P20 3a

Diunggah oleh

aj481216Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

P20 3a

Diunggah oleh

aj481216Hak Cipta:

Format Tersedia

P20-3A

http://edugen.wiley.com/edugen/shared/assignment/test/qprint.uni

Print by: Brandon Jones ACC 122-1N1 Spring 2011 / P20-1a, 3a

P20-3A

Enos Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fiberglass, and lumber, depending upon customer preference. On June 1, 2010, the general ledger for Enos Inc. contains the following data. Raw Materials Inventory Work in Process Inventory $4,200 $5,540 Manufacturing Overhead Applied Manufacturing Overhead Incurred $32,640 $31,650

Subsidiary data for Work in Process Inventory on June 1 are as follows. Job Cost Sheets Cost Element Direct materials Direct labor Manufacturing overhead Fowler $ 600 320 400 $1,320 Customer Job Haines $ 800 540 675 $2,015 Krantz $ 900 580 725 $2,205

During June, raw materials purchased on account were $3,900, and all wages were paid. Additional overhead costs consisted of depreciation on equipment $700 and miscellaneous costs of $400 incurred on account. A summary of materials requisition slips and time tickets for June shows the following. Customer Job Fowler Elgin Haines Krantz Fowler General use Materials Requisition Slips $ 800 2,000 500 1,300 300 4,900 1,500 $6,400 Time Tickets $ 450 800 360 1,600 390 3,600 1,200 $4,800

Overhead was charged to jobs at the same rate of $1.25 per dollar of direct labor cost. The patios for customers Fowler, Haines, and Krantz were completed during June and sold for a total of $18,900. Each customer paid in full. Journalize the June transactions: (i) for purchase of raw materials, factory labor costs incurred, and manufacturing overhead costs incurred; (ii) assignment of direct materials, labor, and overhead to production; and (iii) completion of jobs and sale of goods. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) Account/Description Debit Credit

(Purchase of raw materials.)

(To record factory labor costs.)

1 of 3

4/9/11 6:52 PM

P20-3A

http://edugen.wiley.com/edugen/shared/assignment/test/qprint.uni

(To record manufacturing overhead costs.)

(To assign raw materials to production.)

(To assign factory labor to production.)

(To assign manufacturing overhead to production.)

(To record completion of jobs.)

(To record sale of jobs.)

(To record cost of jobs.) Post the entries to Work in Process Inventory. Work in Process Inventory 6/1 Balance Direct materials Direct labor Overhead applied 6/30 Balance June Completed Work

Reconcile the balance in Work in Process Inventory with the costs of unfinished jobs. Work in process inventory Job: $ $

Prepare a cost of goods manufactured schedule for June. (List amounts from largest to smallest eg 10, 5, 3, 2.) ENOS INC. Cost of Goods Manufactured Schedule For the Month Ended June 30, 2010 $ $

Total manufacturing costs Total cost of work in process

2 of 3

4/9/11 6:52 PM

P20-3A

http://edugen.wiley.com/edugen/shared/assignment/test/qprint.uni

Less: Cost of goods manufactured $ Question Attempts: 0 of 4 used

Copyright 2000-2011 by John Wiley & Sons, Inc. or related companies. All rights reserved.

3 of 3

4/9/11 6:52 PM

Anda mungkin juga menyukai

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryDari EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryBelum ada peringkat

- Job CostingDokumen30 halamanJob Costingzahid_mahmood3811100% (1)

- Job Order Costing Chapter 4Dokumen27 halamanJob Order Costing Chapter 4Emmanuel63% (8)

- Ch02 - Job Order CostingDokumen65 halamanCh02 - Job Order CostingHa sieunhannBelum ada peringkat

- Tutorial 3 - Process CostingDokumen5 halamanTutorial 3 - Process Costingsouayeh wejdenBelum ada peringkat

- Chapter - 02 Job Order CostingDokumen69 halamanChapter - 02 Job Order CostingGonzalo Jr. RualesBelum ada peringkat

- CSEC POB June 2017 P2 PDFDokumen16 halamanCSEC POB June 2017 P2 PDFDarcel Brown100% (1)

- Accounting For Manufacturing BusinessDokumen81 halamanAccounting For Manufacturing BusinessAdrian Faminiano100% (1)

- Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. byDokumen56 halamanSecuritisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. bykannangksBelum ada peringkat

- TATA 1MG Healthcare Solutions Private Limited: Wadi On Jalamb Road Khamgaon,, Buldhana, 444303, IndiaDokumen1 halamanTATA 1MG Healthcare Solutions Private Limited: Wadi On Jalamb Road Khamgaon,, Buldhana, 444303, IndiaTejas Talole0% (1)

- Problem Job Order CostingDokumen6 halamanProblem Job Order CostingAlan Carlo Galvez100% (1)

- Hyundai Forklift Trucks Service Manual Updated 09 2021 Offline DVDDokumen23 halamanHyundai Forklift Trucks Service Manual Updated 09 2021 Offline DVDwalterwatts010985wqa100% (129)

- Produce Job Costing InformationDokumen18 halamanProduce Job Costing InformationAshenafi AbdurkadirBelum ada peringkat

- Problem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andDokumen4 halamanProblem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andIvan BorresBelum ada peringkat

- Job Order CostingDokumen1 halamanJob Order CostingVincent Pham100% (1)

- Acctg201 Exercises2Dokumen18 halamanAcctg201 Exercises2sarahbeeBelum ada peringkat

- Accounting Textbook Solutions - 72Dokumen19 halamanAccounting Textbook Solutions - 72acc-expertBelum ada peringkat

- Week TwoDokumen209 halamanWeek TwodratdratBelum ada peringkat

- 2011-Asaa03-12 230922 GarciaDokumen6 halaman2011-Asaa03-12 230922 GarciaBisharat EmanBelum ada peringkat

- Chapter Four Accounting Cycle For Manufacturing BusinessDokumen5 halamanChapter Four Accounting Cycle For Manufacturing BusinessAbrha636Belum ada peringkat

- Job Order Costing Part 2Dokumen57 halamanJob Order Costing Part 2Kimberly ParciaBelum ada peringkat

- ACCT 505 Managerial Accounting Week 2 Job Order and Process Costing Systems Quiz AnswerDokumen10 halamanACCT 505 Managerial Accounting Week 2 Job Order and Process Costing Systems Quiz AnswerMike RussellBelum ada peringkat

- Chapter 4 Fa1Dokumen6 halamanChapter 4 Fa1Zebib DestaBelum ada peringkat

- Assignment 2Dokumen2 halamanAssignment 2Rence MarcoBelum ada peringkat

- Acc101 Probset1 v2Dokumen5 halamanAcc101 Probset1 v2BamPanggatBelum ada peringkat

- 02.02.2024 Accounting Cycle For A Manufacturing Company1Dokumen34 halaman02.02.2024 Accounting Cycle For A Manufacturing Company1Dennis N. IndigBelum ada peringkat

- Cost Accounting Problem 1 - AnswersDokumen12 halamanCost Accounting Problem 1 - AnswersMARICON BERJABelum ada peringkat

- S03 - Chapter 5 Job Order Costing Without AnswersDokumen2 halamanS03 - Chapter 5 Job Order Costing Without AnswersRigel Kent MansuetoBelum ada peringkat

- Assignment 1 PDFDokumen2 halamanAssignment 1 PDFfdggdh dgfdgBelum ada peringkat

- CH 02Dokumen61 halamanCH 02Linh Trinh NgBelum ada peringkat

- Waterways Continuous ProblemDokumen18 halamanWaterways Continuous ProblemAboi Boboi60% (5)

- ACCT 505 Quiz 1Dokumen6 halamanACCT 505 Quiz 1Bella DavidovaBelum ada peringkat

- Job Order Costing Difficult RoundDokumen8 halamanJob Order Costing Difficult RoundsarahbeeBelum ada peringkat

- Cost Quiz 2Dokumen5 halamanCost Quiz 2alexissosing.cpaBelum ada peringkat

- Managerial Accounting: Job Order CostingDokumen75 halamanManagerial Accounting: Job Order Costingsouayeh wejdenBelum ada peringkat

- Custom Chrome Inc Manufactures Special Chromed Parts Made To TheDokumen2 halamanCustom Chrome Inc Manufactures Special Chromed Parts Made To TheAmit PandeyBelum ada peringkat

- Lecture-8.2 Job Order Costing (Theory With Problem)Dokumen13 halamanLecture-8.2 Job Order Costing (Theory With Problem)Nazmul-Hassan Sumon100% (2)

- 4.2 Tutorial Questions 2Dokumen5 halaman4.2 Tutorial Questions 2Lee XingBelum ada peringkat

- Accounting QuestionDokumen8 halamanAccounting QuestionMusa D Acid100% (1)

- Prelims Reviewer For Cost AccountingDokumen29 halamanPrelims Reviewer For Cost AccountingPamela Cruz100% (1)

- Job Costing and Overhead ER PDFDokumen16 halamanJob Costing and Overhead ER PDFShaira VillaflorBelum ada peringkat

- A WK3 Chp2Dokumen83 halamanA WK3 Chp2Jocelyn LimBelum ada peringkat

- M1 - A3 Calculating Inventory - Finlon Upholstery IncDokumen3 halamanM1 - A3 Calculating Inventory - Finlon Upholstery Inczb83100% (1)

- Assignment 4 Job Order CostingDokumen2 halamanAssignment 4 Job Order CostingMichael Johnson0% (1)

- 6e Brewer CH02 B EOCDokumen12 halaman6e Brewer CH02 B EOCLiyanCenBelum ada peringkat

- Activity # 2Dokumen3 halamanActivity # 2Beboy TorregosaBelum ada peringkat

- Take Home ActivityDokumen7 halamanTake Home ActivityCasper VillanuevaBelum ada peringkat

- Ma. Acctng.Dokumen7 halamanMa. Acctng.Kaname KuranBelum ada peringkat

- 02 Aga Bagoes Ardiansyah 7fkhususDokumen4 halaman02 Aga Bagoes Ardiansyah 7fkhususAga Bagoes ArdiansyahBelum ada peringkat

- Cost Accounting Midterm Exam AKT103-AKT32-WDokumen3 halamanCost Accounting Midterm Exam AKT103-AKT32-Wsangita indrianeBelum ada peringkat

- Essay: Mid-Term Examination Akuntansi Biaya / Cost Accounting AKT 103 - AKT32-WDokumen3 halamanEssay: Mid-Term Examination Akuntansi Biaya / Cost Accounting AKT 103 - AKT32-Wsangita indrianeBelum ada peringkat

- Box Company Makes Shipping Containers The Trial Balance Section ofDokumen1 halamanBox Company Makes Shipping Containers The Trial Balance Section ofMiroslav GegoskiBelum ada peringkat

- (Odd) Acc 101 LT#2B PDFDokumen5 halaman(Odd) Acc 101 LT#2B PDF有福Belum ada peringkat

- MA Quiz 3Dokumen3 halamanMA Quiz 3ANIKET KUMARBelum ada peringkat

- Practice Test 1 New For Summer 2010Dokumen16 halamanPractice Test 1 New For Summer 2010samcarfBelum ada peringkat

- Process Cost SystemDokumen11 halamanProcess Cost Systemmjane2607Belum ada peringkat

- Document 1Dokumen38 halamanDocument 1gosaye desalegnBelum ada peringkat

- Accuzeit Is A Small New England Company That Manufactures CustomDokumen1 halamanAccuzeit Is A Small New England Company That Manufactures CustomAmit PandeyBelum ada peringkat

- Exam # 2 Chapter 15, 16, 17 ReviewDokumen2 halamanExam # 2 Chapter 15, 16, 17 ReviewAnnBelum ada peringkat

- Job OrderDokumen7 halamanJob OrderFrances Alandra SorianoBelum ada peringkat

- Chapter 2 - Job Order CostingDokumen16 halamanChapter 2 - Job Order CostingDecery BardenasBelum ada peringkat

- Topic 2 ExercisesDokumen14 halamanTopic 2 ExercisesCLAUDIA RUIZ CUEVAS SAINZBelum ada peringkat

- Chapter 2 Lab Review WorksheetDokumen4 halamanChapter 2 Lab Review WorksheetKyle Anders0% (1)

- Brewer Chapter 2 Alt ProbDokumen6 halamanBrewer Chapter 2 Alt ProbAtif RehmanBelum ada peringkat

- Team BasicsDokumen3 halamanTeam BasicsSoumya Jyoti BhattacharyaBelum ada peringkat

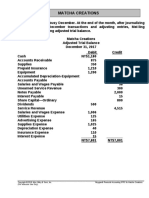

- MC4 Matcha Creations: (For Instructor Use Only)Dokumen2 halamanMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraBelum ada peringkat

- Al in Source Grade 12 For Abm OnlyDokumen275 halamanAl in Source Grade 12 For Abm OnlyAlliah PesebreBelum ada peringkat

- 180 2 1 PDFDokumen34 halaman180 2 1 PDFlaura melissaBelum ada peringkat

- Research Methods For Architecture Ebook - Lucas, Ray - Kindle StoreDokumen1 halamanResearch Methods For Architecture Ebook - Lucas, Ray - Kindle StoreMohammed ShriamBelum ada peringkat

- Std. X Ch. 3 Money and Credit WS (21 - 22)Dokumen3 halamanStd. X Ch. 3 Money and Credit WS (21 - 22)YASHVI MODIBelum ada peringkat

- Practice Question (Accounting Cycle) With Solution v2Dokumen17 halamanPractice Question (Accounting Cycle) With Solution v2Laiba ManzoorBelum ada peringkat

- Affiliated To University of Mumbai Program: COMMERCE Program Code: RJCUCOM (CBCS 2018-19)Dokumen20 halamanAffiliated To University of Mumbai Program: COMMERCE Program Code: RJCUCOM (CBCS 2018-19)Endubai SuryawanshiBelum ada peringkat

- Vendor DetailDokumen4 halamanVendor DetailKamal PashaBelum ada peringkat

- Sample Business Impact AssessmentDokumen2 halamanSample Business Impact AssessmentbdfbgrdfbbuiwefBelum ada peringkat

- Wiley CFA Test Bank 180527 (20 Preguntas)Dokumen12 halamanWiley CFA Test Bank 180527 (20 Preguntas)rafav10Belum ada peringkat

- Sue PisciottaDokumen3 halamanSue PisciottaSubhadip Das SarmaBelum ada peringkat

- S. No. Date and Time Level Session Title Expert Name: 30 June 2021Dokumen2 halamanS. No. Date and Time Level Session Title Expert Name: 30 June 2021Vinodh EwardsBelum ada peringkat

- MHI-05-D11 - CompressedDokumen4 halamanMHI-05-D11 - CompressedDr. Amit JainBelum ada peringkat

- CV Template 0018Dokumen1 halamanCV Template 0018Rahma idahBelum ada peringkat

- Performance Guarantees: A. Guarantees Subject To Liquidated DamagesDokumen3 halamanPerformance Guarantees: A. Guarantees Subject To Liquidated Damagesdeepdaman18891Belum ada peringkat

- Chapter 2-Financial Statement AnalysisDokumen45 halamanChapter 2-Financial Statement AnalysiswubeBelum ada peringkat

- While It Is True That Increases in Efficiency Generate Productivity IncreasesDokumen3 halamanWhile It Is True That Increases in Efficiency Generate Productivity Increasesgod of thunder ThorBelum ada peringkat

- Consumer Buying Behaviour of Cars in India - A Survey: January 2018Dokumen7 halamanConsumer Buying Behaviour of Cars in India - A Survey: January 2018Prashant MishraBelum ada peringkat

- Invitation To CPD On Predicting Corporate FailureDokumen6 halamanInvitation To CPD On Predicting Corporate Failureyakubu I saidBelum ada peringkat

- Lahore School of Economics Financial Management I Time Value of Money - 3 Assignment 4Dokumen2 halamanLahore School of Economics Financial Management I Time Value of Money - 3 Assignment 4Ahmed ZafarBelum ada peringkat

- Deed of Absolute Sale Bod OnDokumen4 halamanDeed of Absolute Sale Bod OnNeil John FelicianoBelum ada peringkat

- Practice Continuti Agreement Flexi Consultancy LTDDokumen3 halamanPractice Continuti Agreement Flexi Consultancy LTDrajguruprajakta26Belum ada peringkat

- Target Shots I-UnlockedDokumen257 halamanTarget Shots I-Unlockedsaumya ranjan nayakBelum ada peringkat

- Personal Lease Adam LightfootDokumen9 halamanPersonal Lease Adam Lightfootaaakinkumi115Belum ada peringkat

- Teaching PowerPoint Slides - Chapter 16Dokumen36 halamanTeaching PowerPoint Slides - Chapter 16Seo ChangBinBelum ada peringkat