Pop 081710

Diunggah oleh

David E. Williams IIDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Pop 081710

Diunggah oleh

David E. Williams IIHak Cipta:

Format Tersedia

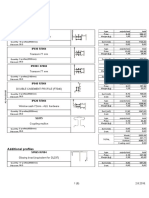

CAUSE NO. 352-247451-10 TERRY FLEENOR AND STEPHANIE FLEENOR V. AMERICAN HOME MORTGAGE SERVICING, INC.

IN THE DISTRICT COURT TARRANT COUNTY, TEXAS 352nd JUDICIAL DISTRICT

PLAINTIFFS ORIGINAL PETITION NOW COME Terry Fleenor and Stephanie Fleenor, Plaintiff and file this Original Petition, complaining of American Home Mortgage Servicing, Inc., Defendants and would respectfully show unto the Court as follows: NATURE OF THE CASE 1. This is a suit for damages for deceptive trade practices, and for breach of

an agreement, in connection with a mortgage loan modification. SUMMARY OF PLAINTIFFS CONTENTIONS 2. On about June 19, 2009, Plaintiffs entered into a loan modification During the

agreement with Defendant, American Home Mortgage Servicing, Inc.

negotiations about the Agreement, Plaintiffs informed Defendant that Plaintiffs had paid the property taxes that were due, by entering into a loan agreement with a company which agreed to loan the money for that purpose. PARTIES AND SERVICE 4. County Texas. 5. Defendant American Home Mortgage Servicing, Inc. is a corporation, and Plaintiffs Terry Fleenor and Stephanie Fleenor, are residents of Tarrant

may be served through its registered agent:

PLAINTIFFS ORIGINAL PETITION Page 1

American Home Mortgage Servicing, Inc. Through Its Registered Agent: CT Corporation System 350 N. St. Paul Dallas, TX 75201 by Certified Mail, Return Receipt Requested. DISCOVERY 6. Plaintiffs designate that discovery be conducted at Level 3, Texas Rules of

Civil Procedure. JURISDICTION AND VENUE 7. The State of Texas has jurisdiction over the parties because this suit is a

dispute over real property which is located in Tarrant County, 8. Venue is appropriate in Tarrant County because the loan in question

originated in Tarrant County, and the subject property is in Tarrant County, Texas. FACTS 9. On or about February 23, 2004, Plaintiffs signed a mortgage loan

agreement with Prime Lending for the home located at 608 Ragweed, Arlington, Texas. 10. On or about April 15, 2009, Plaintiffs borrowed money from Tax Loans

USA, LLC for the purpose of paying property taxes. 11. On or about July 1, 2009, Plaintiffs entered into a loan modification

agreement with Defendant, American Home Mortgage Servicing, Inc. 12. Plaintiffs informed Defendant that the property taxes had been paid and

the escrow funds should be re-allocated in accordance with applicable law. 13. Defendant failed and refused to re-allocate such funds.

PLAINTIFFS ORIGINAL PETITION Page 2

14.

As a result of Defendants failure and refusal to re-allocate the funds a,

Plaintiffs were forced to pay loans for taxes to Tax Loans USA, LLC. 15. As a proximate result of this double billing for taxes, Plaintiffs faced

financial difficulty and were forced to file for bankruptcy which they did on April 4, 2010. CAUSE OF ACTION: DECEPTIVE TRADE PRACTICES ACT 16. Defendant has engaged in deceptive trade practices in that they have failed

and refused to properly allocate Plaintiffs escrow funds and withhold from Plaintiffs escrow funds for property taxes, when in fact, property taxes had been paid. 17. Plaintiffs are consumers under the Texas Deceptive Trade Practices Act

because Plaintiffs are individuals residing in the State of Texas who sought services offered by Defendants doing business in the State of Texas. 18. Defendants violated the Texas Deceptive Trade Practices Act because

Defendant engaged in false, misleading, or deceptive acts or practices that Plaintiffs relied on to their detriment. TREBLE DAMAGES 19. Because Defendant and its agents acted knowingly, Plaintiffs are entitled

to recover treble damages under the Texas Deceptive Trade Practices Act, Texas Business & Commerce Code section 17.50(b)(1). 20. Defendants conduct was a producing cause of mental anguish suffered by

Plaintiffs for which Plaintiffs are entitled to recover damages. Defendants conduct was committed knowingly. At the time of the act and practices complained of, Defendant had

PLAINTIFFS ORIGINAL PETITION Page 3

actual awareness of the falsity, deception, or unfairness of the acts or practices giving rise to Plaintiffs claim. 21. Plaintiff seeks unliquidated damages in an amount that is within the

jurisdictional limits of the Court. ATTORNEYS FEES 22. Plaintiffs are entitled to recover reasonable and necessary attorney fees

under Texas Business & Commerce Code section 17.50(d). REQUEST FOR DISCLOSURE 23. Pursuant to Texas Rule of Civil Procedure 194, Defendant is requested to

disclose no later than thirty (30) days from receipt these matters contained within Rule 194.2 (a) through (l). PRAYER WHEREFORE, PREMISES CONSIDERED, Plaintiff prays for damages against Defendant, for general relief, for pre-judgment interest, for post-judgment interest, and for such other and further relief as they may show themselves to be entitled.

PLAINTIFFS ORIGINAL PETITION Page 4

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Jack Pumpkinhead of Oz - L. Frank BaumDokumen68 halamanJack Pumpkinhead of Oz - L. Frank BaumbobbyejayneBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Security and Azure SQL Database White PaperDokumen15 halamanSecurity and Azure SQL Database White PaperSteve SmithBelum ada peringkat

- MKTG How Analytics Can Drive Growth in Consumer Packaged Goods Trade PromotionsDokumen5 halamanMKTG How Analytics Can Drive Growth in Consumer Packaged Goods Trade PromotionsCultura AnimiBelum ada peringkat

- Wardancer 4e HomebrewDokumen3 halamanWardancer 4e HomebrewWyjecBelum ada peringkat

- Grammar Exercises AnswersDokumen81 halamanGrammar Exercises Answerspole star107100% (1)

- Privileged Communications Between Husband and Wife - Extension of PDFDokumen7 halamanPrivileged Communications Between Husband and Wife - Extension of PDFKitingPadayhagBelum ada peringkat

- Songs of KabirDokumen342 halamanSongs of KabirSant MatBelum ada peringkat

- SANCHEZ V DEMETRIOUDokumen3 halamanSANCHEZ V DEMETRIOUShenna SunicoBelum ada peringkat

- Educ 323 - The Teacher and School Curriculum: Course DescriptionDokumen16 halamanEduc 323 - The Teacher and School Curriculum: Course DescriptionCherry Lyn GaciasBelum ada peringkat

- Lsp404 How To Write An Argumentative Essay NewDokumen52 halamanLsp404 How To Write An Argumentative Essay Newagegae aegaegBelum ada peringkat

- GrandEsta - Double Eyelid Surgery PDFDokumen2 halamanGrandEsta - Double Eyelid Surgery PDFaniyaBelum ada peringkat

- HotsDokumen74 halamanHotsgecko195Belum ada peringkat

- K Unit 1 SeptemberDokumen2 halamanK Unit 1 Septemberapi-169447826Belum ada peringkat

- Plate Tectonics QuizDokumen6 halamanPlate Tectonics QuizJordan Santos100% (1)

- By Nur Fatin Najihah Binti NoruddinDokumen7 halamanBy Nur Fatin Najihah Binti NoruddinNajihah NoruddinBelum ada peringkat

- Rosa Chavez Rhetorical AnalysisDokumen7 halamanRosa Chavez Rhetorical Analysisapi-264005728Belum ada peringkat

- Phonetic Sounds (Vowel Sounds and Consonant Sounds)Dokumen48 halamanPhonetic Sounds (Vowel Sounds and Consonant Sounds)Jayson Donor Zabala100% (1)

- Lista Materijala WordDokumen8 halamanLista Materijala WordAdis MacanovicBelum ada peringkat

- Mactor Report - Taller de Prospectiva D 2Dokumen39 halamanMactor Report - Taller de Prospectiva D 2Giovani Alexis Saez VegaBelum ada peringkat

- Cayman Islands National Youth Policy September 2000Dokumen111 halamanCayman Islands National Youth Policy September 2000Kyler GreenwayBelum ada peringkat

- Hermeneutical Phenomenology and Human Enviroment SystemDokumen12 halamanHermeneutical Phenomenology and Human Enviroment SystemAllen Rose Buenaflor BuenoBelum ada peringkat

- Psi SiDokumen3 halamanPsi Siapi-19973617Belum ada peringkat

- Module 7 - Prob D-E Valuation and Concepts AnswersDokumen3 halamanModule 7 - Prob D-E Valuation and Concepts Answersvenice cambryBelum ada peringkat

- E-Book 4 - Lesson 1 - Literary ApproachesDokumen5 halamanE-Book 4 - Lesson 1 - Literary ApproachesreishaunjavierBelum ada peringkat

- Ebook PDF The Irony of Democracy An Uncommon Introduction To American Politics 17th Edition PDFDokumen42 halamanEbook PDF The Irony of Democracy An Uncommon Introduction To American Politics 17th Edition PDFscott.stokley449100% (39)

- Sepulveda v. de Las CasasDokumen2 halamanSepulveda v. de Las CasasNova GaveBelum ada peringkat

- Swimming Pool - PWTAG CodeofPractice1.13v5 - 000Dokumen58 halamanSwimming Pool - PWTAG CodeofPractice1.13v5 - 000Vin BdsBelum ada peringkat

- I. Title: "REPAINTING: Streetlight Caution Signs"Dokumen5 halamanI. Title: "REPAINTING: Streetlight Caution Signs"Ziegfred AlmonteBelum ada peringkat

- Thermal ComfortDokumen6 halamanThermal ComfortHoucem Eddine MechriBelum ada peringkat

- My AnalysisDokumen4 halamanMy AnalysisMaricris CastillanoBelum ada peringkat