39621689

Diunggah oleh

saravananr04Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

39621689

Diunggah oleh

saravananr04Hak Cipta:

Format Tersedia

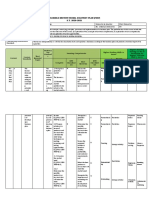

Draft QUESTIONNAIRE - ACCESS TO FINANCE

Population: Business Register database in the year 2009, new enterprises with 5-year survival 2002-2007. Sub-population: gazelles fulfilling the growth criteria 2004-2007; all gazelles to be addressed for response; in the report making up max. 50% of the baseline population. Country coverage: CETO-flagging groups: large countries every. EU-15 and EUNMS-12: possibility for European sampling or aggregates Some SBS-available finance information pre-filled by NSIs No size-class breakdown (all respondents are small, limitation problems/sample sizes) NACE breakdown: o NACE Rev. 2; B to E (Industry: mining and quarrying, manufacture, electricity gas and AC supply, water supply and waste) o NACE 2; F (Construction) o NACE 2; G to N (Services, incl. financial) o NACE 2; J (Information and communication services) o NACE 2; M (Professional, scientific and technical services) Max. 20 questions, max. 25,000 enterprises in EU, max 1.5 hrs individual respondent effort Owner/managers respond Reference period: time of survey What type of start-up was this (select one): a) Start of a completely new enterprise / business / activity b) Creation by an existing enterprise (as an affiliate / subsidiary / daughter) c) Restart of activity / business after being dormant over 2 years d) Restart of activity / business after being dormant for up to 2 years e) Take-over/purchase of another enterprise f) Take-over of a part of another enterprise g) Only a change of legal form of previously existing enterprise h) Other

1.

2. What did you find difficult when starting up your enterprise (multiple answers possible)? a) To get financing b) To establish contacts with customers c) To obtain payment for outstanding invoices d) To price my goods/services e) To find suitable premises f) To find suppliers g) To get suitable personnel h) To use information technology effectively i) To deal with legal / governmental / administrative matters (registration, taxes etc.) j) To be alone as an entrepreneur k) To get backing from my spouse/family

l) 3.

none / not relevant Characteristics of the founder (tick all applicable): male gender female gender age < 30 years age 30-39 years age > 39 citizenship: domestic foreign (EU) foreign outside EU I had experience in the economic activity before starting my enterprise I had experience starting-up an enterprise before starting the current one I had undergone own firm bankruptcy before starting the current enterprise I have followed formal business training I have had univ. entrepreneurship classes

4. Do you consider your enterprise to be innovative with respect to any of the following categories? Yes/No a) A new good or service introduced to the market (product innovation) Y/N b) A new production process or method (process innovation) Y/N c) A new organisation of management (organisational innovation) Y/N d) A new way of selling your goods or services (marketing innovation) Y/N 5. 6. Access to financing for firms in your situation is considered: easy normal difficult What type of equity financing has your enterprise received since (and including) start-up (tick all applicable): only founders own funds funds from spouses or life partners funds from other family members funds from other individuals excluding business angels other companies government funds venture capitalists business angels other Did the enterprise since its start use any of the following debt financing options (tick all applicable): credit cards issued in the name of the enterprise business loans from a commercial bank business loans from a non-bank financial institution business loans from family or friends of the owner business loans from an owner or a life partner of them loans from employees that are not owners loans from government agencies loans from other businesses

7.

business loans from other persons not associated with the enterprises management other sources 8. What is the current ownership/equity situation (tick only one): sole proprietorship partnership with few other individuals limited liability company, not publicly traded limited liability company, publicly traded other After firm start-up until now, have you sought (tick all applicable): Personal loans from family and friends successfully Personal loans from family and friends unsuccessfully Personal loans from other individuals outside the firm successfully Personal loans from other individuals outside the firm unsuccessfully Personal loans from banks or other finance institutions successfully Personal loans from banks or other financial institutions unsuccessfully Other financing sources

9.

10. Loans from banks or other financial institutions (debt) was (only one answer): never sought sought but not granted once sought and not granted more than once sought and granted once without guarantee by others sought and granted once with a guarantee by others sought and granted more than once without a guarantee sought and granted more than once with a guarantee 11. Loans from banks or other financial institutions were (only one answer): never sought granted and considered cheap granted and considered adequate granted and considered expensive never granted although sought 12. Loans from banks or other financial institutions were (only one answer for the most substantial loan): never used from a local bank where personal contacts existed from a local bank where no personal contacts existed from a bank with headquarters in the country of firms establishment from a bank with headquarters in another country in the EU from a bank with headquarters in a country outside the EU During the next 3 years, the enterprise will (only one answer): need no financing seek mainly loans from owners, employees, friends or family

13.

seek mainly loans from banks or other financial institutions seek mainly financing from owners, employees, friends or family against equity given to them seek mainly financing from others against equity prepare or execute an initial public offering on the stock market 14. During the next 3 years, the financing needs of the enterprise will (only one answer): be satisfied through sales only require a first loan from banks or other financial institutions require further loans from banks or other finance institutions require giving away equity for the first time require giving away more equity result in the loss of majority ownership of the founder 15. What percentage of gross sales income of the enterprise is likely needed in the next 3 years to service the debt (interest plus repayment): none 1 to 5% 5 to 10% 10 to 30% more With easier and/or cheaper access to finance, would your enterprise, during the next 3 years, grow (one answer only): as it will anyway faster much faster survive, which it under present conditions likely will not The red tape (burden imposed upon your enterprise by fulfilling all administrative requirements that do not generate sales) is considered (one answer only): little normal high Have you, to your knowledge, directly or indirectly profited from EU financial support programmes or support mechanisms? yes no How much time was needed to fill in this questionnaire: .minutes

16.

17.

18.

19.

Anda mungkin juga menyukai

- PopiaDokumen31 halamanPopiaFaid Ammar0% (1)

- Module 2 - Business Enterprise Simulation-1Dokumen42 halamanModule 2 - Business Enterprise Simulation-1CYRILLE LARGO75% (4)

- Strategic Partnership Agreement TemplateDokumen8 halamanStrategic Partnership Agreement TemplateRico Soberano100% (1)

- CHED CMO On Bachelor of Science in EntrepreneurshipDokumen34 halamanCHED CMO On Bachelor of Science in EntrepreneurshipFernan Fangon Tadeo100% (1)

- Nursing EntrepreneurshipDokumen30 halamanNursing Entrepreneurshipglaiza89% (9)

- MGT601 FinalTerm MEGA MCQsFile PDFDokumen205 halamanMGT601 FinalTerm MEGA MCQsFile PDFAleena Mir100% (1)

- Fidp in EntrepreneurshipDokumen11 halamanFidp in EntrepreneurshipRowena Barcarse100% (1)

- Debt Financing: Mark All That ApplyDokumen2 halamanDebt Financing: Mark All That ApplyMargo SongBelum ada peringkat

- Small Business Survey QuestionnaireDokumen8 halamanSmall Business Survey QuestionnaireErosBelum ada peringkat

- Formalities For Setting Up A Small Business EnterpriseDokumen8 halamanFormalities For Setting Up A Small Business EnterpriseMisba Khan0% (1)

- ViniDokumen34 halamanViniNishantBelum ada peringkat

- 12 Commerce Chapter 1,2 20.4.2020Dokumen8 halaman12 Commerce Chapter 1,2 20.4.2020KaSSeY BTCBelum ada peringkat

- MGT 602Dokumen6 halamanMGT 602saqib_hakeemBelum ada peringkat

- Project Finance Application FormDokumen16 halamanProject Finance Application FormAlidu Abdul-MajeedBelum ada peringkat

- DISB Access To Capital Survey 2015 09Dokumen19 halamanDISB Access To Capital Survey 2015 09Scott RobertsBelum ada peringkat

- EDS411 Entrepreneural FinanceDokumen20 halamanEDS411 Entrepreneural FinanceIwuoha Maxrofuzo ChibuezeBelum ada peringkat

- YDF GUIDELINES August 2022 Final....Dokumen8 halamanYDF GUIDELINES August 2022 Final....Lesego MoabiBelum ada peringkat

- Busifin1 Chapter2Dokumen96 halamanBusifin1 Chapter2Ronald MojadoBelum ada peringkat

- Important Questions For CBSE Class 11 Business Ghjstudies Chapter 7Dokumen11 halamanImportant Questions For CBSE Class 11 Business Ghjstudies Chapter 7Rahul SinglaBelum ada peringkat

- Business Finance Opportunities Part IIDokumen30 halamanBusiness Finance Opportunities Part IItehberbdeanBelum ada peringkat

- Financial SupportDokumen7 halamanFinancial SupportdavidococBelum ada peringkat

- Marking Guide 2022Dokumen10 halamanMarking Guide 2022Meek AdamzBelum ada peringkat

- Topic 3: Finance Chapter 11: Role of Financial Management Strategic Role of Financial ManagementDokumen12 halamanTopic 3: Finance Chapter 11: Role of Financial Management Strategic Role of Financial Managementstregas123Belum ada peringkat

- Public DepositDokumen1 halamanPublic DepositNandini RastogiBelum ada peringkat

- Babajide A. A. and Adetiloye K.ADokumen29 halamanBabajide A. A. and Adetiloye K.ATosin JohnsonBelum ada peringkat

- 5484Dokumen11 halaman5484mairaj08Belum ada peringkat

- Ydf Guidelines 4 July 2017Dokumen8 halamanYdf Guidelines 4 July 2017Mpho Daniel PuleBelum ada peringkat

- Business Life CycleDokumen7 halamanBusiness Life CycleHaron HB WritersBelum ada peringkat

- 2015 Joint Small Business Credit SurveyDokumen13 halaman2015 Joint Small Business Credit SurveyRapha JohnBelum ada peringkat

- Establishing A New EnterpriseDokumen26 halamanEstablishing A New EnterpriseUmang MehraBelum ada peringkat

- IGCSE Business Studies Chapter 09 NotesDokumen5 halamanIGCSE Business Studies Chapter 09 NotesemonimtiazBelum ada peringkat

- MBA 806 Corporate Finance 01 and 02Dokumen22 halamanMBA 806 Corporate Finance 01 and 02ALPASLAN TOKERBelum ada peringkat

- Week 6 Semester 1 2016-2017 DraftDokumen27 halamanWeek 6 Semester 1 2016-2017 DraftSabina TanBelum ada peringkat

- Be Unit-1Dokumen12 halamanBe Unit-1Nilesh MahanandaBelum ada peringkat

- Questionnaire For SMEDokumen2 halamanQuestionnaire For SMELeo JohnBelum ada peringkat

- Manisha Kumari BBA. 40029.19 End Sem E&SBDokumen14 halamanManisha Kumari BBA. 40029.19 End Sem E&SBUjjwal kumarBelum ada peringkat

- Unit - 1 Basic Concepts - Forms of Business Organization PDFDokumen29 halamanUnit - 1 Basic Concepts - Forms of Business Organization PDFShreyash PardeshiBelum ada peringkat

- Chit FundDokumen89 halamanChit FundLalit Bonde50% (2)

- Credit Guarantee CorporationDokumen24 halamanCredit Guarantee Corporationsweet5458Belum ada peringkat

- 1STU102 2023 Part 1 Lecture NotesDokumen21 halaman1STU102 2023 Part 1 Lecture NotesMutorua KaveraBelum ada peringkat

- Entrepreneurship Development ProgrammeDokumen28 halamanEntrepreneurship Development ProgrammeAanchal JiwrajkaBelum ada peringkat

- Cgu Miscellaneous Professional Indemnity Insurance ProposalDokumen8 halamanCgu Miscellaneous Professional Indemnity Insurance ProposalNguyen Hong HaBelum ada peringkat

- 11.university of Nueva CaceresDokumen6 halaman11.university of Nueva CaceresNina Sarah Bulanga JamitoBelum ada peringkat

- Sources of Finance: Managing Financial Resources and DecisionsDokumen25 halamanSources of Finance: Managing Financial Resources and DecisionsVishal GosaviBelum ada peringkat

- Starting A BusinessDokumen13 halamanStarting A BusinessKeen KurashBelum ada peringkat

- 1.1& 1.2 Nature& Organization of Business& TypesDokumen32 halaman1.1& 1.2 Nature& Organization of Business& TypesravichatrathiBelum ada peringkat

- DB 2016 - ROM - Starting - Survey - en - Pop - ClaudiuDokumen14 halamanDB 2016 - ROM - Starting - Survey - en - Pop - ClaudiuCristi GaburBelum ada peringkat

- 2122 Level N Business Studies Exam Related Materials T1 Wk3 UpdatedDokumen8 halaman2122 Level N Business Studies Exam Related Materials T1 Wk3 UpdatedhindBelum ada peringkat

- Acctg 15 - Midterm ExamDokumen3 halamanAcctg 15 - Midterm ExamRannah RaymundoBelum ada peringkat

- Instruments For Financing Working CapitalDokumen6 halamanInstruments For Financing Working CapitalPra SonBelum ada peringkat

- According To Time-PeriodDokumen9 halamanAccording To Time-PeriodMin JeeBelum ada peringkat

- Financing The Business - A Continuous Challenge For The EntrepreneurDokumen29 halamanFinancing The Business - A Continuous Challenge For The EntrepreneurAnto DBelum ada peringkat

- Business FinancingDokumen30 halamanBusiness FinancingMadi2014Belum ada peringkat

- Black Book Chit FundDokumen63 halamanBlack Book Chit FundLalit MakwanaBelum ada peringkat

- Lesson 2 Organization PDFDokumen20 halamanLesson 2 Organization PDFAngelita Dela cruzBelum ada peringkat

- 4 Form of OrganisationDokumen35 halaman4 Form of OrganisationSeiya KapahiBelum ada peringkat

- Summary of POB TopicsDokumen23 halamanSummary of POB TopicsRosemary Reynolds88% (17)

- 5 Introduction To Business ImplementationDokumen19 halaman5 Introduction To Business ImplementationDelsie Falculan75% (4)

- Meanings of Stock MKTDokumen5 halamanMeanings of Stock MKTHemant PawarBelum ada peringkat

- Advance Performance Management: Assignment No 04Dokumen9 halamanAdvance Performance Management: Assignment No 04Mohammad HanifBelum ada peringkat

- Assignment 7 - VikrantDokumen6 halamanAssignment 7 - VikrantVikrant Anil SharmaBelum ada peringkat

- NT 4 Bankruptcy and RestructuringDokumen16 halamanNT 4 Bankruptcy and RestructuringCarmenBelum ada peringkat

- The Eighth Commandment: Go With The (Cash) FlowDokumen7 halamanThe Eighth Commandment: Go With The (Cash) FlowDavid 'Valiant' OnyangoBelum ada peringkat

- Coperate FinanceDokumen17 halamanCoperate Financegift lunguBelum ada peringkat

- How to Get a Business Loan for Commercial Real Estate: 2012 EditionDari EverandHow to Get a Business Loan for Commercial Real Estate: 2012 EditionBelum ada peringkat

- HOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”Dari EverandHOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”Belum ada peringkat

- Get Funded!: How to Find the Money to Successfully Grow Your Business and Solve Its Most Pressing ChallengesDari EverandGet Funded!: How to Find the Money to Successfully Grow Your Business and Solve Its Most Pressing ChallengesBelum ada peringkat

- Pet Word CardsDokumen1 halamanPet Word CardsMehakBatlaBelum ada peringkat

- BUS Bicycle TrainDokumen7 halamanBUS Bicycle TrainMehakBatlaBelum ada peringkat

- Babies DotsDokumen1 halamanBabies DotsMehakBatlaBelum ada peringkat

- Water TransportDokumen1 halamanWater TransportMehakBatlaBelum ada peringkat

- CC Fruit 2Dokumen2 halamanCC Fruit 2MehakBatlaBelum ada peringkat

- CC Fruit 1Dokumen2 halamanCC Fruit 1MehakBatlaBelum ada peringkat

- Example and Definition: Sensitive Periods Is A Term Developed by The Dutch Geneticist Hugo de Vries and Later UsedDokumen10 halamanExample and Definition: Sensitive Periods Is A Term Developed by The Dutch Geneticist Hugo de Vries and Later UsedMehakBatla100% (1)

- GTL Infrastructure LTD: Key Financial IndicatorsDokumen4 halamanGTL Infrastructure LTD: Key Financial IndicatorsMehakBatlaBelum ada peringkat

- Questionnaire CRMDokumen5 halamanQuestionnaire CRMMehakBatla100% (1)

- Definition and Uses of DerivativesDokumen3 halamanDefinition and Uses of DerivativesMehakBatlaBelum ada peringkat

- Investor Presentation q4 Fy 2010 2011 13 April 2011Dokumen33 halamanInvestor Presentation q4 Fy 2010 2011 13 April 2011MehakBatlaBelum ada peringkat

- Assignment On Intra Trade of The: Commodities in IndiaDokumen7 halamanAssignment On Intra Trade of The: Commodities in IndiaMehakBatlaBelum ada peringkat

- Google: Google Search Google (Disambiguation)Dokumen14 halamanGoogle: Google Search Google (Disambiguation)MehakBatlaBelum ada peringkat

- Design EntrepreneurDokumen241 halamanDesign EntrepreneurAriel H. Cochia100% (1)

- Rotterdam Programme On Sustainaibilty and Climate Change 2015-2018Dokumen39 halamanRotterdam Programme On Sustainaibilty and Climate Change 2015-2018David Flood50% (2)

- SNVMDokumen2 halamanSNVMhandeavinash8Belum ada peringkat

- Pretest in Applied Economics - 4TH QuarterDokumen2 halamanPretest in Applied Economics - 4TH QuarterBernardita Sison-CruzBelum ada peringkat

- ENT 300 PresentationDokumen51 halamanENT 300 PresentationAbdullah Muhammad0% (1)

- Unit 1 Basics of TechnopreneurshipDokumen17 halamanUnit 1 Basics of TechnopreneurshipJastine AnneBelum ada peringkat

- Competition RulesDokumen3 halamanCompetition RulesVictorMoreiraMartinsBelum ada peringkat

- EppDokumen6 halamanEppReeya MehtaBelum ada peringkat

- Corporate PresentationDokumen33 halamanCorporate PresentationMuniesh WaranBelum ada peringkat

- Management Principles: MBA SZABIST IslamabadDokumen30 halamanManagement Principles: MBA SZABIST IslamabadUmer KiyaniBelum ada peringkat

- Ijebr 10 2019 0615Dokumen19 halamanIjebr 10 2019 0615Bara PahlawanBelum ada peringkat

- The ChallengesDokumen14 halamanThe ChallengesPrem RajBelum ada peringkat

- TopicsDokumen256 halamanTopicsMaitreyee PalBelum ada peringkat

- Excellence in Employer BrandingDokumen11 halamanExcellence in Employer BrandingNikita ZutshiBelum ada peringkat

- Session 15, 16 VCDokumen35 halamanSession 15, 16 VCdakshaangelBelum ada peringkat

- Entrepreneurship EducationDokumen6 halamanEntrepreneurship EducationGgayi JosephBelum ada peringkat

- Generating Competitive Advantage Strategy Through Entrepreneurial Marketing For Smes in Culinary Sector in Medan IndonesiaDokumen10 halamanGenerating Competitive Advantage Strategy Through Entrepreneurial Marketing For Smes in Culinary Sector in Medan Indonesiapdimfeb UsuBelum ada peringkat

- Ch-1 Innovation and EntrepreneurshipDokumen13 halamanCh-1 Innovation and EntrepreneurshipmelkecoopBelum ada peringkat

- Richest People in The Philippines Are Mostle EntrepreneursDokumen4 halamanRichest People in The Philippines Are Mostle EntrepreneursStephanie AndalBelum ada peringkat

- QuizDokumen9 halamanQuizPadmavathi ShenoyBelum ada peringkat

- MBA/BBA Project ReportDokumen58 halamanMBA/BBA Project Reportchandbali967% (3)

- Jammu & Kashmir Industrial Policy 2021-30Dokumen49 halamanJammu & Kashmir Industrial Policy 2021-30AjayBelum ada peringkat

- Trends in Business and Administrative CommunicationDokumen16 halamanTrends in Business and Administrative CommunicationObakozuwa Edokpolo Oghogho PeterBelum ada peringkat