Deflating Nominal Values To..

Diunggah oleh

vbyusDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Deflating Nominal Values To..

Diunggah oleh

vbyusHak Cipta:

Format Tersedia

Deflating Nominal Values to Real Values - DataBasics - FRB Dallas

http://www.dallasfed.org/data/basics/nominal.html

HOME | EMPLOYMENT | CONTACT US | FAQs | SITE MAP

About the Fed

Economic Research

Economic Data

Banking Info

Financial Services

Publications & Resources

Community Affairs

Economic Education

News & Events

You are here: FRB Dallas Home > Economic Data > DataBasics > Deflating Nominal Values to Real Values

October 24, 2010

Economic Data Economic Data Home Regional Data Resources Regional Data by Topic Regional Data by State Dallas Fed Indexes U.S. Economic Data International Data Financial Data DataBasics Resources and Links Tools E-mail Alerts E-mail This Page RSS Feeds Podcasts Videos View Printer-friendly Page

DataBasics

Deflating Nominal Values to Real Values How to remove the price effect from a data series or change nominal data to real values The Economic Problem Importance of Tracking Economic Data Business and economic researchers like to tally things. They count everything from jobs and houses to cars and toasters. In the aggregate, such information is important because it helps show at what rate the economy is expanding or contracting. And the rate at which the economy grows (independent of population growth) plays an integral part in overall economic well-being. But Some Economic Concepts Are Difficult to Measure Even though measuring any part of the economy creates certain logistical challenges, some concepts are simply harder to quantify than others. For example, keeping track of a meaningful measure of retail sales over a 10-year period presents more difficulty than simply recording housing starts in a given neighborhood. So Count Dollar Value, Not Quantity Enumerating housing starts is straightforward. Measuring retail sales, on the other hand, is not so easy. Retail goods comprise any number of heterogeneous products, ranging from computers, kitchen appliances and clothing to auto parts and garden tools. This characteristic of the variable complicates the counting. Statistics keepers avoid the problem by tracking retail sales by dollar amounts, not quantity. But Price Fluctuations Distort the Data However, tracking data in this way presents another problem. Since retail sales are measured in dollars, changes in price levels over time tend to distort reported figures. In the case of retail transactions, economists are interested in tracking actual sales, independent of any price movements. This enables them to make sensible comparisons across time periods even as prices move. Unadjusted for, price fluctuations distort the measurement of economic variables measured in dollar values. $1 Doesn't Buy What It Used to While theres still debate over which measure of overall price fluctuation is best, the phenomenon of general price movements over timeeither deflation or inflationis undisputed (Chart 1). A few anecdotes help make the point. Some folks can still remember five-cent candy bars and 29-cent gasoline. It hasn't been too long since hamburger sold at three pounds for a dollar and chicken went for 29 cents a pound. The same four-bedroom house that changed hands for $23,500 in 1970 could easily sell for over $120,000 today. Chart 1 Quick Links The Economic Problem Technical Solution Real-World Example Glossary at a Glance Inside DataBasics Data Definitions Indexing Data to a Common Starting Point Deflating Nominal Values into Real Values Annualizing Data Seasonally Adjusting Data Moving Averages Growth Rates versus Levels Article index

1 of 5

10/24/2010 10:06 PM

Deflating Nominal Values to Real Values - DataBasics - FRB Dallas

http://www.dallasfed.org/data/basics/nominal.html

Solution: Remove Price Effects from the Data In effect, $20 will buy less retail output today than it did 20 years ago. But for data collectors, a $20 purchase gets added to total sales in the same manner today as it did 20 years ago, even though it represents a different quantity of goods. Separating out the price effect leaves researchers with a clearer picture of whats really happening to sales levels relative to any time period. The object then becomes to remove any part of the variables change that is attributable to price movements, arriving at a real, or inflation adjusted, indicator. Technical Solution Lesser Known Data Unadjusted for Inflation Though many prominent economic series such as gross domestic product (GDP) and exports are adjusted for inflation, some less prominent indicators are not. A simple methodology can be used to deflate any nominal data series to real values. Changing Nominal to Real To transform a series into real terms, two things are needed: the nominal data and an appropriate price index. The nominal data series is simply the data measured in current dollars and gathered by a government or private survey. The appropriate price index can come from any number of sources. Among the more prominent price indexes are the Consumer Price Index (CPI), the Producer Price Index (PPI), the Personal Consumption Expenditure index (PCE) and the GDP deflator. Common price indexes measure the value of a basket of goods in a certain time period, relative to the value of the same basket in a base period. They are calculated by dividing the value of the basket of goods in the year of interest by the value in the base year. By convention, this ratio is then multiplied by 100. Generally speaking, statisticians set price indexes equal to 100 in a given base year for convenience and reference. To use a price index to deflate a nominal series, the index must be divided by 100 (decimal form). The formula for obtaining a real series is given by dividing nominal values by the price index (decimal form) for that same time period:

Mechanics of Price-Level Effects on Economic Data But how does this simple formula remove price fluctuations from actual changes in a variables overall value? Economic variables measured in dollar values like GDP, exports, construction contract values, venture capital and retail sales are calculated from the product of the quantity sold and the selling price. Analysts want to get their hands around the changes in quantity sold and disregard changes in prices because its the quantity of goods and services consumed by households that affects well-being, not the prices. In effect, the percentage change in real values over a given time period should mirror the percentage change in quantity. Three Sample Scenarios

2 of 5

10/24/2010 10:06 PM

Deflating Nominal Values to Real Values - DataBasics - FRB Dallas

http://www.dallasfed.org/data/basics/nominal.html

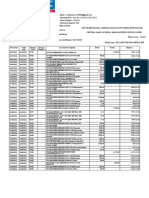

Table 1 provides three scenarios that show how to correct the data for price fluctuations. In each scenario price and quantity are multiplied together to arrive at a nominal value in 1990 and 1995. Then the 1995 nominal value is divided by the ratio of the 1995 price index and the 1990 price index to arrive at a real value (or the 1995 value in 1990 dollars). Table 1 Deflating 1995 Values to 1990 Dollars Deflating Nominal Nominal Quantity Value to Real 12 12 1,200 1,800 Real Value 1,200 1,800/ 1,200 (150/100) = 1,200 1,800/ 1,800 (100/100) = 1,200 1,800/ 1,500 (120/100) =

Scenario 1. Price rises 50%, quantity stays same 2. Price stays the same, quantity rises 50% 3. Price rises 20%, quantity rises 25%

Period Price 1990 1995 100 150

1990 1995

100 100

12 18

1,200 1,800

1990 1995

100 120

12 15

1,200 1,800

The Mechanics of Each Scenario Scenario 1 Prices rise 50 percent from 1990 to 1995 but the quantity stays the same. Result: The nominal value increases 50 percent, but the real value remains the same. Scenario 2 The price remains constant but quantity increases by 50 percent. Result: The real value rises by 50 percent. Scenario 3 The price rises 20 percent and quantity rises 25 percent. Result: After deflating the 1995 value to 1990 dollars, the real value rises 25 percent. Real-World Example Finally, a real-world example is in order. Table 2 shows how to deflate four-anda-half years of nominal quarterly GDP data to real GDP. Column 2 shows nominal GDP. Column 3 is the price series. Column 4 reindexes the price series to the first quarter of 1998 by dividing all price values by 102.76 and multiplying by 100. Column 5 puts the price index in decimal form. Column 6 divides nominal GDP by the price index in decimal form to arrive at real GDPor GDP not affected by price volatility. Table 2 Deflating Nominal GDP Nominal GDP (billions of Price dollars) Index 8,628 8,697 8,817 102.76 103.02 103.38 Real GDP (1998 dollars) 8,628 8,676 8,764

Period Q1_1998 Q2_1998 Q3_1998

Reindex to 1998 100.00 100.25 100.60

Decimal Form 1.00 1.00 1.01

3 of 5

10/24/2010 10:06 PM

Deflating Nominal Values to Real Values - DataBasics - FRB Dallas

http://www.dallasfed.org/data/basics/nominal.html

Q4_1998 Q1_1999 Q2_1999 Q3_1999 Q4_1999 Q1_2000 Q2_2000 Q3_2000 Q4_2000 Q1_2001 Q2_2001 Q3_2001 Q4_2001 Q1_2002 Q2_2002

8,985 9,093 9,172 9,317 9,516 9,650 9,821 9,875 9,954 10,028 10,050 10,098 10,153 10,313 10,377

103.66 104.12 104.52 104.84 105.28 106.08 106.69 107.13 107.68 108.66 109.32 109.92 109.78 110.14 110.48

100.87 101.32 101.71 102.02 102.44 103.22 103.82 104.24 104.78 105.74 106.38 106.96 106.83 107.18 107.51

1.01 1.01 1.02 1.02 1.02 1.03 1.04 1.04 1.05 1.06 1.06 1.07 1.07 1.07 1.08

8,907 8,974 9,018 9,132 9,289 9,348 9,459 9,473 9,499 9,484 9,447 9,440 9,504 9,622 9,652

Chart 2 illustrates the point graphically. As expected, nominal GDP grows faster than real GDP because it includes inflation. Real GDP growth appears more moderate because the calculation has separated out any pricing effects. The real measure is a better overall indication of the increase in output over the sample time period. Chart 2

Glossary at a Glance Deflator: A numeric pricing measure used to change nominal values into real values. Homogeneous: Of the same or a similar kind or nature. Nominal: The value of an economic variable in terms of the price level at the time of its measurement; or, unadjusted for price movements. Real: The value of an economic variable adjusted for price movements.

Disclaimer/Privacy Policy About the Fed | Economic Research | Economic Data | Banking Information | Financial Services | Publications & Resources | Community Affairs | Economic Education | News & Events Home | Employment | Contact Us | FAQs | Site Map

4 of 5

10/24/2010 10:06 PM

Deflating Nominal Values to Real Values - DataBasics - FRB Dallas

http://www.dallasfed.org/data/basics/nominal.html

5 of 5

10/24/2010 10:06 PM

Anda mungkin juga menyukai

- Microeconomic Theory 2 SyllabusDokumen2 halamanMicroeconomic Theory 2 SyllabusvbyusBelum ada peringkat

- MicroeconomicsSolutions02 PDFDokumen27 halamanMicroeconomicsSolutions02 PDFvbyusBelum ada peringkat

- Basic Growth Models: Solow ModelDokumen19 halamanBasic Growth Models: Solow ModelvbyusBelum ada peringkat

- POS Terminal Series: Quick Installation GuideDokumen2 halamanPOS Terminal Series: Quick Installation GuidevbyusBelum ada peringkat

- Is There A Case For Sterilizing Foreign Aid Inflows?: Preliminary DraftDokumen47 halamanIs There A Case For Sterilizing Foreign Aid Inflows?: Preliminary DraftvbyusBelum ada peringkat

- Teacher Guidelines Quantum Spin OffDokumen13 halamanTeacher Guidelines Quantum Spin OffvbyusBelum ada peringkat

- Nepad Strategic Seed Supply Report Feb 14 Final DraftDokumen81 halamanNepad Strategic Seed Supply Report Feb 14 Final DraftvbyusBelum ada peringkat

- Visio 2003Dokumen17 halamanVisio 2003vbyusBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Jiblr 2005 20 10 535-540Dokumen6 halamanJiblr 2005 20 10 535-540Santanu RoyBelum ada peringkat

- Carmela Jia Ming A. Wong Section 20Dokumen2 halamanCarmela Jia Ming A. Wong Section 20Carmela WongBelum ada peringkat

- Project Chapter 1Dokumen62 halamanProject Chapter 1HUMAIR123456Belum ada peringkat

- Ithrees's Whole Ion Finalyzed To PrintDokumen82 halamanIthrees's Whole Ion Finalyzed To PrintMohamed FayasBelum ada peringkat

- The Use of CML and SML in Taking Investments Decisions by An Investor On His/her Risk PreferenceDokumen4 halamanThe Use of CML and SML in Taking Investments Decisions by An Investor On His/her Risk PreferenceChanuka Perera100% (1)

- International Finance W2013Dokumen20 halamanInternational Finance W2013Bahrom Maksudov0% (1)

- Valuation - Multiples and EV Value DriversDokumen27 halamanValuation - Multiples and EV Value DriversstrokemeBelum ada peringkat

- Prelim Take-Home ExamDokumen12 halamanPrelim Take-Home ExamAmbassador WantedBelum ada peringkat

- Standard, The Conceptual Framework Overrides That StandardDokumen6 halamanStandard, The Conceptual Framework Overrides That StandardwivadaBelum ada peringkat

- Hoisington Investment Management - Quarterly Review and Outlook, Second Quarter 2014Dokumen10 halamanHoisington Investment Management - Quarterly Review and Outlook, Second Quarter 2014richardck61Belum ada peringkat

- Is Mers in Your MortgageDokumen9 halamanIs Mers in Your MortgageRicharnellia-RichieRichBattiest-Collins67% (3)

- Illustration For Your HDFC Life Click 2 Protect PlusDokumen1 halamanIllustration For Your HDFC Life Click 2 Protect Plussatish vermaBelum ada peringkat

- Forbes USA - 24 January 2017Dokumen116 halamanForbes USA - 24 January 2017Carlos PanaoBelum ada peringkat

- Statement of Account: HDFC Bank LimitedDokumen1 halamanStatement of Account: HDFC Bank LimitedPraveen Kumar MBelum ada peringkat

- PrathyushaDokumen17 halamanPrathyushaPolamada PrathyushaBelum ada peringkat

- The Coal Mines (Nationalisation) Act, 1973Dokumen65 halamanThe Coal Mines (Nationalisation) Act, 1973shashwat kumarBelum ada peringkat

- MT202-210 Specs For File LoadDokumen8 halamanMT202-210 Specs For File LoadAnaya LaddhaBelum ada peringkat

- Forex Combo System.Dokumen10 halamanForex Combo System.flathonBelum ada peringkat

- CORPORATE LAW REVIEWER (Ladia)Dokumen12 halamanCORPORATE LAW REVIEWER (Ladia)Neil Davis BulanBelum ada peringkat

- AccountStatement 3286686240 Aug04 185310 PDFDokumen2 halamanAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekBelum ada peringkat

- EFG Hermes Final TranscriptDokumen7 halamanEFG Hermes Final TranscriptPPPnewsBelum ada peringkat

- Reading Roy - 2010 - Poverty Capital - Microfinance and The Making of Development - CHDokumen15 halamanReading Roy - 2010 - Poverty Capital - Microfinance and The Making of Development - CHgioanelaBelum ada peringkat

- Transaction StatementDokumen2 halamanTransaction StatementSatya GopalBelum ada peringkat

- ROGEN AssignmentDokumen9 halamanROGEN AssignmentRogen Paul GeromoBelum ada peringkat

- PNB Vs AmoresDokumen3 halamanPNB Vs AmoresLea AndreleiBelum ada peringkat

- ch12 PDFDokumen4 halamanch12 PDFCarmela Isabelle DisilioBelum ada peringkat

- 07 Chapter Seven - Buy Side M&A (By Masood Aijazi)Dokumen51 halaman07 Chapter Seven - Buy Side M&A (By Masood Aijazi)Ahmed El KhateebBelum ada peringkat

- 3063 20170921 Statement PDFDokumen4 halaman3063 20170921 Statement PDFAinur RahmanBelum ada peringkat

- Suryadev 75 InsuranceDokumen15 halamanSuryadev 75 InsuranceKaran ChaudharyBelum ada peringkat

- Account StatementDokumen12 halamanAccount StatementAbhinav AnkarBelum ada peringkat