US Internal Revenue Service: Irb03-39

Diunggah oleh

IRSDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

US Internal Revenue Service: Irb03-39

Diunggah oleh

IRSHak Cipta:

Format Tersedia

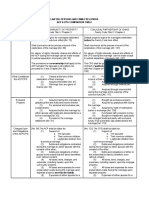

Bulletin No.

2003-39

September 29, 2003

HIGHLIGHTS

OF THIS ISSUE

These synopses are intended only as aids to the reader in

identifying the subject matter covered. They may not be

relied upon as authoritative interpretations.

INCOME TAX Announcement 2003–56, page 694.

This announcement provides information regarding changes to

the reporting for certain 2002 forms affected by the decrease

Rev. Rul. 2003–104, page 636. in the capital gains tax rates. Partnerships, S corporations,

Interest rates; underpayments and overpayments. The rate estates, individuals, real estate investment trusts, and mutual

of interest determined under section 6621 of the Code for the funds and other regulated investment companies with a fiscal

calendar quarter beginning October 1, 2003, will be 4 percent year beginning in 2002 and ending after May 5, 2003, must

for overpayments (3 percent in the case of a corporation), 4 reflect the changes required by this announcement in their re-

percent for underpayments, and 6 percent for large corporate porting for the tax year.

underpayments. The rate of interest paid on the portion of

a corporate overpayment exceeding $10,000 will be 1.5 per-

cent.

EMPLOYEE PLANS

T.D. 9078, page 630.

Final regulations under section 1361 of the Code provide guid- T.D. 9075, page 608.

ance regarding a qualified subchapter S trust election for tes- Final regulations under section 457 of the Code provide guid-

tamentary trusts and the period for which former qualified sub- ance on eligible section 457 deferred compensation plans of

part E trusts and testamentary trusts may be permitted share- state and local governmental employers and tax-exempt enti-

holders of an S corporation. In addition, these regulations pro- ties. The regulations reflect changes made to section 457 by

vide that the definition of a testamentary trust also includes a the Tax Reform Act of 1986, The Small Business Job Protection

trust to which S corporation stock is either transferred under Act of 1996, The Economic Growth and Tax Relief Reconcilia-

the terms of an electing qualified revocable trust during its elec- tion Act of 2001, and other legislation. The regulations also

tion period or deemed to be distributed at the close of the last make various technical changes and clarifications to the exist-

day of the election period. ing final regulations.

Notice 2003–64, page 646.

Investments through multiple CDEs. The Treasury Depart-

ment and the Service announce that they will amend regulations

section 1.45D–1T(d)(1)(iv) to include investments through two

additional qualified community development entities (CDEs) de-

scribed in section 45D(c) of the Code.

(Continued on the next page)

Finding Lists begin on page ii.

ESTATE TAX

T.D. 9077, page 634.

Final regulations under section 2519 of the Code relate to the

amount treated as a transfer when there is a right to recover

gift tax under section 2207A(b). The regulations also include

related gift and estate tax consequences if the right to recover

the gift tax is not exercised. These regulations will affect donee

spouses who make lifetime dispositions of all or part of a qual-

ifying income interest in qualified terminable interest property.

GIFT TAX

T.D. 9077, page 634.

Final regulations under section 2519 of the Code relate to the

amount treated as a transfer when there is a right to recover

gift tax under section 2207A(b). The regulations also include

related gift and estate tax consequences if the right to recover

the gift tax is not exercised. These regulations will affect donee

spouses who make lifetime dispositions of all or part of a qual-

ifying income interest in qualified terminable interest property.

ADMINISTRATIVE

T.D. 9074, page 601.

Final regulations under section 66 of the Code relate to the

treatment of community income for certain married individuals

in community property states who do not file joint federal in-

come tax returns.

Notice 2003–60, page 643.

This notice addresses a number of collection issues arising

from the Supreme Court decision in United States v. Craft,

535 U.S. 274 (2002–38 I.R.B. 548), in which the Court held

that the federal tax lien attaches to the rights of the delinquent

taxpayer in property held as a tenancy by the entirety, even

though state law insulates entireties property from the claims

of creditors of only one spouse.

Rev. Proc. 2003–73, page 647.

Substitute tax forms and schedules. Requirements are set

forth for privately designed and printed federal tax forms and

conditions under which the IRS will accept computer-prepared

and computer-generated tax forms and schedules. Rev. Proc.

2002–60 superseded.

September 29, 2003 2003-39 I.R.B.

The IRS Mission

Provide AmericaÊs taxpayers top quality service by helping

them understand and meet their tax responsibilities and by

applying the tax law with integrity and fairness to all.

Introduction

The Internal Revenue Bulletin is the authoritative instrument of court decisions, rulings, and procedures must be considered,

the Commissioner of Internal Revenue for announcing official and Service personnel and others concerned are cautioned

rulings and procedures of the Internal Revenue Service and for against reaching the same conclusions in other cases unless

publishing Treasury Decisions, Executive Orders, Tax Conven- the facts and circumstances are substantially the same.

tions, legislation, court decisions, and other items of general

interest. It is published weekly and may be obtained from the

The Bulletin is divided into four parts as follows:

Superintendent of Documents on a subscription basis. Bul-

letin contents are consolidated semiannually into Cumulative

Bulletins, which are sold on a single-copy basis. Part I.—1986 Code.

This part includes rulings and decisions based on provisions of

the Internal Revenue Code of 1986.

It is the policy of the Service to publish in the Bulletin all sub-

stantive rulings necessary to promote a uniform application of

the tax laws, including all rulings that supersede, revoke, mod- Part II.—Treaties and Tax Legislation.

ify, or amend any of those previously published in the Bulletin. This part is divided into two subparts as follows: Subpart A,

All published rulings apply retroactively unless otherwise indi- Tax Conventions and Other Related Items, and Subpart B, Leg-

cated. Procedures relating solely to matters of internal man- islation and Related Committee Reports.

agement are not published; however, statements of internal

practices and procedures that affect the rights and duties of Part III.—Administrative, Procedural, and Miscellaneous.

taxpayers are published. To the extent practicable, pertinent cross references to these

subjects are contained in the other Parts and Subparts. Also

Revenue rulings represent the conclusions of the Service on the included in this part are Bank Secrecy Act Administrative Rul-

application of the law to the pivotal facts stated in the revenue ings. Bank Secrecy Act Administrative Rulings are issued by

ruling. In those based on positions taken in rulings to taxpayers the Department of the TreasuryÊs Office of the Assistant Sec-

or technical advice to Service field offices, identifying details retary (Enforcement).

and information of a confidential nature are deleted to prevent

unwarranted invasions of privacy and to comply with statutory Part IV.—Items of General Interest.

requirements. This part includes notices of proposed rulemakings, disbar-

ment and suspension lists, and announcements.

Rulings and procedures reported in the Bulletin do not have the

force and effect of Treasury Department Regulations, but they The first Bulletin for each month includes a cumulative index

may be used as precedents. Unpublished rulings will not be for the matters published during the preceding months. These

relied on, used, or cited as precedents by Service personnel in monthly indexes are cumulated on a semiannual basis, and

the disposition of other cases. In applying published rulings and are published in the first Bulletin of the succeeding semiannual

procedures, the effect of subsequent legislation, regulations, period, respectively.

The contents of this publication are not copyrighted and may be reprinted freely. A citation of the Internal Revenue Bulletin as the source would be appropriate.

For sale by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC 20402.

2003-39 I.R.B. September 29, 2003

Part I. Rulings and Decisions Under the Internal Revenue Code of 1986

Section 66.—Treatment of collection of information displays a valid Explanation and Summary of

Community Income control number assigned by the Office of Comments

Management and Budget.

26 CFR 1.66–1: Treatment of community income.

Estimated total annual reporting burden 1. General

for 2001 for Form 8857, “Request for In-

T.D. 9074 nocent Spouse Relief”: 21,123 hours.

One commentator suggested that the

proposed regulations under section 66

Estimated average annual burden hours

DEPARTMENT OF THE per response: 59 minutes.

(particularly §1.66–2) were not helpful,

given the community property laws of the

TREASURY Estimated number of responses for

commentator’s state. This commentator

Internal Revenue Service 2001 for Form 8857: 21,336.

also suggested that the proposed regula-

26 CFR part 1 and 602 Requests for relief under section 66(c)

tions appear to assume that the community

constitute less than 1% of the total requests

property laws of all community property

Treatment of Community Income filed using Form 8857.

states are the same. The intent of these

Comments on the collection of in-

for Certain Individuals Not Filing formation should be sent to the Office

regulations is not to provide guidance

Joint Returns of Management and Budget, Attn:

based on the community property laws

of any particular state. Instead, the regu-

Desk Officer for the Department of the

AGENCY: Internal Revenue Service lations provide guidance on the effect of

Treasury, Office of Information and Reg-

(IRS), Treasury. section 66 on taxpayers’ community in-

ulatory Affairs, Washington, DC 20503,

come as determined under state law. After

with copies to the Internal Revenue

ACTION: Final regulations. a determination that an item of income is

Service, Attn: IRS Reports Clearance

community income under state law, these

SUMMARY: This document contains fi- Officer, W:CAR:MP:T:T:SP, Washington,

regulations provide guidance on the treat-

nal regulations relating to the treatment of DC 20224.

ment of this income under section 66 for

community income under Internal Rev- Books or records relating to a collection

certain individuals not filing joint returns.

enue Code section 66 for certain married of information must be retained as long as

One commentator noted that there are

individuals in community property states their contents may become material in the

fundamental differences between married

who do not file joint federal income tax administration of any internal revenue law.

taxpayers who filed joint returns and re-

returns. The final regulations also reflect Generally, tax returns and return informa-

quest relief from joint and several liabil-

changes in the law made by the Internal tion are confidential, as required by section

ity under section 6015 and married taxpay-

Revenue Service Restructuring and Re- 6103 of the Internal Revenue Code (Code).

ers who filed separate returns and request

form Act of 1998. relief from the federal income tax liability

Background

resulting from the operation of community

EFFECTIVE DATE: These final regula- This document contains amendments to property law under section 66(c).

tions are effective July 10, 2003. 26 CFR part 1 under section 66 of the The final regulations do not address

Code, relating to the treatment of commu- differences between or make generaliza-

FOR FURTHER INFORMATION

nity income for certain individuals not fil- tions concerning married taxpayers who

CONTACT: Robin M. Tuczak,

ing joint returns. For rules regarding relief file joint returns and those who do not.

202–622–4940 (not a toll-free number).

from joint and several liability when a joint The final regulations focus on providing

SUPPLEMENTARY INFORMATION: return is filed, see section 6015 and the reg- guidance on the treatment of community

ulations thereunder. income for certain taxpayers under section

Paperwork Reduction Act A notice of proposed rulemaking 66.

(REG–115054–01, 2002–1 C.B. 530 [67 The preamble to the proposed regu-

The collection of information con- FR 2841]) was published in the Federal lations under section 66 references the

tained in the final regulations has been Register on January 22, 2002. No public spousal notification requirements set forth

reviewed and approved by the Office of hearing was requested or held. Written in regulations under section 6015 and

Management and Budget in accordance comments responding to the notice of discusses similar notification require-

with the Paperwork Reduction Act of 1995 proposed rulemaking were received. After ments under section 66. If the IRS grants

(44 U.S.C. 3507) under control number consideration of all the comments, the pro- relief under section 66, the liability of

1545–1770. Responses to this collection posed regulations are adopted as amended the requesting spouse will shift to the

of information are required in order for by this Treasury Decision. The comments nonrequesting spouse. Thus, notification

certain individuals to receive relief from and revisions are discussed below. and participation requirements similar to

the operation of community property law. those applicable in section 6015 cases are

An agency may not conduct or sponsor, also appropriate for section 66 cases. In

and a person is not required to respond addition, information provided by a non-

to, a collection of information unless the requesting spouse may help to determine

2003-39 I.R.B. 601 September 29, 2003

the appropriate amount of relief for the the regulations to married taxpayers was 3. §1.66–2

requesting spouse, if any. too restrictive. The commentator noted

Similarities between the guidance set that income earned during a marriage, but One commentator noted that it may be

forth in the regulations under section 6015 received after the dissolution of the mar- difficult to determine whether a transfer

and the regulations under section 66 are ital community, was community income of income is a transfer of earned income

due to the similarities in the elements re- under the laws of the commentator’s state. under §1.66–2(a)(5). A transfer of earned

quired, or factors considered, in determin- The commentator suggested that section income precludes the reporting of income

ing relief under these statutes. The anal- 66 should apply to this income, as it is in accordance with §1.66–2, even if a

ysis set forth in proposed §1.66–4(a)(2) community income under state law. The taxpayer meets the other requirements

and (3) regarding knowledge or reason to final regulations frame the issue in terms of §1.66–2. The commentator suggested

know and benefit is similar to that con- of application of section 66 to community that there should be a presumption under

tained in §1.6015–2(c) and (d). The final income, rather than in terms of marital §1.66–2 that any transfer of income or

regulations modify this analysis and adopt status. property is a transfer of earned income.

commentators’ suggestions to the extent The final regulations state that section The final regulations adopt this recom-

that the suggestions are consistent with the 66 applies only to community income, as mendation with respect to transfers of

statute, legislative history, and case law un- defined by state law. The final regulations, income. It is a logical presumption that

der section 66(c). These changes are more however, make a distinction between com- income is more likely to be earned than

fully discussed in the comments and expla- munity income and income from property unearned, and that a taxpayer who has

nation under §1.66–4 below. that was formerly community property but, unearned income is likely to have earned

in accordance with state law, is converted income as well.

2. §1.66–1 to a form of property that is not commu- Another commentator suggested that

nity property, such as separate property or the final regulations clarify the require-

One commentator stated that §1.66–1 ment of §1.66–2 that spouses live apart.

property held by joint tenancy or tenancy

of the proposed regulations failed to ex- The final regulations adopt this recommen-

in common.

pressly require each of the spouses to dation by cross-referencing the definition

Under the laws of certain community

report those items of separate income of members of the same household in

property states, property that was commu-

that are attributable to each spouse un- §1.6015–3(b).

nity property during the marriage ceases to

der applicable state community property The final regulations clarify that, when

be community property after the dissolu-

laws. Generally, community income is reporting income in accordance with

tion of the marital community. Conversely,

reportable half by each spouse pursuant to section 66(a), an individual must report

some state laws treat property that was not

Poe v. Seaborn, 282 U.S. 101 (1930), and all income in accordance with section

community property as community prop-

section 61. Whether income is separate 66(a). Section 66(a) does not apply on an

erty for the limited purpose of dividing as-

or community is determined under state item-by-item basis.

sets upon divorce. See Estate of Mitchell v.

law and the income is included in gross

Mitchell, 76 Cal. App. 4th 1378 (Cal. Ct.

income under section 61. The final reg- 4. §1.66–3

App. 1999). Income from such property is

ulations do not include guidance on how

not community income subject to the pro- One commentator recommended that

to report income that is not community

visions of section 66. The determination the final regulations emphasize that the

income under state law, as this would be

as to whether income from such property is IRS may disallow the federal income tax

outside the scope of section 66.

community income may be confusing due benefits of any community property law

The final regulations clarify in

to the fact that sometimes courts will re- under section 66(b) on an item-by-item

§1.66–1(a) that the general rule of com-

fer to the property, using “universally rec- basis. Because the proposed regulations

munity property applies to married indi-

ognized shorthand,” as community prop- already reference “item of community

viduals domiciled in community property

erty. See Bouterie v. Commissioner, 36 income” in every sentence of §1.66–3,

states. A taxpayer should report income

F.3d 1361 (5th Cir. 1994) (in which the however, the final regulations do not adopt

in accordance with the laws of the state

court found that the wife did not have com- this recommendation.

in which he or she is domiciled. United

munity income from community property One commentator suggested that the

States v. Mitchell, 403 U.S. 190, 197

and the IRS improperly relied on a state IRS should assert section 66(b) sparingly,

(1971); Commissioner v. Wilkerson, 368

court’s imprecise use of the term “commu- only if “the . . . spouse had no knowledge

F.2d 552, 553 (9th Cir. 1966). For ex-

nity property” in referring to property that whatever of the income . . . and did

ample, a taxpayer who is domiciled in

was formerly community property), rev’g not benefit from the income in a division

State A, a community property state,

T.C. Memo. 1993–510. of marital assets.” Section 66(b) allows

should report income in accordance with

Thus, in determining whether section the IRS to deny the federal income tax

the community property laws of State A,

66 applies to income, it is first necessary to benefits of community property law only

although she may be living in State B

determine whether the income is commu- when a taxpayer acted as if solely entitled

temporarily, due to a work detail, military

nity income under state law. The marital to the income and failed to notify the

assignment, etc.

status of the parties likely will be relevant taxpayer’s spouse of the income. The

One commentator noted that under

to this initial determination.

§1.66–1(b), the limitation of the scope of

September 29, 2003 602 2003-39 I.R.B.

final regulations do not impose additional a requesting spouse is required to prove, transferred no part of the income to the re-

requirements on the IRS. among other things, that “he or she did questing spouse.

Commentators also recommended that not know of, and had no reason to know A majority of cases decided under

the final regulations provide examples of of, such item of community income” to section 66(c) make the determination of

what constitutes treating income as solely obtain traditional relief. The final regula- whether it is equitable to grant relief based

one’s own and how specific a taxpayer tions include a discussion of knowledge on the “benefit” received by the requesting

must be when notifying his or her spouse and reason to know, as this is an element spouse, as opposed to the “significant

of the nature and amount of the income. required by section 66(c)(3). The facts benefit” standard applied by courts in

The final regulations adopt this recommen- and circumstances considered in making determining relief under former section

dation. the determination of knowledge or reason 6013(e) and section 6015(b). See Beck v.

to know are consistent with the knowledge Commissioner, T.C. Memo. 2001–198,

5. §1.66–4 and reason to know analysis set forth in acq. 2002–49 I.R.B.; Hardy v. Commis-

case law determining relief under section sioner, T.C. Memo. 1997–97. The court

The proposed regulations describe re- 66(c). in Beck and Hardy cited the legislative

lief granted under the first sentence of sec- Additionally, the final regulations in- history of section 66(c) when discussing

tion 66(c) as “specific relief.” The final clude new language regarding the knowl- benefit under section 66. The legisla-

regulations adopt the term traditional re- edge standard under section 66(c). To tive history provides that, in determining

lief to describe relief granted under this more closely track the language of sec- whether it is equitable to grant relief under

provision. The final regulations retain the tion 66(c), the phrase item of community section 66(c), the standard is “whether the

term “equitable relief” to describe the re- income replaces the term understatement [requesting] spouse benefitted from the

lief granted under the second sentence of when referring to the item about which the untaxed income.” H. Rep. No. 98–432, pt.

section 66(c). requesting spouse has knowledge or reason 2, at 1503 (1984). The final regulations

The proposed regulations require that a to know. Finally, the final regulations clar- adopt this standard.

spouse requesting relief under §1.66–4 file ify that knowledge of the source of com- One commentator suggested that the

a separate return for the taxable year relat- munity income or the income-producing time limitations set forth in §1.66–4 for

ing to the request. One commentator noted activity, without knowledge of the specific requesting relief under section 66(c) are

that section 66(c)(1) requires only that an amount of income, is sufficient knowledge not supported by the language of section

individual not file a joint return. The leg- to preclude relief under section 66(c). This 66(c). Although the statute itself does not

islative history of section 66(c) confirms is consistent with the knowledge and rea- set forth time limitations on the filing of a

that Congress did not intend to require an son to know analysis set forth in case law request for relief, the time limitations in the

individual to file a return to be eligible for under section 66(c). See, e.g., McGee v. proposed regulations are supported by the

relief under this provision. The House Re- Commissioner, 979 F.2d 66, 70 (5th Cir. legislative history of the traditional relief

port uses the phrase “at the time the re- 1992), aff’g T.C. Memo. 1991–510. provision of section 66(c). Specifically,

turn was filed (if a return is filed).” H.R. Two commentators questioned whether the House Report explaining traditional

Rep. No. 98–432, pt. 2, at 1503 (1984). the standard of significant benefit in excess relief under section 66(c) states that, in

In earlier cases regarding relief under sec- of normal support, which is used in deter- making the determination as to relief, the

tion 66(c), the Tax Court implies that a re- mining whether it is equitable to grant re- IRS should consider (among other things)

questing spouse must file a separate return. lief under section 6015, is the applicable “whether the defense was promptly raised

See, e.g., Roberts v. Commissioner, T.C. standard under section 66. One commen- so as to prevent the period of limitations

Memo. 1987–391, aff’d 860 F.2d 1235 tator noted that under community property from running on the other spouse.” H.R.

(5th Cir. 1988). More recent cases, how- laws, each spouse generally is entitled to Rep. No. 98–432, pt. 2, at 1501 (1984).

ever, specifically state that not filing any half of the income of the other spouse. Thus, the final regulations retain the time

return meets the requirement of not filing Under section 66, a requesting spouse es- limitations set forth in the proposed regu-

a joint return. See, e.g., Ollestad v. Com- sentially is seeking relief for half the in- lations. In contrast, §1.66–4(j)(2)(ii) sets

missioner, T.C. Memo. 1996–139; Costa come of both spouses, which may have forth timing requirements for requesting

v. Commissioner, T.C. Memo. 1990–572. been used to provide normal support to equitable relief that are broader than the

The final regulations adopt the recommen- both spouses. Contrast this situation to that requirements applicable to traditional re-

dation to limit the requirement to not filing under section 6015, which permits a re- lief because the legislative history of the

a joint return. questing spouse to seek relief from joint equitable relief provision does not contain

One commentator suggested that the and several liability for the tax on all of similar timing requirements. Therefore,

discussion of knowledge and reason to the income of the nonrequesting spouse. a requesting spouse who does not meet

know of an item of community income in This commentator suggested that the tax the time limitations to request traditional

§1.66–4 ignores the low probability that liability should be shifted to the nonre- relief may be eligible to request equitable

a requesting spouse would have access questing spouse only if the nonrequesting relief.

to accurate information or knowledge spouse has treated the income in a manner Another commentator noted that per-

regarding what the nonrequesting spouse inconsistent with the community property haps the timeliness of the requesting

reported or did not report for federal in- regime, for example, has not allowed use spouse’s request should be only one factor

come tax purposes. Under section 66(c), of the income for normal support or has in determining whether to grant traditional

2003-39 I.R.B. 603 September 29, 2003

relief under section 66(c), as opposed to not apply to the regulations, and because (4) A requesting spouse qualifies for

a threshold requirement. This comment the regulations do not impose a collection equitable relief from the federal income

was not adopted because a requesting of information on small entities, the Regu- tax liability resulting from the opera-

spouse who does not meet the timing latory Flexibility Act (5 U.S.C. chapter 6) tion of community property law under

requirements for traditional relief still does not apply. §1.66–4(b).

may receive equitable relief under section (b) Applicability. (1) The rules of this

66(c). Drafting Information section apply only to community income,

One commentator urged that no request as defined by state law. The rules of this

The principal author of the regulations

for relief under section 66 should be con- section do not apply to income that is not

is Robin M. Tuczak of the Office of As-

sidered premature. There must be some in- community income. Thus, the rules of this

sociate Chief Counsel (Procedure and

dication that the IRS may determine a defi- section do not apply to income from prop-

Administration), Administrative Provi-

ciency prior to the filing of a request for re- erty that was formerly community prop-

sions and Judicial Practice Division.

lief from a deficiency under section 66(c). erty, but in accordance with state law, has

Thus, the final regulations retain the timing ***** ceased to be community property, becom-

limitations set forth in the proposed regu- ing, e.g., separate property or property held

lations regarding premature requests. Adoption of Amendments to the by joint tenancy or tenancy in common.

The final regulations incorporate an Regulations (2) When taxpayers report income un-

item-by-item approach to relief from the der paragraph (a) of this section, all com-

Accordingly, 26 CFR parts 1 and 602

federal income tax liability resulting from munity income for the calendar year is

are amended as follows:

the operation of community property law treated in accordance with the rules pro-

under section 66(c). If a requesting spouse PART 1—INCOME TAXES vided by section 879(a). Unlike the other

receives relief under section 66(c), the pro- provisions under section 66, section 66(a)

posed regulations provide for treatment of Paragraph 1. The authority citation for does not permit inclusion on an item-by-

any community income of the spouses in part 1 is amended by adding an entry in item basis.

accordance with the rules provided by sec- numerical order to the table to read in part (c) Transferee liability. The provisions

tion 879(a), which is consistent with the as follows: of section 66 do not negate liability that

statutory rule under section 66(a). The fi- Authority: 26 U.S.C. 7805 * * * arises under the operation of other laws.

nal regulations provide that if a requesting Section 1.66–4 also issued under 26 Therefore, a spouse who is not subject to

spouse receives relief for an item, the rules U.S.C. 66(c). * * * federal income tax on community income

provided by section 879(a) will govern the Par. 2. Sections 1.66–1 through 1.66–5 may nevertheless remain liable for the un-

treatment of the item. The item-by-item are added to read as follows: paid tax (including additions to tax, penal-

approach adopted in the final regulations ties, and interest) to the extent provided by

is consistent with the statutory language §1.66–1 Treatment of community income. federal or state transferee liability or prop-

in section 66(c) that states “such item of erty laws (other than community property

(a) In general. Married individuals

community income shall be included in laws). For the rules regarding the liability

domiciled in a community property state

the gross income of the other spouse (and of transferees, see sections 6901 through

who do not elect to file a joint individual

not in the gross income of the individual).” 6904 and the regulations thereunder.

federal income tax return under section

(Emphasis added.)

6013 generally must report half of the total §1.66–2 Treatment of community income

Traditionally, section 66(c) provided

community income earned by the spouses where spouses live apart.

relief from liability resulting only from

during the taxable year except at times

items of income, unlike former section

when one of the following exceptions (a) Community income of spouses

6013(e) and section 6015. The final reg-

applies: domiciled in a community property state

ulations expand equitable relief under

(1) The spouses live apart and meet the will be treated in accordance with the rules

§1.66–4(b) to include relief for underpay-

qualifications of §1.66–2. provided by section 879(a) if all of the

ments of tax or any deficiency, including

(2) The Secretary denies a spouse the following requirements are satisfied—

those arising from disallowed deductions

federal income tax benefits resulting from (1) The spouses are married to each

or credits. This is consistent with the

community property law under §1.66–3, other at any time during the calendar year;

equitable relief provision in section 66(c).

because that spouse acted as if solely en- (2) The spouses live apart at all times

Special Analyses titled to the income and failed to notify his during the calendar year;

or her spouse of the nature and amount of (3) The spouses do not file a joint return

It has been determined that these fi- the income prior to the due date for the fil- with each other for a taxable year begin-

nal regulations are not a significant regu- ing of his or her spouse’s return. ning or ending in the calendar year;

latory action as defined in Executive Order (3) A requesting spouse qualifies for (4) One or both spouses have earned

12866. Therefore, a regulatory assessment traditional relief from the federal income income that is community income for the

is not required. It has also been determined tax liability resulting from the opera- calendar year; and

that section 553(b) of the Administrative tion of community property law under (5) No portion of such earned income is

Procedure Act (5 U.S.C. chapter 5) does §1.66–4(a). transferred (directly or indirectly) between

September 29, 2003 604 2003-39 I.R.B.

such spouses before the close of the calen- that he received from W was not from W’s earned in- income, denying W the federal income tax benefit re-

dar year. come, but from the capital gains income W received sulting from community property law as to this item

(b) Living apart. For purposes of this in 2002. The facts and circumstances surrounding the of income.

periodic payments to H from W do not indicate that (ii) H and W are married and are domiciled in

section, living apart requires that spouses W made the payments out of her capital gains. H and State B, a community property state. For taxable

maintain separate residences. Spouses W may not report their income in accordance with year 2000, H receives $45,000 in wage income that

who maintain separate residences due to this section, as the $6,000 W transferred to H is pre- H places in a separate account. H and W maintain

temporary absences are not considered sumed to be from W’s earned income, and H has not separate residences. H’s wage income is community

to be living apart. Spouses who are not presented any facts to rebut the presumption. income under the laws of State B. That same year, W

loses her job, and H pays W’s mortgage and house-

members of the same household under

§1.66–3 Denial of the federal income tax hold expenses for several months while W seeks em-

§1.6015–3(b) are considered to be living ployment. Neither H nor W files a return for 2000,

benefits resulting from the operation of

apart for purposes of this section. the taxable year for which the IRS subsequently au-

community property law where spouse not

(c) Transferred income. For purposes dits them. The IRS may not raise section 66(b) and

notified. deny H the federal income tax benefits resulting from

of this section, transferred income does

the operation of community property law as to H’s

not include a de minimis amount of earned (a) In general. The Secretary may deny wage income of $45,000, as H has not treated this in-

income that is transferred between the the federal income tax benefits of commu- come as if H were solely entitled to it.

spouses. In addition, any amount of nity property law to any spouse with re- Example 2. Notification of nature and amount of

earned income transferred for the benefit the income. H and W are married and domiciled in

spect to any item of community income

of the spouses’ child will not be treated State C, a community property state. H and W do

if that spouse acted as if solely entitled to not file a joint return for taxable year 2001. H’s and

as an indirect transfer to one spouse. Ad- the income and failed to notify his or her W’s earned income for 2001 is community income

ditionally, income transferred between spouse of the nature and amount of the in- under the laws of State C. H receives $50,000 in wage

spouses is presumed to be a transfer of come before the due date (including exten- income in 2001. In January 2002, H receives a Form

earned income. This presumption is re- W–2 that erroneously states that H earned $45,000 in

sions) for the filing of the return of his or

buttable. taxable year 2001. H provides W a copy of H’s Form

her spouse for the taxable year in which W–2 in February 2002. W files for an extension prior

(d) Examples. The following examples the item of income was derived. Whether a to April 15, 2002. H receives a corrected Form W–2

illustrate the rules of this section: spouse has acted as if solely entitled to the reflecting wages of $50,000 in May 2002. H provides

Example 1. Living apart. H and W are married, a copy of the corrected Form W–2 to W in May 2002.

item of income is a facts and circumstances

domiciled in State A, a community property state, and W files a separate return in June 2002, but reports

have lived apart the entire year of 2002. W, who is in

determination. This determination focuses

one half of $45,000 ($22,500) of wage income that

the Army, was stationed in Korea for the entire calen- on whether the spouse used, or made avail- H earned. H files a separate return reporting half of

dar year. During their separation, W intended to re- able, the item of income for the benefit of $50,000 ($25,000) in wage income. The IRS audits

turn home to H, and H intended to live with W upon the marital community. both H and W. Even if H had acted as if solely entitled

W’s return. H and W do not file a joint return for to the wage income, the IRS may not raise section

(b) Effect. The item of community in-

taxable year 2002. H and W may not report their in- 66(b) as to this income because H notified W of the

come under this section because a temporary absence

come will be included, in its entirety, in

nature and amount of the income prior to the due date

due to military service is not living apart as contem- the gross income of the spouse to whom of W’s return (including extensions).

plated under this section. the Secretary denied the federal income tax

Example 2. Transfer of earned income—de min- benefits resulting from community prop- §1.66–4 Request for relief from the federal

imis exception. H and W are married, domiciled in

erty law. The tax liability arising from the income tax liability resulting from the

State B, a community property state, and have lived

apart the entire year of 2002. H and W are estranged

inclusion of the item of community income operation of community property law.

and intend to live apart indefinitely. H and W do not must be assessed in accordance with sec-

file a joint return for taxable year 2002. H occasion- tion 6212 against this spouse. (a) Traditional relief—(1) In general. A

ally visits W and their two children, who live with W. (c) Examples. The following examples requesting spouse will receive relief from

When H visits, he often buys gifts for the children, the federal income tax liability resulting

illustrate the rules of this section:

takes the children out to dinner, and occasionally buys from the operation of community property

Example 1. Acting as if solely entitled to income.

groceries or gives W money to buy the children new

(i) H and W are married and are domiciled in State A, law for an item of community income if–-

clothes for school. Both W and H have earned income

a community property state. W’s Form W–2 for tax- (i) The requesting spouse did not file a

in the year 2002 that is community income under the

able year 2000 showed wage income of $35,000. W

laws of State B. H and W may report their income on

also received a Form 1099–INT, “Interest Income,”

joint federal income tax return for the tax-

separate returns under this section. able year for which he or she seeks relief;

showing $1,000 W received in taxable year 2000.

Example 3. Transfer of earned income—source of (ii) The requesting spouse did not in-

W’s wage income was directly deposited into H and

transfer. H and W are married, domiciled in State C,

W’s joint account, from which H and W paid bills clude in gross income for the taxable year

a community property state, and have lived apart the

and household expenses. W did not inform H of her an item of community income properly

entire year of 2002. H and W are estranged and intend

interest income or the Form 1099–INT, but W gave

to live apart indefinitely. H and W do not file a joint

H a copy of the W–2 when she received it in January

includible therein, which, under the rules

return for taxable year 2002. W provides H $1,000 a contained in section 879(a), would be

2001. W did not use her interest income for bills or

month from March 2002 through August 2002 while treated as the income of the nonrequesting

household expenses. Instead W gave her interest in-

H is working part-time and seeking full-time employ-

come to her brother, who was unemployed. Neither spouse;

ment. W is not legally obligated to make the $1,000

the separate return filed by H nor the separate return (iii) The requesting spouse establishes

payments. W earns $75,000 in 2002 in wage income.

filed by W included the interest income. In 2002, the

W also receives $10,000 in capital gains income in

IRS audits both H and W. The Internal Revenue Ser-

that he or she did not know of, and had no

December 2002. H wants to report his income in ac- reason to know of, the item of community

vice (IRS) may raise section 66(b) as to W’s interest

cordance with this section, alleging that the $6,000 income; and

2003-39 I.R.B. 605 September 29, 2003

(iv) Taking into account all of the facts attributable to the nonrequesting spouse, wage income as shown on her W–2, in the amount of

and circumstances, it is inequitable to in- the requesting spouse will have benefitted $23,000, and half of H’s wage income as shown on

clude the item of community income in from those items of community income. his Form W–2, in the amount of $28,000. Neither H

nor W reports W’s income from her sole proprietor-

the requesting spouse’s individual gross Other factors may include, if the situation ship of $34,000 or W’s investment income of $5,000

income. warrants, desertion, divorce or separation. for taxable year 2002. The Internal Revenue Service

(2) Knowledge or reason to know. (i) A Factors relevant to whether it would be (IRS) proposes deficiencies with respect to H’s and

requesting spouse had knowledge or rea- inequitable to hold a requesting spouse W’s taxable year 2002 returns due to the omission of

son to know of an item of community in- liable, more specifically described under W’s income from her sole proprietorship and invest-

ments. H timely requests relief under section 66(c).

come if he or she either actually knew of the applicable administrative procedure Because the IRS determines that H satisfies the four

the item of community income, or if a issued under section 66(c) (Revenue Pro- requirements of the traditional relief provision of sec-

reasonable person in similar circumstances cedure 2000–15, 2000–1 C.B. 447) (See tion 66(c) with respect to W’s omitted investment in-

would have known of the item of com- §601.601(d)(2) of this chapter), or other come, the IRS grants H’s request for relief as to the

munity income. All of the facts and cir- applicable guidance published by the Sec- omitted investment income. The IRS determines that

H does not satisfy the four requirements of the tradi-

cumstances are considered in determining retary), are to be considered in making a tional relief provision of section 66(c) as to W’s sole

whether a requesting spouse had reason to determination under this paragraph. proprietorship income. The IRS further determines

know of an item of community income. (b) Equitable relief. Equitable relief that, under the equitable relief provision of section

The relevant facts and circumstances in- may be available when the four require- 66(c), it is not inequitable to hold H liable for the

clude, but are not limited to, the nature of ments of paragraph (a)(1) of this section sole proprietorship income. Relief is applicable on

an item-by-item basis. Thus, H is liable for the tax

the item of community income, the amount are not satisfied, but it would be in- on half of his wage income in the amount of $28,000,

of the item of community income relative equitable to hold the requesting spouse half of W’s wage income in the amount of $23,000,

to other income items, the couple’s finan- liable for the unpaid tax or deficiency. half of W’s sole proprietorship income in the amount

cial situation, the requesting spouse’s ed- Factors relevant to whether it would be of $17,000, but none of W’s investment income, for

ucational background and business experi- inequitable to hold a requesting spouse which H obtained relief under section 66(c). W is li-

able for the tax on half of H’s wage income in the

ence, and whether the item of community liable, more specifically described under amount of $28,000, half of W’s wage income in the

income was reflected on prior years’ re- the applicable administrative procedure amount of $23,000, half of W’s sole proprietorship

turns (e.g., investment income omitted that issued under section 66(c) (Revenue Pro- income in the amount of $17,000, and all of W’s in-

was regularly reported on prior years’ re- cedure 2000–15, 2000–1 C.B. 447), or vestment income in the amount of $5,000, because H

turns). other applicable guidance published by obtained relief under section 66(c).

Example 2. Benefit. H and W are married, liv-

(ii) If the requesting spouse is aware of the Secretary), are to be considered in ing together, and domiciled in State B (a community

the source of community income or the in- making a determination under this para- property state). Neither H nor W files a return for tax-

come-producing activity, but is unaware of graph. able year 2000. H earns $60,000 in 2000, which he

the specific amount of the nonrequesting (c) Applicability. Traditional relief un- deposits in a joint account. H and W pay the mortgage

spouse’s community income, the request- der paragraph (a) of this section applies payment, household bills, and other family expenses

out of the joint account. W earns $20,000 in 2000. W

ing spouse is considered to have knowl- only to deficiencies arising out of items uses a portion of the $20,000 to make monthly loan

edge or reason to know of the item of com- of omitted income. Equitable relief under payments on the family cars, but loses the remain-

munity income. The requesting spouse’s paragraph (b) of this section applies to any der at the local racetrack. In 2002, the IRS audits H

lack of knowledge of the specific amount deficiency or any unpaid tax (or any por- and W. H requests relief under section 66(c), stating

of community income does not provide a tion of either). Equitable relief is available that he did not know or have reason to know of W’s

additional income, as H travels extensively while W

basis for relief under this section. only for the portion of liabilities that were handles the family finances. Regardless of whether

(3) Inequitable. All of the facts and unpaid as of July 22, 1998, and for liabili- H had knowledge or reason to know of the source of

circumstances are considered in deter- ties that arise after July 22, 1998. W’s income, H is not eligible for traditional relief un-

mining whether it is inequitable to hold a (d) Effect of relief. When the requesting der section 66(c) because H benefitted from W’s in-

requesting spouse liable for a deficiency spouse qualifies for relief under paragraph come. H’s benefit, the portion of W’s income used to

make monthly payments on the car loans, was more

attributable to an item of community in- (a) or (b) of this section, the IRS must than a de minimis amount. While this benefit was not

come. One relevant factor for this purpose assess any deficiency of the nonrequesting in excess of normal support, it is enough to preclude

is whether the requesting spouse benefit- spouse arising from the granting of relief to relief under the traditional relief provision of section

ted, directly or indirectly, from the omitted the requesting spouse in accordance with 66(c). H may still qualify for equitable relief under

item of community income. A benefit section 6212. section 66(c), depending on all of the facts and cir-

cumstances.

includes normal support, but does not (e) Examples. The following examples

(f) Fraudulent scheme. If the Secre-

include de minimis amounts. Evidence of illustrate the rules of this section:

Example 1. Item-by-item approach. H and W

tary establishes that a spouse transferred

direct or indirect benefit may consist of

are married, living together, and domiciled in State assets to his or her spouse as part of a

transfers of property or rights to property,

A (a community property state). H and W file sepa- fraudulent scheme, relief is not available

including transfers received several years rate returns for taxable year 2002 on April 15, 2003. under this section. For purposes of this

after the filing of the return. Thus, for H earns $56,000 in wages, and W earns $46,000 in section, a fraudulent scheme includes a

example, if a requesting spouse receives wages, in 2002. H reports half of his wage income as

shown on his Form W–2, in the amount of $28,000,

scheme to defraud the Secretary or another

from the nonrequesting spouse property

and half of W’s wage income as shown on her Form third party, such as a creditor, ex-spouse, or

(including life insurance proceeds) that is

W–2, in the amount of $23,000. W reports half of her business partner.

traceable to items of community income

September 29, 2003 606 2003-39 I.R.B.

(g) Definitions—(1) Requesting spouse. Secretary in identifying and locating the These notices or letters include notices

A requesting spouse is an individual who nonrequesting spouse. of computational adjustment to a partner

does not file a joint federal income tax re- (2) Time period for filing a request for or partner’s spouse (Notice of Income

turn with the nonrequesting spouse for the relief—(i) Traditional relief. The earli- Tax Examination Changes) that reflect a

taxable year in question, and who requests est time for submitting a request for relief computation of the liability attributable

relief from the federal income tax liability from the federal income tax liability re- to partnership items of the partner or the

resulting from the operation of community sulting from the operation of community partner’s spouse.

property law under this section for the por- property law under paragraph (a) of this (k) Nonrequesting spouse’s notice and

tion of the liability arising from his or her section, for an amount underreported on, opportunity to participate in administra-

share of community income for such tax- or omitted from, the requesting spouse’s tive proceedings—(1) In general. When

able year. separate return, is the date the requesting the Secretary receives a request for relief

(2) Nonrequesting spouse. A nonre- spouse receives notification of an audit or from the federal income tax liability result-

questing spouse is the individual to whom a letter or notice from the IRS stating that ing from the operation of community prop-

the requesting spouse was married and there may be an outstanding liability with erty law under this section, the Secretary

whose income or deduction gave rise to regard to that year (as described in para- must send a notice to the nonrequesting

the tax liability from which the requesting graph (j)(2)(iii) of this section). The latest spouse’s last known address that informs

spouse seeks relief in whole or in part. time for requesting relief under paragraph the nonrequesting spouse of the request-

(h) Effect of prior closing agreement or (a) of this section is 6 months before the ing spouse’s request for relief. The no-

offer in compromise. A requesting spouse expiration of the period of limitations on tice must provide the nonrequesting spouse

is not entitled to relief from the federal in- assessment, including extensions, against with an opportunity to submit any infor-

come tax liability resulting from the op- the nonrequesting spouse for the taxable mation for consideration in determining

eration of community property law under year that is the subject of the request for whether to grant the requesting spouse re-

section 66 for any taxable year for which relief, unless the examination of the re- lief from the federal income tax liability

the requesting spouse has entered into a questing spouse’s return commences dur- resulting from the operation of commu-

closing agreement (other than an agree- ing that 6-month period. If the examina- nity property law. The Secretary will share

ment pursuant to section 6224(c) relating tion of the requesting spouse’s return com- with each spouse the information submit-

to partnership items) with the Secretary mences during that 6-month period, the lat- ted by the other spouse, unless the Secre-

that disposes of the same liability that is est time for requesting relief under para- tary determines that the sharing of this in-

the subject of the request for relief. In ad- graph (a) of this section is 30 days after the formation will impair tax administration.

dition, a requesting spouse is not entitled commencement of the examination. (2) Information submitted. The Secre-

to relief from the federal income tax lia- (ii) Equitable relief. The earliest time tary will consider all of the information (as

bility resulting from the operation of com- for submitting a request for relief from the relevant to the particular relief provision)

munity property law under section 66 for federal income tax liability resulting from that the nonrequesting spouse submits in

any taxable year for which the requesting the operation of community property law determining whether to grant relief from

spouse has entered into an offer in compro- under paragraph (b) of this section is the the federal income tax liability resulting

mise with the Secretary. For rules relating date the requesting spouse receives noti- from the operation of community property

to the effect of closing agreements and of- fication of an audit or a letter or notice law under this section.

fers in compromise, see sections 7121 and from the IRS stating that there may be

7122, and the regulations thereunder. an outstanding liability with regard to that §1.66–5 Effective date.

(i) [Reserved] year (as described in paragraph (j)(2)(iii)

(j) Time and manner for requesting re- of this section). A request for equitable Sections 1.66–1 through 1.66–4 are ap-

lief—(1) Requesting relief. To request re- relief from the federal income tax liabil- plicable on July 10, 2003. In addition,

lief from the federal income tax liability re- ity resulting from the operation of com- §1.66–4 applies to any request for relief

sulting from the operation of community munity property law under paragraph (b) filed prior to July 10, 2003, for which the

property law under this section, a request- of this section for a liability that is prop- Internal Revenue Service has not issued a

ing spouse must file, within the time pe- erly reported but unpaid is properly sub- preliminary determination as of July 10,

riod prescribed in paragraph (j)(2) of this mitted with the requesting spouse’s indi- 2003.

section, Form 8857, “Request for Innocent vidual federal income tax return, or after

Spouse Relief” (or other specified form), or the requesting spouse’s individual federal PART 602—OMB CONTROL

other written request, signed under penal- income tax return is filed. NUMBERS UNDER THE PAPERWORK

ties of perjury, stating why relief is appro- (iii) Premature requests for relief. REDUCTION ACT

priate. The requesting spouse must include The Secretary will not consider a prema-

the nonrequesting spouse’s name and tax- ture request for relief under this section. Par. 9. The authority citation for part

payer identification number in the written The notices or letters referenced in this 602 continues to read as follows:

request. The requesting spouse must also paragraph (j)(2) do not include notices Authority: 26 U.S.C. 7805.

comply with the Secretary’s reasonable re- issued pursuant to section 6223 relat- Par. 10. The following entry is added

quests for information that will assist the ing to TEFRA partnership proceedings. in numerical order to the table:

2003-39 I.R.B. 607 September 29, 2003

§602.101 OMB Control numbers.

*****

(b) * * *

CFR part or section where Current OMB

identified and described control No.

*****

1.66–4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1545–1770

*****

David A. Mader, Creation and Worker Assistance Act of per application for approval as a custodian

Commissioner for 2002, and other legislation. The regula- with an estimated average of 35 hours for

Services and Enforcement. tions also make various technical changes each application submitted to qualify as a

and clarifications to the existing final regu- custodian.

Approved July 1, 2003. lations on many discrete issues. These reg- Comments concerning the accuracy

ulations provide the public with guidance of this burden estimate and sugges-

Gregory F. Jenner,

necessary to comply with the law and will tions for reducing this burden should

Assistant Secretary of the Treasury.

affect plan sponsors, administrators, par- be sent to the Internal Revenue Service,

(Filed by the Office of the Federal Register on July 9, 2003, ticipants, and beneficiaries. Attn: IRS Reports Clearance Officer,

8:45 a.m., and published in the issue of the Federal Register

for July 10, 2003, 68 F.R. 41067) W:CAR:MP:T:T:SP, Washington, DC

DATES: Effective Date: July 11, 2003. 20224, and to the Office of Manage-

Applicability Date: These regulations ment and Budget, Attn: Desk Officer for

Section 457.—Deferred apply to taxable years beginning after De- the Department of the Treasury, Office

Compensation Plans of State cember 31, 2001. See “Effective date of of Information and Regulatory Affairs,

and Local Governments and the regulations” for additional information Washington, DC 20503.

Tax-Exempt Organizations concerning the applicability of these regu- Books or records relating to this col-

lations. lection of information must be retained as

26 CFR 1.457–1: General overviews of section 457.

long as their contents may become mate-

FOR FURTHER INFORMATION

rial in the administration of any internal

T.D. 9075 CONTACT: Cheryl Press, (202) 622–6060

revenue law. Generally, tax returns and tax

(not a toll-free number).

return information are confidential, as re-

DEPARTMENT OF quired by 26 U.S.C. 6103.

SUPPLEMENTARY INFORMATION:

THE TREASURY

Internal Revenue Service Paperwork Reduction Act Background

26 CFR Parts 1 and 602

The collection of information con- Section 131 of the Revenue Act of

Compensation Deferred Under tained in these final regulations has been 1978 (92 Stat. 2779) added section 457

reviewed and approved by the Office to the Internal Revenue Code of 1954.

Eligible Deferred Compensation of Management and Budget in accor- On September 27, 1982, final regula-

Plans dance with the Paperwork Reduction Act tions (T.D. 7836, 1982–2 C.B. 91 [47 FR

(44 U.S.C. 3507) under control number 42335]) under section 457 (the 1982 reg-

AGENCY: Internal Revenue Service

1545–1580. Responses to this collection ulations) were published in the Federal

(IRS), Treasury.

of information are mandatory. Register. The 1982 regulations provided

ACTION: Final regulations. An agency may not conduct or sponsor, guidance for complying with the changes

and a person is not required to respond to the applicable tax law made by the

SUMMARY: This document contains final to, a collection of information unless the Revenue Act of 1978 relating to deferred

regulations that provide guidance on de- collection of information displays a valid compensation plans maintained by state

ferred compensation plans of state and lo- control number assigned by the Office of and local governments and rural electric

cal governments and tax-exempt entities. Management and Budget. cooperatives.

The regulations reflect the changes made The estimated burden per respondent Section 1107 of the Tax Reform Act

to section 457 by the Tax Reform Act of varies from .033 hour to 2 hours per trust of 1986 (100 Stat. 2494) extended sec-

1986, the Small Business Job Protection established depending upon individual tion 457 to tax-exempt organizations. Sec-

Act of 1996, the Taxpayer Relief Act of respondents’ circumstances, with an esti- tion 6064 of the Technical and Miscella-

1997, the Economic Growth and Tax Re- mated average of one hour for each trust neous Act of 1988 (102 Stat. 3700) cod-

lief Reconciliation Act of 2001, the Job established, and from 20 hours to 50 hours ified certain exceptions for certain plans.

September 29, 2003 608 2003-39 I.R.B.

Notice 88–68, 1988–1 C.B. 556, addressed are adopted by this Treasury decision, sub- 457(b) tax-exempt plans, the excess de-

the treatment of nonelective deferred com- ject to a number of changes that are gener- ferrals are subject to income tax in the

pensation of nonemployees, and provided ally summarized below. year of distribution to the extent of dis-

an exception under which section 457 does tributed earnings on the excess deferrals

not to apply to certain church plans. Summary of Comments Received and and such earnings should be reported on

Section 1404 of the Small Business Job Changes Made Form W–2 for the year of distribution. See

Protection Act of 1996 (110 Stat. 1755) also Notice 2003–20, 2003–19 I.R.B. 894,

1. Excess Deferrals

added section 457(g) which requires that for information regarding the withholding

section 457(b) plans maintained by state The proposed regulations addressed the and reporting requirements applicable to

and local government employers hold all income tax treatment of excess deferrals eligible plans generally.

plan assets and income in trust, or in cus- and the effect of excess deferrals on plan

todial accounts or annuity contracts (de- 2. Aggregation Rules in the Proposed

eligibility under section 457(b). The pro-

scribed in section 401(f) of the Internal Regulations

posed regulations provided that an eligible

Revenue Code), for the exclusive benefit governmental plan may self-correct and The proposed regulations included sev-

of participants and beneficiaries. distribute excess deferrals and continue eral rules that aggregate multiple plans for

Section 1071 of the Taxpayer Relief Act to satisfy the eligibility requirements of purposes of meeting the eligibility require-

of 1997 (111 Stat. 788) permits certain section 457(b) (including the distribution ments of section 457(b). These regula-

accrued benefits to be cashed out. rules and the funding rules) by reason of a tions retain all of these rules. For exam-

Sections 615, 631, 632, 634, 635, 641, distribution of excess deferrals. However, ple, the regulations provide that in any case

647, and 649 of the Economic Growth the proposed regulations provided that if in which multiple plans are used to avoid

and Tax Relief Reconciliation Act of 2001 an excess deferral arose under an eligible or evade the eligibility requirements un-

(EGTRRA) (115 Stat. 38) included in- plan of a tax-exempt employer, the plan der the regulations, the Commissioner may

creases in elective deferral limits, repeal of was no longer an eligible plan. apply the eligibility requirements as if the

the rules coordinating the section 457 plan Commentators objected to the less fa- plans were a single plan. Also, an eligi-

limit with contributions to certain other vorable treatment for eligible plans of tax- ble employer is required to have no more

types of plans, catch-up contributions for exempt employers. than one normal retirement age for each

individuals age 50 or over, extension of After consideration of the comments re- participant under all of the eligible plans

qualified domestic relation order rules to ceived, the regulations extend self-correc- it sponsors. In addition, all deferrals under

section 457 plans, rollovers among vari- tion for excess deferrals to eligible plans all eligible plans under which an individ-

ous qualified plans, section 403(b) con- of tax-exempt employers. If there is an ex- ual participates by virtue of his or her rela-

tracts and individual retirement arrange- cess deferral under such plan, the plan may tionship with a single employer are treated

ments (IRAs), and transfers to purchase distribute to a participant any excess de- as though deferred under a single plan for

service credits under governmental pen- ferrals (and any income allocable to such purposes of determining excess deferrals.

sion plans. amount) not later than the first April 15 fol- Finally, annual deferrals under all eligible

Section 411(o)(8) and (p)(5) of the Job lowing the close of the taxable year of the plans are combined for purposes of deter-

Creation and Worker Assistance Act of excess deferrals, comparable to the rules mining the maximum deferral limits.

2002 (116 Stat. 21) clarified certain provi- for qualified plans under section 402(g). Few comments were received with re-

sions in EGTRRA concerning section 457 In such a case, the plan will continue to spect to the aggregation rules under the

plans, including the use of certain com- be treated as an eligible plan. However, proposed regulations. However, one com-

pensation reduction elections to be taken in accordance with section 457(c), any ex- mentator requested that, where it is deter-

into account in determining includible cess deferral is included in the gross in- mined that multiple eligible plans main-

compensation. come of a participant for the taxable year tained by a single employer, which have

On May 8, 2002, a notice of proposed of the excess deferral. If an excess deferral been aggregated pursuant to the proposed

rulemaking (REG–105885–99, 2002–1 is not corrected by distribution, the plan is regulations, contain excess deferrals, the

C.B. 1103 [67 FR 30826]) was published an ineligible plan under which benefits are employer have the ability to disaggregate

in the Federal Register to issue new taxable in accordance with ineligible plan those plans solely for the purpose of either

regulations under section 457, including rules. (1) distributing the excess deferrals under

amending the 1982 regulations to conform The income tax treatment and payroll the self-correcting mechanism or (2) lim-

them to the legislative changes that had tax reporting of distributions of excess iting the characterization of such plans as

been made to section 457 since 1982. deferrals from eligible section 457(b) "ineligible" to the one(s) that actually con-

Following publication of the proposed governmental plans are similar to the tain the excess deferrals. Taking into ac-

regulations, comments were received and treatment and reporting of distribution of count the ability for all eligible plans to

a public hearing was held on August 28, excess deferrals from tax-qualified plans. self-correct by distribution, these regula-

2002. After consideration of the com- Such amounts should be reported on Form tions retain without material revision the

ments received, the proposed regulations 1099 and taxed in the year of distribution aggregation rules that were in the proposed

to the extent of distributed earnings on regulations.

the excess deferrals. For eligible section

2003-39 I.R.B. 609 September 29, 2003

3. Deferral of Sick, Vacation, and Back 5. Plan Terminations, Plan-to-Plan three situations. In each case, the trans-

Pay Transfers, and Rollovers feror plan must provide for transfers, the

receiving plan must provide for the re-

The proposed regulations would have The regulations include certain rules ceipt of transfers, and the participant or

allowed an eligible plan to permit partic- regarding plan terminations, plan-to-plan beneficiary whose amounts deferred are

ipants to elect to defer compensation, in- transfers, and rollovers. These topics have being transferred must be entitled to an

cluding accumulated sick and vacation pay been affected by the statutory changes amount deferred immediately after the

and back pay, only if an agreement pro- that impose a trust requirement on eligible transfer that is at least equal to the amount

viding for the deferral is entered into be- governmental plans. The direct rollovers deferred with respect to that participant

fore the beginning of the month in which that were permitted by EGTRRA begin- or beneficiary immediately before the

the amounts would otherwise be paid or ning in 2002 for eligible governmental transfer. Transfers are permitted among

made available and the participant is an plans provide participants affected by eligible governmental plans in the follow-

employee in that month. Comments re- these types of events the ability to re- ing three cases:

quested that terminating participants be al- tain their retirement savings in a funded,

lowed to elect deferral for accumulated tax-deferred savings vehicle by rollover to • A person-by-person transfer is permit-

sick and vacation pay and back pay even if an IRA, qualified plan, or section 403(b) ted for any beneficiary and for any

the participant is not employed at the time contract. The regulations provide an out- participant who has had a severance

of the deferral. line for the different plan termination and from employment with the transferring

The final regulations retain the rule un- plan-to-plan transfer alternatives available employer and is performing services

der which the deferral election must be to sponsors of eligible governmental plans for the entity maintaining the receiving

made during employment and before the in these situations. plan (whether or not the other plan is

beginning of the month when the compen- within the same state).

sation would have been payable. However, a. Plan terminations

the regulations include a special rule that • No severance from employment is re-

The regulations allow a plan to have quired if the entire plan’s assets for all

allows an election for sick pay, vacation

provisions permitting plan termination participants and beneficiaries are trans-

pay, or back pay that is not yet payable

whereupon amounts can be distributed ferred to another eligible governmental

(subject of course to the maximum defer-

without violating the distribution require- plan within the same state.

ral limitations of section 457 in the year of

ments of section 457. Under the regula-

deferral). Under the special rule, an em-

ployee who is retiring or otherwise hav-

tions, an eligible plan is terminated only • No severance from employment is re-

if all amounts deferred under the plan are quired for a transfer from one eligible

ing a severance from employment during a

paid to participants as soon as administra- governmental plan of an employer to

month may nevertheless elect to defer, for

tively practicable. If the amounts deferred another eligible governmental plan of

example, his or her unused vacation pay

under the plan are not distributed, the plan the same employer.

after the beginning of the month, provided

is treated as a frozen plan and must con- The final regulations also allow a

that the vacation pay would otherwise have

tinue to comply with all of the applicable plan-to-plan transfer from an eligible gov-

been payable before the employee has a

statutory requirements necessary for plan ernmental plan to a governmental defined

severance from employment and the elec-

eligibility. benefit plan for permissive service credit,

tion is made before the date on which the

without regard to whether the defined

vacation pay would otherwise have been b. Plan-to-plan transfers among eligible benefit plan is maintained by a govern-

payable. governmental plans and purchase of mental entity that is in the same state. In

permissive service credit by plan-to-plan addition, language that was in an example

4. Unforeseeable Emergency

transfer which implied that section 415(n) (which

Distributions

addresses the application of maximum

The proposed regulations would have

The proposed regulations added exam- benefit limitations with respect to certain

allowed plan-to-plan transfers between el-

ples that would illustrate when an unfore- contributions) might apply to such a trans-

igible governmental plans under new cir-

seeable emergency occurred. In particular, fer has been eliminated because Treasury

cumstances, as well as the purchase of per-

one example provided that the need to pay and the IRS have concluded that section

missive service credits by transfer from

for the funeral expenses of a family mem- 415(n) does not apply to such a transfer

an eligible governmental plan to a govern-

ber may constitute an unforeseeable emer- in any case in which the actuarial value

mental defined benefit plan, but only if the

gency. Several commentators requested of the benefit increase that results from

transfers were made by plans within the

clarification in the final regulations of the the transfer does not exceed the amount

same state. Commentators objected to the

definition of family member. The regula- transferred.

requirement under the new transfer rules

tions have been modified to define a family

that the transfers be to plans within the c. Plan-to-plan transfers among eligible

member as a spouse or dependent as de-

same state. plans of tax-exempt entities

fined in section 152(a).

Upon consideration of the comments

received, the regulations allow transfers The regulations retain the rule from the

among eligible governmental plans in 1982 regulations allowing a plan-to-plan