good at this level also.

Exponential Moving Average of 200 days is 5610 and 50 days is

5646. 74 20 days Exponential Moving Average is 5728.4 which has

crossed 50 days Exponential Moving Average and also 200 days

Exponential Moving Average and is still moving above both of them.

Realty index was in downtrend with -2.52% and Auto index at

-2.15% , Oil & gas -1.41% at which were the major contributor in

the downfall. Banking index was closed with -0.65% loss. CNX IT

closed flat with loss of -0.15% and Infra also closed with loss of

-.99%. Overall, none of the indices were able to close in green &

could not able to support nifty and further downtrend is seen in the

indices in next coming session. People are advised to keep strict

stop loss.

Research Team:

Mr. Sunny Kalia sunnykalia@swastika.co.i

Technical Analyst

n

Mr. Chayan Laddha chayanladdha@swastika.c

Research Associate

o.in

Mr. Ronak Choubey Jr. Research ronakchoubey@swastika.c

Associate o.in

Mr. Deepak Kohade Commodity Analyst deepak.k@swastika.co.in

Ms. Amruta Trivedi Jr. Research amrutatrivedi@swastika.c

Associate o.in

Swastika Intelligence Group,

Contact : research@swastika.co.in 1st Floor , Bandukwala Building, British Hotel Lane, Fort

Mumbai

Nifty Daily Outlook

SWASTIKA INTELLIGENCE GROUP

11th April 2011

Disclaimer:

This document is solely for the personal information of the intended recipient and must not be

exceptionally used as the basis for any investment decision. Nothing in this document should be

construed as investment, Legal, taxation or financial advice. Swastika Investmart Ltd. is not soliciting

any action based upon it. Each recipient of this document should make necessary investigations as they

consider important to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved). This report has been

made based on information that we consider reliable and are publicly available but we do not state that

it is accurate or complete and it should not be solely relied upon such, as this document is for.

Swastika Investmart Limited, its affiliates, directors, its proprietary trading and investment businesses

may, from time to time, make investment decisions that are inconsistent with or contradictory to the

recommendations expressed herein. The views contained in this document are those of the analyst, and

the company may or may not subscribe to all the views expressed within this document. Swastika

Investmart Limited or any of its affiliates/ group companies, or employees shall not be in any way held

responsible for any loss or damage that may arise to any person from any inadvertent error in the

information contained in this report.

Swastika Investmart Limited has not independently verified the information contained in this document.

Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. This document is being supplied to you

solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Swastika Intelligence Group,

Contact : research@swastika.co.in 1st Floor , Bandukwala Building, British Hotel Lane, Fort

Mumbai

Anda mungkin juga menyukai

- Rollover Analysis: HighlightsDokumen7 halamanRollover Analysis: HighlightsBhavya ShivakumarBelum ada peringkat

- Highnoon-Oct14 10Dokumen3 halamanHighnoon-Oct14 10sanjeev77Belum ada peringkat

- (Equities) : Cracks All OverDokumen7 halaman(Equities) : Cracks All OverMahesh PhaleBelum ada peringkat

- Express AM5Dokumen5 halamanExpress AM5Алёна БартязоваBelum ada peringkat

- Chart GoDokumen1 halamanChart Goshaheed jafarBelum ada peringkat

- List Barang Urgent FEB 2023Dokumen1 halamanList Barang Urgent FEB 2023ujang karbitBelum ada peringkat

- List Barang Urgent JAN 2023Dokumen1 halamanList Barang Urgent JAN 2023ujang karbitBelum ada peringkat

- List Barang Urgent MAR 2023Dokumen1 halamanList Barang Urgent MAR 2023ujang karbitBelum ada peringkat

- Kitchen Proposal: Proposed by HOME RagaDokumen17 halamanKitchen Proposal: Proposed by HOME RagaChetna JoshiBelum ada peringkat

- (Shop Drawing) All Pekerjaan Perbaikan-Pt. Sinar Antjol PluitDokumen46 halaman(Shop Drawing) All Pekerjaan Perbaikan-Pt. Sinar Antjol PluitvenusgloryBelum ada peringkat

- Darson Daily Technicals Outlook 15 Jan 2024Dokumen3 halamanDarson Daily Technicals Outlook 15 Jan 2024Muhammad HasanBelum ada peringkat

- Layout PlanDokumen1 halamanLayout PlanChetna JoshiBelum ada peringkat

- List Barang Urgent APR 2023Dokumen1 halamanList Barang Urgent APR 2023ujang karbitBelum ada peringkat

- CE Project - 2F Framing PlanDokumen1 halamanCE Project - 2F Framing PlanVicces P. EstradaBelum ada peringkat

- Panotaj TC153Dokumen1 halamanPanotaj TC153Dumitru GabrielBelum ada peringkat

- Phuluc (Lan 17)Dokumen141 halamanPhuluc (Lan 17)longhoang75Belum ada peringkat

- EF-Decanteurs Lamellaires 03 Rev 0Dokumen3 halamanEF-Decanteurs Lamellaires 03 Rev 0Fares ateBelum ada peringkat

- Warehouse Storage Warehouse Storage: Parking AreaDokumen1 halamanWarehouse Storage Warehouse Storage: Parking AreaVince Bagsit PolicarpioBelum ada peringkat

- CAB2 - Week 1 Workshop S&E QuestionsDokumen25 halamanCAB2 - Week 1 Workshop S&E QuestionsNacho FERNANDEZBelum ada peringkat

- 2 RoofDokumen1 halaman2 Roofchaisabaxter360Belum ada peringkat

- Reliability of Structures 2nd Nowak Solution ManualDokumen38 halamanReliability of Structures 2nd Nowak Solution Manualbuddhaunkardly2s100% (13)

- Ducati-Window ScheduleDokumen1 halamanDucati-Window ScheduleMach VargasBelum ada peringkat

- Reliability of Structures 2nd Nowak Solution ManualDokumen20 halamanReliability of Structures 2nd Nowak Solution ManualAiden Gray100% (29)

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDokumen2 halamanWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimBelum ada peringkat

- Oga Sab - Sheet - A10 - SECTION BBDokumen1 halamanOga Sab - Sheet - A10 - SECTION BBMuhammad Auwal TahirBelum ada peringkat

- Data CNC Piston & Grinding PistonDokumen5 halamanData CNC Piston & Grinding PistonRobi TumewuBelum ada peringkat

- Table 3 - Basic sizes of ИПТ evaporators with heat exchange tube length l=3000 mm and l=6000 mm, mmDokumen2 halamanTable 3 - Basic sizes of ИПТ evaporators with heat exchange tube length l=3000 mm and l=6000 mm, mmzhyhhBelum ada peringkat

- Warehouse Office Ground PDFDokumen1 halamanWarehouse Office Ground PDFJimBeeBelum ada peringkat

- WTF FatigaDokumen2 halamanWTF FatigaAbigail SandíBelum ada peringkat

- Reliabilty of Structures Nowak Solution Manual PDFDokumen55 halamanReliabilty of Structures Nowak Solution Manual PDFAhmed Mohammed0% (1)

- ACTIVITY Analysis of VarianceDokumen4 halamanACTIVITY Analysis of VarianceGwyneth AlsadoBelum ada peringkat

- Bullish Strategies: Long Call Short Put Bull Call Spread Ratio Call Spread Stock Repair Strategy NextDokumen18 halamanBullish Strategies: Long Call Short Put Bull Call Spread Ratio Call Spread Stock Repair Strategy NextmeetwithsanjayBelum ada peringkat

- Hanibal 101 WDBDokumen2 halamanHanibal 101 WDBMugisha IanBelum ada peringkat

- Bareme 2013Dokumen570 halamanBareme 2013ELHADJI NIASS FALLBelum ada peringkat

- Plano Autocad MangoRockDokumen1 halamanPlano Autocad MangoRockAndresAvilanBelum ada peringkat

- LIC Nav Jeevan Plan - Calculation of Returns (IRR - Example)Dokumen3 halamanLIC Nav Jeevan Plan - Calculation of Returns (IRR - Example)SanjivaniBelum ada peringkat

- 610 5Dokumen1 halaman610 5rt1973Belum ada peringkat

- PRESENTATION Group-A-Without-VideoDokumen48 halamanPRESENTATION Group-A-Without-VideohamedkharrazBelum ada peringkat

- 40kw 50kw 60kw 70kw 3phaseDokumen2 halaman40kw 50kw 60kw 70kw 3phaseAhmad DuwaikBelum ada peringkat

- PanOptic User's Manual - Welch AllynDokumen28 halamanPanOptic User's Manual - Welch AllynClaudia Adriana Rodriguez GutierrezBelum ada peringkat

- A 743653Dokumen163 halamanA 743653luis naupariBelum ada peringkat

- September 2015 Octobar 2015: Fund Exp Av FundDokumen3 halamanSeptember 2015 Octobar 2015: Fund Exp Av FundShah AzamBelum ada peringkat

- Naroda Patiya Junction: 8-10 AM 4-6 PM 8-10 PMDokumen2 halamanNaroda Patiya Junction: 8-10 AM 4-6 PM 8-10 PMJay RasadiyaBelum ada peringkat

- CHARTSDokumen2 halamanCHARTSJay RasadiyaBelum ada peringkat

- Bull SpreadDokumen2 halamanBull SpreadmeetwithsanjayBelum ada peringkat

- Obj FN 60 50 Soln Obj STC Ass 4 10 100 Insp 2 1 22 STRG 3 3 39Dokumen3 halamanObj FN 60 50 Soln Obj STC Ass 4 10 100 Insp 2 1 22 STRG 3 3 39vikas upadhyayBelum ada peringkat

- Short StraddleDokumen2 halamanShort StraddlemeetwithsanjayBelum ada peringkat

- ECI 2080lumbang UtilKit and Driveway Key Plan 04082024 LAYOUTDokumen1 halamanECI 2080lumbang UtilKit and Driveway Key Plan 04082024 LAYOUTjosh cuaBelum ada peringkat

- Enm1457-001 TC9 IsoDokumen1 halamanEnm1457-001 TC9 IsoJesus CasasBelum ada peringkat

- Meopta Tactical Optics 2014 en PDFDokumen38 halamanMeopta Tactical Optics 2014 en PDFBrad HepperBelum ada peringkat

- El CallaoRegional Geology PDFDokumen1 halamanEl CallaoRegional Geology PDFJoanMontillaBelum ada peringkat

- Basketball CourtDokumen1 halamanBasketball CourtVaibhav GuptaBelum ada peringkat

- Payoff Schedule Payoff Chart: NIFTY at Expiry Net PayoffDokumen2 halamanPayoff Schedule Payoff Chart: NIFTY at Expiry Net PayoffAKSHAYA AKSHAYABelum ada peringkat

- F G H J K I 8 7: Nook B U Guest RM POR GarageDokumen1 halamanF G H J K I 8 7: Nook B U Guest RM POR GarageGarret Wilkenson SiaBelum ada peringkat

- Gambar Detail Lambung BalancingDokumen1 halamanGambar Detail Lambung BalancingAgus Syukur AriantoBelum ada peringkat

- Manac AssignmentDokumen63 halamanManac AssignmentTanoy DharBelum ada peringkat

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDokumen2 halamanWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimBelum ada peringkat

- MPERS Vs MFRS - KamDokumen28 halamanMPERS Vs MFRS - KamKamaruzzaman Mohd100% (1)

- India Aerospace & Defence Sector ReportDokumen132 halamanIndia Aerospace & Defence Sector ReportManish KayalBelum ada peringkat

- Business Organizations OutlineDokumen29 halamanBusiness Organizations OutlineMissy Meyer100% (1)

- MemoDokumen3 halamanMemopeppermintlatteBelum ada peringkat

- Audit of IntangiblesDokumen5 halamanAudit of IntangiblesMae LaglivaBelum ada peringkat

- ACT349 F13 Assignment and Solutions For Sep 25 Tutorial v12Dokumen10 halamanACT349 F13 Assignment and Solutions For Sep 25 Tutorial v12Crystal B. WongBelum ada peringkat

- ACC3201Dokumen7 halamanACC3201natlyhBelum ada peringkat

- As Level Accounting Topic 1 OddDokumen45 halamanAs Level Accounting Topic 1 OddShoaib AslamBelum ada peringkat

- SALWA Business PlanDokumen62 halamanSALWA Business Planسلوئ اءزواني عبدالله سحىمىBelum ada peringkat

- Case 2 AuditDokumen8 halamanCase 2 AuditReinhard BosBelum ada peringkat

- Investment BooksDokumen2 halamanInvestment Bookssreekanth reddyBelum ada peringkat

- Initiative: Readiness and Ability in Initiating Action. Risk: The Hazard or Chance of LossDokumen5 halamanInitiative: Readiness and Ability in Initiating Action. Risk: The Hazard or Chance of LossButterflyBelum ada peringkat

- Barings Bank ScandalDokumen8 halamanBarings Bank ScandalTim ChemwenoBelum ada peringkat

- Understanding Value Migration Through ExamplesDokumen6 halamanUnderstanding Value Migration Through ExamplesNiruBelum ada peringkat

- Chapter 9 Ethical Business ... SustainabilityDokumen21 halamanChapter 9 Ethical Business ... Sustainabilitychelinti33% (3)

- ManPro-6 Present Worth Analysis 2019Dokumen45 halamanManPro-6 Present Worth Analysis 2019Syifa Fauziah RustoniBelum ada peringkat

- Chapter 8 AnswersDokumen16 halamanChapter 8 AnswersGelynne Arceo25% (4)

- WNISEF Experience in UkraineDokumen21 halamanWNISEF Experience in UkraineVitaliy HamuhaBelum ada peringkat

- About Geogit BNP ParibhasDokumen2 halamanAbout Geogit BNP ParibhasUdaykumar PatilBelum ada peringkat

- Organising AND Entrepreneuring: Josline LoboDokumen31 halamanOrganising AND Entrepreneuring: Josline LoboAkshay NayakBelum ada peringkat

- Classification of AuditDokumen29 halamanClassification of AuditFaizan Ch75% (8)

- Vertical Analysis FinalDokumen8 halamanVertical Analysis FinalLiya JahanBelum ada peringkat

- Jurnal Imbalan KerjaDokumen7 halamanJurnal Imbalan KerjanikadekdiwayamiBelum ada peringkat

- 2019 09 08 12 42 52 789 - Afrpg6518f - 2019 - PDFDokumen7 halaman2019 09 08 12 42 52 789 - Afrpg6518f - 2019 - PDFJADU FRIENDSBelum ada peringkat

- RespMemo - NUJS HSFDokumen36 halamanRespMemo - NUJS HSFNarayan GuptaBelum ada peringkat

- "How Well Am I Doing?" Statement of Cash Flows: Mcgraw-Hill/IrwinDokumen23 halaman"How Well Am I Doing?" Statement of Cash Flows: Mcgraw-Hill/Irwinrayjoshua12Belum ada peringkat

- Class Questions SolutionsDokumen15 halamanClass Questions Solutionsmoneshivangi29Belum ada peringkat

- Corporate Actions, List of Events, Types, Stock Split, Tender OfferDokumen4 halamanCorporate Actions, List of Events, Types, Stock Split, Tender Offerrohit7janBelum ada peringkat

- RAPDokumen42 halamanRAPJozua Oshea PungBelum ada peringkat

- Matlab Real-Time Trading PresentationDokumen25 halamanMatlab Real-Time Trading Presentationloafer555Belum ada peringkat