Global Financial Crises

Diunggah oleh

Fazal Wahab KhattakDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Global Financial Crises

Diunggah oleh

Fazal Wahab KhattakHak Cipta:

Format Tersedia

Global Financial Crises: Impact of Pakistan and Policy Response;

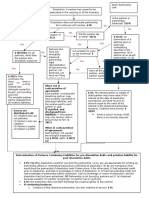

The global recession has posed policymakers around the world with unprecedented challenges. Severely damaged financial sectors seemed immune to most responses, while fiscal stimuli and other policy tools have, at best, been sluggish to establish some stability in economies dealing with the spill-over of the financial crisis into other sectors and a general economic slowdown. In a little over a year, what started off as a sub-prime crisis in US mortgage and housing markets, has amplified to a global economic downturn of an extraordinary scale, bringing to an end four years of booming economic growth across the world. In developed economies, strains in the financial sector, a drying up of credit, and an increasing amount of risk aversion in the face of limited information about potential losses, led to the closing of many credit lines and the evaporation of financing mechanisms. Commodity producing sectors in these economies were hard hit by these events, resulting in a general economic deceleration rather than a crisis limited to the financial sector. In emerging economies, the slowdown manifested itself through various channels. Volatility in financial markets led to a flight of capital. Furthermore, access to external financing became all but impossible and spreads on bonds widened to record levels. Countries relying on trade as a primary means of boosting economic growth saw trade volumes disappear as trading partners in

the rest of the world struggled to deal with the slowdown in their domestic economies. The global financial crisis is impacting the real and social sectors of developing countries through multiple channels. The linkages between developed and developing economies have deepened as well as broadened over the past two decades in the wake of intensifying globalizaation. As the slump in the global economy prevailed, the Pakistans economy witnessed a period of significant instability and a deterioration of most macroeconomic indicators. The timing of the crisis, and Pakistans response to domestic developments might seem contradictory to a layman. As governments around the world lowered interest rates and implemented expansionary fiscal measures to revitalize their economies, Pakistan underwent a phase of fiscal tightening, and a stringent monetary stance with discount rates remaining relatively high for most of the period (discount rates remained at 15 percent till April 2009). Fiscal, Monetary, and External debt policies of Pakistan have primarily been driven by the underlying need to resurrect significant macroeconomic imbalances in the domestic economy, rather than as a response to the financial crisis and global economic slowdown. The financial sector of the economy is still in its developing stages with limited, albeit growing, linkages with global markets. As a result, Pakistan has been relatively well-insulated against the contagion in international financial

markets. It is remarkable to note that Pakistan is among a handful of countries with a positive rate of growth, and among a very few with the lowest decline in real GDP growth as compared to other countries affected by the global financial crisis.

Anda mungkin juga menyukai

- Navigating the Global Storm: A Policy Brief on the Global Financial CrisisDari EverandNavigating the Global Storm: A Policy Brief on the Global Financial CrisisBelum ada peringkat

- Global Economy: Post-Crisis to Sustainable DevelopmentDari EverandGlobal Economy: Post-Crisis to Sustainable DevelopmentBelum ada peringkat

- Impact of CrisisDokumen7 halamanImpact of Crisisummmz_j3719Belum ada peringkat

- Financial CrisisDokumen70 halamanFinancial CrisisSubodh MayekarBelum ada peringkat

- Budget Overview - of - The - Economy 23Dokumen11 halamanBudget Overview - of - The - Economy 23zubairBelum ada peringkat

- Fiscal Sustainability of Assam - 13Dokumen20 halamanFiscal Sustainability of Assam - 13rakesh.rnbdjBelum ada peringkat

- World Economy 2011Dokumen48 halamanWorld Economy 2011Arnold StalonBelum ada peringkat

- World Economic Situation and Prospects 2011Dokumen48 halamanWorld Economic Situation and Prospects 2011Iris De La CalzadaBelum ada peringkat

- Malaysian Economic Outlook 2015Dokumen13 halamanMalaysian Economic Outlook 2015.aisya.Belum ada peringkat

- Executive Summary: The Global OutlookDokumen34 halamanExecutive Summary: The Global OutlookmarrykhiBelum ada peringkat

- ProjectDokumen21 halamanProjectshaikhsfamily18Belum ada peringkat

- Coordinated, Massive and Swift Economic Stimulus Required To Counteract Synchronized Global Downturn, New UN Report AssertsDokumen4 halamanCoordinated, Massive and Swift Economic Stimulus Required To Counteract Synchronized Global Downturn, New UN Report AssertsRahul YenBelum ada peringkat

- Report Noted in Clear Terms That The Global Economy Is Teetering On The Brink of Recession. TheDokumen8 halamanReport Noted in Clear Terms That The Global Economy Is Teetering On The Brink of Recession. TheBlessing Nwosuocha-IbeBelum ada peringkat

- Economic and Financial Situation in Asia: Latest DevelopmentsDokumen7 halamanEconomic and Financial Situation in Asia: Latest DevelopmentsLizette MacatangayBelum ada peringkat

- Impact of Global Financial Crisis On PakistanDokumen16 halamanImpact of Global Financial Crisis On Pakistannaumanayubi93% (15)

- Ge 27Dokumen64 halamanGe 27BaSit RaZaBelum ada peringkat

- Executive Summary: International Monetary Fund - October 2016Dokumen4 halamanExecutive Summary: International Monetary Fund - October 2016Daniel GonzálezBelum ada peringkat

- The Global Financial Crisis, Developing Countries and India: Jayati GhoshDokumen20 halamanThe Global Financial Crisis, Developing Countries and India: Jayati GhoshPritesh_85Belum ada peringkat

- Executive Summary: Global Economic EnvironmentDokumen5 halamanExecutive Summary: Global Economic EnvironmentcherrypickerBelum ada peringkat

- Comparative Analysis of CrisesDokumen11 halamanComparative Analysis of CrisesPhine TanayBelum ada peringkat

- The Theme of The ReportDokumen6 halamanThe Theme of The ReportAnkit SharmaBelum ada peringkat

- GEP June 2023 Executive SummaryDokumen2 halamanGEP June 2023 Executive SummaryKong CreedBelum ada peringkat

- Annual Economic Report 2019 SynopsisDokumen6 halamanAnnual Economic Report 2019 Synopsissh_chandraBelum ada peringkat

- Financial Melt Down and Its Impact On Indian EconomyDokumen56 halamanFinancial Melt Down and Its Impact On Indian EconomyZarna SolankiBelum ada peringkat

- 2021513807liu Xin 3Dokumen2 halaman2021513807liu Xin 39898998hjBelum ada peringkat

- What Role Did The COVIDDokumen3 halamanWhat Role Did The COVIDescutiaadriana97Belum ada peringkat

- GEP January 2023 Executive SummaryDokumen2 halamanGEP January 2023 Executive SummaryRuslanBelum ada peringkat

- The Impact of Global Recession Over Our Economy Next YearDokumen11 halamanThe Impact of Global Recession Over Our Economy Next Yearআশিকুর রহমানBelum ada peringkat

- The International Monetary and Financial Environment Learning ObjectivesDokumen4 halamanThe International Monetary and Financial Environment Learning ObjectivesAna KatulićBelum ada peringkat

- EconDokumen7 halamanEconRainidah Mangotara Ismael-DericoBelum ada peringkat

- Executive Summary: A Weakening ExpansionDokumen2 halamanExecutive Summary: A Weakening Expansionprashantk_106Belum ada peringkat

- Financial Melt Down N Its Impact On Indian EconomyDokumen54 halamanFinancial Melt Down N Its Impact On Indian EconomyZarna SolankiBelum ada peringkat

- Fear of Global Economic RecessionDokumen6 halamanFear of Global Economic RecessionT ForsythBelum ada peringkat

- Executive Summary Restructuring of The Economy A Study On BangladeshDokumen4 halamanExecutive Summary Restructuring of The Economy A Study On BangladeshgulshroffBelum ada peringkat

- Group ADokumen12 halamanGroup AAbdikani Abdullahi HassanBelum ada peringkat

- Global Fin Crisis 2007-08: BangladshDokumen14 halamanGlobal Fin Crisis 2007-08: BangladshPagla HawaBelum ada peringkat

- Finshastra October CirculationDokumen50 halamanFinshastra October Circulationgupvaibhav100% (1)

- Executive Summary: Dealing With A Perfect StormDokumen22 halamanExecutive Summary: Dealing With A Perfect Stormm_awab100% (2)

- Relationship of Economic Crisis 2007 To The Philippine Banking SystemDokumen15 halamanRelationship of Economic Crisis 2007 To The Philippine Banking SystemColeen Jungco GineteBelum ada peringkat

- Global Economic Prospects For 2012 and 2013: Prepared By: J.C. Dassanayake - 2009/MS/3980Dokumen2 halamanGlobal Economic Prospects For 2012 and 2013: Prepared By: J.C. Dassanayake - 2009/MS/3980Dumidu Chathurange DassanayakeBelum ada peringkat

- Tdr2023ch1 enDokumen31 halamanTdr2023ch1 enSuhrobBelum ada peringkat

- Effects of Global Financial CrisisDokumen10 halamanEffects of Global Financial CrisisHusseinBelum ada peringkat

- Policy Perspectives: Sri Lanka: State of The Economy 2009Dokumen7 halamanPolicy Perspectives: Sri Lanka: State of The Economy 2009IPS Sri LankaBelum ada peringkat

- Saps, Imf & PakistanDokumen7 halamanSaps, Imf & PakistanMaya AinBelum ada peringkat

- The Global Economic EnvironnmentDokumen51 halamanThe Global Economic EnvironnmentAbhinav AgrawalBelum ada peringkat

- Economical Situation of PakistanDokumen11 halamanEconomical Situation of PakistanHumaira a RashidBelum ada peringkat

- Safiullah Sir AssDokumen6 halamanSafiullah Sir AssAvijit SahaBelum ada peringkat

- DEON Lopes136. International FinanceDokumen1 halamanDEON Lopes136. International Financedeonlopes057Belum ada peringkat

- China Financial Crisis Liu YunshanDokumen18 halamanChina Financial Crisis Liu YunshanManu VarkeyBelum ada peringkat

- Research Based Article On Financial CrisisDokumen2 halamanResearch Based Article On Financial CrisisSandesh ShresthaBelum ada peringkat

- Globalization and Economic Growth After 2008 CrisisDokumen12 halamanGlobalization and Economic Growth After 2008 CrisisSNS 456Belum ada peringkat

- SummaryDokumen2 halamanSummaryKezia TumalaBelum ada peringkat

- Policymakers Need Steady Hand As Storm Clouds Gather Over Global EconomyDokumen11 halamanPolicymakers Need Steady Hand As Storm Clouds Gather Over Global EconomyNúriaBelum ada peringkat

- Assignment On: TopicDokumen4 halamanAssignment On: TopicshamsilarifenBelum ada peringkat

- Global Economic Crisis Part 1Dokumen8 halamanGlobal Economic Crisis Part 1Phine TanayBelum ada peringkat

- Vol 41Dokumen45 halamanVol 41ANKIT_XXBelum ada peringkat

- Global Economy To Slow Further Amid Signs of Resilience and China Re-OpeningDokumen5 halamanGlobal Economy To Slow Further Amid Signs of Resilience and China Re-Openinggulunakhan0Belum ada peringkat

- ElerianDokumen3 halamanElerianDileep Kumar MaheshwariBelum ada peringkat

- World Economic Outlook, IMF April 2013Dokumen4 halamanWorld Economic Outlook, IMF April 2013redaekBelum ada peringkat

- Summary Of "The Difficult International Insertion Of Latin America" By Enrique Iglesias: UNIVERSITY SUMMARIESDari EverandSummary Of "The Difficult International Insertion Of Latin America" By Enrique Iglesias: UNIVERSITY SUMMARIESBelum ada peringkat

- FIM Unit 1Dokumen8 halamanFIM Unit 1Nikhil MukhiBelum ada peringkat

- BSP Selected Economic Financial IndicatorsDokumen8 halamanBSP Selected Economic Financial IndicatorsGlenBelum ada peringkat

- Winding Up of A CompanyDokumen16 halamanWinding Up of A CompanyFlipFlop Santa100% (2)

- Taxation ManagementDokumen34 halamanTaxation ManagementZaroon KhalidBelum ada peringkat

- Financial Accounting Theory 2e by Deegan 2006 Ch05Dokumen41 halamanFinancial Accounting Theory 2e by Deegan 2006 Ch05Hamarr WandayuBelum ada peringkat

- FPP1x - Slides Introduction To FPP PDFDokumen10 halamanFPP1x - Slides Introduction To FPP PDFEugenio HerreraBelum ada peringkat

- Bba 101Dokumen14 halamanBba 101jithindas050% (1)

- Accounting/Series 4 2011 (Code30124)Dokumen16 halamanAccounting/Series 4 2011 (Code30124)Hein Linn Kyaw100% (1)

- Unit 5 - Foreign Trade & Exchange RateDokumen8 halamanUnit 5 - Foreign Trade & Exchange RateSurekha RammoorthyBelum ada peringkat

- Telecom Due Diligence and Benchmarks in Developing CountriesDokumen10 halamanTelecom Due Diligence and Benchmarks in Developing CountriesJean-Marie Lalanne100% (1)

- UPA DissolutionDokumen1 halamanUPA DissolutionNiraj ThakkerBelum ada peringkat

- Convergent Outsourcing Collection Letter FDCPADokumen1 halamanConvergent Outsourcing Collection Letter FDCPAghostgripBelum ada peringkat

- Leverages 1Dokumen33 halamanLeverages 1mahato28Belum ada peringkat

- LCCI First Level Revision NotesDokumen20 halamanLCCI First Level Revision NotesLinda Martin100% (2)

- Efforts To Reduce The Budget DeficitDokumen6 halamanEfforts To Reduce The Budget DeficitNikkiNapalmBelum ada peringkat

- Aqa Accn2 W QP Jun10Dokumen12 halamanAqa Accn2 W QP Jun10Saadmani RahmanBelum ada peringkat

- Sinclair Company Group Case StudyDokumen20 halamanSinclair Company Group Case StudyNida AmriBelum ada peringkat

- Fin 22Dokumen6 halamanFin 22Princess AduanaBelum ada peringkat

- Bankasdasd Das AsdDokumen9 halamanBankasdasd Das AsdRia AthirahBelum ada peringkat

- 2nd Year Accounting Notes For IDokumen4 halaman2nd Year Accounting Notes For Iiramanwar50% (2)

- High Return Investing: Passive Income and Financial FreedomDokumen12 halamanHigh Return Investing: Passive Income and Financial Freedomapi-154838839Belum ada peringkat

- Inb 372Dokumen3 halamanInb 372Mushfique AhmedBelum ada peringkat

- Cash FlowDokumen6 halamanCash FlowLara Lewis AchillesBelum ada peringkat

- The Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillDokumen36 halamanThe Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillJumma KhanBelum ada peringkat

- Money CollocationsDokumen4 halamanMoney CollocationsTaoufik RadiBelum ada peringkat

- Strategy - Tejasvi RanaDokumen6 halamanStrategy - Tejasvi RanaB AspirantBelum ada peringkat

- Fundamental Analysis Sun PharmaDokumen5 halamanFundamental Analysis Sun PharmadeveshBelum ada peringkat

- Spouses Deo Agner and Maricon Agner v. Bpi Family Savings Bank Inc. GR No. 182963Dokumen2 halamanSpouses Deo Agner and Maricon Agner v. Bpi Family Savings Bank Inc. GR No. 182963Jaypee Ortiz67% (3)

- Liabilities of The Parties To An InstrumentDokumen2 halamanLiabilities of The Parties To An InstrumentRonel Buhay100% (1)

- The Determination of Exchange RatesDokumen20 halamanThe Determination of Exchange RatesSauryadeep DwivediBelum ada peringkat