Entrepreneuial Finance MBA Syllabus Boston Mod D 2011

Diunggah oleh

Madina TadjievaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Entrepreneuial Finance MBA Syllabus Boston Mod D 2011

Diunggah oleh

Madina TadjievaHak Cipta:

Format Tersedia

Course Code: Module D 2011 Boston-MBA Title Instructor: Professor William Hancock william.hancock@hult.

edu (put course name in subject line) Mobile: 857-928-6391 Office Hours: By appointment, before and after class and as needed Level: Master, Level 7 Credit: 3 Course Description:

A new business does not have the financing opportunities of an established business. The purpose of this course is to present effective financial and business techniques necessary for a successful business start-up. The course covers the essential tools and know-how you need to build a sturdy financial foundation for a profitable business. A practical road map is developed to guide the student in crafting a meaningful business plan, fund raising, business execution needed to bringing the business to the next level, and developing an exit strategy. The course offers potent methods for how entrepreneurs can keep financial control of their enterprise and insightful tips for avoiding the multitude of financial barriers that may block their entrepreneurial dream. Pedagogical Approach: The Hult LEAP Method 1. Learn Students are presented a roadmap to financing a new business from the start-up stage, through various growth stages and the final harvesting stage. Sources of new business financing are explored with special emphasis on venture capitalist. Valuation techniques used by financing sources are discussed as the new business gains business value. Real world business examples and cases are used to gain some experience in how a new company is viewed by financing resources.

Entrepreneurial Finance 2 Syllabus Mod. D 2011 Boston MBA

2. Experience

Students will develop their skills with case study analysis and exercises. When possible, guest lecturers will be invited to speak. 3. Action Project Students, working in teams, will conceive of a new product/service to be developed by a start-up company. A business plan will be presented, both written and in a final presentation to their peers, which will cover the valuation and financing of the new company through its growth stages, and an exit plan to harvest the investors investment. Learning outcomes At the completion of the course, students will have had the opportunity to gain knowledge and skills in the following areas. A. Knowledge and understanding Understanding of the business enterprise and its role in national and global economies Understanding of similarities between new and mature businesses Understanding of financial resources available to a business B. Cognitive/intellectual skills: Strategy development based upon synthesizing external and internal operational and financial environments Ability to develop financial solutions based upon partial data C. Subject/professional skills Preparation of a business and financial plan Financial statement analysis Cash management Valuation of the business Working capital management

D. General/Transferable skills Team performance (multi-team assignment deliverables) Problem solving based on incomplete information Ethical conduct and decision making

Methods of Teaching: 1. Interactive lectures will be given during class. 2. Student independent research on factors of entrepreneurship 2. A series of mini and full case studies will be assigned to student teams. 3. Capstone case competition will be performed by student teams.

Entrepreneurial Finance 3 Syllabus Mod. D 2011 Boston MBA Course Assessment 50% team case studies 20% student class participation 30% final case competition 5% elevator talk 5% product/service description 20% final presentation

Course Materials 1. TEXT: Entrepreneurship Finance; J. Chris Leach and Ronald W. Melicher; 4 . edition; (2012); SouthWestern Cengage Learning; ISBN: 0-538-47815-2. 2. Harvard Business School Case: Smartix-Swinging for the Fences HBS #5-809-134 (course pack) 3. Harvard Business School Case: Amazon.com-Going Public HBS #9-899-003 (course pack) 4. HBS Reprint 9-802-131 (Rev. 8/1/2006) New Venture Financing (course pack) 5. HBS Reprint 97409 "How to Write A Great Business Plan" by William A. Sahlman (course pack) 6. "A Note on Valuation of Venture Capital Deals , Stanford Graduate School of Business Case E-95 (rev. 4/20/06) by Thomas Hellmann (course pack) 7. Avery Products (Hult Online) 8. Ellis Printing (Hult Online) 9. Parable of the Sadhu (Hult Online)

rd

MBA Course ScheduleClass start time 1000 hours

UNIT 1 2 3 4 5 6 7 8 9 10 MBA Date 7/7/2011 7/7 7/11 7/11 7/12 7/12 7/13 7/13 7/14 7/14 UNIT 11 12 13 14 15 16 17 18 19 20 MBA Date 7/15 7/15 7/18 7/18 7/19 7/19 7/20 7/20 7/21 7/21

Schedule subject to change.

Entrepreneurial Finance 4 Syllabus Mod. D 2011 Boston MBA

Course Assignments UNIT 7/7/2011 7/7/11 1 2 SUBJECT What is an Entrepreneur? The Business Plan 1 READING Chapter 1 2 + How To Write A Great 1 Business Plan 2 3+ New Venture 8 Financing 4 5 5 6 7 7 8 9 10 10+ A Note on Valuation of Venture Capital 9 Deals 11 + Behind the curtain of 7 VC funding 12 13 14 15 ASSIGNMENT DUE Survey (in class)

7/11 M 7/11 M

3 4

The Business Plan 2 Discussion of final team project Organizing A New Venture

Submit team members

7/12 TU 7/12 TU 7/13 W 7/13 W 7/14 TH 7/14 TH 7/15 F 7/15 F 7/18 M

5 6 7 8 9 10 11 12 13

Measuring Financial Performance Evaluating Financial Performance 1 Evaluating Financial Performance 2 Short and Long Term Financing Financial Capital 1 Financial Capital 2 Ethics & Legal Issues of Raising Capital Valuation of the Early-Stage Venture Venture Capital Valuation Methods 1

Submit team firms product/service Elevator talk in class 2 Case: Avery Case: Ellis Printing Case: Parable of 5 the Sadhu 4 Case: Smartix Submit team business plan outline

3

7/18 M

14

Valuation of the Firm

7/19 TU

15

Working with Venture Capitalist

7/19 TU 7/20 W 7/20 W 7/21 TH 7/21TH

1 2

16 17 18 19 20

Other Financial Alternatives Equity Investments and Derivatives Exit Strategy Turnaround Troubled Ventures Capstone Team Project

Case: 6 Amazon.com

Team Presentation Team Presentation

How to Write a Great Business Plancourse packet Avery Products Hult Online 3 Ellis Printing Hult Online 4 HBS case Smartix- course packet 5 Parable of the Sadhu- Hult Online 6 HBS case Amazon.com course packet 7 Behind the curtain of VC funding from INC, May 2010-Hult Online 8 New Venture Financing-HBS Reprint 9-802-131-course pack 9 A Note on Valuation of Venture Capital Deals, Stanford Graduate School of Business, Reprint E-9 course pack

Entrepreneurial Finance 5 Syllabus Mod. D 2011 Boston MBA

Note: the assignments due are likely to change as we experience the work flow.

The topics below are suggestions you may wish to research to be better able to participate in class discussion. These assignments are optional. It is not expected that you will have time to explore all of the topics.

UNIT 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

SUBJECT What is an Entrepreneur? The Business Plan 1 The Business Plan 2 Organizing A New Venture Measuring Financial Performance Evaluating Financial Performance 1 Evaluating Financial Performance 2 Short and Long Term Financing Financial Capital 1 Financial Capital 2 Ethics & Legal Issues of Raising Capital Valuation of the Early-Stage Venture Venture Capital Valuation Methods 1 Valuation of the Firm Working with Venture Capitalist Other Financial Alternatives Equity Investments and Derivatives Exit Strategy Turnaround Troubled Ventures

TOPIC Identify 1 or 2 local start-up companies How a business plan differ from start-up and mature company Forms of organization and pros/cons Software to help new company (www.nolo.com) Work.-Life Balance (www.inc.com) How can economic news impact your company What is the interest rate structure in your country? How do you register stock in your country? Example of ethical business breakdown How would you value a start-up? How does P/E vary with risk and growth? Look for venture capital web site. Summarize history and current events Get price of option and underlying stock Describe a firm in liquidation or bankruptcy. Possible source www.wsj.com

Entrepreneurial Finance 6 Syllabus Mod. D 2011 Boston MBA INSTRUCTIONS FOR THE ELEVATOR TALK The elevator scenario is that you enter an elevator and suddenly are standing next to a partner in a leading Silicon Valley venture capitalist. You realize you have an incredible opportunity to present your idea for a new business with the hope of securing funding. Of course you would like to obtain immediate funding, but realistically you hope to get a follow-on meeting with the venture capitalist. You will have one-minute to present your idea and explain why the VC should want to invest in your business. The business is the business for which your team has decided to prepare a business plan as the class final project. Each student team will come to the front of the class. Each team member will present their elevator talk. The class will vote on who did the best job. CASE STUDIES Given the limited time you have to work on the cases, I have prepared specific questions for you to answer when completing the case. Cases will be done as a team, with each team member receiving the same team grade. You should present a full discussion of each question. For example, the first question, should you accept the offer from MSG? requires more than just a yes or no answer, but also requires the rationale for your answer.

SMARTIX 1. Imagine you are Vivek Khuller. Should you accept the offer from MSG? 2. Should Vivek have tried to start this venture without co-founders? Could he have been a solo founder? Explain your answer. 3. Discuss the team members Vivek chose. Were they good choices? 4. Assess the equity split process that Vivek initiated, in particular its timing, criteria, and the people involved in the decision. AMAZON.COM 1. Why did Jeff Bezos choose books at the initial category for launching his new company? 2. What is the business model for Amazon.com? How does their business model differ from that of Barnes & Noble or Borders? How would you value Amazon.com? 3. Should Amazon.com go public? Why or why not? 4. What are plausible scenarios for the period leading up to a final pricing meeting, which typically takes place the night before an IPO? How should management respond to these scenarios (e.g., is there a price below which Amazon.com should not go public)? 5. What should Joy Covey, the CFO, do?

Entrepreneurial Finance 7 Syllabus Mod. D 2011 Boston MBA FINAL PROJECT AND TEAM PRESENTATION Each team will conceive of a new business idea for which they will prepare a business plan to be presented to a venture capitalist. The plan should cover the business plan topics discussed in class. The plan does not need to include sections on operations and human relations. Of special interest are the management section, the financial section, whats in it for the VC, and an exit strategy. There are three parts to the final project: Elevator talk (5% of final grade) Written business plan (10% of final grade) Final presentation (15% of final grade) At the conclusion of the team presentations, the class will vote on the best presentations.

Anda mungkin juga menyukai

- Askivy Article List of Competency Interview Questions PDFDokumen4 halamanAskivy Article List of Competency Interview Questions PDFEkrem SafakBelum ada peringkat

- Spring Week GuideDokumen32 halamanSpring Week Guidevimanyu.tanejaBelum ada peringkat

- Original Work Investment Banking PlaybookDokumen9 halamanOriginal Work Investment Banking Playbookapi-584638799Belum ada peringkat

- GoldmanSachsDokumen12 halamanGoldmanSachsAshishBelum ada peringkat

- Investment Banking Resume III - AfterDokumen1 halamanInvestment Banking Resume III - AfterbreakintobankingBelum ada peringkat

- How to structure investments to protect downsideDokumen6 halamanHow to structure investments to protect downsidehelloBelum ada peringkat

- Dardenresume PEDokumen36 halamanDardenresume PEkk235197Belum ada peringkat

- MBA Employability Skills and Interview TipsDokumen6 halamanMBA Employability Skills and Interview TipsAswin PrabhakarBelum ada peringkat

- Investment Banking Interview Guide: Course OutlineDokumen20 halamanInvestment Banking Interview Guide: Course OutlineTawhid SyedBelum ada peringkat

- 1803 Hector Berlioz - Compositions - AllMusicDokumen6 halaman1803 Hector Berlioz - Compositions - AllMusicYannisVarthisBelum ada peringkat

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondDari EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondBelum ada peringkat

- Valuing A Business: Corporate Finance Directors' BriefingDokumen4 halamanValuing A Business: Corporate Finance Directors' BriefingRupika SharmaBelum ada peringkat

- WST TrainingDokumen7 halamanWST TrainingAli Gokhan KocanBelum ada peringkat

- Case Interviews 2 11-12 PDFDokumen194 halamanCase Interviews 2 11-12 PDFPoojaKumariBelum ada peringkat

- Corporate Financial Planning and ForecastingDokumen51 halamanCorporate Financial Planning and ForecastingTetyanaBelum ada peringkat

- Finance Placement Guide 2019Dokumen14 halamanFinance Placement Guide 2019Yash NyatiBelum ada peringkat

- Operational Level Interview QuestionsDokumen6 halamanOperational Level Interview QuestionsPanoramicConsultantBelum ada peringkat

- Bo's Coffee AprmDokumen24 halamanBo's Coffee Aprmalliquemina100% (1)

- Fuqua Case Book 2014Dokumen256 halamanFuqua Case Book 2014Anonymous xjY75jFBelum ada peringkat

- Classwork Notes and Pointers Statutory Construction - TABORDA, CHRISTINE ANNDokumen47 halamanClasswork Notes and Pointers Statutory Construction - TABORDA, CHRISTINE ANNChristine Ann TabordaBelum ada peringkat

- Answering Why Private EquityDokumen5 halamanAnswering Why Private Equityjobsfor karthikanBelum ada peringkat

- Critical Financial Review: Understanding Corporate Financial InformationDari EverandCritical Financial Review: Understanding Corporate Financial InformationBelum ada peringkat

- Advanced Corporate Finance (Moon) SP2016Dokumen7 halamanAdvanced Corporate Finance (Moon) SP2016darwin12100% (1)

- Project Finance Vs Private Equity 6 Key DifferencesDokumen4 halamanProject Finance Vs Private Equity 6 Key DifferencesOwenBelum ada peringkat

- Capital StructureDokumen4 halamanCapital StructurenaveenngowdaBelum ada peringkat

- FS2 Learning Experience 1Dokumen11 halamanFS2 Learning Experience 1Jona May BastidaBelum ada peringkat

- Case Study BriefingDokumen5 halamanCase Study BriefingZohaib AhmedBelum ada peringkat

- Finance and Research Analyst Interview Question 1568208407Dokumen7 halamanFinance and Research Analyst Interview Question 1568208407Hitesh PunjabiBelum ada peringkat

- Swedenborg's Formative Influences: Jewish Mysticism, Christian Cabala and PietismDokumen9 halamanSwedenborg's Formative Influences: Jewish Mysticism, Christian Cabala and PietismPorfirio MoriBelum ada peringkat

- Form 16 PDFDokumen3 halamanForm 16 PDFkk_mishaBelum ada peringkat

- Resume ExampleDokumen1 halamanResume ExampleDavid Bonnemort100% (13)

- Case29trx 130826040031 Phpapp02Dokumen14 halamanCase29trx 130826040031 Phpapp02Vikash GoelBelum ada peringkat

- Investment Banking Resume II - AfterDokumen1 halamanInvestment Banking Resume II - AfterbreakintobankingBelum ada peringkat

- Finance Guide PDFDokumen56 halamanFinance Guide PDFnimeshraoBelum ada peringkat

- TRX IPO CaseDokumen12 halamanTRX IPO Casebiggestyolo0% (1)

- InterviewsDokumen10 halamanInterviewsKristel Jean SalvadorBelum ada peringkat

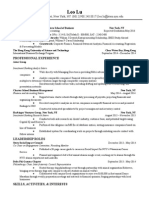

- Lu Leo ResumeDokumen2 halamanLu Leo ResumeLeo LuBelum ada peringkat

- NMIMS M & A Presentation.1Dokumen58 halamanNMIMS M & A Presentation.1Pratik KamaniBelum ada peringkat

- Investment Banking Cover Letter TemplateDokumen2 halamanInvestment Banking Cover Letter TemplateMihnea CraciunescuBelum ada peringkat

- SBL MJ23 Examiner's ReportDokumen21 halamanSBL MJ23 Examiner's ReportAmmar ArifBelum ada peringkat

- Ibig 04 08Dokumen45 halamanIbig 04 08Russell KimBelum ada peringkat

- Mock Interview 11jan16Dokumen1 halamanMock Interview 11jan16Chen ZhenxiongBelum ada peringkat

- HR Training in Agribank Trung YenDokumen21 halamanHR Training in Agribank Trung YenPhuong-Anh NguyenBelum ada peringkat

- Strengthening Organizational Culture Reference MaterialsDokumen6 halamanStrengthening Organizational Culture Reference MaterialsNardsdel RiveraBelum ada peringkat

- 2013 J.P. Morgan The Deal Competition - Competition InstructionsDokumen3 halaman2013 J.P. Morgan The Deal Competition - Competition Instructionshelpperman89773456Belum ada peringkat

- Breaking into Wallstreet GuideDokumen3 halamanBreaking into Wallstreet GuidezzzzzzBelum ada peringkat

- FAQs Recent College Graduate Job Opportunities Morgan StanleyDokumen13 halamanFAQs Recent College Graduate Job Opportunities Morgan StanleydianwenBelum ada peringkat

- Investment Banking Cover Letter TemplateDokumen2 halamanInvestment Banking Cover Letter TemplateBrian OuBelum ada peringkat

- Getting into VCDokumen9 halamanGetting into VCKristie GanBelum ada peringkat

- IIM Shillong Student Seeks Summer Internship at BCN GurugramDokumen1 halamanIIM Shillong Student Seeks Summer Internship at BCN GurugramKshitij JainBelum ada peringkat

- Precedent Transaction AnalysisDokumen6 halamanPrecedent Transaction AnalysisJack JacintoBelum ada peringkat

- ACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFDokumen7 halamanACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFnixn135Belum ada peringkat

- APC308 Financial Management April 2010 AssessmentDokumen4 halamanAPC308 Financial Management April 2010 AssessmentmayatmanBelum ada peringkat

- FS Consulting Capital Markets - Case Study 1 (Regulatory Change)Dokumen1 halamanFS Consulting Capital Markets - Case Study 1 (Regulatory Change)FabrizioBelum ada peringkat

- Annotated Investment Banking Graduate Job Covering LetterDokumen1 halamanAnnotated Investment Banking Graduate Job Covering LetterNuttyahBelum ada peringkat

- Chapter 02 - AnswerDokumen5 halamanChapter 02 - AnswerOscar AntonioBelum ada peringkat

- HEC Starter PackDokumen13 halamanHEC Starter PackHenderson ElizabethBelum ada peringkat

- PitchBook US Institutional Investors 2016 PE VC Allocations ReportDokumen14 halamanPitchBook US Institutional Investors 2016 PE VC Allocations ReportJoJo GunnellBelum ada peringkat

- Accounting Textbook Solutions - 53Dokumen19 halamanAccounting Textbook Solutions - 53acc-expertBelum ada peringkat

- De Clercq, (2006) An Entrepreneur's Guide To The Venture Capital GalaxyDokumen7 halamanDe Clercq, (2006) An Entrepreneur's Guide To The Venture Capital GalaxyafghansherBelum ada peringkat

- Job Interview Questions For Financial AnalystsDokumen5 halamanJob Interview Questions For Financial AnalystsPabitha MonishaBelum ada peringkat

- Certification in Integrated Treasury Management SyllabusDokumen4 halamanCertification in Integrated Treasury Management Syllabusshubh.icai0090Belum ada peringkat

- Certified Management Consultant A Complete Guide - 2020 EditionDari EverandCertified Management Consultant A Complete Guide - 2020 EditionBelum ada peringkat

- Post-merger integration A Complete Guide - 2019 EditionDari EverandPost-merger integration A Complete Guide - 2019 EditionBelum ada peringkat

- Information BulletinDokumen1 halamanInformation BulletinMahmudur RahmanBelum ada peringkat

- Vol 013Dokumen470 halamanVol 013Ajay YadavBelum ada peringkat

- Vipinesh M K: Career ObjectiveDokumen4 halamanVipinesh M K: Career ObjectiveJoseph AugustineBelum ada peringkat

- Daft Presentation 6 EnvironmentDokumen18 halamanDaft Presentation 6 EnvironmentJuan Manuel OvalleBelum ada peringkat

- Brochure Financial Planning Banking & Investment Management 1Dokumen15 halamanBrochure Financial Planning Banking & Investment Management 1AF RajeshBelum ada peringkat

- MEE2041 Vehicle Body EngineeringDokumen2 halamanMEE2041 Vehicle Body Engineeringdude_udit321771Belum ada peringkat

- Opportunity Seeking, Screening, and SeizingDokumen24 halamanOpportunity Seeking, Screening, and SeizingHLeigh Nietes-GabutanBelum ada peringkat

- UA-Series EN F2005E-3.0 0302Dokumen25 halamanUA-Series EN F2005E-3.0 0302PrimanedyBelum ada peringkat

- Part 4: Implementing The Solution in PythonDokumen5 halamanPart 4: Implementing The Solution in PythonHuỳnh Đỗ Tấn ThànhBelum ada peringkat

- Komoiboros Inggoris-KadazandusunDokumen140 halamanKomoiboros Inggoris-KadazandusunJ Alex Gintang33% (6)

- TOP 50 Puzzles For IBPS Clerk Mains 2018-19 WWW - Ibpsguide.com PDFDokumen33 halamanTOP 50 Puzzles For IBPS Clerk Mains 2018-19 WWW - Ibpsguide.com PDFHarika VenuBelum ada peringkat

- De Minimis and Fringe BenefitsDokumen14 halamanDe Minimis and Fringe BenefitsCza PeñaBelum ada peringkat

- Miss Daydreame1Dokumen1 halamanMiss Daydreame1Mary Joy AlbandiaBelum ada peringkat

- 02 Activity 1 (4) (STRA)Dokumen2 halaman02 Activity 1 (4) (STRA)Kathy RamosBelum ada peringkat

- The Gnomes of Zavandor VODokumen8 halamanThe Gnomes of Zavandor VOElias GreemBelum ada peringkat

- SyllabusDokumen8 halamanSyllabusrickyangnwBelum ada peringkat

- Khandelwal Intern ReportDokumen64 halamanKhandelwal Intern ReporttusgBelum ada peringkat

- Preterm Labour: Muhammad Hanif Final Year MBBSDokumen32 halamanPreterm Labour: Muhammad Hanif Final Year MBBSArslan HassanBelum ada peringkat

- Lucy Wang Signature Cocktail List: 1. Passion Martini (Old Card)Dokumen5 halamanLucy Wang Signature Cocktail List: 1. Passion Martini (Old Card)Daca KloseBelum ada peringkat

- Solar Presentation – University of Texas Chem. EngineeringDokumen67 halamanSolar Presentation – University of Texas Chem. EngineeringMardi RahardjoBelum ada peringkat

- Motivation and Emotion FinalDokumen4 halamanMotivation and Emotion Finalapi-644942653Belum ada peringkat

- ESSAYSDokumen5 halamanESSAYSDGM RegistrarBelum ada peringkat

- Decision Support System for Online ScholarshipDokumen3 halamanDecision Support System for Online ScholarshipRONALD RIVERABelum ada peringkat

- Computer Conferencing and Content AnalysisDokumen22 halamanComputer Conferencing and Content AnalysisCarina Mariel GrisolíaBelum ada peringkat