Openwave APA

Diunggah oleh

propertyintangibleDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Openwave APA

Diunggah oleh

propertyintangibleHak Cipta:

Format Tersedia

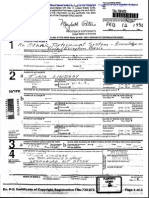

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page1 of 92

EXHIBIT A

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page2 of 92

ASSET PURCHASE AGREEMENT

between

Purple Labs S.A., a French corporation and Openwave Systems Inc., a Delaware corporation

____________________________ Dated as of June 27, 2008 ____________________________

13270.003.875667v15 715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page3 of 92

TABLE OF CONTENTS Page 1. Sale of Assets; Related Transactions. ..................................................................................1 1.1 1.2 1.3 2. Purchase and Sale of Assets.....................................................................................1 Purchase Price..........................................................................................................2 Closing .....................................................................................................................3

Representations and Warranties of the Seller. .....................................................................4 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 2.10 2.11 2.12 2.13 2.14 2.15 2.16 2.17 2.18 Due Organization .....................................................................................................4 Qualification to Do Business ...................................................................................4 Non-contravention ...................................................................................................4 Consents...................................................................................................................4 Authority; Binding Nature Of Agreements..............................................................5 Title To Assets .........................................................................................................5 Intellectual Property.................................................................................................5 Contracts ..................................................................................................................9 Compliance with Legal Requirements...................................................................10 Governmental Authorizations................................................................................10 Employee And Labor Matters..............................................................................101 Employee Benefit Plans and Compensation ........................................................112 Property..................................................................................................................12 Environmental Matters...........................................................................................12 Products and Product Development.....................................................................123 Performance Of Services .....................................................................................123 Suppliers and Customers......................................................................................123 Insurance ................................................................................................................13

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page4 of 92

2.19 2.20 2.21 2.22 2.23 2.24 2.25 2.26 3.

Proceedings; Orders ...............................................................................................14 Tax Matters ..........................................................................................................134 Transactions with Directors, Officers, Managers, and Affiliates ........................145 Brokers.................................................................................................................145 Restrictions on Business Activities......................................................................145 Financial Information.............................................................................................15 Tangible Assets....................................................................................................156 Full Disclosure .....................................................................................................156

Representations and Warranties of the Purchaser............................................................156 3.1 3.2 3.3 3.4 3.5 3.6 Due Organization .................................................................................................156 Qualification to Do Business ...............................................................................156 Authority; Binding Nature Of Agreements..........................................................157 Non-contravention ...............................................................................................167 Consents...............................................................................................................167 Brokers.................................................................................................................167

4.

Indemnification. ...............................................................................................................167 4.1 4.2 4.3 4.4 4.5 4.6 4.7 Survival of Representations .................................................................................167 Indemnification By The Seller.............................................................................168 Indemnification By The Purchaser ......................................................................178 Limitations ...........................................................................................................179 Exclusivity Of Indemnification Remedies.............................................................20 Defense Of Third Party Claims..............................................................................20 Claims for Indemnification; Exercise Of Remedies By Indemnitees Other Than The Purchaser or Seller.................................................................................21

5.

Certain Other Agreements; Post-Closing Covenants.......................................................202

13270.003.875667v15715114 v6/HN

ii

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page5 of 92

5.1 5.2 5.3 5.4 5.5 5.6 6.

Publicity .................................................................................................................20 Nonsolicitation of Employees................................................................................21 Noncompetition....................................................................................................213 Assignment of Contracts.......................................................................................213 Accounts Receivable............................................................................................224 Employees and Employee Benefits .....................................................................224

Miscellaneous Provisions.................................................................................................246 6.1 6.2 6.3 6.4 6.5 6.6 6.7 6.8 6.9 6.10 6.11 6.12 6.13 6.14 6.15 6.16 6.17 6.18 Further Assurances...............................................................................................246 Continuing Access to Information and Confidentiality .......................................257 Fees and Expenses ...............................................................................................268 Sales Taxes...........................................................................................................268 Attorneys' Fees.....................................................................................................268 Notices .................................................................................................................268 Time Of The Essence.............................................................................................30 Headings ................................................................................................................30 Counterparts...........................................................................................................30 Governing Law; Venue..........................................................................................30 Successors And Assigns; Parties In Interest ..........................................................30 Remedies Cumulative; Specific Performance .......................................................31 Waiver....................................................................................................................31 Amendments ..........................................................................................................32 Severability ............................................................................................................32 Entire Agreement ...................................................................................................32 Disclosure Schedule...............................................................................................32 Construction.........................................................................................................302

13270.003.875667v15715114 v6/HN

iii

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page6 of 92

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this "Agreement") is entered into as of June 27, 2008, by and between Purple Labs S.A., a French corporation (the "Purchaser"), and Openwave Systems Inc., a Delaware corporation (the "Seller"). Certain capitalized terms used in this Agreement are defined in Exhibit A. RECITALS A. The Seller is a publicly traded provider of software to communications service providers and, in particular, develops, markets and licenses software for deployment on mobile devices as part of the Business. B. The Seller wishes to sell to the Purchaser, and the Purchaser desires to purchase from the Seller, certain assets owned by the Seller necessary to continue the Business on the terms set forth in this Agreement. C. Seller uses in Seller's Remaining Business certain intellectual property and assets that Purchaser desires to use to conduct the Business and therefore, each of Seller and Purchaser shall grant a license to certain intellectual property and assets for Purchaser's use in the Business and Seller's use in Seller's Remaining Business, respectively, on the terms set forth in this Agreement. D. In connection with the foregoing purchase and license of assets, the Purchaser desires to assume, and the Seller desires to assign to Purchaser, certain liabilities of the Seller on the terms set forth in this Agreement. AGREEMENT NOW THEREFORE, in consideration of the foregoing premises, the mutual agreements and respective covenants hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties to this Agreement, intending to be legally bound, hereby agree as follows: 1. SALE OF ASSETS; RELATED TRANSACTIONS.

1.1 Purchase and Sale of Assets. The Seller shall sell, assign, transfer, convey and deliver to the Purchaser or its designee, and the Purchaser shall purchase, acquire and accept from the Seller, at the Closing, all of the Seller's and the Sellers Subsidiaries right, title and interest in, to and under the Assets on the terms and subject to the conditions set forth in this Agreement. The Assets shall be conveyed free and clear of all Encumbrances, except Permitted Encumbrances. For purposes of this Agreement, "Assets" shall mean all of the equipment, Assigned Contracts, Seller IP and other tangible and intangible assets of the Seller set forth on Schedule 1.1(a) attached hereto and any Contract assumed by the Purchaser pursuant to Section 6.1(b).

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page7 of 92

Notwithstanding anything to the contrary set forth herein or in any other Transaction Document, the term "Assets" does not include any accounts receivable arising out of goods sold or services rendered before June 13, 2008 or any Contracts which are not listed on Schedule 1.1(a) or assumed pursuant to Section 6.1(b) (collectively, the "Excluded Assets"). 1.2 Purchase Price.

(a) As consideration for the sale of the Assets to the Purchaser, the Purchaser shall pay to Seller Thirty Two Million U.S. Dollars ($32,000,000) (the "Purchase Price"), payable as set forth below. (i) At the Closing, the Purchaser shall pay to the Seller Twenty Million U.S. Dollars ($20,000,000) in cash or by wire transfer of immediately available funds to an account or accounts designated by the Seller (the "First Installment"); (ii) On or before July 31, 2008, Purchaser shall issue to the Seller a warrant to purchase 2.0% of the outstanding equity securities of Purchaser on a fully diluted basis, at a purchase price of 27 per share; and (iii) Within seven days after the Closing Date, the Purchaser shall pay to the Seller the balance of the Purchase Price (the "Second Installment") as follows: (a) $4,200,000 shall be deposited with the Escrow Agent pursuant to the Indemnification Escrow Agreement by wire transfer of immediately available funds; (b) $5,800,000 shall be paid to the Seller in cash or by wire transfer of immediately available funds to an account or accounts designated by the Seller; and (c) $2,000,000 shall be deposited with the Escrow Agent by wire transfer of immediately available funds pursuant to the Microsoft Escrow Agreement. (b) In addition to payment of the Purchase Price, at the Closing, the Purchaser shall assume the Assumed Liabilities. For purposes of this Agreement the term "Assumed Liabilities" shall mean and include only the: (i) Liabilities of the Seller pursuant to the terms of the Assigned Contracts, but only to the extent such Liabilities: (A) arise after the Closing Date; (B) do not arise from or relate to any breach by Seller or any subsidiary of Seller of any provision of any such Assigned Contracts; and (C) do not arise from or relate to any event, circumstance or condition occurring or existing on or prior to the Closing Date that, with notice or lapse of time, would constitute or result in a breach of any of such Assigned Contracts; provided, however, that notwithstanding the foregoing, "Assumed Liabilities" shall include indemnity claims pursuant to the terms of the Assigned Contracts arising from sales made and services rendered prior to the Closing, but only to the extent such indemnity claim Liabilities: (A) are based on claims made or otherwise arising after the Closing; (B) do not arise from any breach by Seller of any provision of any such Assigned Contracts other than the warranty provisions thereof; and (C) do not arise from any event, circumstance or condition occurring or existing on or prior to the Closing Date that, with notice, would constitute a breach of any of such Assigned Contracts, other than related to the warranty provisions thereof;

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page8 of 92

(ii) Warranty and support claims pursuant to the terms of the Assigned Contracts and arising from sales made and services rendered prior to the Closing, but only to the extent such claims are made after the Closing or are specified in the Disclosure Schedule; and (iii) Accounts payable (excluding payroll) arising out of goods purchased or services rendered on or after June 13, 2008. (c) Notwithstanding anything to the contrary contained in this Agreement, the Purchaser shall not be required to assume, perform or discharge any Liability of any kind of Seller or any of its Affiliates (whether or not related to the Business or the Assets) other than the Assumed Liabilities, and all such Liabilities (including the Retained Employment Liabilities and the Retained Sales Tax Liabilities) shall remain solely the responsibility of the Seller (the "Excluded Liabilities"). (d) If for any reason, or no reason at all, the Purchaser fails to pay to the Seller the Second Installment within the seven day period as set forth in Section 1.2(a)(ii), then the Seller shall have the right, in its sole discretion, to unilaterally rescind this Agreement upon written notice to the Purchaser. If the Seller rescinds this Agreement under this clause (e), then the Transactions shall thereupon be unwound, and the Purchaser shall promptly return, assign, transfer, convey and deliver all Assets to the Seller, and the Seller shall promptly refund the First Installment to the Purchaser less a break-up fee equal to One Million U.S. Dollars ($1,000,000). The Seller shall be entitled to such break-up fee as compensation for certain costs and expenses incurred by the Seller and its Affiliates as a result of the Transactions, and such fee shall not be deemed to be liquidated damages. 1.3 Closing

(a) The closing of the sale of the Assets to, and the assumption of the Assumed Liabilities by, the Purchaser (the "Closing") is taking place concurrently with the execution hereof at the offices of Coblentz, Patch, Duffy & Bass, LLP, One Ferry Building, Suite 200, San Francisco, California, 94911. For purposes of this Agreement, "Closing Date" shall mean 12:01 a.m. local time in San Francisco, California on June 27, 2008. (b) At the Closing, the Seller is concurrently delivering to the Purchaser an executed counterpart to the Indemnification Escrow Agreement, the Microsoft Escrow Agreement, a Bill of Sale and Assignment and Assumption Agreement (the "Bill of Sale"), a Patent Assignment Agreement (the "Patent Assignment"), a Trademark Assignment Agreement (the "Trademark Assignment"), an Intellectual Property License Agreement (the "License Agreement") and a Transition Services Agreement (the "Transition Services Agreement"). (c) At the Closing, the Purchaser shall deliver to the Seller the First Installment of the Purchase Price and is concurrently delivering to the Seller an executed counterpart to the Indemnification Escrow Agreement, the Microsoft Escrow Agreement, the Bill of Sale, the License Agreement and the Transition Services Agreement.

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page9 of 92

2.

REPRESENTATIONS AND WARRANTIES OF THE SELLER.

Subject to the foregoing and except as set forth on the Disclosure Schedules, the Seller represents and warrants as of the Closing Date, to and for the benefit of the Purchaser, as follows: 2.1 Due Organization. The Seller is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and has all requisite corporate power to own the Assets and to conduct the Business as now conducted. 2.2 Qualification to Do Business. Seller is duly qualified to conduct the Business as a foreign corporation and is in good standing in every jurisdiction in which the character of the Assets, the Leased Real Property or the nature of the Business as conducted by the Seller makes such qualification necessary, except where the failure to be so qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. 2.3 Non-contravention. Except as set forth in Section 2.3 of the Disclosure Schedule, neither the execution and delivery of any of the Transaction Documents, nor the consummation or performance of any of the Transactions, will directly or indirectly (with or without notice or lapse of time): (a) contravene, conflict with or result in a violation of, or give any Governmental Body or other Person the right to challenge any of the Transactions or to exercise any remedy or obtain any relief under, any Legal Requirement or any Order to which the Seller, or any of the Assets, is subject; (b) contravene, conflict with or result in a violation of Seller's Certificate of Incorporation or bylaws; (c) contravene, conflict with or result in a violation or breach of, or result in a default under, any provision of any Assigned Contract; (d) give any Person the right to (i) declare a default or exercise any remedy under any Assigned Contract, (ii) accelerate the maturity or performance of any Assigned Contract, or (iii) cancel, terminate or modify any Assigned Contract; or (e) result in the imposition or creation of any Encumbrance upon or with respect to any of the Assets. 2.4 Consents. Except as set forth in Section 2.4 of the Disclosure Schedule, the Seller is not and will not be required to make any filing with or give any notice to, or to obtain any Consent from, any Person or Governmental Body in connection with the execution and delivery of any of the Transaction Documents or the consummation or performance of any of the Transactions, except with respect to any notice, filings or Consents required under any anti-trust or anti-competition law, regulation or statute of any Governmental Body in any jurisdiction in which the Purchaser conducts business.

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page10 of 92

2.5 Authority; Binding Nature Of Agreements. The Seller has the absolute and unrestricted right, power and authority to enter into and to perform its obligations under each of the Transaction Documents to which it is a party; and the execution, delivery and performance by the Seller of the Transaction Documents to which it is a party have been duly authorized by all necessary action on the part of the Seller. No vote of the Seller's stockholders is necessary in order to execute, deliver or perform this Agreement. Assuming the Purchaser's duly authorized execution hereof and thereof, if applicable, this Agreement and each of the other Transaction Documents to which the Seller is a party constitutes the legal, valid and binding obligation of the Seller, enforceable against the Seller in accordance with its terms, except as the enforceability thereof may be subject to or limited by bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or affecting the rights of creditors generally and the availability of equitable relief (whether in proceedings at law or in equity). 2.6 Title To Assets. The Seller owns, and has good and valid title to, all of the Assets. The Assets are owned by the Seller free and clear of any Encumbrances other than Permitted Encumbrances. The Assets, together with Purchaser's rights under the Transaction Documents, will collectively constitute, as of the Closing Date, all of the properties, rights, interests and other tangible and intangible assets (excepting personnel) necessary to enable the Purchaser to conduct the Business in the manner in which such Business has recently been conducted by the Seller. No subsidiary or Affiliate of the Seller owns (or has any rights with respect to) any properties or tangible or intangible assets that are necessary for the conduct of, or that are primarily used in or held for use for, the Business. Except as otherwise set forth in this Agreement, the Assets are conveyed "AS IS" with no warranty and all other warranties, express and implied, are hereby disclaimed, including, without limitation, any implied warranties of fitness for purpose, merchantability or non-infringement. 2.7 Intellectual Property. (a) Section 2.7(a) of the Disclosure Schedule identifies:

(i) each item of Registered IP, the jurisdiction in which such item of Registered IP has been registered or filed and the applicable registration or serial number; and any other Person that has an ownership interest in such item of Registered IP and the nature of such ownership interest; (ii) all Intellectual Property licensed to the Seller and that is used to conduct the Business (other than (1) readily-available off-the-shelf commercial software that is licensed to Seller for its internal use subject to standard terms, and is generally available under such standard terms for a one-time fee of less than ten thousand U.S. dollars (U.S. $10,000), and (2) non-customized back-office software that is used by Seller solely for its own internal administrative purposes but is not incorporated into, or used directly in the development, manufacturing, testing, distribution, or support of, any Seller Product) and the corresponding Contract or Contracts pursuant to which such Intellectual Property is licensed to the Seller; (iii) each Contract pursuant to which any Person has been granted any license under, or otherwise has received or acquired any right (whether or not currently exercisable), immunity, or interest in, any Seller IP, other than nonexclusive, executable-code 5

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page11 of 92

software licenses granted in the ordinary course of business to end-user customers of the Business pursuant to end-user license agreements that do not substantially deviate from the Sellers standard form of end user license agreement; and (iv) any other material Seller IP not otherwise required to be listed pursuant to (i) through (iii) of this Section 2.7(a). (b) Seller exclusively owns all right, title and interest to and in (or, in the case of Seller IP that is exclusively licensed to Seller, has a valid and enforceable license to use) the Seller IP free and clear of any Encumbrances (other than (i) licenses granted pursuant to the Contracts listed in Section 2.7(a)(iii) of the Disclosure Schedule and (ii) nonexclusive, executable-code software licenses granted in the ordinary course of business to consumer enduser customers of the Business). No Seller IP is subject to any Contract containing any covenant or other provision that in any way limits or restricts the ability of the Purchaser or any of its Affiliates to use, exploit, assert, or enforce any Seller IP anywhere in the world. Without limiting the foregoing: (i) All documents and instruments necessary to perfect the rights of the Seller in the Registered IP have been validly executed, delivered and filed in a timely manner with the appropriate Governmental Body. (ii) Each Person who is or was an employee or independent contractor of the Seller and who is or was involved in the creation or development of any Seller IP (except for Magic4 Trademarks) has signed an enforceable agreement containing an assignment of Intellectual Property Rights to the Seller and confidentiality provisions protecting the Seller IP, and no such Person has any past, present, or future right to or ownership of such Intellectual Property Rights (including any right to revoke such assignment). (iii) No Seller Employee has asserted any written claim, right (whether or not currently exercisable) or interest to or in any Seller IP. No Seller Employee who is or was involved in the creation or development of any Seller IP is (A) to Sellers Knowledge, bound by or otherwise subject to any Contract restricting him from performing his duties for the Seller; or (B) to Seller's Knowledge, in breach of any Contract with any former employer or other Person concerning Intellectual Property Rights or confidentiality due to his activities as an employee of the Seller. (iv) No funding, facilities or personnel of any Governmental Body or any college, university, or other educational institution were used, directly or indirectly, to develop or create, in whole or in part, any Seller IP. (c) The Seller has taken all reasonable steps to maintain the confidentiality of and otherwise protect and enforce its rights in all proprietary information held by the Seller and used primarily in the Business. (d) The Seller owns or otherwise has all necessary rights to conduct the Business as conducted by the Seller on the Closing Date. After the Closing and execution by Purchaser of the Transaction Documents, the Purchaser has, or will be able to obtain through the

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page12 of 92

exercise of Purchaser's rights pursuant to Section 3.2 of the License Agreement, all Intellectual Property Rights necessary to conduct the Business as Seller conducted the Business on the Closing Date. (e) To Seller's Knowledge, all Seller IP (except for Magic4 Trademarks) is valid, subsisting, and enforceable. Without limiting the generality of the foregoing: (i) Each U.S. patent application and U.S. patent that constitutes Seller IP was filed within one year of a printed publication, public use, or offer for sale of each invention described in the U.S. patent application or U.S. patent. Each foreign patent application and foreign patent that constitutes Seller IP has or purports to have an ownership interest was filed or claims priority to a patent application filed prior to each invention described in the foreign patent application or foreign patent being made available to the public. (ii) No trademark or trade name that constitutes Seller IP (other than each of the Magic4 Trademarks) conflicts or interferes with any trademark or trade name owned, used, or applied for by any other Person. No event or circumstance (including a failure to exercise adequate quality controls and an assignment in gross without the accompanying goodwill) has occurred or exists that has resulted in, or could reasonably be expected to result in, the abandonment of any trademark (whether registered or unregistered) that constitutes Seller IP and is not a Magic4 Trademark. For purposes of clarification, no representations or warranties are made by Seller regarding any Magic4 Trademark or the scope, validity, enforceability, condition or status of any Magic4 Trademark and Buyer acquires all rights in Magic4 Trademarks on an "as is" basis. (iii) Each item of Seller IP that is Registered IP is and at all times has been in compliance with all legal requirements to maintain its status as Registered IP, and all filings, payments, and other actions required to be made or taken to maintain such item of Seller IP in full force and effect have been made by the applicable deadline. No application for a patent or a copyright or any other type of Registered IP that constitutes Seller IP has been abandoned, allowed to lapse, or rejected. None of the above representation applies to Magic4 Trademarks. (iv) No interference, opposition, reissue, reexamination, or other Proceeding is or has been pending or, to Sellers Knowledge, threatened, in which the scope, validity, or enforceability of any Seller IP is being, has been, or could reasonably be expected to be contested or challenged. To Seller's Knowledge, there is no basis for a claim that any Seller IP is invalid or unenforceable as a result of patent or copyright misuse or on any other grounds. (f) To Seller's Knowledge, no Person has infringed, misappropriated, or otherwise violated, and no Person is currently infringing, misappropriating or otherwise violating, any Seller IP. Section 2.7(f) of the Disclosure Schedule accurately identifies (and the Seller has provided to the Purchaser a complete and accurate copy of) each letter or other written or electronic communication or correspondence that has been sent or otherwise delivered by or to the Seller or any Representative of the Seller regarding any actual, alleged or suspected infringement or misappropriation of any Seller IP and provides a brief description of the current status of the matter referred to in such letter, communication or correspondence.

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page13 of 92

(g) Neither the execution, delivery, or performance of this Agreement (or any of the Transaction Documents) nor the consummation of any of the transactions contemplated by this Agreement (or any of the Transaction Documents) will, with or without notice or lapse of time, result in, or give any other Person the right or option to cause or declare, (a) a loss of, or Encumbrance on, any Seller IP; (b) the release, disclosure, or delivery of any Seller IP by or to any escrow agent or other Person; or (c) the grant, assignment, or transfer to any other Person of any license or other right or interest under, to, or in any of the Seller IP. (h) The Seller's operation of the Business has not infringed (directly, contributorily, by inducement, or otherwise) or otherwise violated, misappropriated, or made unlawful use of any Intellectual Property Rights of any other Person. Without limiting the foregoing, neither the use of Seller IP nor the use of Licensed IP as permitted under the License Agreement, nor the license, the use or sale of Seller Product in operation of the Business infringes, violates or makes unlawful use of any Intellectual Property Right of any other Person. None of the Seller IP, Licensed IP or the Seller Product contain any Intellectual Property misappropriated from any other Person. (i) No claim or Proceeding involving any Seller IP, Seller Products, or the Business is (i) pending before any Governmental Body, arbitrator, or arbitration panel; or (ii) to Seller's Knowledge, was threatened against Seller. (j) Except as set forth in Section 2.7(j) of the Disclosure Schedule, no source code for any software (including drivers, firmware, APIs, and interface modules) constituting Seller IP (Seller Software) has been delivered, licensed, or made available to any escrow agent or other Person who is not, as of the date of this Agreement, an employee of the Seller. Except as set forth in Schedule 2.7(j), the Seller has no duty or obligation (whether present, contingent, or otherwise) to deliver, license, or make available the source code for any Seller Software to any escrow agent or other Person. No event has occurred, and no circumstance or condition exists, that (with or without notice or lapse of time) will, or could reasonably be expected to, result in the delivery, license, or disclosure of the source code for any Seller Software to any other Person. (k) Except as set forth in Section 2.7(k) of the Disclosure Schedule, to Sellers Knowledge, the Seller has not incorporated any Open Source Software into any Seller Product; provided, however, that the foregoing representation and warranty does not apply with respect to any incorporation of Open Source Software into a Magic4 Product that may have occurred prior to the Magic4 Purchase Date. To Sellers Knowledge, Seller has under no circumstances used, modified, or distributed any Open Source Software in a manner that would require any portion of a Seller Product (other than that portion of a Magic4 Product consisting of Open Source Software that was already present in such Magic4 Product as of the Magic4 Purchase Date) to be (i) disclosed or distributed in source code form; (ii) licensed for the purpose of making derivative works; or (iii) redistributable at no charge (e.g., software licensed to the Seller under the GNU General Public License, GNU Lesser General Public License, or Mozilla Public License). 2.8 Contracts.

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page14 of 92

(a) The Seller has delivered to the Purchaser accurate and complete copies of all Contracts identified in Schedule 1.1(a), including all amendments thereto (collectively, the "Assigned Contracts"). Each Assigned Contract is valid and in full force and effect, enforceable in accordance with its terms, except as the enforceability thereof may be subject to or limited by bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or affecting the rights of creditors generally and the availability of equitable relief (whether in proceedings at law or in equity). To Seller's Knowledge, with respect to each such Assigned Contract, the parties thereto have not agreed to enter into any material amendment or to otherwise make any material modification to such Assigned Contract, except in the ordinary course of business. (b) Except as set forth in Section 2.8(b) of the Disclosure Schedule: (i) neither Seller, nor, to Seller's Knowledge, any other Person has violated or breached, or declared or committed any default under, any Assigned Contract; (ii) to Seller's Knowledge, no event has occurred, and no circumstance or condition exists, that would (with or without notice or lapse of time) (A) result in a violation or breach of any of the provisions of any Assigned Contract, (B) give any Person the right to declare a default or exercise any remedy under any Assigned Contract, (C) give any Person the right to accelerate the maturity or performance of any Assigned Contract or (D) give any Person the right to cancel, terminate or modify any Assigned Contract; (iii) the Seller has not received any notice or other communication (in writing or otherwise) regarding any actual, alleged, possible or potential violation or breach of, or default under, any Assigned Contract; and (iv) the Seller has not waived any right under any Assigned Contract. (c) To Seller's Knowledge, each Person against which the Seller has or may acquire any rights under any Assigned Contract is solvent and is able to satisfy all of such Person's current and future monetary obligations and other obligations and Liabilities thereunder. (d) Except as set forth in Section 2.8(d) of the Disclosure Schedule, the Seller has no Knowledge of any basis upon which any party to any Assigned Contract may object to (i) the assignment to the Purchaser of any right under such Assigned Contract, or (ii) the delegation to or performance by the Purchaser of any obligation under such Assigned Contract. 2.9 Compliance with Legal Requirements. Except as set forth in Section 2.9 of the Disclosure Schedule: (a) the Seller's conduct of the Business is, and has been during and since the quarter ended March 31, 2008, in material compliance with each Legal Requirement that is applicable to it; (b) no event has occurred, and, to Seller's Knowledge, no condition or circumstance exists, that would (with or without notice or lapse of time) constitute or result directly or indirectly in a violation by the Seller of, or a failure on the part of the Seller to comply with, any Legal Requirement applicable to the conduct of the Business or the ownership or use of any of the Assets; and (c) the Seller has not received, at any time, any notice or other communication (in writing or otherwise) from any Governmental Body or any other Person regarding any actual, alleged, possible or potential violation of, or failure to comply with, any Legal Requirement applicable to the conduct of the Business or the ownership or use of any of the Assets. 2.10 Governmental Authorizations. Section 2.10 of the Disclosure Schedule sets forth each Governmental Authorization that is held by the Seller that is applicable to the conduct 9

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page15 of 92

of the Business or the ownership or use of any of the Assets. The Seller has delivered to the Purchaser accurate and complete copies of all of the Governmental Authorizations identified in Section 2.10 of the Disclosure Schedule, including all renewals thereof and all amendments thereto. To Seller's Knowledge, each Governmental Authorization identified or required to be identified in Section 2.10 of the Disclosure Schedule is valid and in full force and effect as of the Closing Date. Except as set forth in Section 2.10 of the Disclosure Schedule: (i) the Seller is and has at all times been in material compliance with all of the terms and requirements of each Governmental Authorization identified or required to be identified in Section 2.10 of the Disclosure Schedule; (ii) no event has occurred, and, to Seller's Knowledge, no condition or circumstance exists, that would (with or without notice or lapse of time) (A) constitute or result directly or indirectly in a violation of or a failure to comply with any term or requirement of any Governmental Authorization identified or required to be identified in Section 2.10 of the Disclosure Schedule, or (B) result directly or indirectly in the revocation, withdrawal, suspension, cancellation, termination or modification of any Governmental Authorization identified or required to be identified in Section 2.10 of the Disclosure Schedule; (iii) the Seller has never received any notice or other communication (in writing or otherwise) from any Governmental Body or any other Person regarding (A) any actual, alleged, possible or potential violation of or failure to comply with any term or requirement of any Governmental Authorization, or (B) any actual, proposed, possible or potential revocation, withdrawal, suspension, cancellation, termination or modification of any Governmental Authorization; and (iv) all applications required to have been filed for the renewal of the Governmental Authorizations required to be identified in Section 2.10 of the Disclosure Schedule have been duly filed on a timely basis with the appropriate Governmental Bodies, and each other notice or filing required to have been given or made with respect to such Governmental Authorizations has been duly given or made on a timely basis with the appropriate Governmental Body. The Governmental Authorizations identified in Section 2.10 of the Disclosure Schedule constitute all of the Governmental Authorizations necessary (i) to enable the Seller to conduct the Business in the manner in which such Business is currently being conducted, and (ii) to permit the Seller to own and use the Assets in the manner in which they are currently owned and used. 2.11 Employee And Labor Matters.

(a) Section 2.11(a) of the Disclosure Schedule sets forth, with respect to each Seller Employee employed by Seller as of the Closing Date: (i) (ii) the name of such employee; such employee's title; and

(iii) such employee's annualized compensation (including wages, salary, commissions, director's fees, fringe benefits, bonuses, profit sharing payments and other payments or benefits of any type) as of the Closing Date (as if they had continued to be employed for all of calendar year 2008). (b) To the Knowledge of the Seller, no Seller Employee is a party to or is bound by any confidentiality agreement, noncompetition agreement or other Contract (with any Person) that could reasonably be expected to have a material effect on: (A) the performance by 10

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page16 of 92

such employee of any of his duties or responsibilities as an employee of the Business; or (B) the Business. (c) Section 2.11(c) of the Disclosure Schedule sets forth the name of, and a general description of the services performed by, each independent contractor to the Business to whom the Seller has made, or is obligated to make, payments totaling in excess of $200,000 during any twelve month period since January 1, 2007. (d) Except as set forth on Section 2.11(d) of the Disclosure Schedule, Seller is not a party to any collective bargaining agreement or other labor union contract applicable to any Seller Employee, other than any such collective bargaining agreement or such other labor union contract required under French law, nor does the Seller know of any activities or proceedings of any labor union within the preceding three years to organize any such employees. (e) Except as set forth in Section 2.11(e) of the Disclosure Schedule, to the extent related to the Business: (i) Seller is in compliance in all material respects with all applicable laws relating to employment and employment practices, the classification of employees, wages, hours, collective bargaining, unlawful discrimination, civil rights, safety and health, workers' compensation, the collection and payment of withholding and/or social security Taxes and terms and conditions of employment; (ii) there are no charges with respect to or relating to the Seller pending or, to Seller's Knowledge, threatened before the Equal Employment Opportunity Commission or any state, local or foreign agency or administrative body responsible for the prevention of unlawful employment practices or the enforcement of labor or employment laws; and (iii) the Seller has not received any notice from any national, state, local or foreign agency responsible for the enforcement of labor or employment laws of an intention to conduct an investigation of the Seller and no such investigation is in progress. 2.12 Employee Benefit Plans and Compensation.

(a) Section 2.12(a) of the Disclosure Schedule sets forth each Seller Employee Plan related to the Business with respect to any Seller Employee who is employed by Seller in the United Kingdom, France or Korea (collectively, the "Foreign Seller Employee Plans"). (b) True, correct and complete copies of each Foreign Seller Employee Plan have been made available or provided to Purchaser. (c) All contributions (including all employer contributions and employee salary reduction contributions) and all premiums required to have been paid under any of the Foreign Seller Employee Plans or by law to any funds or trusts established thereunder or in connection therewith have been made by the due date thereof (including any valid extension) except for any instances of noncompliance that would not reasonably be expected to result in any material liability to the Sellers or any Seller Affiliate. (d) Except as set forth on Section 2.12(d) of the Disclosure Schedule, to Seller's Knowledge, the Foreign Seller Employee Plans have been maintained, in all material

13270.003.875667v15715114 v6/HN

11

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page17 of 92

respects, in accordance with their terms and with all provisions of the applicable laws of the jurisdiction under which each such Foreign Seller Employee Plans has been maintained. 2.13 Property. The Seller does not own any real property that is used in connection with the Business. 2.14 Environmental Matters.

Except as disclosed on Section 2.14 of the Disclosure Schedule, with respect to the Business: (a) the Seller is in compliance in all material respects with all applicable Legal Requirements relating to pollution or the protection of the environment ("Environmental Laws"), which compliance includes obtaining, maintaining and complying in material respects with all material licenses, permits and other authorizations required under all Environmental Laws; (b) to Seller's Knowledge, the Seller has not received any notice of violation or potential liability under any Environmental Laws from any Person or any governmental agency inquiry, request for information, or demand letter under any Environmental Law relating to operations or properties of the Business, which is outstanding; (c) the Seller is not subject to any outstanding orders arising under Environmental Laws nor are there any administrative, civil or criminal actions, suits or proceedings relating to the Business pending or, to Seller's Knowledge, threatened, against the Seller under any Environmental Laws; and (d) Seller has made available to the Purchaser copies of all environmental studies, investigations, reports or assessments prepared by or for the Seller or in the Seller's possession, concerning the Business or the Assets. 2.15 Products and Product Development. Each proprietary product or service developed, manufactured, marketed or sold by the Seller primarily as part of the Business as of the Closing Date, and each product or service (if any) presently under development by the Seller primarily as part of the Business, is set forth in Section 2.15 of the Disclosure Schedule. 2.16 Performance Of Services. To Seller's Knowledge, all services performed by the Seller while conducting the Business prior to the date of Closing have been performed in all material respects in conformity with the terms and requirements of the applicable Contracts and all applicable Legal Requirements. There is no claim pending or, to Seller's Knowledge, being threatened against the Seller relating to any services performed by the Seller in the operation of the Business. 2.17 Suppliers and Customers.

(a) Section 2.17(a) of the Disclosure Schedule sets forth a list of the top 7 suppliers of the Business during fiscal year 2007, from whom Seller has purchased goods and/or services. No such supplier has expressed in writing, and to Seller's Knowledge no such supplier

13270.003.875667v15715114 v6/HN

12

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page18 of 92

has expressed verbally, to the Seller its intention to cancel or otherwise terminate or materially reduce or materially and adversely modify its relationship with respect to the Business. (b) Section 2.17(b) of the Disclosure Schedule sets forth a list of the top 10 customers of the Business to whom Seller has sold goods and/or services, by revenue derived by the Seller during fiscal year 2007. No such customer has expressed in writing, and to Seller's Knowledge no such customer has expressed verbally, to the Seller its intention to cancel or otherwise terminate or materially reduce or materially or adversely modify its relationship with respect to the Business. 2.18 Insurance.

(a) As of the Closing, the Seller maintains insurance customary and typical for the size and nature of the Business. Such policies are valid, enforceable and in full force and effect. All premiums and other amounts owing with respect to said policies have been paid in full on a timely basis. (b) The Seller has not received: (i) any notice or other communication (in writing or otherwise) regarding the actual or possible cancellation or invalidation of any of the policies referred to above or (ii) any indication that the issuer of any such policies may be unwilling or unable to perform any of its obligations thereunder. 2.19 Proceedings; Orders. Except as set forth in Section 2.19 of the Disclosure Schedule, there is no pending Proceeding, and no Person has threatened in writing to Seller or any Seller Representative to commence any Proceeding: (i) that relates to or could reasonably be expected to effect the Business or any of the Assets (whether or not the Seller is named as a party thereto); or (ii) that challenges, or that could reasonably be expected to have the effect of preventing, delaying, making illegal or otherwise interfering with, any of the Transactions. Except as set forth in Section 2.19 of the Disclosure Schedule, no event has occurred, and no claim, dispute or, to Seller's Knowledge, other condition or circumstance exists, that reasonably might be expected to, directly or indirectly, give rise to or serve as a basis for the commencement of any such Proceeding. The Seller has delivered to the Purchaser accurate and complete copies of all correspondence and other written materials that relate to the Proceedings identified in Section 2.19 of the Disclosure Schedule. There is no Order to which the Business, or any of the Assets, is subject. To the Knowledge of the Seller, no Seller Employee is subject to any Order that may prohibit such employee from engaging in or continuing any conduct, activity or practice relating to the Business. There is no proposed Order that, if issued or otherwise put into effect, (i) could reasonably be expected to have a Material Adverse Effect; (ii) would substantially impair the ability of the Seller to comply with or perform any covenant or obligation under any of the Transaction Documents, or (iii) could reasonably be expected to have the effect of preventing, delaying, making illegal or otherwise interfering with any of the Transactions. 2.20 Tax Matters. Except as set forth on Section 2.20 of the Disclosure Schedule:

(a) the Seller has filed on or prior to the due date (after giving effect to any extensions) all Tax returns required by applicable law to have been filed by Seller or any of its

13270.003.875667v15715114 v6/HN

13

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page19 of 92

Affiliates that relate in whole or in part to the Business or the Assets, and all Taxes shown to be due on such Tax returns have been timely paid; (b) there is no action, suit, proceeding, investigation, audit or claim now pending against the Seller in respect of any Tax with respect to the Businesses or the Assets, nor, to the Seller's Knowledge, has any claim for additional Tax been overtly threatened against the Seller by any Tax authority with respect to the Business or the Assets; (c) (i) there is no outstanding request for any extension of time for the Seller to pay any Taxes or file any Tax returns with respect to the Business or the Assets; and (ii) there has been no waiver or extension of any applicable statute of limitations for the assessment or collection of any Taxes of the Seller with respect to the Business or the Assets that is currently in force; (d) the Seller has withheld all Taxes required to have been withheld by it in connection with any amounts paid to any Seller Employee, creditor, independent contractor or other third party relating to the Business, and has paid over to the proper Governmental Body all amounts required to have been so withheld and paid over. 2.21 Transactions with Directors, Officers, Managers, and Affiliates. Except as set forth in Section 2.21 of the Disclosure Schedule, the Seller is not a party to any Contract with any of the directors, officers or stockholders or, to the Knowledge of the Seller, any Seller Affiliate or any family member of any of the foregoing under which it: (i) leases any real or personal property (either to or from such Person) primarily used in connection with the Business; (ii) licenses technology (either to or from such Person) primarily used in connection with the Business; (iii) is obligated to purchase any tangible or intangible asset from or sell such asset to such Person that is primarily used in connection with the Business; (iv) purchases products or services from such Person used primarily in connection with the Business; (v) pays or receives commissions, rebates or other payments in connection with the Business; (vi) lends or borrows money in connection with the Business; or (vii) provides or receives any other material benefit in connection with the Business. To the Knowledge of Seller, during the past two years, none of the directors, officers or stockholders of the Seller, or any family member of any such Person, has been a director or officer of, or has had any direct or indirect interest in, any Person which during such period has been a customer of the Seller in connection with the Business or has competed with the Business. No Seller Affiliate owns or has any rights in or to any of the Assets. 2.22 Brokers. Except as set forth in Section 2.22 of the Disclosure Schedule, there is no investment banker, broker, finder or other intermediary which has been retained by, or is authorized to act on behalf of, the Seller who might be entitled to any fee or commission from the Purchaser upon the consummation of the Transactions. 2.23 Restrictions on Business Activities. There is no agreement (noncompete or otherwise), judgment, injunction, order or decree to which the Seller is a party or is otherwise subject to which has had or could be reasonably expected to have the effect of prohibiting or impairing the Transactions, the operation of the Business (as currently operated by the Seller) or the acquisition of the Assets. 14

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page20 of 92

2.24 Financial Information. The Seller has provided to the Purchaser a statement of income and supporting schedules as of and for the three months ended March 31, 2008 for the Business (the "Financial Statements"). The revenue amount reflected in the Financial Statements were extracted from the Seller's financial statements for the corresponding period. Certain direct expenses reflected in the Financial Statements were either extracted from the Seller's financial statements for the corresponding period, or represent an estimate of expenses based upon management's best estimate of direct resources assigned, including allocations for Facilities and Information Technology. Costs such as executive management, general and administrative (including finance, legal and human resources), sales operations and marketing communications, were excluded. 2.25 Tangible Assets. Each tangible asset listed in Schedule 1.1(a) is free from patent defects and, to the Seller's Knowledge, is free from latent defects, has been maintained in accordance with normal industry practice, is in good operating condition and repair (subject to normal wear and tear), is suitable for the purposes for which it presently is used, and, with respect to each such tangible asset which is leased by the Seller, is in the condition required by the terms of the lease applicable thereto. 2.26 Full Disclosure. To Seller's Knowledge, neither this Agreement nor the Disclosure Schedule contains any untrue statement of material fact; and, to Seller's Knowledge, neither this Agreement nor the Disclosure Schedule omits to state any fact necessary to make any of the representations, warranties or other statements or information contained therein not misleading. To Seller's Knowledge, all of the information set forth in the Disclosure Schedule is accurate and complete in all material respects. 3. REPRESENTATIONS AND WARRANTIES OF THE PURCHASER.

The Purchaser hereby represents and warrants as of the Closing Date, to and for the benefit of the Seller, as follows: 3.1 Due Organization. The Purchaser is a corporation duly organized, validly existing and in good standing under the laws of France and has all requisite corporate power to own its properties and assets and to conduct its business as now conducted. 3.2 Qualification to Do Business. The Purchaser is duly qualified to do business as a foreign corporation and is in good standing in every jurisdiction in which the character of the properties owned or leased by it or the nature of the business conducted by it makes such qualification necessary, except where the failure to be so qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. 3.3 Authority; Binding Nature Of Agreements. The Purchaser has the absolute and unrestricted right, power and authority to enter into and perform its obligations under this Agreement and the other Transaction Documents to which the Purchaser is a party, and the execution and delivery hereof and thereof by the Purchaser have been duly authorized by all necessary action on the part of the Purchaser and its board of directors. This Agreement and each of the other Transaction Documents to which the Purchaser is a party constitutes the legal, valid and binding obligation of the Purchaser, enforceable against it in accordance with its terms, 15

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page21 of 92

except as the enforceability thereof may be subject to or limited by bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or affecting the rights of creditors generally and the availability of equitable relief (whether in proceedings at law or in equity). 3.4 Non-contravention. Neither the execution and delivery of any of the Transaction Documents, nor the consummation or performance of any of the Transactions, will directly or indirectly (with or without notice or lapse of time), contravene, conflict with or result in a material violation of, or give any Governmental Body or other Person the right to challenge any of the Transactions or to exercise any remedy or obtain any relief under, any Legal Requirement or any Order to which the Purchaser is subject. 3.5 Consents. Purchaser is not, nor will be, required to make any filing with or give any notice to, or to obtain any Consent from, any Person or Governmental Body in connection with the execution and delivery of any of the Transaction Documents or the consummation or performance of any of the Transactions, except with respect to any notice, filings or Consents required under any anti-trust or anti-competition law, regulation or statute of any Governmental Body in any jurisdiction in which the Seller conducts the Business. 3.6 Brokers. There is no investment banker, broker, finder or other intermediary which has been retained by, or is authorized to act on behalf of, the Purchaser who might be entitled to any fee or commission upon the consummation of the Transactions. 4. INDEMNIFICATION. 4.1 Survival of Representations.

(a) Subject to Section 4.1(b): (i) the Specified Representations shall survive the Closing until the expiration of the applicable statute of limitations; and (ii) the other representations and warranties of Seller shall survive the Closing and shall expire at 5:00 p.m. local time in San Francisco, California on the date 15 months following the Closing; provided, however, that if a Claim Notice with respect to a particular representation or warranty of Seller is given to Seller on or prior to the applicable expiration date of such representation or warranty, then, notwithstanding anything to the contrary contained in this Section 4.1(a), such representation or warranty shall not so expire, but rather shall remain in full force and effect until such time as each and every claim (including any indemnification claim asserted by any Indemnitee under Section 4.2) has been fully and finally resolved. (b) The representations, warranties, covenants and obligations of Seller, and the rights and remedies that may be exercised by the Indemnitees, shall not be limited or otherwise affected by or as a result of any information furnished to, or any investigation made by or any knowledge of, any of the Indemnitees or any of their Representatives. 4.2 Indemnification By The Seller. The Seller shall hold harmless and indemnify each of the Purchaser Indemnitees from and against, and shall compensate and reimburse each of the Purchaser Indemnitees for, any Damages that are directly or indirectly suffered or incurred by any of the Purchaser Indemnitees or to which any of the Purchaser Indemnitees may

13270.003.875667v15715114 v6/HN

16

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page22 of 92

otherwise become subject at any time (regardless of whether or not such Damages relate to any third party claim) and that arise directly or indirectly from or as a direct or indirect result of: (a) Agreement; (b) any Breach of any covenant made by the Seller in this Agreement; any Breach of any representation, or warranty made by the Seller in this

(c) any Liability arising out of the operation of the Business or ownership of the Assets prior to the Closing, which is not an Assumed Liability and which arises, out of a breach of any representation, warranty or covenant made by Seller in this Agreement; (d) any failure to timely fulfill or discharge any of the Excluded Liabilities; or

(e) any Proceeding relating directly or indirectly to any Breach, alleged Breach, Liability or matter of the type referred to in clauses (a), (b), (c) or (d) of this Section 4.2 (including any Proceeding commenced by any Purchaser Indemnitee for the purpose of enforcing any of its rights under this Section 4.2). 4.3 Indemnification By The Purchaser. The Purchaser shall hold harmless and indemnify the Seller Indemnitees from and against, and shall compensate and reimburse the Seller Indemnitees for, any Damages that are directly or indirectly suffered or incurred by the Seller Indemnitees or to which the Seller Indemnitees may otherwise become subject at any time (regardless of whether or not such Damages relate to any third party claim) and that arise directly or indirectly from or as a direct or indirect result of, or are directly or indirectly connected with: (a) this Agreement; (b) (c) any Breach of any representation or warranty made by the Purchaser in any Breach of any covenant made by the Seller in this Agreement any failure to timely fulfill or discharge any of the Assumed Liabilities; or

(d) any Liability arising out of or related to the operation of the Business or ownership of the Assets on or after Closing; or (e) any Proceeding relating directly or indirectly to any failure or Breach of the type referred to in clauses (a), (b), (c) or (d) of this Section 4.3 (including any Proceeding commenced by the Seller Indemnitees for the purpose of enforcing rights under this Section 4.3). 4.4 Limitations.

(a) Notwithstanding anything to the contrary set forth in this Agreement, but subject to Section 4.4(e), the aggregate Liability of the Seller with respect to representations and warranties, other than the Specified Seller Representations (for which the aggregate Liability of the Seller shall not be limited), shall not exceed $4,200,000, and the aggregate Liability of the Purchaser with respect to representations and warranties, other than the Specified Purchaser

13270.003.875667v15715114 v6/HN

17

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page23 of 92

Representations (for which the aggregate Liability of the Purchaser shall not be limited), shall not exceed $4,200,000. (b) Subject to Section 4.4(e), the amount of any Damages for which indemnification is provided under this Section 4 shall be net of any amounts in excess of $75,000 recovered by the Indemnitees (less any increase in insurance costs and payment of deductibles incurred or expected to be incurred in connection with such recovery) under any applicable insurance policies with respect to such Damages. (c) Notwithstanding anything to the contrary set forth in this Agreement but subject to Section 4.4(e), the Seller shall not have any liability for indemnification under Section 4.2(a) (and Section 4.2(f) to the extent related to Section 4.2(a)) with respect to representations and warranties other than the Specified Seller Representations unless the aggregate of all Damages relating thereto for which the Seller Indemnitees would, but for this Section 4.4(c) be liable, exceeds on a cumulative basis an amount equal to $225,000, and then only to the extent such aggregate amount of Damages exceeds $75,000. (d) Notwithstanding anything to the contrary set forth in this Agreement but subject to Section 4.4(e), the Purchaser shall not have any liability for indemnification under Section 4.3(a) (and Section 4.3(e) to the extent related to Section 4.3(a)) with respect to representations and warranties other than the Specified Purchaser Representations unless the aggregate of all Damages relating thereto for which the Purchaser Indemnitees would, but for this Section 4.4(d) be liable, exceeds on a cumulative basis an amount equal to $225,000, and then only to the extent such aggregate amount of Damages exceeds $75,000. (e) Neither the limitations set forth in this Section 4.4 nor the limitations set forth in Section 4.1 or elsewhere in this Agreement shall apply in the case of, or limit any rights or remedy of any Indemnitee for, claims based on fraudulent or intentional misrepresentation. 4.5 Exclusivity Of Indemnification Remedies. Except as otherwise expressly set forth in this Agreement, the remedies set forth in this Section 4 shall constitute the parties' exclusive monetary remedies for any breach of this Agreement. In no event shall any party be entitled to any indirect, special, consequential or punitive damages except to the extent such damages are included in Damages that are directly or indirectly suffered or incurred by any of the Indemnitees or to which any of the Indemnitees may otherwise become subject at any time in connection with a third party claim. 4.6 Defense Of Third Party Claims. In the event of the assertion or commencement by any Person other than a party hereto of any claim or Proceeding (whether against Purchaser or against any other Person) with respect to which any Indemnitee may be entitled to indemnification, compensation or reimbursement pursuant to this Section 4, the Purchaser shall have the right, at its election, to have the Seller assume the defense of such claim or Proceeding (in which case the Seller must proceed with the defense of such Claim or Proceeding) or to assume the defense of such claim or Proceeding, with Purchasers legal costs and expenses of the Purchasers defense being at the sole expense of the Purchaser (it being understood that payments made to such third party in connection with such claim or Proceeding are not legal defense costs and it being further understood that if the Purchaser elects that the Seller shall 18

13270.003.875667v15715114 v6/HN

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page24 of 92

assume the defense, in the event that the Seller breaches its obligation to do so, the Purchasers legal costs and expenses of such defense would not be at Purchasers sole expense but rather would be taken into account in calculating the Purchasers indemnifiable Damages). (a) Proceeding: (i) the Seller shall have the right, at any time, to participate in the defense of such claim or Proceeding at its own expense; and (ii) the Purchaser shall keep the Seller informed of all material developments and events relating to such claim or Proceeding. (b) If the Purchaser does not elect to assume the defense of any such claim or Proceeding (or if, after it initially assumes such defense, the Purchaser abandons such defense) or elects that the Seller assume the defense of such claim or Proceeding, the Seller shall proceed with the defense of such claim or Proceeding on its own at the sole expense of the Seller, and: (i) the Purchaser shall have the right, at any time, to participate in the defense of such claim or Proceeding at its own expense; and (ii) the Seller shall keep the Purchaser informed of all material developments and events relating to such claim or Proceeding. (c) Each party shall make available to the other party any non-privileged documents and materials in the possession of such party, or any other Indemnitee controlled by or affiliated with such party, that may be necessary to the defense of such claim or Proceeding (d) Notwithstanding anything to the contrary in this Section 4, neither party nor any other Indemnitee shall settle, adjust or compromise any claim or Proceeding without the prior written consent of the other party, such consent not to be unreasonably withheld. 4.7 Claims for Indemnification; Exercise Of Remedies By Indemnitees Other Than The Purchaser or Seller. (a) Except as set forth in Section 4.7(b) below, claims for indemnity by an Indemnitee pursuant to this Section 4 shall be made by delivery of a Claim Notice (as defined below) to the indemnifying parties; provided, however, that no delay on the part of any Indemnitee in notifying the indemnifying parties shall relieve such indemnifying parties from any obligation hereunder unless (and then solely to the extent) such indemnifying parties are thereby prejudiced. For purposes of this Section 6.6, "Claim Notice" shall mean a notice (i) stating that such Indemnitee has become aware of a matter that may give rise to an indemnifiable claim or has suffered, accrued or incurred any Damages or anticipates that it may suffer, accrue or incur any Damages and (ii) specifying the facts pertinent to such indemnification claim and the individual items of losses, costs and other Damages so stated and, in the case of potential Damages, the basis for such potential Damages. If the Purchaser so elects to assume the defense of any such claim or

13270.003.875667v15715114 v6/HN

19

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page25 of 92

(i) Any indemnifying party may make a written objection (an "Objection Notice") to any claim for indemnification stating the basis for such objection in reasonable detail to permit the Indemnitees to evaluate such objection. Such Objection Notice shall be delivered to the Indemnitees within 10 Business Days after delivery of the Claim Notice to such indemnifying parties. (ii) If no indemnifying party timely delivers an Objection Notice in accordance with Section 4.7(a)(i) above, such failure to object shall be deemed an irrevocable acknowledgment by such indemnifying parties that the Indemnitees are entitled to the full amount of the claim for Damages arising from the indemnification claim as set forth in such Claim Notice. (iii) The indemnifying parties and the Indemnitees shall attempt in good faith to resolve any claim for indemnification to which an Objection Notice is made. If the indemnifying parties and the Indemnitees are unable to resolve a claim for indemnification to which an Objection Notice has been timely delivered in accordance with Section 4.7(a)(i) above within 30 days after delivery thereof, any indemnifying party that filed an Objection Notice may pursue any other right or remedy provided in this Agreement or as otherwise allowed by law or equity. (iv) Entry of an order by a court of competent jurisdiction as to the validity and amount of any claim in such Claim Notice shall be final, binding and conclusive upon the parties to this Agreement. (b) If any third party notifies any Indemnitee with respect to any matter that may give rise to a claim for indemnification against any indemnifying party under this Section 4, then the Indemnitee shall promptly notify the indemnifying party thereof in writing; provided, however, that no delay on the part of such Indemnitee in notifying the indemnifying party shall relieve such indemnifying party from any obligation hereunder unless (and then solely to the extent) the indemnifying party is thereby prejudiced. (c) Notwithstanding anything in this Agreement to the contrary, no Indemnitee (other than the Purchaser or Seller or any successor thereto or assign thereof) shall be permitted to assert any indemnification claim or exercise any other remedy under this Agreement. (d) Any Damages for which the Seller is liable pursuant to Section 4.2(a) (other than with respect to the Specified Seller Representations) shall first be satisfied from the escrow account established pursuant to the Indemnification Escrow Agreement. 5. CERTAIN OTHER AGREEMENTS; POST-CLOSING COVENANTS.

5.1 Publicity. The parties hereto shall ensure that, on and at all times after the Closing Date: (a) no press release or other publicity concerning any of the Transactions is issued or otherwise disseminated by or on behalf of either party without the prior written consent of the other party, which consent shall not be unreasonably withheld; (b) the parties keep the terms of this Agreement and the other Transaction Documents strictly confidential; and (c) the parties

13270.003.875667v15715114 v6/HN

20

Case3:10-cv-02805-WHA Document138-1

Filed04/07/11 Page26 of 92