Operating, Financial & Combined Leverage

Diunggah oleh

m_manjari_g0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

226 tayangan13 halamanLeverageis taking the advantage of the Fixed Expenses to increase the level of production or any other activity. Leverages helps in determining the total risk i.e. Business Risk and Financial Risk.

Deskripsi Asli:

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniLeverageis taking the advantage of the Fixed Expenses to increase the level of production or any other activity. Leverages helps in determining the total risk i.e. Business Risk and Financial Risk.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

226 tayangan13 halamanOperating, Financial & Combined Leverage

Diunggah oleh

m_manjari_gLeverageis taking the advantage of the Fixed Expenses to increase the level of production or any other activity. Leverages helps in determining the total risk i.e. Business Risk and Financial Risk.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 13

Operating, Financial &

Combined Leverage

By: Ms. Manjari Sharma

Contents-

• Introduction

• Financial Decision

• Types of Leverage

• Operating Leverage

• Degree of Operating Leverage

• Financial leverage

• Degree of Financial Leverage

• Total / Combined Leverage

• Degree of Total /Combined Leverage

• Table- Income Statement

Introduction-

Leverage- is taking the advantage of the Fixed

Expenses to increase the level of production or

any other activity, that is incurred either in the

form of Business Fixed Expenses like Rent, etc

and Financial Fixed Expenses like Interest.

Financial Decision-

Operating, Financial and Combined Leverage

are used as a tool for framing the Business

Decisions regarding the operating profit

attained in respect of different level of sales or

Firms Break even operating profit & Firms

Break even Sales.

Leverages helps in determining the total risk

i.e. business risk and financial risk.

Types of Leverage

Operating Leverage

Financial Leverage

Combined Leverage

Operating Leverage

Usage of Fixed Operating Cost by the

Firm - to utilize the existing operating

cost

Degree of Operating Leverage

The Degree of Operating Leverage is the

percentage change in the firms Operating

Profit/ EBIT resulting from a one percentage

change in the sales.

DOL = Percentage Change in EBIT

Percentage Change in Sales

Interpretation of the DOL

• DOL is the sensitivity of the firm Operating

Profit to its level of Sales.

• The firm whose DOL is highest among all

firms it means the firm is having highest

sensitivity to the changes in the level of sales.

Financial Leverage

• The use of Fixed Cost by the firm in the form

of Interest

Degree of Financial Leverage

• The Percentage Change in a firms EPS

resulting from a one percentage change in the

level of Operating Profit.

DFL = Percentage Change in EPS

Percentage Change in EBIT

Total Firm Risk

• Total firm risk is the mix of Business &

Financial risk.

Total Firm Risk= Business Risk +

Financial Risk

• It is the Variability in the Earning per Share.

EBIT is used to measure the Business Risk.

EPS is used to measure the Financial Risk.

Degree of Total Leverage

• The percentage change in a firm’s EPS

resulting from a one percentage change in its

output/ sales.

DTL= Percentage Change in EPS

Percentage Change in Sales

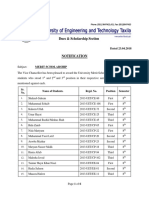

Table- Income Statement

Particulars Amount

Sales XXX

Less- Variable Expenses XXX

Contribution (C ) XXX

Less- Fixed Expenses XXX

Operating Profit/ EBIT XXX

Less- Interest XXX

Earning Before Tax (EBT) XXX

Less-Income Tax XXX

Earning After Tax (EAT) XXX

Number of Equity Shares XXX

Preference Dividend XXX

Earning Per Share = Earnings Available to Equity Shareholders or EAT- Pref., Dividend

Number of Equity Shares

Anda mungkin juga menyukai

- Financial Leverage: Presented By: Dr. Hari Prapan Sharma Assistant Professor GLA University MathuraDokumen29 halamanFinancial Leverage: Presented By: Dr. Hari Prapan Sharma Assistant Professor GLA University MathuraArsh SinghalBelum ada peringkat

- Capital Structure and LeveragesDokumen13 halamanCapital Structure and LeveragesbansalparthBelum ada peringkat

- Analysis of Leverage: Team:-Isha S.Yusra Jamal Samrjeet KaurDokumen21 halamanAnalysis of Leverage: Team:-Isha S.Yusra Jamal Samrjeet KaurpranavBelum ada peringkat

- LeveragesDokumen41 halamanLeveragesSohini ChakrabortyBelum ada peringkat

- Analysis and Impact of Leverages DR Pawan GuptaDokumen53 halamanAnalysis and Impact of Leverages DR Pawan Guptamithunbanerjee2009Belum ada peringkat

- Leverage: " Give Me A Lever Long Enough and A Fulcrum On Which To Place It and I Shall Move The World"Dokumen51 halamanLeverage: " Give Me A Lever Long Enough and A Fulcrum On Which To Place It and I Shall Move The World"vints_87Belum ada peringkat

- Leverage: Team Anuradha Kumar Akanksha Birmole Sumit DasDokumen21 halamanLeverage: Team Anuradha Kumar Akanksha Birmole Sumit Dasanu2789Belum ada peringkat

- Analysis and Impact of LeverageDokumen88 halamanAnalysis and Impact of LeveragePuneet Sethi50% (2)

- Leverage: Team Anuradha Kumar Akanksha Birmole Sumit DasDokumen21 halamanLeverage: Team Anuradha Kumar Akanksha Birmole Sumit Dasanu2789Belum ada peringkat

- Leverage 1Dokumen13 halamanLeverage 1Madhav RajbanshiBelum ada peringkat

- Leverage Analysis: Operating, Financial and Combined ImpactDokumen98 halamanLeverage Analysis: Operating, Financial and Combined Impactthella deva prasadBelum ada peringkat

- Financial LeverageDokumen16 halamanFinancial LeverageEvan MiñozaBelum ada peringkat

- Chapter 7 LeverageDokumen21 halamanChapter 7 Leveragemuluken walelgnBelum ada peringkat

- Capital Structure 1207335005590278 8Dokumen4 halamanCapital Structure 1207335005590278 8Sumit SinglaBelum ada peringkat

- Operating and Financial Liverage: Presented by Deepak Anand Zafar KamalDokumen13 halamanOperating and Financial Liverage: Presented by Deepak Anand Zafar KamalZafar KamalBelum ada peringkat

- Inancing Ecisions Everages: Analysis of LeverageDokumen8 halamanInancing Ecisions Everages: Analysis of LeverageParth BindalBelum ada peringkat

- Leverage: Presented by Sandesh YadavDokumen14 halamanLeverage: Presented by Sandesh YadavSandesh011Belum ada peringkat

- Financil Leverage, Operating Leverage, Combined LeverageDokumen12 halamanFinancil Leverage, Operating Leverage, Combined LeverageChandan SinghBelum ada peringkat

- Leverage AND TYPES of LeaverageDokumen10 halamanLeverage AND TYPES of Leaveragesalim1321100% (2)

- LeverageDokumen7 halamanLeveragePrateek GuptaBelum ada peringkat

- Operating and Financial Leverages - FinalDokumen51 halamanOperating and Financial Leverages - Finalchittesh23Belum ada peringkat

- Topic 7 - Financial Leverage - Part 1Dokumen82 halamanTopic 7 - Financial Leverage - Part 1Baby KhorBelum ada peringkat

- Analysis and Impact of LeverageDokumen97 halamanAnalysis and Impact of Leverageapi-19482678Belum ada peringkat

- Capital Structure & Leverage: Key Concepts ExplainedDokumen25 halamanCapital Structure & Leverage: Key Concepts ExplainedRishabh SarawagiBelum ada peringkat

- Leverage Chap 7 - PoliteknikDokumen83 halamanLeverage Chap 7 - PoliteknikShazwani AzmanBelum ada peringkat

- Leverage AnalysisDokumen22 halamanLeverage AnalysisSiddharthBelum ada peringkat

- Leverage AnalysisDokumen29 halamanLeverage AnalysisFALAK OBERAIBelum ada peringkat

- Leverage Analysis: Understanding Operating, Financial and Combined LeverageDokumen3 halamanLeverage Analysis: Understanding Operating, Financial and Combined LeverageCrazy BuddyBelum ada peringkat

- Analysis and Interpretation of Financial StatementsDokumen27 halamanAnalysis and Interpretation of Financial StatementspatilgscribdBelum ada peringkat

- 1) If sales increase by 10%, operating income should increase by 17.14%2) If operating income increases by 10%, EPS should increase by 15.56% 3) If sales increase by 10%, EPS should increase by 26.67Dokumen38 halaman1) If sales increase by 10%, operating income should increase by 17.14%2) If operating income increases by 10%, EPS should increase by 15.56% 3) If sales increase by 10%, EPS should increase by 26.67pranavBelum ada peringkat

- LeverageDokumen20 halamanLeveragekapish1mittal100% (1)

- LeveragesDokumen13 halamanLeveragesmansi dhimanBelum ada peringkat

- Chapter 6Dokumen15 halamanChapter 6RebelliousRascalBelum ada peringkat

- Analysis and Interpretation of Financial StatementsDokumen27 halamanAnalysis and Interpretation of Financial StatementsRajesh PatilBelum ada peringkat

- Break-Even & Leverage AnalysisDokumen17 halamanBreak-Even & Leverage Analysisspyeye1978Belum ada peringkat

- Topic 2 - Cost-Volume-Profit (CVP) AnalysisDokumen4 halamanTopic 2 - Cost-Volume-Profit (CVP) AnalysisJanus Aries Simbillo100% (1)

- The Measure Indicates How A Particular Product Contributes To The Overall Profit of The CompanyDokumen3 halamanThe Measure Indicates How A Particular Product Contributes To The Overall Profit of The CompanyNathalie matitoBelum ada peringkat

- ProfitabilityDokumen30 halamanProfitabilitySumit KumarBelum ada peringkat

- Breakeven AnalysisDokumen7 halamanBreakeven AnalysisMohit SidhwaniBelum ada peringkat

- Dol DFL DTLDokumen30 halamanDol DFL DTLZiya M MursalzadeBelum ada peringkat

- FINANCIAL MANAGEMENT FUNDAMENTALSDokumen38 halamanFINANCIAL MANAGEMENT FUNDAMENTALSahmedBelum ada peringkat

- Chapter One: Financing DecisionDokumen40 halamanChapter One: Financing Decisiontamirat tadeseBelum ada peringkat

- Leverage (Financial Management)Dokumen2 halamanLeverage (Financial Management)Rika Miyazaki100% (1)

- Leverage & Capital Structure: Prepared by Keldon BauerDokumen25 halamanLeverage & Capital Structure: Prepared by Keldon Bauergeeths207Belum ada peringkat

- Leverage My PptsDokumen34 halamanLeverage My PptsMadhuram SharmaBelum ada peringkat

- Ratio Analysis Part 1Dokumen27 halamanRatio Analysis Part 1RAVI KUMARBelum ada peringkat

- Leverage: Presented By: Name-Pinaky Sethy Branch-CSE Semester-7th Guided By: Prof - Joytiranjan SahooDokumen20 halamanLeverage: Presented By: Name-Pinaky Sethy Branch-CSE Semester-7th Guided By: Prof - Joytiranjan SahooPinaky SethyBelum ada peringkat

- CVP Analysis GuideDokumen4 halamanCVP Analysis GuideEidel PantaleonBelum ada peringkat

- Bus121 Ch7 VocabDokumen4 halamanBus121 Ch7 VocabNigussie BerhanuBelum ada peringkat

- Leverages: Prof. Sankersan SarkarDokumen35 halamanLeverages: Prof. Sankersan Sarkarvivek guptaBelum ada peringkat

- Break-Even Analysis or CVP Analysis: Profits Will Vary When Production Costs, SalesDokumen17 halamanBreak-Even Analysis or CVP Analysis: Profits Will Vary When Production Costs, SalessmurtazarizviBelum ada peringkat

- Financial LeverageDokumen18 halamanFinancial LeverageSTEVE ROGERSBelum ada peringkat

- D. Ratio AnalysisDokumen6 halamanD. Ratio AnalysisMohit JainBelum ada peringkat

- Operation Leverage-Financial Leverage and Break Even PointDokumen3 halamanOperation Leverage-Financial Leverage and Break Even PointAmar Stunts ManBelum ada peringkat

- Capital Structure and Leverage Chapter - One Part-1Dokumen38 halamanCapital Structure and Leverage Chapter - One Part-1shimelisBelum ada peringkat

- Operating and Financial LeverageDokumen23 halamanOperating and Financial Leverageheraaa12345Belum ada peringkat

- Profitability RatiosDokumen24 halamanProfitability RatiosEjaz Ahmed100% (1)

- 3.1 Leverage and Capital StructureDokumen57 halaman3.1 Leverage and Capital StructureMaha Bianca Charisma CastroBelum ada peringkat

- Accounting and Finance Formulas: A Simple IntroductionDari EverandAccounting and Finance Formulas: A Simple IntroductionPenilaian: 4 dari 5 bintang4/5 (8)

- ToonHub - Articles of PartnershipDokumen13 halamanToonHub - Articles of PartnershipKingBelum ada peringkat

- Multidimensional ScalingDokumen25 halamanMultidimensional ScalingRinkiBelum ada peringkat

- Lucid Motors Stock Prediction 2022, 2023, 2024, 2025, 2030Dokumen8 halamanLucid Motors Stock Prediction 2022, 2023, 2024, 2025, 2030Sahil DadashovBelum ada peringkat

- Container sizes: 20', 40' dimensions and specificationsDokumen3 halamanContainer sizes: 20', 40' dimensions and specificationsStylefasBelum ada peringkat

- Human Resource Development's Evaluation in Public ManagementDokumen9 halamanHuman Resource Development's Evaluation in Public ManagementKelas KP LAN 2018Belum ada peringkat

- Dues & Scholarship Section: NotificationDokumen6 halamanDues & Scholarship Section: NotificationMUNEEB WAHEEDBelum ada peringkat

- Intentional Replantation TechniquesDokumen8 halamanIntentional Replantation Techniquessoho1303Belum ada peringkat

- Cell Types: Plant and Animal TissuesDokumen40 halamanCell Types: Plant and Animal TissuesMARY ANN PANGANBelum ada peringkat

- Introduction To Competitor AnalysisDokumen18 halamanIntroduction To Competitor AnalysisSrinivas NandikantiBelum ada peringkat

- The Magic Limits in Harry PotterDokumen14 halamanThe Magic Limits in Harry Potterdanacream100% (1)

- (Evolutionary Psychology) Virgil Zeigler-Hill, Lisa L. M. Welling, Todd K. Shackelford - Evolutionary Perspectives On Social Psychology (2015, Springer) PDFDokumen488 halaman(Evolutionary Psychology) Virgil Zeigler-Hill, Lisa L. M. Welling, Todd K. Shackelford - Evolutionary Perspectives On Social Psychology (2015, Springer) PDFVinicius Francisco ApolinarioBelum ada peringkat

- FIITJEE Talent Reward Exam 2020: Proctored Online Test - Guidelines For StudentsDokumen3 halamanFIITJEE Talent Reward Exam 2020: Proctored Online Test - Guidelines For StudentsShivesh PANDEYBelum ada peringkat

- A COIN FOR A BETTER WILDLIFEDokumen8 halamanA COIN FOR A BETTER WILDLIFEDragomir DanielBelum ada peringkat

- Preterm Labour: Muhammad Hanif Final Year MBBSDokumen32 halamanPreterm Labour: Muhammad Hanif Final Year MBBSArslan HassanBelum ada peringkat

- Elliptic FunctionsDokumen66 halamanElliptic FunctionsNshuti Rene FabriceBelum ada peringkat

- SS2 8113 0200 16Dokumen16 halamanSS2 8113 0200 16hidayatBelum ada peringkat

- Study Habits Guide for Busy StudentsDokumen18 halamanStudy Habits Guide for Busy StudentsJoel Alejandro Castro CasaresBelum ada peringkat

- Price and Volume Effects of Devaluation of CurrencyDokumen3 halamanPrice and Volume Effects of Devaluation of Currencymutale besaBelum ada peringkat

- Principles of DisplaysDokumen2 halamanPrinciples of DisplaysShamanthakBelum ada peringkat

- Monetbil Payment Widget v2.1 enDokumen7 halamanMonetbil Payment Widget v2.1 enDekassBelum ada peringkat

- Platform Tests Forj Udging Quality of MilkDokumen10 halamanPlatform Tests Forj Udging Quality of MilkAbubaker IbrahimBelum ada peringkat

- City Government of San Juan: Business Permits and License OfficeDokumen3 halamanCity Government of San Juan: Business Permits and License Officeaihr.campBelum ada peringkat

- MAY-2006 International Business Paper - Mumbai UniversityDokumen2 halamanMAY-2006 International Business Paper - Mumbai UniversityMAHENDRA SHIVAJI DHENAKBelum ada peringkat

- UAE Cooling Tower Blow DownDokumen3 halamanUAE Cooling Tower Blow DownRamkiBelum ada peringkat

- ESSAYSDokumen5 halamanESSAYSDGM RegistrarBelum ada peringkat

- New U. 4. 2Dokumen6 halamanNew U. 4. 2Jerald Sagaya NathanBelum ada peringkat

- Com 10003 Assignment 3Dokumen8 halamanCom 10003 Assignment 3AmandaBelum ada peringkat

- Social Responsibility and Ethics in Marketing: Anupreet Kaur MokhaDokumen7 halamanSocial Responsibility and Ethics in Marketing: Anupreet Kaur MokhaVlog With BongBelum ada peringkat

- Negotiating For SuccessDokumen11 halamanNegotiating For SuccessRoqaia AlwanBelum ada peringkat

- Week 4-LS1 Eng. LAS (Types of Verbals)Dokumen14 halamanWeek 4-LS1 Eng. LAS (Types of Verbals)DONALYN VERGARA100% (1)