Creed Market Report

Diunggah oleh

nsopheaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Creed Market Report

Diunggah oleh

nsopheaHak Cipta:

Format Tersedia

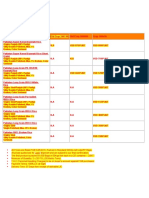

Market Report

April 13, 2011

U.S.D.A. World Market Price:

World Market Price This week Last week 1 Year Ago 2010 Loan WMP and Loan Rates

LDP

Value Factors 04/13/10 04/06/10 04/14/10 Factors ‘10 crop L/G M/G

Long Grain To be 18.66 16.19 00.00 9.91 Yield 52.78/14.31 61.03/8.69

Medium Grain issued 18.34 15.90 00.00 9.65 WMP 11.74 12.34

Short Grain April 13 18.34 15.90 00.00 9.65 Loan 6.23 6.50

Brokens 8:30am 13.20 11.15 - 7.01 Difference (5.51) (5.74)

Posting: (April/May Shipment)

Southern U.S. - Long Grain Abbreviation Quote Basis

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $22.50 per cwt. sacked, F.A.S. U.S. Gulf

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $22.50 per cwt, BULK, FOB Vessel US Gulf

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $23.0 per cwt. containerized FOB US Gulf

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $550.00 per mt sacked delivered Laredo TX

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $24.00 per cwt sacked delivered Miami FL

U.S. #3 Long Grain, max. 15% Broken, Hard Milled #3/15 $21.50 per cwt. sacked, F.A.S. U.S. Gulf

U.S. #3 Long Grain, max. 15% Broken, Hard Milled #3/15 $540.00 per mt sacked delivered Laredo TX

U.S. #2 Long Grain Brown, max. 4% Broken, 75% yield #2/4/75 no quote per mt bulk FOB vessel NOLA

U.S. #1 Parboiled L/G Brown, max. 4% Broken, 88% yield #1/4/88 no quote per mt bulk FOB vessel NOLA

U.S. #1 Parboiled L/G MILLED, max. 4% Broken (except 0.8% damage) #1/4 Parb no quote per mt sacked FOB vessel NOLA

U.S. #1 Parboiled L/G MILLED, max. 4% Broken #1/4 Parb $600.00 per mt bulk FOB vessel NOLA

U.S. #2 Long Grain Paddy, 55/70 yield #2 55/70 $280.00 per mt bulk F.O.B. vessel NOLA

Long Grain, max. 20% broken, Hard milled (Ghana specs) #4/20/hm $20.50 per cwt. sacked, F.A.S. U.S. Gulf

U.S. #5 L/G, max. 20% broken, WELL MILLED #5/20/wm $20.00 per cwt. sacked, F.A.S. U.S. Gulf

Southern U.S. - Medium Grain

U.S. #2 Medium Grain, max. 4% broken, Hard Milled #2/4% no quote per mt bulk FOB vessel NOLA

U.S. #2 Medium Grain Paddy, 58/69 yield #2 58/69 no quote per mt bulk FOB vessel NOLA

Southern U.S. - Package Quality

Package Quality Parboiled L/G, max. 4% broken (0.8% damage) Pkg. Parb. $28.00 per cwt. bulk F.O.B. mill

Package Quality Long Grain Milled, max. 4% broken Pkg. L/G $21.50 per cwt. bulk F.O.B. mill

Package Quality Long Grain Milled, max. 4% broken (select variety) Pkg. L/G $24.00 per cwt. bulk F.O.B. mill

Package Quality Long Grain Brown Rice, max. 4% broken Pkg. Br. $31.00 per cwt. bulk F.O.B. mill

Package Quality Medium Grain Milled, max. 4% broken Pkg. M/G $35.00 per cwt. bulk F.O.B. mill

California - Medium Grain

U.S. #1 Medium Grain, max. 4% Broken #1/4 $835.00 per mt sacked containerized FOB Mill

U.S. #1 Medium Grain, max. 4% Broken #1/4 $875.00 per mt sacked containerized Oakland

U.S. #1 Medium Grain milled rice, except max. 7% Broken (Japan Specs) #1/7% $875.00 per mt sacked in 30kg bags FOB vessel

U.S. #3 Medium Grain Brown rice, max. 8% broken (Korea Specs) #3 Brown $810.00 per mt in totes containerized Oakland

U.S. #1 Medium Grain Paddy, 58/69 yield #1 58/69 $550.00 per mt bulk ex-spout Sacramento CA

California - Package Quality

Package Rice for Industrial Use and Repackers #1/4% $37-$38 per cwt. bulk F.O.B. Mill

U.S. South Brokens:

Flour Quality brokens Flour Qlty $15.00 per cwt. bulk, F.O.B. rail

Pet Food Quality / #4 Brewers (milled) contracts M/A $13.50 per cwt. bulk, F.O.B. rail

U.S. California Brokens:

Flour Quality brokens Flour Qlty $19.00 per cwt. bulk, F.O.B. mill

Pet Food Quality / #4 Brewers contracts M/A $14.00 per cwt. bulk, F.O.B. mill

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

April 13, 2011 - Page 1 of 4

Far East Report

SOUTHEAST ASIAN MARKETS

I think the entire report this week will be rather Thailand Exports

brief as all markets are quiet. In Thailand, the Jan. 1 - Mar. 31, 2011: 3,012,021 mt

Songkran water festival (their new years) extends Jan. 1 - Mar. 31, 2010: 2,136,391 mt

from Wednesday to Friday, however most businesses Jan. 1 - April 1, 2009: 2,051,242 mt

take off all week. Consequently, other than the Iraq Thai Baht: 30:1 vs US Dollar

tender closing on Monday, there is not much going

on as prices are mostly sideways and seem to have

leveled out for the time being, with the exception of INDIA, PAKISTAN, AND BANGLADESH

fragrant brokens which have jumped some $20-30 per mt over Not much new to report here, as the $64,000

the past week or so ($430-435). question continues to focus on easing of the export

Early indications are that IGB will likely confirm 60,000 mt ban...lots of chatter, a few small exceptions, but no

of Thai 5% as their only purchase, in line with our projection sign of an opening on a larger scale. One concept raised by a

in our last few market reports. No price has been disclosed, government official working on the planning commission is to

but in sharp contrast to the previous three tenders, we believe place a tax on wheat, where there resides huge buffer stocks,

exporters offered in line with today’s quoted values. and perhaps do similar starting in the 4th quarter of 2011

100% B is quoted at $485-495 per mt FOB Bangkok; 5% is with rice, provided they harvest a bumper crop, similar to the

$465-480 (depending on whether it is old crop, main season record 100 MMT ‘08 crop. In the meantime, we look for small

harvest, or second crop 2011). Parboil prices are unchanged exceptions, albeit varietal in nature, for humanitarian

at $490-500. purposes, or to satisfy some of the demand in the

In Vietnam, the market is also relatively quiet as region they regard as traditional core markets, like

there was a Buddhist holiday today that closed the Bangladesh and Sri Lanka.

market as it did in Burma. Prices are steady to firm In Bangladesh, there have been steady import

with 5% quoted at $$465-470 by some of the private tenders for the past 8-10 months. Those tenders have

local exporters, amid a MEP of $490. totaled about 600,000 mt of which about 400,000 mt -

For now, the Indonesian business is finished, and 500,000 mt have been bought. This does not include

The Philippines have yet to really get started. the 200,000 mt recently concluded with Thailand on a G to G

To summarize, I think these markets have found basis, nor the rumored 100,000 mt - 200,000 mt of Vinafood

at least a temporary bottom. If you go back to my parboil and white.

reports months ago, we have always maintained that In Pakistan, the market is also quiet with prices

there is fundamental support for Asian 5% rice at mostly sideways. IRRI-6 5% is quoted at $470-480

$450-475, with resistance at $550. I think this analysis still per mt FOB Karachi; whilst 25% is around $430-440.

stands true today. Generally speaking, aside from the Bengali activity, this

Whereas I do think prices could rally $10-15 per mt, I do region is fairly quiet.

not see prices in the near term surpassing $525 for 5%.

OFFSHORE QUOTES

Thailand Vietnam India Pakistan Uru. Arg. Brazil

100%B $490.00 5% $465.00 Export ban, MEP $900

5% $470.00 5% N/A 5% $480.00 $515.00 $515.00

10% $465.00 10% $460.00 10% N/A 10% no quote $505.00 $505.00

15% $460.00 15% $450.00 15% N/A 15% no quote no quote no quote

25% $445.00 25% $430.00 25% N/A 25% $430.00

Parb. 5% N/A Parb 5% $530.00 $480.00

Brokens $405.00 Brokens $410.00 Var. 1121 $1350 Parb 15%* $515.00

Parb. 100B sorted $495.00 MEP-5% $490.00 Basmati Brokens $390.00 Paddy

Thai Hom Mali $900.00 MEP-25% $470.00 Traditional $1800 Basmati $300.00

Frag. Brokens $435.00 Pusa $1300 S. Kernal $1300.00

All prices basis U.S. dollars per metric ton, F.O.B. vessel, corresponding home port *Bangladesh Specs.

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

April 13, 2011 - Page 2 of 4

CBOT Rough Rice Futures (04/11/11 Volume: 1,234 Open Interest: 24,730)

Contract Tuesday’s Close Net Change From Prices

Month Price Monday Last Report One Year Ago 04/13/10

‘11 May $13.370 DOWN 0.350 DOWN 0.740 ‘10 May $13.030

‘11 Jul $13.690 DOWN 0.345 DOWN 0.735 ‘10 Jul $13.300

‘11 Sep $14.470 DOWN 0.305 DOWN 0.695 ‘10 Sep $12.725

‘11 Nov $14.780 DOWN 0.290 DOWN 0.670 ‘10 Nov $12.845

‘12 Jan $15.095 DOWN 0.275 DOWN 0.615 ‘11 Jan $13.115

‘12 Mar $15.420 DOWN 0.255 DOWN 0.550 ‘11 Mar $13.410

U.S. Paddy Market Report not be enough water for second crop.

California - 2010 Calrose M/G last traded at $13.50 per cwt over loan. 2011

Texas - The market continues to be quiet with no new trading reported. new crop last traded at $13.50 per cwt over loan.

Buyers’ price ideas are still $6.00 per cwt over loan. New crop planting

continues with about 80% completed. Reflective Prices (all basis per cwt FOB country, 2010 Crop)

Louisiana - The market is very quiet with long grain bids $11.48 - $11.73

Texas Louisianna Mid-South California

per cwt FOB farm. Planting of new crop continues with southwest La. about

80% completed. Long grain 11.50-12.50 11.50 - 11.75 $9.75b/11.11a *

Mid South - Bids for long grain are $10.50 per cwt loaded barge up-river Med Grain * 14.50 new crop $17.25 $20.55

for May shipment while sellers’ price ideas are $12.00 per cwt loaded barge. L/G is #2 55/70, M/G is #2 58/69 (California #1)

Planting continues to be interrupted by rain, something that Texas dearly * - These areas do not have sufficient supplies of this type to quote.

needs as there are concerns that if the drought in Texas continues there may

U.S. Report

U.S. GULF, FUTURES, & MERCOSUR

The market in the South remains very quiet, amid very limited mt basis bulk. As regards paddy, long grain barges are being bid/

demand for milled rice. In rather sharp contrast, the paddy exports asked at levels that reflect $255/$285 per mt bulk FOB NOLA. No

have been fairly steady. Of particular note is a sale of 50,000 mt activity on medium grain reported in quite some time and that

to Panama, with an upcoming tender for 30,000 with Costa Rica. was for new crop at $15.50 per cwt. delivered mill.

Paddy shipments continue on a regular weekly basis to Mexico The undertone of the market is steady, as prices seem to have

and other destinations in Central America. bottomed-out, for now. The big question is where is the business

Now, let me attempt to analyze this a bit closer and point out going to come from for the mills between now and new crop,

some very interesting ironies early on in the season that reflect and what will be the ultimate fate of what looks to be a carryover

contradictory export numbers. of some 40,000,000 cwt. of low yielding, low quality rice. As

1- Overall, paddy exports trail last year’s pace by over aforementioned in previous reports, new crop contracts call for

150,000 mt. no blending of 2010 and 2011 crops...it will be interesting to see

2- However, this does not include the aforementioned how buyers try to police that!

80,000 mt of Costa Rica and Panama business this Amid profit taking by speculators and a soft cash market, the

month that have not yet shown up in the export sales futures ended the week down $0.60 - $0.75 cents per cwt.

reports.

3- Much to most people’s surprise, milled rice exports CALIFORNIA, AUSTRALIA & THE “MED”

actually lead last year by about 140,000 mt...complete No substantive change in the market here as

opposite of what one might think giving the atmosphere the mills continue to ship against (primarily) old

today. business for Japan and Libya. So far, we have had

4- However, one has to realize this gain was all at the no disruptions in execution, given the conditions on

beginning of the crop year when our prices were much the ground at destination.

cheaper, and we were able to increase market share Price are steady to slightly softer with #1-4% quoted at $37-

in places like Ghana, sell brokens to Senegal due to 38 per cwt bulk FOB mill, or $875 per mt CY Oakland.

low yielding paddy, and parboil to Nigeria and Benin As regards the cash paddy market, things are pretty slow,

account competitive pricing with Thai. Most likely, all of with light trading reported around $13.50 per cwt over loan.

that is in our rear view mirror; plus it appears as though No fresh new crop trades reported, however last trade for 2011

we have lost Iraq for the season, and are slowly but surely crop was coincidentally at $13.50 as well.

losing market share in Canada and the Caribbean. The Australia harvest is in full swing, as

In the meantime, we would place nominal values on #2-4% the conditions look good so far and we are still

at $515-520 per mt bagged FOB vessel, or around $490-500 per anticipating a crop of around 800,000 mt basis paddy.

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

April 13, 2011 - Page 3 of 4

Upcoming Tenders: USDA Export Sales Highlights

End April Costa Rica tender to buy 30,000mt of of long grain (March 25 - 31, 2011)

paddy.

Sales

Tenders Results: Net sales of 74,400 MT were up noticeably from the previous week

April 3 Panama tender for 50,000mt long grain paddy, bought at ap- and up 13 percent from the prior 4-week average. Increases were

proximately $305 per mt basis loaded truck in Panama. reported for:

April 5 KCCO MR-22-041 tender - 13,000mt of #2/4% was not Mexico (26,100 MT)

bought. KCCO did buy: Haiti (14,500 MT)

#5/20% L/G at $439.29 - $471.60 per mt BHOU-LCHI. Libya (12,000 MT)

#3/15% L/G at 448.87 pet mt FAS Lake Charles. unknown destinations (6,000 MT)

#2/7% Parboiled at $622.30-$659.17 BLC-FAS Lake Charles. Jordan (5,000 MT)

#5/20% Parboiled $572.60 LCHI. Decreases were reported for:

Senegal (2,200 MT)

April 11 IRAQ tender to buy 30,000mt of of long grain milled rice.

IGB likely to confirm 60,000mt Thai long grain milled rice. Exports

Exports of 52,500 MT were down 26 percent from the previous

USDA Supply Demand Report Highlights week and 16 percent from the prior 4-week average. The primary

1) No changes are made on the supply side of the U.S. 2010/11 rice supply and use balance sheets. On destinations were :

the use side, all rice domestic use and residual is estimated at 127.0 million cwt, still a record, but down

2.0 million from last month, but 4.4 million above 2009/10. All of the reduction is in long-grain rice now es-

timated at a near-record 99.0 million cwt. Combined medium- and short-grain domestic use is unchanged Mexico (24,800 MT)

at 28.0 million cwt. The changes in the 2010/11 domestic use and residual estimates are based largely on

the March 1 Rice Stocks report released by the National Agricultural Statistics Service (NASS) on March

Japan (14,200 MT)

31. NASS reported all rice stocks on a rough-equivalent basis at nearly 130.0 million cwt, up 17 percent Canada (3,600 MT)

from a year earlier, and above trade expectations.

2) The all rice 2010/11 export projection is unchanged at 116.0 million cwt; however, the rough-rice export Saudi Arabia (2,500 MT)

projection is lowered 3.0 million to 39.0 million because of slower-than-expected sales and shipments to Israel (800 MT)

markets primarily in Central America. Conversely, the combined milled and brown rice export projection is

raised 3.0 million cwt to 77.0 million (on rough-rice basis) due mostly to recent, large food-aid announce- Source: USDA

ments. The 2010/11 long-grain export projection is raised 1.0 million cwt to 79.0 million, while the com-

bined medium- and short-grain export projection is lowered the same amount to 37.0 million. The increase

in the long-grain export projection is due mostly to an increase in the non-commercial portion of exports

(virtually all long-grain rice) and the reduction in the combined medium- and short-grain export forecast is

due to lower-than-expected exports to Taiwan.

3) All rice ending stocks are projected at 54.8 million cwt, 2.0 million above last month, 18.1 million above Upcoming Events:

the previous year, and the largest stocks since 1985/86.

4) World rice production is reduced 0.8 million tons to 450.7 million based mostly on decreases for Indone- June 7-9, 2011 TRT Americas Conference 2011

sia, Iran, Laos, North Korea, and Sri Lanka, which is partially offset by increases for Brazil and Colombia.

5) Global imports for 2010/11 are lowered 0.8 million tons to 29.2 million due mostly to reductions for

Hotel Riu Plaza Panama, Panama City, Panama

Malaysia, Madagascar, the Philippines, and Thailand, which is partially offset by increases for some Sub- For more info go to: http://trtamericas.com/

Saharan Africa markets. Additionally, global exports are lowered from last month owing to expected de-

clines in shipments from mostly South American markets including Argentina, Peru, and Uruguay. Global

consumption is increased slightly based mostly on increases to a number of Sub-Saharan Africa markets.

6) Global ending stocks are projected at 97.1 million tons, down 1.7 million from last month, but an in-

June 26-30, 2011 USA Rice Millers’ Association Convention

crease of 3.3 million from 2009/10, and the largest stocks since 2002/03. The largest reductions in ending

stocks occurred in Indonesia, the Philippines, and Thailand, which are partially offset by an increase for

Brazil.

USDA Crop Progress

Rice Planted - Selected States -- Week Ending Rice Emerged - Selected States -- Week Ending

April 10, April 3, April 10, 2006- 2010 April 10, April 3, April 3, 2006- 2010

State State

2010 2011 2011 Avg. 2010 2011 2011 Avg.

Arkansas 17 7 21 15 Arkansas 1 (NA) 1 2

California - - - - California - (NA) - -

Louisiana 64 57 67 57 Louisiana 9 (NA) 38 24

Mississippi 13 6 10 11 Mississippi 3 (NA) 4 2

Missouri 6 - 4 7 Missouri - (NA) - -

Texas 50 67 79 63 Texas 19 (NA) 57 38

6 States 22 16 26 21 6 States 3 (NA) 9 7

Rice Co-Products - Spot market prices basis $ per short ton bulk, FOB mill (virtually no spot supply available for sale in South, except hulls)

Texas Louisiana Arkansas California

Bran: $110-$115 $110 Not Available ($110) $140-$150

Mill Feed: $45 $30 Not Available ($40)

Ground Hulls: $5 $5 $15

Unground Hulls: $5 $5 $12 $8

Creed Rice Co. Inc. 800 Wilcrest Suite 200 Houston, Texas 77042 USA

Ph 1.713.782.3260 Fax 1.713.782.4671 www.creedrice.com email: ricecreed@aol.com & creedinc@swbell.net

Brokers • Consultants • Market Reports • Arbitrators

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

April 13, 2011 - Page 4 of 4

Anda mungkin juga menyukai

- Creed Rice Market ReportDokumen4 halamanCreed Rice Market ReportnsopheaBelum ada peringkat

- Creed Rice Market Report.Dokumen4 halamanCreed Rice Market Report.nsopheaBelum ada peringkat

- Creed Market ReportDokumen4 halamanCreed Market ReportangkorriceBelum ada peringkat

- Container and Substrate Production of Raspberries HansonDokumen20 halamanContainer and Substrate Production of Raspberries HansonYana SamirBelum ada peringkat

- PricesDokumen2 halamanPricessoftbreezeBelum ada peringkat

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Dokumen1 halamanShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeBelum ada peringkat

- 9 1 10 SpecialsDokumen1 halaman9 1 10 SpecialsTalcove ExoticwoodsBelum ada peringkat

- Requirements & TermsDokumen4 halamanRequirements & TermsmasariieBelum ada peringkat

- Mou CustomerDokumen9 halamanMou Customerdovi deasyBelum ada peringkat

- Regan's Product HandbookDokumen131 halamanRegan's Product Handbookjomz100% (7)

- Container EMHU634152 StocktonDokumen1 halamanContainer EMHU634152 StocktonSusan Diggs HibdonBelum ada peringkat

- Master Stonefruit Programme 2020Dokumen1 halamanMaster Stonefruit Programme 2020foreverourgodBelum ada peringkat

- Master Strawberry Programme 2020Dokumen1 halamanMaster Strawberry Programme 2020foreverourgodBelum ada peringkat

- Fob, F, Elf: Green Coffee C ContractDokumen6 halamanFob, F, Elf: Green Coffee C ContractcoffeepathBelum ada peringkat

- Major Decline in Onion Plantation: Required WTD Natural WTD Optimal ScenarioDokumen1 halamanMajor Decline in Onion Plantation: Required WTD Natural WTD Optimal ScenarioGengjiaqi CHANGBelum ada peringkat

- Real Price IndexDokumen3 halamanReal Price IndexAsif IqbalBelum ada peringkat

- Korean Natural Farming Recipe1Dokumen9 halamanKorean Natural Farming Recipe1Anonymous KWgCUokT100% (1)

- Covington Informacion 2Dokumen3 halamanCovington Informacion 2jlarreluceBelum ada peringkat

- Updates For Genomic GiantDokumen8 halamanUpdates For Genomic GiantHolstein PlazaBelum ada peringkat

- GC 08-18 A8 AgribusinessDokumen1 halamanGC 08-18 A8 AgribusinessNikki MaxwellBelum ada peringkat

- April Monthly Retail 2023Dokumen6 halamanApril Monthly Retail 2023swogtfBelum ada peringkat

- Rice Data SheetDokumen6 halamanRice Data SheetDandapani Sivakumar SharmaBelum ada peringkat

- Aico MM LABORATORYDokumen2 halamanAico MM LABORATORYWinwin CahindeBelum ada peringkat

- Vist Our Yard at 5637 Davidson Road, Just Off Motherlode DRDokumen1 halamanVist Our Yard at 5637 Davidson Road, Just Off Motherlode DRrrr44Belum ada peringkat

- Product Details Macadamia Nuts: SpecificationsDokumen10 halamanProduct Details Macadamia Nuts: SpecificationsJess keramaBelum ada peringkat

- Starview Farms Order Form 2020 Meghan Cook May 2020Dokumen1 halamanStarview Farms Order Form 2020 Meghan Cook May 2020Meghan CookBelum ada peringkat

- Proforma 1 PolloDokumen1 halamanProforma 1 PolloJhonathan075Belum ada peringkat

- Таблица огородDokumen18 halamanТаблица огородMarunaBelum ada peringkat

- Composite Fish Farming - 8870851Dokumen5 halamanComposite Fish Farming - 8870851Telugu kabbilli SirishaBelum ada peringkat

- The Economics of Small-Scale Indoor Mushroom Cultivation: Stephen RussellDokumen20 halamanThe Economics of Small-Scale Indoor Mushroom Cultivation: Stephen RussellEmir KarabegovićBelum ada peringkat

- Also Available TodayDokumen1 halamanAlso Available TodayJm2345234029Belum ada peringkat

- Wholesale Price List: Item No. Gluten-Free MixesDokumen6 halamanWholesale Price List: Item No. Gluten-Free MixesnoniBelum ada peringkat

- Crops PDFDokumen12 halamanCrops PDFUsama JavedBelum ada peringkat

- PEANUT MARKETING NEWS - April 16, 2020 - Tyron Spearman, EditorDokumen1 halamanPEANUT MARKETING NEWS - April 16, 2020 - Tyron Spearman, EditorBrittany EtheridgeBelum ada peringkat

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDokumen1 halamanNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeBelum ada peringkat

- Planet Holstein Sale Updates2013Dokumen5 halamanPlanet Holstein Sale Updates2013Holstein PlazaBelum ada peringkat

- Split-Top Roubo WorkbenchDokumen29 halamanSplit-Top Roubo WorkbenchamelieBelum ada peringkat

- Price Monitoring October 4,2021Dokumen11 halamanPrice Monitoring October 4,2021Jessebel SantiagoBelum ada peringkat

- Weekly Cattle Market Update: For The Week Ending May 1, 2020Dokumen4 halamanWeekly Cattle Market Update: For The Week Ending May 1, 2020jenBelum ada peringkat

- New FOB Price Anesta LLC 1621151439Dokumen1 halamanNew FOB Price Anesta LLC 1621151439Ankit AgarwalBelum ada peringkat

- ProduceDokumen2 halamanProduceapi-239040842Belum ada peringkat

- Rice Preferences, Price Margins and Constraints of Rice Value Chain Actors in Nueva Ecija, PhilippinesDokumen47 halamanRice Preferences, Price Margins and Constraints of Rice Value Chain Actors in Nueva Ecija, Philippinesirri_social_sciences100% (2)

- Harvest Shepherd's Pie With Whipped Sweet PotatoDokumen3 halamanHarvest Shepherd's Pie With Whipped Sweet PotatoVALERIE JOY CATUDIOBelum ada peringkat

- Market Loan Weekly Prices: Shelled MKT PriceDokumen1 halamanMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramBelum ada peringkat

- Pasture Sowing Costs: OperationsDokumen4 halamanPasture Sowing Costs: Operationsapi-25932006Belum ada peringkat

- Green Coffee FOB, C & F, CIF Contract: Specialty Coffee Association of AmericaDokumen6 halamanGreen Coffee FOB, C & F, CIF Contract: Specialty Coffee Association of AmericacoffeepathBelum ada peringkat

- FISH Products in EnglishDokumen11 halamanFISH Products in Englishailu macchiaBelum ada peringkat

- FiberMax & Stoneville - 2013 Georgia Cotton Variety GuideDokumen2 halamanFiberMax & Stoneville - 2013 Georgia Cotton Variety GuideFiberMax & Stoneville CottonBelum ada peringkat

- Latin American: Market CommentaryDokumen6 halamanLatin American: Market Commentarycharles luisBelum ada peringkat

- Peanut Production GuideDokumen41 halamanPeanut Production Guidekang_eebBelum ada peringkat

- Prairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideDari EverandPrairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideBelum ada peringkat

- Hemp Hurds as Paper-Making Material United States Department of Agriculture, Bulletin No. 404Dari EverandHemp Hurds as Paper-Making Material United States Department of Agriculture, Bulletin No. 404Belum ada peringkat

- PGT Computer Science Kendriya Vidyalaya Entrance Exam Question PapersDokumen117 halamanPGT Computer Science Kendriya Vidyalaya Entrance Exam Question PapersimshwezBelum ada peringkat

- Pineapple Ice CreamsDokumen9 halamanPineapple Ice CreamsbhaleshBelum ada peringkat

- G11 Bio WS1 Characteristics of LifeDokumen2 halamanG11 Bio WS1 Characteristics of LifeArlance Sandra Marie Medina100% (1)

- RDO No. 60 - Lucena City (For Uploading)Dokumen578 halamanRDO No. 60 - Lucena City (For Uploading)Federico DomingoBelum ada peringkat

- Principles of GraftingDokumen49 halamanPrinciples of GraftingMelissa Es GoBelum ada peringkat

- Resolution Approving A Cooperative Purchasing Agreement With West Coast Arborists 09-10-13Dokumen10 halamanResolution Approving A Cooperative Purchasing Agreement With West Coast Arborists 09-10-13L. A. PatersonBelum ada peringkat

- Asda Magazine - 01 - 2013Dokumen100 halamanAsda Magazine - 01 - 2013Arikan983100% (1)

- Exercitii Cu Present Simple Si Present ContinuousDokumen22 halamanExercitii Cu Present Simple Si Present ContinuousGabriela Badea100% (1)

- PNABG526Dokumen463 halamanPNABG526Yano100% (1)

- Storage TankDokumen10 halamanStorage TankJacekBelum ada peringkat

- PB - Interpreting An Investigation of Plant Hormones QPDokumen6 halamanPB - Interpreting An Investigation of Plant Hormones QPRutba SafdarBelum ada peringkat

- Cell Parts and Functions 2Dokumen3 halamanCell Parts and Functions 2Arshelyn Donna NovenoBelum ada peringkat

- Biotechnology AssignmentDokumen7 halamanBiotechnology AssignmentCamille LeiBelum ada peringkat

- Oil and Fat Technology Lectures IDokumen27 halamanOil and Fat Technology Lectures Iaulger100% (4)

- King Abdullah II IrbidDokumen19 halamanKing Abdullah II Irbidعمر رائد مشتهى احمدBelum ada peringkat

- BIOLOGY Edexcel (9-1) Student Book Answers PDF Cell (Biology) FertilisationDokumen1 halamanBIOLOGY Edexcel (9-1) Student Book Answers PDF Cell (Biology) Fertilisationjasmine.elabedBelum ada peringkat

- 6 English Lyp 2016 Sa1 SetaDokumen13 halaman6 English Lyp 2016 Sa1 Setasiba padhyBelum ada peringkat

- FastPlants2 LPA 21-22Dokumen16 halamanFastPlants2 LPA 21-22Isabelle VershawBelum ada peringkat

- Piping Design and Operations Guidebook Volume 1 PDFDokumen86 halamanPiping Design and Operations Guidebook Volume 1 PDFAn'nur Fauzi Syaputra100% (1)

- CV-UMMAR FAROOQ - PipingMechanical Site EngineerDokumen4 halamanCV-UMMAR FAROOQ - PipingMechanical Site EngineerUmmar FarooqBelum ada peringkat

- VESDA SpecificationsDokumen10 halamanVESDA SpecificationsAhmed HassanBelum ada peringkat

- 710 - Marine Ply WoodDokumen18 halaman710 - Marine Ply WoodpraupdBelum ada peringkat

- Biology 02 TissuesDokumen10 halamanBiology 02 TissuesMonika Mehan67% (3)

- Flowers of CreteDokumen27 halamanFlowers of CreteZacharias AngourakisBelum ada peringkat

- Mahaguyog FestivalDokumen3 halamanMahaguyog FestivalĮvąn ĮvąnBelum ada peringkat

- Difference Between Radial and Bilateral SymmetryDokumen1 halamanDifference Between Radial and Bilateral Symmetrymanojitchatterjee2007Belum ada peringkat

- 3Dokumen20 halaman3khairunnisa P.O.V.PBelum ada peringkat

- Stories of Juan TamadDokumen5 halamanStories of Juan Tamadaintenough80% (5)

- Plant Tissue Culture For BiotechnologyDokumen8 halamanPlant Tissue Culture For Biotechnologyargos1301100% (1)

- Protectors Are ThievesDokumen8 halamanProtectors Are ThievessanghamitrabBelum ada peringkat