LN TBond Form

Diunggah oleh

boargzcrJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

LN TBond Form

Diunggah oleh

boargzcrHak Cipta:

Format Tersedia

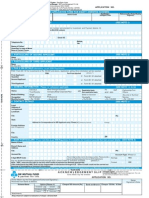

CK L&T INFRASTRUCTURE FINANCE COMPANY LIMITED APPLICATION FORM (FOR RESIDENT INDIVIDUALS / HINDU UNDIVIDED FAMILIES) Registered Office:

Mount Poonamallee Road, Manapakkam, Chennai - 600 089; Tel: + 91 44 2252 6000; ISSUE OPENS ON : MONDAY, FEBRUARY 7, 2011 Fax: +91 44 2252 8688; Corporate Office: 3B, Laxmi Towers, C-25, G Block, Bandra-K urla Complex, Bandra (E), Mumbai - 400 051; Tel: +91 22 4060 5300; Fax: +91 22 4060 5353; Website: ww w.ltinfra.com; ISSUE CLOSES ON : MONDAY, MARCH 7, 2011 Compliance Officer: Mr. Vinay Tripathi; 3A/Laxmi Towers, First Floor, Bandra Kur la Complex, Bandra (East), Application No. 2299 Mumbai 400 051; Tel: +91 22 4060 5411; Fax: +91 22 4060 5353; E-mail: infrabonds 2011A@ltinfra.com PUBLIC ISSUE BY L&T INFRASTRUCTURE FINANCE COMPANY LIMITED (THE "COMPANY" OR "IS SUER") OF LONG TERM INFRASTRUCTURE BONDS WITH A FACE VALUE OF ` 1,000 EACH, IN T HE NATURE OF SECURED, REDEEMABLE, NON-CONVERTIBLE DEBENTURES, HAVING BENEFITS UNDER SECTION 80 CCF OF THE INCOME T AX ACT, 1961 (THE "DEBENTURES" OR THE "BONDS"), AGGREGATING UP TO ` 1,000 MILLIO N WITH AN OPTION TO RETAIN AN OVERSUBSCRIPTION OF UP TO ` 3,000 MILLION FOR ALLOTMENT OF ADDITIONAL BONDS (THE "ISSUE"). THE ISSUE BEING REFERRED TO AS THE ISSUE OF LONG TERM INFRASTRUCTURE BONDS 2011A SERIES. CREDIT RATING : 'CARE AA+' by CARE, TEAR HERE ACKNOWLEDGEMENTSLIP FOR APPLICANT L&T INFRASTRUCTURE FINANCE COMPANY LIMITED LONG TERM INFRASTRUCTURE BONDS 2011A SERIES To, The Board of Directors, L&T INFRASTRUCTURE FINANCE COMPANY LIMITED, Register ed Office: Mount Poonamallee Road, Manapakkam, Chennai - 600 089. Broker s Name & Code Bank Branch Stamp Bank Branch Serial No. Date of ReceiptSub-B roker s/ Agent s Code FOR ANY QUERIES REGARDING THE ISSUE, PLEASE CONTACT US ON EITHER OF OUR TOLL FRE E NOS. 1800 102 2131 OR +91 22 4060 5444 OR WRITE TO US AT savetax@ltinfra.com. FOR FURTHER DETAILS, INVESTORS CAN VISIT THE WEBSITE: www.ltinfrabond.com. DIRECT Dear Sirs, Having read, understood and agreed to the contents and terms and conditions of L &T Infrastructure Finance Company Limited s Prospectus dated February 1, 2011, ( Pro spectus ) I/We hereby apply for allotment to me/us; of the under mentioned Bonds o ut of the Issue. The amount payable on application for the below mentioned Bonds LAA+ by ICRA

is remitted herewith. I/We hereby agree to accept the Bonds applied for or such les ser number as may be allotted to me/us in accordance with the contents of the Pr ospectus subject to applicable statutory and/or regulatory requirements. I/We ir revocably give my/our authority and consent to Bank of Maharashtra, to act as my /our trustees and for doing such acts and signing such documents as are necessary to carry out the ir duties in such capacity. I/We confirm that : I am/We are Indian National(s) r esident in India and I am/ we are not applying for the said Bonds Issues as nomi nee(s) of any person resident outside India and/or Foreign National(s). Notwithstanding anything contained in this form and the attachments hereto, I/we confirm that I/we have carefully read and understood the contents, terms and co nditions of the Prospectus, in their entirety and further confirm that in making my/our investment decision, (i)I/We have relied on my/our own examination of th e Company and the terms of the Issue, including the merits and risks involved, (ii) my/our decisio n to make this application is solely based on the disclosures contained in the P rospectus, (iii)my/our application for Bonds under the Issue is subject to the a pplicable statutory and/or regulatory requirements in connection with the subscr iption to Indian securities by me/us, (iv) I am/We are not persons resident outside India and/or foreign nat ionals within the meaning thereof under the Foreign Exchange Management Act, 199 9, as amended and rules, regulations, notifications and circulars issued thereun der, and (v) I/We have obtained the necessary statutory and/or regulatory permis sions/consents/ approvals in connection with applying for, subscribing to, or seeking allotment of Bonds pursuant to the Issue. d d / m m / 2011 Please fill in the Form in English using BLOCK letters Date OPTION TO HOLD THE BONDS IN PHYSICAL FORM (If this option is selected, the KYC D ocuments as mentioned in Instruction No. 29 are mandatory) TEAR HERE APPLICANTS DETAILS NAME OF SOLE/FIRST APPLICANT Mr./Mrs./Ms. ADDRESS (of Sole / First Applicant) Please Note : Cheque / DD should be drawn in favour of L&T Infra Bonds 2011A by al l applicants. Cheques should be crossed A/c Payee only . Please write the sole/first Applicant s name, phone no. and Application no. on the reverse of Cheque/DD. Demographic details for purpose of refunds, if any, shall be taken from (i) Bank details as mentioned above for applicants who select the option to hold the Bond s in Physical Form; or (ii) the records of the Depositories otherwise. City PERMANENT ACCOUNT NUMBER (Furnishing of Subscriber s PAN is mandatory. For additional details, refer Instruction no. 23) SOLE/FIRST APPLICANT SECOND APPLICANT THIRD APPLICANT SIGNATURE(S) AGE years PAYMENT DETAILS (See General Instruction no. 27) Total Amount Payable (` in figures) (` in words) Cheque / Demand Draft No. Dated / 2011 Drawn on Bank Branch In terms of Section (8)(1) of the Depositories Act, 1996, I/we wish to hold the

Bonds in physical form. I/We hereby confirm that the information provided in APPLICANTS DETAILS is true and correct. I/We enclose herewi th self attested copies of PAN Card, Proof of Individual ID, Proof of Residence Address as the KYC Documents. The Bonds are classified as "Long Term Infrastructure Bonds" and are being issue d in terms of Section 80CCF of the Income Tax Act and the Notification. In accor dance with Section 80CCF of the Income Tax Act, the amount, not exceeding ` 20,0 00, paid or deposited as subscription to Long Term Infrastructure Bonds during the previous year relevant to the asses sment year beginning April 01, 2011 shall be deducted in computing the taxable i ncome of a resident individual or HUF. For further details, please refer to page 80 of the Prospectus. Nomination (Please see instruction no. 15) Name of the Nominee : In case of Minor, Guardian : Bank Details for payment of Refund / Interest / Maturity Amount Bank Name : Branch : Account No.: IFSC Code : Central Depository Services (India) Limited (16 digit beneficiary A/c. No. to be mentioned above) Depository Name (Please .) Depository Participant Name DP - ID Beneficiary Account Number National Securities Depository Limited I N DEPOSITORY PARTICIPANT DETAILS (These details need not be given if the option to hold the Bonds in Physical Form is selected. Please also refer to instruction n o. 35(e)) INVESTMENT DETAILS Series 1 2 Frequency of Interest Annual, i.e. yearly payment of interest Cumulative, i.e. c umulative interest payment at the end of maturity or buyback, as applicable Face Value and Issue Price (`/Bond) (A) 1,000 1,000 Minimum Application Five (5) Bonds. For the purpose of fulfilling the requiremen t of minimum subscription of five (5) Bonds, an Applicant may choose to apply for five (5) Bonds of the same series or five ( 5) Bonds across different series Buyback Facility Yes Yes Buyback Date First Working Day after 5 years from the Date of Allotment and Firs t Working Day after 5 years from the Date of Allotment and first Working Day after 7 years from the Date of Allotment first Working Day aft er 7 years from the Date of Allotment Interest Rate 8.20% p.a. 8.30% p.a. compounded annually Maturity Date 10 years from the Date of Allotment. 10 years from the Date of All otment. Maturity Amount (`/Bond) 1,000 2,220 Buyback Amount (`/Bond) 1,000 at the end of 5 years / 1,000 at the end of 7 year s 1,490 at the end of 5 years / 1,748 at the end of 7 years Buyback Intimation Period The period commencing from 6 months preceding the corr esponding Buyback Date and ending 3 months prior to the corresponding Buyback Da te Yield of the Bond on Maturity 8.20% p.a. 8.30% p.a. compounded annually Yield of the Bond on Buyback 8.20% p.a. 8.30% p.a. compounded annually No of Bonds applied for (B) Amount Payable (`) (AxB) Total Numbers of Bonds (Series 1+ Series 2) Total Amount Payable (Series 1+ Series 2) (`) Sole/First Applicant Second Applicant Third Applicant THIRD APPLICANT Mr./Mrs./Ms.

SECOND APPLICANT Mr./Mrs./Ms. Resident Indian individuals HUF through the KartaCATEGORY : I/We hereby consent for my/our details being shared with other L&T Group Entitie s for the purpose of receiving future communication on products of L&T Group Entities. E-mail Pin Code (Compulsory) Telephone MobileCOMMON TERMS OF THE ISSUE: Issuer : L&T Infrastructure Finance Company Limited Security : Exclusive first charge on receivables of the Company, being one time of the issue size. For further details, please refer to page 28 of the Prospectus. Debenture Trustee : Bank of Maharashtra Depositories : NSDL & CDSL Listing : NSE (Designated Stock Exchange) Trading : In demat form after the end of the Lock-in period Lock-in Period : 5 years from the Date of Allotment Interest on Application Money : 6% per annum on amount allotted. For further det ails, please see General Instruction no. 9 Interest on Refund : NIL -For further details, please see General Instruction no . 9 Buyback Date : First Working Day after 5 years from the Date of Allotment and fi rst Working Day after 7 years from the Date of Allotment Option to hold Bonds : The investors have the option to hold the Bonds in demat or physical form. For further details, please see General Instruction no. 3.1.1 Redemption/Maturity Date : 10 years from the Date of Allotment Basis of Allotment : On a FIRST COME FIRST SERVE basis. For further details, ple ase see General Instruction no. 35 ACKNOWLEDGEMENT SLIP L&T INFRASTRUCTURE FINANCE COMPANY LIMITED Date d d / m m / 2011 Registered Office: Mount Poonamallee Road, Manapakkam, Chennai - 600 089; Tel: + 91 44 2252 6000; Fax: +91 44 2252 8688; Corporate Office: 3B, Laxmi Towers, C-25, G Block, Bandra-Kurla Complex, Ban dra (E), Mumbai - 400 051; Tel: +91 22 4060 5300; Fax: +91 22 4060 5353; Website: www.ltinfra.com; Complian ce Officer: Mr. Vinay Tripathi; Application No. 2299 3A/Laxmi Towers, First Floor, Bandra Kurla Complex, Bandra (East), Mumbai 400 05 1; Tel: +91 22 4060 5411; Fax: +91 22 4060 5353; E-mail: infrabonds2011A@ltinfra.com FOR ANY QUERIES REGARDING THE ISSUE, PLEASE CONTACT US ON EITHER OF OUR TOLL FRE E NOS. 1800 102 2131 OR +91 22 4060 5444 OR WRITE TO US AT savetax@ltinfra.com. FOR FURTHER DETAILS, INVESTORS CAN VISIT THE WEBSITE: www.ltinfrabond.com. Received From All future communication in connection with this application should be addressed to the Registrar to the Issue Sharepro Services (India) Pvt. Ltd., 13 AB,

Samhita Warehousing Complex, 2nd Floor, Sakinaka Telephone Exchange Lane, Andher i-Kurla Road, Sakinaka, Andheri (E), Mumbai 400 072. Contact Person: Mr. Prakash Khare, Tel: +91 22 61915419/408/416/402, Fax : +91 2 2 61915444, E-mail: prakashk@shareproservices.com, Investor Grievance E-mail: ltinfra2@shareproservices.com, Compliance Officer: Mr. Prakash Khare, Website: www.shareproservices.com, SEBI Registration Number: INR000001476; quoting full name of Sole/First Applican t, Application No., Series of Bonds applied for, Number of Bonds applied for under each Series, Date, Bank and Branch where the application was s ubmitted and Cheque/Demand Draft Number and Issuing bank. Cheque/Demand Draft No. Dated 2011 Drawn on (Name of the Bank and Branch) Series Face Value No. of Bonds applied for Amount Payable (`) (A) (B) (A x B) 1 ` 1,000 2 ` 1,000 Acknowledgement is subject to realization of Cheque / Demand Draft. Grand Total (1+2) Bank's Stamp & Date This slip is an acknowledgement of an application made for Long Term Infrastructu re Bonds , being issued by L&T Infrastructure Finance Company Limited in terms of section 80CCF of the Income Tax Act, 1961 and the Notification No. 48/2010/F. No.149/84/2010-SO(TPL) dated July 9, 2010 issued by the Central Board of Direct Taxes. Allotment of the Bonds shall be made within 30 days of the Issue Closing D ate; Credit to dematerialised accounts will be made within two Working Days from the date of Allotment; Dispatch of physical certificates shall be within 15 Working Days from the date of Allotment; While submitting the Application Form, the Applicant should ensure that the date stamp being put on the Application Form by the Bank matches with the date stamp on the Acknowledgement Slip. CK

L&T INFRASTRUCTURE FINANCE COMPANY LIMITED : APPLICATION FORMS AVAILABLE AT FOLL OWING LOCATIONS L&T INFRASTRUCTURE FINANCE COMPANY LIMITED : APPLICATION FORMS A VAILABLE AT FOLLOWING LOCATIONS LEAD MANAGERS TO THE ISSUE ICICI Securities Limited AGRA: 13A, 1St Floor, Sadar Bazar, SADAR BAZAR, AGRA-282002, Tel 9219439387, 975 9215721; AHMEDABAD: Shop no 6, Sun complex, C.G. Road, C G ROAD, AHMEDABAD-38000 9, Tel 079-64501668, 9099935130; First Floor Shop No 119, Akshar Commercial Comp lex Nr.Shivranjani Cross Road, Satellite Road, SATELLITE ROAD, AHMEDABAD-380015, Tel 079-40060134; Ground Floor, Shop No 4 & 5, Shilp Corner, Subhash Chowk, Gurukul Road, Memnagar, MEMNAGAR, AHMEDABAD-380052, Tel 0 79-40059883, 9909949567; First Floor, Shop No. 106/107, Krishnabaug Char Rasta, Kesharkunj Complex Maninagar, KESHARKUNJ, MANINAGAR, AHMEDABAD-380008, Tel 079-6 5411235, 8980036526; Ground Floor Shop No 39, 40, 41, 42, Sarjan 2, 100 Feet Roa d, Sarjan 2, New C.G Road, Chandkheda, CHANDKHEDA, AHMEDABAD382424, Tel 079-65445296, 8980006706; Sardar Centre, Grd Floor, Shop no. 31 to 35, Near Vastrapur Lake, Vastrapur, VASTRAPUR, AHMEDABAD-380015, Tel 079-40035920, 898000 6707; Shop No. 1, 2, 3, 4, Suvas Complex, 1St Floor, Above ICICI Bank, Opp. Raja sthan Hospital, Shahibaug., SHAHIBAUG, AHMEDABAD-380004, Tel 079-65411338, 90990 11188; ALLAHABAD: 27/17, 1St Floor, Algin Road, Civil Lines, CIVIL LINES, ALLAHABAD-211001, Tel , 9918200285; AMRITSAR: 3, Lawrence Road, LAW RENCE ROAD, AMRITSAR-143002, Tel 0183-5019992; AURANGABAD: Gr. Floor, Ghai Chamb ers, Jalna Road, JALNA ROAD, AURANGABAD-431001, Tel , 9923201073; BANGALORE: 73/ 1-1, Krishna, Infantry Road, INFANTRY ROAD, BANGALORE-560001, Tel 080-41239413, 9739006838; First Flr, CNN & Yashosha, Complex, No.87, HBCS Layout, Near West Of Chord Road Shankarmath Circle, Opp Chord Hospit al, Basweswar Nagar, BASWESWAR NAGAR, BANGALORE-560079, Tel 080-41288270, 953888 9294; First Floor, No. 9/1, Cambridge Road Layout, First Cross, CAMNRIDGE ROAD, BANGALORE-560008, Tel 080-64526810; First Floor, No.778/A, Chinnaswamy Chambers, off CMH Road, Indira Nagar., INDIRA NAGAR -BGLR, BANGALORE-560038, Tel 080-41261159; Sriranga Complex, No. 77, First Floor, Dr. Modi Road, 2Nd Stag e West of Chord Road, DR. MODI ROAD, BANGALORE-560086, Tel 080-64526798, 9739149 569; First Floor No.50 Little Plaza, Cunningham Road, CUNNINGHAM ROAD, BANGALORE -560052, Tel 080-41231688, 9739149992; First Floor, 135/5, 15Th Cross, 100 Ft Ri ng Road, 3Rd Phase, J P Nagar, J P NAGAR, BANGALORE-560078, Tel 08041208808, 9986489674; First Floor, No 81/B, 22Nd Cross, Jaya Nagar, 3Rd Block, JAYA NAGAR, 3RD BLOCK, BANGALORE-560041, Tel 080-41308445; No:399 , White Gold, 1St Floor, 24Th Cross, Bhanashankari, II Stage, BHANASHANKARI II STAGE, BANGALORE-560070, T el 080-26713969, 9916102953; Second Floor, No:4C-402, HRBR Layout Kamanahalli, I I Block, KAMANAHALLI, BANGALORE-560043, Tel 080-64526802, 9886393727; 1039/B, 2Nd Floor, 2Nd Main, Near Manovana Bus Stand, Vijaynagar, VI JAY NAGAR, BANGALORE-560040, Tel 080 41270890; First floor No. 209, New BEL Road , NEW BEL ROAD, BANGALORE-560054, Tel 080-41675355; #105, A.E.C.S. Layout, 2Nd S tage 5Th Main Post Office road, Sanjay Nagar Main Road, SANJAY NAGAR, BANGALORE560094, Tel 080-64526801, 9739014148; First Floor, No: 430/363, Nh7, Santhey Circle, Ballary Road, Yelalhanka, YELALHANKA, BANGALORE-560063, Tel 08041686223, 9739246181; 6/1, Ghandi Bazar, First Floor, Basavanagudi, Main Road, G andhi Bazar., GANDHI BAZAR, BANGALORE-560004, Tel 080-41692569, 9886534636; No.2 , 100Ft Ring Road, Katriguppa Circle, Bhanashankari III Stage, BHANASHANKARI III STAGE, BANGALORE-560085, Tel 080-41711313, 9739015159; No 72/1-B, Kanakapura, Mani Road, Jarganahalli, KANAKAPURA ROAD, BANGALORE-560078, Tel 080-41461441, 96 20267021; 290/1, 11Th Cross, Wilson Garden, WILSON GARDEN, BANGALORE-560027, Tel 080-64526482, 9739688211; No. 121, Atr Complexe, Airport Road, Murugesh Palaya, AIRPORT ROAD, BANGALORE-560017, Tel 080-64528748, 9742999773; No.20, 1St Main, Gandhinagar, GANDHINAGAR, BANGALORE-560009, Tel , 9916301350; No. 46, 100 Feet Road, First Floor, Koramangala, 6th Block, KORAMANGALA, BANGALO RE-560095, Tel , 9886150793; BHOPAL: 2, Malviya Nagar, Opp. Old Vidhan Sabha, MA

LVIYA NAGAR, BHOPAL, BHOPAL-462001, ; B-16, Indrapuri, INDRAPURI, BHOPAL-462001, Tel , 9584753111; BHUBANESHWAR: Ground Floor, Plot No-99, Janpath, Unit-3, Khar belnagar, JANPATH, BHUBANESHWAR-751001, Tel , 9776733377; BHUJ: Jubilee Circle, Opp. All India Radio, Bhuj, Kutch, BHUJ, BHUJ-370001, Stat e - GUJARAT, Tel , +91-9909949547; BIKANER: Gr. Floor, 44, Panchshati Circle, Sa dulganj,, BIKANER, BIKANER-334001, State - RAJASTHAN, Tel , +91-9783733888; CHAN DIGARH: SCO-181/182, 1st floor, Next to British Library, Sector 9C, SECTOR 9C, C HANDIGARH-160017, Tel 0172-6510232; Sco 62, Sec - 47C, SEC 47C, CHANDIGARH, CHANDIGARH-160047, Tel , 9988297207; CHENNAI: Shop No. 10 & 11 Arihant Vaikunt, No 123, Brick Kiln Road, Purasawalkkam , PURASAWALKKAM, CHENNAI-600007, Tel 044-4 3546139, 9176687856; Ashok Sriranga, No.1, 9Th Street, Nanganallur, NANGANALLUR, CHENNAI-600061, Tel 044 23460211; Ground Floor, Plot No. 1072 Munusamy Salai, N ext to Pondicherry Guest House, West K K Nagar, WEST K K NAGAR, CHENNAI-600078, Tel 044-23460262, 9962590369; 405, Tiruvalluvar Salai, Mogappair , Paneer Nagar, MOGAPPAIR, CHENNAI-600037, Tel 044-24360227, 9176695275; First F loor T-1, Yesesi Supermarket Building, Annanagar, CHENNAI-600040, Tel 044-234602 15, 9176565750; First Floor, New No. 87/2, Old No. 6/17, Annasalai, Mount Road., MOUNT ROAD, CHENNAI-600002, Tel 044-23460220, 9176988238; Flat No 4, 70/27, North Mada Street, Mylapore, MYLAPORE, CHENNAI-600004, Tel 044-23460202, 9176617431; 475, Kilpauk Garden Road, Kilpauk, KILPAUK, CHENNAI-600010, Tel 044 23460234, 9176635422; Pvm Complex, Plot No 1& 2, Vgp Vimala Nagar, Velacherry Ma ni Road, Medavakkam, MEDAVAKKAM, CHENNAI-600100, Tel 044-22772691, 9962563060; 1 , 3Rd Cross Street, Kasturibai Nagar, Adyar, ADYAR, CHENNAI-600020, Tel 044 23460211; Ground Floor, No. 17, Arunachalam Road, Saligramam, SALIGRAMAM , CHENNAI-600093, Tel 044-23460253, 9962542518; Shop No. 2, Century Plaza, 560-5 62, Annasalai, Teynampet, ANNASALAI TEYNAMPET, CHENNAI-600018, Tel , 91-91767210 55; No. 228, Thambu Chetty Street, Parrys, PARRYS, CHENNAI, CHENNAI-600001, Tel , 9176992510; COIMBATORE: 444, X-Cut Road, Gandhipuram, Coimbatore, GANDHIPURAM, COIMBATORE, COIMBATORE-641012, Tel , 9176690327; FARIDABAD: Ground Floor, SCO 52, HUDA Market, Sector-29., HUDA MARKET, SECTOR 29, FARIDABAD-121008 , Tel 4108033; GHAZIABAD: Office No S-4, 5, 7 & 8, Ground Floor, Girdhar Plaza.P lot No.H-1, Block No.B, Shalimar garden, Sahibabad, SHALIMAR GARDEN, GHAZIABAD-2 01005, Tel 0120-2639752, 9873670373; Ground Floor, Supertech Icon, Nayay Khand-I, Indira Puram, INDIRA PURAM, GHAZIABAD-201010, Tel 9810314264, 9999689290; GUNTUR: H.No. 5-37-57, 417 Line Road, Ground Floor, Bro dipet Main Road, Brodipet,, GUNTUR, GUNTUR-522002, State - ANDHRA PRADESH, Tel , +91-9052442237; GURGAON: A-4, 5, DLF Shopping Mall, Arjun Marg, DLF City-I, DLF CITY-I, GURGAON-122002, Tel 0124-4381240, 9711129820; Sco 4, Sector 14, SCO 4, GURGAON, GURGAON-120001; GUWAHATI: 3rd & 4th Floor, D.R.Bra j Mohan Building, Opp. Abc Bus Stand, G.S.Road, GUWAHATI, GUWAHATI-781005, Tel , 9706024017; HUBLI: 1st Floor, Next to JTK Show Room, Club Road (Bellow VLCC), H UBLI, HUBLI-580029, Tel 0836-4265221; HYDERABAD: D. No. 19-64, 1St Floor, Prasan na Heights Brundavan Colony, Opp. A. S Rao Nagar Colony, A S RAO NAGAR, HYDERABAD-500062, Tel 040-64530409, 9703218716; 1St Floor, Shop N o.1, 2&3, Sreeram Rama Towers, Chaitanyapuri, Dilsukhnagar, DILSUKHNAGAR, HYDERA BAD-500060, Tel 040-64530404; D No. 2-2-1130/25A, Chintala Arcade Sivam Main Roa d, Prasanth Nagar New Nalllakunta, NALLAKUNTA, HYDERABAD-500044, Tel 040-6453041 2, 9642328111; 1St Floor, 3-6-517, Shop No-103, Sai Datta Arcade, Himayatnagar, Main Road, HIMAYATNAGAR, HYDERABAD-500029, Tel 040-64530452, 81423 33533; Ground Floor, 101 & 102, Prashanthi Ram Towers, Behind Saradhi Studio, Ye llareddy Guda., YELLAREDDY GUDA, HYDERABAD-500073, Tel 040-64530456, 8142333502; Ground Floor, 11-4-659, Bhavya Farooqi Splendid Towers, Red Hills, Lakdikapool, LAKDI KA POOL, HYDERABAD-500004, Tel 040-64530474, 9642328177; First Floor, B- 44, Journalist Colony, Film Nagar Road, Jubilee Hills, JUBILEE H ILLS, HYDERABAD-500016, Tel 040-64530463, 7799017034; First Floor, 6-3-111, Amru tha Mall Somajiguda, SOMAJIGUDA, HYDERABAD-500082, Tel 040-64530440, 9160993839; First Floor, D.No.1-10-209, Kamala Towers, Ashoknagar, ASHOKNAGAR, HYDERABAD-50 0020, Tel 040-64530480, 9703216365; Ground Floor, Plot No-03, Kimtee Banjara Heights, Road No-12, Banjara-Hills, BANJARA HILLS RD#12, HYDERABAD-500034, Tel 0 40-64530477, 9642328131; 32/3RT, First Floor, Municipal No.7-1-261/92E, Sanjeeva

Reddy Nagar, Opp Nest Apartment, S R NAGAR, HYDERABAD-500038, Tel 040-64530497; First Floor, Concourse Building, Opp:Meridian Plaza, Green Lands Road, Ameerpet , AMEERPET, HYDERABAD-500016, Tel 040-64530418, 8142045305; Plot No 3 & 4, Sreerama Towers, Opp: Andhra Bank, Miyapur., MIYAPUR, HYDERABAD-500049, Tel 040-64530492, 9642328110; 214 MIG KPHB Colony, Road No.1, Near KPHB Kaman, Kuka tpalli, KUKATAPALLI, HYDERABAD-500072, Tel 040-64530432, 9052220564; Groud Flr, D.No:1-8-138 To 143, Krishna Castle, Besi - Heritage Flights, Penderghast Road, PENDERGHAST ROAD, SECUNDERABAD-500003, Tel 040-64530400, 8142045304; D No. 3-6-100/B, Ground Floor, Opp. Vijaya Bank, West Marredpally, MARREDPALLY, SECUNDERABAD-500026, Tel 040-64530429, 9642328125; Ground Floor, Plot No 29, Opp . Cyber Towers, Hi- Tech City, Madhapur, HI TECH CITY, SECUNDERABAD-500033, Tel 040-64530444, 9642328117; A-G-1 & A-G-2, Conjeevaram House, Padmarao Nagar., PAD MARAO NAGAR, SECUNDERABAD-500025, Tel 040-64530500, 9642328167; Ground Floor, Survey No.19/A, Ward No1 D. No. 4-65/5, Street No, 8 Habsiguda, HA BSIGUDA, SECUNDERABAD-500007, Tel , 9160993822; INDORE: UG 5/6, Royal Road Gold, A.Y.N.Road, AYN ROAD, INDORE-452001, Tel 731-4205430, 9584460466; Ug-6, Ug-7, S hekhar Residency, Opp Hotel Forture Land Mark, Scheme - 54, Sector F, SHEKHAR RE SIDENCY, INDORE-452001, ; 1St Floor, Anjani Plaza, Ashok Nagar, ASHOK NAGAR, INDORE, INDORE-452001, Tel , 9584460467; JABALPUR: 655, Napier Town, Kata nga Gorakhpur Crossing, NAPIER TOWN, JABALPUR-462001, Tel , 7566668222; JAIPUR: G-34, Ganpati Paradise, Central Spine, Vidhyadhar Nagar, VIDHYADHAR NAGAR, JAIPU R-302023, Tel 0141-5119281, 9772201292; Gr.Floor, Opp. G. P. O. M I Road, M I RO AD, JAIPUR-302001, Tel 0141-4027611, 9983311226; Shop No. G-8, G-9, Vaishali Tower II, Vaishali Nagar, Nursery Circle, VAISHALI NAGAR, JAI PUR-302021, Tel 0141-4027601, 9772202012; A-2, Lal Kothi Shopping Center, Near L akshmi Mandir Cinema, Tonk Road, TONK ROAD, JAIPUR-302015, Tel 0141-4027618, 954 9659869; 4Th Floor, A-34, Prabhu Marg, Opp. AC Market, Raja Park, RAJA PARK 4TH FLR, JAIPUR-302001, ; JALANDHAR: 188, Model Town, MODEL TOWN, JALANDHAR144001, Tel , 9988881320; JALGAON: Gr. Floor, City Enclave, Near Royal Palace Hotel, CIT Y ENCLAVE, JALGAON-425002; JAMNAGAR: 3Rd Floor, Cross Road Complex, Opp. D.K.V. College, Bedi Bunder Road, BEDI BUNDER ROAD, JAMNAGAR-361008, Tel , 8980022399; JAMSHEDPUR: Gayatri Enclave, 2nd Floor (Rear Portoin),Bistupur., JAMSHEDPUR, JAM SHEDPUR-831001, Tel 0657 - 6576455, 9570220223; KANPUR: 111/432, 80 Ft Road, Ashok Nagar, ASHOK NAGAR, KANPUR, KANPUR-208001, Te l , 9721458473; KOCHI: First floor, Adonai Towers, S.A.Road, SA ROAD, COCHIN, KO CHI-682016, Tel 0484-4011946, 9846686227; 44/2102-C, Deshabhimani Junction, Kalo or , KALOOR, KOCHI-682017, Tel , 9846755221; 1St Floor, Prabhus Towers, Mg Road, North End, MG ROAD, KOCHI, KOCHI-682035, Tel , 9846365229; KOLKATA: Sriniketan, Howrah AC Market, 20, Dobson Road, DOBSON ROAD, HOWRAH-7111 01, Tel 033-64509810, 8017516149; 30-G, Chowringee Mansion, J L Nehru Road, Park Street., PARK STREET, KOLKATA-700016, Tel 033-22275034, 9830674730; 112A, Third floor, Rash Behari Avenue, RASHBEHARI AVENUE, KOLKATA-700029, Tel 033 ? 6550210 1, 9674725735; Victoria Plaza, 385, Garia Main Road, GARIA MAIN ROAD, KOLKATA-700084, Tel 033-64506571, 9674725734; 339, Canal Street, Lake Town, LAKE TOWN, KOLKATA-700048, Tel , 9051615306; 95, Dumdum Road, DUMDUM ROAD , KOLKATA, KOLKATA-700074, Tel , 9830549993; Gr. And 2Nd Floor, 97/4, B.T. Road, B.T. ROAD, KOLKATA-700090, Tel , 9836003395; KOTTAYAM: 2nd floor, Ashirwad Towe rs, No.3, Block 54, Shastri Road, KOTTAYAM, KOTTAYAM686001, Tel 4816451011, 9745003220; LUCKNOW: Ground Floor, Landmark Arcade2, Badshah Nag ar Crossing, Faizabad Road, BADSHAH NAGAR CROSSING, LUCKNOW-226006, Tel 0522-404 7519, 9918200325; Raj Palace, A1/15, Sector H, Purania Chauraha, Aliganj, ALIGAN J, LUCKNOW-226024, Tel 0522 - 4048855, 9721458460; S/268, E Block Market, Awasth i Complex, Rajajipuram, RAJAJIPURAM, LUCKNOW-226017, Tel 0522-4046306, 9721458474; First And Second Floor, Speed Building, 3, Shahnaj af Road, SHAHNAJAF ROAD, LUCKNOW-226001, Tel , 9721455147; LUDHIANA: Sayal Compl ex, Near Cycle Market, Gill Road, GILL ROAD, LUDHIANA-141001, Tel , 9988881402; MEERUT: P P Plaza, Plot No. 177/1, Mangal Pandey Nagar, MANGAL PANDEY NAGAR, MEE RUT-250005, Tel 0121-4022012, 9759010925; MUMBAI: H T Parekh Marg, Chuhrchgate, Mumbai-400020, Tel 022-66377350; Sawan Knowledge P ark, Groud Floor, Plot No. D-507, TTC Industrial Area, Near Jui Nagar Railway St

ation, Navi Mumbai-400707, Tel 40701089; Shop no 11, Megh Apartment, Junction of factory lanes & LT road, MEGH APT -BORIWALI(W), MUMBAI-400092, Tel , 9930469052 ; Jaya Apartments, R B Mehta road, Near Patel Chowk, Ghatkopar (E), JAYA APT, GHATKOPAR (E), MUMBAI-400075, Tel 022-65972581, 9619661362; Shop no. 9, 10, Meri line Corner, Near Sion Circle, SION (E), SION, MUMBAI-400022, Tel 022 65972877, 9930258038; Shop No. 1 & 2, Dilkush Bungalow, J. P. Road, Andheri West, ANDHERI (W), MUMBAI-400058, Tel 022-65972185; 56/57, Saraf Choudhari Nagar Co. Op. Soc., Thakur Complex, Kandivali East, THAKUR COMPLEX, KANDIVALI (E), MUMBAI400101, Tel 022-65972165; Shop No. 26, 27 & 51, Gr.Floor, Ashoka Shopping Centre, LT Mar g, GT Hospital Compound, Marine Lines, MARINE LINES, MUMBAI-400002, Tel 022-6597 2151, 9619661299; 1A&2, Balaji Arcade, S.V Road Kandivili (W), KANDIVALI(W), MUM BAI-400067, Tel 022-67252026, 9769114518; Ground Floor, Jayshree Plaza, L.B.S. M arg, Bhandup (W), BHANDUP (W), MUMBAI-400078, Tel 022-67252071, 9833774119; Gr Floor, Devraj Mall, Krishna Kunj Hsg Soc., Harishankar Joshi Road , Opp. Madhuram Hall, Dahisar (E)., DAHISAR (E), MUMBAI-400068, Tel 022 65973037 , 9769114725; 1St Floor Sai Kiran, Central Avenue, 11Th Road Junction, Chembur., CHEMBUR, MUMBAI-400074, Tel 022 67706455, 9930262488; Azadnagar, Vile Parle Wes t, VILE PARLE WEST, MUMBAI-400056, Tel 022 66712660; Gr. Floor, Vardhaman Apt., 40, Hanuman Road, Vile Parle (E), VILE PARLE (E), MUMBAI-400028, Tel , 992 0552981; Gr. Floor, Shop No. 2, Grace Chamber, Amrit Nagar, Chakala, Andheri (E) , AMRIT NAGAR, ANDHERI (E), MUMBAI-400093, Tel , 9619130249; Shop No 4, 5, 6, 7, Roop Maya Co-Op Hsg.Soc., Sector 6, Airoli, AIROLI, NAVI MUMBAI-400708, Tel 022 65143243, 9930469001; Shop No.6, 7 & 8, Ground Flr. Vaishnavi Tower, Sector-44, Nerul (W)., NERUL (W)SEC-44, NAVI MUMBAI-400706, Tel 022 65143650, 9619140868; A psara Building, Shop No. 4, Sector - 17, Vashi., VASHI, SECTOR 17, NAVI MUMBAI-4 00702, Tel 022 67124805, 9833774129; Gr. Floor, Tulsi Pooja Shopping Center, New Panvel (E)., NEW PANVEL (E), NAVI MUMBAI-410206, Tel 022 65143687, 9930469073; Ground Floor, Block 1, Shop No 3, Emerald Plaza, Hiranandani Meadows, Glady Alvares Marg, Off Pokhran Road No. 2, Thane (W), EMERALD PLAZA, THANE-400610, Te l 022-67252084, 9930468334; Olympia Bldg, Poonam Sagar, Mira Road (East), MIRA R OAD (E), THANE-401107, Tel 022-65972171; 1St Floor, Office No. 2, Gaurangi Chamb ers, Opp. Damani Estate, L.B.S. Marg., L.B.S. MARG, THANE-400602, Tel 022-659706 65; Ground Floor, Galleria, Talao Pali, TALAO PALI, THANE (WEST), THANE400602; MYSORE: Natraj Aracade, # MIG 35, Urs Road, First floor, HUDCO 1st stage, Kuvemp unagar, Opp. Akshay Bhandar, KUVEMPUNAGAR, MYSORE-570023, ; D. No. 86/3A, Panabv ati Circle, Kalidasa Road, Jayalakshmipuram, KALIDASA ROAD, MYSORE-570012, Tel , 9986098910; NAGPUR: Ground Floor, Plot No.263 &264, BrijBhumi Complex., BRIJBHU MI COMPLEX, NAGPUR-440008, Tel 0712-6631611, 9158882697; Kotwal Nagar, Ring Road, Khamla, KHAMLA, NAGPUR-440015, Tel 0712 - 6452494; Firs t Floor, Shop No. 138 To 140, Shree Ram Shyam Towers, SADAR - HUB, NAGPUR-440001 , Tel 0712-6631608, 9673333724; NASIK: Ground Floor, Plot No. 7, Mahindra Memori al Centre, Near Babu Bunglow, Rathchakra Chowk, Vadala- Pathardi Road, Indira Na gar, INDIRA NAGAR, NASIK-422009, Tel 0253 6572116, 91-9158005613; NEW DELHI: B-1, B-2, Third Floor, Above Hot Spot, Janakpuri, JANAKPURI, NEW DELH I-110058, Tel 011-64546535; Gr. & 1st Floor, Premises No F-3/28, Abadi Krishna N agar, Shahdara, Village Ghondali, KRISHNA NAGAR, NEW DELHI-110051, Tel 011-22097 257, 9999169986; Ground Floor, UG-05, Upper Gr. Floor, Vikas Surya Plaza, 7 Comm unity Centre, Road No. 44, Pitam Pura, Rani Bagh, PITAM PURA, RANI BAGH, NEW DELHI-110034, Tel 011-42644297, 9899103587; Ground Floor, Plot No. 24 , 25, LSC, Mayur Vihar-II, MAYUR VIHAR-II, NEW DELHI-110091, Tel 9810898215, 958221419 7; Ground Floor & Mezzanine, Ab-11, Community Center, Safdarjung Enclave, SAFDAR JUNG ENCLAVE, NEW DELHI-110029, Tel 011-46026136, 9582947952; Ground Floor & Mez zanine, 29, Community Centre, Naraina Industrial Estate, Phase - I, NARAINA, NEW DELHI-110028, Tel 011-45009954, 9582162081; Building No 4, 1St Floor, SMR Ho use, Basant Lok Vasant Vihar, VASANT VIHAR, NEW DELHI-110057, Tel 011-46039807; 1st Floor, Shop No. 39, Pushpa Market, Lajpat nagar II, LAJPAT NAGAR, NEW DELHI110024, Tel 9910692530, 9899235323; Ground Floor Plot no-8A, Block No.E, Hauz Kh as, HAUZ KHAS, NEW DELHI-110016, Tel 011-41654853, 9582947953; Ground Floor & First Floor, Plot No 17, Community Center, Mayapuri, MAYAPURI, NEW DELHI

-110064, Tel 011-45501297, 9999592704; Ground Floor 4435-3/6, Portion 4/7 Ansari Road, Next to Corrporation Bank ATM, Daryaganj, DARYAGANJ, NEW DELHI-110002, Te l 011-43540813, 9582217663; 1St Floor, Plot No-10, LSC Rajdhani Enclave, Vikas M arg, RAJDHANI ENCLAVE, NEAR KARKARDOOMA, RAJDHANI ENCLAVE, NEW DELHI110092, Tel 9971091474; Ground Floor, Rohini Sector-9, Near Kadambri CGHS Ltd, ROHINI SE C 9, NEW DELHI-110085, Tel 9910692511, 9582202002; Ground Floor & Upper, 22, Cen tral Market, Ashok Vihar, ASHOK VIHAR, NEW DELHI-110052, Tel 011-47023584; Unit F-7, 8, 9, 10, 11, 12, 13, 14, Malik Buildcon Plaza-2 Pocket-V, Sec 12, Dwarka, DWARKA, NEW DELHI-110075, Tel 011- 45537264, 9873232440; Gr. Floor 30/5, Nangia Park Circle, Shakti Nagar, NANGIA PARK; SHAKTI NAGAR, NEW DELHI-110 007, Tel 011- 47013716, 9759215706; Ground Floor, 3C/4, New Rohtak Road, NEW ROH TAK ROAD, NEW DELHI-110005, Tel 9910990777, 9999283746; First Floor (Left Side), DDA Shopping Complex, Alaknanda, ALAKNANDA, NEW DELHI-110019, Tel 011 - 4176751 4; Plot No. 13, Community Centre, New Friends Colony, NEW FRIENDS COLONY, NEW DELHI-110065, Tel 011- 41672696; 179 - 182, Dda Office Complex, Rajendra Bha wan, Rajendra Palace, RAJENDRA PLACE, NEW DELHI-110008, Tel , 9999351142; Shop N o. 45 & 46, Tilak Nagar, TILAK NAGAR, NEW DELHI-110018, Tel , 9582947696; Shop N o. 1, I Pocket, Dilshad Garden, DILSHAD GARDEN, NEW DELHI-110095, Tel , 58221418 9; 114/115, 1St Floor, Arunachal Bldg 19, Barakhamba Road, Connaught Place, CONNAUGHT PLACE, NEW DELHI-110001, Tel , 9582158521; J2/21, 1St Floor, Ra jouri Garden, RAJOURI GARDEN, DELHI, NEW DELHI-110027, Tel , 9999035683; NOIDA: 16, 15, 14, & 12-A, Ground Floor, Msx Tower Ii, GREATER NOIDA, GREATER NOIDA-201 306, Tel , 9811482354; B 1/34-35, Central Market, Sector-50, NOIDA SECTOR 50, NO IDA-201301, Tel 9810139014, 9582200473; PATNA: ICICI Bank Premises, Sumitra Sadan, Boring Road Crossing, PATNA, PATNA-800001, Tel 0612 - 2205690, 95 70900596; PUNE: Ground Floor, Abhimanshree Apartments-2, Condominium, Bhuvaneshw ar Society, Aundh, AUNDH, PUNE-411007, Tel 020-64009578; Ground Floor, Sheetal P laza, CTS No. 1125, Final Plot No.499, Model Colony, Shivajinagar, Bhamburda, MO DEL COLONY, PUNE-411016, Tel 020-64009581, 7798981523; RAMA S.No 682/A, CTS No 1048, Plot No 49, Chatrapati Rajaram Co-Op Hou.Soc, Jedhenagar, Bi bwewadi, BIBWEWADI, PUNE-411037, Tel 020-64780045, 9158882629; Office No.3, Tedd ies Apartment, Opp. Gera Junction, Kondhawa, KONDHAWA, PUNE-411048, Tel 020 6478 9996, 7798981535; Gr. Floor & Mezzanine, Krishnakunj, S No.211, Hissa No. 2E, Pl ot No. 17, Kalyaninagar, Yerwada, KALYANINAGAR, PUNE-411006, Tel 020-64000280, 7798981528; Gr. Floor & Basement, Pramila Apt, Plot No. 16, Beside Hotel Kamat, Dahanukar Colony Circle, Kothrud, KOTHRUD, PUNE-411029, Tel 020-64000279; Gr.Flo or, 86A, Survey No.390/1684-1, M.G.Road, Opp. Kohinoor Restaurant, Camp, M.G.ROA D, PUNE-411001, Tel 020 64000284, 9158882700; Groud Floor, Premsagar, H Wing, Ne ar PCMC Auditorium, Chinchwad, CHINCHWAD, PUNE-411033, Tel 020-27463416, 7798981252; Shop No 1 & 2 Gr. Floor, Sneh Bldg, Cts No 1404, Near Jamtani Cross, Pimpri, PIMPRI, PUNE-411017, Tel 020-26451574, 9923201041; Ground Floor, near V ishal Megamart, KPCT B Wing, S No.16, Hisa No.1/1, CTS No.912, Wanawadi, Fatiman agar., FATIMANAGAR, PUNE-411040, Tel 020-64009551, 7798981509; RAJAHMUNDARY: Doo r No: 46-22-11, Karrisu Reddy Plaza, Danavaipeta, East Godavari District,, RAJAHMUNDRY, RAJAHMUNDRY-533103, State - ANDHRA PRADESH, Tel , +91-91 60993820; RAJKOT: 1st Floor, Shantiniketan Complex, 150 Feet Ring Road, Opposite KKV Hall, 150 FEET RING ROAD, RAJKOT, RAJKOT-360007, Tel 0281-6451154, 97277398 40; RANCHI: First Floor, Ranchi Club Complex , Main Road, RANCHI CLUB COMPLEX, R ANCHI-834001, Tel , 7631998820; SURAT: Shop No.35, 36 & 37, 2Nd Floor, Shreeji Arcade Complex, Anand Mahal Road, Adjan Road, SHREEJI COMPLEX , SURAT-395009, Tel 0261-6548419, 8980006745; G/10, 11, 12, Sarthi Complex, Hira Baug, Warachha, HIRA BAUG, SURAT-395006, Tel 0261-6548438, 79-9099935176; 1St F loor, Viishal Chambers, Nr. Athwagate Charrasta, Besides Sardar Bridge, ATHWAGAT E CHARRASTA, SURAT-395001, Tel 0261-6548407, 8980022395; THRISSUR: R.V.Trade Centre, Third Floor,Patturaickal, THRISSUR, THRISSUR-680022, State - K ERALA, Tel 9995429332, +91-9846495206; TIRUPATI: Gr.Flr D/o: 19-3-12/J4, Ramanuj a Circle, Tirchanoor Road,, TIRUPATI, TIRUPATI-517501, State - ANDHRA PRADESH, T el , +91-7799017079; TRIVANDRUM: 2 Nd Floor, Kamala Towers , Vazhuthacaud, TRIVA NDRUM, TRIVANDRUM-695014, Tel , 9846645223; UDAIPUR: Sf, 5C, Madhuvan, Above Kotak Mahindra Bank, UDAIPUR, UDAIPUR-313001, Tel , 9983345015;

VADODARA: Ground Floor, Gardenview Chambers, Opp Kala Ghoda Circle, Sayajiganj, SAYAJIGANJ, VADODARA-390005, Tel 0256-6540546, 8980022367; Amrapali Complex, 1St Floor, Shop No. 142, 143, 144, 145, 146, Water Tank Road, Karelibaug., KARELIBA UG, VADODARA-390018, Tel 0278-2433288, 8980022359; Gr Floor, Shop No 7, 8, 9 Tulsidham Char rasta, Manzalpur, MANZALPUR, VADODARA-390011, Tel 0265 6566911; 1St Floor, Gokulesh Ii, 96 Sampatrao Colony, R.C.Dutta Road, Alka puri., GOKULESH, ALKAPURI, VADODARA-390007, Tel , 9909947855; VAPI: Ground Floor , City Surver No. 1913, Rozy Empire, Opp Govt Yatri Niwas, VAPI, VAPI-396191, Te l , 8980022376; VIJAYAWADA: 29-6-31, 1St Floor, Sai Srinivasa Shopping Complex, Nakkal Road, Suryaraopet, VIJAYAWADA-520001, Tel , 9160993807; VISHAKHA PATNAM: 1-83-43, 1St Floor, Narendra Polyclinic Building, M V P Colony., VISAKHA PATNAM, VISAKHAPATNAM-530017, Tel 0891-6520468, 7799017078; HDFC Bank Limited : LOCATIONS WOULD BE SAME AS GIVEN BELOW FOR HDFC BANK LIMITED AS COLLECTION BANK. Karvy Stock Broking Limited Agra : 17/2/4, 2nd Floor, Deepak Wasan Plaza, Sanjay Place, (Behind Holiday Inn) , 282 002, 0562 2526660 / 61; Shop No 11, Nanak Towers, Opp.Telegraph Office, Be lagunj, 282 004; 0562 3247077; Ahmedbad : 7 - 8, 2nd Floor, 3rd Eye Building, Ne ar Panchvati Circle, C.G.Road, 380 006, 079 26403134 / 2403171; 27, Suman Tower, Near Hotel Haveli, Sector No.11, Gandhinagar, 382 011, 079 23249943, 23249985; 208 H J House, Near Ram Baug Police Station, Opp IOC Petro Pump, Rambaug, Manina gar, 380 008, 079 25466548 / 25466654; 1, Millenium Plaza, Opp. Mansi Towers, Va strapur 380 015, 079 26750401 / 26750434; Ajmer : 12, II Floor, Ajmer Tower, Kut chary Road, 305 001, 0145 2628055, 2628065; Akolaakola : Shop No-30, Ground Floo r, Yamuna Tarang Complex, N.H. No.-06, Murtizapur Road, 444 004, 0724 2451874; Alleppey : First Floor, J P Towers, West Of Zilla Court Bridge, Ne ar Agricultural Office, Mullakkal, 688 011, 0477 2230160; Aligarh : 1st Floor, K umar Plaza, Ramgath Road, Vishnupuri, 202 001, 0571 2509106/07; Allahabad : 2nd Floor, Rsa Towers, Above Sony Showroom, 57, Sardar Patel Marg, Civil Lines, 211 001, 0532 2260291 / 92; 138/13 Nai Bazar (Above Yash Automobiles Hero Honda Agency), Opp Nisc (Udyog Nagar) Naini, 211 007, 0532 22695031; Alwar : 101, Saur abh Towers, Road No # 2, Bhagat Singh Circle, 301 001, 0144 3291200/300; Amaravt hi : Shop No. 13 & 27, First Floor, Gulshan Plaza, Raj Peth, Badnera Road, 444 6 01, 0721 2565617/2573972; Ambala : 6349, Nichoson Road, Adjacent Kos Hospital, A mbala Cantonement ,133 001, 0171 2640668,69; SCF-15, Vikas Vihar ,~ ,134 003, 0171 2551757,58; Amritsar : 72-A Taylor s Road, Opp.Aga Heritage Gand hi Ground, 143 001, 0183 5053802/3; Anand : FF-6, Chitrangana, Opp: Motikaka Cha wl, Vidyanagar Road, Anand 388 120, 02692 248980, 248873; Ankleshwar : Shop No.F -4/5, 1st Floor, Shree Narmada Arcade, Opp. Hdfc Bank, 393 001, 02646 227348 / 2 27349; Asansol : 18 G T Road, 2nd Floor, 713 301, 0341 2214623, 2214624; Bangalore : 156/1, 30th Cross, 6th Main, 4th Block, Jayanagar, 560 011, 080 26554328/29; No.279, 3rd Floor, 67th Cross, 5th Block, Rajajinagar (Near Bhashyam Cirlce), 560 010, 080 23143559 / 23143560; T K N Complex, No. 51 /2, Vanivilas Road, Opp: National College, Basavanagudi 560 004, 080, 26621192 / 93; Skanda No 59, Putana Road, Basavanagudi, 560 004, 080 26621192 / 93; # 3, Thimmaiah Chambers,1st Cross Road, Opp To Kamat Yatri Nivas, Gandhinagar 56 0 009, 080 22350761/62/63/64; No 746, First Floor, Krishna Temple Road, Indira N agar, First Stage, 560 038, 080 25264344 / 2930; A/8, 1st Floor, Khb Colony, (Op p.Microland, (In Airtel Bldg), 80 Feet Road, Koramangala, 560 095, 080 25527301 / 25501647; No.337, Gf-3, Karuna Complex, Sampige Road, Opp: Vegetable Market, Malleshwaram, 560 003, 080 23314678 / 23314680; No.1714, 14/1, 1st Floor, K S S Chambers (Behind Maruthi Mandir) 21st Main Road, Vijayanagar, 560 040, 080 23119 028 / 9041; 2019/A, 1st Floor, 3rd B Corss, B Sector, Yelahnaka New Town, 560 064, 080 28562726/ 2729; 165 & 166, Manjunatha Chambers, Shankarnagar Main Road, 5600 96, 080 23375292, 23471375; No.628, 8th Main, 3rd Stage, 3rd Block, Basaveshwaranagar 560 079, 080 30982058 / 1794 ; Bareilly : 1st Floor, 165, Civi l Lines, Opp.Hotel Bareilly Palace, Near Rly Station, 243 001, 0581 2310470; Bel

gaum : FK-1, Khimajibhai Complex, Ambedkar Road, Opp: Civil Hospital, 590 001, 0 831 2402544 / 722; Bellary : No.1, 1st Floor, KHB Colony, Gandhinagar, 583 101, 08392 254531 / 32 ; Bharuch : Ff 47/48 Aditya Complex, Opp. Kasak Fuwara, 392 001, 02642 225207 / 08; Bhathinda : 2048, First Floor, Opp.Canara Bank, The Mall Road, 151 001, 0164 5006725/26/27; Bhavnagar : 301, 3rd Floor, Surabhi Mall , Near ICICI Bank Waghawadi Road, 364 001, 0278 2567005, 3001004; Bhilai : Shop No.138, New Civic Centre, 490 006, 0788 2295329 / 37; Bhopal : Kay Kay Business Centre, 133, Zone 1, MP Nagar, 462 011, 0755 4092712, 4092714; Bhubaneshwar : 624, Saheednagar, First Floor, 751 007, 0674 2511011 - 14,; Plot No. 104/105, P Besides Pal Heights Hotel, Jayadev Vihar, 751 310, 0674 2360334/3 35; Bilaspur : Shop No 201/202, V.R.Plaza, Link Road, 495 001, 07752 519598 / 23 6466; Bokaro Steel City : B-1,First Floor, City Centre, Near Sona Chandi, Sector -4, 827004, 06542 233330/31/32; Burdwan : Birhata (Halder Complex), 63, G T Road, 713 101, 0342 2550801 / 0840; Calicut : First Floor, Savithri Buil ding, Opp.Fatima Hospital, Bank Road, 673 001, 0495 2760882 / 2760884; II Floor, Soubhagya Shopping Complex, Mavoor Road, Arayedathypalam, 673 004, 0495 2742105 / 2742107; Chandigarh : Sco 371-372, Above Hdfc Bank, Sector 35-B, 160 036, 017 2 5071726, 5071727, ; Chennai : F-3 Adyar Business, Court, Old No 5, New # 51, Gandhi Nagar First Main Road, Adayar, 600 020, 044 42116586, 421165 87, ; Ac 155, 6th Main Road, Near KHM Hospital, Anna Salai, 600 040, 044 2622448 2, 42103538, ; No 77A, Radha Nagar Main Road, Chromepet, 600 044, 044 22653604, 22653605, ; No. 48, Ist Floor, Ist Main Road, Nanganallur, 600 061, 044 42056266 / 267 / 68; F 22, Prince Towers, Purasawalkam High Road, Purasaiwakkam, 600 010, 044 42042567 / 568; G-1, Swati Court, 22, Vijaya Raghava Road, T Nagar, 600 017, 044 28155967 / 28153658; Sundar Krishnaplaza, 3rd Floor, No.8, Luckmodoss Street, Sowcarpet, 600 003, 044 42051557/ 1471; F-7 & 8, 3rd Floor, Mahbubani To wers, No. 48, Dr. D N Road, T. Nagar, 600 017, 044 42076808 / 09; No. 7, Sripera mbadur Road, Thiruvallur, 602 002, 044 27640552; Doshi Gardens, Shop No.10, 2nd Floor D-Block No. 174 N.S.K Salai, 600 026, 044 42013425 / 27 42013002; Coim batore: Ground Floor, , 29/1, Chinthamani Nagar, N S R Road, Sai Baba Colony, 64 1 011, 0422 2452161 / 162 / 163; Jaya Enclave 1057/1508, Avanashi Road, 641 018, 0 422 4291000 30; Cuttack : Opp.Jaganath Petrol Pump, Arunodya Market, Link Road, 753 012, 0671 2332680 / 81 / ; Dargha Bazar, 1st Floor, 753001, 0671, 2613905, 2613906; Dehradun : 48/49, Patel Market, Opp: Punjab Jewellers, N ear Gandhi Park, Rajpur Road, 248 001, 0135 2713351 / 2714046 ; Kaulagarh Road, Near Sirmour Marg, 248 001, 0135 2754334, 2754336; Durgapur : Old Dutta Automobi le Building, 1st Floor, Benachity, Malancha Road, 713 213, 0343 2586375 To 77; E rode : No.4, Kmy Salai, Veerapan Traders Complex, Opp: Erode Bus Stand, Sathy Road, 638 003, 0424 2225601 / 03; Faridabad : A-2b, 1st Floor, Neel am Bata Road, Nit, 121 001, 0129 4024441to 43; Gandhidham : 14, Komal Complex, P lot No 305, Near Shivaji Park, Sector 12-B, 370 201, 02836 228640 / 30; Ghaziaba d : 1st Floor, C-7, Lohia Nagar, 201 001, 0120 2701886 / 2701891; Gorakpur: Abov e V.I.P. House, Adjacent, A.D. Girls College, Bank Road, Gorakpur, 273 001, 0551 2346519/2333825, Guntur : 6-10-18, II Floor, 10/1, Arundelpet 2nd Floor, 522 002, 0863 2326684 / 2326686; Gurgaon : Shop No 18, Near Huda Office, Ground Floor, Opp. AKD Office, Sec.14, Old Delhi Road, Near Madras Restaurant, 1 22 001, 0124 4086419/ 3243535; Guwahati : 2nd Floor, Ram Kumar Plaza, Chatribari Road, Near Himatshinga Petrol Pump, 781 001, 0361 2608016 / 8102; Gwalior : Near Nadigate Pul, MLB Road, Shinde Ki Chawani, 474 001, 0751 4069001, 4069002, ; 52, Mayur Market, First Floor, Near Petrol Pump, Thatipur, Gandhi Ro ad, 474 001, 0751 2340200/0751-2340201; Haldwani : No.4, Durga City Center, 1st Floor, Near M B College, Naintal Road, 263 139, 5946 282635, 311950; Hanamkonda : Shop No.5 & 6, 1st Floor, Chandra Complex, 5-6-94, Lashkar Bazar, Opp: B.Ed College, 506 001, 0870 2551484, 2553884,; Hassan : St. Anthony s Complex , Ground Floor, Opp: Canara Bank, H N Pura Road, 573 201, 08172 262032, 262051, ; Hissar : SCO 17 Red Square Market, 1st Floor, 125 001, 01662 225868 (D) / 2258 45 / 836; Hoshiarpur : 1st Floor, The Mall, Sutheri Road, 146 001, 01882 503201 - 204; Hubli : Giriraja House, No.451 /B, Ward No.1, Club Road, 580 029, 0836 2353962, 2353974, 2353975; 8 & 9, Upper Ground Floor, C Block, Aks haya Park, Gokul Road, 580 030, 0836 2232773, 2232774; Hyderabad : 15-6-464/470,

1st Floor, Salasar Complex, (Near Fish Market), Begum Bazar, 500 012, 040 23433 100; 1st Floor, Plot No.2, 1-1-128/B, Chanda Nagar, Serilingampally, Near Bhel, 500 050, 040 23030028, 23030029, ; Vijetha Golden Empire, Flat No. 103, First Floor, H No.16-11-762/762b & C, Beside Anadal Nilayam, Moosarambagh, 500 036, 04 0 23433116 / 117; 3-5-890, Paras Chambers, Plot No.14-15, Ground Floor, Himayat Nagar, 500 029, 040 23388771, 23388772; Sai Vikram Towers, 1st Floor, Kukatpally Main Road, Near Kukatpally Bus Stop, Kukatpally, 500 072, 040 23433137/119; Bui lding No.160 (Part), Opp: Mayfair Complex, Rasoolpura, S P Road, 500 003, 040 23433110 To 15; 21, Avenue 4 Street No.1, Banjara Hills, 500 034, 040 23312454 / 23320251; Block No 176, Opp. Chola Residency, Old Vasavi Nagar, Kharkana, 500 0 16, 040 23433166 -169 ; Indore : 105, 106 & 107,D M Towers, 21/1, Race Cource Ro ad, Near Janjeerwala Chowrah, 452 001, 0731 3014200 - 19; Jaipur : S-16/A, Land Mark, 3rd Floor, Opp Jai Club, Mahaveer Marg, C Scheme, 302 001, 0141 2378703 / 604; Jalandhar : Prime Tower, Lower Ground Floor Off.No.3, Plot No 28, G T Road, 144 001, 0181 4634401 - 14; Jalgoan : Laxminarayan Plaza, 148, Navipe th, Opp. Vijaya Bank, 425 001, 0257 2227432 /2223671; Jamnagar : G-12 & 108 Madh av Plaza, Opp: Sbs Bank, Near Lal Bungalow, 361 001, 0288 2556520 /2556260; Jams hedpur : 2nd Floor, Kanchan Towers, 3 Sb Shop Area, Main Road, Bistupur, 831 001, 0657 2487020, 2487045, Jammu : 1st Floor, 29 D/C, Near Services Selection Board, Gandhinagar, 180 004, 0191 9906297556, 9906200000; Jha nsi : 371/01, Narayana Plaza, Jeevan Shah Crossing, Opp Telephone Exchange, Gwal ior Road, Jhansi, 284 003, 0517 2333682 - 85, 2332141; Jodhpur : 203, Modi Arcad e Chopasni Road, 342 001, 0291 5103026 / 5103046; Junagadh : 124 - 125, Punit Shopping Centre, M G Road, Ranavav Chowk, 362 001, 0285 26241 40 / 2624154; Kakinada: 13-1-46, I Floor, Sri Deepthi Towers, ICICI Bank Complex , Main Road, 533 001, 0884 2387382 / 2387383; Kannur : II Floor, Prabhat Road, F ort Road, 670 141, 0460 27681120 / 1130; Kanpur : 15/46, Civil Lines, Near Muir Mills, Stock Exchange Road, 208 001, 0512 2330127, 2331445,; 81/ 4, Block No. 9, Govindnagar, 208 006, 0512 329600; Karelibaug : SB 3, Amrapaali Complex, Near Muktanand, Water Tank Road, 390 018, 0265 3950628, 3951011; Karnal : Sco 26, Kunjpura Road, Nehru Place, 132 001, 0184 2251524 / 525 / 526; Kochi : G 39, Panampilly Nagar, 682 036, 0484 2310884 (D) / 2322152; Room No XIX / 135 (16) 1st Floor, Noor Point Opp. Federal Towers, Bank Junction, 683 101, 0484, 3202627/ 637; 7 / 462, B 5trans Avenue, Near EKM Dist Coop Bank H ead Quarters , Kakanad, 682 030, 0484 2423191 / 3949087; D. No. 6/0290, Opp: Haz i Essa School, Gujarathi Road, 682 002, 0484 2211229 / 2211225; 1st Floor, Pindy s Complex, XX/773, Market Junction, 682 301, 0484 2777330 / 3571041; Kolhapur : Omkar Plaza Shop No. F2 & F4, 1st Floor, Rajaram Road, Near ICICI Bank, 416 008, 0231 2520650, 2520655; Kolkata : 19, R N Mukherjee Road, 2nd Floor, 700 001, 033 22437863 - 69; 493/C/A, G T Road (S), Block G, 1st Floor, 711 101, 033 26382345 / 2535; 22n/1, Block A, New Alipore, 700 053, 033 24576203-05 / 2407 0 992; AD-60, Sector - 1, Salt Lake, 700 064, 033 23210461 - 64 / 0587 / 23344140; 49, Jatin Das Road, Near Deshpriya Park, 700 029, 033 24634787 - 89 / 24647231/ 32 / 4891 / 24650308; P-335, CIT Scheme No. VI M, ~ 700 054, 033 23648927 ; 2362 8486; Kollam : Seemas Centre 2nd Floor, Kadapakkada, 691 008, 0474 2768327 / 8337 / 8347; Kota : 29, Shopping Centre, 1 Floor, Near Lala Lapatrai Circle, 324 007, 0744 2365145 / 146 / 144; Kottayam : 1st Floor, CSI Ascension Square, Collector ate P.O, 686 002, 0481 2302420-21; Kumbakonam : 45, First Floor, City Plaza , Mutt Street, 612 001, 0435 2403436 / 37; Lucknow : K S M Tower , CP 1, Sinder Dump, Alambagh, 226 005, 0522 2453168/158 / 176; Hig 67, Sector E , Aliganj, 226 016, 0522 2329419, 2329938/39; 24, Usha Sadan, Prem Nagar, Ashok Marg, 226 001, 0522 3213183; Tej Krishan Plaza, 313/9, Khun Khunji Road, Chowk, 226 003, 0522 2258454 / 455; Shivani Plaza, Khunkhunji Plaza, 2/54, Vijay Khand, Gomtinagar, 226 010, 0522 2391664/65 / 2391280; 94, Mahatma Gandhi Marg, Opp: Governor House, Hazratganj, 226 001, 0522 2236819-28, 3817001 (Rim); Ludhia na : Ground Floor, Sco -3, Feroze Gandhi Market, 141 001, 0161 4680050 To 468006 2; Madurai : 274, Goods Shed Street, ~ 625 001, 0452 2350855 (D) / 2350852 - 854 ; Rakesh Towers, Opp Murugappa Motors, No.30, By Pass Road, 625 010, 0452 2600851 - 855; Plot No 654 - 80 Feet Road, Next To Lakshmi Arasu K

alyana Mandapam, K K Nagar, 625 020, 0452 5391700 / 600; Mangalore : Mahendra Ar cade, Ground Floor, No.4-6-577/21/22, Kodial Bail, 575 003, 0824 2492302, 249633 2, 2492901; Mathura : 3538 / 3540, Infront Of B.S.A. College, Gaushala Road, 281 004, 0565 2463172- 74 , 3202615; Meerut : 1st Floor, Medi Centre, Opp Eves Centre, Hapur Road Near Bachha Park, 250 002, 0121 2520068; Mehsana : U l 47, Apollo Enclave, Opp Simdhear Temple, Modhera Cross Road, 384002, 2762 2429 50; Moga : Near Dharamshala Brat Ghar, Civil Line, Dutt Road, 142 001, 01636 230 792 / 5022400; Moradabad : Om Arcade, First Floor, Parkar Road, Above Syndicate Bank, Taari Khana Chowk, 244 001, 0591 2310470, 2320470; Morbi : 9/10, F F Luvkush Complex, Ravaparroad, 363 641, 02822 220822, 325650; Mumbai : Jeevan Udyog Building, 2nd Floor, D N Road, Fort, 400 001, 022 22062077, 2087, ; 29, Patel Shopping Centre, Wst Floor, Opp. Foodland Restaurant Sainath Road, Malad (West), 400 064, 022 28824241 / 28828281; B-153, Vashi Plaza, Sector 17, V ashi, 400 705, 022 67912087, 67912168,; 7, Andheri Industrial Estate, Off: Veera Desai Road, 400 053, 022 26730799 / 843; 7&8, Eric House, Ground Floor, 16 th Road, Chembur Gymkhana Road, Near Ambedkar Garden, Chembur, 400 071, 022 2520 9335, 25209336, ; 101 Sapna Building, Above Idbi Bank, S K Bhole Marg, Dadar Wes t, 400 028, 022 24329763, 24322158, ; 16/26, 16/22, Transworld, Maharashtra Cham bers Of Commerce Lane, Opp Mcs Bank, Fort, 400 023, 022 22819709 - 11 / 22819721 - 24; 115, Arun Chambers, 1st Floor, Next To A/C Market, Tardeo, 400 034, 022 66607042 / 66607043; 103, 1st Floor, Jeevan Chaya Bldg., Ram Marut i Road, Naupada , 400 602, 022 25446124 / 25446121; Muzaffarnagar : 203/99 C, Sa dar Bazar, Town Hall Road, Opp. Peace Library, Above Bank Of India, 251001, 0131 2437349, 2437359; Muzaffarpur : 1st Floor, Adj. Central Bank Of India, Uma Market, Thana Gumti, Motijheel, 842 001, 0621 2269795/ 2241733; Mysore : L-3 50, Silver Tower, 1st Floor, Ashoka Road, Opp: Clock Tower, 570 001, 0821 252429 2, 2524294; Nirala Bazar : Shop No.214/215, Tapadiya City Centre, 431 001, 0240 2363517 / 23 ; Nadiad : 104-105, City Point, Near Paras Cinema, 387 001, 0268 25 63210 / 2563245; Nagpur : 230-231, 3rd Floor, Shriram Shyam Towers, Next To NIIT Building, Sardar, Kingsway, 440 001, 0712 6614146 / 6614145; Nasik : F1, Suyojit Sankul Sharanpur Road, Near Rajiv Gandhi Bhavan, 422 002, 0253 660 2542 / 6602543; Navsari : 1st Floor, Chinmay Arcade, Opp: Sattapir, Sayaji Road, 396 445, 02637 280362, 280363,; New Delhi : 110-112, First Floor, Suneja Tower I, Janak Puri District Centre, 110 058, 011 41588242 / 41511403; 23, Shivaji Marg, Motinagar, 110 015, 011 45436371 /41428630; 301, Vishal Bhavan, 95, Nehru Place, 110 019, 011 26447065 / 26447066; 103, Savithri Sadan - I, 11, Community Centre, Preet Vihar, 110 092, 011 22460978 / 22460952; 402, 4th Floor, Vikrant T ower, Rajendra Place, 110 008, 011 41539961 / 41539962; 104, 1st Floor, Nanda De vi Towers, Prashanth Vihar, Central Market, 110 085, 011 27864193 / 27864281; 103, 1st Floor, C.S.C. Sector-B, Pocket 8&9, Opp G D Goenka Public School, Vasan t Kunj, 110 070, 011 41787159 / 41787160; G-29, Ansal Chambers-1, Bhikaji Cama P lace, 110 066, 011 41659719 / 47659722; 105-108, Arunachal Building, 19, Barakha mba Road, Connaught Place, 110 001, 011 23324401 / 23324409; B 2 Dd A Market, Sh op No 50, First Floor, Paschim Vihar, 110 063, 011 25263901 / 25263903; Noida : 307, Jaipuria Plaza, D-68A, 2nd Floor, (Opp Delhi Public School) Sector 26, 20 1 301, 0120 2539271, 2539272; Palghat : 12/310 (No.20 & 21), Metro Complex, Head Post Office Road, Sultanpet, 678 001, 0491 2547143; Panipath : 1st Floor, Krish na Tower, Above Amertex G T Road, 132 103, 0180 2644308 /2644376; Panjim : No.7 & 8, El. Dorado Plaza, Heliodoro Salgado Road, Panjim, 403 001, 0832 2426870, 2426871,; Patiala : Sco 27 D, Chhoti Baradari, ~ 147 001, 0175 5051726 / 27; Patna : Anand Tower, 2nd Floor, Exhibition Road, Near Republic Hotel, Opp: Mithila Motors, 800 001, 0612 2321354 / 55; Phagwara : 1st Floor, Ohri Tower, G T Road, 144 401, 01824 501533 - 36; Pondicherry : First Floor, No.7, Thiayagara ja Street, 605 001, 0413 2220636 / 2220640; Pune : Off.No.6, 3rd Floor, Rachana Trade Estate, Law College Road, Sndt Circle, Cts No.105, Erandwane, 411 033, 020 66048790 (5 Lines) / 91; Rameera Towers, 130 / 24,Pimprichinchwad, New Township Road, Tilak Road, Nigidi, 411 044, 020 27659116 / 115; Shop No 2, Groun d Floor, Sacred Heart Township, Wanowarie 411 040, 020 56610451/56610452; Raipur : 02& 03, Lower Level, Millennium Plaza, Ground Floor, Behind Indian Coffee

House, G E Road, 492 001, 0771 2236694-96, 6450194; Rajahmundry : D.No.79-1-3/1, Jawahar Lal Nehru Road, 533 102, 0883 2437494,2434470,; Rajkot : 102-103, Siddh i Vinayak Complex, Yagnik Road, 360 001, 0281 3291043, 3291042,; Rajpura : 13 Bl ock A, First Floor, Caliber Market, Chandigarh Patila Road, 140 401, 01762 52349 0 / 491; Ranchi : Commerce Towers , 3rd Floor, Beside Mahabir Towers Main Road, 834 001, 0651 2330386, 2330394, ; Rewa : Ist Floor, Angoori Bu ilding, Besides Allahabad Bank, Trans University Road, Civil Lines, 485 001, 076 62 408522; Rohtak : 1st Floor, Ashok Plaza, Delhi Road, 124 001, 01262 253597, 2 71982,; Ropar : Sco 51-52, Above Kulwant Electronics, Bella Chowk, 140 001, 0188 1 501771 / 772; Rourkela : Plot No. 554, 1st Floor, Sandhu Complex, Kachery Road, Uditnagar, 769 012, 0661 2510770, 2510771,; Sagar : Above Poshak, 5 Civil Lines, Opposite Income Tax Office, 470 001, 07582 402401, 402402, ; Salem : 40, Brindavan Road, Near Perumal Koil, Fair Lands, 636 016, 0427 2335700 / 2335705; First Floor, Old 17, New 49, 50 Fort Main Road, 636 002, 0427 2210835 / 836; Sam balpur : Quality Mansion, 1st Floor, Above Bata Shoe Shop/ Preeti Auto Combine, Nayapara, 768 001, 0663 3091038 / 2230195; Shillong : Mani Bhawan Annex e, Ground Floor, Opp. R K M Elp School, Lower Police Bazar, 739 001, 0364 222417 5 / 4186 / 8172; Shimla : Triveni Building, By Pass Chowk, Khallini, 171 002, 01 77 2624453; Shimoga: LLR Road, Opp: Telecom GM s Office, Durgigudi, Shimoga, 577 2 01 08182, 228795, 228797; Siliguri : Nanak Complex, 2nd Floor, Sevoke Road, 734 001, 0353 2526393, 2526394, ; Surat : Gf-16, Empire State Build ing, Nr.Udhana Darwaja, Ring Road, 395 002, 0261 3017151 - 55; Tanjore : Nalliah Complex , No.70, Srinivasam Pillai Road, 613 001, 04362 279407 / 279408; Thrissur : 2nd Floor, Brothers Complex, Near Dhanalakshmi Bank Ho, Naikkanal Junction, 68 0 001, 0487 2322483 / 484; Tirupati : 12-3-330, 1st Floor, Tilak Road, Near Four Pillar Mantapam, 517 501, 0877 2252756; Tirupur : 244 A, 1st Floor, Ka marj Road, Opp Cotton Market Complex, 641 604, 0421 2214221 / 2214319; Trichy : Sri Krishna Arcade, 1st Floor, No.60, Thennur High Road, Thennur, 621 017, 0431 2791322 / 2798200; Trivandrum : 2nd Floor, Akshaya Towers, Sasthamangalam, 695 0 10, 0471 2725987, 2725989 - 991; Vadodara : FF-4, Shital Plaza, Uday Nagar Soc, Ajwa Road, 390 019, 0265 3240417, 2510318; C-1/2/3, Jalanand Tow nship, Nr. Undera Jakat Naka, Gorwa, 390 016, 0265 3259060, 3240300; FF11-12, Ru tukalash, Tulasidham Char Rasta, Manjalpur, 390 011, 0265 9725055783 / 972501069 5; GF-11/12, Alian Complex, Nr Devdeep Complex, Nizampura, 390 002, 0265 3209888 / 9725395222; T-2, 3rd Floor Savoy Complex, Haribhakti Extn, Opp. ABS Tower, Old Padra Road, 390 007, 0265 6456183 / 6456186; 38, Payal Complex, Near Vadodara Stock Exch, Sayajigunj, 390 005, 0265 2225168 / 169, 2361514; FF4, Chan akya Complex, High Tension Char Rasta, Subhanpura, 390 007, 0265 3259056, 324463 4; Valsad : 2, Phiroza Corner, Next Showroom Cross Road, 396 001, 02632 326901, 326902; Vapi : Shop No.5, Bhikhaji Regency, Opp: DCB Bank, Vapi-Silvassa Road, 396 195, 0260 3206404. 3205955, Varanasi : D 64 / 132, KA, 1st Floor, Anant Complex, Sigra, Varanasi, 221 001, 0542 2225365 / 2223814; Varanasi (Chowk) : S hop N. 2-3, Gyan Mandal, Plaza Maidgin, Varanasi, 221005, 0542 2225365 / 2223814 ; Vijayawada : 39-10-7, Opp: Municipal Water Tank, Labbipet, 520 010, 0866 24952 00 / 400; 11-1-25, GMR Plaza, First Floor,BRP Road, 520 001, 0866 2565536/38; Vishakapatnam : 47-14-4, Eswar Paradise, Dwaraka Nagar Main Road, 53 0 016, 0891 2752915 To 18 ; D.No.180/129, Jhaala Complex, A.V.K.College Bldg., B eside Uti Bank, 530 026, 0891 2511685, 25116862, ; Udaipur : 201-202, Madhav Cha mbers, Opp.Gpo, Madhuban Chetak Circle, 313 001, 0294 5101601 / 602; Udupi : Gro und Floor, Sriram Arcade, Opp: Head Post Office, 576 101, 0820 2530962, 2530963, ; SBICAP Securities Ltd Agra: SBICAP Securities Ltd C/O Sbi Main Branch, Chipitola,282001,2252079.Ahmeda bad: SBICAP Securities Ltd 4, Nishka Avenue, Opp Pizza Hut, Navrangpura,380009,2 6561450. SBICAP Securities Ltd C/O State Bank Of India, 1St Floor, Memnagar Bran ch, 21 New Rajdeep Society, Opp Suryadeep Towers, Memnagar,,380052,9879559050. S BICAP Securities Ltd C/O State Bank Of India, 1St Floor, Modi Arcade, Near Rly Station, Maninagar (West),380008,2546920 5.Amravati: SBICAP Securities Ltd C/O State Bank Of India, 2Nd Floor, Sbi Amrava

ti Main Branch,444605,8055448978.Amritsar: SBICAP Securities Ltd C/O, State Bank Of India, Main Branch, Town Hall,143001,.Bangalore: SBICAP Securities Ltd Sbi L ho Campus Behind Spb Branch St. Marks Road,560001,32905247. SBICAP Securities Ltd Pb No-483, No-73 K R Road. Sbm Building 1St Flr, Basavangu di,560004,42103575.Bharuch: SBICAP Securities Ltd C/O. Sbi Sevashram Road Branch , B/H Icici Bank, Near Panchpatti, Sevashram Road, Bharuch - 392001, Gujarat,392 001,252030.Bhavnagar: SBICAP Securities Ltd C/O State Bank Of Saurashtra - Kalan ala Branch, Kalanala,364001,2520009.Bhilai: SBICAP Securities Ltd Sbi Main Branch,Sector 1,490001,0.Bhopal: SBICAP Securities Ltd S tate Bank Of Indore Paanchanan T T Nagar,462003,6549108.Chandigarh: SBICAP Secur ities Ltd C/O State Bank Of India, Main Branch, Sco 43-48, 1St Flr, Sector 17 B, 160017,5079240.Chennai: SBICAP Securities Ltd Sbi Main Branch New No.84, 22 Raja ji Salai,600001,42065997. SBICAP Securities Ltd Sbi Building No 2 A Prakasam Road Panagal Park T Nagar,600017,42606204. SBIC AP Securities Ltd Sbi Spb Branch,Plot No.4, Teachers Colony,Indiranagar, Adyar,6 00020,42607565.Coimbatore: SBICAP Securities Ltd Sbi Main Branch,State Bank Road .,641018,2395711. SBICAP Securities Ltd Sbi Premises - First Floor, 451, D.B. Ro ad, R.S.Puram,641018,4355527. SBICAP Securities Ltd C/O Sbi, Pollachi Branch,,642001,9943490621.Dehradun: SBICAP Securities Ltd C/O, Sbi Idt Branch, 47- Rajendranagar, Kaulagarh Road,248001,2752298.Durgapur: SBICAP Securities Ltd C/O. State Bank India, Durgapur Branch, Dsp Maingate, Po D urgapur-3,,713203,.Ernakulam: SBICAP Securities Ltd Sbi Shanmugham Rd. Branch 2N d Floor, Ktdc Bldg, Ernakulam,682031,3248745.Erode: SBICAP Securities Ltd C/O. Sbi Main Branch, D-48,State Bank Road,638003,4270818. Faridabad: SBICAP Securities Ltd State Bank Of India, 1St Flr, Neelam Chowk, N.I .T,121001,.Guntur: SBICAP Securities Ltd Shop No-13, Second Floor, Raghu Mansion , 4/1, Brodipet,522002,3244001.Gurgaon: SBICAP Securities Ltd Sbicap Securites, Sbi Sushant Lok 1, B/05, Unitech Trade Centre, Gurgaon,12209,2385365.Guwahati: SBICAP Securities Ltd Sbi, Lho, I Floor, Opp.Ass am Sectt., Dispur,781006,2237513.Gwalior: SBICAP Securities Ltd C/O State Bank O f India,Basement, Main Branch ,Jiwaji Chowk, Lashkar,474001,2620727.Hyderabad: S BICAP Securities Ltd State Bank Of Hyderabad Ground Floor, Gunfoundry,500001,233 21875. SBICAP Securities Ltd Room 4, 1St Flr H.No 10-2-199, Nehrunagar, Entrenchment Rd, Marred Pally, Secunderabad,50002 6,27700135. SBICAP Securities Ltd 1St Floor, Dmc Center, Above State Bank Of Ind ia, St. John S Road, East Marredpally, Secunderabad,500026,9676670666.Indore: SBIC AP Securities Ltd State Bank Of Indore 5,Yashwant Niwas Road,452003,2547517. SBI CAP Securities Ltd State Bank Of India Gpo Main Branch,452001,4036625.Jabalpur: SBICAP Securities Ltd C/O. Sbi Main Branch, Civi l Lines,482001,4218261.Jaipur: SBICAP Securities Ltd 128 , A - Block , First Flo or , Opp. Sbbj Bank,Ganpati Plaza, M I Road,302001,3221945. SBICAP Securities Lt d C/O Sbi Special Branch, Ground Floor, Sangeneri Gate,302003,4006483.Jalandhar: SBICAP Securities Ltd C/O. State Bank Ofindia, Civil Lines,144001,4636317.Jammu: SBICAP Securities Ltd C/O State Bank Of India, Railway Road Branch,,180001,9858600756.Jamnagar: SBICAP Securities Ltd G-3, Gro und Flr, Madhav Darshan Complex, Opposite Cricket Bungalow Near Limda Line,36100 1,2555170.Jamshedpur: SBICAP Securities Ltd Sbi, Jamshedpur Bistupur,831001,3206 515.Jodhpur: SBICAP Securities Ltd C/O Sbi, Special Branch, High Court Campus, Kachauri,,342001,9352940575.Kanpur: SBICAP Securities Ltd Sbi, Main Branch Campus, Zonal Office,16/101 Civil Line Ma ll Road,,208001,3253398.Kolkata: SBICAP Securities Ltd Sbi Main Branch Sammriddi Bhavan 3Rd Floor, 1- Strand Road,700001,22481729. SBICAP Securities Ltd State B ank Of India Jeevandeep Bldg,Ground Floor Middleton Street,700071,22886604. SBICAP Securities Ltd C/O Sbi, 50 A, Gariahat Road, Ball ygunge,,700019,0.Lucknow: SBICAP Securities Ltd C/O Sbi Govt.Business Branch Mot i Mahal Marg Behind K.D.Singh Babu Stadium Hajrath Ganj,226001,3202184. SBICAP S ecurities Ltd C/O State Bank Of India, 2/103 Vijay Khand First Flr, Gomti Nagar, 226010,2303261.Ludhiana: SBICAP Securities Ltd Sbi, 1St Floor Fountain Chowk Civil Lines,141001,5025634.Madurai: SBICAP Sec urities Ltd C/O State Bank Of India, Number -7A, West Veli Street, Opposite Rail

way Station,,625001,4506404.Mangalore: SBICAP Securities Ltd C/O Sbi, Mangalore Main Branch, Port Road, P.B.No-90,575011,9844818617.Meerut: SBICAP Securities Lt d C/O Sbi, Commercial Branch, Ganga Plaza Complex, Begum Bridge Road,,250001,2668896.Mumbai: SBICAP Securities Ltd State Bank Of In dia M.G.Road Ghatkopar East,400077,25020964. SBICAP Securities Ltd 1St Floor, Tu lsani Chembers, Nariman Point,400021,32660218. SBICAP Securities Ltd Sbi Admin B uilding Compound, Madam Cama Rd., Nariman Point,400021,22023214. SBICAP Securiti es Ltd C/O Sbi Spb Branch, Mumbai Samachar Marg, Gate No 7, Horniman Circle, Fort,,400001,32660216. SBICAP Securit ies Ltd 2Nd Flr, A Wing, Mafatlal Chambers, N.M Joshi Marg, Lower Parel,400013,4 2273451. SBICAP Securities Ltd C/O, State Bank Of India, Khadi & Village Industr ies Commission Premises, Erla Road, Vile Parle-W,400056,26238299.Mysore: SBICAP Securities Ltd C/O State Bank Of India, Mysore Main Branch,P.B.No204, Motikhana Building, New Sayaji Rao Road,570024,2435866.Nagpur: SBICAP Securities Ltd C/O Sbi Seva Sadan Branch, 75 Moti Mohan Complex Seva Sadan Chowk, C.A.Road ,440018,3257729.Nashik: SBICAP Securities Ltd C/O Sbi Spbb Br., Plot No. 56 ,Opp . Wadnagare Bhavan, Thatte Wadi, College Road,422005,2232152.New Delhi: SBICAP S ecurities Ltd State Bank Of India, C Block, Ground Flr, 11, Parliament Street,110001,23744235. SBICAP Securities Ltd State B ank Of India Personal Banking Branch, A-15 Hauz Khas,110016,26511104. SBICAP Sec urities Ltd C/O State Bank Of India, Deepak Building , Near Placecinema,13 Nehru Place,110019,26447454. SBICAP Securities Ltd C/O, State Bank Of India, A-61, Ma dhuban Branch, Madhuban,110092,22410061. SBICAP Securities Ltd C/O State Bank Of India, J-2/17, B K Dutt Market, Rajouri Garden, 110027,25193391. SBICAP Securities Ltd C/O, State Bank Of India, E-2/28, Sector7, Rohini,110085,27055815.Noida: SBICAP Securities Ltd C/O State Bank Of India, Sector-26, Noida,201301,2532133.Panjim: SBICAP Securities Ltd Sbi, Panaji Main B ranch Dayanand Bandodkar Marg Near Hotel Mandovi,403001,3253886.Patiala: SBICAP Securities Ltd State Bank Of Patiala Mall Road, The Mall Near Sherawala Gate, Demat Section,147001,5013356.Patna: SBICAP Securities Ltd C/O State Bank Of India ,Spb Gandhi Maidan,Biscoman Bhavan,800001 ,3260943.Pondicherry: SBICAP Securities Ltd 164, Kamraj Salai, 1St Flr, Above Sb i Adb Branch,605013,4304236.Pune: SBICAP Securities Ltd State Bank Of India Deccan Gymkhana Branch J.M.Road, Deccan Gymkhana,411004, 25539399. SBICAP Securities Ltd C/O Sbi Bund Garden Branch, Grale 171/B, 1St Flo or, Dp Road,411001,30221091.Raipur: SBICAP Securities Ltd C/O State Bank Of Indi a,Kutchery Branch,Kutchey Chowk,492001,4075329.Rajkot: SBICAP Securities Ltd 608 , Dhanrajni Complex, 6Th Flr, Near Imperial Palace Hotel, Dr Yagnik Road,360001,3043328.Salem: SBICAP Securities Ltd Sbi Siruthozhi l Branch Bank House,No. 68 Cherry Road,636007,4031780.Shimla: SBICAP Securities Ltd C/O State Bank Of India, New Building, 2Nd Floor, The Mall,171003,2652726.Su rat: SBICAP Securities Ltd 1/580, Pore Street, Nanpura, Opp Sbi,395001,987959131 5.Surendranagar: SBICAP Securities Ltd Sbicap Sec Ltdc/O Sbi Bank, Opp Swaminarayan Deal, Vadipara,363001,0.Thiruchirappalli: SBICAP Securities Ltd C/O, State Bank Of India, Micr Center, Ground Flr, Asha Ar cade, 73 Promenade Road, Cantonment,520001,9597640259.Trivandrum: SBICAP Securit ies Ltd First Floor, State Bank Of Travancore Building, Sasthamangalam, Thiruvan anthapuram,695010,6454296.Udaipur: SBICAP Securities Ltd C/O Sbi, Main Branch, 23/C Madhuban,313001,9784461170.Vadodara: SBICAP Secur ities Ltd Sbi, Alkapuri, R.C.Dutt Road,390007,6535747. SBICAP Securities Ltd C/O . Sbi Mandvi Main Branch, Opp Jamnabhai Hospital, Mandvi,,390001,. SBICAP Securi ties Ltd C/O. Sbi Makarpura I.E. Branch, Vcci Building, Makarpura,390010,2632533 .Varanasi: SBICAP Securities Ltd C/O State Bank Of India , Bhelupur Branch,221010,22277558.Vijayawada: SBICAP Securities Ltd Sbi ,Governorpet Branch Ali Begh Street Governorpet,520002,2577887.Visakhapatnam: S BICAP Securities Ltd C/O Sbi Main Branch, Demat Section, Opposite Jail Road Junc tion, Near Redham Gardens,530002,9949324544. CO-MANAGERS TO THE ISSUE

Bajaj Capital Limited Agra : Shop No. 110, Ground Floor, Block No. 27/2/4, Sanjay Palace, Near Hotel P anchrattan, Agra - 282002. Ph : 0562-6457307; Ahmedabad : 2-L, Akik Opp Lions Hall , Mithakhali Six Raod, Near Nalanda Hotel, Ellisbridge, Ahmedabad - 380006. Ph: 079-64500171, 72; Ajmer : 26, Ground Floor, Ajmer Tower, Kutchery Road, Ajmer 305001. Ph : 0145-6451231,0145-6451232;Allahabad : Shop No. F-5 , Indira Bhawan, Civil Lines, ALLAHABAD - 211001. Ph : 0532-6452481,0532-6452482; Bangalore : Unit 104107, First Floor, A Wing, Mittal Towers, M.G. Road, Bangalore - 560001. Ph: 080-65 471121, 65471123; 759, Shri Jayalakshmi Nivasa, 100-ft Road, Indira Nagar, (Opp. SBI Personal Bank) Bangalore-38. Ph : 080-65471127 / 26; 4, Lakshmi Mansion, 81 /B, 8th Main Road, Opp. Food World, 3rd Block, Jaya Nagar, Bangalore -11. Ph : 0 80-65471128 / 29; Raheja Arcade, 1st Floor, #122, Koramangala, Bangalore-34. Ph:080-65471130 / 31; 197, Sampige Rd, Near 11th Cross, (Above Karnataka Bank) Malleshwaram, Bangalor e- 3. Ph : 080-65471132 / 33; Rajaji Nagar 293/1, 17th Main Road D , IIIrd Block, R ajaji Nagar, Bangalore-10. Ph : 080-65471139 / 38; Bhopal : Shop No. 6, First Fl oor, Jyoti Cinema Complex, M.P. Nagar, Zone1, Bhopal - 462011. Ph: 0755-6459550; Bhubaneshwar : Plot No. 1/A, Ground Floor, Station Square, Kharvel Nagar, Bhubneswar - 751001. Ph: 0674 - 6451257, 6451269;Chandigardh : SCO 341 - 342, First Floor, Sector 35B , Chandigarh 160036. Ph.:(0172) , 6451612 13 Chennai : Wellington Plaza, 3rd Flo or, 90, Anna Salai, Chennai - 600002. Ph: 044-23451207, 08; K.R. BUILDINGS, No. 12, L.B. Road, Adyar, Chennai - 600 020. Ph : 64588304 / 305 / 306; W.111, First Floor, 3rd Avenue, Anna Nagar, Chennai - 40. Ph : 64588309 / 310, 64581539; Shop No. 4, Trinity Com plex, No.110, 4th Avenue, Ashok Nagar, Chennai - 83. Ph : 64588311 / 312; No. 7, R.K. Mutt Road, (Near Indian Bank) Mylapore, Chennai - 4. Ph : 64581540 / 64588 318 / 317; Shop No. 4, Plot No. 3, 29th Street, Nanganallur, Chennai-61. Ph : 64 588320 / 319; Bridge Port, New No. 29, Old No. 12, Burkit Rd, T.Nagar, Chennai-1 7. Ph : 64588321 / 22; Shop No.5, Ground Floor, Vikas Plaza, 37/C, Velachery, Tambaram Road, Chennai - 42. Ph : 64 588326 / 24; Coimbatore : No. 575, D.B. Road, First Floor, (Near Head Post Offic e) R.S. Puram, Coimbatore - 641002. Ph: 6470136, 38; Dehradun : 15, Rohini Plaza , 11-E Rajpur Road, Dehradun - 248001. Ph : 0135-6452648,0135-6452649; Faridabad : 5R/1 Ground Floor, B.K. Chowk, Near HDFC Bank, Faridabad - 121001 Ph: 0129 6466566, Ghaziabad : G-5, Ansals Satyam Building, Raj Nagar, District Centre, Ghaziabad 201002. Ph : 0120-6493211,0120-6494070; Gorakhpur : Ground Floor, A D Towers, B ank Road, Gorakhpur, Gorakhpur - 273001. Ph : 0551-6453025,0551-6453026; Gurgaon : Super Mart B-201, Super Mart - 1, DLF City Phase - IV, Gurgaon - 122002. Ph : 0124-6469991,0124-6468105; Sec 14 102, AKD Tower, U+B6pper Ground Floor, Near L&T Infrastructure Finance Company Limited

L&T INFRASTRUCTURE FINANCE COMPANY LIMITED : APPLICATION FORMS AVAILABLE AT FOLL OWING LOCATIONS L&T INFRASTRUCTURE FINANCE COMPANY LIMITED : APPLICATION FORMS A VAILABLE AT FOLLOWING LOCATIONS CO-MANAGERS TO THE ISSUE Bajaj Capital Limited (Contd .....) HUDA Office, Sector-14, Gurgaon- 122001. Ph. 124- 6468101, 6468102; Guwahati : R oom No.102, 1st Floor, Dunfur Apartment, R G Baruah Road, Guwahati - 781024. Ph: 9207045530, 31; Hyderabad : 3-6-522, 2nd & 3rd Floor, Archies Showroom, Opp. KF C, Himayath Nagar, Hyderabad - 500029. Ph: 040 - 44555555, 64631421, 22; Shop No . 4, Ground Floor, Swarnajayanthi Complex (HUDA) Ameerpet, Hyderabad-500 016. Ph : 04064631425 / 24; No.3/MIG-I, Near ICICI Bank, K.P.H.B. Colony, Kukatpally, Hyderabad - 500 072. Ph: 64631427 / 26;Indore : Shop No. 3, City Plaza, M.G. Road near Regal Cin ema, Indore- 452001 Ph.: (0731) 6452014;Jaipur : G-3, Anukampa Tower, Opp. Sanga mTower, Church Road (M. I. Road), Jaipur - 302001. Ph: 0141-6503342, 43;Jalgaon : Beside ICICI Bank, Dhake Corporate Centre, Dhake Colony, Jalgaon - 425101. Ph: 02576451511; Jamnagar : 36 AB, Ground Floor, Indraprashtha Complex, Near Pancheshwar Tower Ro ad, Jamnagar - 361001. Ph : 0288-6450105; Jamshedpur : Shop No. 53, 2nd Floor, K amani Business Centre Bishtupur, Jamshedpur - 831001. Ph: 6457603, 6457627; Kanp ur : 106, Ratan Esquire, 14/144, Chunni Ganj, Kanpur - 208001. Ph:(0512) 6451763 64;Karur : Shop No. 11, Jeyam Towers, No. 1-B, North Pradhakshanam, Road, Near Thinappa Theatre, Karur - 639001. Ph : 645623,645624; Kochi : Rubicon Building, S.A. Road, South Over Bridge, Valanjambalam, Kochi - 682016. KERELA. Ph: 0484-6452566, 65;Kolkata : 5th Floor, Room No. 507, 7/1, Lord Sinha Road, Ko lkata - 700071. Ph: 033 - 22820383; 9, Ezra Street, Kolkata-700001. Ph: 64578545 - 47; Gagananchal Complex, Shop No. 38A, 37, Dr. Abani Dutta Road, Howrah-71110 6. Ph: 64602157 - 58, 64604011; B-9/20 (C. A), P O. Kalyani, Dist. Nadia, Kalyani-741235. Ph: 64 605211, 64605214; No. 507, 7/1, Lord Sinha Road, Kolkata-700071. Ph: 64578532 41 Call Centre: 44400444; 182, Jessore Road (Satgachi Crossing), Dum Dum, Kolkat a-700074. Ph: 64578543; Mezanine Floor, Flat No. 3, P - 24A, C I T Road Scheme V I M, Kolkata-700054. Ph: 64578551 - 52; Martin Burn House, Ground Floor, Room No . 15, 1, R N Mukherjee Road Kolkata- 700001. Ph: 64578553 - 54; Sec-I BF-192, Sec-I, Salt Lake, Kolkata - 700064. Ph: 64578627 - 29; Sec-V Plot No. IX-16, Block EP & GP, Sec-V, Salt La ke, Kolkata- 700091. Ph: 64578555 - 56; 1st Floor, 4 Jatin Bagchi Road, Kolkata700029. Ph: , 64578548 - 50; Ground Floor, Shop No. 9, ShreeramNagar, Teghoria, V I P Road, Kolkata-700052. Ph: 64578625; 25/A, Raja Ram Mohan Roy Road, Kolkata - 700008. Ph: 64578542; C36, Lakshmi Narayan Colony, Po. Naktala, PS. Jadavpur, Kolkata-700047. Ph: 64578626; Kottayam : Skline Citadel Building, Opp. Plantation Corporation, Ground Floor, Kanjikuzhy, K.K. Road, Kottayam - 686004. Ph : 6452249,6452251; Lucknow : 5, Com merce House, Habibullah Compound, 11, M.G. Marg, Hazratganj, Lucknow - 226001. P h : 0522 - 6565568; Ludhiana : M-3, ABC Services, SCO-137, Feroze Gandhi Market, Ludhiana-1 Ph: (0161) 2412287; Madurai : Suriya Towers, No.5, First Floor, 272/2 73, Good Shed Street, Madurai - 625001. Ph : 0452 - 6461023, 6461024, 6461025; M angalore : Essel Towers, BS 4, Bunts Hostel Circle, Mangalore - 575003. Ph: 0824 -6451218, 17; Meerut : G-43, Ganga Plaza, Near Begam Bridge, Meerut cantt. - 250 001. Ph : 0121 - 6451510, 6451511;Mumbai : Agra Bldg, Gr. Floor, 7/9 Oak Lane, F ort, Mumbai - 400023. Ph: 022 - 66376999; 16, Shopper s Point, Behind Motimahal Restaurent, S V Road , Andheri - (W), Mumbai - 400058. Ph 022 - 65210112, 65210116; Rashesh Bu ilding, Shop no 11, 1stFloor, Near Maxus Mall, 150 ft Road, Bhayandar (w), Thane - 401104. Ph 022 - 65991662 - 63; Shop no.1, Shantinath Apt, Opp star Apt, S V R

oad, Borivali(w), Mumbai-400092, Ph. 65991664 - 66; Room No.1, Gr Floor, Sunil S adan Opp Grand Central Restaurant, M.D.S Marg, Chembur (E) Mumbai- 400 071. Ph 022- 65991667 68; Shop No. 5, Abdul Kadar Jilani Building, Gokhale Road, Opp. Portugese Church , Dadar (w), Mumbai- 400 028. Tel: 65991669 - 70; Office No. 8, Nandashish Build ing, R. B. Mehta Marg, Ghatkopar (E), Mumbai 400 077 Tel. 022 65991671 / 6521011 5; Shop No 61, Vasant Sagar, Krishna Bldg, Opp Thakur Cinema, Thakur Village, Ka ndivali (E), Mumbai- 400101. Ph 022 - 64507728, 65991672; Shop No 102, Sai Arcade, N.S. Marg, Above Union Bank Of India, Mulund (W), Mumbai - 400080. Ph. 65210113, 65991673+ B91; Shop No 1, Dhara Complex, Plot No.3&4, Sec-No 44, Seawoods, Nerul, Navi Mum bai-400706. Ph: 022- 65991674 - 75; Shop No 11, Gr. Floor, Dheeraj Heritage Bldg , SV Road, Santacruz: (W) ,Mumbai-400054. Ph 022 - 64507727, 65991676; Shop no 3, Chaman House Co-op Hsg Society, plot no - 34 ,Beside IDBI Bank Atm, Sion (E) Mumbai - 4 00022. Ph 022 - 64518004, 65991677; Shop No 3, 5th Floor, Tardeo Airconditioned Market, Mumbai 400 034. Ph 64534950,64534954; R.No 5, Above Khandelwal Sweets, O pp Thane Railway Station, Gokhale Road, Thane (W) Mumbai 400601. Ph 022-25376898 , 65991678 - 79; Nagpur : Shop No. 5, Pushpakunja Commercial Complex, Central Ba zar Road, Ramdas Peth, NAGPUR - 440010. Ph : 0712-6618577; Nashik : G 18 & 19, Suyojit San kul, Tilak Wadi, Sharanpur Road, Nashik - 422002. Ph : 0253 - 6629011, 6629012;N ew Delhi : Bajaj House, 97, Nehru Place, New Delhi - 110019. Ph: 011 -41693000,2 6410315; N-10, Kalkaji, New Delhi-, 64736914, 64640919; 15, L.G.F. Central Marke t, Masoodpur, Vasant Kunj, New Delhi-110070, Ph: 64736918, 64640940; Shop no. 15 , Ground Floor, Deep Cinema Complex, Phase - 1, Ashok Vihar, Delhi -110052 Ph: 64736944, 64640908; United India Life Building, F-Block, Connaught Place, New Delhi - 1. P h.: 41790444 (30 Lines) 64640900-07; DDA Shop No. 24, Ground Floor, Rama Krishna Market, No.1, I. P. Extension, Patparganj, Delhi-110092 Ph.: 64736942, 64640931 ; DDA Shop No. 4, FD Market, Near Madhuban Chowk, Pitampura, Delhi-110088, Ph: 6 4736902, 64640933; 5/ 201, Sikka Complex, IInd Floor, Community Centre, Preet Vihar, Delhi-110092 Ph: 64736909, 64640935 - 6; 9, Ground Floor, Rajendra Bhawan, Rajendra Place (Opp. R achna Cinema) New Delhi- 110008, ph:, 64736940, 64640938; Shop No. 4, 1st Floor, Lajwanti Plaza, Sector-4, Main Market, Vaishali, Ghaziabad. Ph: 6493212, 649407 2; 112, 1st Floor, Ansal Chamber- 1, Bhikaji Cama Place, New Delhi-110066 Ph: 64 736916, 64640910; F-1, Ist floor, B-87, Defence colony, New Delhi- 110024. Ph: 64736930, 64640912; F-4, HL Square, Plot No. 6, Sector-5, Dwarka, New Delhi - 110075 Ph: , 64736925, 6464091 5; Shop No. 11 & 12, 7-A, Janakpuri Dist.Centre (Opp. Janak Puri Transport Autho rity), New Delhi - 110058. Ph: 64736912, 64640917; Shop No. 3, Ground Floor, B-5 , Tagore Market (Next to Post Office), Kirti Nagar-110015, Ph: 64736922; C-50, S hivalik, Main Road, Malviya Nagar, New Delhi-110017. Ph:, 64736907, 64640923; G-8&9, Ground Floor, Bhanot To wer, A-Block Opp. Jawala Heri Market, Paschim Vihar, New Delhi-110063. Ph: 64640 929, 64736947; 19, DDA Market, Commercial Complex, Yusuf Sarai, New Delhi-110016 Ph: 64640943 - 44, 64736937; NOIDA : Sector -29 A-2, Brahmputra Commercial Comp lex, Near Rail Reservation Centre, Sec. 29,Noida-201301 Ph: 6494074 - 75, 649321 3; NOIDA : Sec-41 C-20, C Block Market, Sector-41, Noida-201301. Ph: 2570410, 64940 77 - 78; Patna : Flat No. 108, 1st Floor, Ashiana, Plaza, Budha Marg, Patna - 80 0001. Ph: 0612- 6451056 - 59, 61 - 63; Pondicherry : No. 127/A, 100 Ft. Road,Nat esan Tower, 1st Floor, Natesan Nagar, Pondicherry - 605001. Ph : 0413 - 6452334, 6452335; Pune : Shop No 6, Sanas Plaza, 1302, Subhash Nagar, Bazirao Road, Pune - 411002. Ph: 020-65009460, 61; Suyash Plaza, Office No.08, 3rd floor, Opp-Selene Building, Bh andarkar road, Near Kamla nehru Park. Pune 411004 Ph: 020 65009463; Office no. 1 3, A Wing, Kamala Cross Road, Opp. PMPC office, old Mumbai highway,Pimpri, Pune - 411018. Ph : 020 - 46500150-51; Rajkot : Prathibha Complex, Near Jayesh Public