AAA Tutorial 7

Diunggah oleh

Xie QiquanDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

AAA Tutorial 7

Diunggah oleh

Xie QiquanHak Cipta:

Format Tersedia

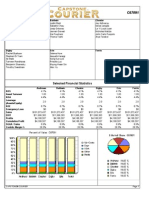

AAA Tutorial 7 Question 1 Liquidity: The current and quick ratios show a weaker position relative to the industry

average. (the net working capital figure should not be used in this cross-sectional analysis. It would be better applied for comparison against a trend in a time-series analysis.) Activity: All activity ratios indicate a faster turnover of assets compared to the industry. Further analysis is necessary to determine whether the firm is in a weaker or stronger position than the industry. A higher inventory turnover ratio may indicate low inventory, resulting in stock outs and lost sales. A shorter average collection period may indicate extremely efficient receivables management, an overly zealous credit department, or credit terms which prohibit growth in sales. Debt: The firm uses more debt than the average firm, resulting in higher interest obligations which could reduce its ability to meet other financial obligations. Profitability: The firm has a higher gross profit margin than the industry, indicating either a higher sales price or a lower cost of goods sold. The net profit margin is lower than industry, an indication that expenses other than cost of goods sold are higher than the industry. Most likely, the damaging factor is high interest expenses due to a greater than average amount of debt. The increased leverage, however, magnifies the return the owners receive, as evidenced by the superior ROE. b) Fox Manufacturing Company needs improvement in its liquidity ratios and possibly a reduction in its total liabilities. The firm is more highly leveraged than the average firm in its industry and, therefore, has more financial risk. The profitability of the firm is lower than average but is enhanced by the use of debt in the capital structure, resulting in a superior ROE.

Question 2 (i) Liquidity Liquidity as measured by the current ratio which has increased slightly from 2007 to 2008. However, the quick ratio has decreased over the same period and this is more acute in measuring liquidity. The liquidity levels over the two years were below the industry averages but were above the recommended levels of 2 for current ratio and 1 for quick ratio. The company was slightly more able to meet its current obligations but actions should be taken to improve the liquidity position further. (ii) Activity or Efficiency Although the company had improved slightly on its collection policy 2008 compared to 2007, it still took a longer time to collect from debtors, as compared to other companies in the same industry. More relaxed collection policy might have accounted for increased sales in 2008 but Excel Limited must realize the adverse consequences of slow collection with its greater probability of bad and doubtful debts. Excel Limited s inventory turnover was at a slower rate over the two years compared to other firms in the same industry as could be seen from a much lower than average inventory turnover figure. Excel Limited increased its stock holding by 61.22% in 2008 when its sales only increased by 14.87% during the same period. Large accumulation of inventory balance would contribute to high storage and insurance costs, contributing to lower profitability. (iii) Debt The debt position of the company has improved slightly as evidenced from debt ratio that had decreased slightly over the two years. However, for both years, the debt ratio of Excel Limited was higher than the industry average figure. The times interest earned ratio had also declined over the two years and they were lower than the industry average figure, showing that the earnings of Excel Limited could not cover interest expenses by as much times as the industry s. Excel Limited is increasingly more dependent on outside borrowings to finance its operations, resulting in greater risk from the higher financial leverage.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Chapter 11 Financial Accounting With Adjustment: Question 1 FuguangDokumen15 halamanChapter 11 Financial Accounting With Adjustment: Question 1 FuguangClaudia WongBelum ada peringkat

- Intermediate: AccountingDokumen74 halamanIntermediate: AccountingTiến NguyễnBelum ada peringkat

- Capstone Round 0 ReportDokumen16 halamanCapstone Round 0 Reportcricket1223100% (1)

- Crowd Funding Models ExplainedDokumen3 halamanCrowd Funding Models ExplainedBelly BelssBelum ada peringkat

- L T NBFCDokumen122 halamanL T NBFCsheshatri ramachandranBelum ada peringkat

- Deposition of Jeff StenmanDokumen28 halamanDeposition of Jeff StenmanSTOP RCO NOWBelum ada peringkat

- Fixed Income ValuationDokumen54 halamanFixed Income ValuationAnurag MishraBelum ada peringkat

- BFS Foreclosed Properties for Sale in June 2017Dokumen28 halamanBFS Foreclosed Properties for Sale in June 2017kerwin100% (1)

- Comprehensive Scheme For Regulation of SisDokumen158 halamanComprehensive Scheme For Regulation of SispatrickBelum ada peringkat

- Lecture 1. Ratio Analysis Financial AppraisalDokumen11 halamanLecture 1. Ratio Analysis Financial AppraisaltiiworksBelum ada peringkat

- Gitman Chapter1Dokumen11 halamanGitman Chapter1Jehad SelaweBelum ada peringkat

- Project earnings per share calculation with debt issuanceDokumen14 halamanProject earnings per share calculation with debt issuanceElisabete PadilhaBelum ada peringkat

- Thermo Fisher To Acquire Life Technologies IR PresentationDokumen13 halamanThermo Fisher To Acquire Life Technologies IR PresentationTariq MotiwalaBelum ada peringkat

- Answer To The Question No.1Dokumen4 halamanAnswer To The Question No.1Riyazul IslamBelum ada peringkat

- Econ 2020 Term PaperDokumen5 halamanEcon 2020 Term Paperapi-273009910Belum ada peringkat

- Continental CarriersDokumen2 halamanContinental Carrierschch917100% (1)

- Sas#12 Bam128Dokumen6 halamanSas#12 Bam128Dhaisy BarbadoBelum ada peringkat

- Chapter 1 HWDokumen5 halamanChapter 1 HWValerie Bodden Kluge100% (1)

- Analysis NikeDokumen16 halamanAnalysis NikeMario Mitsuo100% (2)

- Garden of Riches - A Practical Guide To Financial SuccessDokumen177 halamanGarden of Riches - A Practical Guide To Financial Successwolf manBelum ada peringkat

- Bond ValuationDokumen36 halamanBond ValuationBhavesh RoheraBelum ada peringkat

- Trans-Pacific Industrial v. CADokumen1 halamanTrans-Pacific Industrial v. CAKimBelum ada peringkat

- Applying IFRS: IFRS 12 - Example Disclosures For Interests in Unconsolidated Structured EntitiesDokumen24 halamanApplying IFRS: IFRS 12 - Example Disclosures For Interests in Unconsolidated Structured Entitiesnicolai aquino0% (1)

- Report APOL Konsol - Des 2018 PDFDokumen138 halamanReport APOL Konsol - Des 2018 PDFCitra DianaBelum ada peringkat

- CIRP REGULATION AMENDMENTS: KEY CHANGESDokumen30 halamanCIRP REGULATION AMENDMENTS: KEY CHANGESJyoti SinghBelum ada peringkat

- Escorts Fsa WorksheetDokumen14 halamanEscorts Fsa Worksheetkaushal talukderBelum ada peringkat

- Discuss What Is The Shariah Advisory Council of Bank Negara MalaysiaDokumen2 halamanDiscuss What Is The Shariah Advisory Council of Bank Negara Malaysiaotaku himeBelum ada peringkat

- Demo - Nism 5 A - Mutual Fund Module PDFDokumen7 halamanDemo - Nism 5 A - Mutual Fund Module PDFrinkesh barnwalBelum ada peringkat

- Topic 8 - Receivable Financing - Rev (Students)Dokumen37 halamanTopic 8 - Receivable Financing - Rev (Students)Romzi100% (1)

- Barclays Bank (GH) LTD v. Heli Enterprises (Kofi Krom Co LTD, Third Party)Dokumen3 halamanBarclays Bank (GH) LTD v. Heli Enterprises (Kofi Krom Co LTD, Third Party)Musah YahayaBelum ada peringkat