(110401) MPAM Market Letter

Diunggah oleh

gsprivDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

(110401) MPAM Market Letter

Diunggah oleh

gsprivHak Cipta:

Format Tersedia

asset management

Market Letter (Apr 01, 2011)

Markets today:

Labor Markets: Mar Non-farm payrolls surprised on the upside (↑216K vs. ↑190K [est] & ↑194K [Dec]) as private

sector job creation remained strong (↑230K vs. ↑206K [est] & ↑240K [Jan]) and in line with the recent ADP print

(↑201K). Payrolls for the prior 2 months were revised up by 7K: Feb (194K; ↑2K) and Jan (68K; ↑5K). Payroll

employment grew by 1.5mn (or 115K/month) from its recent low seen in Feb’10, as private sector job creation

(↑1.8mn or 138K/month) was partially offset by the 320K jobs lost in the government sector during that period.

Goods-producing sector added 31K jobs (vs. ↑73K [Feb]), as construction came in flat (vs. ↑37K) and factory

payrolls moderated (↑17K vs. ↑32K). Mining-related jobs however rose (↑15K vs. ↑4K). Job creation accelerated

in service-providing sector (↑199K vs. ↑167K) reflecting sequentially higher numbers across most heads: Wholesale

trade (↑14.1K vs. ↑13.6K), Retail trade (↑17.7K vs. ↓7.8K), Financial services (↑6K vs. ↓3K), Professional/business

services (↑78K vs. ↑44K), Temporaries (↑29K vs. ↑23K), and Education/health (↑45K vs. ↑41K). Leisure and

hospitality moderated (↑37K vs. ↑48K), while transportation and warehousing came in flat (↑22K) post its Feb

spike. Job losses in Government got extended (↓14K vs. ↓46K), all of which in Mar was at the Local level.

Average workweek remained unchanged at 34.3hrs as expected. Average hourly earnings also came in flat ($22.87),

but trailed expectations (↑0.2%) once again. Its YoY gain exhibited a similar pattern (↑1.7% vs. ↑1.9% [est]), while

lagging the headline CPI (↑2.1%) for the same period.

Household Survey reported a fractional drop in unemployment rate to 8.8% (vs. 8.9% [Feb] & 8.9% [est]) as

employment (↑291K vs. ↑250K) rose faster than the expansion in labor force (↑160K vs. ↑60K), which in turn

pushed the number of unemployed to 13.542mn (↓131K); 6.1mn or 45.5% (↑1.6%) of whom have been jobless for

27+ weeks. 2.4mn remained marginally attached to the labor force, of which the share of discouraged workers stood

unchanged at 921K. The broadest measure of unemployment/under-employment (U-6) edged down further to

15.7% (↓0.2%). And among the employed, the number of involuntary part-time workers held steady at 8.4mn. Both

Civilian labor force participation (64.2%) and Employment-population ratio (58.5%) also held steady during March.

Manufacturing: Mar ISM/PMI dipped (61.2 vs. 61.4 [Mar]), but beat expectations (61.1) to signal continuing

th

expansion in the nation’s manufacturing sector for a 20 straight month. 15 of the 18 industries that comprise the

sector reported growth during the month. Production rose (69 vs. 66.3), while New Orders (63.3 vs. 68), Backlogs

(52.5 vs. 59) and Exports (56 vs. 62.5) plunged. Employment expanded at a slower pace (63 vs. 64.5). Inventories

jumped up to a strong build from a weak draw (57.4 vs. 48.8). Prices Paid accelerated further in the 80’s (85 vs. 82).

Fedspeak: NY Fed’s Dudley said the recovery was still tenuous and still far from the mark on Fed’s dual mandate;

that the unemployment rate was much too high and the coast was not completely clear. Noting that the recent rise

in inflation was not due to monetary policy, he saw no reason to pull back from stimulus. However, Philly Fed’s

Plosser noted that an exit from stimulus may be warranted should the economy witness a stronger rebound. He

commented core inflation did not matter. Dallas Fed’s Fisher felt the Fed may be doing too much now, suggesting

that the stimulus could come off. Richmond Fed’s Lacker expressed satisfaction over economic recovery and said it

would not surprise him if the Fed acted on inflation in 2011.

NY: Stocks opened higher following better-than-expected payroll data, and went on to post impressive gains through

much of the session before paring a large chunk of their gains in late afternoon selling of Tech (semis), but only to

rebound and close on a strong note. Averages ended well off their day’s highs. Industrials and Financials led, while

Tech and Telecom lagged. Trading remained very light. Treasuries sold off at the open on stock strength and Fed

Presidents’ comments, but rallied back after Dudley’s remarks. Dollar rolled over after Dudley statement. Crude

rallied on dollar weakness. Grains rose further. Precious metals pared their intra-day losses, but still ended in red.

Copper was noticeably weak. VIX plunged at the open, but recouped bulk of its losses amid choppy trading.

This proprietary and confidential document is a market commentary meant for informational purpose only and not an advice or solicitation or an offer to enter into any transaction.

Marco Polo Asset Management 75 Broad Street, New York

asset management

Close: Dow (12377, ↑0.46%); S&P (1332, ↑0.5%); NASDAQ (2789, ↑0.3%); R2K (847, ↑0.4%); VIX (17.52, ↓1.5%);

10yr (3.448, ↓2bp); 2/10 (265, -----); FN4.0 (80, ↓2bp); EUR (1.4227, ↑0.5%); DXY (75.85, -----); CRB (360.9, ↑0.4%);

Oil (108.16, ↑1.4%); Ngas (4.33, ↓1.30%); Au (1428, ↓0.8%); Ag (37.76, ↓0.3%); Cu (4.242, ↓1.4%).

Macro Outlook:

Sequentially better job creation in the private sector and stability seen across various cuts of unemployment are

certainly encouraging. The pace of job growth during Q1 has also edged up to 159K/month (↑20K). Nonetheless,

today’s employment report is somewhat similar to the last one in some ways, when it comes to growth outlook. For

instance, flat hours worked would call for a significant pickup in productivity to deliver on growth expectations. But

we see no obvious catalysts for this in the near term. On the other hand, corporate margins are getting squeezed as

input costs, notably energy, have been on the rise in the face of limited pricing power. Businesses have shown

reluctance to build inventories and invest in capex. Therefore productivity may not get much of a lift at this stage.

On the personal consumption side too, higher energy costs could cap discretionary spending as income growth has

been weak, so much so that consumers had to draw down their savings. We see Q1 GDP centered at 2.75%.

Click here to access our top global macro calls for 2011.

Portfolio Strategy:

Risk assets have shown great resilience while facing serious headwinds from MENA political crisis, Japan earthquake,

peripheral European debt issue, the end of Fed’s QE2 in June and concerns over government shutdown in

Washington DC. To this list we should also add the risk of below-trend growth in the US during Q1 and Q2. Of

course, the market is not unaware of any of these. For instance, even as assets rallied, trading volumes remained

thin, participation from Financials was lackluster, and price action was outsized to almost any piece of news (or

speech for that matter). From a macro perspective, leading indicators and ISM indices have either peaked or in the

process of doing so. While absence of wage inflation is the foundation on which the Fed’s easy money policy rests, it

also spotlights the elevated level of slack in labor markets. And despite job creation, consumer sentiment has

plateaued and is currently at levels last seen in Mar’10, telegraphing clearly that it is not just jobs, but rising incomes

that make consumers feel good. Housing has double-dipped and home prices continue to deflate.

That being said, US equity valuations are not too expensive by historical comparison, as multiple-expansion has been

relatively steady. Sure there are sectors that are a bit rich after the heady bull-run, but the broad market does offer

some interesting opportunities here. Cyclicals still look appealing, but may not be compelling anymore. On the other

hand, Staples may merit consideration, not only to navigate uncertainty but also to benefit from their pricing power

in fast growing global markets. The current commodities-led rally is not over yet. In fact, it has formed a strong base

from which it can grind higher. Within commodities, Ag plays will endure as they have become thematic and the

speculative bid for oil would hold as MENA unrest cannot be wished away anytime soon, certainly not in one

quarter. Commodity-indexed currencies remain biased to the upside, while Yen and Euro are to concede significant

ground to the dollar. Precious metals are well-entrenched to benefit from exogenous shocks and unintended

consequences of economic policies. Our macro arguments do not suggest inflation to be a major concern at this

stage. Treasury yields are unlikely to take flight, but offer useful range trades. However, with corporate balance-

sheets in such fine shape, better relative value can be found in corporate credits. We expect spreads to remain

stable, credit environment robust and defaults fewer. By mid-March, we had also begun to rotate out of our

underweight allocation to EM. Given how well that had worked, this process may well have more room to run in Q2.

Bottom line: We expect growth to moderate and inflation to stay low, against the backdrop of numerous headline

risks. Our portfolio strategy is to stay consistent with these expectations, while favoring select risk assets.

– Shiva Ganapathy (See marcopoloam.com for more)

This proprietary and confidential document is a market commentary meant for informational purpose only and not an advice or solicitation or an offer to enter into any transaction.

Marco Polo Asset Management 75 Broad Street, New York

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Case Studies in Islamic Banking and FinanceDokumen2 halamanCase Studies in Islamic Banking and FinanceMahfuz An-NurBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Chapter 2 Financial Intermediaries and Other ParticipantsDokumen45 halamanChapter 2 Financial Intermediaries and Other ParticipantsWill De OcampoBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Strategy Based On PsychSignal - DeltixDokumen9 halamanStrategy Based On PsychSignal - DeltixtabbforumBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Working Capital Management (2015)Dokumen62 halamanWorking Capital Management (2015)AJBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Bumi ArmadaDokumen60 halamanBumi Armadamanimaran75Belum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Income Funds Annual Report PDFDokumen320 halamanIncome Funds Annual Report PDFHarshal PatelBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Equitize LLC Operating Agreement 1 2Dokumen9 halamanEquitize LLC Operating Agreement 1 2api-228674656Belum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Green Register - Spring 2011Dokumen11 halamanThe Green Register - Spring 2011EcoBudBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Sept 2013Dokumen256 halamanSept 2013Vivek KhareBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Interface Management PDFDokumen2 halamanInterface Management PDFEdwin HarrisBelum ada peringkat

- Assets FormDokumen4 halamanAssets FormAnonymous k5CcMyU6100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Customer SegmentationDokumen10 halamanCustomer SegmentationGirish GhorpadeBelum ada peringkat

- CFO Controller Real Estate in New York NY Resume Ronald GuggenheimDokumen2 halamanCFO Controller Real Estate in New York NY Resume Ronald GuggenheimRonaldGuggenheimBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- CH 18Dokumen15 halamanCH 18Damy RoseBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

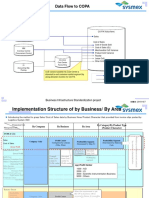

- Data Flow To COPA: Business Infrastructure Standardization ProjectDokumen3 halamanData Flow To COPA: Business Infrastructure Standardization ProjectT SAIKIRANBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Modules List For Financial Accounting B.com (Hons.)Dokumen4 halamanModules List For Financial Accounting B.com (Hons.)yash khatriBelum ada peringkat

- Democratic Republic Congo Mining Guide PDFDokumen40 halamanDemocratic Republic Congo Mining Guide PDFtatekBelum ada peringkat

- 2008 June Paper 1Dokumen2 halaman2008 June Paper 1zahid_mahmood3811Belum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- International Marketing LogisticsDokumen8 halamanInternational Marketing LogisticsSammir MalhotraBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- 14 A Study On Financial Performance of Ponlait, PuducherryDokumen69 halaman14 A Study On Financial Performance of Ponlait, PuducherrySaravanan Sankari40% (5)

- LHAG Brochure 1Dokumen3 halamanLHAG Brochure 1pohlevoonBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- KPMG BI Point of ViewDokumen20 halamanKPMG BI Point of ViewFrederic DucrosBelum ada peringkat

- Derivatives - The Tools That Changed FinanceDokumen205 halamanDerivatives - The Tools That Changed FinanceAlvin AuBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Incomplete Records - Principles of AccountingDokumen8 halamanIncomplete Records - Principles of AccountingAbdulla Maseeh100% (2)

- Companies Act 2013 (Brochure) PDFDokumen4 halamanCompanies Act 2013 (Brochure) PDFDeepTi SinGhBelum ada peringkat

- February 11, 2015Dokumen14 halamanFebruary 11, 2015The Delphos HeraldBelum ada peringkat

- Tax Filling For Unit Trust DividendsDokumen4 halamanTax Filling For Unit Trust DividendsYew Toh TatBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Management of Foreign Exchange RiskDokumen97 halamanThe Management of Foreign Exchange RiskVajira Weerasena100% (1)

- Wilson Dennis Colberg Trigo - FINRA BrokerCheck ReportDokumen28 halamanWilson Dennis Colberg Trigo - FINRA BrokerCheck ReportvernonhealylawBelum ada peringkat

- Mbfs Question BankDokumen15 halamanMbfs Question BankAswin SivaramakrishnanBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)