US Internal Revenue Service: I4868 - 1993

Diunggah oleh

IRS0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan2 halamanUse Form 4868 to ask for 4 more months to File Form 1040EZ, form 1040A, or form 1040. Do not file if you want the IRS to figure your tax or you are under a court order. An extension of time to file your 1993 calendar year income tax return also extends the time to file a gift tax return.

Deskripsi Asli:

Judul Asli

US Internal Revenue Service: i4868--1993

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniUse Form 4868 to ask for 4 more months to File Form 1040EZ, form 1040A, or form 1040. Do not file if you want the IRS to figure your tax or you are under a court order. An extension of time to file your 1993 calendar year income tax return also extends the time to file a gift tax return.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan2 halamanUS Internal Revenue Service: I4868 - 1993

Diunggah oleh

IRSUse Form 4868 to ask for 4 more months to File Form 1040EZ, form 1040A, or form 1040. Do not file if you want the IRS to figure your tax or you are under a court order. An extension of time to file your 1993 calendar year income tax return also extends the time to file a gift tax return.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

Department of the Treasury

Internal Revenue Service

Instructions for Form 4868

Application for Automatic Extension of Time To File

U.S. Individual Income Tax Return

General Instructions you can still file your return on time if your

request is not approved. California (all other

Fresno, CA 93888

counties), Hawaii

Purpose of Form When To File Form 4868 American Samoa Philadelphia, PA 19255

Caution: If the new tax rates for Department of

high-income taxpayers apply to you, you File Form 4868 by April 15, 1994. If you

Revenue and Taxation

may be able to defer part of your 1993 tax are filing a fiscal year Form 1040, file Form Guam:

Government of Guam

4868 by the regular due date of your Permanent residents

liability. But to do so, you must pay by the 378 Chalan San Antonio

regular due date of your return, at least return. Tamuning, Guam 96911

90% of your 1993 tax liability, minus the If you had 2 extra months to file your Guam:

tax you would be eligible to defer. For return because you were out of the Nonpermanent residents

details, get Form 8841, Deferral of country, file Form 4868 by June 15, 1994, Puerto Rico (or if excluding

Additional 1993 Taxes. for a 1993 calendar year return. income under section Philadelphia, PA 19255

933)

Use Form 4868 to ask for 4 more Virgin Islands:

months to file Form 1040EZ, Form 1040A, Where To File Nonpermanent residents

or Form 1040. You do not have to explain

Mail this form to the Internal Revenue V.I. Bureau of

why you are asking for the extension. We

Service Center for the place where you Virgin Islands: Internal Revenue

will contact you only if your request is Permanent Lockhart Gardens No. 1-A

live.

denied. residents Charlotte Amalie

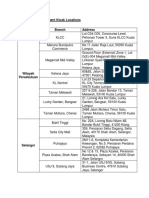

To get the extra time you MUST: If you live in: Use this address: St. Thomas, VI 00802

● Properly estimate your 1993 tax liability Florida, Georgia, South

Atlanta, GA 39901

Foreign country:

using the information available to you, Carolina U.S. citizens and those

filing Form 2555, Philadelphia, PA 19255

● Enter your tax liability on line 1 of Form New Jersey, New York Form 2555-EZ, or

4868, AND (New York City and Form 4563

counties of Nassau, Holtsville, NY 00501

● File Form 4868 by the due date of your Rockland, Suffolk, and All A.P.O. and F.P.O.

return. Philadelphia, PA 19255

Westchester) addresses

If you cannot pay the amount on line 3, New York (all other

see the instructions for line 3. counties), Connecticut,

If you already had 2 extra months to file Maine, Massachusetts, New Andover, MA 05501

Filing Your Tax Return

because you were “out of the country” Hampshire, Rhode Island, You may file Form 1040EZ, Form 1040A,

Vermont

(explained on page 2) when your return or Form 1040 any time before the

was due, use this form to ask for an Illinois, Iowa, Minnesota, extension of time is up. But remember,

Kansas City, MO 64999

additional 2 months to file. Missouri, Wisconsin Form 4868 does not extend the time to

Do not file Form 4868 if you want the pay taxes. If you do not pay the amount

Delaware, District of

IRS to figure your tax or you are under a Columbia, Maryland, Philadelphia, PA 19255 due by the regular due date, you will owe

court order to file your return by the Pennsylvania, Virginia interest. You may also be charged

regular due date. penalties. Do not attach a copy of Form

Indiana, Kentucky, 4868 to your return.

Note: An extension of time to file your Michigan, Ohio, West Cincinnati, OH 45999

1993 calendar year income tax return also Virginia Interest

extends the time to file a gift tax return Kansas, New Mexico,

(Form 709 or 709-A) for 1993. Austin, TX 73301 You will owe interest on any tax not paid

Oklahoma, Texas

by the regular due date of your return. The

If the automatic extension does not give Alabama, Arkansas, interest runs until you pay the tax. Even if

you enough time, you can ask for Louisiana, Mississippi, Memphis, TN 37501 you had a good reason for not paying on

additional time later. But you’ll have to give North Carolina, Tennessee time, you will still owe interest.

a good reason, and it must be approved

by the IRS. To ask for the additional time, Alaska, Arizona, California

(counties of Alpine, Amador, Late Payment Penalty

you must do either of the following: Butte, Calaveras, Colusa, The penalty is usually 1⁄2 of 1% of any tax

1. File Form 2688, Application for Contra Costa, Del Norte, El

(other than estimated tax) not paid by the

Additional Extension of Time To File U.S. Dorado, Glenn, Humboldt,

Lake, Lassen, Marin, regular due date. It is charged for each

Individual Income Tax Return, or month or part of a month the tax is unpaid.

Mendocino, Modoc, Napa,

2. Explain your reason in a letter. Mail it Nevada, Placer, Plumas, The maximum penalty is 25%.

to the address under Where To File on Sacramento, San Joaquin,

Ogden, UT 84201 For purposes of applying the late

this page. Shasta, Sierra, Siskiyou,

Solano, Sonoma, Sutter, payment penalty only, the penalty will not

File Form 4868 before you file Form Tehama, Trinity, Yolo, and be charged if you can show reasonable

2688 or write a letter asking for more time. Yuba), Colorado, Idaho, cause for not paying on time. To show

Only in cases of undue hardship will the Montana, Nebraska, reasonable cause, attach a statement to

IRS approve your request for more time Nevada, North Dakota, your return, not Form 4868, fully explaining

without receiving Form 4868 first. If you Oregon, South Dakota,

Utah, Washington,

your reason.

need this extra time, ask for it early so that Wyoming

Cat. No. 15358N

You are considered to have reasonable before filing your Form 4868. This prevents Lines 5a and 5b

cause for the period covered by this delays in processing your extension

automatic extension if at least 90% of your request. Enter the amount you (or your spouse)

actual 1993 tax liability is paid before the expect to owe on these lines. If your

regular due date of your return through Address Change spouse files a separate Form 4868, enter

withholding, estimated tax payments, or on your form only the total gift tax and

If you changed your mailing address after GST tax you expect to owe. Pay in full

with Form 4868. you filed your last return, you should use with this form to avoid interest and

Form 8822, Change of Address, to notify

Late Filing Penalty the IRS of the change. A new address

penalties. If paying gift and GST taxes on

time would cause you undue hardship (not

A penalty is usually charged if your return shown on Form 4868 will not update your just inconvenience), attach an explanation

is filed after the due date (including record. You can get Form 8822 by calling to Form 4868.

extensions). It is usually 5% of the tax not 1-800-TAX-FORM (1-800-829-3676).

paid by the regular due date for each

month or part of a month your return is Fiscal Year Filers Signature

late. Generally, the maximum penalty is Form 4868 must be signed. If you plan to

25%. If your return is more than 60 days In the area provided above Part I, enter the file a joint return, both of you should sign.

late, the minimum penalty is $100 or the date your 4-month extension will end and If there is a good reason why one of you

balance of tax due on your return, the date your tax year ends. cannot, the other spouse may sign for

whichever is smaller. You might not owe both. Attach a statement explaining why

the penalty if you have a good reason for Out of the Country the other spouse cannot sign.

filing late. Attach a full explanation to your

return, not Form 4868, if you file late. If you already had 2 extra months to file Others Who Can Sign for You

because you were a U.S. citizen or

How To Claim Credit for Payment resident and were out of the country on Anyone with a power of attorney can sign.

the due date of your return, write But the following can sign for you without

Made With This Form a power of attorney:

“Taxpayer Abroad” across the top of Form

When you file your return, include the 4868. “Out of the country” means either ● Attorneys, CPAs, and enrolled agents.

amount of any payment (line 3) sent with (1) you live outside the United States and

Form 4868 on the appropriate line of your ● A person in close personal or business

Puerto Rico and your main place of work

tax return. If you file Form 1040EZ, the relationship to you who is signing because

is outside the United States and Puerto

instructions for line 7 will tell you how to you cannot. There must be a good reason

Rico, or (2) you are in military or naval

report the payment. If you file Form 1040A, why you cannot sign, such as illness or

service outside the United States and

see the instructions for line 28d. If you file absence. Attach an explanation to Form

Puerto Rico.

Form 1040, enter the payment on line 57. 4868.

If you and your spouse each filed a Line 1

separate Form 4868 but later file a joint

return for 1993, enter the total paid with If we later determine that the amount Paperwork Reduction Act

both Forms 4868 on the appropriate line of entered on line 1 was not reasonable, the Notice

your joint return. extension is null and void. You will owe the

late filing penalty as explained earlier. We ask for the information on this form to

If you and your spouse jointly filed Form carry out the Internal Revenue laws of the

4868 but later file separate returns for United States. You are required to give us

1993, you may enter the total amount paid Line 3 the information. We need it to ensure that

with Form 4868 on either of your separate If you find you can’t pay the full amount you are complying with these laws and to

returns. Or you and your spouse may shown on line 3, you can still get the allow us to figure and collect the right

divide the payment in any agreed amounts. extension. But you should pay as much as amount of tax.

Be sure each separate return has the you can to limit the amount of interest you The time needed to complete and file

social security numbers of both spouses. will owe. Also, you may be charged the this form will vary depending on individual

late payment penalty on the unpaid tax circumstances. The estimated average time

Specific Instructions from the regular due date of your return.

See Late Payment Penalty on page 1.

is: Recordkeeping, 26 min.; Learning

about the law or the form, 13 min.;

Attach your check or money order to Preparing the form, 16 min.; and

Name, Address, and Social Form 4868. Make it payable to the Copying, assembling, and sending the

Security Number “Internal Revenue Service.” Write your form to the IRS, 20 min.

Enter your name, address, and social name, address, social security number, If you have comments concerning the

security number. If you plan to file a joint daytime phone number, and “1993 Form accuracy of these time estimates or

return, also enter your spouse’s name and 4868” on your payment. suggestions for making this form more

social security number. simple, we would be happy to hear from

Line 4 you. You can write to both the Internal

P.O. Box Revenue Service, Attention: Reports

If you or your spouse are also using the Clearance Officer, PC:FP, Washington, DC

If your post office does not bring mail to extra 4 months to file a 1993 gift tax 20224; and the Office of Management

your street address and you have a P.O. return, check whichever box applies on line and Budget, Paperwork Reduction Project

box, enter the box number instead. 4. But if your spouse files a separate Form (1545-0188), Washington, DC 20503. DO

4868, do not check the box for your NOT send this form to either of these

Name Change spouse. offices. Instead, see Where To File on

If you changed your name after you filed page 1.

your last return because of marriage,

divorce, etc., be sure to report this to your

local Social Security Administration office

Page 2 Printed on recycled paper

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Debit Card Replacement Kiosk Locations v2Dokumen3 halamanDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Tratamentul Total Al CanceruluiDokumen71 halamanTratamentul Total Al CanceruluiAntal98% (98)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Customary of The House of Initia Nova - OsbDokumen62 halamanThe Customary of The House of Initia Nova - OsbScott KnitterBelum ada peringkat

- 01 - Quality Improvement in The Modern Business Environment - Montgomery Ch01Dokumen75 halaman01 - Quality Improvement in The Modern Business Environment - Montgomery Ch01Ollyvia Faliani MuchlisBelum ada peringkat

- MH15 - Street WarsDokumen78 halamanMH15 - Street WarsBrin Bly100% (1)

- 2008 Credit Card Bulk Provider RequirementsDokumen112 halaman2008 Credit Card Bulk Provider RequirementsIRSBelum ada peringkat

- US Internal Revenue Service: 2290rulesty2007v4 0Dokumen6 halamanUS Internal Revenue Service: 2290rulesty2007v4 0IRSBelum ada peringkat

- 2008 Objectives Report To Congress v2Dokumen153 halaman2008 Objectives Report To Congress v2IRSBelum ada peringkat

- 2008 Data DictionaryDokumen260 halaman2008 Data DictionaryIRSBelum ada peringkat

- NYSERDA AnalysisDokumen145 halamanNYSERDA AnalysisNick PopeBelum ada peringkat

- ASSIGNMENT MGT 657 myNEWSDokumen35 halamanASSIGNMENT MGT 657 myNEWSazrin aziziBelum ada peringkat

- Variable Ticket PricingDokumen3 halamanVariable Ticket Pricingn8mckittrick16Belum ada peringkat

- Charlotte BronteDokumen4 halamanCharlotte BronteJonathan BorlonganBelum ada peringkat

- Power of The High Courts To Transfer CasesDokumen2 halamanPower of The High Courts To Transfer CasesShweta ChauhanBelum ada peringkat

- Case LawsDokumen4 halamanCase LawsLalgin KurianBelum ada peringkat

- Ooad Lab Question SetDokumen3 halamanOoad Lab Question SetMUKESH RAJA P IT Student100% (1)

- Ssa 1170 KitDokumen6 halamanSsa 1170 Kitkruno.grubesicBelum ada peringkat

- Republic Act. 10157Dokumen24 halamanRepublic Act. 10157roa yusonBelum ada peringkat

- Sources of Criminal LawDokumen7 halamanSources of Criminal LawDavid Lemayian SalatonBelum ada peringkat

- Price Build UpsDokumen22 halamanPrice Build UpsFirasAlnaimiBelum ada peringkat

- Company Profile 2018: However, The Cover Is ExcludedDokumen16 halamanCompany Profile 2018: However, The Cover Is ExcludedJimmy R. Mendoza LeguaBelum ada peringkat

- 24 BL-BK SP List (2930130900)Dokumen56 halaman24 BL-BK SP List (2930130900)CapricorniusxxBelum ada peringkat

- Naseer CV Dubai - 231017 - 215141-1Dokumen2 halamanNaseer CV Dubai - 231017 - 215141-1krachinaseebbiryaniBelum ada peringkat

- KGBV Bassi Profile NewDokumen5 halamanKGBV Bassi Profile NewAbhilash MohapatraBelum ada peringkat

- Resume: Md. Saiful IslamDokumen2 halamanResume: Md. Saiful IslamSaiful IslamBelum ada peringkat

- SwingDokumen94 halamanSwinggilles TedonkengBelum ada peringkat

- A Term Paper On The Application of Tort Law in BangladeshDokumen7 halamanA Term Paper On The Application of Tort Law in BangladeshRakib UL IslamBelum ada peringkat

- Types of NounsDokumen6 halamanTypes of NounsHend HamedBelum ada peringkat

- Catalogu PDFDokumen24 halamanCatalogu PDFFer GuBelum ada peringkat

- World Oil April 2010Dokumen200 halamanWorld Oil April 2010Tahar Hajji0% (1)

- 006 2014 Hans TjioDokumen17 halaman006 2014 Hans TjioarshadtabassumBelum ada peringkat

- 50CDokumen65 halaman50Cvvikram7566Belum ada peringkat

- CrackJPSC Mains Paper III Module A HistoryDokumen172 halamanCrackJPSC Mains Paper III Module A HistoryL S KalundiaBelum ada peringkat

- A Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippinesDokumen42 halamanA Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippineschaynagirlBelum ada peringkat

- Alcpt 27R (Script)Dokumen21 halamanAlcpt 27R (Script)Matt Dahiam RinconBelum ada peringkat