US Internal Revenue Service: f12508 Accessible

Diunggah oleh

IRSDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

US Internal Revenue Service: f12508 Accessible

Diunggah oleh

IRSHak Cipta:

Format Tersedia

Form 12508 Questionnaire for Non-Requesting Spouse

(April 2005)

Name Tax Year Social Security Number

We recognize that some of these questions involve sensitive subjects. However, we need this information to evaluate the

circumstances of the claim and properly determine whether relief should be given. If this form is not completed and returned, the

claim will be considered based on the information available to us.

1. What is the current relationship between you and your (former) spouse with whom you filed the joint return(s) for

the year(s) relief is being requested?

[ ] Married and living together

[ ] Married and living apart Provide date you started living apart (month, day, year) / /

[ ] Legally Separated Provide date of legal separation (month, day, year) / /

[ ] Divorced Provide date of divorce decree (month, day, year) / /

[ ] Widowed Provide date of death of spouse (month, day, year) / /

Enclose a complete copy of the separation agreement, divorce decree, death certificate

and will, if applicable. If you are still married but living apart, provide documentation to

verify the date of your separation such as copies of your lease agreement or utility bills

in your individual name.

1a. During the year(s) in question, did you and your (former) spouse live together the full year?

If no, please list dates of separation.

2. Why did you file a joint return instead of your own separate return?

3. What was your involvement in the preparation of the return(s)? For example, did you gather the receipts and cancelled

checks, or just provide your W-2's, etc.

4. Did your (former) spouse review the tax returns(s) before signing? [ ] Yes [ ] No

4a. If no, explain why not.

4b. If yes, did your (former) spouse ask you or the return preparer for an explanation of any items or amounts on the tax

returns?

Please list the questions asked, who responded and the response given.

5. During the year(s) in question did you have your own separate bank account(s)? [ ] Yes [ ] No

If yes, indicate the type of account(s).

[ ] Checking [ ] Savings [ ] Other

Catalog Number 28730P www.irs.gov Page 1 of 3 Form 12508 (Rev. 4-2005)

5a. What access did your (former) spouse have to the account(s)? (For example, were they able to make deposits,

write checks and withdraw funds)?

5b. What funds were deposited to the account(s)?

5c. What bills were paid out of the account(s)?

6. During the year(s) in question did you and your (former) spouse have any joint bank account(s)? [ ] Yes [ ] No

If yes, indicate the type of account(s).ˇ

[ ] Checking [ ] Savings [ ] Other

6a. What access did your (former) spouse have to the account(s)? (For example, were they able to make deposits,

write checks and withdraw funds)

6b. What funds were deposited to the account(s)?

6c. Who made these deposits?

6d. What bills were paid out of the account(s)?

6e. Who wrote and signed the checks?

6f. Did you review the monthly bank statements?

[ ] Yes [ ] No

6g. Did you balance the checkbook to the bank statements?

[ ] Yes [ ] No

7. Did you pick up and open the household mail?

[ ] Yes [ ] No

9. What was your highest level of education during the year(s) in question?

Note any business or tax related courses you completed by that time.

10. What was your (former) spouse's highest level of education during the year(s) in question?

Note any business or tax related courses he or she completed by that time.

11. Have any assets been transferred from you to your (former) spouse? [ ] Yes [ ] No

If yes, list the assets and the date of transfer. Explain why the assets were transferred.

Form 12508 (Rev. 4-2005) Page 2 of 3 Catalog Number 28730P

12. If the tax years in question were filed with a balance due, what arrangements did you have regarding payment of the taxes

due and was your (former) spouse aware of your plan?

12a. Was your (former) spouse aware of any financial problems you were having such as bankruptcy, high credit card debt or

difficulty paying monthly living expenses? If yes, please explain.

14. If the tax year(s) in question were audited, what items, if any, changed? Were the changed items yours or your (former)

spouse's? (For example, unreported income, disallowed deductions, unclaimed credits)

15. If the audit results changed your business income or deductions on your tax return, did your (former) spouse help you in the

business? If so how? If not, did your (former) spouse know about your business affairs? Explain

16. If the items changed by audit were yours, did your (former) spouse benefit from them? Explain

17. Explain any other factors you feel should be considered.

Under penalties of perjury, I declare that I have examined this statement and to the best of my knowledge it is true, correct, and

complete.

Signature SSN Date

Daytime Phone # Best Time to Call

Form 12508 (Rev. 4-2005) Catalog Number 28730P Page 3 of 3 Department of the Treasury–Internal Revenue Service

Anda mungkin juga menyukai

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Dokumen6 halamanUS Internal Revenue Service: 2290rulesty2007v4 0IRSBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Dokumen153 halaman2008 Objectives Report To Congress v2IRSBelum ada peringkat

- 2008 Data DictionaryDokumen260 halaman2008 Data DictionaryIRSBelum ada peringkat

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Credit Card Bulk Provider RequirementsDokumen112 halaman2008 Credit Card Bulk Provider RequirementsIRSBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

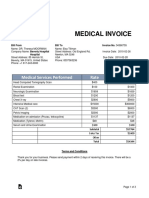

- Medical InvoiceDokumen3 halamanMedical InvoiceAditya JagtapBelum ada peringkat

- Pantaleon v. AMEX credit card approval disputeDokumen3 halamanPantaleon v. AMEX credit card approval disputeJet SiangBelum ada peringkat

- Revision of Au Small Finance Bank Credit Card Usage Terms Condition - 1st - March - 2024Dokumen2 halamanRevision of Au Small Finance Bank Credit Card Usage Terms Condition - 1st - March - 2024ARUN SBelum ada peringkat

- Application Form For CSWIP 5 Year Renewal (Overseas) - v2Dokumen7 halamanApplication Form For CSWIP 5 Year Renewal (Overseas) - v2nddkBelum ada peringkat

- Internship ReportDokumen84 halamanInternship ReportAhsan MalikBelum ada peringkat

- TaxyDokumen4 halamanTaxyNeevinternational NeevBelum ada peringkat

- Nov 2023 AirtelDokumen4 halamanNov 2023 AirtelAnkitBelum ada peringkat

- Criminal Complaint Against Kevin Ford and OthersDokumen43 halamanCriminal Complaint Against Kevin Ford and OthersSteve Warmbir50% (2)

- Bid DocumentDokumen113 halamanBid DocumentAbu MariamBelum ada peringkat

- WordDokumen3 halamanWordnoah9698Belum ada peringkat

- Greenwich College Application FormDokumen2 halamanGreenwich College Application FormPatricia Fernández GonzálezBelum ada peringkat

- Mailbox Rental Instructions - For Package Forwarding ServiceDokumen5 halamanMailbox Rental Instructions - For Package Forwarding Servicesafe wayBelum ada peringkat

- Four Seasons Hotel Vancouver Reservation - Booking PDFDokumen1 halamanFour Seasons Hotel Vancouver Reservation - Booking PDFHakan DemirciBelum ada peringkat

- Part Three Applied Art: Lots A1 - A171 5pm - Thursday 18 April 2013Dokumen20 halamanPart Three Applied Art: Lots A1 - A171 5pm - Thursday 18 April 2013miller999Belum ada peringkat

- Direct Debit SetupDokumen2 halamanDirect Debit Setupishtee894Belum ada peringkat

- 2017 Rain Flo CatalogDokumen84 halaman2017 Rain Flo CatalogLuis AvilaBelum ada peringkat

- Managing Service GuideDokumen25 halamanManaging Service GuideBoris JohnsonBelum ada peringkat

- Solving Business Math Problems with Fractions, Decimals & PercentDokumen7 halamanSolving Business Math Problems with Fractions, Decimals & PercentJoyen AtilloBelum ada peringkat

- Financcial LiteracyDokumen3 halamanFinanccial LiteracyTushar GuptaBelum ada peringkat

- Guidance EDC Android YokkeDokumen41 halamanGuidance EDC Android YokkeAndri KadirBelum ada peringkat

- Account StatementDokumen4 halamanAccount StatementDure ShehwarBelum ada peringkat

- HBL Credit Card SummaryDokumen3 halamanHBL Credit Card SummaryMubin AshrafBelum ada peringkat

- 2019 April Vacation Horse Camp at Mack Hill Riding AcademyDokumen4 halaman2019 April Vacation Horse Camp at Mack Hill Riding AcademyLauren SmithBelum ada peringkat

- Quizlet Mission Pega DecisioningDokumen7 halamanQuizlet Mission Pega DecisioningKumarBelum ada peringkat

- ReportDokumen78 halamanReportapi-3810664100% (2)

- Wells Fargo Everyday CheckingDokumen7 halamanWells Fargo Everyday CheckingSergio LitumaBelum ada peringkat

- Day Care Policy StatementDokumen6 halamanDay Care Policy StatementRocketLawyerBelum ada peringkat

- Henrico Retail Sales Audit TrailDokumen4 halamanHenrico Retail Sales Audit TrailKim NguyenBelum ada peringkat

- Format - SIP Progress Report SamikshaDokumen10 halamanFormat - SIP Progress Report Samikshavinuta wagheBelum ada peringkat

- CFO or Treasurer or VP Treasury Operations or VP Finance or DireDokumen3 halamanCFO or Treasurer or VP Treasury Operations or VP Finance or Direapi-79164703Belum ada peringkat