US Internal Revenue Service: f211

Diunggah oleh

IRSDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

US Internal Revenue Service: f211

Diunggah oleh

IRSHak Cipta:

Format Tersedia

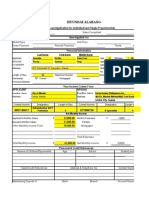

Department of the Treasury - Internal Revenue Service OMB No.

1545-0409

Form 211 Application for Reward for Original Claim No.

(Rev. June 2006)

Information

This application is voluntary and the information requested enables us to determine and pay rewards. We use the information to

record a claimant's reward as taxable income and to identify any tax outstanding (including taxes on a joint return filed with a spouse)

against which the reward would first be applied. We need taxpayer identification numbers, i.e., social security number (SSN) or

employer identification number (EIN), as applicable, in order to process it. Failure to provide the information requested may result in

suspension of processing this application. Our authority for asking for the information on this form is 26 USC 6001, 6011, 6109,

7602, 7623, 7802, and 5 USC 301.

Date of Birth Claimant's Taxpayer Identification

Name of claimant. If an individual, provide date of birth

(Month) (Day) (Year) Number (SSN or EIN)

Name of spouse (if applicable) Date of Birth Social Security Number

(Month) (Day) (Year)

Address of claimant, including zip code, and telephone number (telephone number is optional)

I am applying for a reward, in accordance with the law and regulations, for original information furnished, which led to the detection of

a violation of the internal revenue laws of the United States and the collection of taxes, penalties, and fines. I was not an employee of

the Department of the Treasury at the time I came into possession of the information nor at the time I divulged it.

Name of IRS employee to whom violation was reported Title of IRS employee Date violation reported (mmddyyyy)

Method of reporting the information (check applicable box) Telephone Mail In person

Name of taxpayer who committed the violation and, if known, the taxpayer's SSN or EIN

Address of taxpayer, including zip code, if known

Relative to information I furnished on the above taxpayer, the Internal Revenue Service made the following payments to me or on my

behalf

:Date of Payment Amount Name of Person/Entity to Whom Payment was made

Under penalties of perjury, I declare that I have examined this application and my accompanying statements, if any, and to the best of

my knowledge and belief, they are true, correct, and complete. I understand the amount of any reward will represent what the Area

Director/Compliance Services Field Director considers appropriate in this particular case. I agree to repay the reward, or an

appropriate percentage thereof, if the collection on which it is based is subsequently reduced.

Signature of Claimant Date

The following is to be completed by the Internal Revenue Service

Authorization of Reward

Area Director/Compliance Services Field Director Sum Recovered Amount of Reward

$ $

In consideration of the original information that was furnished by the claimant named above, which concerns a violation of the

internal revenue laws and which led to the collection of taxes, penalties, and fines in the sum shown above, I approve payment of a

reward in the amount stated.

Signature of the Compliance Services Field Director Date

MAIL COMPLETED FORM TO THE APPROPRIATE ADDRESS SHOWN ON THE BACK

Catalog Number 16571S www.irs.gov Form 211 (Rev. 6-2006)

Send the completed Form 211 to the following Address below.

Ogden Campus Center

Internal Revenue Service

1973 N. Rulon White Blvd.

MS/4110 — ICE

Ogden, UT 84404

PAPERWORK REDUCTION ACT NOTICE: We ask for the information on this form to carry out the internal

revenue laws of the United States. We need it to insure that taxpayers are complying with these laws and to allow

us to figure and collect the right amount of tax.

You are required to give us the information if you are applying for a reward.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act

unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be

retained as long as their contents may become material in the administration of any internal revenue law. Generally,

tax returns and return information are confidential, as required by Code section 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average

time is 15 minutes. If you have comments concerning the accuracy of these time estimates or suggestions for

making this form simpler, we would be happy to hear from you. You can email us at *taxforms@irs.gov (please

type "Forms Comment" on the subject line) or write to the Internal Revenue Service, Tax Forms Coordinating

Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR-6406, Washington, DC 20224.

Do NOT send the completed Form 211 to the Tax Forms Coordinating Committee. Instead, send it to the address

shown above for the IRS in Ogden, UT.

Catalog Number 16571S www.irs.gov Form 211 (Rev. 6-2006)

Anda mungkin juga menyukai

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Dokumen6 halamanUS Internal Revenue Service: 2290rulesty2007v4 0IRSBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Dokumen153 halaman2008 Objectives Report To Congress v2IRSBelum ada peringkat

- 2008 Data DictionaryDokumen260 halaman2008 Data DictionaryIRSBelum ada peringkat

- 2008 Credit Card Bulk Provider RequirementsDokumen112 halaman2008 Credit Card Bulk Provider RequirementsIRSBelum ada peringkat

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 004 Sarmiento Eulogio v. BellDokumen3 halaman004 Sarmiento Eulogio v. BelltheresebernadetteBelum ada peringkat

- Financial InclusionDokumen69 halamanFinancial InclusionthenosweenBelum ada peringkat

- Salary Slip (00745207 September, 2019)Dokumen1 halamanSalary Slip (00745207 September, 2019)Mushtaq AhmadBelum ada peringkat

- Taxation Law Discussions by Professor ORTEGADokumen15 halamanTaxation Law Discussions by Professor ORTEGAKring de VeraBelum ada peringkat

- Paper8 - PendingDokumen9 halamanPaper8 - PendingApooBelum ada peringkat

- Checklist Addition Alterations 8july16Dokumen1 halamanChecklist Addition Alterations 8july16reyazmumbaikarBelum ada peringkat

- ICRA Research MFIDokumen8 halamanICRA Research MFIJaiganesh M SBelum ada peringkat

- RESEARCH FinalDokumen42 halamanRESEARCH FinalNesru Siraj100% (1)

- Accounting CycleDokumen6 halamanAccounting CycleElla Acosta0% (1)

- Reciprocal Relation (RR) Based Payment Mechanism For Highway Ppps - Introductory Concepts Concepts by Devayan DeyDokumen18 halamanReciprocal Relation (RR) Based Payment Mechanism For Highway Ppps - Introductory Concepts Concepts by Devayan DeyAjay PannuBelum ada peringkat

- Gomez-Jimenez v. NYLS: Motion For Leave To AppealDokumen51 halamanGomez-Jimenez v. NYLS: Motion For Leave To AppealStaci ZaretskyBelum ada peringkat

- Course Title: MICRO FINANCE Course Code: FIBA203 Credit Units: 3 Level: UGDokumen3 halamanCourse Title: MICRO FINANCE Course Code: FIBA203 Credit Units: 3 Level: UGchhaayaachitran akshuBelum ada peringkat

- Mrunal (Economic Survey Ch7) International Trade, FTA, PTA, ASIDE, E-BRC, CEPA Vs CECA Difference Explained MrunalDokumen21 halamanMrunal (Economic Survey Ch7) International Trade, FTA, PTA, ASIDE, E-BRC, CEPA Vs CECA Difference Explained MrunalHamdard BoparaiBelum ada peringkat

- EF3e Int Filetest 2aDokumen6 halamanEF3e Int Filetest 2aJhony EspinozaBelum ada peringkat

- CMBS Trading - ACES IO Strategy Overview (07!19!16 Plain)Dokumen21 halamanCMBS Trading - ACES IO Strategy Overview (07!19!16 Plain)Darren WolbergBelum ada peringkat

- Banks' Risk Management: A Comparison Study of UAE National and Foreign BanksDokumen16 halamanBanks' Risk Management: A Comparison Study of UAE National and Foreign Bankssajid bhattiBelum ada peringkat

- Investment BankingDokumen12 halamanInvestment BankingrocksonBelum ada peringkat

- Final S12014 MarkingGuideDokumen13 halamanFinal S12014 MarkingGuideYuuki KiryuuBelum ada peringkat

- Hyundai Alabang: Auto Loan Application For Individual and Single ProprietorshipDokumen4 halamanHyundai Alabang: Auto Loan Application For Individual and Single ProprietorshipXierylleAngelicaBelum ada peringkat

- Buenaventura Vs MetrobankDokumen8 halamanBuenaventura Vs MetrobankI'm a Smart CatBelum ada peringkat

- Corporation Law (3SS) - Case DigestsDokumen75 halamanCorporation Law (3SS) - Case DigestsKenette Diane CantubaBelum ada peringkat

- Commercial PapersDokumen13 halamanCommercial PapersAbhinav SharmaBelum ada peringkat

- Illustrative Problems Chap7-8Dokumen3 halamanIllustrative Problems Chap7-8Nikki GarciaBelum ada peringkat

- Daily PeoplesDokumen32 halamanDaily PeoplesBobb KetterBelum ada peringkat

- Jean Jamailah Tomugdan JD - 2: Property Case Digests Makati Leasing and Finance Corp. Vs Wearever Textile Mills Inc.Dokumen4 halamanJean Jamailah Tomugdan JD - 2: Property Case Digests Makati Leasing and Finance Corp. Vs Wearever Textile Mills Inc.Jean Jamailah TomugdanBelum ada peringkat

- Philsec Investment Corp., V. CADokumen2 halamanPhilsec Investment Corp., V. CARalph Deric EspirituBelum ada peringkat

- Sample ExamDokumen9 halamanSample ExamrichardBelum ada peringkat

- Balance Sheet of JK Tyre and IndustriesDokumen4 halamanBalance Sheet of JK Tyre and IndustriesHimanshu MangeBelum ada peringkat

- TEST Bank Chapter 22Dokumen19 halamanTEST Bank Chapter 22Rhea llyn BacquialBelum ada peringkat

- Loan Appraisal Format For Limits Less Than One CroreDokumen14 halamanLoan Appraisal Format For Limits Less Than One Croresidh09870% (1)