Procure to Pay Process in Pharmaceutical Industry

Diunggah oleh

Ceekay InweregbuDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Procure to Pay Process in Pharmaceutical Industry

Diunggah oleh

Ceekay InweregbuHak Cipta:

Format Tersedia

PROCURE TO PAY

BUSINESS SCENARIO

Key Performance Indicators y Raw Material & WIP Inventory Turnover (Quantity) y Source Cycle Time y Supplier Quality Engineering Costs as a % of Material Acquisition Costs Partner Opportunities y Partner Opportunities in Pharmaceuticals See also y SAP NetWeaver Benefits y SRM Procure to Pay is the process of obtaining and managing all raw materials needed for manufacturing. This cycle starts with th e source selection, auditing followed by procurement of goods and services. The contracts with the suppliers are managed and can also include supplier managed inventories or direct inventory visibility. It also comprises direct procurement requirements through conversion from demands to purchase orders and confirmation of goods receipt. The inc oming materials are then inspected and posted into inventory as part of managing the warehouse. The last activity in this cycle is payment of the suppliers which consists of receiving, entering and checking vendor's invoice for correctness.

Business Goals & Objectives

Lowering Working Capital Lower work-in-process inventory

Reducing Operating Costs & Increasing Efficiency Improve procurement processes Integrate processes across divisions and functions

Processes

Sourcing & Planning Improving the product quality and lower the costs for material acquisition by qualifying a supplier is mandatory for companies in a regulated environment. A supplier qualification that is compliant to regulatory requirements (e.g. 21CFR Part211) includes the inspection of incoming goods, an audit of the vendor and contractual agreements about product quality and financial conditions. These preconditions enable a pharmaceutical manufacturer to plan the procurement of the demands that results out of an MRP run or manually created purchase requisitions.

Supplier Qualification Procurement Planning

To fully utilize this functionality, the following products should be evaluated y SAP ERP y SAP Extended Procurement for Life Sciences y SAP Extended Sourcing for Life Sciences Supplier Collaboration Supplier collaboration provides a cost-effective way for companies to improve replenishment cycles and quality of materials delivered by a trusted supplier. Order collaboration capabilities provide suppliers and buyers with a streamlined order management system, a user friendly interface and comprehensive search options. The collaboration with suppliers can be extended to a vendor managed inventory, where the manufacturer grants authorization to manage his inventory.

Design Collaboration Inventory Collaboration

To fully utilize this functionality, the following products should be evaluated y SAP ERP y SAP Extended Procurement for Life Sciences y SAP Extended Sourcing for Life Sciences

Procurement

Improving procurement processes and integrate them across divisions will lower the costs of procured good and the work-in-process inventory. The procurement process consists of the administrative functions, such as contract management and the creation of p urchase requisitions. Requisitions have to be converted to purchase orders or delivery schedules for a scheduling agreement and the fulfillment of the documents after electronic transfer to business partners has be to monitored.. After successful delivery of the purchased goods, the follow-up operational tasks such as supplier payment, warranty issues have to be performed.

Contract Management Purchase Requisitions Purchase Orders Accounts Payable Supplier Payment

To fully utilize this functionality, the following products should be evaluated y SAP ERP y SAP Extended Procurement for Life Sciences y SAP Extended Sourcing for Life Sciences Receiving and Inspection Deliveries to the Pharmaceutical companies are subjected to stringent quality procedures to improve the product quality. Warehouse personnel receive the goods, followed by incoming inspection by quality control. The inspection costs can be reduced by use of quality certificates send by qualified suppliers. The stock is moved to quarantine inventory and after the lot disposition they are moved to the appropriate warehouse location. The integration of warehousing and quality control will the operating costs.

Receive Materials Material Inspection

To fully utilize this functionality, the following products should be evaluated y SAP ERP y SAP Extended Procurement for Life Sciences y SAP Extended Sourcing for Life Sciences Inventory Management The inventory management comprises control of the stock transfers within the warehouse or intercompany distribution centers, display correct quality status and the accuracy of the physical inventory. Stock status has an impact on production scheduling i.e. a not released material lot must not be used or reserved for production. Automated warehousing and reduction in inventory carrying cost are key strategic goals pursued by the Pharmaceutical companies.

Inventory Control Stock Transfers Physical Inventory

To fully utilize this functionality, the following products should be evaluated y SAP ERP y SAP Extended Procurement for Life Sciences y SAP Extended Sourcing for Life Sciences Reporting The reporting provides accurate real time visibility into the inventory and status of the purchasing documents during various stages of procurement. Proactive monitoring enables a correct supplier scorecard by accessing historical data about the reliance on the delivery schedule and the quality of the delivered materials. The reporting enable pharmaceutical companies to focus on suppliers with a reliable product quality and low supplier lead time.

Inventory Visibility Supplier Scorecard Proactive Monitoring

To fully utilize this functionality, the following products should be evaluated y SAP ERP y SAP Extended Procurement for Life Sciences y SAP Extended Sourcing for Life Sciences SAP Product Available Partner Product Available SAP Product Available with Future Releases Partner Product Available with Future Releases Future Focus

The Procure - to - Pay Cycle

Kehinde Eseyin | Jul 18, 2006 | Comments (14)

Introduction SAP Business One has the capability to meet the procurement process needs of SMBs - small and medium scale businesses. In a typically organization, there's usually a purchasing department. The responsibility of this department is to handle the procurement of materials. However, this process impacts on other departments inventory, material requirement planning, production and Financial. Suffice to say that, at any point in time, you are either impacting on stock quantity and/or stock value. In this posting, I shall be explaining the procurement process in SAP Business One as it relates to inventory and of course financial. Ideally, the process starts with a purchase requisition is created and then purchase order. A goods receipt that is based on the purchase order is then created. Based on the goods receipt, an invoice is then created upon which the outgoing payment transaction is based. However, in SAP Business One, purchase requistion is not catered for.

Figure 1. At this juncture, it is worth mentioning that SAP Business One leverages the draw document wizard to facilitate the creation of a target document (e.g Goods Receipt PO) based on a source document (e.g purchase order). During the copying process, options as to how the inheritance of definitions should be carried out can be customized if need be. It is important to state that the A/P Invoice is the only document that is mandatory in order to register a procurement process. Base documents such as the purchase order and the goods receipt PO are optional. The Purchase Order The purchase order is a document used to request a supplier to supply goods or services. This document usually contains strict conditions on which the supply is based. A purchase order can be tied to cost centers or projects. The essence is to allow for better analysis as to what it's actually meant for. Goods receipt and invoicing ideally references the purchase order. You can minimize data entry by duplicating an existing purchase order. Also, when purchase order data such as the vendor and items are entered, default values are displayed based on the definition in the relevant master data. For example, the address of the vendor, the payment terms and payment systems, price and item

description are copied from the corresponding master data. The purchase order contains the header part, line details and the footer. The header part contain information about the entire purchase order such as document currency, document date and due date. The line item level contains information about the items ordered such as item code and name. The footer also displays general document information such as payment due and total discount value. When a purchase order is created, no entry is made in accounting; however, the inventory status is updated based on the quantity ordered. This is reflected in the ordered and in stock fields in the inventory tab of the item master data and the inventory report. The Purchase Order can be accessed under: Purchasing - A/P > Purchase Order Figure 2 shows the Purchase Order screen.

Figure 2

Goods Receipt PO (GPO) The second step in the procurement process in SAP Business One is the creation of goods receipt that is based on a purchase order. Ideally, referencing a previously created purchasing order creates this document. However, it can be created without referencing the purchase order. When you record the receipt of goods, the system updates the open item for the purchase order. At this stage, it is pertinent for the appropriate department to check whether the correct items are delivered and whether the actual quantity has been delivered, over delivery and under delivery is also ascertained at this level. In more complex situation that involves perishable items like pharmaceuticals, the expiration date can also be validated at this stage. It is possible to create several goods receipt by referencing a single purchase order especially when batch delivery is practiced. When a goods receipt is created based on a purchase order, the information entered in the purchase order is inherited. Hence, the elimination of the need for double entry. However, some of these definitions can also be edited or modified when creating the goods receipt.

When goods receipt PO is created in the system, the inventory status is updated by the quantity received. Also, if stocks are continuously managed, relevant accounting information is updated in financials. The Goods Receipt PO can be accessed under Purchasing - A/P > Goods Receipt PO Figure 3 shows the Goods Receipt PO screen.

Figure 3 AP Invoice After purchase order and goods receipt creation, comes invoicing. When you reference a purchase order or goods receipt when creating an invoice, the system copies the data defined in the preceding document(s). This information includes vendor details, item code, item description and quantity. These inherited values can be modified, for example, installment payment. However, the system verifies if there are irregularities between the purchase order or goods receipt and the invoice. System messages are displayed accordingly depending on the business rule defined in the system and invoices can be blocked as a consequence. Basically what happens at the background is that when an invoice is based on a purchase order and goods receipt, the system copies the order prices from the purchase order document and the received quantities from the purchase order document. Furthermore, the system determines the quantities that are yet to be invoiced by calculating the difference between the quantity delivered and the quantity that was invoiced earlier. The system also calculates the expected value for the items, which is a product of the quantity to be invoiced and the order price. This value is not static. It can be modified accordingly. When an invoice is created, the corresponding vendor accounts is updated accordingly. The AP Invoice can be accessed under this path: Purchasing - A/P > AP Invoice Figure 4 shows the AP Invoice screen

Figure 4 Outgoing Payment Most times, outgoing payment is based on account payable invoices. When a vendor is chosen, a list of all invoices awaiting payment is displayed. You simply click on the particular invoice to be paid and effect the transaction. When an outgoing payment transaction is created, corresponding journal entry is created. Payment could be made in check, bank transfer, credit card or cash. If you create outgoing payment for a vendor that has a pre-defined consolidating business partner, the journal entry is created against the consolidating business partner. It is possible for outgoing payment to be based on one or more invoices that were fully paid. In such case, the transaction of the paid invoices and the outgoing payment are automatically reconciled. Furthermore, the amount due and the paid/credit fields in the paid invoice are updated accordingly and the status of the invoice changes to closed. The outgoing payment can be accessed under this path: Banking > Outgoing Payments > Outgoing Payment Figure 5 shows the Outgoing Payment screen

Figure 5 It is important to state that workflow - approval procedures and document reversal - Goods Return and Credit Memo are not discussed here

SAP MM Procurement Process

ADVERTISEMENT One of the main areas covered by MM module is Purchasing/Procurement. The purchasing process is initially started when there is a requirement of material/service from a user. If the material/service can not be obtained from companys internal resource, the responsible person of that company must find the vendor/supplier which can provide it on the required date. The purchasing process is ended when the payment processing to the vendor that supply the material/service has been done. In this post, I will explain about the basic of the purchasing/procurement process, which usually known as Procurement Cycle as the following steps.

1. Determination of Requirements

In this step, there is a requirement of material or service, which must be procured externally, from the user. The requirement must be recorded as Purchase Requisition (PR) document in SAP MM.

Purchase Requisition (PR) is an internal purchasing document in SAP ERP that is used to give notification to responsible department about the requirement of material/service and to keep track of such requirement. PR must contain clear information about the description and quantity of the material/service, the required date, and other information.

PR can be created directly in SAP MM module with ME51N t-code, or indirectly by another SAP component, such as: materials planning, maintenance order of PM module, production order of PP module, network activity of PS module, etc. We have explained this in the previous article about MM integration with other modules.

We can set in SAP that the PR must be approved or released before it can be passed to the next step of purchasing processes. We have explaine about the PR Release Strategy in the previous d article. 2. Determination of the source of supply After the PR has been created (and released if needed) in the previous step, the responsible department (usually purchasing/procurement department of the company) must process it. The buyer of the procurement department must determine the possible sources of supply of the material/service specified in the PR. With ME57 t-code, the buyer can check in the SAP whether the material/service needed can be obtained from the existing outline agreement (contract or scheduling agreement) documents or not. If there is no existing outline agreement, the buyer can also check whether there is an existing info record documents (which contain information about the price and delivery conditions of the material/service agreed with vendor in the last Purchase Order/PO) that still can be used(valid) as a reference to create new PO to the same vendor. If there is no valid info record at that time, the buyer can create Request For Quotation (RFQ) documents to one or some prospective vendors. The buyer can access the procurement history of the material/service specified in the PR, so he can see which vendors that have provided it to the company before. He can also create the RFQ to the new prospective vendor that might have never provided the material/service to the company before. Request For Quotation (RFQ) is an external purchasing document that usually used as bidding process invitation. RFQ is sent by a company to the prospective vendor to request the vendor to provide a quotation which contains information about the price and delivery conditions, terms of

payment, etc that the vendor formally agree in case it is appointed to provide the material/service to the company.

In the RFQ, the buyer must include the information about the material/service needed from the vendors (can be copied from the PR), the latest submission date of the quotation, the preferred term of delivery, term of payment, currency, etc. 1.3. Vendor Selection If in the previous step, there are some outline agreement or info record documents that can be used as references to create a PO, the buyer can select or choose which vendor that will be appointed to provide the material/service at this time. If there is no outline agreement or info record documents that can be used as references to create PO, in the previous steps, the buyer will send the RFQ documents to one or some vendors. The vendors will send their quotations which include the information about the price, delivery terms, terms of payment, etc that they offered to the company. The buyer can input that information into SAP with ME47 t-code. With ME49 t-code, the buyer can compare the offering of all vendors that have sent their quotation. The comparison can be used to determine which vendor should be appointed to provide the material/service to the company. 4. SAP ERP can also create rejection letters to the vendors that are not selected as the supplier of the material/service. 5. PO Processing: In the previous step, the buyer has selected the vendor which will provide the material/service needed in PR. In this step, the buyer creates a Purchase Order (PO) based on the PR and the reference document (that can be an outline agreement, an info record, or a quotation). Purchase Order (PO) is a legally binding document that issued by a company to a vendor which contains information about description, quantity, delivery date, agreed prices, terms of delivery, and terms of payment for material or service the vendor will provide to the company. 6. PO Monitoring: After the PO has been sent to the vendor, the buyer has the responsibility to monitor whether the vendor delivers the material/service at the right time on the right place. The buyer can monitor whether the material/service has been received by the person responsible (such as the warehouse man) online with PO history function in the PO document. If the warehouse man or anyone else has received the material/service and posted the Goods Receipt/Service acceptance document, the PO history will be updated in a real-time basis. SAP ERP can also has a functionality to give the reminder to the buyer if the PO item has not been GR in the specified period in respect of the delivery date agreed with vendors.

7.

Goods Receipt: When the vendor delivers the material or perform the service, the responsible person of the company must perform the goods receipt (GR) or service acceptance (SA) transaction. The GR/SA will update the PO history. If the PO item is an inventory material, the GR will increase the stock level of the material. When we perform the GR for the PO item for the first time, SAP will propose the quantity to be GR as the PO order quantity. Depends on the delivery terms agreed with the vendor, the vendor might deliver the material partially. We can post the GR partially too, so when the next material delivery is received, SAP will propose the quantity to be GR as the remaining quantity that has not been GR yet.

8.

Invoice Verification: After the vendor delivered the material/service, it will send the invoice to the person responsible in the company. Invoice is a formal document issued by a vendor to the company to request the payment for the material or service that the vendor has already provide to the company according to the terms of payment agreed in the PO. An invoice is usually attached with the delivery note (goods receipt) document. The person responsible, usually an accounting staff, will perform the three way matches. He will check whether the invoice information (such as price, terms of payment, etc) is the same with the PO, and whether the PO item has been received (GR/SA). If yes, then he will post the Invoice Receipt (IR) transaction in MM module. The IR transaction will credit the account payable of the vendor which specified in the "pay to" partner function in the PO.

9.

Payment Processing: After the IR transaction has been posted, the vendors account payable will increase and the company must process the payment to that vendor as stated in the terms of payment of the PO. The payment transaction will be performed in FI module. After the payment has been posted, the vendors account payable will be debited and the cash or ban account will k be credited.

MM

FICO

SD

PP

PM

PS

WM

QM

MM: 0ne of core modules of ERP (SAP R/3) Covered areas: 1. Enterprise structure: y Master Data (vendor and material) y Purchasing/procurement 2. Materials planning (MRP and CBP) y Inventory management and Physical Inventory Management 3. Material valuation and Account determination y Invoice verification

Sales and Distribution

SO/demand forecast of a finished product from SD requirement in SAP MM 1. Available finished product delivered to customer via outbound delivery, then goods issue (GI) transaction base on outbound delivery in inventory management. 2. Not available finished product trigger requirement MRP in MM. MRP in SAP can automatically create procurement proposals like planned order. Planned order can be converted into: a. Purchase Requisition (PR) for external procurement b. Production order in PP for internal production of finished product. In the production order, the requirement for the component or raw materials will be considered dependent requirement. Hence, SAP will determine these dependent requirements through the info of the BOM of the finished product. In this case, there will be another cycle of planned order for these components. Also, MRP can directly create purchase requisition as a procurement proposal. There is no planned order in this case.

Plant Maintenance (PM) (maintenance order MO) or Project System (PS) (Network Activity NA)

MO or NA from PM and PS respectively can create: 1. PR of material/service that is procured external or 2. Reservation (which can be considered as requirement) of the stock material. y Availability of stock material will directly trigger the reservation item to be issued with GI transaction in Inventory Management. y In the case of non availability, the reservation (requirement) can be processed by materials planning to create procurement proposals like planned order which is converted to PR or PO. The PR will be processed by the purchasing department to be PO. Based on this PO, the vendor will deliver the material/service which in turn will be received in the IM via Goods Receipt (GR) transaction. Note: If the material is finished product, can be delivered to the customer by converting the SO to outbound delivery, the GI transaction in IM. If material is component or raw material, then we can use the production order to produce the finished product with GI to production order transaction. When the finished product is produced, we can perform GR to the production order in the IM.

The vendor that delivered the material will send an invoice based on the PO to the responsible person in the company and this person will perform the invoice receipt IR in MM. It is on this IR transaction that the finance department will process payment for the vendor in the FI module.

GR, GI and other transactions in the IM can be linked in details to the WM module. We have maintenance of material stock at a more detail level storage bins (WM) than storage location (MM). These same materials can be stored at several storage bins in a storage location.

Quality Management (QM)

Under the QM, Quality master data such as certificate required of a material that is ordered in a PO. When we post GR transaction, we can post it to the quality inspection check. Also score/quality level can be given to material delivered by vendor.

Financial Accounting & Control (FICO)

The GR and GI transactions in the IM triggers the accounting journals in FI module for real-time up to date company s financial reports such as balance sheet and profit and loss statement The budgeting in the PS can also be linked to the PR and PO of MM module to make sure the total value (price) in PR and PO does not exceed the budget.

Accounting (FICO) Journals of SAP Material Management (MM) Transactions

SAP R/3 is an Enterprise Resource Planning (ERP) software that makes an enterprise able to integrate all of its business processes so it can be run more efficient. It can reduce the duplication of data and process. Data recorded by one department can be used by other departments in a real-time process. As an example we will explain the typical business process in an enterprise.

Typical business processes in an enterprise

Demand for finished products from customer will be recorded by Sales department in a sales order document. Sales order data can be analyzed by Inventory department. If there are not enough finished products in current stock, the sales order can trigger a production order that request the Production department to start producing the finished products. In order to produce the finished products maybe it requires some raw materials that have to be bought from vendors. The production order can trigger a purchase requisition for the raw materials. The purchase requisition will be processed by Procurement department to be a purchase order that is sent to vendor. Vendor will deliver the raw materials and Inventory department will receive them. Accounting department will record the vendors invoice and Finance department will process the payment. Once the raw materials are available, the Production process begins. Then the finished products will be delivered to the customer, and Finance department will send invoice to the customer.All of the above processes need man powers that are managed by HR department and paid by Payroll Accounting department. All of the above processes can be recorded by SAP R/3 in:

y y y y y

Sales and Distribution (SD) module. Production Planning (PP) Material Management (MM) module. Finance & Controlling (FICO) module HR Module

Certain transactions in the above example also trigger accounting business process. FICO module posts accounting documents for some transactions that have an accounting effect in SD, PP, and MM module, such as finished products issue for sale to customer, raw materials receipt from vendor, etc. These processes will affect the financial reports such as Balance Sheet and Profit & Lost Statement. In this blog-post, we will explain the way MM transactions affect the FICO module. First, we will explain basic accounting business process principle that used in FICO module.

Accounting Business Process Basic Principle

Accounting is the systematic process of measuring the economic activity of a business to provide useful information to those who make economic decisions (internal or external parties of an enterprise). It records all economic transactions (usually, but not always, involves money) in a systematic and generally accepted way. The transaction records are organized and presented in certain forms of reports. The most used reports in financial accounting business process are Balance Sheet and Profit & Lost Statement.

Balance Sheet

The balance sheet shows an enterprises Assets, Liabilities, and Equity at a specific time (such as Balance Sheet on December 31, 2007). It is sometimes described as a snapshot of the business in financial terms.

Asset = Liabilities + Equity

Assets are valuable resources that a firm owns or controls, such as: Cash Bank account Inventory Account Receivable Fixed Asset

y y y y y

y y

Intangible Asset etc

Liabilities are obligations of the business to convey something of value in the future, such as: Account Payable Notes Payable etc

y y y

Equity refers to the owner's interest in the business, such as: Capital stock Retained earning Current year net profit/loss (in traditional accounting that is without a real-time software such as SAP, there is no current year net profit/loss account. The Balance Sheet is usually prepared at the end of fiscal period, such as December 31 every year. All of the profit/loss in that year from Profit & Loss Statement, after deducted by dividend that given to shareholders, will be recorded as an addition to Retained earning account. But, in SAP system, the current year net profit/loss from Profit & Loss Statement is directly recorded in balance sheet under equity, without waiting transferred to retained earning account, so it is possible to have a snapshot of enterprise balance sheet at any time along the year, not have to wait until the end of year.)

y y y

Profit & Loss Statement

The Profit & Loss Statement summarizes the earnings generated by an enterprise during a specified period of time (such as Profit & Loss Statement in year 2007).

It contains at least two major sections: revenues and expenses.

Revenues are inflows of assets from providing goods and services to customers, such as: Sales to customers. Gain from foreign currency exchange transaction etc

y y y

Expenses are the costs incurred to generate revenues, such as: Cost of goods sold (COGS) include raw material consumption, etc General and administrative expenses include salaries, rent, and other items Tax expense etc

y y y y

The difference between revenues and expenses is net profit (or net loss if expenses are greater than revenues).

Relationship between Balance Sheet and Profit & Loss Statement

Balance Sheet and Profit & Loss Statement are all based on the same underlying transaction information, but they present different views of an enterprise. They should not be thought of as alternatives to each other but as a complement.

The balance sheet represents an expansion of the accounting equation and explains the various categories of assets, liabilities, and equity. The profit & loss statement explains changes in financial position (that is, assets and liabilities) that result from profit generating transactions in terms of revenue and expense transactions. The resulting number, net profit, represents an addition to the equity in the enterprise. This relationship is called articulation.

DEBIT and CREDIT rules in accounting journal

Name of account Debit Credit

Increases in Assets are recorded by debits. Decreases in Assets are recorded by credits. Increases in Liabilities and Equity are recorded by credits. Decreases in Liabilities and Equity are recorded by debits. Revenues increases equity, therefore revenue are recorded by a credits. Expenses decreases equity, therefore expenses are recorded by a debits. Accounting journals of MM Transactions

The MM transactions which have effect to accounting (FICO module) are transactions that involve valuated-materials (and also non-valuated-materials for GR for PO transaction), such as: Goods Receipt (GR):

o o o

GR for initial entry for stock balance (movement type: 561) GR for Purchase Order/PO (movement type: 101) GR other/without PO (movement type: 501)

Goods Issue (GI):

o o o o o o

GI to cost center (movement type: 201) GI to sales order (movement type: 231) GI to asset (movement type: 241) GI for sales (movement type: 251) GI to order (movement type: 261) GI for scrapping (movement type: 551)

Invoice Receipt Transfer material to material (movement type: 309) if the receiving material has different valuation class with the supplying material

GR Subcontract PO

o

GR for Subcontract PO material (movement type: 101) and GI for component material provided to vendor (movement type: 543)

Physical Inventory difference posting

o o

GR for gain on physical inventory count (movement type: 701) o GI for loss on physical inventory count (movement type: 702)

Anda mungkin juga menyukai

- Procure To PayDokumen14 halamanProcure To PaymeegunBelum ada peringkat

- p2p Best PracticesDokumen6 halamanp2p Best PracticesamolkingBelum ada peringkat

- Purchase-to-Pay Example Using Sap Erp: Product Motivation PrerequisitesDokumen26 halamanPurchase-to-Pay Example Using Sap Erp: Product Motivation PrerequisitesShashank MallepulaBelum ada peringkat

- Procure-to-Pay Reports Summary/TITLEDokumen45 halamanProcure-to-Pay Reports Summary/TITLEOscar Jimenez Carazo100% (1)

- Training Manual (Bevrage)Dokumen249 halamanTraining Manual (Bevrage)Juan Mario AndradyBelum ada peringkat

- SFIN Demo - Configuration DocumentDokumen105 halamanSFIN Demo - Configuration DocumentPavan SharmaBelum ada peringkat

- SAP Procure To PayDokumen2 halamanSAP Procure To PayKarim Derouiche100% (1)

- SAP HANA and Real Time Analytics - BIDokumen8 halamanSAP HANA and Real Time Analytics - BIaslamharysBelum ada peringkat

- Sap s4 Hana Procure To Pay Process (p2p)Dokumen100 halamanSap s4 Hana Procure To Pay Process (p2p)Muhammad Kashif Shabbir100% (1)

- 03 SAP Purchase To PayDokumen58 halaman03 SAP Purchase To PayDanielBelum ada peringkat

- Getting Started With SAP Roadmap ViewerDokumen15 halamanGetting Started With SAP Roadmap ViewerGiomBelum ada peringkat

- Questionnaire MMDokumen130 halamanQuestionnaire MMMuhammad NassrBelum ada peringkat

- SAP Sourcing Process FlowDokumen1 halamanSAP Sourcing Process FlowSDKadaveBelum ada peringkat

- SAP BW Rapid Deployment Solution For APO - v1 6Dokumen39 halamanSAP BW Rapid Deployment Solution For APO - v1 6Rahul MahajanBelum ada peringkat

- SD MM FlowDokumen5 halamanSD MM Flowharish2912Belum ada peringkat

- PPT on Procure to Pay Cycle and its ChallengesDokumen15 halamanPPT on Procure to Pay Cycle and its ChallengesAnkit SaxenaBelum ada peringkat

- SAP Hierarchy OverviewDokumen38 halamanSAP Hierarchy OverviewsowjanyaBelum ada peringkat

- Design Financial Organizational StructuresDokumen22 halamanDesign Financial Organizational Structuresranga2702Belum ada peringkat

- Business Processes in SAP S/4HANA Sales: Enterprise StructuresDokumen6 halamanBusiness Processes in SAP S/4HANA Sales: Enterprise Structuresspsuman05Belum ada peringkat

- SAP Audit Guide: For InventoryDokumen8 halamanSAP Audit Guide: For InventoryPritpal Singh SBelum ada peringkat

- Fundamentals of Procure To PayDokumen254 halamanFundamentals of Procure To Paysweetshene100% (3)

- Order To Cash Automation For SAPDokumen4 halamanOrder To Cash Automation For SAPPaul McdonaldBelum ada peringkat

- Sap Project PhaseDokumen2 halamanSap Project PhaseRaj ChaudharyBelum ada peringkat

- S4 HANA Course ContentDokumen6 halamanS4 HANA Course ContentSudhindraBelum ada peringkat

- Supply Chain Collaboration Center of Excellence OverviewDokumen74 halamanSupply Chain Collaboration Center of Excellence OverviewAlexandraBelum ada peringkat

- Admin Guide Fresh Product Forecasting AddOn 1.2 FBSDokumen44 halamanAdmin Guide Fresh Product Forecasting AddOn 1.2 FBSNoppawan BuangernBelum ada peringkat

- Procure To Pay SAP Business Process March 2013Dokumen155 halamanProcure To Pay SAP Business Process March 2013NaveenBelum ada peringkat

- SAP - FICO Course ContentDokumen10 halamanSAP - FICO Course Contentchaitanya vutukuriBelum ada peringkat

- Cycle Time in Days To Generate Complete and Correct Billing DataDokumen5 halamanCycle Time in Days To Generate Complete and Correct Billing DataZaid ImranBelum ada peringkat

- Complete Order To Cash Cycle Steps IncludingDokumen25 halamanComplete Order To Cash Cycle Steps Includingsayeedkhan100% (1)

- Procure To Pay Lifecycle - MarkedDokumen15 halamanProcure To Pay Lifecycle - MarkedYogesh SalviBelum ada peringkat

- Revenue Recognition PDFDokumen6 halamanRevenue Recognition PDFObilesu RekatlaBelum ada peringkat

- SAP Legacy System Migration Workbench PDFDokumen23 halamanSAP Legacy System Migration Workbench PDFMohammed AhmedBelum ada peringkat

- XML Structure Min Occurs Max Occurs Type: InvoiceDokumen27 halamanXML Structure Min Occurs Max Occurs Type: Invoiceapi-26420083100% (1)

- Deployment Recommendations For SAP Master Data GovernanceDokumen36 halamanDeployment Recommendations For SAP Master Data GovernanceKalpana KadamBelum ada peringkat

- Transfer PricingDokumen17 halamanTransfer PricingsharadkulloliBelum ada peringkat

- Business Driven ConfigurationDokumen21 halamanBusiness Driven ConfigurationMukul WadhwaBelum ada peringkat

- An Overview - Process Journal EntriesDokumen30 halamanAn Overview - Process Journal Entriestalupurum1Belum ada peringkat

- Financial Accounting Organizational UnitsDokumen120 halamanFinancial Accounting Organizational UnitsEryx LetzBelum ada peringkat

- SAP HANA Course Syllabus OverviewDokumen2 halamanSAP HANA Course Syllabus OverviewnikkusonikBelum ada peringkat

- E2E STO Knowledge Share 11-19-2007Dokumen118 halamanE2E STO Knowledge Share 11-19-2007isabshireenBelum ada peringkat

- Study Unit TwoDokumen6 halamanStudy Unit TwoDong-Kyun RyuBelum ada peringkat

- Planning & Budgeting Using SAP Cost Center PlanningDokumen12 halamanPlanning & Budgeting Using SAP Cost Center PlanningFaraz Ahmed QuddusiBelum ada peringkat

- SAP FI MapDokumen2 halamanSAP FI MapVivek AnandhanBelum ada peringkat

- Financials in Purchase to Pay Process - Guide to Integrating Procurement and Accounting in SAPDokumen41 halamanFinancials in Purchase to Pay Process - Guide to Integrating Procurement and Accounting in SAPelixi67% (3)

- Vending Machine ProposalDokumen7 halamanVending Machine ProposalNik Syukriah Amin100% (1)

- Making Agile Retailers Globally with Local PresenceDokumen21 halamanMaking Agile Retailers Globally with Local PresenceniteshBelum ada peringkat

- Questionnaire MM WMDokumen141 halamanQuestionnaire MM WMRavindra Sadar Joshi100% (1)

- Business Use Case Article Load Currency Rates in Oracle ERPDokumen12 halamanBusiness Use Case Article Load Currency Rates in Oracle ERPYuvaraj M100% (1)

- Evaluated Receipt Settlement Sap PDFDokumen2 halamanEvaluated Receipt Settlement Sap PDFTim0% (2)

- Benefits and Steps On Performing SAP Post Implementation Audit GulfCementDokumen36 halamanBenefits and Steps On Performing SAP Post Implementation Audit GulfCementranganv100% (1)

- SAP - SAP S/4HANA Overview: Skills GainedDokumen2 halamanSAP - SAP S/4HANA Overview: Skills GainedSSBelum ada peringkat

- 1FOrder To Cash Cycle SAP FI-SD IntegrationDokumen7 halaman1FOrder To Cash Cycle SAP FI-SD IntegrationKunjunni MashBelum ada peringkat

- SAP MM OverviewDokumen26 halamanSAP MM Overviewsappp_vikasBelum ada peringkat

- Intro ERP Using GBI Slides FI en v2.01Dokumen25 halamanIntro ERP Using GBI Slides FI en v2.01shobhit1980inBelum ada peringkat

- Accounting Entries For The Asset Life CycleDokumen12 halamanAccounting Entries For The Asset Life Cyclebrianodwyer100% (1)

- SAP Question and AnswerDokumen13 halamanSAP Question and AnswerDurga Tripathy DptBelum ada peringkat

- 4 HANA Procure To Pay ProcessDokumen29 halaman4 HANA Procure To Pay ProcessPadmanaban SubramaniyamBelum ada peringkat

- Implementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesDari EverandImplementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesBelum ada peringkat

- The Secrets of Successful Tailoring - E Watkins (1910)Dokumen106 halamanThe Secrets of Successful Tailoring - E Watkins (1910)Cary MacMahon-dann67% (6)

- Elem Na PDFDokumen174 halamanElem Na PDFPhilBoardResultsBelum ada peringkat

- Bookkeeper employment contractDokumen2 halamanBookkeeper employment contractdenvergamlosen0% (1)

- Economics Course OutlineDokumen15 halamanEconomics Course OutlineDavidHuBelum ada peringkat

- MCQ - III Sem BCom - Corporate AccountingDokumen7 halamanMCQ - III Sem BCom - Corporate AccountingWani SuhailBelum ada peringkat

- Recipe and CookingDokumen45 halamanRecipe and Cookingtsanzo100% (2)

- Why Auditor Cannot Provide Absolute Level of Assurance in Audit EngagementDokumen2 halamanWhy Auditor Cannot Provide Absolute Level of Assurance in Audit EngagementAkif AlamBelum ada peringkat

- Toeic Vocabulary 1Dokumen2 halamanToeic Vocabulary 1giangmilk0812Belum ada peringkat

- GIZ SUTP TD14 On Street Parking Management enDokumen120 halamanGIZ SUTP TD14 On Street Parking Management enPrabesh AdhikariBelum ada peringkat

- 11 March 2014 PIM ReportDokumen6 halaman11 March 2014 PIM Reportsathi11189100% (1)

- Bay Field Mud CaseDokumen3 halamanBay Field Mud CaseexsavezeroBelum ada peringkat

- Brochure 021820 Spanish Single-Pages ICML-webDokumen4 halamanBrochure 021820 Spanish Single-Pages ICML-webAMERICO SANTIAGOBelum ada peringkat

- Asiana Airlines Reports Improved 4Q PerformanceDokumen16 halamanAsiana Airlines Reports Improved 4Q PerformanceShiamak FrancoBelum ada peringkat

- Vita Milk PlantDokumen17 halamanVita Milk PlantNirmal Yadav0% (1)

- Sop F&B Controls (Dokumen12 halamanSop F&B Controls (Abid SayyedBelum ada peringkat

- Elf Shoes PDFDokumen4 halamanElf Shoes PDFIreneIrene100% (1)

- Understand Residence Status for Individuals in MalaysiaDokumen40 halamanUnderstand Residence Status for Individuals in MalaysiaIfa Chan100% (1)

- Profile PropelisDokumen6 halamanProfile PropelismaverickmuglikarBelum ada peringkat

- Green & White RevolutionDokumen16 halamanGreen & White Revolutiondranita@yahoo.com100% (3)

- Assignment 1 - FinalDokumen10 halamanAssignment 1 - FinalarafatBelum ada peringkat

- Chapter 2 Solutions To Assignment ProblemsDokumen2 halamanChapter 2 Solutions To Assignment ProblemsBhadra MenonBelum ada peringkat

- 01 Ufshsi 4 Pczuf 2 FKWKTC 7 PDG 1 PyDokumen9 halaman01 Ufshsi 4 Pczuf 2 FKWKTC 7 PDG 1 PyPuti Benny LakraBelum ada peringkat

- Common Size AnalysisDokumen5 halamanCommon Size Analysissu2nil0% (2)

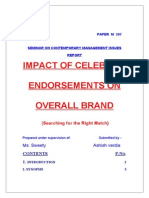

- Celebrity EndorsementDokumen76 halamanCelebrity Endorsementverdiaashish100% (2)

- East Coast Yachts Financial Ratio AnalysisDokumen3 halamanEast Coast Yachts Financial Ratio Analysisbrentk112100% (1)

- 1, Aset TetapDokumen45 halaman1, Aset TetapM Syukrihady IrsyadBelum ada peringkat

- Ashraf TextileDokumen5 halamanAshraf Textiles_iqbalBelum ada peringkat

- Korean Film IndustryDokumen5 halamanKorean Film IndustryYasmim YonekuraBelum ada peringkat

- Request for new PAN card acknowledgementDokumen2 halamanRequest for new PAN card acknowledgementprabin kumar ashishBelum ada peringkat

- Ratio Analysis of Crown CementDokumen26 halamanRatio Analysis of Crown CementMohammed Akhtab Ul Huda100% (1)