Gane 1824

Diunggah oleh

govindansanDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Gane 1824

Diunggah oleh

govindansanHak Cipta:

Format Tersedia

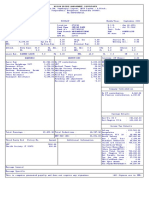

ING VYSYA LIFE INSURANCE COMPANY LTD

Regd. & Corporate Office Bangalore, Karnataka, India

PAYSLIP FOR THE MONTH OF SEPTEMBER 2009

EMP. NO : 26034 PF NO. : KN/25113/27753 Leave Details

NAME. : R Ganesha Subramaniyam COST CENTRE : 2011 Entitlement Opening Claimed Closing

DESIGNATION : SALES MANAGER LOCATION : Salem Balance This Month Balance

PAN NO. : AJSPG2034R DATE OF JOINING : 01/07/2009 CASUAL / SICK 7.00 3 2.00 1.00

DATE OF BIRTH : 02/07/1973 LEVEL : L7 ANNUAL 22.00 12 0.00 12.00

DEPARTMENT : SALES PAYMENT MODE : BANK TRANSFER

LOP : 0 No. of Days Paid : 30

BANK : VYSYA BANK A/C No. : 404010157358

EARNINGS Amt YTD DEDUCTIONS Amt YTD

FIXED COMPONENTS PROVIDENT FUND 660.00 1,980.00

BASIC 5,500.00 16,500.00 FBT ON BUSINESS CONV REIMB 417.00 854.00

HOUSE RENT ALLOWANCE 2,200.00 6,600.00

TRANSPORT ALLOWANCE 800.00 2,400.00

LTA 1,250.00 3,750.00

MEDICAL REIMBURSEMENT 1,250.00 3,750.00

SPECIAL ALLOWANCE 1,980.00 5,940.00

BUSINESS CONVEYANCE 6,667.00 20,001.00

Special Allowance Break Up :

Reimbursement 6,135.00

Balance Special Allow. Taxable -4,155.00

TOTAL EARNINGS - (A) 19,647.00 58,941.00 TOTAL DEDUCTIONS 1,077.00 2,834.00

NET SALARY : Rs. 18,570.00

Income Tax Calculation Investment Details

Particulars Cumulative Total Add: Projected Less: Exempted Amount Life Insurance Premium 0.00

Rs. Rs. Rs. Rs. National Savings Certificate 0.00

Basic 16,500.00 33,000.00 0.00 49,500.00 NSC Accrued Interest 0.00

House Rent Allowance 6,600.00 13,200.00 0.00 19,800.00 Housing Loan Repayment 0.00

Transport Allowance 2,400.00 4,800.00 7,200.00 0.00 Unit Linked Home Plan 0.00

Lta 3,750.00 7,500.00 0.00 11,250.00 Provident Fund 5,940.00

Medical Reimbursement 3,750.00 7,500.00 11,250.00 0.00 National Saving Scheme 0.00

Special Allowance Taxable 17,820.00 0.00 0.00 17,820.00 Equity Linked Saving Scheme / CTD 0.00

Total Income 98,370.00 Public Provident Fund 0.00

Add: Income received from Previous Employer 0.00 Infrastructure Bonds & Securities 0.00

Net Taxable Income 98,370.00 Voluntary Provident Fund 0.00

Less: Standard Deduction 0.00 LIC Deduction 0.00

Less: Prof. Tax recovered by Previous Employer 0.00 Other Deduction 0.00

Less: Prof. Tax recovered by Current Employer 1,605.00 Fixed Deposit Scheme 0.00

Add: Other Taxable Income reported by the employee 0.00 Senior Citizen Savings Scheme 0.00

Gross Taxable Income 96,765.00 5 YR Post Office Time Deposit 0.00

Less: Loss under income from House Property (Sec 24) 0.00 Other Declarations

Less: Deduction U/s 80DD/80DDB 0.00 HRA Rent Paid Details 0.00

Less: Deduction U/s 80D 0.00 CLA Rent Paid Details 0.00

Less: Deduction U/s 80CCC 0.00 Number of Children for Edu. Rebate 0

Less: Deduction U/s 80E/80U 0.00

Less: Other Deductions 0.00

Bill Submission details for the month of SEPTEMBER 2009

Less: Sec 80C Total 5,940.00

Sl. No Reimb. Heads Amt YTD

Income Chargeable to Tax (Rounded Off) 90,830.00

1 Conveyance Reimbursement 6,135.00 12,557.00

Income Tax Deduction

0.00 Total Reimbursements 6,135.00 12,557.00

Income Tax Payable

Less: Rebate under Section 88 0.00

Others - Included for CTC

Net Income Tax Payable 0.00

Add: Surcharge on Income Tax 0.00 1 P F Company Contribution 660.00 1,980.00

Add: Cess 0.00 2 Gratuity Company Contribution 110.00 330.00

Total Income Tax & S/C & Cess Payable 0.00 Total - (B) 770.00 2,310.00

Less: I Tax & S/C paid by Prev. Employer 0.00

I Tax & S/C & Cess to be recovered 0.00

I Tax & S/C & Cess recovered till SEP 2009 0.00

Balance Tax & S/C & Cess to be recovered 0.00

Avg. Monthly I. Tax & S/C & Cess to be recovered 0.00

Note:

Tue Sep 29 17:47:34 IST 2009 Please Send Your Queries to infoHOS@hewitt.com

This document contains confidential information. If you are not the intended recipient,you are not authorized to use or disclose it in any form.If you have received this in error, please destroy it along with any

copies and notify the sender immediately.

Anda mungkin juga menyukai

- Payslip For The Month of November 2020: Cms It Services Private LimitedDokumen2 halamanPayslip For The Month of November 2020: Cms It Services Private LimitedKrishna AryanBelum ada peringkat

- Salma Saifi May SlipDokumen2 halamanSalma Saifi May Slipsalma saifiBelum ada peringkat

- Pay Slip - 604316 - May-22Dokumen1 halamanPay Slip - 604316 - May-22ArchanaBelum ada peringkat

- Payslip Sep2022Dokumen1 halamanPayslip Sep2022Raut AbhimanBelum ada peringkat

- SRL Limited: Payslip For The Month of JANUARY 2019Dokumen1 halamanSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaBelum ada peringkat

- Full and Final Settlement Statement of January 2021 Associate InformationDokumen1 halamanFull and Final Settlement Statement of January 2021 Associate InformationB BhaskarBelum ada peringkat

- Payslip March 2023Dokumen1 halamanPayslip March 2023kaushalBelum ada peringkat

- Salary Slip - February 2023 - Gurjeet Singh SainiDokumen1 halamanSalary Slip - February 2023 - Gurjeet Singh SainiGurjeet SainiBelum ada peringkat

- PayslipDokumen1 halamanPayslipSahil shahBelum ada peringkat

- Payslip 2023 2024 10 05607 VASTUGROUPDokumen1 halamanPayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshBelum ada peringkat

- Cryoliten India Softwares: A-5 Faizabad Road Near Bhootnath Market Uttar, Pradesh India - 226016Dokumen1 halamanCryoliten India Softwares: A-5 Faizabad Road Near Bhootnath Market Uttar, Pradesh India - 226016Rohit raagBelum ada peringkat

- Payslip Oct-2022 NareshDokumen3 halamanPayslip Oct-2022 NareshDharshan Raj0% (1)

- Salary SlipsDokumen6 halamanSalary SlipsIMSaMiBelum ada peringkat

- SalarySlipwithTaxDetails PDFDokumen1 halamanSalarySlipwithTaxDetails PDFRahul mishraBelum ada peringkat

- Salary Slip EDIT-JULYDokumen4 halamanSalary Slip EDIT-JULYpathyashisBelum ada peringkat

- Payslip 03Dokumen1 halamanPayslip 03kroopeshreddy2298Belum ada peringkat

- Pushparaj R PayslipDokumen3 halamanPushparaj R PayslipHenry suryaBelum ada peringkat

- Anuja Tejinkar3Dokumen1 halamanAnuja Tejinkar3javed9890Belum ada peringkat

- PayslipSalary Slips - 9-2020 PDFDokumen1 halamanPayslipSalary Slips - 9-2020 PDFSukant ChampatiBelum ada peringkat

- SalarySlipwithTaxDetailsDokumen2 halamanSalarySlipwithTaxDetailsVivek ViviBelum ada peringkat

- Ub23m03 561476Dokumen1 halamanUb23m03 561476Ratul KochBelum ada peringkat

- Earnings Deductions: Eicher Motors LimitedDokumen1 halamanEarnings Deductions: Eicher Motors LimitedBarath BiberBelum ada peringkat

- Purview India Consulting and Services LLPDokumen1 halamanPurview India Consulting and Services LLPmamatha vemulaBelum ada peringkat

- Teleperformance Global Services Private Limited: Full and Final Settlement - December 2023Dokumen3 halamanTeleperformance Global Services Private Limited: Full and Final Settlement - December 2023vishal.upadhyay9279Belum ada peringkat

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDokumen3 halamanCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaBelum ada peringkat

- Salary Slip Feb 2019 of SandeepDokumen1 halamanSalary Slip Feb 2019 of SandeepSawan YadavBelum ada peringkat

- India Payslip January 2022Dokumen1 halamanIndia Payslip January 2022Mir KazimBelum ada peringkat

- Sep2022 STFC PayslipDokumen1 halamanSep2022 STFC PayslipAjith NandhaBelum ada peringkat

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Dokumen1 halaman2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanBelum ada peringkat

- Servlet ControllerDokumen1 halamanServlet Controllermukesh sahuBelum ada peringkat

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Dokumen1 halamanMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanBelum ada peringkat

- Employee Details Payment & Working Days Details Location Details Nilu KumariDokumen1 halamanEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagBelum ada peringkat

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDokumen1 halamanPay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyBelum ada peringkat

- Payslip 5 2021Dokumen1 halamanPayslip 5 2021Mehraj PashaBelum ada peringkat

- Salary SlipDokumen1 halamanSalary SlipPranav Kumar100% (1)

- PayslipDokumen6 halamanPayslipmohamed arabathBelum ada peringkat

- PDF 472850270150723Dokumen1 halamanPDF 472850270150723Pijush SinhaBelum ada peringkat

- EPF Universal Account Number: LIC ID / Policy IDDokumen2 halamanEPF Universal Account Number: LIC ID / Policy IDBiswajit DasBelum ada peringkat

- Kelly PayslipDokumen1 halamanKelly PayslipadtyshkhrBelum ada peringkat

- 157salaryslip g5sxl3g6Dokumen1 halaman157salaryslip g5sxl3g6Shakti NaikBelum ada peringkat

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDokumen124 halamanEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinBelum ada peringkat

- Payslip For BeginnerDokumen1 halamanPayslip For BeginnerKhan SahbBelum ada peringkat

- Earnings Deductions: B9 Beverages LimitedDokumen1 halamanEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyBelum ada peringkat

- Amount in Words Is Rupees Eleven Thousand Six OnlyDokumen1 halamanAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshBelum ada peringkat

- India Payslip January 2023 PDFDokumen1 halamanIndia Payslip January 2023 PDFN RamPrasadBelum ada peringkat

- Employee Details Payment & Leave Details: Arrears Current AmountDokumen1 halamanEmployee Details Payment & Leave Details: Arrears Current AmountAkhila ChinniBelum ada peringkat

- Servlet ControllerDokumen1 halamanServlet ControllerYashasvi GuptaBelum ada peringkat

- PaySlip1 OctDokumen1 halamanPaySlip1 Octjesten jadeBelum ada peringkat

- Salary Slip 07Dokumen1 halamanSalary Slip 07Parveen SainiBelum ada peringkat

- PayslipDokumen3 halamanPayslipWILLOFDREAMBelum ada peringkat

- Salary Slip MayDokumen1 halamanSalary Slip MayhappytiwariBelum ada peringkat

- Payslip 11860967 AugDokumen1 halamanPayslip 11860967 Augshreya arunBelum ada peringkat

- Divi Atchut Kumar - TCL11442 - April - 2021 - Employee - Basic - PayslipDokumen1 halamanDivi Atchut Kumar - TCL11442 - April - 2021 - Employee - Basic - PayslipDivi AtchutBelum ada peringkat

- Payslip 172820180712150142Dokumen1 halamanPayslip 172820180712150142LakshmananBelum ada peringkat

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Dokumen1 halamanEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerBelum ada peringkat

- Salary SlipDokumen1 halamanSalary SlipSanjay SolankiBelum ada peringkat

- Square Yards Consulting Private Limited: Payslip For The Month of April 2023Dokumen1 halamanSquare Yards Consulting Private Limited: Payslip For The Month of April 2023Neelesh PandeyBelum ada peringkat

- Kirandeep September SalaryDokumen1 halamanKirandeep September Salaryprince.gill07Belum ada peringkat

- Runi 1816Dokumen1 halamanRuni 1816Harsh JasaniBelum ada peringkat

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDokumen1 halaman3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiBelum ada peringkat

- The History of Origin and Growth of Merchant Banking Throughout The WorldDokumen18 halamanThe History of Origin and Growth of Merchant Banking Throughout The WorldJeegar Shah0% (1)

- Republic Act No. 11131Dokumen12 halamanRepublic Act No. 11131Nikko PedrozaBelum ada peringkat

- Tertiary ActivitiesDokumen5 halamanTertiary Activitieshimanshu singhBelum ada peringkat

- SOP Regulation Rate Charges and Terms&ConditionDokumen12 halamanSOP Regulation Rate Charges and Terms&ConditionSPIgroupBelum ada peringkat

- Navig8 Almandine - Inv No 2019-002 - Santa Barbara Invoice + Voucher PDFDokumen2 halamanNavig8 Almandine - Inv No 2019-002 - Santa Barbara Invoice + Voucher PDFAnonymous MoQ28DEBPBelum ada peringkat

- GMS 4.07 Web Client - Operator Guide v1.0Dokumen30 halamanGMS 4.07 Web Client - Operator Guide v1.0DANILO AYALABelum ada peringkat

- Peaceful Settlement of Disputes - Dr. Walid Abdulrahim Professor of LawDokumen18 halamanPeaceful Settlement of Disputes - Dr. Walid Abdulrahim Professor of LawThejaBelum ada peringkat

- New YESDokumen345 halamanNew YESnaguficoBelum ada peringkat

- Read The Passage Given Carefully and Answer The QuestionsDokumen2 halamanRead The Passage Given Carefully and Answer The QuestionsgovinjementahBelum ada peringkat

- Rules World Armwrestling Federation (WAF)Dokumen14 halamanRules World Armwrestling Federation (WAF)Ison StudiosBelum ada peringkat

- Daniel 6:1-10 - LIARS, LAWS & LIONSDokumen7 halamanDaniel 6:1-10 - LIARS, LAWS & LIONSCalvary Tengah Bible-Presbyterian ChurchBelum ada peringkat

- Sales Agency AgreementDokumen12 halamanSales Agency AgreementABINASH MAHAPATRABelum ada peringkat

- CH 12 - Fraud and ErrorDokumen5 halamanCH 12 - Fraud and ErrorJwyneth Royce DenolanBelum ada peringkat

- SFA HANDBOOK 201-280 Registration ProceduresDokumen80 halamanSFA HANDBOOK 201-280 Registration ProceduresGraeme NichollsBelum ada peringkat

- II Sem English NotesDokumen8 halamanII Sem English NotesAbishek RajuBelum ada peringkat

- It deters criminals from committing serious crimes. Common sense tells us that the most frightening thing for a human being is to lose their life; therefore, the death penalty is the best deterrent when it comes (1).pdfDokumen3 halamanIt deters criminals from committing serious crimes. Common sense tells us that the most frightening thing for a human being is to lose their life; therefore, the death penalty is the best deterrent when it comes (1).pdfJasmine AlbaBelum ada peringkat

- Download Full Test Bank For South Western Federal Taxation 2021 Corporations Partnerships Estates And Trusts 44Th Edition William A Raabe James C Young Annette Nellen William H Hoffman Jr David M Mal pdf docx full chapter chapterDokumen36 halamanDownload Full Test Bank For South Western Federal Taxation 2021 Corporations Partnerships Estates And Trusts 44Th Edition William A Raabe James C Young Annette Nellen William H Hoffman Jr David M Mal pdf docx full chapter chapterpannageimban.81c15100% (8)

- Philippine Drug Enforcement Agency: Regional Office VIIIDokumen2 halamanPhilippine Drug Enforcement Agency: Regional Office VIIIBerga Hi TaaBelum ada peringkat

- Investigación y Proyecto de Tesis: Módulo 2Dokumen51 halamanInvestigación y Proyecto de Tesis: Módulo 2Joel DíazBelum ada peringkat

- Asiavest Merchant Bankers V CADokumen3 halamanAsiavest Merchant Bankers V CAXtina MolinaBelum ada peringkat

- Taxation 2 Project - UG18-54Dokumen12 halamanTaxation 2 Project - UG18-54ManasiBelum ada peringkat

- Bro Foreclosed PropertyDokumen19 halamanBro Foreclosed PropertyAnthony SerranoBelum ada peringkat

- S.No Ward Zone License No License Validity Date Hawker Type Name Age Fathar/Husband NameDokumen41 halamanS.No Ward Zone License No License Validity Date Hawker Type Name Age Fathar/Husband NameSandeep DhimanBelum ada peringkat

- M - Use of Magallanes Coliseum - Mco - 100818Dokumen2 halamanM - Use of Magallanes Coliseum - Mco - 100818Mai MomayBelum ada peringkat

- PDS (PNP) - 2Dokumen5 halamanPDS (PNP) - 2Deng HarborBelum ada peringkat

- Partnership: Owned by TWO or MORE People. Share Profits Equally. The Owner Is Called A PartnerDokumen14 halamanPartnership: Owned by TWO or MORE People. Share Profits Equally. The Owner Is Called A PartnerGiann Lorrenze Famisan RagatBelum ada peringkat

- KMRC MTN 2021 Information Memorandum January 2022Dokumen142 halamanKMRC MTN 2021 Information Memorandum January 2022K MBelum ada peringkat

- State vs. Johnny Church (Drew Blahnik)Dokumen15 halamanState vs. Johnny Church (Drew Blahnik)Michael Howell100% (1)

- Presentation On Home Loan DocumentationDokumen16 halamanPresentation On Home Loan Documentationmesba_17Belum ada peringkat

- Annual Return: Form No. Mgt-7Dokumen19 halamanAnnual Return: Form No. Mgt-7Shivani KelvalkarBelum ada peringkat