Special Drawing Rights

Diunggah oleh

sanjoykumer5370Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Special Drawing Rights

Diunggah oleh

sanjoykumer5370Hak Cipta:

Format Tersedia

Special Drawing Rights (SDRs)

The SDR is an international reserve asset, created by the IMF in 1969 to supplement the existing official reserves of member countries. SDRs are allocated to member countries in proportion to their IMF quotas. The SDR also serves as the unit of account of the IMF and some other international organizations. Its value is based on a basket of key international currencies.

Why was the SDR created and what is it used for today?

The Special Drawing Right (SDR) was created by the IMF in 1969 to support the Bretton Woods fixed exchange rate system. A country participating in this system needed official reservesgovernment or central bank holdings of gold and widely accepted foreign currenciesthat could be used to purchase the domestic currency in world foreign exchange markets, as required to maintain its exchange rate. But the international supply of two key reserve assets gold and the U.S. dollarproved inadequate for supporting the expansion of world trade and financial development that was taking place. Therefore, the international community decided to create a new international reserve asset under the auspices (SUPORT, BACKING, HELP) of the IMF. However, only a few years later, the Bretton Woods system collapsed and the major currencies shifted to a floating exchange rate regime (RULE, ADMINISTRATION). In addition, the growth in international capital markets facilitated borrowing by creditworthy governments. Both of these developments lessened the need for SDRs. Today, the SDR has only limited use as a reserve asset, and its main function is to serve as the unit of account of the IMF and some other international organizations. The SDR is neither a currency, nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. Holders of SDRs can obtain these currencies in exchange for their SDRs in two ways: first, through the arrangement of voluntary exchanges between members; and second, by the IMF designating members with strong external positions to purchase SDRs from members with weak external positions.

SDR valuation

The value of the SDR was initially defined as equivalent to 0.888671 grams of fine gold which, at the time, was also equivalent to one U.S. dollar. After the collapse of the Bretton Woods system in 1973, however, the SDR was redefined as a basket of currencies,today consisting of the euro, Japanese yen, pound sterling, and U.S. dollar. The U.S. dollar-value of the SDR is posted daily on the IMF's website. It is calculated as the sum of specific amounts of the four currencies valued in U.S. dollars, on the basis of exchange rates quoted at noon each day in the London market. The basket composition is reviewed every five years to ensure that it reflects the relative importance of currencies in the world's trading and financial systems. In the most recent review in November 2005, the weights of the currencies in the SDR basket were revised based on the value of the exports of goods and services and the amount of reserves denominated in the respective currencies which were held by other members of the IMF. These changes became effective on January 1, 2006. The next review by the Executive Board will take place in late 2010.

The SDR interest rate

The SDR interest rate provides the basis for calculating the interest charged to members on regular (non-concessional) IMF loans, the interest paid and charged to members on their SDR holdings, and the interest paid to members on a portion of their quota subscriptions. The SDR interest rate is determined weekly and is based on a weighted

average of representative interest rates on short-term debt in the money markets of the SDR basket currencies.

SDR allocations

Under its Articles of Agreement, the IMF may allocate SDRs to members in proportion to their IMF quotas. Such an allocation provides each member with a costless asset on which interest is neither earned nor paid. However, if a member's SDR holdings rise above its allocation, it earns interest on the excess; conversely, if it holds fewer SDRs than allocated, it pays interest on the shortfall. The Articles of Agreement also allow for cancellations of SDRs, but this provision has never been used. The IMF cannot allocate SDRs to itself. There are two kinds of allocations: General allocations of SDRs have to be based on a long-term global need to supplement existing reserve assets. General allocations are considered every five years, although decisions to allocate SDRs have been made only twice. The first allocation was for a total amount of SDR 9.3 billion, distributed in 1970-72. The second allocation was distributed in 1979-81 and brought the cumulative total of SDR allocations to SDR 21.4 billion. A proposal for a special one-time allocation of SDRs was approved by the IMF's Board of Governors in September 1997 through the proposed Fourth Amendment of the Articles of Agreement. This allocation would double cumulative SDR allocations to SDR 42.8 billion. Its intent is to enable all members of the IMF to participate in the SDR system on an equitable basis and correct for the fact that countries that joined the Fund after 1981more than one fifth of the current IMF membershiphave never received an SDR allocation. The Fourth Amendment will become effective when three fifths of the IMF membership (111 members) with 85 percent of the total voting power accept it. As of end-March, 2008, 131 members with 77.68 percent of total voting power had accepted the proposed amendment. Approval by the United States, with 16.75 percent of total votes, would put the amendment into effect.

SDR Valuation

The currency value of the SDR is determined by summing the values in U.S. dollars, based on market exchange rates, of a basket of major currencies (the U.S. dollar, Euro, Japanese yen, and pound sterling). The SDR currency value is calculated daily and the valuation basket is reviewed and adjusted every five years.

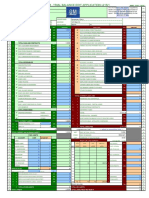

Tuesday, November 04, 2008 Currency Currency amount under Rule O-1 Exchange rate 1 U.S. dollar equivalent Percent change in exchange rate against U.S. dollar from previous calculation

Euro Japanese yen Pound sterling U.S. dollar

0.4100 18.4000 0.0903 0.6320

1.27820 99.57000 1.58700 1.00000

U.S.$1.00 = SDR SDR1 = US$

0.524062 0.184795 0.143306 0.632000 1.484163 0.673780 2 1.48416 4

-0.483 -0.392 -2.007

0.418 3

Notes:

(1)

The exchange rate for the Japanese yen is expressed in terms of currency units per U.S. dollar; other rates are expressed as U.S. dollars per currency unit. IMF Rule O-2(a) defines the value of the U.S. dollar in terms of the SDR as the reciprocal of the sum of the equivalents in U.S. dollars of the amounts of the currencies in the SDR basket, rounded to six significant digits. Each U.S. dollar equivalent is calculated on the basis of the middle rate between the buying and selling exchange rates at noon in the London market. If the exchange rate for any currency cannot be obtained from the London Market, the rate shall be the middle rate between the buying and selling exchange rates at noon in the New York market or, if not available there, the rate shall be determined on the basis of euro reference rates published by the European Central Bank. Percent change in value of one U.S. dollar in terms of SDRs from previous calculation. The reciprocal of the value of the U.S dollar in terms of the SDR, rounded to six significant digits.

(2)

(3) (4)

Special Drawing Rights (SDRs) are potential claims on the freely usable currencies of International Monetary Fund members. SDRs have the ISO 4217 currency code XDR.

Definition

SDRs are defined in terms of a basket of major currencies used in international trade and finance. At present, the currencies in the basket are the euro, the pound sterling, the Japanese yen and the United States dollar. Before the introduction of the euro in 1999, the Deutsche mark and the French franc were included in the basket. The amounts of each currency making up one SDR are chosen in accordance with the relative importance of the currency in international trade and finance. The determination of the currencies in the SDR basket and their amounts is made by the IMF Executive Board every five years. The exact amounts of each currency in the basket, and their approximate relative contributions to the value of an SDR, in the past were and currently are:[1] Composition of basket (value of 1 XDR) Period USD DEM JPY GBP FRF

1981 1985 1986 1990 1991 1995 1996 1998 Period 1999 2000 2001 2005 2006 2010

0.540 (42%) 0.452 (42%) 0.572 (40%) 0.582 (39%) USD 0.5820 (39%) 0.5770 (45%) 0.6320 (44%)

0.460 (19%) 0.527 (19%) 0.453 (21%) 0.446 (21%) EUR 0.3519 (32%) 0.4260 (29%) 0.4100 (34%)

34.0 (13%) 33.4 (15%) 31.8 (17%) 27.2 (18%) JPY 27.2 (18%) 21.0 (15%) 18.4 (11%)

0.0710 (13%) 0.0893 (12%) 0.0812 (11%) 0.1050 (11%) GBP 0.1050 (11%) 0.0984 (11%) 0.0903 (11%)

0.740 (13%) 1.020 (12%) 0.800 (11%) 0.813 (11%)

Purpose

SDRs are used as a unit of account by the IMF and several other international organizations. A few countries peg their currencies against SDRs, and it is also used to denominate some private international financial instruments. For example, the Warsaw convention, which regulates liability for international carriage of persons, luggage or goods by air uses SDRs to value the maximum liability of the carrier. In Europe, the Euro is displacing the SDR as a basis to set values of various currencies, including Latvian lats. This is a result of the ERM II convergence criteria which now apply to states entering the European Union.

SDRs basically were created to replace gold in large international transactions. Being that under a strict (international) gold standard, the quantity of gold worldwide is relatively fixed, and the economies of all participating IMF members as an aggregate are growing, a perceived need arose to increase the supply of the basic unit or standard proportionately. Thus SDRs, or "paper gold", are credits that nations with balance of trade surpluses can 'draw' upon nations with balance of trade deficits. So-called "paper gold" is little more than an accounting transaction within a ledger of accounts, which eliminates the logistical and security problems of shipping gold back and forth across borders to settle national accounts. Joseph Stiglitz has argued that usage by central banks of SDRs as foreign exchange reserve could be viewed as the prelude to the creation of a single world currency.[2] It has also been suggested that having holders of US dollars convert those dollars into SDRs would allow diversification away from the dollar without accelerating the decline of the value of the dollar.[3][4]

Other uses

SDRs are the basis for the international fees of the Universal Postal Union, responsible for the world-wide postal system. As a spinoff from the postal services, SDRs are also used to transfer roaming charge files between international mobile telecoms operators and charges for some radio communications.[citation needed] SDRs limit carrier liability on international flights (see Montreal Convention, Warsaw Convention), as well as ship owner liability for cargo damages and oil pollution.

Value

The value of one SDR in terms of United States dollars is determined daily by the IMF, based on the exchange rates of the currencies making up the basket, as quoted at noon at the London market. (If the London market is closed, New York market rates are used; if both markets are closed, European Central Bank reference rates are used.) The latest value of the SDR in terms of the US dollar is available from the IMF, updated daily.

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Introduction of Icici BankDokumen6 halamanIntroduction of Icici BankAyush JainBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- INS21Dokumen109 halamanINS21contactsmBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Capital Asset Pricing Model Written ReportDokumen7 halamanCapital Asset Pricing Model Written Reportgalilleagalillee0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- SWOT MatrixDokumen18 halamanSWOT Matrixtanmoy2000100% (1)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- BofA Investor PresentationDokumen30 halamanBofA Investor PresentationZerohedgeBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Lecture4 BODokumen14 halamanLecture4 BOgjadhaoBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Next PLC - Press ReleaseDokumen20 halamanNext PLC - Press Releasecasefortrils0% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Credit Analysis RatiosDokumen24 halamanCredit Analysis RatiosParul Jain100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Dairy Farming 1Dokumen3 halamanDairy Farming 1Anonymous E7DMoIBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- AcknowledgementDokumen9 halamanAcknowledgementDeepika DedhiaBelum ada peringkat

- ZapatoesDokumen12 halamanZapatoesCheeze cake100% (6)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Google Strategic PlanDokumen6 halamanGoogle Strategic PlanAngelie Lasprillas ArguillesBelum ada peringkat

- Bebchuk Cohen and Ferrell (2009) RFSDokumen45 halamanBebchuk Cohen and Ferrell (2009) RFSktsakasBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Carson Block: Muddy Waters 101Dokumen60 halamanCarson Block: Muddy Waters 101ValueWalkBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Taxation TutorialDokumen25 halamanTaxation TutorialseyeBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Spread Trading GuideDokumen17 halamanSpread Trading GuideJose Bueno100% (2)

- Investment Incentives For Tourism IndustryDokumen27 halamanInvestment Incentives For Tourism Industryqhaibey100% (3)

- Saide NikkarDokumen2 halamanSaide NikkarSaideNikkarBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Asset Under Construction PSDokumen58 halamanAsset Under Construction PSSharad IngleBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Autopista Central Case: Group CDokumen44 halamanAutopista Central Case: Group CKirti VohraBelum ada peringkat

- SCF 11 1-16Dokumen16 halamanSCF 11 1-16Tamar ChippBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Question Bank ICSE Class 10th MathematicsDokumen7 halamanQuestion Bank ICSE Class 10th MathematicsAshwin0% (1)

- Session - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFDokumen27 halamanSession - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFShashank Pandey100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- GM OEM Financials Dgi9ja-2Dokumen1 halamanGM OEM Financials Dgi9ja-2Dananjaya GokhaleBelum ada peringkat

- 2nd Examination For DistributionDokumen8 halaman2nd Examination For DistributionShibaInu DogeBelum ada peringkat

- McKinsey Innovation MetricsDokumen11 halamanMcKinsey Innovation MetricsLeocadio DobladoBelum ada peringkat

- CVIF Monthly FebDokumen6 halamanCVIF Monthly FebvictoruhBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Deresky Chapter1Dokumen41 halamanDeresky Chapter1IUSBelum ada peringkat

- National Aluminium: Performance HighlightsDokumen12 halamanNational Aluminium: Performance HighlightsAngel BrokingBelum ada peringkat

- Daily Nation 4th April 2016Dokumen60 halamanDaily Nation 4th April 2016Maraka Philip100% (1)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)