Jobber Bill Cmte Report

Diunggah oleh

mdebonisDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Jobber Bill Cmte Report

Diunggah oleh

mdebonisHak Cipta:

Format Tersedia

1

Council of the District of Columbia

Committee on Government Operations and the Environment

Draft Report

1350 Pennsylvania Avenue, N.W., Washington, D.C. 20004

To: Members of the Council of the District of Columbia

From: Mary M. Cheh, Chairperson

Committee on Government Operations and the Environment

Date: July 11, 2011

Subject: Bill 19-299, the Retail Service Station Amendment Act of 2011

The Committee on Government Operations and the Environment, to which Bill 19-299,

the Retail Service Station Amendment Act of 2011 was referred, reports favorably on the

legislation, which the committee revised to better achieve the aims of the original act, and

recommends its approval by the Council of the District of Columbia.

Statement of Purpose and Effect Page 2

Legislative History Page 2

Background and Committee Reasoning Page 2

Section-by-Section Analysis

CONTENTS

_____ Page 14

Fiscal Impact _____________ _____ Page 14

Analysis of Impact on Existing Law _____ Page 15

Committee Action _____________ _____ Page 15

Attachments ____________ _____ Page 15

2

Bill 19-299, the Retail Service Station Amendment of 2011, was introduced on May

17, 2011. The legislation would prohibit gasoline distributors from operating retail service

stations in the District, clarify that marketing agreements may not preclude competition by

prohibiting the purchase of competitively priced fuel from third parties who are not part of the

agreement, provide franchisees with the right of first refusal when a sale, assignment, or transfer

is set to take place, and empower the Attorney General of the District of Columbia to bring legal

actions in Superior Court for violations of this chapter.

STATEMENT OF PURPOSE AND EFFECT

May 17, 2011 Introduction of B19-299 by Councilmembers Cheh, Evans, Mendelson,

and Wells

May 17, 2011 Referral of B19-299 to the Committee on Government Operations and the

Environment

May 27, 2011 Notice of Intent to Act on B19-299 is published in the District of

Columbia Register

June 3, 2011 Notice of Public Hearing on B19-299 is published in the District of

Columbia Register

June 17, 2011 Public Hearing on B19-299 held by the Committee on Government

Operations and the Environment

July 11, 2011 Consideration and vote on B18-521 by the Committee on Government

Operations and the Environment

LEGISLATIVE HISTORY

I. Background

A. Retail Service Station History in the District

BACKGROUND/COMMITTEE REASONING

The District has a long history of regulating the retail service station industry dating back

to the passage of the Retail Service Station Act of 1976 (RSS). Out of concern over domination

of the market by major oil companies like BP or Exxon, the District passed the RSS, which is a

divorcement law preventing refiners from operating retail stations.

1

1

D.C. Law 1-123. The Retail Service Station Act of 1976.

During the same time period,

several other states passed divorcement laws as well. In 1979, the District amended the RSS,

enacting the first of several laws establishing a moratorium on conversions of full-service retail

3

service stations without a waiver from the Mayor.

2

In 2004, the Council again amended the RSS

by enacting the moratorium permanently and adding jobbers into the divorcement law with a

two-year phase-out period. By 2007, however, the jobber divorcement provision had not yet been

fully implemented.

3

The Committee report on the 2007 legislation noted that the provision

adding jobbers to the divorcement law in 2004 had not been included in the introduced version of

the bill, which deprived potential opponents of the measure an opportunity to speak against it.

4

Taken together, the lack of adoption and less visible notice of the change prompted

Councilmember Mary Cheh and then-Councilmember, now-Chairman Kwame Brown to

introduce a measure removing jobbers from the divorcement law, so all interested parties would

have an opportunity to testify on the matter.

5

The Committee on Public Services and Consumer Affairs conducted a full hearing on the

amendment to remove jobbers from the statute on May 24, 2007. The Committee report

concluded that any expansion of the divorcement statute would only create further disincentives

for new competitors to enter the marketplace.

6

With these pieces of legislation and with changing market conditions, the gasoline

industry has changed significantly in the District. Over the years, the total number of retail

service stations has steadily decreased. According to a September 2008 report prepared by the

District Department of the Environment (DDOE), the total number of service stations fell from

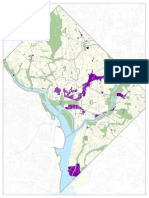

270 (1977) to 108 (2006). More recent data shows that number to have dropped to 105.

Subsequently, the Council passed the 2007

legislation, and jobbers were once again free to operate service stations.

The Council then amended the RSS in 2009. In that year, the legislation added new

restrictions on converting full-service stations and provided franchisee station operators with a

right of first refusal if a franchisor sought to sell, transfer, or assign his interest in a station to a

third party. The added protections also included a duty to negotiate a lease in good faith.

Although the enhanced requirements for converting a full-service station remain, the other

protections sunset on January 1, 2011.

7

2

D.C. Law 3-44. Also, because the Act contained a two-year sunset clause, the Council was forced to reexamine

the issue in 1981. The Council passed nine subsequent emergency and temporary measures, keeping the moratorium

in place until 2004, when the moratorium was finally made permanent.

3

Committee on Public Services and Consumer Affairs Report on Bill No. 17-142, the Retail Service Station

Amendment Act of 2007, September 25, 2007, at 3.

4

Id.

5

Id. at 4.

6

Id.

7

Robert W. Doyle Testimony, Committee on Government Operations and the Environment Hearing on B19-299,

June 17, 2011, at 4.

As of

2006, only 47 full-service stations were left in the District. Those that do remain have

engendered significant goodwill from their respective communities. Notably, the Committee

received dozens of letters, emails, and calls praising the service provided by one local operator,

whose station has been serving a District neighborhood for years. The letters and support

demonstrate that in spite of any changes to the industry, the community still values independent

operators, who are able to devote time and energy to develop a relationship with the

neighborhoods they serve.

4

B. Market Shifts

The RSS set out the following goals in the regulation of service stations through

divorcement: (1) the further deterioration of free and open competition in the retail motor fuel

market by increases in the number of directly operated retail service stations will be prevented;

(2) competition in the motor fuel market will be enhanced by a dispersion of the concentration in

control and economic power inherent in existing directly operated retail service stations; (3) the

competitive position of independently operated retail service stations will be strengthened; and

(4) a downward pressure on retail motor fuel prices will be created.

8

During the 1970s, a few oil refiners like BP, Shell, and Exxon controlled the vast

majority of stations in the District.

Unfortunately, market

shifts seem to have frustrated the Councils purpose.

9

In 2004, the Council recognized that jobbers had begun to resemble large oil refiners in

the way that they interacted with the retail service station market and passed legislation adding

jobbers into the divorcement statute. The corresponding committee report explained: jobbers

instead of the oil companies are the entities exerting pressure to convert and otherwise

threatening the independence of the local retail operators. The legislative intent undergirding

divorcement is being undermined.

In cases where the refiners also operated stations, a refiner

could serve as the landlord, supplier, and competitor of a station it supplied. That situation

threatened the competitive viability of an independent service station operator.

10

Currently, fewer companies actually control a larger share of the market than in 2007.

During that year, five jobbers owned 68 of the Districts 108 service station, with the two largest

jobbers owning a combined 47 stations.

The concern was justified. Reversing the 2004 legislation

by removing jobbers from the divorcement statute in 2007 has led to greater market

concentration and reduced competition.

11

Today, the two largest jobbers account for 72 of the

Districts 105 service stations, which is nearly 70%.

12

District customers are paying the second highest prices in the nation for gasoline.

Moreover, the pricing gap between the

District and other jurisdictions has increased, sharply. The prediction that removing jobbers from

the divorcement law would reduce disincentives to market entry made in the Committees 2007

report has not come true. Instead, removing jobbers from the divorcement statute has created

rather than eliminated disincentives to enter the gasoline market in the District.

C. Prices

13

8

Committee on Transportation and Environmental Affairs Report on Bill No. 1-133, the Retail Service Station Act

of 1976, September 10, 1976.

9

Subcommittee on Public Interest on Bill No. 15-914, the Retail Service Station Amendment Act of 2004, October

27, 2004, at 5.

10

Id.

11

Ralph McMillan Testimony, Committee on Public Services and Consumer Affairs Hearing on B17-142, June 12,

2007 (contained in attachment I), at 2.

12

Doyle Testimony on B19-299, at 5.

13

http://www.washingtoncitypaper.com/articles/41082/why-does-gas-cost-so-much-in-dc-joe-mamo/

More

troubling is the fact that the gap between prices in the District and the rest of the nation,

5

including nearby suburban Virginia and Maryland, is growing. Gas prices will invariably rise

and fall with crude oil prices, but those variations do not explain the growth of the pricing gap.

Although opinions vary over the extent of the increase, no evidence presented to the Committee

disputes that the gap has grown.

In a May 27, 2011 editorial, a local paper attributed the Districts historically higher gas

prices to the higher insurance and rents paid in town.

14

Nevertheless, AAA reports that the price

gap between the District and national average stood at just five cents in 2007.

15

On June 17,

2011, the price gap stood at 28 cents, according to AAA.

16

On the same day, gas could be

purchased for an average of 41 cents per gallon less in Virginia than in the District.

17

Higher

rents and insurance costs may explain the smaller, historical pricing gap that had existed for

years in the District, but they do not explain the gaps rapid growth over the past four years, as

AAA testified in the Committees hearing.

18

The same local paper argued that the growth over the past two years, which it reports has

increased by seven cents since 2009, between the District and nearby Virginia and Maryland

suburban areas is attributable almost entirely to tax increases.

19

That argument is questionable

and premised partially on an error. While the Districts excise tax on fuel did increase 3.5 cents

per gallon in 2010, that change accounts for only half of the reported seven-cent increase. The

newspapers report errantly relies on a sales tax increase of 0.25 percent to account for the

remainder of the growth. The District, however, does not apply sales tax to motor vehicle fuels;

it applies only an excise tax to them.

20

Currently, neither the District nor Maryland applies any

sales tax to motor vehicles fuels. In contrast, Virginia imposes a 2.1% sales tax on motor vehicle

fuels sold in Northern Virginia.

21

The Committee notes the value of objective expert testimony, particularly in complex

economic matters such as this one. When the Committee on Public Services and Consumer

Consequently, ifas AAA reported at the hearinga gallon of

gas is approximately a dollar more expensive than it was a year ago, the gap between the District

and Northern Virginia should have actually decreased by two cents as the result of sales tax,

significantly offsetting the Districts excise tax increase. The District and Maryland apply

identical excise taxes to unleaded fuels, and the District applies a lower excise tax to diesel fuels.

Virginia applies a smaller excise tax than does the District, but adds the 2.1% sales tax in

Northern Virginia. Taxes may help explain some very small fluctuations, but they do not account

for anything approaching the price gap growth the District has experienced since 2007.

D. Expert Testimony

14

http://www.washingtonpost.com/opinions/pumped-up-for-gas-price-scapegoating-in-

dc/2011/05/26/AGkamyCH_story.html

15

John B. Townsend II Testimony, Committee on Government Operations and the Environment Hearing on B19-

299, June 17, 2011, at 4.

16

Id. at 1.

17

Id.

18

Id. at 5.

19

http://www.washingtonpost.com/opinions/pumped-up-for-gas-price-scapegoating-in-

dc/2011/05/26/AGkamyCH_story.html

20

D.C. Code 47-2005 (20)

21

Va. Code 58.1-1720

6

Affairs moved forward with a provision removing jobbers from the divorcement statute in 2007,

the corresponding report relied on a recommendation from the Federal Trade Commission (FTC)

and analysis from the Districts Office of the Attorney General.

22

In 2007, the FTC concluded

that removing jobbers from the statute would increase competition and eliminate a potential

double markup resulting from both a distributor and a retailer earning profits for their efforts.

23

According to the FTC, prices would likely drop as a result of the legislation.

24

The Attorney

General, without taking a firm position on the legislation argued that entry into the jobber market

was not difficult and predicted that removing jobbers from the divorcement statute would not

lead to further market concentration.

25

The Attorney General, along with other neutral experts, argued at the June 17, 2011

Committee hearing that adding jobbers back into the divorcement statute is the right course of

action and would to help to restore competitive balance to the market.

Those predictions, however, did not bear out.

26

David A. Balto, a current senior fellow at the Center for American Progress, a former

policy director at the FTC, and a long-time antitrust attorney, testified in strong support of the

bill. He argued that removing jobbers from the divorcement law and allowing vertical integration

from the distribution level to the retail level has created a market that is not competitively

healthy.

27

Mr. Balto also explained that the FTC study offered in 2007 was flawed in several critical

ways. The study began with a faulty premise, failing to examine the Districts specific market

and instead examining the retail service station industry as a whole nationally. The mistake

prevented the FTC from taking into account the high levels of market concentration already

present in the District in 2007 and how a partial repeal of divorcement would affect a market

The retail service station market has been harmed in three primary ways, he

explained. First, the retail service station industry suffers from weak competition, particularly at

the wholesale level. Mr. Balto referred to the current market structure as a tight duopoly. With

two major jobbers controlling 70% of that market, competition for price and business simply

isnt sufficient to drive prices down. Second, high barriers for entry into the wholesale market

preclude conditions from improving. He explained that the presence of integrated stations, which

are owned by a distributor, limits the number of stations looking to competitively purchase fuel.

Consequently, little business is available for a jobber interested in entering the Districts

wholesale gasoline market. Third, as the landlord, supplier, and competitor of station operators,

jobbers control rent prices, gasoline prices, and have access to sensitive business data for

competing stations. With knowledge of overhead costs and profit margins, Mr. Balto warned that

jobbers can manipulate prices to maximize profits at the expense of fair competition.

22

See generally Committee Report on B17-142

23

Comment from United States Federal Trade Commission, Office of Policy and Planning (June 8, 2007) (contained

in attachment I) at 5.

24

Id. at 6

25

Committee Report on B17-142, at 7

26

The Districts Attorney General did not appear in person at the June 17, 2011 hearing, but the office submitted a

letter detailing its views, which Councilmember Cheh read into the record.

27

Committee on Government Operations and the Environment Hearing on B19-299, June 17, 2011 (available at:

http://oct.dc.gov/services/on_demand_video/on_demand_June_2011_week_3.shtm).

7

structured in that specific way.

28

Mr. Balto concluded by stating that he strongly supports the legislation because it would

break the ownership bind over service stations and help to restore competition at both the retail

and wholesale levels. He also noted concern that the District is losing excise tax revenues as

consumers choose to purchase gasoline outside the District due to higher pricesa proposition

supported by a drop in excise tax revenues from 2009 to 2010.

Next, the study examined the effects of refiner divorcement

while failing to address the specific issue of jobber divorcement in any meaningful way. Refiner

ownership of stations offered the District some benefits that jobber ownership has not. Refiners

like Exxon or BP not only wished to sell fuel, they also wished to protect the value of a

trademark. For example, Mr. Balto noted that a major oil company like Exxon might seek to

ensure that all its stations were in good repair to maintain a uniformly positive image of its

branded stations. In contrast, jobbers do not have a visible brand name to protect and may devote

fewer resources to leased stations. Finally, Mr. Balto argued that whatever the basis for the

FTCs study in 2007, it is clear in 2011 that they were simply wrong. Prices are higher, and

competition has decreased.

29

Robert W. Doyle, a former trial attorney at the FTC and a long-time antitrust practitioner,

also testified in support of the legislation. He identified concerns over market concentration with

ownership ties, particularly after a large merger in 2009, and potential sales of gasoline stations

to developers. Mr. Doyle presented a study of the gasoline service stations in the District

concluding that 46% of all stations in the District and 53% of all branded stations in the District

are owned by one jobber.

30

Mr. Doyle argued that the jobbers share of the market, which had

increased considerably since acquiring 30 stations in 2009, had allowed jobbers to set prices

irrespective of the competition. For example, if the jobber owned a Shell station on one corner

and its only nearby competitor is an Exxon station across the street, the jobber, who owns both

stations, could simply set both stations prices at higher levels because the jobber could no longer

be pressured into lowering prices through competition. Prior to the 2009 acquisition, brands were

forced to compete. After the merger, though, as Mr. Doyle put it, that jobber, who now owns

multiple brands, would be disinclined to go head to head with himself.

31

28

Mr. Balto noted in oral testimony that the District has one of the highest concentrations of jobber ownership in the

nation.

29

Excise tax revenues from gasoline dropped more than $1.5 million from 2009 to 2010. Source: Districts Office

of Revenue Analysis. Nevertheless, the consumption of finished motor gasoline nationally increased over that same

time period, according to the U.S. Energy Information Administration.

http://www.eia.gov/dnav/pet/pet_cons_psup_dc_nus_mbblpd_a.htm

30

Prior to one jobbers acquisition of the Districts 30 Exxon stations in 2009, the market had been less

concentrated.

31

Committee Hearing on B19-299.

He argued that the

situation could be magnified throughout the city, leading to much higher comparative prices.

Mr. Doyle also emphasized the danger that a jobber might simply begin to sell stations,

particularly given the two-year phase-out period required by the legislation. He noted that

Capitol Petroleum had already sold one station on Capitol Hill and had obtained permits to sell

another. He then said that he supported adding a right of first refusal to the legislation to prevent

jobbers from selling stations without giving operators the right to buy it and retain it as a service

station for the benefit of District residents.

8

In summation, Mr. Doyle supports the legislation because he believes that it will break

the ownership tie present in integrated stations. Breaking the tie, he argued, should inject some

needed competition into the retail and wholesale markets.

32

John B. Townsend II, Manager of Public and Government Affairs for AAA Mid-Atlantic,

discussed changes in pricing over the past four years, since the jobber divorcement was repealed.

Mr. Townsend explained that, historically, District gas prices were only marginally higher than

the national average and than in neighboring suburban areas in Maryland and Virginia.

He also explained that divorcement

should offer more opportunities for small businesses, as stations will each need an independent

operator to run them.

33

Since

2007, however, the pricing gap has widened rapidly.

34

He testified that taxes, rents, and

insurance costs could not account for the price gap growth, noting that the District and Maryland

applied identical excise taxes to unleaded fuels and that rents in the District are not necessarily

higher than in surrounding areas such as Bethesda, Maryland.

35

The Attorney General for the District of Columbia, Irvin B. Nathan, also submitted

testimony strongly supporting this legislation. Mr. Nathan acknowledged that this support

represented somewhat of a reversal from 2007 when a representative from his office testified,

[b]y allowing jobbers to operate their own retail stations in D.C., Bill 17-142 ha[d] the potential

to encourage retail competition by increasing the number of stations that [were] not controlled

and supplied by the major oil companies."

Moreover, distributors in the

District purchased gasoline at the same rack prices as distributors traveling to stations in nearby

Maryland and Virginia. Mr. Townsend reported that his research showed delivery costs for

gasoline to be somewhere around 4 cents per gallon nationally and less than 3.5 cents per gallon

locally. He said that neither rack prices nor delivery costs could account for the price gap growth

either. He argued that the only significant change over the past four yearsand the only

plausible explanation for the price gap increaseis the change in market concentration at the

jobber level.

36

The reversal comes out of recognition that [s]ince

2007, the landscape has changed dramatically in D.C.'s retail gasoline market.

37

Whereas in

2007, the retail gasoline market was shared by oil companies and jobbers, the current market is

dominated by two jobbers.

38

In contrast to 2007, when the Office of the Attorney General suggested in its

written testimony that the Council might "consider additional statutory changes in

order to allow D.C.'s independent [gasoline station] operators to operate more

independently of particular oil companies" (emphasis added), now the primary

Mr. Nathan also notes that:

32

Although fully supportive of the legislation, Mr. Doyle went further and argued that full divestiture might be

needed to ensure adequate competition at the retail level.

33

Mr. Townsend testified that prices were generally 2-5 cents per gallon higher in the District.

34

Mr. Townsend testified that prices in the District were 40 cents per gallon higher than in Virginia as of June 17,

2011, the day of the Committee hearing.

35

Committee Hearing on B19-299.

36

Letter from the Attorney General for the District of Columbia, Irvin Nathan (June 17, 2011) (contained in

Committee Report, attachment G at 2).

37

Id.

38

Id.

9

concern at the retail level is the high proportion of D.C. gasoline stations owned

by particular wholesalers.

39

The proposed bill would prohibit distributors from operating retail service stations in the

District. The change is needed to help restore a competitive balance in the retail service station

market in the District.

Market concentration allows jobbers to use market power to increase prices to the

detriment of consumers. Thus, the Attorney General strongly supports enacting B19-299 because

he argues that it will reduce the risk that jobbers could use market power to increase prices.

In 2007, the Committee relied on the FTCs recommendation and the Attorney Generals

analysis, in no small part, because they lacked a pecuniary interest in the outcome of the

legislation. However valuable and informative testimony from supporters of station operators or

supporters of jobbers may be, their positions remain essentially unchanged since 2007 because

their pecuniary interests remain largely the same. Each side presented illuminating facts, but the

conclusionssupporting or opposing the legislationwere foregone.

In contrast to 2007, though, the weight of expert testimony supports the passage of jobber

divorcement. Mr. Balto, Mr. Doyle, Mr. Townsend, and Attorney General Irvin Nathan lack

pecuniary interest in the outcome of the legislation. In fact, as stated before, the Attorney

Generals position represents a partial reversal from 2007 because of changes in the gasoline

industry. Taken with rising prices, declining station numbers, and increased market

concentration, the experts recommendations for jobber divorcement, along with accompanying

measures, are well justified.

II. Legislative Action: Description & Analysis

As experts testified, the retail service station industry in the District is no longer

structurally competitive. The result is fewer service stations in the District and higher prices at

those that remain. Legislative changes are needed to restore a competitive balance in the industry

and to achieve the long-established and accepted goals of the RSS. Bill 19-299 will make the

needed changes to achieve both of these objectives.

A. Divorcement

40

Approximately 70% of stations in the District are controlled by two

jobbers. This structure has led to more rapid price growth in the District than has been

experienced in surrounding jurisdictions and creates significant barriers to market entry,

preventing meaningful competition from entering the market.

41

In 2007, the Council removed jobbers from the divorcement statute, enabling a more

vertically integrated market to take shape. At the time, the FTC argued that vertical integration

39

Id.

40

See generally David A. Balto Testimony, Committee on Government Operations and the Environment Hearing on

B19-299, June 17, 2011; Doyle Testimony on B19-299.

41

Balto Testimony on B19-299, at 2.

10

would lower prices because the price at the pump would reflect fewer markups.

42

The FTCs

analysis, however, relied on the assumption that wholesale and retail markets would be

structurally competitive.

43

In the Districtwith two jobbers controlling a large majority of the

wholesale marketthis assumption is unsound.

44

Although vertical integration offers the

potential to maximize efficiencies and lower prices, prices have increasedand industry

representatives report that service from distributors has deteriorated.

45

For any potential benefits vertical integration offers, it presents dangers as well. In the

District, vertical integration has permitted three significant issues to develop. First, barriers to

entry into the Districts wholesale or retail gasoline markets have become very tough to

overcome.

46

Nonintegrated jobbers report that it is extremely difficult to enter the District

market, given the prevalence of integrated stations.

47

Second, current law permits a jobber to too easily manipulate the prices of competing

stations by allowing jobbers to serve as landlord, supplier, and competitor of independent station

operators. As landlord and supplier, a jobber has access to sensitive information such as

overhead costs, volume, and sales trends. Jobbers can use that information to modify prices in a

way that is anticompetitive, such as through the use of zone pricing.

The lack of nonintegrated systems means

that fewer stations are seeking to competitively purchase fuel from third-party distributors.

Vertical integration has allowed significant barriers to restrict entry into the jobber market in the

District.

48

Zone pricing establishes a

station or a group of stations as part of a zone that will pay the same thing for gasoline. Station

operators report that the gap in what they pay for gasoline versus some closely situated

competitors has grown significantly. One operator reported to Anacostia Realty, a subsidiary of

Capitol Petroleum, I have been advised by other dealers in Northwest Washington that I am

paying a premium of about ten cents per gallon over [their dealer tank wagon prices].

4950

Third, a system permitting vertical integration and encouraging concentrated ownership

is generally detrimental to small businesses, who wish to establish relationships with the

community. Vertical integration and market concentration may, in some situations, benefit

consumers if efficiencies and economies of scale are used to drive down prices.

Other

station operators reported at the hearing that stations in Virginia and Maryland were charging

less at the pump than they were paying for wholesale gasoline. The existing statute has

contributed to a competitively unhealthy gasoline marketand higher prices.

51

42

[W]hen both suppliers and station operators have the ability to price above cost, each will add a mark-up to the

final price. This double mark-up problem reduces supplier profits because retail prices are higher than they would

be if the supplier set them, causing business to be lost to lower-priced retailers. Comment from Federal Trade

Commission at 5.

43

Balto Testimony on B19-299 at 4.

44

Id.

45

Id. at 3.

46

Id. at 2.

47

Id.

48

Id.

49

Letter from Stacy Milford, Circle Exxon, to Anacostia Realty (Feb. 17, 2011) (contained in attachment F)

50

Dealer tank wagon price is the price paid by a dealer to a distributor when gasoline is delivered to the station.

51

Comment from FTC on B17-142, 4-6.

Even when

they benefit consumers in terms of the prices paid, thoughwhich they have not done for the

11

Districts gasoline pricesthe system prefers larger businesses positioned at several layers of the

market to the detriment of smaller ones. Unlike the larger businesses, single station operators

cannot, for example, raise prices at one isolated station as a way to lower them at a station facing

greater competition. Particularly when faced with anticompetitive practices, independent station

operators will find it difficult to compete. Protecting the viability of independent station

operators is one of the four stated goals of the RSS.

52

District residents continue to find the protection of independent station operators to be a

worthy goal. As stated earlier, dozens of community members contacted the Committee to

express support for the continued operation of an independent service station operator.

53

His

excellent service and connection to the community are greatly valued by nearby residents. Mat

Thorp, who testified on behalf of the Palisades Citizens Association (PCA), reiterated the

importance of full-service stations to the community. PCA testified at the Committee Hearing

because it seeks to protect its neighborhoods last remaining full-service station. This legislation

would ensure that stations are operated by independent operators. This will mean that the

Districts 105 stations will support the development of small community businesses, which is an

aim of the RSS and a desire of District residents.

54

Reinstituting jobber divorcement will break the vertical control that jobbers currently

exercise over individual stations. By breaking the ownership bind, more stations will be in

position to competitively select their suppliers and negotiate the lowest possible price.

55

With

more stations free to purchase fuel from their preferred supplier, more jobbers may choose to

enter the market.

56

The proposed bill would reinstate the right of first refusal. The right of first refusal allows

franchisees the opportunity to purchase the franchisors interest in a station if the franchisor

seeks to sell, assign, or transfer its interests to third party. Such a right had been added to the

RSS as an amendment in 2009the provision, however, sunset on January 1, 2011.

More jobbers in the market will mean better competition at the wholesale

level. At the retail level, all market entrants should, after the passage of B19-299, be similarly

situated. No longer will some participants have access to competitors sensitive business

information or the ability to control their pricing. This will lead to lower comparative prices for

consumers and help to ensure the continued viability of independent station operators.

B. Right of First Refusal

57

In 2009,

the Committee explained that action was needed to protect the interests of retaining service

stations in the long term.

58

52

Committee Report on B1-133.

53

Letters from Community (contained in attachment H)

54

Doyle Testimony on B19-299. Mr. Doyle explained at the hearing that divorcement would open up additional

opportunities for small businesses because all stations would need to be run by independent dealers.

55

Balto Testimony on B19-299, 3-4.

56

Doyle Testimony on B19-299, at 1.

57

The right of first refusal included in the 2009 legislation applied to sales, assignments, or transfers by a refiner.

58

Committee on Government Operations and the Environment Report on Bill No. 17-142, the Retail Service Station

Amendment Act of 2009, April 2, 2009, at 6.

Many district service stations are located on valuable pieces of

propertyoften property coveted by a developer. This issue was explored in a February 18, 2011

Washington City Paper article. When discussing the future of his stations, Capitol Petroleum

12

owner Joe Mamo noted, We are really a real estate company . . . . [l]ong term, the real estate is

where the value is.

59

Capitol Petroleum already converted and sold one station on Capitol Hill,

which is now the site of condominiums.

60

Mr. Mamos company has reportedly obtained permits

to convert another as well. Protecting the viability of independently operated, neighborhood

service stations is a well-established goal of the RSS, which the reinstitution of a right of first

refusal would help to accomplish.

61

The District was not the first jurisdiction to enact a right of first refusal for dealers.

California has extended this right to dealers for more than twenty years.

62

New Jersey recently

extended this right to dealers as well.

63

Courts have found Californias law to be Constitutional

and not preempted by the Petroleum Marketing Practices Act, which regulates the termination

and non-renewal of franchise agreements.

64

The Committee finds that as in 2009, extending the

right of first refusal is consistent with federal law [] and is a proper exercise of the

legislature.

65

B19-299 would clarify that existing District law prohibits marketing agreements that

preclude the purchase of fuel from any person or entity who is not a party to the marketing

agreement.

C. Clarification of Nonwaiverable Conditions

66

Prohibit a retail dealer from purchasing or accepting delivery of, on consignment

or otherwise, any motor fuels, petroleum products, automotive products, or other

products from any person who is not a party to the marketing agreement or

prohibit a retail dealer from selling such motor fuels or products, provided that if

the marketing agreement permits the retail dealer to use the distributor's

trademark, the marketing agreement may require such motor fuels, petroleum

products, and automotive products to be of a reasonably similar quality to those

of the distributor, and provided further that the retail dealer shall neither

represent such motor fuels or products as having been procured from the

distributor nor sell such motor fuels or products under the distributor's

trademark[.]

The language in the statute is straightforward and states that no marketing

agreement shall:

67

59

http://www.washingtoncitypaper.com/articles/40430/joe-mamo-dc-gas-station-master/page5/

60

http://www.washingtoncitypaper.com/articles/40430/joe-mamo-dc-gas-station-master/page5/

61

See generally Committee Report on 1-133.

62

Cal Bus. & Prof. Code 20999 et seq.

63

N.J. Stat. 56:10-6.1

64

Forty-Niner Truck Plaza, Inc. v. Union Oil Co. of Cal., 589 Cal. App. 4

th

1261 (Cal. Ct. App. 1997).

65

Committee Report on B18-89, at 7.

66

Marketing agreement is defined broadly as a contract, lease, franchise, or other agreement, which is entered

into between a distributor and a retail pertaining to, inter alia, the sale or distribution of gasoline, the use of a

trademark for the purposes of selling gasoline, and the occupancy of property for the purposes of selling gasoline.

D.C. Code 36-301.01 (7).

67

D.C. Code 36-303.01

13

The provision, as the Attorney General explains, means that a distributor may seek to secure a

station operator's loyalty through better prices or better service, but not through contractual

restraints on the station operator's ability to buy gasoline from other suppliers.

68

Recent decisions out of the Superior Court of the District of Columbia reiterate that the

provision applies to franchise arrangements and preclude exclusivity agreements. Kazemzadeh

v. Eastern Petroleum Corp., 2006 CA 009077, at 15 (D.C. Super. Ct. R. Civ. August 19, 2010)

(holding that D.C. Code 36-303.01(a)(6) precludes exclusivity arrangements even when

franchise agreements are present).

Despite the

seemingly plain language, local jobbers are not complying, according to testimony provided at

the Committees June 17 hearing.

69

The Attorney General explains, []while District law does

not permit a gasoline station operating under the Brand "X" trademark to purchase Brand "Y"

gasoline and dispense it from a Brand X pump, the law does give the Brand X gasoline station

the right to purchase Brand X gasoline from any available supplier.

70

Finally, B19-299 would expressly empower the Attorney General to bring actions in the

name of the District of Columbia for violations of the RSS. This comes at the request of the

Attorney General and is a logical extension of the RSS.

Available legal

interpretations and the plain language of the statute all point to the same thing: District law

permits dealers to purchase gasoline from any available source.

Nonetheless, testimony provided at the hearing demonstrates that marketing agreements

do not adhere to the law as written or are being implemented in a way that does not adhere to the

law as written. A jobber and station operators indicated that their marketing agreements

precluded the purchase of fuel from anyone but that jobber. Consequently, the Committee finds

that clarifying language is necessary to underscore the original meaning and purpose of the

statute.

D. Empower Attorney General to Bring Actions

71

As explained, the legislation sought to

encourage competition and drive prices down, for the benefit of consumers. If the law is not

being adhered to, however, consumers are not well equipped to either detect a violation or to

bring an action as result of one. Unless a consumer could assemble a suitably large class,

individual damages would likely prove quite small and prohibitive to bringing a complicated

lawsuit.

72

Station operators are also poorly situated to bring an action against owners. Although the

operators are in much better position to detect violations of RSS, the operators would be forced

to bring a suit against their landlord, supplier, and competitor. Whatever the legal protections in

place to prevent retaliation, most station operators have not brought actions against their

The Attorney General is best situated to bring an action on behalf of District residents

and consumers.

68

Letter from Attorney General on B19-299, at 2.

69

See also, Kazemzadeh v. Eastern Petroleum Corp., 2006 CA 009077, at 15 (D.C. Super. Ct. R. Civ. July 18,

2007).

70

Id. at 3.

71

Letter from Attorney General on B19-299, at 3.

72

Hypothetically, if a consumer drives 12,000 miles per year and consumes one gallon of gasoline per 25 miles, that

consumer would pay an extra $96 per year as a result of a 20-cent per gallon pricing gap.

14

respective distributors, despite documented concern surrounding pricing, as discussed earlier in

this report. Bringing legal action is also a financial drain on operators, who may not have the

resources to bring a complex legal action against a much wealthier adversary. The Attorney

General can pursue actions against any party violating this act to the detriment of District

residents and consumers without fear of reprisal or significant concern over being priced out of

pursuing the action.

The Committee notes that empowering the Attorney General to bring actions on behalf of

the District in no way extends or removes existing protections. It merely enables the most

appropriate agency in the District to ensure that a consumer protection law is implemented as

written.

SECTION-BY-SECTION ANALYSIS

Section 1 provides the long and short title of the legislation.

Section 2 amends the Retail Service Station Act of 1976 as follows:

Subsection (a) adds jobbers back into the divorcement statute, prohibiting jobbers

from operating service stations in the District.

Subsection (b) provides jobbers with two years to come into compliance with

subsection (a).

Subsection (c) clarifies the meaning of D.C. Code 36-303.01 (a)(6) to include

franchise agreements and branded fuel.

Subsection (d) empowers the Attorney General of the District of Columbia to

bring legal actions in the name of the District against parties who violate this act.

Subsection (e) creates a right of first refusal in the event that a franchisor sells,

transfers, or assigns its interest in the premises of a retail service station to a third party. It also

establishes a judicial remedy for failure to provide a right of first refusal.

Section 3 contains the fiscal impact statement.

Section 4 contains the effective date.

FISCAL IMPACT

A fiscal impact statement prepared by the Chief Financial Officer and dated July 5, 2011

is attached to this report. The fiscal impact statement notes that B19-299 would have no fiscal

impact.

15

IMPACT ON EXISTING LAW

Bill 19-299 would amend the Retail Service Station Act of 1976 (D.C. Law 1-123; D.C.

Official Code 36-301.01 et seq.). The bill will (1) prevent jobbers from operating service

stations in the District after a two-year phase-out period, (2) clarify the meaning of D.C. Code

36-303.01 (a)(6), so that it is clear that operators may purchase branded fuel from any available

supplier, (3) empower the Attorney General to bring actions on behalf of the District for

violations of this Act, and (4) creates a right of first refusal for station operators.

[to be added]

COMMITTEE ACTION

LIST OF ATTACHMENTS

(A) Bill 19-299, as introduced

(B) Notice of Intent to Act, published in the District of Columbia Register

(C) Public Hearing Notice, published in the District of Columbia Register

(D) Public Hearing Agenda and Witness List

(E) Committee Print of Bill 19-299

(F) Testimony

(G) Letter from Attorney General for the District of Columbia

(H) Letters from Community

(I) Testimony from Previous Hearings

(J) Fiscal Impact Statement

Attachment A

_______________________ ________________________ 1

Councilmember Phil Mendelson Councilmember Mary M. Cheh 2

3

_______________________ ________________________ 4

Councilmember Tommy Wells Councilmember Jack Evans 5

6

7

8

9

A BILL 10

11

_________ 12

13

14

IN THE COUNCIL OF THE DISTRICT OF COLUMBIA 15

16

_______________ 17

18

19

Councilmembers Mary M. Cheh, Phil Mendelson, Jack Evans, and Tommy Wells 20

introduced the following bill, which was referred to the Committee on 21

___________. 22

23

To amend the Retail Service Station Act of 1976 to prohibit gasoline distributors from 24

owning and operating retail service stations in the District of Columbia. 25

26

BE IT ENACTED BY THE COUNCIL OF THE DISTRICT OF COLUMBIA, 27

That this act may be cited as the Retail Service Station Amendment Act of 2011. 28

Sec. 2. Section 3-102 of the Retail Service Station Act of 1976, effective April 19, 29

1977 (D.C. Law 1-123; D.C. Official Code 36-302.02), is amended as follows: 30

(a) Subsections (a) and (b) are amended by striking the phrase no producer, 31

refiner, or manufacturer wherever it appears and inserting the phrase no jobber, 32

producer, refiner, or manufacturer in its place. 33

(b) Subsection (c) is amended to read as follows: 34

(c) Any jobber in violation of subsections (a) or (b) of this subsection as of the 35

effective date of this Act, shall have 2 years following the effective date to come into 36

compliance.. 37

2

Sec. 3. Fiscal impact statement 1

The Council adopts the fiscal impact statement in the committee report as the 2

fiscal impact statement required by section 602(c)(3) of the District of Columbia Home 3

Rule Act, approved December 24, 1973 (87 Stat. 813; D.C. Official Code 1- 4

206.02(c)(3)). 5

Sec. 4. Effective date 6

This act shall take effect following approval by the Mayor (or in the event of veto 7

by the Mayor, action by the Council to override the veto), a 30-day period of 8

Congressional review as provided in section 602(c)(1) of the District of Columbia Home 9

Rule Act, approved December 24, 1973 (87 Stat. 813; D.C. Official Code 1- 10

206.02(c)(1)), and publication in the District of Columbia Register. 11

Attachment B

Attachment C

Attachment D

C O U N C I L O F T H E D I S T R I C T O F C O L U M B I A

1 3 5 0 P ENNS YL VANI A AVENUE, N. W. S UI TE 1 1 1

WAS HI NGTON, DC 2 0 0 0 4

T EL EP HONE: ( 2 0 2 ) 7 2 4 - 8 0 6 2 F AX: ( 2 0 2 ) 7 2 4 - 8 1 1 8

COMMITTEE ON GOVERNMENT OPERATIONS

AND THE ENVIRONMENT

MARY M. CHEH, CHAIR

WITNESS LIST

COUNCILMEMBER MARY M. CHEH, CHAIRPERSON

COMMITTEE ON GOVERNMENT OPERATIONS & THE ENVIRONMENT

ANNOUNCES A PUBLIC HEARING ON

B19-299, the Retail Service Station Amendment Act of 2011

June 17, 2011

11:00 AM

Room 412

John A. Wilson Building

1350 Pennsylvania Ave., N.W.

WITNESSES

David Balto, Law Offices of David A. Balto

Robert Doyle, Doyle, Barlow & Mazard PLLC

Melvin Sherbert, The Washington, Maryland, Delaware Service Station

and Automotive Repair Association

Kirk McCauley, The Washington, Maryland, Delaware Service Station

and Automotive Repair Association

Lynn Cook, Parkers Exxon

John Connor, BP Station Operator

John Townsend, AAA Mid-Atlantic

Matt Thorpe, Palisades Citizens Association

John Ray, Partner, Manatt Phelps & Phillips

Joe Mamo, President, Capitol Petroleum Group, Inc.

David L. Calhoun, Senior RAM, Capitol Petroleum Group, Inc.

Al Alfano, Partner, Bassman, Mitchell & Alfano

Steven Smith, Representative, Rainbow PUSH Coalition

Pete Horrigan, Mid Atlantic Petroleum Dealers Association

Pierpont Mobley, Private Citizen

Bruce Bereano, Offices of Bruce Bereano

John Distad, BP Station Operator

James Giles, Former Shell Station Operator

John Johnson, Exxon Station Operator

Alma Gates, Neighbors United Trust

Petros Kiflu, Commission Operator, Shell Station @ 3355 Benning Road NE

Alexander Anenia, Commission Operator, Shell Station at 1830 Rhode Island Ave NE

Dawit Habte Selasie, Commission Operator, Shell Station at 6201 New Hampshire Ave NE

Redi Hassan, Commission Operator, Shell Station @ 4140 Georgia Ave NE

Frank Wilds, Private Citizen

Robert Vinson Brannum, President, DC Federation of Civic Associations, Inc.

Attachment E

Draft Committee Print, B19-299 1

Committee on Government Operations and the Environment 2

July 11, 2011 3

4

5

A BILL 6

7

_________ 8

9

10

IN THE COUNCIL OF THE DISTRICT OF COLUMBIA 11

12

_______________ 13

14

15

To amend the Retail Service Station Act of 1976 to prohibit gasoline distributors from 16

operating retail service stations in the District of Columbia, to clarify that 17

marketing agreements may not prohibit the purchase of fuel from any nonparties 18

to the agreement, to empower the Attorney General of the District of Columbia to 19

bring legal actions in Superior Court for violations of this chapter, and to provide 20

franchisees with the right of first refusal if a sale takes place. 21

22

BE IT ENACTED BY THE COUNCIL OF THE DISTRICT OF COLUMBIA, 23

That this act may be cited as the Retail Service Station Amendment Act of 2011. 24

Sec. 2. The Retail Service Station Act of 1976, effective April 19, 1977 (D.C. 25

Law 1-123; D.C. Official Code 36-301.01 et seq.), is amended as follows: 26

(a) Section 3-102 is amended as follows: 27

(1) Subsection (a) is amended by striking the phrase no producer, refiner, 28

or manufacturer wherever it appears and inserting the phrase no jobber, 29

producer, refiner, or manufacturer in its place. 30

(2) Subsection (b) is amended by striking the phrase no producer, 31

refiner, or manufacturer wherever it appears and inserting the phrase no jobber, 32

producer, refiner, or manufacturer in its place. 33

(b) Subsection (c) is amended to read as follows: 34

2

(c) Any jobber in violation of subsections (a) or (b) of this section as of the 1

effective date of this Act, shall have 2 years following the effective date to come into 2

compliance.. 3

(c) Section 4-201(f) is amended by adding new paragraph (1) to read as follows: 4

(f)(1) this subsection shall apply to all marketing agreements, including 5

marketing agreements under which a retailer would sell a particular brand of fuel under a 6

trademark. Marketing agreements shall not prohibit a retailer from purchasing any brand 7

of fuel from any person not a party to the marketing agreement. 8

(d) Section 4-206 is amended by adding new (d) to read as follows: 9

(d) (1) The Attorney General for the District of Columbia, or any of his 10

assistants, is hereby empowered to maintain an action or actions in the Superior Court for 11

the District of Columbia in the name of the District of Columbia to enjoin any refiner, 12

distributor, or retail dealer, and those acting in concert with such refiner, distributor, and 13

retail dealer, from violating this subchapter, to recover a civil penalty of not more than 14

$5,000 for each violation, and to recover the costs of the action and reasonable attorneys 15

fees. 16

(2) If the Attorney General, in the course of an investigation to determine 17

whether to bring a court action under this section, has reason to believe that a person may 18

have information, or may be in possession, custody, or control of documentary material, 19

relevant to the investigation, the Attorney General may issue in writing and cause to be 20

served upon the person or entity, a subpoena or subpoenas requiring the person or entity 21

to give oral testimony under oath, or to produce records, books, papers, contracts, 22

electronically-stored data and other documentary material for inspection and copying. 23

3

(3) Information obtained pursuant to this authority to subpoena is not admissible 1

in a later criminal proceeding against the person who provided the information. 2

(4) The Attorney General may petition the Superior Court of the District of 3

Columbia for an order compelling compliance with a subpoena issued pursuant to this 4

authority to subpoena.. 5

(e) A new title III-A is added to read as follows: 6

III-A. Franchisee Purchase Rights. 7

Sec. 5A-301. Definitions. 8

For the purposes of this title, the term: 9

(1) Distributor means any person, including any affiliate of such person, who 10

either purchases fuel for sale, consignment, or distribution to another, or receives fuel on 11

consignment for consignment or distribution to his or her own fuel accounts or to 12

accounts of his or her supplier, but shall not include a person who is an employee of, or 13

merely serves as a common carrier providing transportation service for, such supplier. 14

(2) Franchise means any contract between a refiner and a distributor, between 15

a refiner and a retailer, between a distributor and another distributor, or between a 16

distributor and a retailer, under which a refiner or distributor authorizes or permits a 17

retailer or distributor to use, in connection with the sale, consignment, or distribution of 18

gasoline, diesel, gasohol, or aviation fuel, a trademark which is owned or controlled by 19

such refiner or by a refiner which supplies fuel to the distributor which authorizes or 20

permits such use. The term "franchise" includes the following: 21

(A) Any contract under which a retailer or distributor is authorized or 22

permitted to occupy leased marketing premises, which premises are to be employed in 23

connection with the sale, consignment, or distribution of fuel under a trademark which is 24

4

owned or controlled by such refiner or by a refiner which supplies fuel to the distributor 1

which authorizes or permits such occupancy; 2

(B) Any contract pertaining to the supply of fuel which is to be sold, 3

consigned, or distributed under a trademark owned or controlled by a refiner or 4

distributor; and 5

(C) The unexpired portion of any franchise, as defined by this paragraph, 6

which is transferred or assigned as authorized by the provisions of such franchise or by 7

any applicable provision of District law which permits such transfer or assignment 8

without regard to any provision of the franchise. 9

(3) Franchisee means a retailer or distributor who is authorized or permitted, 10

under a franchise, to use a trademark in connection with the sale, consignment, or 11

distribution of fuel. 12

(4) Franchise relationship means the respective fuel marketing or distribution 13

obligations and responsibilities of a franchisor and a franchisee that result from the 14

marketing of fuel under a franchise. 15

(5) Franchisor means a refiner or distributor that authorizes or permits, under 16

a franchise, a retailer or distributor to use a trademark in connection with the sale, 17

consignment, or distribution of fuel. 18

(6) Leased marketing premises means marketing premises owned, leased, or 19

in any way controlled by a franchisor and which the franchisee is authorized or permitted, 20

under the franchise, to employ in connection with the sale, consignment, or distribution 21

of fuel. 22

(7) Refiner means any person engaged in the refining of crude oil to produce 23

fuel, and includes any affiliate of such person. 24

5

(8) Retailer means any person who purchases fuel for sale to the general 1

public for ultimate consumption. 2

Sec. 5A-302. Franchisees right of first refusal. 3

(a) In the case of leased marketing premises as to which the franchisor owns a 4

fee interest, the franchisor shall not sell, transfer, or assign to another person the 5

franchisor's interest in the premises unless the franchisor has first either made a bona fide 6

offer to sell, transfer, or assign to the franchisee the franchisor's interest in the premises, 7

other than signs displaying the franchisor's insignia and any other trademarked, 8

servicemarked, copyrighted or patented items of the franchisor, or, if applicable, offered 9

to the franchisee a right of first refusal of any bona fide offer acceptable to the franchisor 10

made by another to purchase the franchisor's interest in the premises. 11

(b) In the case of leased marketing premises which the franchisor leases from a 12

third party, following notice by the franchisor to the franchisee of termination or 13

nonrenewal of the franchise by reason of the expiration of the franchisor's underlying 14

lease from the third party, the franchisor shall, upon request by the franchisee and subject 15

to the franchisee purchasing or leasing the premises from the third party prior to the date 16

of termination or nonrenewal of the franchise set forth in the notice, make a bona fide 17

offer to sell to the franchisee any interest the franchisor may have in the improvements on 18

the premises, other than signs displaying the franchisor's insignia and any other 19

trademarked, servicemarked, copyrighted or patented items of the franchisor, at a price 20

not to exceed the fair market value of the improvements or the book value, whichever is 21

greater, or, if applicable, offer the franchisee a right of first refusal of any bona fide offer 22

acceptable to the franchisor made by another to purchase the franchisor's interest in the 23

6

improvements. For the purposes of this subdivision, "book value" means actual cost less 1

actual depreciation taken. 2

(c) This section shall not require a franchisor to continue an existing franchise 3

agreement or to renew a franchise relationship if not otherwise required by federal law. 4

Sec. 5A-303. Remedy for violation of title. 5

(a) Any person who violates any provision of this title may be sued in the 6

Superior Court of the District of Columbia for temporary and permanent injunctive relief 7

and damages, if any, and the costs of suit. 8

(b) No action shall be maintained to enforce any liability created under any 9

provision of this title unless brought before the expiration of 2 years after the violation 10

upon which it is based or the expiration of one year after the discovery of the facts 11

constituting such violation, whichever occurs first.. 12

Sec. 3. Fiscal impact statement 13

The Council adopts the fiscal impact statement in the committee report as the 14

fiscal impact statement required by section 602(c)(3) of the District of Columbia Home 15

Rule Act, approved December 24, 1973 (87 Stat. 813; D.C. Official Code 1- 16

206.02(c)(3)). 17

Sec. 4. Effective date 18

This act shall take effect following approval by the Mayor (or in the event of veto 19

by the Mayor, action by the Council to override the veto), a 30-day period of 20

Congressional review as provided in section 602(c)(1) of the District of Columbia Home 21

Rule Act, approved December 24, 1973 (87 Stat. 813; D.C. Official Code 1- 22

206.02(c)(1)), and publication in the District of Columbia Register. 23

Attachment F

Statement of Alexander Anenia

on Retail Service Station Amendment Act of 2011 (Bill 19-299)

My name is Alexander Anenia. Like Petros KifIu, I run the convenience store at the

Shell gas station at 1830 Rhode Island Avenue NE. I have been working at this station for 4

years. There is also a repair bay at my gas station. A total of eight employees work at these

facilities.

As I understand this legislation, it would force Mr. Mamo to go to the single franchise

system. If Bill 19-299 becomes law, DAG Petroleum may be forced to sell this station. It will

surely have to bring in a franchisee. As for me, the cost to purchase a service station franchise

business is beyond my reach. So there will be a lot of unknown if the station is sold to someone

else.

Bill 19-299 is creating a lot of troubles and worries for me and my family. A change

from DAG to someone else means I will have to deal with a new operator of the gas station who

mayor may not renew my lease at the mini-market. This is bad. It is bad for me and my family.

It is bad for my employees and their families.

I assume that what you are doing is legal and that you have the power to do it, but why

does the government want to meddle in our jobs? I along with other tenants at these gas stations !

are small, hardworking entrepreneurs and employees. We go to work every day and we provide :

a needed and a convenient service to our customers. At my store, I do not know of any .

complaints from our customers. Madam Chair and other members of the City Council, I petition:

you today not to support such a legislation. Please let us work in peace. Do not interfere with

my business and threaten my and my employees' livelihoods.

I ask for your help. Thank You!

COUNCIL OF THE DISTRICT OF COLUMBIA'

COMMITTEE ON GOVERNMENT OPERATIONS

AND THE ENVIRONMENT

Mary M. Cheh, Chairperson

Friday, June 17, 2009

RETAIL SERVICE STATION AMENDMENT ACT OF 2011

BILL 19-0299

Testimony of Alma Hardy Gates on behalf of Neighbors United Trust

Good morning Councilmember Cheh and Members of the Committee. My name is

Alma Gates. I live at 4911 Ashby Street, NW.

I am pleased to appear before the committee today in support of Bill 19-0299, the

"Retail Service Station Amendment Act of 2011." (The Bill)

I sat before this Committee on March 25, 2009, in support of an amendment to

prohibit converting Washington's full-service filling stations into gas-and-go

stations; and, in particular to support World Famous Parker's Exxon, located at

4812 MacArthur Boulevard that has served residents ofthe Palisades for five

generations.

When Exxon sold off a group of stations to Joe Mamo three years ago, he became

distributor and owner ofthe stations, the same role Exxon exercised in the past.

Now he wants to operate his stations, and replace operators who held the station

franchise under Exxon. Lynn Cook, an operator the Palisades community has

come to know and respect, would be replaced by a manager of Mamo' s choice and :

it is safe to assume a similar fate would befall station operators across the city as

well as their employees. This would allow the jobber to pocket all the receipts.

As you are aware similar legislation was passed by Council in 2004 and then

repealed in 2007 under heavy lobbying on behalf of Mamo. Today John Ray and

Jessie Jackson are actively lobbying on behalf of gas station magnate Joe Mamo so

he might function as distributor, owner and operator of his many retail service

stations. Yes, they oppose the Bill.

There is also the issue of homeland security in the Nation's Capital. As jobber for

his many stations, Mr. Mamo controls whether or not gasoline is available.

The proposed amendment to the Retail Service Station Act of 1976 would ensure '

the current management structure at Parker's continues and with it the service uponi

which the Palisades community depends. It would prevent a total monopoly.

Neighbors United Trust supports Bill 19-0299 to prohibit gasoline distributors

from owning and operating retail service stations in the District of Columbia, and

suggests its scope be broadened to allow existing station operators to hire their

replacements, independent of the and, to divorce station

operators from the requirement they purchase petroleum from a single source

distributor.

Please, let's get the legislation right this time!

TESTIMONY OF ALPHONSE M. ALFANO

Before The Council of The District of Columbia

Committee on Government Operations And The Environment

Friday, June 17,2011

John A. Wilson Building

1350 Pennsylvania Avenue, N.W.

Room 412

Madam Chairperson and Members of the Committee

F or the past 28 years, I have been engaged in the practice of law in

the District of Columbia. All of my clients are wholesale distributors of

refined petroleum products, sometimes referred to as "jobbers." The

purpose of this hearing is to determine whether jobbers should be

prohibited from selling motor fuels at retail in the District of Columbia.

Jobbers purchase motor fuels from nlajor oil companies, like Shell,

Exxon, and Chevron, and resell the products at wholesale and retail. In

some cases, they act as middlemen, purchasing from a major oil

companies and selling at wholesale to independent dealers. In other

cases, they own and operate stations and sell motor fuels directly to the

general motoring public. In still other cases, they consign motor fuels to .

an operator who sells the products on their behalf and the operator is

paid a commission for each gallon sold.

Jobbers decide the most economical and efficient means of selling

their motor fuels; if it is most efficient to make a nlajor capital

investment to purchase a service station and sell directly to consumers,

they will do it. Where it is more efficient to sell at wholesale to

independent dealers, they confine their activities to wholesale sales.

They operate in the manner that is most efficient and economical for the

particular geographic market in which they operate so they can be as

competitive as possible.

Other than the District of Columbia, no state or other political

subdivision in the country has ever enacted a jobber divorcement law.

That is, no state or political subdivision prohibits jobbers from selling

motor fuels at retail. Service station dealers, however, and the

organizations that represent them, have been pushing jobber

divorcement for decades. They've pushed it in a number of states

without any success. This lack of success is understandable. The

2

legislatures in the various states saw jobber divorcement for what it is,

special interest legislation (protectionism, if you will) that eliminates all

competition for service station dealers.

More importantly, it is special interest legislation with no benefit

to consunlers in the District of Columbia and with significant anti

competitive effects. Because of the anti-competitive nature ofjobber

divorcement, the Federal Trade Commission's Bureau of Economics

determined that divorcement regulations would raise the price of

gasoline by about 3 cents per gallon. Speaking to a joint subcommittee

of the Virginia Senate and House of Delegates, Ronald B. Rowe,

Director for Litigation of the Federal Trade Commission's Bureau of

Competition stated: "There appears to be no factual support for

divorcement legislation, but there are compelling reasons to believe that

such legislation would be harnlful to competition and to Virginia

consumers and visitors." The same would be true in the District of

Columbia.

In fact, the only benefits ofjobber divorcement accrue to about 30

independent service station dealers who may not even be residents of the

3

District. It eliminates their competition so that they compete only with

one another. The only basis given by these dealers for jobber

divorcement is that jobbers will somehow "get rid of the dealers," so that

jobbers can engage in direct operations. If this happens, the dealers

argue, District of Columbia residents will be deprived of the services

offered by independent dealers at their stations, like automotive repairs.

This argument has no merit whatsoever. The Petroleum Marketing

Practices Act was enacted by Congress in 1978, and it prohibits jobbers

from terminating a dealer lease or motor fuel supply contract, or even

nonrenewing a lease or supply contract, except on specified grounds that

are explicitly set forth in the Act. Quite simply, a jobber cannot

terminate (or "get rid of') a dealer unless there are proper grounds

therefor and there is proper notice.

Nor can jobbers take other actions to deprive communities of the

automotive repair services that independent dealers offer at their

stations. As you know, the Retail Service Station Act of 1976 placed a

moratorium on the conversion of service stations from bay operations

(that is, automotive repair facilities) to convenience stores or other

4

methods of operation. Thus, dealers are fully protected by federal law

and by the laws ofthe District of Columbia.

In short, if the jobber divorcement law is allowed to go into effect,

there will be no benefits to the District of Columbia or its residents. The

only beneficiaries would be a group of service station dealers who would

be insulated from any effective competition. Jobbers, on the other hand,

who invested millions of dollars to purchase service stations with an eye

towards operating them directly, will have to tum them over to dealers

and earn a significantly lower return on the investments they made and

the entrepreneurial risks they took to build, modernize, and improve

service stations in the District. Jobber divorcement would discourage

these types of investments leading to a deterioration ofthe condition of

service stations in the City. And, of course, with less competition,

gasoline prices will rise.

These are true effects ofjobber divorcement and, for these reasons,

Bill 19299 should not be enacted.

C:Wfano\2011 Testimony Before DC Council.doc

5

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF THE ATTORNEY GENERAL

***

-

-

June 17,2011

BY HAND

Councilmember Mary M. Cheh, Chairperson

Committee on Government Operations and the Environment

Council of the District of Columbia

1350 Pennsylvania Avenue, N.W.

Washington, DC 20004

Re: Bill 19-299, the "Retail Service Station Amendment Act of2011"

Dear Chairperson Cheh:

I am pleased to provide the Committee on Government Operations and the Environment with the

views of the executive branch of the District of Columbia Government ("District") in support of

Bill 19-299, the "Retail Service Station Amendment Act of2011."

In recent years, the Attorney General's office has sought to apply consumer protection and

antitrust laws to protect D.C. consumers from anti-competitive practices by sellers of gasoline

that result in higher prices to consumers. Bill 19-299 would provide a major assist to our efforts.

It would amend the provision of the Retail Service Station Act of 1976 that has prohibited

gasoline producers, refiners, and manufacturers from opening or operating gasoline service

stations in D.C. D.C. Official Code 36-302.02. The proposed amendment would extend this

prohibition to "jobbers," which are defined by statute as "wholesale supplier[s] or distributor[s]

of motor fuel." D.C. Official Code 36-301.01(6A). Jobbers that currently operate gasoline

service stations in D.C. would have two years to come into compliance with the new restriction.

The primary benefit of prohibiting jobbers from operating gasoline service stations in D.C. is to

make it more difficult for jobbers to use any market power they may have as the owners of

multiple D.C.-area service stations in a way that increases the retail gasoline prices charged by

D.C. stations. The recent trend towards concentration of D.C. service station ownership in the

hands of a few major jobbers leads the Administration to conclude that additional statutory

protection is needed. For this reason, we support Bill 19-299.

We point out, however, an inconsistency between the caption of the bill and the statute it is

amending. The long title says the intent of the bill is to prohibit gasoline distributors from

441 Fourth Street, NW, Suite 1100S, Washington, D.C. 20001, (202) 724-1301, Fax (202) 741-0580

Councilmember Mary M. Cheh, Chairperson

June 17,2011

Page 2

"owning and operating retail service stations in the District of Columbia." The statute, however,

as it presently exists, simply prevents producers, refiners, and manufacturers from "opening" and

"operating" retail gas stations. The premise of the existing law is that those covered - i. e, the

producers, manufacturers, and refiners - can continue to own the stations but cannot operate

them; the stations need to have independent operators. Thus, if jobbers and wholesalers were

simply added to the list ofthose covered by the law, they could continue to own the stations but

could not operate them. If the intent of the legislation is to prevent jobbers from "owning" the

stations and the real estate on which they are located, as the long title seems to suggest, then the

text of the bill would need to be amended to reflect that intent.

Back in May 2007, at a Council Committee hearing on Bill No. 17-142, the "Retail Service

Station Clarification Amendment Act of2007," the Office of the Attorney General presented

testimony that offered some support for allowing jobbers to own and operate gas stations in D.C.

The focus at that time was to keep producers, manufacturers and refiners from controlling the

price at the pumps. It was believed that jobbers would be a pro-competitive force. According to