G5023 - Syllabus

Diunggah oleh

ed_win25Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

G5023 - Syllabus

Diunggah oleh

ed_win25Hak Cipta:

Format Tersedia

BINUS BUSINESS SCHOOL

G5023 - Corporate Finance and Valuation

Syllabus

SCU : 3 credits

ECTS : NONE

Pre-requisites : NONE

Teaching Team : L2403 - Iwan Prijono Pontjowinoto, Ph.D ( iwan.pontjowinoto@gmail.com )

Unit Outline

Term 3 / 2010

Syllabus Designed by : Dr. Stephanus Remond Waworuntu, MBA.

BINUS BUSINESS SCHOOL

Joseph Wibowo Center - BINUS UNIVERSITY

Jl.Hang Lekir I No. 6 Kebayoran Baru, Jakarta Selatan 12120, Indonesia

FM - BINUS - AA - FPA - 13 / R7

Version :1 Revision Date : 13 April 2009

Revision :1 Effective From : 18 April 2009

1. Course Description

An understanding of how financial decisions are made is the most essential factor in the success of

executives in any organization. A sound financial decision ensures maintenance and creation of

economic value or wealth. In general, finance executives are involved in three areas of decision

making: investment, financing, and operations. Corporate finance involves raising, allocating and

operating scarce resources across competing uses inside an organization. As a course for

executives, however, this course emphasizes more in investment, financing and business decision

as it is more strategic ones than the other. In addition, this course also disccuses a basic knowledge

about valuation, which is the heart of every finance decision, whether that decision is to buy, sell, or

hold but the pricing of any financial and real asset has become a more complex task in modern

financial markets. As valuation models are universal and not market -specific, they provide principles

and methods on how to value virtually any type of asset in any country.. allocation and Financing

decisions involve raising funds to finance the investment projects.

2. Learning Outcomes

This course is to give the students problem solving skills in finance from the point of view of

management and investors. In this setting, some basic finance tools are important. The tools are :

mathematics of finance (present value, future value, annuity, mixed stream, etc), risk-return models,

and valuation models. In addition, Sessions on business decision review various models and

techniques used to value firms, particularly in the context of an acquisition to reflect the trend in

finance area.

3. Course Structure

Classes & Participation

During classes, lecturer will use lecture and discussion/case mode to deliver the materials. Lecturer

will also apply a student-based learning by stimulating questions to students. Therefore, students are

expected to read the assigned chapters before the class so to be able to participate in the

discussion. Students are highly encouraged to actively participate in class discussions as

participation is part of grading.

Cases and Assignments

1. Each student will choose a private company of her/his own and estimate the value of the

company. The result will be presented and submitted in Session 12ab.

2. The assignment evaluation is based on the presentation and the thoroughness and the depth of

the written report.

3. Other assignments including homework will be given by the lecturer during class sessions.

Exams

Student will have an open book final exam. The forms of Exams can be multiple choice, short

answer, and essay.

4. Course Requirements

Student must attend all classes. Student must read references before class. Do not rely on lecturer’s

presentation slide or (if any) handout distributed by lecturer.

5. Text And Other Resourcces

5.1 Text

BINUS BUSINESS SCHOOL

G5023 - Corporate Finance and Valuation Page 2 of 5

FM - BINUS - AA - FPA - 13 / R7

Version :1 Revision Date : 13 April 2009

Revision :1 Effective From : 18 April 2009

Gabriel Hawawini and Claude Viallet, “Finance for Executive: Managing for Value

Creation”,, 3 Ed, South-Western, USA., -

5.2 Other Resources

-, Other course materials, if any, will be provided in class, -, -, -

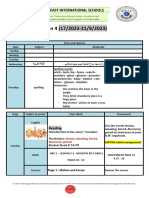

6. Course Outline

Week Topic Description

1 Syllabus Explanation Ch 1 (SR)

Overview: Financial Management and Value Website: www.bi.go.id (see: SBI time series)

Creation

2 Understanding Balance Sheets and Income Ch 2 (SR)

Statements

3 Assessing Liquidity and Operational Efficiency Ch 3 (SR)

4 Measuring Cash Flows Ch 4 (SR)

5 Diagnosing Profitability, Risk and Growth Ch 5 (DL)

6 NPV and alternatives to the NPV Rule Ch 6 & 7 (DL)

7 Identifying Project’s Cash Flows Ch 8 (DL)

8 Valuing Securities and the Cost of Capital Ch 9 & 10 (DL)

9 Designing a Capital Structure Ch 11 (JT)

10 Valuing and Acquiring a Business Ch 12 (JT)

11 Managing for Value Creation Ch 13 and 14 (JT)

12 Individual Presentation (JT)

Assignment (written report) Due

Review

7. Assesment

7.1 Component

NO Components Percentage

1 Class Participation 20%

2 Presentation 20%

3 Induvidual Ass 30%

4 Final Exam 30%

7.2 Class Policies

A student’s honest attitude and conduct are valued, while cheating at any circumstances will not

be tolerated. During exams, students must bring their own pen and calculator.

BINUS BUSINESS SCHOOL

G5023 - Corporate Finance and Valuation Page 3 of 5

FM - BINUS - AA - FPA - 13 / R7

Version :1 Revision Date : 13 April 2009

Revision :1 Effective From : 18 April 2009

7.3 Submission And Collection Of Assignment

The assignment will be collected at the last class meeting. No late submission is accepted

regardless any reason provided

8. General Information

Students are required to be familiar with the BINUS UNIVERSITY – BINUS BUSINESS SCHOOL

Code of Conduct, and to abide by its terms and conditions.

8.1 Copying of Copyright Material By Student

A condition of acceptance as a student is the obligation to abide by the University’s policy on

the copying of copyright material. This obligation covers photocopying of any material using the

University’s photocopying machines, and the recording off air, and making subsequent copies ,

of radio or television broadcasts, and photocopying textbooks. Students who flagrantly

disregard University policy and copyright requirements will be liable to disciplinary action under

the Code of Conduct.

8.2 Academic Misconduct

Please refer to the Code of Conduct for definitions and penalties for Academic Misconduct ,

plagiarism, collusion, and other specific acts of academic dishonesty.

Academic honesty is crucial to a student's credibility and self-esteem, and ultimately

reflects the values and morals of the University as a whole. A student may work together with

one or a group of students discussing assignment content, identifying relevant references, and

debating issues relevant to the subject. Academic investigation is not limited to the views and

opinions of one individual, but is built by forming opinion based on past and present work in the

field. It is legitimate and appropriate to synthesize the work of others, provided that such work is

clearly and accurately referenced.

Plagiarism occurs when the work (including such things as text, figures, ideas, or

conceptual structure, whether verbatim or not) created by another person or persons is used

and presented as one’s own creation, unless the source of each quotation or piece of borrowed

material is acknowledged with an appropriate citation.

Encouraging or assisting another person to commit plagiarism is a form of improper

collusion and may attract the same penalties.

To prevent Academic Misconduct occurring, students are expected to familiarize

themselves with the University policy, the Subject Outline statements, and specific assignment

guidelines. Students should also seek advice from Subject Leaders on acceptable academic

conduct.

8.2.1 Guidelines To Avoid Plagiarism

8.2.2 Referencing For Written Work

Referencing is necessary to acknowledge others' ideas, avoid plagiarism, and allow

readers to access those others’ ideas. Referencing should:

1. Acknowledge others' ideas

2. Allow readers to find the source

3. Be consistent in format and

4. Acknowledge the source of the referencing format

To attain these qualities, the school recommends use of either the Harvard or

American Psychological Association style of referencing, both of which use the

author/date.

BINUS BUSINESS SCHOOL

G5023 - Corporate Finance and Valuation Page 4 of 5

FM - BINUS - AA - FPA - 13 / R7

Version :1 Revision Date : 13 April 2009

Revision :1 Effective From : 18 April 2009

8.2.3 Referencing Standards

APA style referencing.

Checked By Approved By

Tubagus Hanafi Soeriaatmadja, MBA., M.Si. Minaldi Loeis, M.Sc., MM.

Program Director - MM Executive Dean of Program

BINUS BUSINESS SCHOOL BINUS BUSINESS SCHOOL

BINUS BUSINESS SCHOOL

G5023 - Corporate Finance and Valuation Page 5 of 5

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Lansing NAACP Investigation Into Haslett High SchoolDokumen8 halamanLansing NAACP Investigation Into Haslett High SchoolKrystal NurseBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Discipline of Social WorkDokumen29 halamanThe Discipline of Social WorkRachel Valenzuela54% (13)

- Emcee ScriptDokumen9 halamanEmcee ScriptChe Amin Che HassanBelum ada peringkat

- Eden, G. F., & Moats, L. (2002) - The Role of Neuroscience in The Remediation of Students With Dyslexia. Nature Neuroscience, 5, 1080-1084.Dokumen5 halamanEden, G. F., & Moats, L. (2002) - The Role of Neuroscience in The Remediation of Students With Dyslexia. Nature Neuroscience, 5, 1080-1084.Jose LuisBelum ada peringkat

- Detailed Lesson PlanDokumen8 halamanDetailed Lesson PlanSvg Frendz75% (4)

- Certified International Procurement Professional - IndiaDokumen4 halamanCertified International Procurement Professional - IndiaapdesepedaBelum ada peringkat

- Croft Thesis Prospectus GuideDokumen3 halamanCroft Thesis Prospectus GuideMiguel CentellasBelum ada peringkat

- BCA Full DetailsDokumen3 halamanBCA Full DetailsAnkit MishraBelum ada peringkat

- Full-Time Salaried Employees: Salary by Career Stage: Base Salary Total RemunerationDokumen14 halamanFull-Time Salaried Employees: Salary by Career Stage: Base Salary Total RemunerationChuckbartowskiBelum ada peringkat

- WHLP Mapeh 6 Q1 W5Dokumen5 halamanWHLP Mapeh 6 Q1 W5JAN ALFRED NOMBREBelum ada peringkat

- Renaissance Counterpoit Acoording To ZarlinoDokumen8 halamanRenaissance Counterpoit Acoording To ZarlinoAnonymous Ytzo9Jdtk100% (2)

- Chapter 4 Job Analysis and The Talent Management ProcessDokumen61 halamanChapter 4 Job Analysis and The Talent Management Processmalik1000malikBelum ada peringkat

- 04 Personnel Admin Sit RationDokumen292 halaman04 Personnel Admin Sit RationTrivedishanBelum ada peringkat

- Academic Performance and Social Behavior: ArticleDokumen21 halamanAcademic Performance and Social Behavior: ArticleEunice FacunBelum ada peringkat

- Updated SaroDokumen559 halamanUpdated SaroBiZayangAmaZonaBelum ada peringkat

- Modern Labor Economics: Inequality in EarningsDokumen37 halamanModern Labor Economics: Inequality in EarningssamuelBelum ada peringkat

- Implementasi Manajemen Kurikulum Dalam Meningkatan Mutu Pembelajaran Di Sma Yabakii 2 Gandrungmangu CilacapDokumen13 halamanImplementasi Manajemen Kurikulum Dalam Meningkatan Mutu Pembelajaran Di Sma Yabakii 2 Gandrungmangu CilacapLasiminBinSuhadiBelum ada peringkat

- B.ed NotesDokumen17 halamanB.ed Notesanees kakarBelum ada peringkat

- Introduction Two Kinds of ProportionDokumen54 halamanIntroduction Two Kinds of ProportionMohit SinghBelum ada peringkat

- "Way Forward" Study Pack - English Grade Eight First Term-2021Dokumen37 halaman"Way Forward" Study Pack - English Grade Eight First Term-2021su87Belum ada peringkat

- TASK 4 - ELP Assignment (Nur Izatul Atikah)Dokumen7 halamanTASK 4 - ELP Assignment (Nur Izatul Atikah)BNK2062021 Muhammad Zahir Bin Mohd FadleBelum ada peringkat

- WK T1 Week 4 gr3Dokumen4 halamanWK T1 Week 4 gr3eman abdelftahBelum ada peringkat

- Expectancy Theory of MotivationDokumen5 halamanExpectancy Theory of MotivationArmstrong BosantogBelum ada peringkat

- Form 1 & 2 Lesson Plan CefrDokumen3 halamanForm 1 & 2 Lesson Plan CefrTc NorBelum ada peringkat

- Anatomi Berorientasi Klinis: A. Sentot Suropati. Dr. SPPD, FinasimDokumen47 halamanAnatomi Berorientasi Klinis: A. Sentot Suropati. Dr. SPPD, FinasimYudhistira NugrahaBelum ada peringkat

- Idol ProspectusDokumen54 halamanIdol ProspectusprezstruckBelum ada peringkat

- thdUdLs) 99eDokumen1 halamanthdUdLs) 99eHaji HayanoBelum ada peringkat

- Program Assessment Tool Kit:: A Guide To Conducting Interviews and Surveys A Guide To Conducting Interviews and SurveysDokumen74 halamanProgram Assessment Tool Kit:: A Guide To Conducting Interviews and Surveys A Guide To Conducting Interviews and Surveyswinter55Belum ada peringkat

- Ucsp q2 Module 4 Week 12Dokumen28 halamanUcsp q2 Module 4 Week 12hannierakistaBelum ada peringkat

- Regan Walton ResumeDokumen2 halamanRegan Walton Resumeapi-487845926Belum ada peringkat