Financial Planning Sip Insurance or ULIP

Diunggah oleh

sharad_soni_2Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Financial Planning Sip Insurance or ULIP

Diunggah oleh

sharad_soni_2Hak Cipta:

Format Tersedia

business.outlookindia.

com |

http://money.outlookindia.com/printarticle.aspx?91022

Mutual Funds / Industrywatch

MAGAZINE | SEP 24, 2008

Dont let the free insurance bait lure you to new SIPs. a term plan plus MFs, or ULIPs make sense if you want to combine investing and insurance

SUNIL DHAWAN

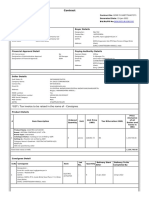

Theres no such thing as a free lunch as they say. That holds true for offers of free insurance with a systematic investment plan (SIP) being offered by some mutual funds. The cover comes at the cost of liquidity of funds. So, these plans do not give an investor the flexibility that open-ended mutual funds give. Before settling in for one of these product, it will be worthwhile to compare them with a similar productunit-linked insurance plans (Ulips)that combine insurance and investment. Consistent market volatility has put pressure on the inflow of funds in the coffers of asset management companies (AMCs) due to dwindling sales of mutual fund units. The offer of free insurance, along with SIPs, seems to be a bait to attract investors as well as to get regular income, the way insurers do. Although the sale of Ulips, also a marketrelated product, has also gone down due to weak stockmarkets, it has not affected life insurers kitty too much. This is because insurers at least have a passive inflow in the form of renewal premiums. ULIPs vs SIP WITH INSURANCE The products. For the financially disciplined, a pure term plan works best if the rest of the savings are being channelised into MFs. For others, Ulips do the job, albeit at a cost. The SIP with insurance plans work slightly differently (see One & One Makes Two? 27 August). Reliance SIP + Insure (RSIP), Birla Sun Life Century SIP (BSIP) and Kotak Star Kid are the only such products available in the market now. These offer a cover for the period the investor keeps his SIP alive. If there is no claim during the tenure, the SIP will continue like a normal one and the investor will get no insurance benefit. In BSIP, if death occurs mid-way, the nominee gets the sum assured as well as the fund value on the payout date. In the case of RSIP, the death benefit does not go to the nominee and instead gets reinvested along with other fund units. Here we take into account only RSIP and BSIP since Kotak Star Kid entails an additional 1.25 per cent entry cost. We compare these with Ulips that give the sum assured as well as the fund value in case of death. Amount of cover. The life cover in SIPs will depend entirely on the monthly contribution. Ulips, meanwhile, take into account factors like the age and term before fixing the cover. In a Ulip, a monthly premium of Rs 1,000 will fetch a cover of around Rs 4.86 lakh. On the other hand, in BSIP, the same amount will give a cover of just Rs 1 lakh, and that too after three years. In RSIP, the insurance cover will be Rs 3.60 lakh. To make the comparison clearer, heres another calculation. A 30-year-old who needs a cover of Rs 9 lakh over 15 years will have to make a monthly investment of Rs 9,000 in BSIP, or around Rs 2,500 in RSIP, or around Rs 2,400 in a Ulip. While in Ulips, the sum assured remains the same throughout the term, in RSIP and BSIP, the amount varies across different time periods. Maturity benefit. The front-end costs are higher in a Ulip than any SIP. However, low fund management charges in a Ulip helps generate a bigger corpus over the long term. The SIPs entail just two costsentry load of 2.25 per cent and the annual fund management charge of about 2.2 per

1 of 2

9/8/2009 8:36 PM

business.outlookindia.com |

http://money.outlookindia.com/printarticle.aspx?91022

cent. Ulips, on the other hand, normally charge six to eight costs. In our example above, if the 30-year-old invests Rs 2,500 per month in any of the two SIPs being discussed here, the maturity benefit will come to Rs 8.29 lakh, assuming a growth of 10 per cent. In a Ulip, for the same amount and term, the maturity benefit would be Rs 8.34 lakh. For the Ulip, we assume an entry cost of 25 per cent each in the first two years, 3 per cent in the third and fourth years and 1 per cent thereafter (see The Benefits and Costs). Premium payment and redemption. Most Ulips give the flexibility of stopping premium payments, and making full or part redemption at no cost anytime after the initial five years. BSIP does not ask for regular payments. The investor can stop paying instalments after the first three years for a term of 55 years minus his age. However, any withdrawalfull or partor a fund switchover during the term would cancel the insurance cover. So, in order to retain the cover, the investor will have to leave his money locked in for longer periods. The good part is that there is no exit cost for such withdrawals. In RSIP, regular premium payment throughout the term is a must. Whats more, any withdrawal attracts an exit load of 2 per cent. In our example, if the investor exits in the 10th year, he would have to pay an exit load of around Rs 8,900, a price that you would have paid for a group cover for that period. This means that the insurance cover comes at a cost and is not really free. The investor is paying at the end of the term what he normally pays at the beginning in case of an insurance policy. WHAT TO DO The primary aim of investing in these SIPs should be investment and not insurance. Remember that your financial planning is not complete without a combination of a term plan and mutual funds, or a standalone Ulip. However, if you still want to go for these new products for your insurance needs, among the two discussed above, RSIP looks better placed. Before buying, make sure you fully understand the product. sunildhawan@outlookindia.com

http://money.outlookindia.com/article.aspx?91022

Money

| Profit | Business | Outlook | Traveller

Contact us

| Disclaimers | About us | Best Viewed With | Advertise

2 of 2

9/8/2009 8:36 PM

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Innovation and Design Thinking PDFDokumen20 halamanInnovation and Design Thinking PDFEnjoy ShesheBelum ada peringkat

- ch6 TestbankDokumen41 halamanch6 TestbankSoweirdBelum ada peringkat

- ScienceDirect Citations 1522851638967Dokumen42 halamanScienceDirect Citations 1522851638967Manoj KumarBelum ada peringkat

- Chapter 4 - Seat Work - Assignment #4 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDokumen3 halamanChapter 4 - Seat Work - Assignment #4 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDonise Ronadel SantosBelum ada peringkat

- Isms Scope Document: Code: ####### Confidentiality Level: Internal UseDokumen6 halamanIsms Scope Document: Code: ####### Confidentiality Level: Internal UseAparna Agarwal100% (1)

- Musharakah FinancingDokumen23 halamanMusharakah FinancingTayyaba TariqBelum ada peringkat

- Contoh Financial PlanDokumen4 halamanContoh Financial PlanJonathan ChandhikaBelum ada peringkat

- Managerial Accounting BBA 3rdDokumen3 halamanManagerial Accounting BBA 3rdNadeemBelum ada peringkat

- Marketing Glossary For InterviewDokumen14 halamanMarketing Glossary For Interviewramteja_hbs14Belum ada peringkat

- NestleDokumen8 halamanNestleYasmin khanBelum ada peringkat

- Marketing Plan OutlineDokumen16 halamanMarketing Plan OutlineAttila GárdosBelum ada peringkat

- Sap CMLDokumen5 halamanSap CMLabir_finance16Belum ada peringkat

- Exchange Rates ForecastingDokumen25 halamanExchange Rates ForecastingBarrath RamakrishnanBelum ada peringkat

- Airtel EcrmDokumen9 halamanAirtel EcrmParker SenBelum ada peringkat

- HR Issues and Activities in Mergers & AcquisitionsDokumen15 halamanHR Issues and Activities in Mergers & AcquisitionsPriyanka Narayanan100% (1)

- Executive SummaryDokumen1 halamanExecutive SummaryIdowu Abike HBelum ada peringkat

- Yoma Design Annual ReportDokumen60 halamanYoma Design Annual ReportSai MoonBelum ada peringkat

- BM Paper 1 Case Study May 2021Dokumen5 halamanBM Paper 1 Case Study May 2021Amr AwadBelum ada peringkat

- The Impact of International Experience On Firm Economic Per - 2023 - Journal ofDokumen14 halamanThe Impact of International Experience On Firm Economic Per - 2023 - Journal ofSamuel SilitongaBelum ada peringkat

- FAR - Learning Assessment 2 - For PostingDokumen6 halamanFAR - Learning Assessment 2 - For PostingDarlene JacaBelum ada peringkat

- Rajesh Ramesh Project ManagerDokumen7 halamanRajesh Ramesh Project ManagerAlex InfinityBelum ada peringkat

- Gemc 511687758407371 15012022Dokumen3 halamanGemc 511687758407371 15012022Preeti YaduBelum ada peringkat

- Chapter 1 - The Systems Development Environment - 2Dokumen23 halamanChapter 1 - The Systems Development Environment - 2Mahdi GhulamiBelum ada peringkat

- Technical AnalysisDokumen124 halamanTechnical Analysiskat10108100% (1)

- Service Flower of Insurance Sector - BMS - CoDokumen4 halamanService Flower of Insurance Sector - BMS - Co92Sgope100% (1)

- A5 - Ukio-1Dokumen8 halamanA5 - Ukio-1securify.fmsBelum ada peringkat

- Swift Gpi MT 103 Cash Transfer Auiomatic Direct Account (M0) .Eg.1bDokumen18 halamanSwift Gpi MT 103 Cash Transfer Auiomatic Direct Account (M0) .Eg.1bPraphon Vanaphitak80% (10)

- Managerial Accounting Garrison 15th Edition Solutions ManualDokumen36 halamanManagerial Accounting Garrison 15th Edition Solutions Manualbriber.soordus2a4j100% (41)

- The Essential Tax Guide - 2023 EditionDokumen116 halamanThe Essential Tax Guide - 2023 Editionธนวัฒน์ ปิยะวิสุทธิกุล100% (2)

- Multiple Choice Questions Distrubution Logistic PDFDokumen14 halamanMultiple Choice Questions Distrubution Logistic PDFYogesh Bantanur50% (2)