Exchange Rate 25m Essay (Full Length)

Diunggah oleh

emily_liu_5Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Exchange Rate 25m Essay (Full Length)

Diunggah oleh

emily_liu_5Hak Cipta:

Format Tersedia

URL: www.economics-tuition.

com

A-LEVEL H1/H2 ECONOMICS REVISION TOPIC: Exchange Rates

Discuss the view that a strong Singapore dollar policy has been the most appropriate policy in overcoming the main economic problems faced by Singapore in recent years. [25]

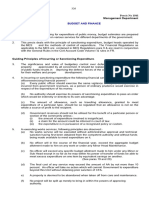

The Spore Govt adopts a managed float system for the Spore dollar (SGD), such that she aims to have a gradual and modest appreciation of the S$ under the managed float system whereby the S$ given is an upward bias against a trade-weighted basket of currencies of its trading partners and competitors. Hence, a strong S$ policy means an appreciation of the SGD, the external value of the SGD rises, and now it costs less than before to buy our trading partners' goods, for eg, Msia goods. It can be achieved by raising the demand (DD) for SGD. Fig 1 illustrates the process of doing so.

Price of SGD SS

PU P1 P0 PL DD0 Q0 QS DD1 Qty of SGD Fig 1: Market for SGD

In Fig 1, the prices PU and PL represent the upper and lower boundaries of the undisclosed exchange rate bands that the Monetary Authority of Spore (MAS) adopts in the managed float system. As long as the price remains within the boundaries, MAS would not intervene. If MAS needs to strengthen the SGD, it maybe due to the existing being too low. MAS can raise it by appreciating the currency. If does so by acting as a player in the market, raising the demand for SGD (from DD0 to DD1). Raising the demand for SGD is equivalent to raising the supply (SS) of Msian Ringgit (RM). Hence, MAS has to reduce its holding of official reserves by raising DD for SGD.

2010 Adam Smith Economics Tuition Agency All Rights Reserved.

Page 1

URL: www.economics-tuition.com

Alternatively, MAS can deliberately revalue the lower and the upper limit of the trading band upwards, so that we obtain a stronger SGD. It simply raises upwards either band or both bands, so as to make revaluation effective. Before we examine if the strong SGD is the most apt policy to overcome the main macro problems Spore faces in recent years, we need to identify what the recent challenges are. Lately, many countries, including Spore have experienced oil price hikes and a soar in food prices. Given our need to import everything, from consumption goods to production raw materials, Spore reliance on imports has seen her experiencing a higher rate of imported inflation as price of oil and other commodities rose. This trend is expected to continue for the near future. Also in 2008, the USA experienced devastating subprime mortgage crises that led to a serious global recession. Spores reliance on trade and export demand has seen Spore growing slower as there is much weaker demand for exports from US, EU and Japan. In fact, she almost saw negative growth rates foe the following year. Hence, actual growth slows down due to lower aggregate demand (AD). At the same time, cyclical unemployment falls, and retrenchment levels in Spore went up to a record high. In addition, more rapid globalisation has seen higher rates of structural unemployment due to rapid shifts in comparative advantages (CA) as many regional economies catch up with Singapore trade patterns. Countries such as Msia, Thailand and Korea have taken over several industries in which Spore used to have CA in, such as low-value and middle-value added manufacturing output like consumer electronics, TVs, etc. Finally, Spore has also seen more foreign direct investments (FDIs), flowing over to China and India, currently, the best place for setting up operations, relocations and outsourcing. Hence, shes seen slower potential growth rates than the previous decade. In view of such recent problems, a stronger SGD has managed to overcome some of the main macro problems. In order to overcome the problem of imported inflation, MAS has made the SGD stronger, by buying up S$ to raise the external value of the S$. This raises the DD for S$ and causes an appreciation of the S$. Import prices fall, and the MAS counters the threat posed by imported inflation. An appreciation of the S$ lowers price of imported raw materials, commodities and finished products in domestic currency. Thus, prices of imported inputs and hence cost of production fall. This lowers cost-push inflation shifting SRAS to the right, and lowers GPL (use AD-AS diagram to explain). This is especially important given the high import content of its exports. The strong S$ policy has also overcome lower economic growth. The stronger S$ policy can enhance FDI by giving investors confidence in the Singapore dollar as expected future returns on investment is likely to retain its value. This raises AD and enhances actual growth in SR (explain

2010 Adam Smith Economics Tuition Agency All Rights Reserved.

Page 2

URL: www.economics-tuition.com

and illustrate with the same AD-AS diagram). Also, in LR, a stronger SGD benefits potential growth as the productive capacity, i.e. LRAS is higher as well. However, the strong Singapore dollar policy has not been the most appropriate policy in overcoming certain main economic problems. Although the strong SGD does combat imported inflation very well, there is a conflict with the BOT objective. For eg, the strong S$ reduces Singapores export price competitiveness. The increase in Px leads to a more than proportionate fall in Qty DDX. The Marshall Lerner condition should be satisfied, i.e. PEDX + PEDm>1. This is because based on the nature of Singapores exports being partly lowand middle- value-added manufacturing goods such as computers and consumer electronics, such exports face several substitutes from the regional economies. The worsening of the B.O.T sees a fall in AD, a fall in actual growth and employment. (Explain with AD-AS diagram). Another limitation lies in the effectiveness of the stronger SGD in attracting FDIs. Unfortunately, FDIs relies on many more factors, rather than a strong SGD only, such as a skilled labour force, good infrastructural network, sophisticated communication and computer know-how, strong intellectual property laws, etc. A strong SGD alone cannot attract significant levels of FDIs. Another problem is the need of MAS to maintain a huge foreign exchange reserves to conduct its exchange rate policy. This implies a trade off with domestic goals, for eg, such reserves can be otherwise used to build more infrastructural needs that can raise the LRAS of Spore. Also, a strong ER cannot solve structural unemployment, as it is basically a problem of skills mismatch. Due to the changing nature of comparative advantage in light of globalisation, especially with the rise of emerging economies like China and India, structural unemployment essentially means a skills-mismatch problem that poses a threat to low skilled workers in declining industries. Appropriate SS-side policies would need to be employed instead. For eg, manpower policies to retrain and upgrade skills of workers facing the threat of structural unemployment. E.g. Skills Redevelopment Programme for InfoComm to retrain displaced workers for employment in InfoComm sector, WDAs Workforce Skills Qualification (WSQ) programme to train workers in sector specific skills, job redesign to make jobs more attractive to workers especially among the older workers. To overcome it is necessary to identify and develop new growth industries for job creation to develop new comparative advantages, for eg Spore has targeted the Environment and Water Technology sector, Interactive Digital Media sector as new sources of growth. Hence, the new training has to be geared towards such industries needs.

2010 Adam Smith Economics Tuition Agency All Rights Reserved.

Page 3

URL: www.economics-tuition.com

However, we face time lag needed to retrain workers and to develop new growth industries. On top of the cost of financing training, we face uncertainty in the success of such training because there is a potential risk in the selection of such winning industries. If the industries turn out to be unable to develop a new CA, the skills learnt would be quickly obsolete. Not forgetting the need for the workers to be willing and able to undergo training. The mindset change is needed for any significant degree of renewing Spore industries. As to attract more FDIs, Spore can adopt an expansionary FP, with SS-side effects. For eg, an incomes policy that ensures productivity growth outweighs wage growth, so that firms enjoy higher profit levels and find Spore more attractive. Also increase G on physical and social infrastructure spending, spending on R&D, education provide conducive environment to support foreign investors increase FDI incentive raise FDI. Also can lower T cuts in corporate taxes to raise the rate of return from I for foreign investors increase FDI incentive raise FDI However, if lower direct and raise indirect tax, in order to maintain current tax revenue, cost push inflation will worsen! Finally, in order to keep export demand high, can push for more FTAs and boost productivity to lower export prices. Plus kick in the flexi-wages policy, so that firms in the export sector can stay solvent and remain in production and to minimise retrenchment. In summary, we have explained that the strong Singapore dollar policy is indeed in very important in solving imported inflation and attracting FDIs. However, its not the most appropriate policy in overcoming structural unemployment. Supply-side policies and incomes policies are needed instead. As for cyclical unN, theres nothing much Spore can do to overcome this problem.

2010 Adam Smith Economics Tuition Agency All Rights Reserved.

Page 4

URL: www.economics-tuition.com

KNOWLEDGE, APPLICATION AND ANALYSIS L1 Where the answer is mostly irrelevant and contains only a few valid points made incidentally in an irrelevant context. For an answer that shows some knowledge of exchange policy and/or one other policy targeted at the macroeconomic problems. The question has not been properly grasped, and there is inadequate development of analysis AND application. 1-9 Low L1: 1-5

High L1: 6-9

L2

For an accurate but undeveloped explanation of the use of exchange rate policy for Singapore and 1 other relevant policy in addressing the main economic problems faced by Singapore in recent years. Little reference to the nature of the Singapore economy. No attempt at evaluation. Expect an accurate though undeveloped explanation of the use of exchange rate policy for Singapore and at least 2 other relevant policies in addressing the main economic problems faced by Singapore in recent years.

1014

Low L2: 10-11

High L2: 12-14 1521 Low L3: 15-17

L3

Expect a good knowledge of the facts and theory of the question. Clear evidence of the ability to present a logical and reasoned analysis. Good attempt at examining the appropriateness of exchange rate policy weighed against the use of at least 2 other policies for Singapore set in the context of the main macroeconomic problems in recent years and the underlying nature of the Singapore economy. Good attempt at evaluation by providing a clearly reasoned structure to the whole answer. Expect a thorough knowledge of facts and theory with an excellent ability to describe and explain this in a precise, logical, reasoned manner. Excellent attempt at examining the appropriateness of exchange rate policy for Singapore set in the context of the main macroeconomic problems and the underlying nature of the Singapore economy.

High L3: 18-21

EVALUATION E1 E2 For an unjustified judgment. For a judgment based on analysis 1-2 3-4

2010 Adam Smith Economics Tuition Agency All Rights Reserved.

Page 5

Anda mungkin juga menyukai

- Redox and Acid-Base Titration CalculationsDokumen9 halamanRedox and Acid-Base Titration Calculationsemily_liu_5Belum ada peringkat

- EuthanasiaDokumen6 halamanEuthanasiaemily_liu_5Belum ada peringkat

- Colors and C N of Some TM CpdsDokumen1 halamanColors and C N of Some TM Cpdsemily_liu_5Belum ada peringkat

- GP EssayDokumen1 halamanGP Essayemily_liu_5Belum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- McGill IT Services Change Management Process GuideDokumen81 halamanMcGill IT Services Change Management Process Guidediego_sq100% (1)

- Crisp DM1Dokumen9 halamanCrisp DM1David_liauwBelum ada peringkat

- What Is Fundamental AnalysisDokumen13 halamanWhat Is Fundamental AnalysisvishnucnkBelum ada peringkat

- Vol II (E5)Dokumen261 halamanVol II (E5)nitinBelum ada peringkat

- Chapter 4 Cash Flow Financial PlanningDokumen63 halamanChapter 4 Cash Flow Financial PlanningThenivaalaven VimalBelum ada peringkat

- How To Manage Contractor's Health and Safety Onsite EffectivelyDokumen10 halamanHow To Manage Contractor's Health and Safety Onsite EffectivelyCormac FeoreBelum ada peringkat

- Franchise & Consignment ProblemsDokumen10 halamanFranchise & Consignment ProblemsCeline Marie AntonioBelum ada peringkat

- Macro Tut 9Dokumen7 halamanMacro Tut 9Phạm Minh NgọcBelum ada peringkat

- House#45 Ishrat Town Near Wafaqi Colony Pakistan.Dokumen3 halamanHouse#45 Ishrat Town Near Wafaqi Colony Pakistan.nafrizaidi0% (1)

- The Science of Ship ValuationDokumen10 halamanThe Science of Ship ValuationWisnu KertaningnagoroBelum ada peringkat

- Asian Paints Bse: 500820 - Nse: Asianpaint ISIN: INE021A01018 - Paints/VarnishesDokumen27 halamanAsian Paints Bse: 500820 - Nse: Asianpaint ISIN: INE021A01018 - Paints/VarnishesGaurav ShahareBelum ada peringkat

- Cranes Today April 08Dokumen68 halamanCranes Today April 08Vishal VajatBelum ada peringkat

- Shekhar Biz ProfileDokumen2 halamanShekhar Biz ProfileshekharcBelum ada peringkat

- Organizational Behavior Through Contingency ApproachDokumen21 halamanOrganizational Behavior Through Contingency Approachjaydee_atc581460% (5)

- ETOM Level-2 ProcessesDokumen2 halamanETOM Level-2 ProcessesFahimBelum ada peringkat

- Adjusting Entries Quiz - Accounting CoachDokumen4 halamanAdjusting Entries Quiz - Accounting CoachSudip BhattacharyaBelum ada peringkat

- PFRS 8 Segment ReportingDokumen3 halamanPFRS 8 Segment ReportingAllaine ElfaBelum ada peringkat

- 2009 Level 2 Series 3 (Code 2007)Dokumen15 halaman2009 Level 2 Series 3 (Code 2007)keithwkk100% (1)

- EMMPPE ASSOCIATES MONTHLY PRODUCTION REPORTDokumen10 halamanEMMPPE ASSOCIATES MONTHLY PRODUCTION REPORTdsivakumarBelum ada peringkat

- Explain The Potential Causes of A Balance of Payments Deficit On Current AccountDokumen11 halamanExplain The Potential Causes of A Balance of Payments Deficit On Current AccountGirish SampathBelum ada peringkat

- Deed of Absolute Sale - Golden Rod, Inc. (Mandarin)Dokumen7 halamanDeed of Absolute Sale - Golden Rod, Inc. (Mandarin)Antonio Timothy FernandezBelum ada peringkat

- ISO 9001 For Hammer Strength Fitness ClubDokumen9 halamanISO 9001 For Hammer Strength Fitness Clubsayem.unicertBelum ada peringkat

- Audit Report Cash SalesDokumen30 halamanAudit Report Cash SalesPlanco RosanaBelum ada peringkat

- Non Conflict of Interest TemplateDokumen1 halamanNon Conflict of Interest Templaterhizza basilioBelum ada peringkat

- Sample Form Legal Opinion LetterDokumen2 halamanSample Form Legal Opinion LetterLindsay Mills100% (1)

- Eng301 Midterm MCQsDokumen12 halamanEng301 Midterm MCQsUsman AliBelum ada peringkat

- Signavio - BPMN Modeling ConventionsDokumen3 halamanSignavio - BPMN Modeling ConventionsleoaugBelum ada peringkat

- FDG-Droid Tech #1 - Sentry DroidDokumen10 halamanFDG-Droid Tech #1 - Sentry DroidBatzarroTorreta100% (1)

- Korea Chocolate Market Report To 2021Dokumen12 halamanKorea Chocolate Market Report To 2021johnnyBelum ada peringkat

- Transfer Prices and Multiple Valuation ApproachesDokumen6 halamanTransfer Prices and Multiple Valuation Approachessampath0% (1)