2011-06-08 UniCredit Markets Today

Diunggah oleh

kjlaqiDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2011-06-08 UniCredit Markets Today

Diunggah oleh

kjlaqiHak Cipta:

Format Tersedia

8 June 2011 Economics & FI/FX Research

Markets Today

News and Events MONEY MARKET FUTURES

Euribor Last 1D ch (bp) 1M ch (bp)

■ Fed: Yesterday, Bernanke said the recovery is “frustratingly slow, Jun11 1.49 1.5 -3.0

uneven and well below potential”, and that the current accommodative Sep11 1.74 1.0 -5.0

monetary policy stance is still needed. Dec11 1.93 2.5 -6.0

■ JN: April trade balance recorded a JPY 417.5bn deficit. In the first 20 Mar12 2.06 3.5 -8.0

days of May the trade deficit was JPY 1.05tn. Eurodollar Last 1D ch (bp) 1M ch (bp)

■ GE (I): In April, exports plunged by 5.5% mom, while imports declined by Jun11 0.26 -0.3 -2.3

Sep11 0.33 -0.5 0.0

2.5%. Accordingly, the trade surplus narrowed to EUR 10.9bn from

Dec11 0.39 -0.5 -2.0

18.8bn in the previous month.

Mar12 0.47 0.0 -8.0

■ GE (II): We expect April industrial production to grow 0.2% mom (vs. Sterling Last 1D ch (bp) 1M ch (bp)

0.7% in March). Jun11 0.83 0.0 0.0

■ EMU: The GDP expenditure breakdown for 1Q11 will be released today. Sep11 0.90 0.0 -3.0

We expect that the upside surprise came from domestic demand, but net Dec11 1.01 0.0 -8.0

exports are expected to have added to growth as well. Mar12 1.13 0.0 -12.0

■ US: Today, the Fed will publish the Beige Book. GOVERNMENT BOND YIELDS

EGB Last 1D ch (bp) 1M ch (bp)

(C.Corsa, UniCredit Bank Milan)

2Y (BKO Mar13) 1.65 4.5 -4

5Y (DE0 Feb16) 2.34 4.1 -10

FI/FX Strategy 10Y (DBR Jan21) 3.04 5.4 -3

■ Mkt recap/Overnight: Yesterday, some improvement in risk appetite 30Y (DBR Jul40) 3.63 5.4 0

and a bit of supply pressure (from Belgium) pushed Bund yields up. The 2/10 138 1 2

10Y closed just below 3.10% (+7bp) while the 2Y rose to 1.71%. UST Last 1D ch (bp) 1M ch (bp)

Bernanke's dovish tone weighed on US equities and helped USTs 2Y (T Mar13) 0.38 -0.9 -14

5Y (T Nov15) 1.36 -1.6 -31

erasing previous losses. The 2Y yield hit its lowest level since November.

10Y (T Feb21) 2.96 1.0 -21

■ FI view: Market uncertainty remains high and a light data calendar today

30Y (T Feb40) 4.25 0.7 -6

should favor choppy trading. News regarding Greece remains a wildcard. 2/10 258 2 -7

Bunds might remain on the sell side ahead of the ECB meeting UK Last 1D ch (bp) 1M ch (bp)

tomorrow, with yields edging up especially at the short end. 2Y (GB0 Mar13) 0.88 1.1 -10

■ IT (I): Italy has mandated banks to sell a new 15Y BTPei 15Sep2026. A 5Y (UKT Sep15) 1.90 2.5 -13

linear interpolation of BTPei Sep23 and BTPeiSep41 yields a BE level in 10Y (UKT Sep20) 3.33 6.4 -3

the 210/212bp area. Subtracting this from the BTP Mar26 yield level, 30Y (UKT Dec40) 4.21 6.7 1

results in a real yield of ca. 2.98%, 25bp above the BTPei Sep23. OATei 2/10 245 5.3 7

10Y Spreads Last 1D ch (bp) 1M ch (bp)

Jul27 trades at 1.61% with a BE (vs. OAT Apr26) of 223bp.

T/Bund (time adj.) -7 -6 -12

■ IT (II): On 10 June, Italy will sell EUR 6bn of 12M BOT 15Jun12, much

UKT/Bund 26 1 -1

less than the EUR 10.1bn expiring (EUR 6.6bn from a 12M and EUR BTP/Bund (2020) 164 2 0

3.5bn form a 3M). On 14 June, it will reopen the BTP 3.75% Apr16, while GGB/Bund (2020) 1271 -1 19

it will not sell long maturity bonds. SPGB/Bund 233 1 5

■ FX View: The USD remains on offer after the dovish Fed Bernanke, but PGB/Bund (2020) 722 0 20

the upcoming ECB & BoE meetings may still spark some book squaring CURRENCIES

later today, also taking into account that the data calendar is fairly light. Currencies Last 1D ch (%) 1M ch (%)

EUR-USD 1.4674 0.7 2.2

■ EUR: Debate about the definitive green light to the new rescue plan for

USD-JPY 80.06 0.0 -0.4

Greece did not prevent investors from pushing EUR-USD towards 1.47. USD-CHF 0.8365 0.2 -4.0

We would remain long ahead of the ECB’s verdict tomorrow. GBP-USD 1.6427 0.4 0.1

■ CHF: EUR-CHF managed to recover back to 1.23, as the SNB may stay EUR-JPY 117.48 0.6 1.8

on hold on rates next week. Indeed, as long as USD-CHF stays below EUR-GBP 0.8933 0.2 2.0

0.85, EUR-CHF upside potential should remain quite limited. EUR-CHF 1.2274 0.9 -2.0

EUR-SEK 9.01 -0.1 0.3

■ GBP: Cable holding the line above 1.64, despite weak UK data, indicates EUR-NOK 7.84 0.0 -0.2

that sterling is largely USD dependent for now and that any EUR-GBP OVERNIGHT

break above 0.90 should be capped, even in case of a firmer EUR-USD. Last O'night 1m ch. (%)

■ NZD: The RBNZ should remain on hold on rates tonight, but may sound S&P 1284.9 -0.60% -3.9%

slightly more hawkish in its statement. In turn, this may push NZD-USD Nikkei 9449.0 0.06% -2.1%

above 0.8250 and AUD-NZD back to the 1.2950/1.29 area. Oil (WTI) 98.7 0.20% -5.6%

O’night denotes changes between 6:00 pm and 7:45 am

■ NOK: Norway’s industrial production should reveal a sound 0.5% mom

Prices at: 08:00 a.m.

rise for April today. However, this will not be sufficient to trigger a EUR-

Bloomberg: UCGR, UCFR

NOK sustained break towards the 7.82 base again. Internet: www.research.unicreditgroup.eu

(L.Cazzulani, C. Cremonesi, E. Lattuga, R. Mialich, UniCredit Bank Milan)

UniCredit Research page 1 See last pages for disclaimer.

8 June 2011 Economics & FI/FX Research

Markets Today

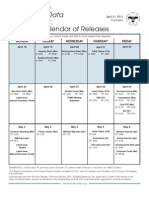

DATA & EVENTS CALENDAR

Time UniCredit Exp. Mkt

Country Data Period Consensus Previous

(CET) Est. Impact

08 June

09.00 EU EU Rehn speaks on Governance to EU Parliament - - - - *

10.00 NO Industrial Production (mom) Apr - 0.5% 0.9% *

11.00 IT Bank of Italy Lending & Bad Debt Data Apr - - - *

11.00 EU GDP (qoq/yoy) 1QP 0.8/2.5% 0.8/2.5% 0.8/2.5% **

12.00 GE Industrial Production (mom) Apr 0.2% 0.1% 0.7% ***

14.15 CA Housing Starts May - 184K 179K *

18.00 EU EU Rehn speaks in Koenigstein - - - - *

20.00 US Fed Beige Book - - - - ***

23.00 NZ RBNZ Cash Rate - 2.50% 2.50% 2.50% ***

09-June

01.50 JN GDP Annualized (yoy) 1QF - -3.1% -3.7% *

02.00 NZ MoF English speaks in Wellington - - - - *

03.15 NZ RBNZ Bollard speaks at Finance Select Committee - - - - **

03.30 AU Unemployment Rate May - 4.9% 4.9% *

*=low importance, ** =medium importance, *** = high importance

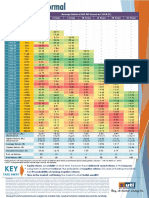

PRIMARY MARKET

Gross Supply Liquidity

Date Week day Country Bond in issue Amount Maturity bucket Country Bond Amount Cpn

redeemed Amount

(-) (-) IT New 15Y ILB, BTPei Sep26 3 - - ILB

08-Jun Wed FI RFGB Apr21 0 / 1.5 10Y

BKO 1 1/2

10-Jun Fri IT 12M BOT 6 MM GE 15

10Jun11

14-Jun Tue NL DSL Jan14 2.5 / 3.5 5Y

SP 12M & 18M T-bills 5 / 6 MM

14-Jun Tue IT BTP Apr16 3 / 3.5 5Y

GR 26W T-bills - - - MM

PGB 5.15

15-Jun Wed GE Schatz Jun13 6 - - 2Y PT 4.9 1.7

15Jun11

PT BT Sep11 & Dec11 0.75 / 1.25 MM

16-Jun Thu FR New Btan Aug16 & 3Y Btan 8.5 / 9 3Y & 5Y

FR OATei, OATi, BTNi auction 1.5 / 2 ILB

16-Jun Thu SP SPGB Apr21 & Jul26 3.5 / 4 10Y & 15Y

21-Jun Tue SP 3M & 6M T-bills 2 / 3 MM

NL New DSL Jan17 5 / 6 5Y

21-Jun Tue GR 13W T-bills - - - MM

BGB

22-Jun Wed GE Bund Jul21 4 - - 10Y BE 3

22Jun11

24-Jun Fri IT BTPei Sep16 1.5 / 2 ILB

27-Jun Mon BE 3Y, 5Y & 10Y BGB 3 / 3.5 3Y, 5Y &10Y

IT 6M BOT 9 - - MM

27-Jun Mon IT CTZ Apr13 2 / 2.5 CTZ

28-Jun Tue IT BTP Apr14 & BTP Sep21 6 / 6.5 3Y & 10Y

IT CCTeu Apr18 1.5 / 2 CCT

29-Jun Wed GE Obl Apr16 6 - - 5Y

CTZ

30-Jun Thu - - - - - - IT 12.1

30Jun11

Numbers and bonds in grey indicate our estimates.

UniCredit Research page 2 See last pages for disclaimer.

8 June 2011 Economics & FI/FX Research

Markets Today

Disclaimer

Our recommendations are based on information obtained from, or are based upon public information sources that we consider to be reliable but for the completeness and

accuracy of which we assume no liability. All estimates and opinions included in the report represent the independent judgment of the analysts as of the date of the issue. We reserve the

right to modify the views expressed herein at any time without notice. Moreover, we reserve the right not to update this information or to discontinue it altogether without notice.

This analysis is for information purposes only and (i) does not constitute or form part of any offer for sale or subscription of or solicitation of any offer to buy or subscribe for any

financial, money market or investment instrument or any security, (ii) is neither intended as such an offer for sale or subscription of or solicitation of an offer to buy or subscribe

for any financial, money market or investment instrument or any security nor (iii) as an advertisement thereof. The investment possibilities discussed in this report may not be

suitable for certain investors depending on their specific investment objectives and time horizon or in the context of their overall financial situation. The investments discussed

may fluctuate in price or value. Investors may get back less than they invested. Changes in rates of exchange may have an adverse effect on the value of investments.

Furthermore, past performance is not necessarily indicative of future results. In particular, the risks associated with an investment in the financial, money market or investment

instrument or security under discussion are not explained in their entirety.

This information is given without any warranty on an "as is" basis and should not be regarded as a substitute for obtaining individual advice. Investors must make their own

determination of the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy and their legal,

fiscal and financial position. As this document does not qualify as an investment recommendation or as a direct investment recommendation, neither this document nor any part

of it shall form the basis of, or be relied on in connection with or act as an inducement to enter into, any contract or commitment whatsoever. Investors are urged to contact their

bank's investment advisor for individual explanations and advice.

Neither UniCredit Bank AG, UniCredit Bank AG London Branch, UniCredit Bank AG Vienna Branch, UniCredit Bank AG Milan Branch, UniCredit Securities, UniCredit Menkul

Değerler A.Ş., UniCredit Bulbank, Zagrebačka banka, UniCredit Bank, Bank Pekao, Yapi Kredi, UniCredit Tiriac Bank, ATFBank nor any of their respective directors, officers or

employees nor any other person accepts any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or

otherwise arising in connection therewith.

This analysis is being distributed by electronic and ordinary mail to professional investors, who are expected to make their own investment decisions without undue reliance on

this publication, and may not be redistributed, reproduced or published in whole or in part for any purpose.

Responsibility for the content of this publication lies with:

a) UniCredit Bank AG, Am Tucherpark 16, 80538 Munich, Germany, (also responsible for the distribution pursuant to §34b WpHG). The company belongs to UCI Group.

Regulatory authority: “BaFin“ – Bundesanstalt für Finanzdienstleistungsaufsicht, Lurgiallee 12, 60439 Frankfurt, Germany.

b) UniCredit Bank AG London Branch, Moor House, 120 London Wall, London EC2Y 5ET, United Kingdom.

Regulatory authority: “BaFin“ – Bundesanstalt für Finanzdienstleistungsaufsicht, Lurgiallee 12, 60439 Frankfurt, Germany and subject to limited regulation by the Financial

Services Authority (FSA), 25 The North Colonnade, Canary Wharf, London E14 5HS, United Kingdom. Details about the extent of our regulation by the Financial Services

Authority are available from us on request.

c) UniCredit Bank AG Milan Branch, Via Tommaso Grossi 10, 20121 Milan, Italy, duly authorized by the Bank of Italy to provide investment services.

Regulatory authority: “Bank of Italy”, Via Nazionale 91, 00184 Roma, Italy and Bundesanstalt für Finanzdienstleistungsaufsicht, Lurgiallee 12, 60439 Frankfurt, Germany.

d) UniCredit Bank AG Vienna Branch, Julius-Tandler-Platz 3, 1090 Vienna, Austria

Regulatory authority: Finanzmarktaufsichtsbehörde (FMA), Praterstrasse 23, 1020 Vienna, Austria and subject to limited regulation by the “BaFin“ – Bundesanstalt für Finanz-

dienstleistungsaufsicht, Lurgiallee 12, 60439 Frankfurt, Germany. Details about the extent of our regulation by the Bundesanstalt für Finanzdienstleistungsaufsicht are available

from us on request.

e) UniCredit Securities, Boulevard Ring Office Building, 17/1 Chistoprudni Boulevard, Moscow 101000, Russia

Regulatory authority: Federal Service on Financial Markets, 9 Leninsky prospekt, Moscow 119991, Russia

f) UniCredit Menkul Değerler A.Ş., Büyükdere Cad. No. 195, Büyükdere Plaza Kat. 5, 34394 Levent, Istanbul, Turkey

Regulatory authority: Sermaye Piyasası Kurulu – Capital Markets Board of Turkey, Eskişehir Yolu 8.Km No:156, 06530 Ankara, Turkey

g) UniCredit Bulbank, Sveta Nedelya Sq. 7, BG-1000 Sofia, Bulgaria

Regulatory authority: Financial Supervision Commission (FSC), 33 Shar Planina str.,1303 Sofia, Bulgaria

h) Zagrebačka banka, Paromlinska 2, HR-10000 Zagreb, Croatia

Regulatory authority: Croatian Agency for Supervision of Financial Services, Miramarska 24B, 10000 Zagreb, Croatia

i) UniCredit Bank, Na Príkope 858/20, CZ-11121 Prague, Czech Republic

Regulatory authority: CNB Czech National Bank, Na Příkopě 28, 115 03 Praha 1, Czech Republic

j) Bank Pekao, ul. Grzybowska 53/57, PL-00-950 Warsaw, Poland

Regulatory authority: Polish Financial Supervision Authority, Plac Powstańców Warszawy 1, 00-950 Warsaw, Poland

k) UniCredit Bank, Prechistenskaya emb. 9, RF-19034 Moscow, Russia

Regulatory authority: Federal Service on Financial Markets, 9 Leninsky prospekt, Moscow 119991, Russia

l) UniCredit Bank, Šancova 1/A, SK-813 33 Bratislava, Slovakia

Regulatory authority: National Bank of Slovakia, Stefanikovo nam. 10/19, 967 01 Kremnica, Slovakia

m) Yapi Kredi, Yapi Kredi Plaza D Blok, Levent, TR-80620 Istanbul, Turkey

Regulatory authority: Sermaye Piyasası Kurulu – Capital Markets Board of Turkey, Eskişehir Yolu 8.Km No:156, 06530 Ankara, Turkey

n) UniCredit Tiriac Bank, Ghetarilor Street 23-25, RO-014106 Bucharest 1,Romania

Regulatory authority: CNVM, Romanian National Securities Commission, Foişorului street, no.2, sector 3, Bucharest, Romania

o) ATFBank, 100 Furmanov Str., KZ-050000 Almaty, Kazakhstan

Agency of the Republic of Kazakhstan on the state regulation and supervision of financial market and financial organisations, 050000, Almaty, 67 Aiteke Bi str., Kazakhstan

POTENTIAL CONFLICTS OF INTEREST

UniCredit Bank AG acts as a Specialist or Primary Dealer in government bonds issued by the Italian, Portuguese and Greek Treasury. Main tasks of the Specialist are to

participate with continuity and efficiency to the governments' securities auctions, to contribute to the efficiency of the secondary market through market making activity and

quoting requirements and to contribute to the management of public debt and to the debt issuance policy choices, also through advisory and research activities.

ANALYST DECLARATION

The author’s remuneration has not been, and will not be, geared to the recommendations or views expressed in this study, neither directly nor indirectly.

ORGANIZATIONAL AND ADMINISTRATIVE ARRANGEMENTS TO AVOID AND PREVENT CONFLICTS OF INTEREST

To prevent or remedy conflicts of interest, UniCredit Bank AG, UniCredit Bank AG London Branch, UniCredit Bank AG Vienna Branch, UniCredit Bank AG Milan Branch,

UniCredit Securities, UniCredit Menkul Değerler A.Ş., UniCredit Bulbank, Zagrebačka banka, UniCredit Bank, Bank Pekao, Yapi Kredi, UniCredit Tiriac Bank, ATFBank have

established the organizational arrangements required from a legal and supervisory aspect, adherence to which is monitored by its compliance department. Conflicts of interest

arising are managed by legal and physical and non-physical barriers (collectively referred to as “Chinese Walls”) designed to restrict the flow of information between one

area/department of UniCredit Bank AG, UniCredit Bank AG London Branch, UniCredit Bank AG Vienna Branch, UniCredit Bank AG Milan Branch, UniCredit Securities, UniCredit

Menkul Değerler A.Ş., UniCredit Bulbank, Zagrebačka banka, UniCredit Bank, Bank Pekao, Yapi Kredi, UniCredit Tiriac Bank, ATFBank and another. In particular, Investment

Banking units, including corporate finance, capital market activities, financial advisory and other capital raising activities, are segregated by physical and non-physical boundaries

from Markets Units, as well as the research department. In the case of equities execution by UniCredit Bank AG Milan Branch, other than as a matter of client facilitation or delta

hedging of OTC and listed derivative positions, there is no proprietary trading. Disclosure of publicly available conflicts of interest and other material interests is made in the

research. Analysts are supervised and managed on a day-to-day basis by line managers who do not have responsibility for Investment Banking activities, including corporate

finance activities, or other activities other than the sale of securities to clients.

UniCredit Research page 3 See last pages for disclaimer.

8 June 2011 Economics & FI/FX Research

Markets Today

ADDITIONAL REQUIRED DISCLOSURES UNDER THE LAWS AND REGULATIONS OF JURISDICTIONS INDICATED

Notice to Austrian investors

This document does not constitute or form part of any offer for sale or subscription of or solicitation of any offer to buy or subscribe for any securities and neither this document

nor any part of it shall form the basis of, or be relied on in connection with or act as an inducement to enter into, any contract or commitment whatsoever.

This document is confidential and is being supplied to you solely for your information and may not be reproduced, redistributed or passed on to any other person or published, in

whole or part, for any purpose.

Notice to Czech investors

This report is intended for clients of UniCredit Bank AG, UniCredit Bank AG London Branch, UniCredit Bank AG Vienna Branch, UniCredit Bank AG Milan Branch, UniCredit

Securities, UniCredit Menkul Değerler A.Ş., UniCredit Bulbank, Zagrebačka banka, UniCredit Bank, Bank Pekao, Yapi Kredi, UniCredit Tiriac Bank, ATFBank in the Czech

Republic and may not be used or relied upon by any other person for any purpose.

Notice to Italian investors

This document is not for distribution to retail clients as defined in article 26, paragraph 1(e) of Regulation n. 16190 approved by CONSOB on October 29, 2007. In the case of a

short note, we invite the investors to read the related company report that can be found on UniCredit Research website www.research.unicreditgroup.eu.

Notice to Japanese investors

This document does not constitute or form part of any offer for sale or subscription for or solicitation of any offer to buy or subscribe for any securities and neither this document

nor any part of it shall form the basis of, or be relied on in connection with or act as an inducement to enter into, any contract or commitment whatsoever.

Notice to Polish investors

This document is intended solely for professional clients as defined in Art. 3 39b of the Trading in Financial Instruments Act of 29 July 2005.The publisher and distributor of the

recommendation certifies that it has acted with due care and diligence in preparing the recommendation, however, assumes no liability for its completeness and accuracy.

Notice to Russian investors

As far as we are aware, not all of the financial instruments referred to in this analysis have been registered under the federal law of the Russian Federation "On the Securities

Market" dated 22 April 1996, as amended (the "Law"), and are not being offered, sold, delivered or advertised in the Russian Federation. This analysis is intended for qualified

investors, as defined by the Law, and shall not be distributed or disseminated to a general public and to any person, who is not a qualified investor.

Notice to Turkish investors

Investment information, comments and recommendations stated herein are not within the scope of investment advisory activities. Investment advisory services are provided in

accordance with a contract of engagement on investment advisory services concluded with brokerage houses, portfolio management companies, non-deposit banks and the

clients. Comments and recommendations stated herein rely on the individual opinions of the ones providing these comments and recommendations. These opinions may not suit

your financial status, risk and return preferences. For this reason, to make an investment decision by relying solely on the information stated here may not result in consequences

that meet your expectations.

Notice to UK investors

This communication is directed only at clients of UniCredit Bank AG, UniCredit Bank AG London Branch, UniCredit Bank AG Vienna Branch, UniCredit Bank AG Milan Branch,

UniCredit Securities, UniCredit Menkul Değerler A.Ş., UniCredit Bulbank, Zagrebačka banka, UniCredit Bank, Bank Pekao, Yapi Kredi, UniCredit Tiriac Bank, ATFBank in the

Czech Republic who (i) have professional experience in matters relating to investments or (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies,

unincorporated associations, etc.”) of the United Kingdom Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or (iii) to whom it may otherwise lawfully be

communicated (all such persons together being referred to as “relevant persons”). This communication must not be acted on or relied on by persons who are not relevant

persons. Any investment or investment activity to which this communication relates is available only to relevant persons and will be engaged in only with relevant persons.

Notice to U.S. investors

This report is being furnished to U.S. recipients in reliance on Rule 15a-6 ("Rule 15a-6") under the U.S. Securities Exchange Act of 1934, as amended. Each U.S. recipient of this

report represents and agrees, by virtue of its acceptance thereof, that it is such a "major U.S. institutional investor" (as such term is defined in Rule 15a-6) and that it understands

the risks involved in executing transactions in such securities. Any U.S. recipient of this report that wishes to discuss or receive additional information regarding any security or

issuer mentioned herein, or engage in any transaction to purchase or sell or solicit or offer the purchase or sale of such securities, should contact a registered representative of

UniCredit Capital Markets, LLC (“UCI Capital Markets”).

Any transaction by U.S. persons (other than a registered U.S. broker-dealer or bank acting in a broker-dealer capacity) must be effected with or through UCI Capital Markets.

The securities referred to in this report may not be registered under the U.S. Securities Act of 1933, as amended, and the issuer of such securities may not be subject to U.S.

reporting and/or other requirements. Available information regarding the issuers of such securities may be limited, and such issuers may not be subject to the same auditing and

reporting standards as U.S. issuers.

The information contained in this report is intended solely for certain "major U.S. institutional investors" and may not be used or relied upon by any other person for any purpose.

Such information is provided for informational purposes only and does not constitute a solicitation to buy or an offer to sell any securities under the Securities Act of 1933, as

amended, or under any other U.S. federal or state securities laws, rules or regulations. The investment opportunities discussed in this report may be unsuitable for certain

investors depending on their specific investment objectives, risk tolerance and financial position. In jurisdictions where UCI Capital Markets is not registered or licensed to trade in

securities, commodities or other financial products, transactions may be executed only in accordance with applicable law and legislation, which may vary from jurisdiction to

jurisdiction and which may require that a transaction be made in accordance with applicable exemptions from registration or licensing requirements.

The information in this publication is based on carefully selected sources believed to be reliable, but UCI Capital Markets does not make any representation with respect to its

completeness or accuracy. All opinions expressed herein reflect the author’s judgment at the original time of publication, without regard to the date on which you may receive

such information, and are subject to change without notice.

UCI Capital Markets may have issued other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. These publications

reflect the different assumptions, views and analytical methods of the analysts who prepared them. Past performance should not be taken as an indication or guarantee of future

performance, and no representation or warranty, express or implied, is provided in relation to future performance.

UCI Capital Markets and any company affiliated with it may, with respect to any securities discussed herein: (a) take a long or short position and buy or sell such securities; (b)

act as investment and/or commercial bankers for issuers of such securities; (c) act as market makers for such securities; (d) serve on the board of any issuer of such securities;

and (e) act as paid consultant or advisor to any issuer.

The information contained herein may include forward-looking statements within the meaning of U.S. federal securities laws that are subject to risks and uncertainties. Factors

that could cause a company’s actual results and financial condition to differ from expectations include, without limitation: political uncertainty, changes in general economic

conditions that adversely affect the level of demand for the company’s products or services, changes in foreign exchange markets, changes in international and domestic

financial markets and in the competitive environment, and other factors relating to the foregoing. All forward-looking statements contained in this report are qualified in their

entirety by this cautionary statement

This document may not be distributed in Canada or Australia.

UniCredit Research page 4 See last pages for disclaimer.

8 June 2011 Economics & FI/FX Research

Markets Today

UniCredit Research*

Thorsten Weinelt, CFA Dr. Ingo Heimig

Global Head of Research & Chief Strategist Head of Research Operations

+49 89 378-15110 +49 89 378-13952

thorsten.weinelt@unicreditgroup.de ingo.heimig@unicreditgroup.de

Economics & FI/FX Research

Economics & Commodity Research EEMEA Economics & FI/FX Strategy

European Economics Gillian Edgeworth, Chief EEMEA Economist

+44 0207 826 1772, gillian.edgeworth@unicredit.eu

Marco Valli, Chief Eurozone Economist

+39 02 8862-8688 Gyula Toth, Head of EEMEA FI/FX Strategy

marco.valli@unicredit.eu +43 50505 823-62, gyula.toth@unicreditgroup.at

Andreas Rees, Chief German Economist Güldem Atabay, Economist, Turkey

+49 89 378-12576 +90 212 385 9551, guldem.atabay@unicreditgroup.com.tr

andreas.rees@unicreditgroup.de

Dmitry Gourov, Economist, EEMEA

Stefan Bruckbauer, Chief Austrian Economist +43 50505 823-64, dmitry.gourov@unicreditgroup.at

+43 50505 41951

stefan.bruckbauer@unicreditgroup.at Hans Holzhacker, Chief Economist, Kazakhstan

+7 727 244-1463, h.holzhacker@atfbank.kz

Tullia Bucco

+39 02 8862-2079 Marcin Mrowiec, Chief Economist, Poland

tullia.bucco@unicredit.eu +48 22 656-0678, marcin.mrowiec@pekao.com.pl

Chiara Corsa Rozália Pál, Ph.D., Chief Economist, Romania

+39 02 8862-2209 +40 21 203-2376, rozalia.pal@unicredit.ro

chiara.corsa@unicredit.eu Kristofor Pavlov, Chief Economist, Bulgaria

Dr. Loredana Federico +359 2 9269-390, kristofor.pavlov@unicreditgroup.bg

+39 02 8862-3180 Goran Šaravanja, Chief Economist, Croatia

loredana.federico@unicredit.eu +385 1 6006-678, goran.saravanja@unicreditgroup.zaba.hr

Mauro Giorgio Marrano Pavel Sobisek, Chief Economist, Czech Republic

+39 02 8862-8222 +420 2 211-12504, pavel.sobisek@unicreditgroup.cz

mauro.giorgiomarrano@unicredit.eu

Dmitry Veselov, Ph.D., Economist, EEMEA

Alexander Koch, CFA +44 207 826 1808, dmitry.veselov@unicredit.eu

+49 89 378-13013

alexander.koch1@unicreditgroup.de Vladimír Zlacký, Chief Economist, Slovakia

+421 2 4950-2267, vladimir.zlacky@unicreditgroup.sk

Chiara Silvestre

chiara.silvestre@unicredit.eu

Global FI/FX Strategy

US Economics Michael Rottmann, Head

+49 89 378-15121, michael.rottmann1@unicreditgroup.de

Dr. Harm Bandholz, CFA, Chief US Economist

+1 212 672 5957 Dr. Luca Cazzulani, Deputy Head, FI Strategy

harm.bandholz@unicredit.eu +39 02 8862-0640, luca.cazzulani@unicredit.eu

Chiara Cremonesi, FI Strategy

Commodity Research +44 20 7826-1771, chiara.cremonesi@unicredit.eu

Jochen Hitzfeld Elia Lattuga, FI Strategy

+49 89 378-18709 +39 02 8862-2027, elia.lattuga@unicredit.eu

jochen.hitzfeld@unicreditgroup.de

Armin Mekelburg, FX Strategy

Nikolaus Keis +49 89 378-14307, armin.mekelburg@unicreditgroup.de

+49 89 378-12560

Roberto Mialich, FX Strategy

nikolaus.keis@unicreditgroup.de

+39 02 8862-0658, roberto.mialich@unicredit.eu

Kornelius Purps, FI Strategy

+49 89 378-12753, kornelius.purps@unicreditgroup.de

Herbert Stocker, Technical Analysis

+49 89 378-14305, herbert.stocker@unicreditgroup.de

Publication Address

UniCredit Research

Corporate & Investment Banking Bloomberg

UniCredit Bank AG Milan Branch UCGR

Economics & FI/FX Research

Via Tommaso Grossi, 10 - 20121 Milan Internet

Tel +39 02 8862.2019 - Fax +39 02 8862.2585 www.research.unicreditgroup.eu

*UniCredit Research is the joint research department of UniCredit Bank AG (UniCredit Bank), UniCredit CAIB Group (UniCredit CAIB), UniCredit Securities (UniCredit Securities),

UniCredit Menkul Değerler A.Ş. (UniCredit Menkul), UniCredit Bulbank, Zagrebačka banka, UniCredit Bank, Bank Pekao, Yapi Kredi, UniCredit Tiriac Bank and ATFBank.

UniCredit Research page 5 See last pages for disclaimer.

Anda mungkin juga menyukai

- Acc 501 Midterm Solved MCQ SDokumen697 halamanAcc 501 Midterm Solved MCQ Sbani100% (3)

- 2011-06-07 Natixis The Eurozone-France Inflation Differential at Its Highest Level in Ten Years - Causes and OutlookDokumen3 halaman2011-06-07 Natixis The Eurozone-France Inflation Differential at Its Highest Level in Ten Years - Causes and OutlookkjlaqiBelum ada peringkat

- Hull OFOD10e MultipleChoice Questions Only Ch08Dokumen4 halamanHull OFOD10e MultipleChoice Questions Only Ch08Kevin Molly KamrathBelum ada peringkat

- Double in A Day Forex TechniqueDokumen11 halamanDouble in A Day Forex Techniqueabdulrazakyunus75% (4)

- Global - Macro - Weekly - 8 March 2019 PDFDokumen60 halamanGlobal - Macro - Weekly - 8 March 2019 PDFchaotic_pandemoniumBelum ada peringkat

- Advanced Financial Accounting 11th Edition Christensen Test BankDokumen51 halamanAdvanced Financial Accounting 11th Edition Christensen Test BankHeatherRobertstwopa100% (29)

- Import Dropped Due To Covid-19 Disruption 16 Mar 2020Dokumen3 halamanImport Dropped Due To Covid-19 Disruption 16 Mar 2020botoy26Belum ada peringkat

- Global Markets Minesweeper: F e B R U A R y 6, 2 0 1 5Dokumen4 halamanGlobal Markets Minesweeper: F e B R U A R y 6, 2 0 1 5anisdangasBelum ada peringkat

- JUL 22 DanskeDailyDokumen3 halamanJUL 22 DanskeDailyMiir ViirBelum ada peringkat

- JUL 15 DanskeDailyDokumen3 halamanJUL 15 DanskeDailyMiir ViirBelum ada peringkat

- UniCredit - Friday Notes 29.9.10Dokumen31 halamanUniCredit - Friday Notes 29.9.10jockxyzBelum ada peringkat

- Capital Daily (13th Nov 08)Dokumen3 halamanCapital Daily (13th Nov 08)babytooth2100% (1)

- Woori Daily 221110Dokumen2 halamanWoori Daily 221110Teuku Hendry AndreanBelum ada peringkat

- Economic Calendar Us LAST WEEKDokumen6 halamanEconomic Calendar Us LAST WEEKMo AlamBelum ada peringkat

- JUL 19 DanskeDailyDokumen3 halamanJUL 19 DanskeDailyMiir ViirBelum ada peringkat

- JUL 13 Danske Research DanskeDailyDokumen3 halamanJUL 13 Danske Research DanskeDailyMiir ViirBelum ada peringkat

- Morning Call - June 3 2010Dokumen7 halamanMorning Call - June 3 2010chibondkingBelum ada peringkat

- Korean Financial Markets During January 2010Dokumen8 halamanKorean Financial Markets During January 2010Republic of Korea (Korea.net)Belum ada peringkat

- PHPDPF FJGDokumen9 halamanPHPDPF FJGfred607Belum ada peringkat

- RBCCapitalMarkets RBAminutesleavespacefortaperingU-turn Aug 17 2021Dokumen11 halamanRBCCapitalMarkets RBAminutesleavespacefortaperingU-turn Aug 17 2021Dylan AdrianBelum ada peringkat

- Morning Call June 21 2010Dokumen5 halamanMorning Call June 21 2010chibondkingBelum ada peringkat

- PHP 43 L TMIDokumen5 halamanPHP 43 L TMIfred607Belum ada peringkat

- Weekly Observatory Weekly Observatory: Latin LatinDokumen7 halamanWeekly Observatory Weekly Observatory: Latin Latinogutierrez3Belum ada peringkat

- AUG 04 UOB Global MarketsDokumen3 halamanAUG 04 UOB Global MarketsMiir ViirBelum ada peringkat

- Phpurt QKNDokumen7 halamanPhpurt QKNfred607Belum ada peringkat

- AUG 10 UOB Global MarketsDokumen3 halamanAUG 10 UOB Global MarketsMiir ViirBelum ada peringkat

- Danske Daily: Key NewsDokumen4 halamanDanske Daily: Key NewsMiir ViirBelum ada peringkat

- Economic CalendarDokumen12 halamanEconomic CalendarMaria januario TembeBelum ada peringkat

- 29 Juni 2023Dokumen4 halaman29 Juni 2023cahyono79Belum ada peringkat

- Phpiei KS0Dokumen5 halamanPhpiei KS0fred607Belum ada peringkat

- PHP GF QM2 KDokumen9 halamanPHP GF QM2 Kfred607Belum ada peringkat

- 2023 03 24 Weekly Economic ReleaseDokumen13 halaman2023 03 24 Weekly Economic ReleaseStephen EddlestonBelum ada peringkat

- PHP 3 LR M5 KDokumen7 halamanPHP 3 LR M5 Kfred607Belum ada peringkat

- Westpack JUN 16 Mornng ReportDokumen1 halamanWestpack JUN 16 Mornng ReportMiir ViirBelum ada peringkat

- ING FX TalkingDokumen20 halamanING FX TalkingCiocoiu Vlad AndreiBelum ada peringkat

- AUG 08 DanskeDailyDokumen4 halamanAUG 08 DanskeDailyMiir ViirBelum ada peringkat

- Economic CalendarDokumen6 halamanEconomic CalendarAtulBelum ada peringkat

- ABL Funds Manager Report - Conventional - August 2022Dokumen14 halamanABL Funds Manager Report - Conventional - August 2022Aniqa AsgharBelum ada peringkat

- Calendar of Releases: FinancialdataDokumen24 halamanCalendar of Releases: Financialdatarryan123123Belum ada peringkat

- ABL - FMR - JULY'23 ConventionalDokumen14 halamanABL - FMR - JULY'23 ConventionalAniqa AsgharBelum ada peringkat

- Monitor Markets 20230908Dokumen2 halamanMonitor Markets 20230908Kicki AnderssonBelum ada peringkat

- Commodity Eye Catchers of The Week: Buy MCX Copper (Feb) Around 443 SL 438 TGT 453Dokumen4 halamanCommodity Eye Catchers of The Week: Buy MCX Copper (Feb) Around 443 SL 438 TGT 453Padma SriBelum ada peringkat

- PHPV ZAQKbDokumen9 halamanPHPV ZAQKbfred607Belum ada peringkat

- Ashika Morning Report - 6.06.11Dokumen7 halamanAshika Morning Report - 6.06.11ratishblue7650Belum ada peringkat

- Stevo's Market Update 7-30-2010Dokumen10 halamanStevo's Market Update 7-30-2010HedgedInBelum ada peringkat

- US Fed Between A Stock and A Bond Place 100810Dokumen4 halamanUS Fed Between A Stock and A Bond Place 100810tuyetnt20016337Belum ada peringkat

- PHPW J2 FKQDokumen5 halamanPHPW J2 FKQfred607Belum ada peringkat

- Dow 12,288.17 +61.53 +0.50% S&P 500 1,336.32 +8.31 +0.63% Nasdaq 2,825.56 +21.21 +0.76%Dokumen6 halamanDow 12,288.17 +61.53 +0.50% S&P 500 1,336.32 +8.31 +0.63% Nasdaq 2,825.56 +21.21 +0.76%Andre_Setiawan_1986Belum ada peringkat

- Second Quarterly ReportDokumen67 halamanSecond Quarterly ReportsultanabidBelum ada peringkat

- JUL 23 DanskeDailyDokumen3 halamanJUL 23 DanskeDailyMiir ViirBelum ada peringkat

- ICICI PrudentialDokumen6 halamanICICI PrudentialMoumita DasBelum ada peringkat

- Market Commentary 3/6Dokumen10 halamanMarket Commentary 3/6pdoorBelum ada peringkat

- Daily Treasury Report0405-EnGDokumen3 halamanDaily Treasury Report0405-EnGBiliguudei AmarsaikhanBelum ada peringkat

- DailyNewsLetter - 20 Oct 10Dokumen3 halamanDailyNewsLetter - 20 Oct 10checrucifixBelum ada peringkat

- EGB Bond Analysis 20032023Dokumen7 halamanEGB Bond Analysis 20032023asdf23Belum ada peringkat

- AUG 11 UOB Global MarketsDokumen3 halamanAUG 11 UOB Global MarketsMiir ViirBelum ada peringkat

- Phpi 2 KB 84Dokumen5 halamanPhpi 2 KB 84fred607Belum ada peringkat

- 2011-05-04 Unicredit Euro Compass - How Long Before The Next Cyclical DownturnDokumen40 halaman2011-05-04 Unicredit Euro Compass - How Long Before The Next Cyclical DownturnkjlaqiBelum ada peringkat

- Daily Treasury Report0320 ENGDokumen3 halamanDaily Treasury Report0320 ENGBiliguudei AmarsaikhanBelum ada peringkat

- PHP Ilt KW KDokumen5 halamanPHP Ilt KW Kfred607Belum ada peringkat

- Surge in Chinese Imports: Morning ReportDokumen3 halamanSurge in Chinese Imports: Morning Reportnaudaslietas_lvBelum ada peringkat

- PHPG KWZAYDokumen5 halamanPHPG KWZAYfred607Belum ada peringkat

- Market Overview Weekly Analysis With Fundamental and Technical Outlook Important Events of The WeekDokumen6 halamanMarket Overview Weekly Analysis With Fundamental and Technical Outlook Important Events of The WeekshivaBelum ada peringkat

- Useianalysis 20101211114753Dokumen5 halamanUseianalysis 20101211114753Gautham KoderiBelum ada peringkat

- Japan's Financial Crisis: Institutional Rigidity and Reluctant ChangeDari EverandJapan's Financial Crisis: Institutional Rigidity and Reluctant ChangeBelum ada peringkat

- 2011-06-17 LLOY Data Analysis - Greek TragedyDokumen4 halaman2011-06-17 LLOY Data Analysis - Greek TragedykjlaqiBelum ada peringkat

- 2011-07-12 LLOY European Risk - Oversold and Ready To Recover For Medium-TermDokumen9 halaman2011-07-12 LLOY European Risk - Oversold and Ready To Recover For Medium-TermkjlaqiBelum ada peringkat

- 2011-06-15 AXA IM Weekly Comment Japan - V-Shaped Rebound ConfirmedDokumen3 halaman2011-06-15 AXA IM Weekly Comment Japan - V-Shaped Rebound ConfirmedkjlaqiBelum ada peringkat

- 2011-06-28 Natixis Do Germans Work More Than Southern Europeans - No, They Work Much Less, and Not More IntenselyDokumen10 halaman2011-06-28 Natixis Do Germans Work More Than Southern Europeans - No, They Work Much Less, and Not More IntenselykjlaqiBelum ada peringkat

- 2011-06-17 Erste Financial Focus WeeklyDokumen14 halaman2011-06-17 Erste Financial Focus WeeklykjlaqiBelum ada peringkat

- 2011-06-27 HSBC FX Edge - EURUSD in The Bigger PictureDokumen4 halaman2011-06-27 HSBC FX Edge - EURUSD in The Bigger PicturekjlaqiBelum ada peringkat

- 2011-06-09 Scotia FX DailyDokumen3 halaman2011-06-09 Scotia FX DailykjlaqiBelum ada peringkat

- 2011-06-10 LLOY UK Consumer Discretionary Sector AnalysisDokumen3 halaman2011-06-10 LLOY UK Consumer Discretionary Sector AnalysiskjlaqiBelum ada peringkat

- 2011-06-16 Natixis Tunisia - What's Next After The Jasmine RevolutionDokumen11 halaman2011-06-16 Natixis Tunisia - What's Next After The Jasmine RevolutionkjlaqiBelum ada peringkat

- 2011-06-10 DBS Daily Breakfast SpreadDokumen8 halaman2011-06-10 DBS Daily Breakfast SpreadkjlaqiBelum ada peringkat

- 2011-06-10 UOB Asian MarketsDokumen2 halaman2011-06-10 UOB Asian MarketskjlaqiBelum ada peringkat

- 2011-06-06 Danske Flash Comm - Greece Is Likely To Get A Second Rescue Package SoonDokumen5 halaman2011-06-06 Danske Flash Comm - Greece Is Likely To Get A Second Rescue Package SoonkjlaqiBelum ada peringkat

- 2011-06-15 UOB Asian MarketsDokumen3 halaman2011-06-15 UOB Asian MarketskjlaqiBelum ada peringkat

- 2011-06-09 UniCredit - ECB Ready To HikeDokumen4 halaman2011-06-09 UniCredit - ECB Ready To HikekjlaqiBelum ada peringkat

- 2011-06-07 DBS Daily Breakfast SpreadDokumen8 halaman2011-06-07 DBS Daily Breakfast SpreadkjlaqiBelum ada peringkat

- 2011-06-08 DBS Daily Breakfast SpreadDokumen6 halaman2011-06-08 DBS Daily Breakfast SpreadkjlaqiBelum ada peringkat

- 2011-06-07 RMB Daily FXDokumen7 halaman2011-06-07 RMB Daily FXkjlaqiBelum ada peringkat

- 2011-06-07 Scotia Asian FX UpdateDokumen3 halaman2011-06-07 Scotia Asian FX UpdatekjlaqiBelum ada peringkat

- 2011-06-07 Forsyth Barr NZ Corporate Credit WeeklyDokumen8 halaman2011-06-07 Forsyth Barr NZ Corporate Credit WeeklykjlaqiBelum ada peringkat

- 2011-06-06 DBS Daily Breakfast SpreadDokumen9 halaman2011-06-06 DBS Daily Breakfast SpreadkjlaqiBelum ada peringkat

- Euro Area Housing Markets: A Temperature GaugeDokumen8 halamanEuro Area Housing Markets: A Temperature GaugekjlaqiBelum ada peringkat

- 2011-06-07 CommBank RBA Board Meeting - Rates UnchangedDokumen4 halaman2011-06-07 CommBank RBA Board Meeting - Rates UnchangedkjlaqiBelum ada peringkat

- 2011-06-07 Mitsubishi UFJ Britains Lessons in Monetary Failure - Devaluation and QE Procude Starkly Negative ResultsDokumen3 halaman2011-06-07 Mitsubishi UFJ Britains Lessons in Monetary Failure - Devaluation and QE Procude Starkly Negative ResultskjlaqiBelum ada peringkat

- 2011-06-03 LYOD UK Industrial Production Expected To Drop SharplyDokumen4 halaman2011-06-03 LYOD UK Industrial Production Expected To Drop SharplykjlaqiBelum ada peringkat

- 2011-06-03 Erste CEE FI & FX InsightsDokumen16 halaman2011-06-03 Erste CEE FI & FX InsightskjlaqiBelum ada peringkat

- United States: Real and Nominal Consumer SpendingDokumen8 halamanUnited States: Real and Nominal Consumer SpendingkjlaqiBelum ada peringkat

- 2011 Robeco Emergence of A Global Middle Class - Impact On CommoditiesDokumen7 halaman2011 Robeco Emergence of A Global Middle Class - Impact On CommoditieskjlaqiBelum ada peringkat

- 2011-06-03 Danske Flash US - Nonfarm Payroll Weak, But Probably Too WeakDokumen5 halaman2011-06-03 Danske Flash US - Nonfarm Payroll Weak, But Probably Too WeakkjlaqiBelum ada peringkat

- SDL NSDLDokumen2 halamanSDL NSDLNeha KrishnaniBelum ada peringkat

- Chapter 9-STOCK VALUATION-FIXDokumen33 halamanChapter 9-STOCK VALUATION-FIXRacing FirmanBelum ada peringkat

- Sensex Rolling ReturnsDokumen1 halamanSensex Rolling Returnsmaheshtech76Belum ada peringkat

- Debt Structure Interest Term Corporate Paper Capital Fixed Loan Legal Bank Supply Function Nbqbs PAY Crime CurrencyDokumen20 halamanDebt Structure Interest Term Corporate Paper Capital Fixed Loan Legal Bank Supply Function Nbqbs PAY Crime CurrencyMa. Kristine Laurice AmancioBelum ada peringkat

- Consolidated FDI Policy, 2017Dokumen113 halamanConsolidated FDI Policy, 2017Latest Laws TeamBelum ada peringkat

- MARS Portfolio Performance 31 MarchDokumen3 halamanMARS Portfolio Performance 31 MarchMukesh KumarBelum ada peringkat

- Fin358 Individual Assignment Nur Hazani 2020818012Dokumen12 halamanFin358 Individual Assignment Nur Hazani 2020818012nur hazaniBelum ada peringkat

- Portfolio Optimization Maximizing Returns and Reducing RiskDokumen8 halamanPortfolio Optimization Maximizing Returns and Reducing Riskpramodkumar808751528270Belum ada peringkat

- Project PPT in Mutual Fund SipDokumen13 halamanProject PPT in Mutual Fund SipNARASIMHA REDDYBelum ada peringkat

- 6 Pas 23 28 PDFDokumen1 halaman6 Pas 23 28 PDFcherry blossomBelum ada peringkat

- Morrissette ProfileAngelInvestors 2007Dokumen16 halamanMorrissette ProfileAngelInvestors 2007pattitil.ppBelum ada peringkat

- Capital Market in India ProjectDokumen26 halamanCapital Market in India ProjectNamrataShahaniBelum ada peringkat

- United States District Court Central District of California: 8:21-Cv-00403-Jvs-AdsxDokumen114 halamanUnited States District Court Central District of California: 8:21-Cv-00403-Jvs-Adsxtriguy_2010Belum ada peringkat

- Lecture Notes Topic 6 Student PDFDokumen94 halamanLecture Notes Topic 6 Student PDFAnDy YiMBelum ada peringkat

- Quiz 1 - Understanding Investments and Investment Alternatives - Attempt ReviewDokumen6 halamanQuiz 1 - Understanding Investments and Investment Alternatives - Attempt ReviewDivya chandBelum ada peringkat

- Annual Report Aces 2020Dokumen161 halamanAnnual Report Aces 2020Dua TigaBelum ada peringkat

- Statement of CashflowDokumen2 halamanStatement of CashflowAna Marie IllutBelum ada peringkat

- Cbip Q&aDokumen4 halamanCbip Q&aZerohedgeBelum ada peringkat

- Sec Form Auf-002-R: Securities and Exchange CommissionDokumen3 halamanSec Form Auf-002-R: Securities and Exchange CommissionRodolfo KhiaBelum ada peringkat

- Amanah Saham Nasional: January 2023Dokumen1 halamanAmanah Saham Nasional: January 2023Afif ApihBelum ada peringkat

- The Investing Secrets Of: ISA MillionairesDokumen6 halamanThe Investing Secrets Of: ISA MillionairesRamBelum ada peringkat

- Review Questions - CH 3Dokumen2 halamanReview Questions - CH 3bigbadbear30% (2)

- ChemaliteDokumen8 halamanChemaliteamitinfo_mishraBelum ada peringkat

- Advertising: Academic Year 2022-2023 Elective Courses (EC) Group B. Marketing ElectivesDokumen119 halamanAdvertising: Academic Year 2022-2023 Elective Courses (EC) Group B. Marketing ElectivesMilan JainBelum ada peringkat

- Chapter 7 - Portfolio Theory and The Capital Asset Model Pricing (Compatibility Mode)Dokumen21 halamanChapter 7 - Portfolio Theory and The Capital Asset Model Pricing (Compatibility Mode)Hanh TranBelum ada peringkat

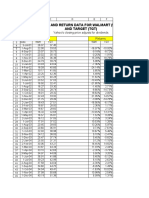

- Price and Return Data For Walmart (WMT) and Target (TGT) : Prices Returns Yahoo's Closing Price Adjusts For DividendsDokumen19 halamanPrice and Return Data For Walmart (WMT) and Target (TGT) : Prices Returns Yahoo's Closing Price Adjusts For DividendsSyed Ameer Ali ShahBelum ada peringkat